It is widely agreed among the world’s Islamic finance community that Islamic finance is a global phenomenon. Not just in Muslim countries, but non-Muslim countries also find benefits in introducing Islamic finance into their financial markets. UK and Singapore are major examples. These countries mainly focus on their wholesale banking industry, to strengthen their global competitiveness and to better function as a hub for international finance.

Islamic finance is universal, with products and services intended to meet the needs of diverse communities. Having originated in Muslim countries, it spread quickly throughout the world, and institutions in most countries, have utilized Islamic finance products. Much more needs to be done, but there is no doubt that the spread of Islamic finance will continue.

In this chapter, we explore Islamic finance in Latin America, Russia, Bahrain, India and Indonesia: a cross-section of the industry, not only in terms of geography but also in terms of activity. Latin America remains an unchartered market but has much potential in adopting Islamic finance, both from a demand and supply side. The market in Russia has seen a little more activity, especially in federal subjects such as Tatarstan. The state remains cautious about all things Islamic, but with growing demand – and the strengthening Islamic financial markets in the GCC and the Far East – interest is likely to increase. The government in India, it appears, is far more ambivalent about Islamic finance in the country even though there are over 175 million Muslims (The Economist). India’s example shows that even with a large Muslim population, there is no guarantee that Islamic finance will prosper. A lot has to do with government support. In this regard, Bahrain has been at the forefront of developing the global Islamic finance industry but has recently taken something of a backseat as countries like Malaysia and Saudi Arabia build their Islamic finance capacity. Indonesia, on the hand, is a growing Islamic financial market. With government support strong, and containing the highest number of Muslims, Indonesia is likely to be a foremost player in the global Islamic financial market. These five markets are in different stages, but they are all dynamic markets and offer lessons to other nations seeking to build their own Islamic financial capacity.

LATIN AMERICA

Introduction

Latin America tends to be regarded as an outsider to the global Islamic financial markets. The Muslim population in this region is a minority as seen in Table 1, making the continent a virtual blank canvas for Islamic finance. However, there is a growing belief that many Latin American countries provide the perfect market for Islamic finance. Many industry observers believe Latin American countries have the essentials to issue sukuk. Best RE, a retakaful subsidiary of Salama, a Dubai-based Takaful conglomerate, expressed its interest to step into Latin America in the next few years. The general manager feels Brazil would be one of the major targets. Finally, a number of training providers in Islamic finance have shown interest in launching training services in the region. These examples show that there is an interest to expand Islamic financial services into Latin America.

| Country | Estimated Muslim (‘000) | % of the total |

| Argentina | 784 | 1.9 |

| Brazil | 191 | 0.1 |

| Mexico | 110 | 0.1 |

| Venezuela | 94 | 0.3 |

| Suriname | 83 | 15.9 |

| Trinidad & Tobago | 78 | 5.8 |

| Guyana | 55 | 7.2 |

| Panama | 24 | 0.7 |

| USA | 2,454 | 0.8 |

| Canada | 657 | 2.0 |

| Total of Americas | 4,596 | 0.5 |

Brazil’s Experience and Potential

On the demand side, there is also interest. In 2000, Chase Manhattan Bank and Saudi National Commercial Bank arranged a one-year USD50 million Islamic syndicated financing facility. This was intended to finance the import of oil from the Gulf region, mainly the Kingdom of Saudi Arabia. A subsidiary, Petrobras International Finance Company, used an Islamic note programme for their funding in the same year. One of the most apparent and promising fields on the Islamic finance landscape in Latin America is financing related to the halal food industry, especially poultry exporters in the region (Table 2). Brazil exports a tremendous amount of chicken to the rest of the world, part of which is produced as halal. Producers of halal foods export products to overseas Muslim buyers using Shari’a-compliant financing, typically a Murabaha. The local financier has the incentive to provide finance in a faith-based way to attract its Muslim customer base abroad.

| (‘000 ton) | 2007 | 2008 | 2009 | 2010 | 2011 |

| Brazil | 2,992 | 3,242 | 2,992 | 3,181 | 3,310 |

| USA | 2,678 | 3,157 | 3,093 | 3,072 | 2,971 |

| EU | 635 | 742 | 783 | 992 | 940 |

| Thailand | 296 | 383 | 379 | 432 | 475 |

| China | 358 | 285 | 291 | 379 | 440 |

| Argentina | 125 | 164 | 178 | 214 | 250 |

| Canada | 139 | 152 | 147 | 147 | 155 |

| Chili | 39 | 63 | 87 | 79 | 80 |

| Kuwait | 60 | 70 | 70 | 70 | 70 |

| Ukraine | 6 | 8 | 19 | 33 | 35 |

| Australia | 25 | 27 | 30 | 26 | 30 |

| Others | 98 | 120 | 144 | 168 | 157 |

| Total | 7,381 | 8,413 | 8,213 | 8,793 | 8,913 |

Introducing the Latin America model

Latin American countries can create a new model of Islamic finance development in non-Muslim countries. To date, most non-Muslim countries that have adopted Islamic finance have concentrated on the financial markets: creating Islamic financial products to bring in the Shari’a sensitive investor. However, given the importance of exporting halal meat in Brazil, this new model can tie trade with finance. Hence, there is almost a blank canvas from which Islamic financial players can formulate a more trade-based model.

The push for Islamic finance in Latin America has to be investor-led. In February 2012, Almarai Company, the Saudi dairy corporation, acquired stakes in Fondomente Argentina SA, with Islamic and conventional financing. Apparently, the Shari’a compliant portion was due to the investor, as there was no reason for the Argentinean entity to go Islamic. Latin America is also one of the most active destinations for microfinance. According to data from the Microfinance Information Exchange (MIX), the region accounts for 39% of the world’s microfinance assets and is ranked at the top, followed by Eastern Europe, East Asia, South Asia, Africa and MENA. As a matter of course, the call for being Shari’a compliant should come from the side of Muslim investors to local microfinance companies, not from that of the local borrowers given that the continent does not have a substantial Muslim population as shown in Table 1.

Implications of the Latin American Model

If we take a more careful look at financial demands in the region, the Latin American model, or more specifically Brazil, is characterised by huge financial demands for

(1) export of agricultural products, (2) export of natural recourses such as gold, iron, copper, rubber, timber and coffee beans, and (3) investment in infrastructure projects on the continent.

The Latin American model has analogues elsewhere. The above three aspects can be applied to Australia. It too is a major exporter of agricultural products, rich in natural resources and has huge infrastructure demands. In this sense, building up a classification of the Latin America model, as a sub-set of the non-Muslim model, has a precedent. Australia, with a Muslim population ratio of less than 2% of the total, is already active in incorporating Islamic finance into its system. There are several Islamic financial institutions, including local community banks, offering services. Kuwait Finance House has an Australian subsidiary as an investment arm for local projects. The local banking giant Westpac includes Shari’a-compliant services in their product suites. Not only the private sector, but the government is positive. AUSTRADE, the government arm of promoting cross-border trade and investment, published an official report on Islamic finance. The report picks up some promising areas for Islamic finance in the country: agriculture, mineral resources (iron ore, uranium, nickel, etc) and infrastructure. They are exactly the same as that of Latin America.

