The emergence of the Islamic Fintech industry in 2010 reflects the growth of the broader global Fintech ecosystem, with the main focus on Shari’a-compliant products and services. Although still at its early stage, its potential is far-reaching and is set to become a game changer for the Islamic banking and finance industry. According to the Global Islamic Finance Report 2018, the potential market for the industry is estimated at US$4.84 trillion with the actual size being US$2.431 trillion; creating a gap of US$6.155 trillion. Hence, the utilization and adoption of Islamic Fintech could potentially close this gap.

The growth of Islamic Fintech provides innovative opportunities within the industry. Innovations utilizing blockchain, smart contract and Robo-advisory have significantly gained uprising attention in recent years. For example, Wahed Invest launched its Islamic Robo-advisory solutions which give access to Shari’a-compliant Exchange Traded Funds, Yielders developed a halal investment marketplace for property based on crowdfunding, Blossom Finance launched the first sukuk using smart contracts and Ethis Crowd developed the worlds first Islamic-based property crowdfunding platform. These are just a few of the groundbreaking initiatives in the Islamic Fintech space.

The Islamic Fintech landscape currently maps about 93 players globally, predominantly leveraging peer-to-peer technology to disrupt personal and business finance, and eliminate subsidiary service providers (Dinarstandards, 2018). About 66 Islamic Fintech companies are focused on peer-to-peer solutions to facilitate consumer and business financing whilst 14 are deploying blockchain technology in their solutions. As Islamic Fintech gained in significance, financial regulators are forced to consider how to balance the traditional regulatory objectives of financial stability and consumer protection with the objectives of growth and innovation. In response to the growing importance of Islamic Fintech and its potential disruptive impact, regulators have adopted different approaches to address Islamic Fintech and innovations in their respective jurisdictions.

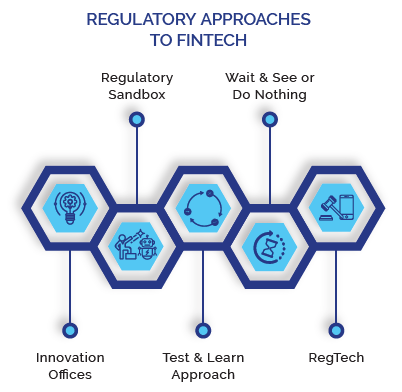

Regulatory Approaches to Fintech

When it comes to financial regulation, each jurisdiction has different views and approach of promoting an innovation-friendly environment or drawing more people into the banking sector. However, at the core of any financial regulatory mandate is consumer protection and financial market stability. With the advent of Fintech companies, the regulatory environment has been equally challenged and this has raised concerns on whether or not regulators will be empowered to adequately regulate them (McWaters & Galaski 2017; Weichert 2017). Whilst financial innovation is central to economic growth and enhancing inclusiveness, regulators need to balance support for innovation with their core regulatory mandates of systemic stability and consumer protection. Five approaches have so far emerged from this challenge.

1. Regulatory Sandbox

The regulatory sandbox has been widely adopted as an innovative regulatory initiative as most regulators have taken this approach when adopting new relevant regulatory and supervisory frameworks for technology solutions. The concept of sandbox originated from the world of software development where developers are allowed to test a proof of concept within a control environment; and subsequently amend and improve a product based on feedback (European Banking Authority, 2017). Such sandboxes include appropriate safeguards to contain the consequences of failure of the new product/service, while maintaining the overall safety and soundness of the regulatory framework.

The regulatory sandbox functions as a catalyst for future innovation by accepting firms that would otherwise be precluded from operating tests due to inhibiting regulations or the unknown risks inherent in new technology (Piri, 2019). The sandbox regulatory approach allows Fintech startups to launch products on a limited scale to actual customers without incurring the large regulatory burdens and cost that they would otherwise face (Ehret, 2017). Regulators, on the other hand, gain a better understanding of Fintech and thus, can develop more appropriate regulatory policies that promote inclusive Fintech. Customers get better protection, firstly because company products are tested in a controlled environment before official rollouts, and secondly, because regulatory bodies are able to implement more focused policies (Finextra, 2018).

