Indonesia is a maritime country consisting of thousands of islands, stretching from Sabang to Merauke. As the third most populous country in the world, Indonesia’s position is very important. The country’s vision is to become ‘Golden Indonesia’ by 2045, which means no poverty, low economic disparity, and full employment level. In 2019, Indonesia’s population is expected to reach 267 million, of which 87% are Muslims. This puts Indonesia as one of the countries with the largest number of Muslims in the world. The population is divided into more than 300 ethnic groups, or precisely 1,340 tribes (according to the 2010 census), with the largest dominance being the Javanese. When viewed from its geographical characteristics, Indonesia is an archipelagic country consisting of more than 13,000 islands with a total area of 7.81 million km2 consisting of 2.01 million km2 of land, and 3.25 million km2 of ocean.

Because of this uniqueness, the practice of waqf and the waqf institutions in Indonesia is also unique and specific to the country. Despite this, the Indonesian Waqf Board (BWI) considers the crucial role of waqf in sustaining Indonesia’s socio-economy development. The potential of waqf in Indonesia is huge and the funds can be used for economic as well as social, productive projects. Through the development of endowments, institutional and literacy products; the role of waqf is expected to be one of the nation’s economic pillars towards achieving Golden Indonesia.

Development of Waqf in Indonesia

Waqf is a charitable endowment whose principal assets cannot be exhausted, unlike zakat which must be consumed immediately even though both have social goals. Waqf has played a significant role throughout Islamic history towards enhancing the social and economic status of Muslim societies including facilitating education and spreading the true spirit of Islam among Muslims (Siraj, 2012). The benefits of waqf assets are not restricted for the use of Muslim communities and religious activities but encompass broader scope of activities to improve and strengthen the development of social and economic conditions of a society (Cajee, 2007). Moreover, the perpetual nature of waqf makes it a highly effective platform for sustainable economic growth.

In Indonesia, the practice of waqf is embedded in Muslim’s traditions and governed by local customs where the institutions of waqf is as old as Islam in the country. In the Dutch colonial period, a waqf law in the form of Circular of the Government Secretary was created. During the administration of President Soekarno, the Ministry of Religious Affairs of the Republic of Indonesia issued instructions on waqf on December 22, 1953; which later became the authority of Part D (social worship), Religious Affairs Office. Since then waqf regulations have evolved, not only in relations to waqf administration and institutions but also the types and objects of waqf. Originally, waqf assets were only in the form of land, but now includes movable objects such as money, stock and securities. In 2004, the Indonesian government legislated Act Number 41 of 2004 on waqf, which has since regulated waqf affairs in Indonesia. Article 47 of the Act established BWI as an independent institution “in order to improve and develop the national waqf”. The Act provides a comprehensive definition of waqf that includes both permanent and temporary waqf. However, once the waqf has been declared, it is irrevocable (Article 3). This was soon followed by Government Regulation Number 42 of 2006 promulgated on December 15, 2006 and the Fatwa of the Indonesian Ulema Council (MUI) concerning cash waqf.

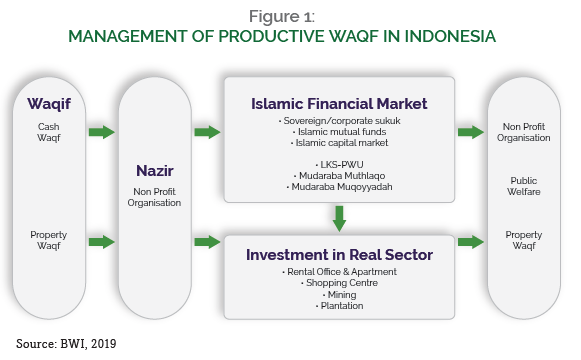

Endowments have expanded to include social waqf and productive waqf. Under social waqf, benefits of the waqf assets are used for social purposes. Meanwhile, in productive waqf, productive assets are used to produce goods or services, where the profits from these activities are then handed over to the beneficiaries or mauquf alaih. For the management of productive waqf and cash waqf in Indonesia, a framework has been issued by BWI (for productive waqf and cash waqf) and the Financial Service Authority or OJK (specifically for cash waqf) as shown in Figure 1. In several Muslim-majority countries such as Turkey, Egypt, Saudi, and Jordan; the functions and roles of nazir (administrator) are carried out through state institutions at the ministerial level or a national nazir body. At present, BWI acts as a waqf regulator to manage waqf assets through nazirs although Article 49.1b, Law No. 14 of 2014 provides a provision for BWI to act as a nazir as well.