Given this similarity, Latin American countries can learn from Australia’s policy measures if they intend to introduce Islamic finance into their jurisdictions. For instance, in Australia, a group of local finance experts, the Australian Financial Center Forum, under the government’s initiative published a report titled “Australia as a Financial Centre – Building on Our Strengths”. They proposed in the report that taxation and regulatory frameworks should be amended, if necessary, to accommodate Islamic finance transactions. Governments of Latin American nations can follow these steps, given that economic conditions are similar.

Closer ties between Latin America and the Gulf

With the globalization of economic and financial activities reducing communication barriers, Latin American countries are getting closer to Islamic countries. The recently-signed economic agreement between Peru and the GCC countries on economic, commercial, investment and technical cooperation is a very good example. It was developed by the bi-regional cooperation mechanism called ASPA, the Summit of South American and Arab countries (in Spanish, umbre América del Sur-Países Árabes, and in Portuguese, Cúpula América do Sul- Países Árabes). The conflation of food security issues in GCC and conditions for agriculture in Latin America is one of the big reasons for this mechanism. The initiation of comprehensive cooperation is likely to result in a more diversified outcome, including collaboration in Islamic finance.

Outlook

Looking ahead, Islamic finance is likely to develop differently in each Latin American nation. Typically, corporate financing, such as trade finance (mainly for agricultural and resource products) and infrastructure and other investments from Islamic countries are possibilities. Some countries may issue sukuk to attract Muslim investors. Others may want to welcome Islamic microfinance companies to alleviate poverty using Islamic funds. Furthermore, even retail products can be sold in a country like Suriname, the only Islamic country and member of the Organization for Islamic Cooperation (OIC) on the Latin American continent. If there are signs of growth, ancillary services for Islamic finance, such as education, law and tax, can also be expected. The region can never be a virtually blank area as described in the beginning of this paper.

BAHRAIN

Bahrain has an established reputation as one of the global hubs for Islamic finance and has played a key role in its development. Although the initial development of Shari’a-compliant finance in the 1960s took place outside of the Gulf region, the subsequent oil boom in the 1970s quickly began to change this. Following the establishment of the Jeddah-based multilateral organization, the Islamic Development Bank in 1975, Bahrain Islamic Bank, set up in 1978-9, became the second commercial institution in the region providing Islamic finance (after Dubai Islamic Bank which began operations in 1975).

The further expansion of the sector capitalized on Bahrain’s position as a leading regional financial hub. Faisal Islamic Bank, subsequently renamed Shamil Bank (and eventually absorbed by Ithmaar Bank in 2010) was set up in 1982. Faisal Bank was, among other things, a pioneer of Islamic syndicated finance which it first introduced in 1987. Al Baraka Islamic Bank began operations in 1983 and has been instrumental in fostering the spread of Islamic finance to other jurisdictions through its subsidiaries in Turkey and Egypt. By 1994, Bahrain was home to five Islamic banks and one off-shore entity. Renewed growth followed during the past decade thanks to the liquidity boom created by rising oil prices. By 2007, Bahrain hosted 27 Islamic banks and 13 takaful companies.

The growth of Islamic finance in Bahrain has benefited from the proactive role of the Central Bank of Bahrain (CBB) (known in 1973-2006 as the Bahrain Monetary Agency), and the existence of multilateral Islamic infrastructure institutions, including the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), The International Islamic Financial Market (IIFM) and the Liquidity Management Center (LMC) as well as a wider array of ancillary financial services.

Industry landscape

Bahrain has historically been the dominant hub of Shari’a-compliant finance in the Gulf region and the number of GCC Islamic financial institutions domiciled in the Kingdom peaked at as much as two-thirds of the regional total. This erstwhile dominance has been challenged somewhat by the growing maturity of Shari’a-compliant finance elsewhere in the region due to new investments and regulatory initiatives. For instance, Oman in 2011 became the last GCC member state to formally authorize Islamic banking. In spite of the more contested landscape, however, Bahraini Islamic financial institutions have continued to perform well, both in relation to their conventional counterparts and in absolute terms. As of December 2012, Bahrain had 26 Islamic bank licenses, seven takaful companies, and two re-takaful firms. Industry consolidation is clearly underway as the sector evolves and develops, especially in the area of banking where

some of the smaller players are joining forces or merging with bigger institutions. Ithmaar Bank last year announced its merger with First Leasing Bank. January 2012 saw the announcement of a three-way merger between Elaf Bank, Capital Management House, and Capinvest to create an international group with assets in excess of USD400 million.

Apart from purely Islamic banks, a number of conventional banks offer Shari’a-compliant products through Islamic windows. Some international banking groups have used Bahrain as the main hub for developing their Islamic product offering. The CBB was the first regulator globally to permit Islamic windows by conventional institutions. As a result of industry consolidation, the number of Shari’a-compliant banks as of January 2013 was 24: six retail banks and 18 wholesale banks.

Islamic finance remains one of the most dynamic areas in the Bahraini financial services sector, reflecting both the growing maturity of the sector in terms of its product offerings as well as the increasing popularity of Shari’a-compliant financial solutions. The consolidated assets of Bahrain-domiciled Islamic banks rose from USD1.9 billion in 2000 to USD25.5 billion in October 2012. As a result of this rapid growth, their share of total banking assets increased from 1.8% to 13.5% over the same time period.

The growth of Islamic banking assets has fairly consistently outpaced conventional bank asset growth, a discrepancy that was particularly pronounced in connection with the onset of the global financial crisis in 2008. Before the global crisis, Islamic banks exhibited extremely high growth rates of around 30%-50% between 2004 and 2008. Since 2010, however, Islamic banks have felt the effects of the regional housing and equity market corrections, reflecting the challenges they still often face in terms of diversifying their asset portfolios. Nonetheless, Islamic institutions have been far more resilient than their conventional counterparts, partly due to their lower leverage levels and lesser reliance on complex products.

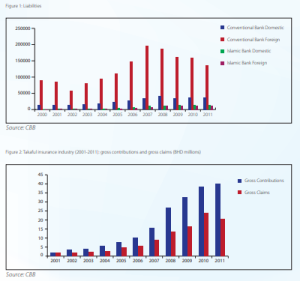

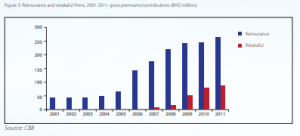

In contrast to conventional banks, most liabilities of Bahraini Islamic banks are domestic (Figure 1). Alongside Islamic banks, cooperative takaful providers play an important role in the financial sector due to their growing importance in insurance provision, something that reflects Bahrain’s broader stature as a regional insurance centre. The average annual growth rate of the local takaful sector over the past decade was 35.7%, with gross contributions standing at BHD40.2 million in 2011, compared to BHD1.9 million in 2001. Takaful’s share of total gross written premiums/contributions has expanded more than six-fold from 3% in 2001 to 19% in 2011 (Figure 2).

