Introduction:

“The real thing about Islamic finance is that it is not only about Islamic finance. Islamic finance is in reality a peaceful contribution to a wider set of efforts aimed at the renaissance of Islam as a modern religion that has to co-exist in the modern world, with a multitude of interdependence of communities and mutuality of faiths” (GIFR 2010, p. 26). The message contained in the first sentence of Chapter 1 of the inaugural edition of this report remain relevant to the current state of affairs of the global Islamic financial services industry.

The global Islamic financial services industry offers a market-based solution for engagement of Muslim communities with other faith-based and secular groups. It offers an excellent opportunity to build or re-build the Muslim lands, which are being torn apart by killings and bombings in Iraq and Syria, terrorism and its aftermath in Afghanistan and Pakistan, civil war in Somalia, and ethnic and faith-based political conflict and unrest in Nigeria. Muslims face harsh treatment and live in adverse circumstances even in the countries where they are in minorities. The Indian-held Kashmir has a long history of mass killings of Muslims, and in recent times genocide of Rohingya Muslims in Myanmar has created a crisis that succeeded in gaining international attention only after thousands of Muslims were killed.

It is little wonder that 7 out of 10 world’s least peaceful countries are Muslim-majority countries (Table 1). The prolonged wars and violence in the Muslim world must stop and peaceful phenomena like Islamic banking and finance (IBF) should play their roles in rebuilding communities and countries.

| TOP 10 MOST PEACEFUL COUNTRIES | 10 LEAST PEACEFUL COUNTRIES | ||

| 1 | Iceland | 154 | Ukraine |

| 2 | New Zealand | =155 | Central African Republic |

| 3 | Portugal | =155 | Sudan |

| 4 | Austria | 157 | Libya |

| 5 | Denmark | 158 | Somalia |

| 6 | Czech Republic | 159 | Yemen |

| 7 | Slovenia | 160 | South Sudan |

| 8 | Canada | 161 | Iraq |

| 9 | Switzerland | 162 | Afghanistan |

| =9 | Ireland | 163 | Syria |

THE WORLD’S MOST & LEAST PEACEFUL COUNTRIES

There is a need to learn from the experiences the likes of Bank Bosna International, an Islamic bank set up in Bosnia-Herzegovina after the civil war that had resulted in the killings of thousands of Muslims. In the Muslim countries torn by war and facing law & order and securities issue, IBF can play a role similar to what Bosna Bank International played.

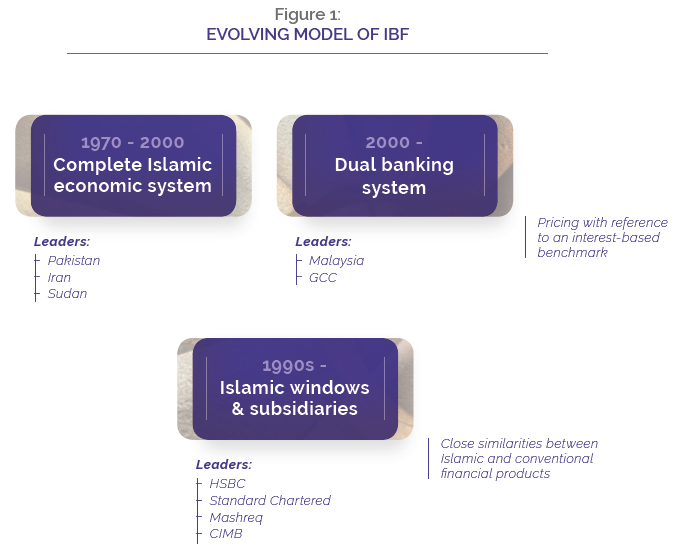

Eight years after the inaugural edition of GIFR, we are inclined to present IBF as a disruption to the conventional financial system. The initial emphasis on developing IBF as part of the conventional financial system has had its own benefits but now it endangers the industry to get marginalized in the powerful ecosystem of conventional finance. The Islamic stance on the nature of money and its creation, aversion to a debt-based banking system, and an economy based on sharing of profits and diversification of risks must have been considered as “disruptive” right from the beginning but the history took its own path whereby IBF was developed as part of the conventional financial system. Earlier attempts to Islamise entire economies (e.g., Pakistan, Iran and Sudan) were aborted (in the case of Pakistan) or marginalized (in the case of Iran and Sudan, which faced severe international sanctions). Dual banking system (explicitly spearheaded by Malaysia and silently supported by the governments in the Gulf states) became the accepted and feasible alternative. Dual banking system on the systemic level gave way to Islamic windows model, which allowed conventional banks and other financial institutions (e.g., insurance companies) to offer Islamic financial products. It influenced the industry that continued to rely on interest-based benchmarks for pricing of its products, which eventually led to dangerously close similarities between Islamic and conventional products (see Figure 1).