Waqf Asset

According to BWI, there are no less than 4 billion meter square of waqf land in Indonesia. These lands are divided into more than 430,000 land parcels whereby about 60% have been issued certificates by the State Land Agency (BPN). Even though the total area is quite large, the utilization of the waqf land is mostly limited to use for schools, mosques or public graves, while others remain idle. This is very contrasting to the area of oil palm plantation concessions owned by large private plantations in Indonesia, which is more than 7 billion meter square in the form of overlays. About 10% of waqf assets are strategically located in urban areas, which implies that these waqf land can be developed into productive assets in the form of property. Although the potential of utilizing waqf productively is huge, this remains untapped. Currently, much of the waqf assets are being used for mosques (74%), cemeteries (5%) and for educational facilities (13%). Unfortunately, the investment needed to develop waqf assets for productive income-generating activities is very large. As of March 2018, BWI recorded only Rp. 199 billion of waqf assets in the form of cash collected by the nazirs. Mobilization of cash waqf is hindered by misperception, low waqf literacy, limited waqf instruments, and not to mention the optimal level of capacity and competence of the nazir.

So far 201 cash waqf institutions have been registered with BWI and are active in developing the potential of waqf assets productively. The majority of these cash waqf institutions are Islamic cooperatives or Baitul Mal wat-Tamwil (BMT). Investment of waqf assets through BMT takes the form of equity participation in community projects, whereby returns from the investment are used for social activities. In order to optimize the mobilization of cash waqf from the public, the Indonesian government requires cash waqf to be made through Islamic financial institutions duly appointed by the government to receive this cash was from the public as per Article 28 of Act No. 14 of 2004. These Islamic financial institutions are known as Lembaga Keuangan Syariah Penerima Wakaf Uang or LKS-PWU. Created to mobilize cash waqf, LKS-PWU consists of Islamic banks, as well as commercial banks and regional banks. As of December 2018, there were 19 LKS-PWU as shown in Table 1.

Variety of Waqf Products

In addition to traditional social waqf models such as religious facilities, cemeteries and schools; BWI is currently promoting the development of productive waqf assets such as asset property, cash waqf investment, and stock waqf. On the sidelines of the IMF-World Bank Annual Meetings in Bali in October 2018, BWI together with the Ministry of Finance and the Ministry of Religious Affairs issued the Cash Waqf Linked Sukuk (CWLS). This investment-based waqf instrument has a 5 year tenure and waqf assets are used as the underlying assets. The proceeds from the sukuk will be used for social assistance, such as disaster relief efforts in areas hit by earthquakes (such as in Lombok and Palu) or public infrastructure projects. Under this scheme, when the sukuk matures, the funds will be returned to the donors in full, but not including the yield. The yield will be reinvested to manage waqf assets.

In order to increase the level of professionalism amongst nazirs, BWI together with Bank Indonesia and international partners have prepared guidelines for managing risk-based waqf assets, called the Waqf Core Principles (WCP). Having a robust standard for waqf governance like WCP is a significant step towards realizing the potential of waqf, as well as reviving this institution to play an important role in the socio-economic development of the society. As a governance framework containing 29 principles, WCP is intended to guarantee the accountability of waqf management. In addition, the WCP provides a methodology for regulating the main principles in the waqf supervision and management system. In addition, BWI together with the Indonesian Institute of Accountants is also preparing a waqf accounting standard, namely PSAK No. 112 to improve standards, transparency and accountability of waqf asset management by the nazirs.

Awqaf Institutions

The manager of waqf (nazir) in Indonesia consists of individuals, organizations and legal entities. However, waqf institutions in Indonesia are managed mostly by nazir on a part-time basis (84%) with only a handful of them (16%) are full-time nazirs, which is not an ideal condition. These part-time nazirs are mostly individuals who have been trusted to manage the waqf assets by the waqif personally. Article 9 of the Act No. 41 of 2004 permits an individual or an organization or a legal institution to be stipulated as nazir. In the past, people gave waqf to people they believed in, usually the local Islamic scholars; rather than through waqf institutions. Some are managed successfully, while others suffer from poor management. Supervision of waqf assets that are nullified by individuals is also difficult, because generally they do not have good financial accounting knowledge. Often waqf assets are mixed with personal assets of the individual nazirs. Due to this, BWI no longer issues permits to individual nazirs.

In Indonesia, nazir comprises of individuals (66%), organization (16%) and legal entity (8%). The Law stipulates that an organization can only be a nazir if it fulfils the requirements of individual nazir and is actively involved in social activities, education, society development and/or Islamic (religious) activities. Nazir in the form of a legal entity must be an Indonesian legal entity formed in accordance with applicable laws and regulations and operates in the field of social, educational, social and/or Islamic (religious) activities. At present, a waqf information system is being developed to boost the professionalism of nazirs in managing and developing waqf assets.