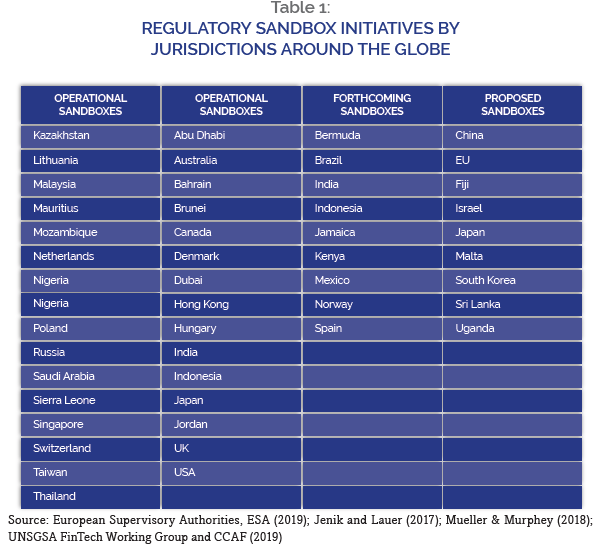

Table 1 shows the list of countries that have approved sandboxes for their new banking and Fintech entities. Every jurisdiction lists some of the rules that Fintech must adhere to while entering the sandbox. In many parts of the world like the United Kingdom, Australia and Singapore; the regulators demand that sandbox provides information about eligibility criteria, the level of risk, the cost to regulators and methods of management and testing (Jenik & Lauer, 2017). In Canada, Fintech startups have to observe additional customer protection rights and safeguards.

However, regulating sandbox requires specific personal monitoring efforts. It is worth noting that regulators have already been experiencing difficulty in regulating Fintech (Jenik & Lauer, 2017). On the other hand, sandbox provides ample opportunities for both regulators and Fintech companies to deal with the subject efficiently instead of waiting to see what will happen next. Another consideration is that very little information is discussed and exchanged within both parties. In majority cases, sandbox prefers exemptions and no-action letters granted under the traditional restricted licensing regime (Zetzsche et al., 2017). From a regulatory perspective, the authorities should create a regulatory sandbox for Fintech and regulate marketplace lending and crowdfunding platforms.

2. Wait and See or Doing Nothing Approach

The wait-and-see approach is risky as regulators do nothing but allow Fintech companies to develop and flourish according to any available method with nominal intrusion. The Chinese regulators’ “wait and see” approach sparked the Fintech boom in the country. The approach begins with an incredibly open framework, allowing models to evolve before tightening regulation once the entity has become well-known in the market. Firms face regulations only after they become stable. Such an approach encourages market efficiency by reducing the cost of innovation, which in turn incentivizes companies to develop new financial services that reduce transaction costs (Magnuson, 2018). However, this approach could potentially reduce the ability of regulators to protect consumers and investors from fraudulent schemes. It could also increase systemic risk if complex new financial products are put in the market without fully understanding how they might interact with other forms of finance (Magnuson, 2018).

3. Innovation Offices and Central Banks’ Linked Accelerators

Some countries have developed innovation offices as an initial step in their journey towards regulatory innovation. Innovation offices are given different names in different jurisdictions, but they are usually established to give regulatory understanding and clarification to existing as well as new entrants with the aim of providing innovative financial products and services. Innovation offices are used to collaboratively explore new financial technologies and regulations to oversee them. The benefit to setting up innovation offices is Fintechs and other innovative firms would have a designated office to turn to when facing challenges with current regulations (Gardner, 2018). In some jurisdictions, the regulators are associated with Fintech accelerators to monitor and to facilitate Fintech platforms by providing mentoring, networking opportunities and initial funding (Armstrong, 2016).

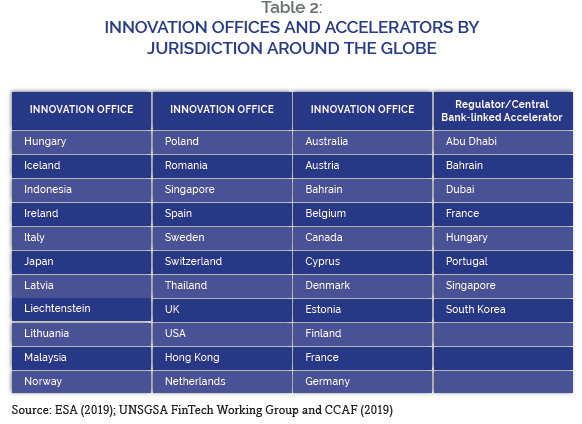

Experts and private entities usually manage accelerators and firms, which provide training on Fintech for interested candidates for a given period. At the end of the training, the candidate presents his innovative model (BCBS, 2018). Hong Kong and Singapore form the hub of accelerators and are very keen to provide these services to their potential candidates (Arner et al., 2015). Examples of innovation offices include Australia’s ASIC Innovation Hub, Bahrain’s Fintech Unit, Dubai’s Fintech Hive, and Singapore’s Global Fintech Hackcelerator. Table 2 indicates the existing innovation offices and Fintech accelerators distributed around the globe.