Consequently, IBF has yet to discover its true identity and its real objectives. Infact it has just lost its spirit in the conventional financial system. Everything is not lost though. There has been a surge in analyzing synergies between IBF and Sustainable Development Goals (SDGs) as espoused by the United Nations Development Program (UNDP).

This necessitates a re-look at the value proposition of IBF in the context of an Islamic economic system. It is not entirely naïve to ask if IBF is compatible with or an alternative to conventional financial system. Furthermore, there is a genuine need to take a holistic view on the phenomenon of IBF as it has emerged in practice. The widening gulf between economic analyses of IBF and juristic reasoning will not help the industry to develop itself in line with the paradigm that must continue to remain central to IBF.

Objectives of Islamic Economic System

Islam treats money differently from its exchange in an interest-based financial system. Islamic economists have taken a view on debt, diagonal to what is held by Shari’a fraternity involved in IBF. Islamic economists frown upon debt, to say the least. Furthermore, profit loss sharing remains the preferred choice over trade-based fixed return modes of financing. However, the wider objectives of Islamic economic system go far beyond these three issues. These include:Achievement of social welfare and comprehensive well-being of communities; Fair and equitable distribution of income and wealth;

Provision of basic human needs; Establishment of social justice; Promotion of social cohesion and unity;

of exploitation.

“QUESTIONS LIKE “IS ISLAMIC BANKING REALLY ISLAMIC?” ARE IRRELEVANT TO ANY MEANINGFUL DEBATE ON IBF. AT THE SAME TIME, IT IS ALSO NOT UNTRUE THAT IBF DOES NOT ATTEMPT TO PROMOTE THE CORE OBJECTIVES OF ISLAMIC ECONOMIC SYSTEM.”

It is true that the current practices of IBF do not contradict with the above-listed objectives, and, hence, IBF is not un-Islamic in its very nature. Therefore, questions like “Is Islamic banking really Islamic?” are irrelevant to any meaningful debate on IBF. At the same time, It is also not untrue that IBF does not attempt to promote the core objectives of Islamic economic system. This is not necessarily due to some inherent problems with IBF but it may very well be due to the overall environment in which Islamic banks and financial institutions operate. In other words, it may be due to the overall system on a national level and the socio-political fabrics of the societies.

In any country where the above objectives inspire to delineate guiding principles for running social, political and economic institutions, businesses will attempt to ensure the realization of these goals. Islamic banks and financial institutions operating in contemporary environments merely follow the prevailing norms. Given the socio-economic norms, regulatory requirements and market forces; Islamic banks and financial institutions owned by private shareholders attempt to maximize profits, and it is futile to expect from managers of such entities to try to pursue social objectives or philanthropic activities.

Accepting this, IBF is then merely a Shari’a-compliant or halal alternative to an interest-based financial system. Proclaiming it to be a more just, a more inclusive, and a superior form of banking and finance is not a justifiable claim. In its present form, IBF does not even attempt to achieve social objectives more than its conventional counterpart. It is also not a means to promote equitable distribution of income and wealth. Provision of basic human needs is not its domain either. The establishment of social justice is not one of its objectives. Promotion of social cohesion and unity, morality, wider circulation of wealth, and elimination of exploitation are all not distinguishing features of IBF.

If all the above is true, then it is certainly not a disruption. It is just setting up a halal KFC to cater for the demand of those who insist on eating halal KFC. Halal KFC is no healthier than non-halal KFC. Any claim that a halal KFC franchise is superior in terms of nutrition value of its products, and its better effects on health is obviously ridiculous.