Gross premiums of the reinsurance and retakaful industries in Bahrain increased from BHD181 million in 2007 (when the first takaful company was established) to BHD349.5 million in 2011, exhibiting a growth of 147% over the four-year period. The premiums of the country’s two retakaful companies have increased 15-fold, from BHD5.7 million to BHD 86 million. The retakaful providers held some 25% of the total reinsurance and retakaful premiums in the last two years. Gross retakaful and reinsurance claims reached BHD272.8 million following 261% growth in 2001-2011 (Figure 3). has been driven by the Bahrain Monetary Agency/ Central Bank of Bahrain which was a global pioneer in regularly issuing sukuk starting in 2001, primarily for the purpose of providing Islamic financial institutions with quality liquidity management tools. The first BMA sukuk al salam was issued in June 2001. It was a three-month bill initially issued with a monthly volume of USD25 million with the underlying al-salam contracts based on aluminium. The first five-year USD100 million government sukuk al ijara was issued in August 2001, the first of its kind by any central bank in the world. In 2002,

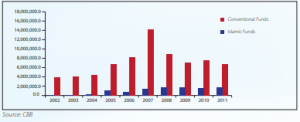

Other Islamic financial institutions in the country include one rating agency, two financing companies, one microfinance bank, and one credit card company. In addition, Bahrain is home to Islamic investment firms and Islamic funds. Overall, Bahrain’s mutual fund’s industry has more than USD 9 billion in assets. Islamic funds domiciled in Bahrain numbered 101 of the total of 2,838 and had combined assets of USD1.7 billion as of 2011, which compared to just under USD1.6 billion in 2010. Shari’a-compliant vehicles accounted for around 20% of total fund investments in 2011, up sharply from a mere 3% in 2002 (Figure 4).

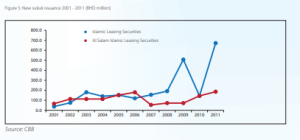

the government issued a USD70 million, three-year ijara sukuk. The CBB now issues sukuk al ijara regularly with a six-month tenor. The total new CBB sukuk issuance in 2011 reached BHD858 million (Figure 5).

The CBB also arranges sukuk issuances for the Government of Bahrain. The government most recently issued a seven-year USD750 million sukuk in November 2011. Much of the longer-term issuance over the years has also been listed on the Bahrain Stock Exchange (Bahrain Bourse).

Islamic capital markets

Bahrain has been a regional pioneer in developing Shari’a-compliant capital market products. The process

Central Bank of Bahrain

Since its establishment in 1973, the CBB has actively promoted Bahrain as an international financial centre

It has, similarly, been a key enabler of Islamic finance through regulatory initiatives and the development of new products and market infrastructure. It provides guidance to the industry through ongoing consultations with various stakeholders and research. In many cases, its initiatives have marked world firsts. For instance in 2001, Bahrain became the first country in the world to develop and implement regulations specifically for Islamic banking through the CBB’s comprehensive Prudential Information and Regulatory Framework for Islamic Banks. The implementation of this regulatory framework began in 2002 and it has been repeatedly updated. CBB regulation has sought to equalize the operating environment facing conventional and Islamic banks. Also, the takaful/retakaful rulebooks, approved in 2005, provided the first comprehensive regulatory framework in the international Islamic finance industry. Bahrain’s Collective Investment Undertakings regulations provide for the establishment of Shari’a-compliant funds. The CBB has actively supported the standardization of products and practices in the industry by supporting and working with various standard-setting bodies in the sector (see below), in many cases formally mandating their recommendations.

Apart from its role as a proactive regulator, the CBB in 2006 established a dedicated fund – the Waqf Fund – to support research as well as education and training in Islamic finance. The fund was created with the participation of the leading Islamic banks in the Kingdom. The fund currently has 21 member institutions. The fund spends its returns on a number of training, education, and research initiatives. These include a Graduate Sponsorship Program established in 2011 which funds a six-month diploma program for 25 graduates every year. Training programs include a Shari’a Reviewer Development Program and an Advanced Diploma in Islamic Commercial Jurisprudence. In addition, an Islamic Banking Ethics for Bankers course is under preparation.

The Waqf Fund supports the Bahrain Institute of Banking and Finance in upgrading its programs for Shari’a financial professionals, arranges occasional roundtable discussions among industry participants and Shari’a scholars on topics of importance, and has also organised a number of corporate governance workshops for industry professionals. The CBB is also an active sponsor of industry events and conferences.

Infrastructure institutions

As mentioned above, Bahrain is home to a number of important multilateral institutions supporting the development of Shari’a-compliant finance globally. These entities typically came into being as a result of joint initiatives involving national regulators and the Islamic Development Bank. The first one of these was the Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) which was established in 1990 and began operations in Bahrain the following year. The main objective of the organization was to establish accounting and Shari’a standards for Islamic institutions. The CBB was the first central bank to make the AAOIFI standards mandatory within its jurisdiction. At present, seven Middle Eastern jurisdictions have adopted the AAOIFI standards while six others, most of them outside of the region, have issued guidelines based on them. The organization has prepared 26 accounting standards, five auditing standards, seven governance standards, two ethical standards, and 45 Shari’a standards. 18 new standards are currently under preparation.

The International Islamic Financial Market (IIFM) was established in November 2001 to create a structured global financial market and to foster cooperation among Islamic countries and financial institutions. Specifically, the IIFM has sought to foster the development and self-regulation of Islamic capital and money markets. It has been a key player in developing standardized structures and contracts for Islamic capital markets while improving products and market infrastructure. Current initiatives include further work to build on existing efforts to develop frameworks for Islamic hedging, master agreements for Islamic treasury murabaha contracts, and a framework for a secondary market for sukuk and other Islamic instruments. The IIFM works with market participants ranging from regulators to financial firms, lawyers, stock exchange, industry bodies, and other service providers through working groups and committees which are open to non-members as well.

Bahrain is further home to the Liquidity Management Center (LMC) which was set up in February 2002 with the objective of creating an active secondary market for the treasury management of Islamic banks. The centre seeks to facilitate the creation of an Islamic interbank money market which can enable Islamic financial institutions to manage their liquidity with ease and efficiency. The initial objective was to cut the reliance of Shari’a-compliant institutions on commodity murabaha transactions by creating a pool of liquid assets for Islamic financial institutions to trade in so as to manage their asset-liability mismatches. In order to develop longer-term assets for the industry to invest in, the LMC has operated as a sukuk arranger. It has further advised the CBB on the development of its sukuk program.

The Islamic International Rating Agency (IIRA) began operations in July 2005 following an IDB initiative. It is a leading provider of credit analysis and ratings on Shari’a-compliant products and institutions. The Fiduciary Rating System of the IIRA is based on recognizing the mutually dependent nature of credit and fiduciary risks in Islamic financial institutions. It is composed of a Credit Rating and Fiduciary Score. The Fiduciary Score seeks to accommodate the specific qualities of Islamic institutions as well as jurisdiction-specific variation in Shari’a standards. The score is based on Corporate and Shari’a Governance, Shari’a Compliance, and Asset Manager Quality. IIRA ratings are recognised by the Central Bank of Bahrain and the Islamic Development Bank. IIRA is supported by multilateral development institutions, financial service providers, and other rating agencies. Its shareholders are financial institutions representing 11 countries which are the primary focus jurisdictions of the agency.

