Smart sukuk structure is one of the most recent and significant structures for future sukuk issuance. In the era of crowdfunding and financial technology enhancement, smart sukuk seems to be the future of Islamic fundraising for infrastructure and business development. Mudaraba contract of Islamic equity-based mode of finance has proven to be one of the most feasible contracts to govern the smart sukuk issuance. The conventional mudaraba sukuk structure represents projects or business activities managed based on the mudaraba contract. However, the unique features of smart sukuk and the proposed mudaraba smart contract have given room for more players to participate in sukuk issuance; whereas the conventional sukuk issuance have technically allowed mostly the participation of big players, such as government agencies, banks and large companies among others.

The revolutionary smart sukuk use blockchain technology to boost efficiency and make the process more transparent and reduce the issuance cost to secure the involvement of small and medium enterprises (SMEs), associations and social impact project owners to participate in the sukuk issuance. This chapter describes the structure of the conventional mudaraba sukuk and proposes a new smart sukuk structure with its unique and innovative features structured under the concept of mudaraba smart contract.

What is Smart Sukuk?

Smart sukuk structure uses blockchain technology and the smart contracts in its effort to enhance transparency, and eliminate fraud and speculations in sukuk transactions. It is also designed to avoid the involvement of intermediaries and save costs and time, which are vital in today’s marketplace. Smart contracts avert tempering and assist in fair dealings. Blockchain technology guarantees the delivery of certain commodities or services once the payment has been made. It can also automatically record the delay if any, and this is revolutionary when it is attached to the mudaraba sukuk transaction. It is undoubtedly important to stress that blockchain technology has the potential to serve and benefit humanity.

However, governments and major financial institutions have been very cautious for their own reasons. But it seems that technology will definitely change the way we bank, the way we finance and the way we do business and many other things. Therefore, it will be a good idea to embrace it, understand it and enforce the necessary regulations to harness its potential and mitigate its risks. Many technology and regulation issues need be resolved to pave the way for the upcoming technology potentials and its authentic impact, and one of those potentials is the smart sukuk structure in the Islamic finance industry.

Mudaraba Sukuk

Mudaraba sukuk are certificates that represent projects or activities managed on the basis of mudaraba principle. This happens via the appointment of one of the contracting partners or any other person as mudarib for operational management (Thomas, 2009). The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) defines mudaraba as a trust contract whereby one party is a capital provider (rab al-mal) and the other party is a manager of the capital provided (mudarib). The main essence of a mudaraba transaction is trust, whereby the rab al-mal entrusts capital to the entrepreneur or mudarib to invest based on his skills and knowledge. Mudaraba is of two different forms: restricted and unrestricted mudaraba. An unrestricted mudaraba allows an open hand to the mudarib to manage the mudaraba funds without specific limitations or constraints. Restricted mudaraba, on the other hand, specifies the nature as well as the type of activities in which the funds should be invested.

The term mudaraba is broadly understood to refer to a form of equity-based partnership arrangement whereby one partner provides capital (the rab al-mal) and the other provides managerial skills (the mudarib). The same characteristics of the mudaraba structure can also be adopted as the underlying structure in sukuk issuance as each investor’s purchase of sukuk would represent units of equal value in the mudaraba capital and are registered in the names of the sukuk certificate holders on the basis of undivided ownership of shares in the mudaraba capital. The returns to the investors could represent profit from the mudaraba capital at a pre-agreed ratio between the rab al-mal and the mudarib, which would then pass to the investors according to the investor’s participating amount of their investments in mudaraba sukuk, or according to the prior agreed percentage (DIFC, 2009).

It is widely argued that the profit-sharing principle suggests that any profit earned without risk-taking is unjustifiable. However, Shari’a-based solutions also exist to help mitigate risks in business transactions. Mudaraba is the most important contract based on the profit-sharing principle. This implies that an Islamic banking model differs significantly from its conventional counterparts primarily by its “profit-sharing” nature, which is effectively challenging the essence of modern or conventional banking in terms of risk and reward (Thomas, 2009).

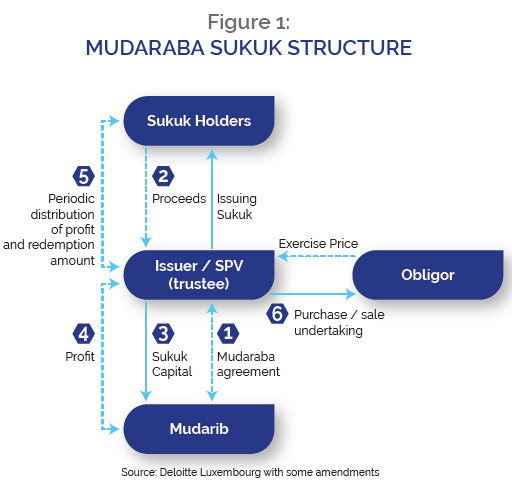

Mudaraba sukuk could be defined as an investment instrument that allocates the mudaraba capital by floating certificates, as an evidence of capital ownership, on the basis of shares of equal value registered in the name of their owners, as joint owners of shares in the venture capital or whatever shape it may take; in proportion to each one’s share therein. Mudaraba sukuk have been used and accepted in the market for some time. Their simplicity makes them both investor and issuer friendly, especially to those issuers without an asset that can be readily used as an underlying in the sukuk pool. The typical mudaraba sukuk structure is shown in Figure 1.

STRUCTURING OVERVIEW

- The issuer is an SPV enters into Mudaraba agreement with Mudarib

- The Sukuk Holders pay the proceeds to the issuer Issuer pays the proceeds of the sukuk as capital of the mudaraba and issues sukuk certificates to Sukuk Holders

- Profit generated from the mudaraba is distributed between the issuer and the mudarib in pre-agreed proportions, with profit in excess of periodic distribution amounts paid to the mudarib as incentive fees.