4. Test and Learn Approach

Under this approach to foster innovation, reputable early implementers are empowered to pilot products and models under close monitoring and frequent contact, rather than imposing a predetermined regulatory framework upfront. This allows regulator to observe actual operations, appreciate the risks better and craft appropriate regulatory responses. The central banks of the Philippines, Kenya and Tanzania employed the ‘test and learn’ approach to enable innovation in the retail electronic payment systems by allowing telecommunication operators to launch mobile money services. For example, through this approach the Central Bank of Kenya allowed Safaricom to bring M-Pesa to market. This approach also enables established firms to use all the available information in Fintech to test and check the viability of their innovations. The hubs can also arrange events and seminars to help Fintechs to grow. In the United States, where there are many requests for information about current and future regulations, the Office of the Comptroller of the Currency (OCC) is providing innovation hub facilities to Fintech companies (Office of the Comptroller of the Currency, 2018).

5. RegTech

The term ‘Regtech’ was coined by the Financial Conduct Authority in 2015, which described it as “a sub-set of Fintech that focuses on technologies that may facilitate the delivery of regulatory requirements more efficiently and effectively than existing capabilities” (Beall, 2017). Today, RegTech has emerged as a new way adopted by regulators to supervise and monitor the financial industry on matters related to financial reporting, risk management and compliance. In this approach, technology is being used for regulatory purposes. RegTech encapsulates all kinds of technology such as distribution ledgers, algorithmic-based financial standards, automated legal writing, and artificial intelligence-based compliance and risk supervision. It also allows regulators to swiftly respond to market developments, better protect consumers, and enhance institutional supervision. RegTech can support better delivery of innovative financial services, which can directly improve financial inclusion (UNSGSA FinTech Working Group and CCAF, 2019). By leveraging RegTech, officials can more swiftly respond to market developments. Table 3 presents RegTech initiatives adopted by authorities globally.

GLOBAL REGTECH INITIATIVES BY JURISDICTION

Islamic Fintech and Regulations

Islamic Fintech plays a crucial role in the development of the Islamic finance industry especially in promoting standardization and harmonization of Islamic finance products and integration. With the advent of new and advanced technology, Fintech hubs are rapidly springing up across many countries where Islamic finance is prominent such as Malaysia, Indonesia and the United Arab Emirate (UAE). With the growth in which Fintech is spreading across wider markets continue, as well as the pace of Islamic finance expansion across the world, Islamic Fintech seems likely to become part of the mainstream global Fintech revolution (McCaw, 2018). Against this backdrop, regulatory infrastructure is important to ensure financial stability and strong customer protection and empowerment. However, Fintech regulation remains a challenge for the Islamic finance industry. The best example is the evolving nature of Initial Coin Offering (ICO) market.

The effective regulation of Islamic Fintech requires reaching consensus over future goals. First, financial stability should be the aim; second, finance should serve the real economy and bring benefits to society; third, finance should strike a balance between innovation, stability, and development; and fourth, consumer rights should be protected (Shenglin, 2018). But what is more important is that the Islamic Fintech regulatory infrastructure should lay the foundation for a more conducive environment that promotes innovation and growth. Changes in the regulatory process are also needed due to its harsh and non-flexible nature. More flexible rules and regulations are needed in the constantly changing Fintech sector (especially for Islamic Fintech). The previous harsh and rigid rules, which were applied to the traditional financial industry, cannot be applied to this new sector.

This fast-growing sector needs new rules and regulations to deal with certain issues and to make it flourish in accordance with effective rules and regulations. Regulation support is the central pillar that provides opportunities for startups to test their innovative ideas in a competitive and controlled environment. In some Islamic countries like Malaysia, its central bank, Bank Negara Malaysia, is doing well as can be seen from the clear and established rules and regulations for the Islamic finance industry, including the Islamic Fintech sector.