The General Council for Islamic Banks and Financial Institutions was established in May 2001 by the Islamic Development Bank and a number of Shari’a-compliant financial institutions with 39 members participating in its initial session. It serves as a coordinating body for Shari’a-compliant financial institutions. It disseminates information about the sector through events and publications. It supports its members through a range of training programs, typically provided jointly with external partners. An example is the globally recognized Certified Islamic Bankers qualification launched in 2010. The General Council currently has 114 members, 48 of whom are observers.

In the area of financial education and training, the Bahrain Institute for Banking and Finance (BIBIF) is recognised as one of the regional leaders. The BIBF was founded in 1981 and now provides more than 300 programs in different areas. More than 18,000 people participated in BIBF programs in 2011, up from just over 6,000 in 2000. The institute has, among other things, played a key role in providing training and education programs in the area of Islamic finance. The BIBF works closely with a number of international partners provided internationally recognized qualifications from DePaul University and the University of Cambridge. Apart from training programs, the BIBF operates a Center of Assessment and Development as well as a Center for Research. The BIBF has been repeatedly recognised as the leading global training provider for Islamic finance and has received a number of other international awards.

The Shari’ah Review Bureau is a leading Shari’a advisor active in a number of Middle Eastern, North African, and Asian countries. The Bureau provides access to Shari’a experts, produces fatwas and offers structuring solutions.

Outlook

Bahrain clearly enjoys an important position in the evolving landscape of global Islamic finance and is increasingly being joined by other players in the region as they develop their own Islamic finance industries. At the same time, Islamic financial services in Bahrain are going through a process of consolidation and refocusing reflecting the challenges and opportunities created by the global financial crisis and the industry’s evolution. The end result of the process is likely to be a smaller number of more focused but stronger Shari’a-compliant service providers.

Bahrain will continue to play an important role as an innovator thanks to the concentration of a number of globally significant service providers and the growing global demand for better products and services. Innovation will continue to benefit from the presence of a proactive regulator committed to the development of the sector. Beyond this, the importance of Bahraini training and education institutions will likely remain particularly important at a time when Shari’a-compliance is taking shaping and experiencing the phase of rapid initial growth in a number of countries in North Africa, Asia, and elsewhere.

RUSSIA

Introduction

Interest in procuring Islamic financial products in Russia is constantly increasing but the potential is still underestimated. Given that many Muslims have no choice but to use the services of conventional banks, such potential has yet to be fully realized. Islamic finance attracts investors and businessmen, and while there is much discussion on the issue, the development of the market remains slow. There might be two reasons explaining the situation: either demand has not matured – people are not interested in the products thus requiring more marketing efforts from service providers – or suppliers do not meet the expectations of the Muslim population. Reasons can also be found in legislation, which is shaped for the conventional banking system, thus, though unintentionally, putting obstacles to the smooth operation of Islamic finance instruments. On the other hand, the market potential may in fact be very limited.

Despite the aforesaid, there were several highlights in 2012. In September 2011, AK BARS Bank executed the first USD60 million Murabaha transaction, syndication with foreign banks. In September 2012, the facility was successfully repaid. The bank is now aiming to renew and increase this facility.

The success of AK BARS illustrates that Islamic finance instruments have the capability of attracting funds for medium and large-size projects. In this regard, there are real business opportunities within this sector that needs to be capitalized upon.

The retail market

Muslims in Russia are increasingly bringing Shari’a values to their day-to-day lives, although within parameters permitted by Russian law. Bankers are acknowledging the importance of religion in determining choices, and are offering Shari’a-compliant products to the retail market.

Ellips Bank, the regional bank with its head office located in Nizhny Novgorod, opened its Islamic branch, Vostok Capital in Ufa, another major Russian city recognised by Forbes as the second most attractive city for investment. Ufa is the capital of Bashkortostan, a major Muslim region in Russia, along with Dagestan and Tatarstan.

Vostok Capital offers its clients ijara, mudaraba and card-based products. The client base is growing, currently below a thousand customers, but the bank itself considers this positive given the general status of Islamic finance in Russia. The bank also provides clients with the standard number of banking services in Russia: money transfer, sale of precious metals and gold/silver coins, salary cards, etc.

The paucity of products on offer is in large part due to the fact that not all Shari’a contracts can be executed by commercial banks in Russia as certain requirements of these contracts come into collision with Russian banking legislation. For instance, musharaka contracts assume that the bank acts as the co-investor. The bank has to buy a part of the business. One of the most important characteristics of each bank is the size of the equity capital. According to the Regulations of the Bank of Russia No. 215: “About the Methodology for the Evaluation of the Equity Funds (capital) in Credit Companies”, the equity capital of the bank is to be diminished by the number of funds which have been invested by the bank in the equity capital of subsidiaries or affiliated companies (in the case where the bank holds at least 20% of the equity capital of such a company). This means that it is not efficient, or cost-effective, for banks to massively invest in the projects which leads to the diminishment of the equity capital of the bank itself. In Islamic finance institutions, most of the funds are deposited under mudaraba or Wadia structures. Mudaraba cannot be classified as a deposit under Russian law and Wadia-based agreements guarantee the refund of the deposit but it doesn’t guarantee the interest. According to Russian banking rules, the deposit agreement is to guarantee the refund and the interest. The mudaraba agreement does not guarantee reimbursement. As Russian Muslim depositors have gotten used to the banking system with guaranteed principles and interest, they do not want to take this risk even in the case where the risk is justified by the Shari’a.

The ijara-based product, offered by Ellips Bank, attracted the attention of borrowers looking to purchase vehicles. Here the bank has faced some difficulties related to central bank rules. Among them, a high number of movables (i.e. cars) itemized on accounts, a situation which is not standard for Russian banks. The bank will have to create an SPV to transfer the physical property in order to offer this product.

Notwithstanding these facts, the bank itself has an optimistic view of business growth. Knowledge of the bank is spreading throughout the city of Ufa with more Muslims showing interest in the bank’s products and services. On the back of this, Vostok Capital plans to launch a Murabaha-based product soon. Moreover, the bank aims to open new offices in other cities of Russia including Moscow.

It is worth mentioning that the employees of the bank take part in advancing the idea of Islamic finance among students, workers and businessmen. They speak at seminars where Muslims can receive basic knowledge of the principles of Islamic finance. Chief executives of Vostok Capital also manage a popular online social network service in Russia in order to get feedback on the quality of services and inform (potential) clients on new offers and products.

In 2012, Lariba Finance (“Lariba”) was incorporated in Dagestan. The limited partnership structure, which is analogous to the mudaraba, allows general partners to receive funds from limited partners and provide Muslims with halal funds. The project quickly gained credence in the community. One of the major factors for this is the fact that the monetary contribution of limited partners was guaranteed by the largest bank in the region, Express Bank, which itself had intended to open an Islamic window, but strict banking rules prevent the attainment of this goal.