The question arises if IBF should remain a halal financial alternative or it should go beyond to develop itself into a comprehensive financial system, as an alternative to the prevailing mainstream banking and finance. If it wants to develop itself into a credible alternative, then all its stakeholders – regulators, Islamic bankers, public sector policy-making institutions and Shari’a scholars – must agree on a strategy to do so. It will not happen automatically but rather a deliberate effort is required to move to the next level on its progression spectrum.

In the West, a number of research projects are being funded by governments and non-government organizations to study how various reforms may be introduced to conduct business in line with the requirements of modern times. One such initiative is Future of Corporation, funded by The British Academy. This project aims at bringing reforms in the modern corporations to make businesses more socially responsible and involving less moral hazard and adverse selection in business operations.

It is proposed that such a radical approach must be taken to bring reforms in IBF at this still early stage of development of the industry.

IBF in the Context of Islamic Economic System

Achievement of Social Welfare and Comprehensive Well-being of Communities

In light of the above-listed objectives of Islamic economic system, it is proposed that the collection and disbursement of zakat must be incorporated in the core business of Islamic banks and financial institutions to achieve social welfare and well-being of communities. In a number of countries (e.g., Pakistan and UAE), banks are already involved in zakat collection. The disbursement of zakat, however, remains a prerogative of other public sector agencies. A comprehensive approach to zakat will allow Islamic banks to not only collect zakat funds from individuals and organizations but also to disburse zakat for the well-being of communities.

Table 2:

POTENTIAL OF ZAKAT IN THE TOP 5 MOST POPULATED MUSLIM COUNTRIES IN THE WORLD

| COUNTRIES | ||||

| POPULATION | GDP | ESTIMATED ANNUAL ZAKAT | ISLAMIC BANKING DEPOSITS | |

| (MILLION) | (US$ BILLION) | (US$ BILLION) | (US$ BILLION) | |

| INDONESIA | 266.79 | 932 | 65 | 21 |

| PAKISTAN | 200.81 | 304 | 21 | 9 |

| BANGLADESH | 166.37 | 246 | 17 | 23 |

| TURKEY | 81.91 | 858 | 60 | 30 |

| EGYPT | 99.37 | 336 | 23 | 8 |

| SAUDI ARABIA | 33.55 | 646 | 45 | 117 |

| MALAYSIA | 32.04 | 296 | 20 | 94 |

| OIC | 1,6001 | 6,871 | 480 | 6002 |

Notes:

Data sources are multiple, as we used statistics on Islamic banking from IFSB and the individual regulators; Data on population comes from World meter.

1 ,2 Estimated by Edbiz Consulting.

Potential of zakat remains grossly underestimated in IBF. For example, estimated zakat in the case of Pakistan could be 7% of the gross domestic product (GDP), which for the fiscal year 2016-17 is Rs2.2 trillion (US$21.28 billion). This is more than double of the current total of Islamic deposits in the country.

Table 2 reveals an interesting story. If zakat is internalized in the IBF system, it is expected to increase the size of the industry by US$1.44 trillion, as every US$1 in deposits increases the Islamic financial assets by US$3. Thus, US$480 billion of annual collection of zakat will add $1.44 trillion every year.

“IF ZAKAT IS INTERNALISED IN THE IBF SYSTEM, IT IS EXPECTED TO INCREASE THE SIZE OF THE INDUSTRY BY US$1. 44 TRILLION ANNUALLY.”

Fair and Equitable Distribution of Income & Wealth

There is a growing interest amongst young Shari’a scholars involved in IBF to shun any suggestion or proposal of making IBF a tool for distributing wealth and income fairly and equitably. The common reaction to such suggestions is that this kind of requirements will make IBF even more burdened. In this context, IBF is purely a business phenomenon and should remain as such, i.e., its first and foremost objective should be the maximization of shareholders’ value.

It is true that Islamic banks and financial institutions are commercial organizations, with very clear aims and objectives in terms of profit maximization and shareholders’ value. However, it must be stressed that even in the West there are calls being made to bring in reforms in compensation packages of the management of banks, especially with reference to bonuses and other such benefits.

Call for fair and equitable distribution of income and wealth has a special relevance to the treatment of mudaraba pools and the process of profit smoothening (by way of profit equalization reserves and investment risk reserves). Through such profit smoothening, Islamic banks ensure that investment account holders receive no more than the depositors of conventional interest-based accounts. The end result is that Islamic investment accounts behave more or less in the same fashion as a conventional deposit account.