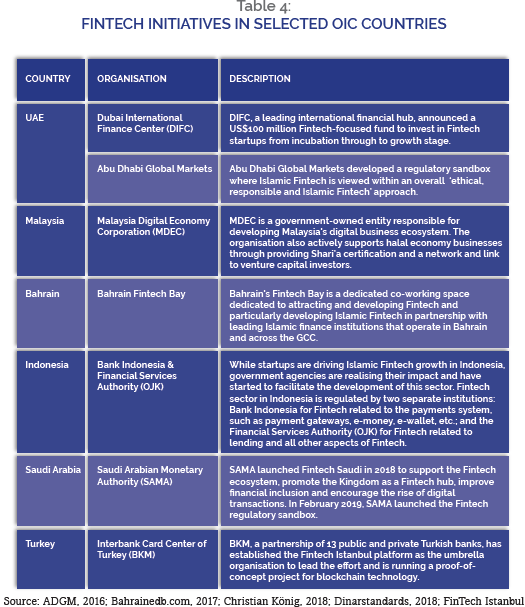

Islamic financial regulatory bodies and forums like AAOIFI, ISDB, IFSB, ISRA and IRTI all need to collaborate amongst themselves and with Islamic Fintech start-ups to make these rules more effective. Since 2017, increasing number of events such as conferences, seminars and forums were organized around Fintech. These events, on the one hand, have encouraged the development of Fintech sector and on the other, have helped the policymakers deal with complex and multidimensional issues. Regulators do not just expect players to follow the rules but they want them to develop a creative and effective business that is compliant with the rules. To date, a number of Islamic countries have taken initiatives for the establishment of an Islamic Fintech ecosystem within their jurisdictions as shown in Table 4.

FINTECH INITIATIVES IN SELECTED OIC COUNTRIES

Smart Regulations for Islamic Fintech

Islamic Fintech has a potentially transformative impact on the economy, and as such, authorities and regulators need to carefully nurture a policy regime that promotes innovation and growth of Islamic Fintech companies and startups. In this era of digitalization, traditional rules and regulations will not be sufficient for the existing and new entrants in the financial industry. Increasing commoditization of technologies such as artificial intelligence and machine learning produce new pandora boxes for regulators (Zetzsche et al., 2017). Smart regulations are fundamental to the future of the Islamic Fintech sector.

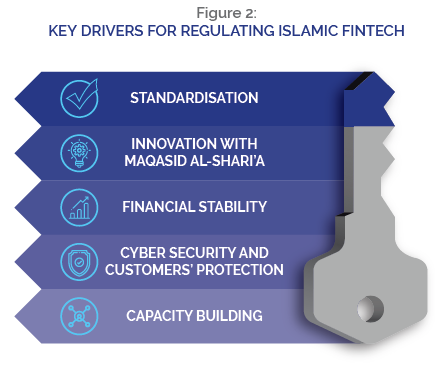

Smart regulations minimize the obstacles to Islamic financial markets including Islamic Fintech while maintaining control. Regulators through smart regulations can test and experiment with the new service providers. They can also monitor their performance and be flexible in issuing them with a license, which should be improved subsequently. Innovation office, regulatory sandboxes and RegTech can together be very supportive for regulators instead of depending on only one approach that may leave pitfalls and room for inaccuracy (Arner et al., 2017). In formulating an effective regulatory framework for Islamic Fintech, regulators have to comply with fundamentals such as standardization, financial stability, innovation with maqasid al-Shari’a, cyber-security, consumers’ protection and capacity building. These essential features are indispensable for the growth, development and sustainability of Islamic Fintech given the unique nature of Islamic finance itself. These features are discussed below.

1. Standardisation

A prerequisite for the rapid growth of Islamic finance in general and Islamic Fintech in particular, is standardization of Shari’a interpretations and legal documentation. This would fuel growth by streamlining the whole process, which is still complicated and time-consuming. This is also one of the critical reasons for the lack of Islamic Fintechs as compared with conventional Fintech companies. According to McMillen (2011), standardization means the establishment of universal Shari’a standards by the flexible codification of Shari’a principles, which would ultimately reduce the shortage of Shari’a scholars and also help promote unity among the different schools of fiqh. This signifies that a universally recognized Islamic manuscript or standard should be issued to harmonies differences in fiqh opinions concerning Islamic finance in order to further enhance product development and reduce Shari’a non-compliance risk.