Lariba has been working without any external funding. With about 30 limited partners acting as depositors, Lariba has been able to provide nearly 200 clients with funds. The return on the capital invested by some major limited partners reached 18% in 2012.

The central product for Lariba is the mudaraba. Each client may become a limited partner and contribute to the capital of the partnership. Remuneration is paid on a monthly basis depending on Lariba’s investment activities, the time of the deposit and the deposit amount. Earnings could reach 30%.

In a murabaha transaction, Lariba acquires the asset and sells it to the client at the initial price plus a margin. The company which acquires the asset becomes the legal owner of it. The amount stated in the contract cannot be changed upward (in case of late debt repayment) or downward (in case of early payment).

Solvency is secured by the assets which are received from the borrowers as pledges. According to Russian banking rules, individual savings in banks are insured by the Russian Federation subject to the depositor bank being a participant of the federal program on savings insurance. The amount of guaranteed savings to be refunded by the State cannot exceed RUB700,000 (USD23,400). By taking the borrower’s property as a pledge, limited partners have more security.

In addition to financial services, Lariba also provides its clients with accounting and consulting services. This is useful as limited partnerships, as a form of incorporation, are not that popular in Russia. General partners are held fully and jointly liable by their own property for all the debts of the limited partnership owed to the creditors, a feature that can be a burden for the business. Most businesses in Russia use another form of incorporation, a limited liability company, which is flexible, and simple and limits investor liability by the amount of their investment.

Lariba is a step in the right direction for Islamic finance in Russia, but there are several obstacles confronting the organisation. First, the absence of rules and regulations aimed specifically at Islamic finance. Secondly, there is an absence of qualified professionals who would be able to advise on complex transactions. Thirdly, there is a lack of knowledge on how the Islamic model of economics should work. Finally, there is still suspicion from state institutions about activities related to Islam.

The insurance market

In 2012, ISK Euro-Policy commenced the sale of Shari’a-compliant insurance policies in Kazan, the capital of Tatarstan, one of the brightest Islamic centres in Russia with a high ethnic Muslim population.

ISK Euro-Policy offers a limited number of products (in comparison with conventional insurance companies): comprehensive motor cover, world travellers insurance and property insurance (for both individuals and companies). The insurance company is expected to receive a license to provide obligatory motor insurance to customers soon. It has already insured the cathedral mosque of Kazan, Al-Marjani – the oldest mosque of Kazan built circa 1770.

ISK Euro-Policy plans to sell at least 150 insurance policies in a city with over a million inhabitants. This is quite a low amount, but with a lack of insurance products on offer, choice is limited. Nevertheless, the company does have an optimistic view on the future of takaful in Russia, although insurance rules and standards impose limitations on the use of insurance funds for investment. In some circumstances, insurance funds may be invested in non-Shari’a-compliant activities. Shari’a also limits the use of takaful fund resources.

The incentives of local authorities

A proposal for SmartCity, a large, ambitious project to develop a business suburb in Kazan, Tatarstan, was presented to the President of Tatarstan in July 2012, and upon approval has been successfully promoted among investors. SmartCity is aimed at the creation of a regional and international business hub in Tatarstan, as well as a major exhibition and conference centre. Islamic financial instruments are going to be one of the major sources of financing for this project. The project has significant Malaysian participation: AJM Planning and Urban Design Group and Amanah Capital Group have been involved. The project is supported by governmental bodies, Tatarstan Investment Development Agency and JSC Tatarstan Development Corporation.

Outlook

As demonstrated by developments in 2012, Russian financial institutions, businesses, government agencies and the general population have become more involved in Islamic finance projects. Major restrictions in the development of Islamic finance are to be found in banking and insurance rules and standards. However, these restrictions are justified by the intention of the authorities to minimise possible fraud in the conventional banking system of Russia. The system itself was established only in the 1990s so it has not had enough time to fully develop.

Further progress of the Islamic finance industry in Russia requires a) assistance and advice to businesses willing to be involved in Shari’a-compliant activities; b) knowledge dissemination; c) efficient cooperation with investment banks and funds prepared to invest in projects; and d) choice of efficient instruments for attractive investment projects, ready to structure in a Shari’a compliant way. In any case, the Islamic finance sector can grow from stand-alone deals into a niche market, potentially available to a larger number of domestic businesses.

Following the success of Islamic windows in Kazan and Ufa, it is expected that in 2013 we will see the opening of Islamic windows in Moscow. Within Russia, it is reasonable to expect that not only Tatarstan and Bashkortostan, but other Russian regions, including non-Muslim parts of Russia, will become more involved in Islamic finance projects.

Two local banks in Tatarstan, among which is Tatagroprombank, announced Islamic finance programs. Tatagroprombank is implementing trade finance products. Another Tatartain bank intends to execute an Islamic finance program worth USD 100 million. The program is focused on financing local Shari’a-compliant projects with the use of Islamic finance instruments. Following Russia’s accession in 2012 into the WTO, the Russian market will become more open for foreign products and services, so more halal products and services may be imported. Banking restrictions are expected to be changed. Overall, the Russian business community and retail customers will receive access to a larger volume of products and services, while foreign players will become more active in the Russian market. This bodes well for Islamic finance in the country.

INDIA

Introduction

In recent years, India has emerged as a prominent economy. At present it is the 10th largest economy in terms of size, and in terms of purchasing power parity (PPP) India has become the 3rd largest economy after the USA and China. A BRIC Report has projected India to become the world’s largest economy by the first half of this century. Since the launch of full-fledged economic reforms in the early 1990s, there has been enormous change in the Indian financial market, and it has now become more transparent and investor friendly. Regulators of the financial market – the Reserve Bank of India (RBI), Security Exchange Board of India (SEBI), and Insurance Regulatory and Development Authority (IRDA) – have worked in tandem to bring discipline and transparency to the working of Indian financial institutions and products. The country’s legal system has proven robust in checking any aberrations. The financial market has deepened and foreign investors have shown confidence in the Indian market.

However, one area where India is still considered a laggard and not without reason- is the area of Islamic banking and finance. Many believe India to be the birthplace of modern-day Islamic economic thinking, and considering the huge numbers of Muslim citizens, India should have been a leading destination for Islamic finance. But owing to rigid banking laws in the country, Islamic banking and finance have not really picked up the pace. Among the three major regulators, mentioned above, only SEBI (the capital markets regulator) has shown commitment and resilience to allow Shari’a-compliant products in the country. There are some other positive developments which are covered in this brief report.

Notwithstanding this, the future of Islamic finance in India is highly promising primarily owing to the direction in which the Indian economy is heading and the growing number of Muslim youngsters who have been asserting their preference for Shari’a-compliant products. Today we see many Shari’a-compliant products in the Indian market although the quality and quantity require improvement.

Islamic mutual funds

A mutual fund is a capital market product and provides retail investors avenues to deploy their funds in an interest-free manner. Under this category, the fund is invested in Shari’a-compliant equities. This provides an alternative to retail investors who do not wish to save their money with a conventional bank. At present, there are two Shari’a-compliant investment schemes launched by mainstream capital market players. Both are hundred per cent equity-based investment schemes.