There is a need to further develop businesses like mudaraba2 companies and mudarabas in Pakistan. It is an excellent structure that has potential to be developed into a full-fledged Islamic financial system.

“THERE IS A NEED TO FURTHER DEVELOP BUSINESSES LIKE MUDARABA COMPANIES AND MUDARABAS IN PAKISTAN. IT IS AN EXCELLENT STRUCTURE THAT HAS POTENTIAL TO BE DEVELOPED INTO A FULL-FLEDGED ISLAMIC FINANCIAL SYSTEM.”

Provision of Basic Human Needs

First reaction to suggesting a role for Islamic banks and financial institutions in provision of basic human need is expected to be ridiculing. However, through specific-purpose mudarabas, Islamic banks and financial institutions can invest in housing, education and health projects. In fact, most of the real estate development companies rely on financing from banks and other specialized institutions like building societies and cooperatives, which help their customers and members to purchase homes.

Specialized Islamic financial institutions with investments in housing, education and health projects may prove to be the most profitable institutional form for IBF.

Establishment of Social Justice

Islamic banks and financial institutions should also play a role in establishing social justice in the communities that they attempt to serve. Social justice can be established by way of helping businesses and other organizations invest in their employees and nurture and retain the best talent. Islamic banks and financial institutions should apply some positive screens to favor such businesses that show commitment to social justice and are in fact socially responsible.

Promotion of Social Cohesion & Unity

If an authentic PLS-based model of IBF is developed, it will help in aligning interests of owners of different factors of production, especially, entrepreneurs and providers of capital. Furthermore, a comprehensive programme for Islamic financial literacy must be initiated to make all the stakeholders in the industry aware of the benefits of social cohesion through financial relationships.

The realisation of Moral & Material Development

IBF is legalistic in its very nature. Those who are involved in product development in Islamic financial institutions are very well aware that the Islamic jurisprudence of financial transactions is deeply rooted in ethics. There is an explicit emphasis on under- standing of contractual arrangements and honouring the terms and conditions therein. Morality in Islam is governed by implicit and explicit contracts that people enter for different economic activities. There is no conflict between the Islamic law and morality; the former merely formalizes the latter.

Working for an Islamic business (i.e., an Islamic bank) in itself should induce good behaviour on part of its employees. In addition, it is the responsibility of Islamic banks and financial institutions to provide character-building trainings to its employees so that the business does not face undue reputational risks.

It may not be too demanding to ask Islamic banks to start spending on character-building of their customers and clients. There are well-established credit scorecards that banks (including Islamic banks) use to assess credit worthiness of their customers. Similarly, character scorecardscan easily be developed to assess morality of their customers. In the beginning, the proposed character scorecards may be based on the voluntarily provided information by their employees and customers, which can be further developed and refined with the availability of more detailed data.

“THERE IS NO CONFLICT BETWEEN THE ISLAMIC LAW AND MORALITY; THE FORMER MERELY FORMALISES THE LATTER.”

This is not a far-fetched idea, as the government of China has already embarked upon such a project3 to develop a social credit score, which will be based on all the actions and activities of the companies and individuals, stored in a central place. Based on the social credit scores, the individuals and businesses will be given certain concessions or will face restrictions if their score falls short of a threshold. Credit scoring companies like Experian have credit files of all the individuals (who are listed on the national voters list) in the UK. The proposal here can be seen as an extension of the practice to include social behaviour.

As such social credit scores are not available at present, CSR-related activities of corporate clients of Islamic banks should be taken as preliminary indicators of good behaviour, and hence they should be positively discriminated. The inclusion of positive screens in addition to negative screens in Islamic asset management is a relevant trend in this respect.

Islamic banks should also start investing in a character scorecard similar to the proposed Chinese social credit card, which could be based on certain social, moral, and economic factors. For example, if someone is found to be involved in domestic violence, that person could be denied access to financial services offered by Islamic banks. In the beginning, it will be difficult to collect and collate data on customers, but it should be relatively easier to have such information on the employees of Islamic banks. Hence, a good start will be to develop the system for employees of Islamic banks, later extending it to customers.