Waqf Opportunities And Challenges In Indonesia

Opportunities for developing waqf in Indonesia are huge, especially cash waqf. This is driven by Indonesia’s large Muslim population, its status as an emerging economy in Southeast Asia and the growing awareness of giving waqf amongst the middle class and millennials. It is estimated that potential cash waqf in Indonesia amounts to Rp. 70-80 trillion per year. Waqf assets in Indonesia have immense potential of being developed into income-earning ventures generating enough income to support social welfare programmes in the areas of education, health and social sectors, thereby reducing government expenditure in these areas.

However, in practice the realization of the optimization of the potential and utilization of waqf funds in Indonesia is still low. Lack of professional and technical expertise in developing waqf assets by nazir is part of the constraint in developing waqf. The management of waqf must be entrusted to experienced and knowledgeable experts with the highest integrity – that is, people with the right calibre, right competency and right character. Hence, nazirs have to be equipped with proper knowledge, skills and guidelines for productive utilisation of the waqf assets. Another challenge is the lack of awareness and willingness of Muslims to contribute to the waqf fund. There is the perception that waqf assets are only in the form of mosques, cemeteries and religious schools. In addition, most of them think that zakat is the only best tool in helping the poor and needy in reducing the gap between the rich and poor (Sapuan et. al, 2017). Many remain unaware of the different ways in which the waqf system can be harnessed to generate revenues to be distributed to beneficiaries. As a result, this strict view has to a certain extent curtailed or slowed down the process of development of waqf (Mohamad et al., 2012).

But perhaps the biggest impediment to the development of waqf is the perceived poor management of waqf institutions, as a result of limited regulation and supervision mechanisms. Hence, strong governance and professionalism are keys to inspiring public trust in waqf institutions. Adequate internal controls have to be put in place, including risk management, internal and external audits, and compliance systems. High standards on disclosure and transparency in reporting of waqf activities is imperative to instil trust and confidence among donors. Opportunities and challenges of waqf development in Indonesia from an economic, regulatory, technological, social, environmental and political perspective are summarized in Table 2.

Strategies to Develop Waqf

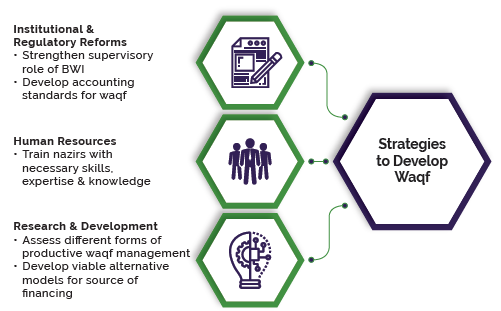

In order to develop waqf as a potential source of financing and a mechanism for wealth distribution, clear strategies for developing waqf must be put in place. Taking into account the various opportunities and challenges in developing waqf in Indonesia, three key strategies are proposed – institutional and regulatory support, human resources, as well as research and development.

Realizing the constraints that have been briefly mentioned earlier, institutional and regulatory environment for mobilization and utilization of waqf must be strengthened to include greater supervision of nazirs by BWI. At present, the weak supervision of nazirs makes the management of waqf less than optimal. Under Islamic law, nazirs can be removed for negligence, misconduct or breach of trust if their wrongs are proven. As such, BWI has the power to remove nazirs for related violations. The development of accounting standards and code of good corporate governance for waqf is essential because it could improve the accountability of nazir in managing waqf. The responsibility of waqf management should not only emphasize on the preservation and protection of waqf assets, but also their development, which include transparent and honest reporting of financials. Studies on accounting practices in waqf institutions indicate that there is diversity with regard to accounting and reporting of waqf. The uncertainty over accounting practices in charitable sectors and other not-for-profit organizations is not only due to the absence of accounting standards but also because the failure to establish a generally accepted definition of accountability for that sector (Cordery and Morley, 2005).

Technical and managerial expertise is needed to manage, maintain and develop waqf assets. To this end, clear eligibility criteria for a nazir must not only cover professional competence, but aspects of integrity and trustworthiness. BWI has conducted several training programmes including trainings on waqf digitalization, waqf accounting and others; aimed at equipping nazirs with the necessary knowledge and skills to manage waqf effectively. As a step in increasing the level of professionalism of nazirs, a certification body will be set up to offer professional-level certification, which will be issued by BWI.

No less important is the role of research. Scientific research and analysis should be focused on developing innovative areas of endowments that instil the culture of endowment among individuals as well as organizations. Studies should also be carried out to assess different forms of productive waqf management that are compatible with the culture of Indonesian society. Differences in fiqh views sometimes become obstacles in developing waqf. Hence, research into contemporary jurisprudence for waqf financial instruments, such as the fiqh of waqf shares, and mutual fund endowments, are imperative. Viable alternative models for waqf institution as a source of financing such as crowdfunding to develop waqf land, should be developed for the development of waqf in the 21st century.