- Tata Ethical Fund

TATA Ethical Fund is India’s first Shari’a-compliant mutual fund scheme launched in 1996. The scheme is an open-ended equity fund with a mandate to invest only in Shari’a-compliant stocks. The scheme has two variants (growth and dividend); presently the size of the fund is Rs110 crore (USD23 million) which has grown with a CAGR of 9.54% over a period of five years 2008 to 2012 (Figures 6 and 7).

- Taurus Ethical Fund

This is India’s second Shari’a-compliant mutual fund scheme launched in April 2009. The scheme has three variants: Growth, Bonus and Dividend. This is also an open-ended equity-oriented scheme which invests only in Shari’a-compliant stocks. The present size of the asset under management is Rs25 crore (USD 4.6 million). The AUM from 2009 to 2012 has grown with a CAGR of 20.63%. The scheme offered a return of approximately 99% in the year 2009 which declined to approximately 12% in the year 2012.

Takaful and retakaful

Formally, the Islamic insurance market is not open in India as yet. According to IRDA regulation, an insurance scheme must offer insurance cover (Shari’a is non-compliant at the moment) and also offer guaranteed returns. This is a recent change in regulation after a spat between the two regulators (SEBI and IRDA) over regulating certain types of products. The new changes were brought to distinguish insurance activities from purely investment activities. The new IRDA regulation to offer guaranteed returns to the insured makes it compulsory to invest (at least a portion) in fixed-income securities.

- Pure Stock Pension Plan (PSPEN)

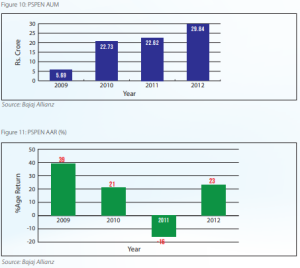

This was India’s first Shari’a-compliant pension scheme launched by Bajaj Allianz in 2009. The scheme was launched a year before new IRDA regulations came into force. Since the new regulation was not implemented retrospectively, the scheme continued after the regulation for existing investors. However, the scheme cannot invite new customers without compromising on Shari’a compliance (since premiums collected from new customers were required to be invested in debt securities). Though Bajaj Allianz under the PSPEN scheme cannot add new customers, they have efficiently managed the funds of existing customers. The AUM of PSPEN in 2009 was Rs5.69 crore (USD1.04 million), and in 2010 it reached to Rs20.73 crore (USD3.81 million), an increase of 264%. After the new IRDA regulation, the fund only managed to grow to Rs22.62 crore (USD 4.17 million)in 2011. Since its launch in 2009, and over the period of four years, AUM has grown with a CAGR of 51.33%. (Figures 10 and 11)

- GIC Retakaful

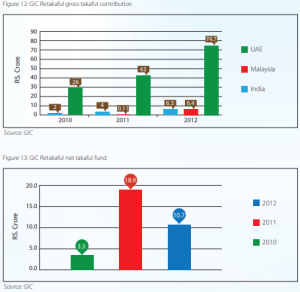

The General Insurance Corporation of India (GIC) is an Indian government-owned reinsurance company. To capture the takaful market in the Middle East, GIC introduced a retakaful scheme. The scheme was launched in 2009 and since then it has achieved decent growth. GIC Retakaful has been extended to South East Asian countries. Contribution collected from the UAE forms the major portion of the total premium collected. The average percentage of contribution collected from the UAE to the total contribution is 87.8%. Data shows that GIC’s market base is strongly growing in Malaysia. The contribution collected from Malaysia in 2011 was Rs0.11 crore (USD20,200) which increased to Rs6.5 crore (USD1.2 million) in 2012. The net takaful fund (after meeting claims) increased 5.4 times from 2010 to 2011. In 2011, claims were high which led to reductions in the fund (Figures 12 and 13).

Commodity markets

Commodity marketsThe National Spot Exchange Ltd (NSEL) is a commodity exchange for spot trading of bullion and agricultural commodities. In 2010, they introduced a series of innovative products called E-series. The first products launched under the E-series categories were E-Gold, E-Silver and E-Copper. Later, E-Zinc, E-Lead, E-Nickel and, recently, E-platinum were added. These E-series products are certified by the Indian-based Shari’a advisory firm, TASIS. These E-series products enable even small investors to invest and keep their holding in demat form. The equivalent amount of each E-series product’s unit (traded in the market) is stored in the vault of NSEL in physical form. The vault is regularly inspected by TASIS to assure Shari’a compliance. Investors are also provided with the option to take physical delivery of the E-series products.

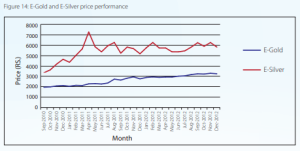

If we analyze the performance of the bullion (E-Gold, E-Silver), they have provided healthy returns to their investors over a period of time. E-Gold, over the period of three years, has given an average return of 17.8% per annum, whereas E-Silver has given an average return of 20.05% per annum over the same period. (Figures 14 and 15).

Venture capital

- Secura India Real Estate Fund Domestic Scheme 1

Secura India Real Estate Fund (Domestic Scheme 1) is the first Shari’a-compliant real estate scheme in India which is approved by SEBI as a venture capital fund. The funds raised have been invested in potential real estate projects and now the scheme has matured with an 18% return to its investors. Immediately upon the successful completion of Scheme 1, Secura announced the launch of Scheme 2.

- Cheraman Premium Fund 1

This is India’s second Shari’a-compliant venture capital fund launched by the Kerala government and promoted by Al-Barakah Financial Services Ltd (a subsidiary company of Kerala State Industrial Development Corporation, KSIDC). The fund is initially targeting Rs250 crore (USD46 million) with a green shoe option of another Rs50 crore(USD 9.21 million). Another unique feature of this fund is that it will develop idle waqf properties in the state on the basis of musharaka.

| PRODUCTS | ABSOLUTE ANNUAL RETURN (%) | RETURN SINCE LAUNCH | ||

| 2010 | 2011 | 2012 | ||

| E-Gold | 8.30 | 30.36 | 14.76 | 65.62 |

| E-Silver | 38.34 | 11.30 | 10.51 | 72.06 |

| E-Platinum | 5.50 | 5.50 | ||

| E-Copper | 18.17 | -9.33 | 5.37 | 13.22 |

| E-Zinc | -9.48 | 8.89 | -1.43 | |

| E-Nickel | -14.23 | -14.23 | ||

| E-Lead | -11.62 | 14.33 | 1.04 |

Conclusion

In this brief exposition of the Indian Islamic finance market, one can see that there is activity in the market, in a number of different sectors. We have concentrated primarily on commercial markets, leaving aside the retail sector which has yet to experience a significant boost. However, just as in the UK, by focusing on high-end investors, there is potential for a trickle-down effect, especially in a country that contains 177 million Muslims (To compare, Pakistan has 178 million, while Bangladesh has 149 million). India proves that it is not the size of the Muslim population, but the willingness of the government to promote and push forward Islamic finance. Undoubtedly, with the growing interest in this sector, it is likely that the government will be more proactive in developing the market.