The best solution provided in the matter of standardization is by Dr. Muhammad Tahir ul Qadri. He suggested that the solution to this problem lays in the adoption of the theory of Taqlid-al-Madhahib “Neo-Juristic approach of inclusive accommodation and flexibility”, which is based on strong Islamic legal foundations. He is of the view that, with the application of this approach, the uncertainty in post-default resolution mechanism in Islamic finance matters will be eliminated (Qadri, 2018). This will subsequently enhance investors’ confidence, resulting in transparency and appropriate risk management.

2. Innovation with Maqasid Al-Shari’a

Standardization without innovation does not guarantee the sustainability of Islamic Fintech. Without a doubt, innovation is imperative for the development of the Islamic Fintech sector. But at the same time, achieving maqasid al-Shari’a should be the primary objective. Without attaining this goal, Islamic Fintech cannot compensate and fill the gaps left by the Islamic finance industry. Financial innovation in Islamic finance must be within the Shari’a parameters and tested against the maqasid al-Shari’a, both in form and substance, where the primary objective is the realization of benefits to the people (IFSB-IRTI- IDB, 2010). When formulating regulations for the Islamic Fintech sector, authorities and regulators should aim to fulfil maqasid al-Shari’a through two main objectives: financial stability and sustainable development.

3. Financial Stability

Fintech is changing the landscape of financial services, providing more opportunities to seek financing and increasing financial inclusion. Regulators are responsible to provide a framework that supports the sustainable development of the industry while protecting consumers and ensuring financial stability. The Financial Stability Board (FSB) recently published a report on Fintech and its implications and the risk to financial stability. The report concludes that, while there are no irresistible financial stability hazards and risks from emerging Fintech innovations given the relatively small size of the Fintech industry relative to the global financial system, experience depicts that they can flourish quickly if left neglected (Financial Stability Board, 2017). It also underscores the demand for international bodies and national authorities to pay attention to Fintech in their risk assessments, monitoring and regulatory frameworks.

The mixture of greater efficiency and better use of big data could give essential support to financial stability if the linked risks are appropriately managed, especially those related to pro-cyclicality and excess volatility. Fintech has enormous potential to expand access to financial services for both businesses and individual households. This could increase sustainable and inclusive growth, provided that the associated risks are managed to keep trust in the system and to avoid a build-up of risks that could result in financial instability.

4. Cyber Security and Customers’ Protection

Although there are many opportunities connected with Fintech, the risks and potential vulnerabilities emerging from new Fintech solutions cannot be overlooked. New risks emerging from Fintech include risk of cyber crimes, data breaching, data theft, etc. These risks may be due to uncertainties in regulation, lack of required technological skills, smart workers, heavy compliance costs and issues of scalability in handling the massive volume of unstructured and structured data. In this scenario, customers’ protection is an important point that has to be considered appropriately while enforcing regulations (Ng & Kwok, 2017).

The combined use of blockchain, big data and artificial intelligence can lead to a better, more sophisticated and integrated cybersecurity system, which are adaptable and effective. In addition, one of the major challenges from the end users is lack of awareness of cyber or digital risks or also their negligence in taking precautionary measures while accessing financial services through digital channels (Villasenor, 2016). Awareness programme to educate users may be helpful to manage the cybersecurity risks. Another big challenge for policymakers and regulators is protecting customers from cyber risks and at the same time allowing them the usage of digital channel to access financial services.

5. Capacity Building Islamic Fintech is still at its infancy with only 93 Islamic Fintechs established world over. One of the factors behind the slow growth and meagre number of Islamic Fintechs is the lack of skilled human resources (Todorof, 2018). Regulators have to play their role in this vital element of capacity building to ensure the sustainable growth of the Islamic Fintech sector. Regulators in different countries are adopting the approach of integration and collaboration with new entrants in Fintech in terms of their trainings, especially on regulatory matters. Different hackathon programmes have been developed by regulators to enhance awareness among the new entrants.

Conclusion

Digital transformation of the Islamic Fintech sector is vital in this era of digitalization and smart regulations are essential to enhance its development. Islamic Fintech can be a tool to reach out to the masses, which are not currently served by the Islamic finance industry, especially Islamic banks. The numerous opportunities provided by Islamic Fintech such as financial inclusion, empowerment of underserved consumers and the achievement of maqasid al-Shari’a; will become apparent when regulators’ concern for financial stability, consumers’ protection, innovation and capacity building are assured. Standardizations and harmonization in regulations have great significance and act as catalysts in the growth and sustainability of the Islamic finance industry.