Waqf Development Plan in Indonesia

In developing waqf in Indonesia, BWI focuses on short, medium and long-term plans. In the short term, efforts are focused on assessing rules, principles and programmes that have been launched. In addition, this short-term plan is also focused on finding solutions to waqf issues currently faced. Several initiatives undertaken by BWI are as follows:

1. Socializing the Waqf Core Principles (WCP), which was launched on October 14, 2018 to nazirs and related parties.

2. Promote Sukuk Linked Waqf Cash (CWLS), which was launched on October 14, 2018.

3. Compile Waqf Information System, together with Bank Indonesia, Productive Waqf forum, and other related parties.

4. Empowering the Nazir Association of Indonesia, which was formed on May 9, 2018.

5. Develop competency standards for nazir, and conduct training and certification for nazir in order to protect waqf assets and increase waqf added value.

6. Form a team for the settlement of the Use of Waqf Asset Problems by the Government consisting of representatives from the Ministry of Religious Affairs, BWI, Ministry of Finance, the Supreme Audit Agency and other related parties.

7. Increase synergies between BWI and the Ministry of Religious Affairs in relation to duties and functions of the authority and institutional status that has been regulated by legislation. A team consisting of representatives from these two agencies was established to form joint regulations.

8. Develop a waqf digitisation system with adequate technological tools.

The medium-term plan is focused on efforts to continue initiatives undertaken in the short term with a focus on improving waqf laws and other regulations. In the next 3 to 5 years, BWI will focus on developing national waqf as follows:

1. Develop ecosystems and paradigm shifts, especially among nazirs who are originally partial and tend to compete with each other, to work together in synergy especially in managing large-scale waqf projects (musabaqoh-muawwanah).

2. Increase the number of waqif through literacy and awareness of giving waqf, especially amongst millennials and the young generation through the introduction of waqf curricula in schools and universities.

3. Increase the number and diversification of waqf assets, variety and improved product innovations with an emphasis on modern investment instruments such as stock waqf, sukuk waqf and so on.

4. Strengthen financial capacity-building competencies to increase the value added of waqf assets (business, entrepreneurship, risk management and value creation).

5. Improve the quality of governance compliance with the principles of good governance and waqf core principles.

6. Diversity of management of waqf assets with managed risks (waqf linked sukuk) and supporting Islamic economic growth.

7. Utilize digital technology (including asset digitalization) in terms of inventory and mobilization of waqf assets.

8. Revise the waqf law and its derivative legal products so that the implementation of waqf is in line with market trends and technological advancement.

Act no. 41 of 2004 concerning waqf first came into being some 15 years ago. Since then, numerous developments in waqf have taken place. These changes must be reflected in the law and regulations concerning waqf. Towards this end, BWI proposes several amendments including:

a. Strengthen institutional roles of BWI centres and distinguish them from the Ministry of Religious Affairs.

b. Improve the rights and duties of nazir.

c. Strengthen BWI’s role as the nation’s nazir.

d. Introduce additional requirements on the appointment of nazir in relation to entrepreneurship competency capabilities, achievements, tax exemption on waqf/ management, regulation of things that have not been regulated (refer to the shafi’i school/fatwa, and restrictions on the validity period of ‘waqf ahli’).

e. Land waqf recognized as endowments based on its value, with government support for productive endowments and pilot projects.

f. Recognition of waqf assets as commercial assets in a productive endowment.

g. Follow up on Government Regulation Number 25 Year 2018 concerning Amendment to Government Regulation Number 42 of 2006. The Ministry of Religious Affairs and BWI need to develop their SOPs/Technical Guidelines and socialize them.

h. All government agencies and private institutions that use the word ‘waqf’ must fulfil the elements of waqf.

The BWI’s long-term plans for waqf development in the country are focused on literacy efforts, public awareness and education of waqf. These include:

1. Formulate literacy, outreach, and waqf education programmes such as the formulation of waqf curriculum for all levels of education, starting from elementary, junior high, high school and university involving the Ministry of Religious Affairs, BWI, BI, OJK, LKS-PWU and other stakeholders, to develop awareness of giving waqf (waqf society).

2. Hold regular thematic mudzakarah between the Ministry of Religious Affairs and BWI to respond to the latest developments regarding waqf.

3. Realising the generation of waqf-preneur as an alternative socio-economic framework of society’s wellbeing. Waqf-preneur is a new term for productive waqf activists who are mainly carried out by young entrepreneurs in Indonesia. The synergies between waqf and entrepreneurship are important as an alternative to the sustainability of waqf itself.

Conclusion

Waqf can be an important instrument in the socio-economic development of the ummah and society if it is properly mobilized and managed. Among the critical success factors to achieve this are the existence of a strong legal framework, good governance, management and administration, and a significant increase in the awareness and participation of the society. Best practices in waqf management to promote the culture of innovation in the waqf sector and enhance its economic and social impact should be the focus as waqf is developed as a potential tool for empowering the ummah.