INDONESIA

In 2012, Indonesian Islamic banking experienced a slowdown in growth due to the impact of the global economic crisis on the country’s economic growth. Additional factors such as the decline of deposits, partly because of the withdrawal of hajj pilgrimage funds from Islamic banks, contributed to the slowdown in the growth of Islamic assets, compared to the previous year.

Statistics on Islamic banking development up to October 2012 show that Islamic banking services are increasingly widely spread throughout the archipelago with as many as 11 Islamic commercial banks (BUS), 24 Islamic Business Units (UUS) and 156 Islamic Rural Banks (BPRS). Total Islamic banking assets reached Rp1,741 trillion; a 36.9% year-on-year (yoy) growth. Its market share is 4.3% of total national banking assets. Financing also grew by 40.1% which amounted to Rp135.6 trillion. The expansion of the Islamic banking branch network and services increased the number of Islamic bank customers as reflected by the increase in the total number of financing and third-party deposit accounts by 3.4 million accounts – from 9 million accounts to 12.4 million accounts.

In line with the achievements of the previous year, Islamic banking remains committed to optimizing the real sector. As much as 80.8% of total Islamic banking funds or Rp135.6 trillion has been invested in financing activities, followed by placements at Bank Indonesia in the form of Bank Indonesia Shari’a Securities (SBIS), Giro and Bank Indonesia Facilities (FASBI) amounting to Rp.

18.5 trillion (11.0%), placement of securities amounting to Rp7.8 trillion (4.7%), and placement with other banks amounting to Rp5.2 trillion (3.1%).

The intermediary function of banks can be relatively subdued as reflected in Islamic bank FDR (Financing to Deposit Ratio) aggregates recording high increases of 100.8%, higher than the previous year which stood at 95.1%. In addition to the intermediary function and in an effort to provide services to a wider range of the community, access to office networks increased to 2188 (29.3%) from 1692 offices the previous year. This expansion of branch networks has enabled an increase in Islamic banking customers.

Although the number of BUS (11) and UUS (24) did not change in 2012, the availability of Islamic banking services has become more widespread as reflected by the increase in the number of branch offices, from 452 to 508 offices, while the sub-branch offices (KCP) and cash offices (KK) increased by 440 offices in the same period (October 2012).

An increase in funding of Islamic banking arose while maintaining regard to the precautionary principle that Non-Performing Financing (NPF) can be maintained within a stable range. On average, gross NPF decreased from 3.11% in 2011 to 2.58% in 2012. An increase in funding and improved quality of financing has driven profitability and cost efficiency so that profitability can be maintained and even increased, which in turn would increase the accumulated earnings to strengthen capital.

The profitability of Islamic banks with respect to its assets was favourable as reflected in ROA and ROE ratios of 2.1% and 25.5% respectively, better than the previous year’s ratios of 1.8% and 17.4%. Increasing funding coupled with improved performance has lowered the ratio of operating expenses to operating income from 79.2% last year to 75% this year.

The Micro, Small and Medium Enterprises (MSME) sector is an important sector in driving the national economy reflected by its contribution to the national GDP reaching 56.5%. The advantage of MSMEs as a domestic sector that is able to drive the national economy is due to its strong dependence on local forces. As a financial institution that has great concern over the development of the real sector, Islamic banking has been able to capitalise on the opportunities of the financial needs of the MSME sector. As many as 61.3% or Rp83.1 trillion of the total financing of Islamic banks (BUS + UUS) is channelled to the MSME sector.

Based on Bank Indonesia Act No. 21 of 2008 on Islamic Banking, Islamic banks can carry out charitable and BUS -UUS linkage functions through fund collection from zakat, infaq, alms and other charity funds to be distributed to zakat fund organizations. As many as 8 BUS and 4 UUS reported carrying out charitable and linkage functions. This charity function reflects the role of Islamic banks in the equitable distribution of the economic welfare of the community.

Bank Indonesia Act No. 3 of 2004 states that the task of banking supervision oversight will be carried out by an independent financial services supervision body. In accordance with Financial Services Authority (OJK) Act of 2011, Bank Indonesia’s macroprudential banking supervision will be reassigned to the OJK. The OJK’s new assignment will come into effect on January 1, 2014.

Bank Indonesia (BI), as the central bank, is optimistic that the era of high growth of Islamic banking will continue even as the global economy today, particularly in Europe and the United States, is still overshadowed by the crisis and decelerating economic growth. The growth of Islamic banking will not be affected much by the global crisis as asset portfolio exposure in foreign currency and foreign exposure is very small. Slowing global economic growth is going to decrease demand for Indonesia’s export commodities, but the current portion of Islamic bank financing directly related to foreign trade is relatively small.

BI has a strong commitment to continue to facilitate the development of Islamic economics and finance, particularly Islamic banking because BI is certain of its benefits to the national economy. BI will also continue to work closely with stakeholders, such as the National Shari’a Board (DSN), the Indonesian Accountants Association (IAI) and the Government (specifically the Ministry of Finance), and especially with the Financial Services Authority (OJK) in developing the Islamic banking industry at this crucial period of transition.

In order to continue to promote and maintain the sustainable development of Islamic banking, Bank Indonesia sees the need to focus on development and policy measures of Islamic banking in the following:

- Islamic banking financing is geared toward a more productive economic sector and the broader community

Indonesia’s demographic advantage is a huge opportunity for the growth of the national economy. Financing the productive sector increases the market share of Islamic banking and supports a more self-sufficient national economy. Some of the breakthroughs that can be taken are to enter a number of priority

projects including construction, electricity and gas, agriculture and creative industries, the productive sector for business start-ups and SMEs as well as projects included in the MP3EI initiative (Master Plan for the Acceleration and Expansion of Indonesian Economic Development).

The challenges for the Islamic banking industry in the financing of a productive economy are capital and infrastructure aspects including office networks, information technology and human capital (HC). Several attempts to reduce the HC gap can be achieved through training, workshops, and seminars, as well as communities within Islamic banking. All the challenges of financing productive sectors would assuredly require a strong commitment from the Islamic banking industry itself and the readiness of risk management associated with its business concentration, among others, through the preparation of risk management products.

This policy direction to the productive sector must be balanced with the spirit of inclusiveness of Islamic banking services to all communities across borders and economic power. This inclusivity is demonstrated by the availability of Islamic banking services across 33 provinces and by Islamic banks’ availability and sociological proximity to Islamic Financial Cooperatives (KJKS) particularly Baitul Maal wa Tamwil (BMT) institutions. The total number of BMT / KJKS per April 2012 amounted to approximately 4,117 with a total membership of about 762 thousand people and total assets reaching Rp5 to Rp8 trillion. This provides great potential for financial inclusion. KJKS / BMT linkage strategy is worthy of consideration as a strategic partner for the disbursement of Islamic banking financing through channelling and executing schemes, lending of last resort (APEX bank) and technical assistance.