Some people may opine that this will amount to Big Brother watching you all the time, which goes against civil liberties and individual freedom. This is certainly a valid argument. However, in this world of big data analytics, we are all being watched all the time in one way or the other. Smartphones and social media platform continuously collect and store data on their users and customers. Credit card companies have detailed information on their cardholders and can very easily analyze their spending behaviour.

Obviously, a comprehensive character scorecard can only be developed with the help of government bodies and other big market players. The national citizenship registration authorities have data on all the individuals living in a country and through IT systems each and every individual is assigned a unique registration number. More data can be stitched around these unique registration numbers to develop a character scorecard.

Without suggesting to have an open-ended all-encompassing character score system, we suggest that it should initially be based on five pillars:

- Financial integrity

- Personal morality

- Social behaviour

- Commitment to Islamic banking and finance

- Adherence to Shari’a

Financial integrity can easily be quantified by looking into the factors like involvement in fraud, tax evasion, and wilful default etc. Personal morality should be based on whether the person has lied in the past, is involved in child labor (e.g., whether the person employs a child as a domestic worker), has been proven to be involved in domestic violence, and the related factors. Social behaviour should refer to contribution to charitable and good causes, involvement in promotion of civic services, and voluntary services like lollypop man services (or what is otherwise known as crossing guide services), etc. Commitment to Islamic banking and finance may be gauged by looking into multiple accounts (with Islamic and conventional banks), attitude towards the prohibition of interest, and the general perception of Islamic banking and finance the person may have, etc. Adherence to Shari’a is perhaps the most controversial from a secular viewpoint, and the Islamic banks must take extra care to incorporate it in the proposed character scoring. It is recommended that the non-Muslims should not be discriminated against on the basis of Shari’a adherence.

“SOCIAL BEHAVIOUR SHOULD REFER TO CONTRIBUTION TO CHARITABLE AND GOOD CAUSES, INVOLVEMENT IN PROMOTION OF CIVIC SERVICES, AND VOLUNTARY SERVICES LIKE LOLLYPOP MAN SERVICES (OR WHAT IS OTHERWISE KNOWN AS CROSSING GUIDE SERVICES), ETC.”

In the beginning, the proposed character scoring system may not be perfect but it will evolve into something meaningful. Like Human Development Index (HDI), as developed by United Nations Development Programme (UNDP), was not all-encompassing in the beginning but over the years it has given birth to a number of other sub-in-dices that have incorporated human development more comprehensively. Similarly, the proposed character scoring will also improve with the passage of the time.

Why is the proposed character scoring system important and why Islamic banks should spearhead this initiative? It is important because it will be a market-led process to reform Islamic societies. All other efforts (political, religious and purely reform-based) have failed to bring social reforms in the Muslim world. With the IT revolution, it has for the first time become possible for the private sector to collect and collate information on individuals and corporates on various aspects of their lives and businesses. Hence, it is important for Islamic banks to come forward and play an important role in this respect. Access to finance is a basic need and there is huge emphasis being placed

on financial inclusion all over the world. Islamic banks, emerging as important players in the financial systems of the countries where they operate, are in the best position to induce the required changes in individual behaviour and through an aggregation pro- cess in the social thinking and practices.

Circulation of Wealth

The Islamic economic system also aims at spreading circulation of wealth among all strata of the society. The concentration of wealth is discouraged in the Quran. Although a number of economic tools can be used to reduce income and wealth disparities, the Quran clearly favours a system of charity and passionate lending. As mentioned earlier, in this respect, obligatory charity like zakat is the default requirement but other voluntary payments must also be incorporated in IBF to make it more socially responsible.

Elimination of Exploitation

Elimination of exploitation through tools like interest-free loans will make Islamic banks and financial institutions immensely popular amongst masses. For example, microfinance is in general perceived to be exploitative, and it will greatly help the cause of IBF if Islamic microfinance is developed on the basis of interest-free loans. Also, practices like Time Multiple Counter Value Loans (TMCVLs) should be adopted to make IBF more user-friendly and less prone to abuse and exploitation.

GIFR 2018 – Global Islamic Economic System and Islamic Finance

It is in the context of the above discussion that GIFR 2018 is dedicated to highlighting the role of Islamic economic system in the global scenario to the further development of IBF in the world.