In order to ensure its inclusive financial intermediary role and to focus more on the productive sector and financing to the broader community, Islamic banking and MSME productive financing targets will therefore be set at a minimum of 20% corresponding to its conventional banking counterparts.

- Product development to better meet the needs of society and the productive sector

Bank Indonesia will prioritise support for product development related to the productive sector and to better meet the needs of the wider society. Support is provided among others, through improved regulation, the product licensing process, product assessment and dissemination of knowledge and skills for financial/ productive sector analysts through activities such as workshops and seminars. The improvement of regulations related to Islamic banking products will continue to be improved through the Islamic Banking Working Group cooperation forum as a tripartite with the National Shari’a Board and the Indonesian Accountants Association which assuredly would continue to involve industry players in order to accelerate product development tailored to the needs of banks and the public.

- The transition of oversight whilst maintaining the continuity of Islamic banking development

2013 is a very crucial year in preparing the transfer of regulation and supervision function of Islamic banking from BI to the OJK which will come into effect on January 1, 2014. The establishment of the OJK has divided the two authorities of banking regulation and supervision, namely the macroprudential of OJK and the macroprudential of BI. In practice, there is a possibility of overlapping between the macroprudential and microprudential policy; therefore during the transition period, it is expected that the supervision will not interfere with the development and growth process of Islamic banking itself.

Macroprudential policy among others is outlined in the Islamic banking provisions of Financing to Value (FTV) and Down Payment (DP) and capital requirement that can accommodate changes in the business cycle and the economy. Along with macro surveillance, and as a liquidity provider for banks, the function of Lender of Last Resort (LOLR) remains a function that will be executed by Bank Indonesia.

A number of infrastructures prepared by BI include Islamic Banking Information Systems (SIP) that implement a new concept of Islamic Banking Soundness (Islamic RBBR) by adding two risks associated with Shari’a aspects (Risk of Return and Investment Risk) and is also equipped with statistical information and efforts to complete the LBUS plan reporting system using XBRL. Other infrastructures include the preparation of Islamic banking regulations related to the management of risk concentration and governance such as Islamic banking capital as well as guidance for new products and activities. Additionally, BI will consider the following items to be put in the 2013 agenda: the process of revising the Blueprint of Islamic Banking and taking part in formulating the Indonesian Islamic Finance Architecture that will be required by OJK, BI and other agencies for the development of Islamic banking and finance.

- Revitalisation on increasing synergies with parent banks

Strategies of expansion and increasing Islamic banking assets remain centred on synergistic strategic partnerships between conventional parent banks and Islamic banks. The strategy is aimed to optimise the utilisation of technological facilities, office networks and human capital for funding services and financing analysis.

BI wishes to encourage regulatory incentive-based policies with regard to institutions and improve Islamic banking services availability within the parent bank network. This is to support more progressive innovation including support for capital and business expansion on a regular basis. Thus, the development of cross-selling and product equivalency with the support of network infrastructure such as office network and IT along with human capital policies can be better integrated into enhancing the growth of Islamic banking including employee job assessment (key performance indicator) on Islamic banking service activities by the parent bank. In addition, the sharing of competence in designing and selling products on the one hand, and Shari’a contract comprehension on the other, will increase Shari’a service products outreach to diverse customer segments, whether micro, retail or commercial

/ corporate.

Policies on the utilisation and expansion of networks and services through the parent bank, and/or banks under one group (leveraging) should not create a disincentive for expansion of Islamic bank branch networks. It can be anticipated through measures such as: (i) an increase in productivity or cost efficiency, but within the limits of acceptable risk, (ii) clarity of responsibility and fulfilment of compliance and supervisory access, (iii) maintaining continuity of service, reputation and ability of banks to meet its obligations, and (iv) obligations for opening an Islamic bank branch by meeting certain requirements upon opening Islamic banking services in offices of the network of the parent bank/banks under one group.

- Increasing education and communication to continue promoting Islamic banking capacity in productive sectors and communication of the “parity” and “distinctiveness” of Islamic banking products

In order to increase the number of people who use Islamic banking products and services through educational activities/dissemination, BI hopes to optimise its strategic cooperation with the Communication Center for Islamic Economics (PKES), Islamic Banking Committee and the National Shari’a Board. The alliance will be focused on increasing the capacity of Islamic banking in productive sectors, and communicate the benefits of diversified Islamic banking products advancing aspects of parity and the trademark differences that define Islamic banking products. This will be effectively implemented through various relevant media and forums.

As a mandate of the National Convention of PKES Members of July 13 2012, in order to optimise the target achievement of communication and dissemination of Islamic finance/economics, the Forumon Communication and Advocacy of Islamic Economics (ForKAES) was established. This forum is a medium of communication for associations formed both by practitioners of Islamic finance and related professions, as well as observers of Islamic economics. ForKAES aims to coordinate and synchronise programs and dissemination activities, publications and communications made by associations such as the Islamic Economic Society (MES), Indonesian Islamic Bank Association (ASBISINDO), Islamic Economic Experts Association (IAEI), Indonesian BMT Association (ABSINDO), Indonesian Islamic Insurance Association (AASI) and Communication Center for Islamic Economics (PKES).

In an effort to improve the competence of human capital in Islamic banking, Bank Indonesia is expected to continue its cooperation with the International Center for Development in Islamic Finance of the Indonesian Banking Development Institute (ICDIF-LPPI) through the support of training and education programs vital to enhancing the skills / operational technical competence and analytical skills of Islamic banking human capital in marketing prudential-based and Shari’a-compliant Islamic products.

Outlook

For 2013, three scenarios are possible for the Islamic banking sector, namely (i) a pessimistic scenario, (ii) a moderate scenario and (iii) an optimistic scenario. The pessimistic scenario will occur if the expansion of Islamic banking comes under pressure from both internal and external factors. Pressure from internal sources originates from the limited funding that has been collected from the public, especially given the ability of a number of banks which have declined in raising deposits. Pressure from external factors comes from the declining performance of the national economy. The Euro economic crisis has had an impact on the national economy even as Indonesia’s economy remains growing positively, but at a slower pace.

The moderate scenario is when the acceleration of the current Islamic banking continues and does not experience any pressure, or continues to be supported by organic factors. Financing continues to expand, and deposits continue to increase to offset the asset side. The optimistic scenario is where non-organic factors coincide together with organic factors (moderate scenario) as displayed in the opening of new Islamic banks, a spin-off from UUS to BUS, conversion of conventional banks into Islamic banks including increased placement of government funds into Islamic banks (hajj pilgrimage fund, sukuk, etc). Through these scenarios, the projected total assets in 2013 are Rp255 trillion (pessimistic scenario), Rp269 trillion (moderate scenario) and Rp296 trillion (optimistic scenario). Islamic Banking market share of 5% is expected to be reached between April 2013 – May 2013, and by the end of 2013, it is estimated to have a market share of 6.5%. Total deposits at the end of 2013 are estimated to be Rp168 trillion (pessimistic), Rp177 trillion (moderate), and Rp186 trillion (optimistic). Total financing in 2013 is estimated at Rp200 trillion (pessimistic), Rp211 trillion (moderate) and Rp222 trillion (optimistic).