- The issuer distributes profits to sukuk holders as periodic distribution amounts.

- The obligor executes a purchase undertaking in favour of the issuer (as trustee) for sukuk redemption at maturity or early redemption following default. A sale undertaking is typically used for tax redemption

Shari’a Issues for Mudaraba Sukuk Structure

One of the most important issues in mudaraba sukuk is capital guarantee. AAOIFI standards state that mudarib may provide guarantee to the rab al-mal. At the same time, they restrict the enforceability of such guarantees only to cases of negligence or breach of contract. The issue of capital guarantee is the cornerstone of fixed-income instruments issuance and for that matter, mudaraba sukuk issuance is strongly debated by Islamic finance scholars (Thomas, 2009). Mudaraba capital contribution should not be in the form of debt in any circumstances; but instead, it should be in either cash or in kind. There are three main issues that render mudaraba sukuk questionable by the Islamic scholars in which the mudaraba sukuk seem to be debt-based rather than equity-based sukuk. These critical issues are: (1) capital guarantee, (2) fixed periodic payments, and (3) redemption at maturity or dissolution event.

Sukuk are being criticized for replicating conventional bonds, with the notable difference that sukuk are a tool for the equitable distribution of wealth as they allow all investors to benefit from true profits resulting from the enterprise in equal contributions (Usmani, 2013). Sukuk resemble conventional bonds in terms of tradability, guarantee of the principal amount, the predictability of fixed returns and redemption at maturity or a dissolution event. This makes the Sukuk holders similar to lenders and not owners of the sukuk assets. Hence, the Sukuk holders real ownership of the underlying asset has been critically compromised.

Most of the sukuk, including mudaraba sukuk, are identical to conventional bonds in relation to profit distributions. They return fixed percentages usually based on LIBOR. Even though issuing LIBOR benchmarked instruments are defended on the premise that LIBOR is only used as a benchmark, the fact that the sukukholders are getting fixed returns, especially in the case of mudaraba sukuk, is an active issue of debate in Islamic finance. The mechanism used to fix returns is that of the “incentive fee”. However, if the profits are less than the anticipated return, the issuer/obligor stands ready with a liquidity facility to make up for the shortfall.

Sheikh Taqi Usmani validates the opinion that generally sukuk are different from conventional bonds because the underlying asset is owned by the investors. The sukuk certificates represent ownership portions in assets that bring profits or revenue such as leased assets, or commercial or industrial enterprises, or investment vehicles; which may include several projects. However, Sheikh Taqi Usmani mentioned that the market has witnessed several sukuk issuances that have doubts in terms of their ownership representation. He argued that some sukukholders only hold the right on returns, but not the real ownership of the sukuk asset. Thus, if the returns do not flow from the assets that are in ownership, then the returns are considered to be unlawful (Usmani, 2013). In this regard, it is suggested that smart sukuk can be the answer to all these questions and obstacles related to the conventional sukuk issuance in terms of compliance with the Shari’a laws and regulations.

Technicality of Smart Sukuk

Smart sukuk have different features from conventional sukuk. It is obvious that sukuk markets are the most significant and active within the Islamic finance industry. It is also clear that sukuk are primarily issued by powerful institutions and government agencies. Therefore, making sukuk issuance very costly. The smart sukuk structure has endeavoured to use the blockchain technology and boost efficiency, transparency, reduce cost and make it possible for SMEs, social impact projects, groups and associations to issue their own sukuk using the new technology. The world’s first innovation in smart sukuk was introduced by Blossom Finance. The facility endeavoured to change the conventional ways of sukuk issuance via blockchain.

Blossom Finance’s smart sukuk use Ethereum blockchain smart contracts in order to strengthen the efficiency and make it globally acceptable. The main significance of smart sukuk is the standardization and automation of the accounting, legal and overhead payments of conventional sukuk offerings. All these will be fully backed by a licensed legal entity in the issuing country. In terms of fees, Blossom Finance’s smart sukuk product will not charge any up-front fees or costs to the institutions or investors as is normally practiced in the conventional sukuk. Rather, the issuer or Blossom Finance takes a 20% share of the investor’s profits, which is called a carried capital interest. This means that the company makes money only if investors make money, and Blossom Finance may lose if investors fail to make any profit in the deal. This is exactly the essence of Islamic system of sharing profit and loses collectively.

Mudaraba Smart Contract

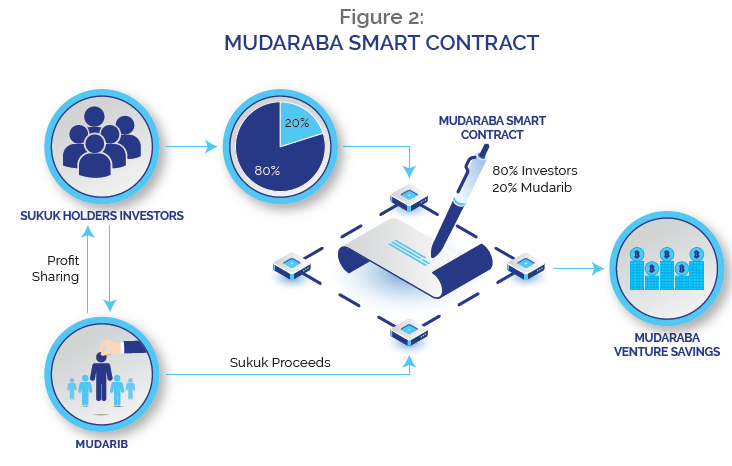

A smart contract is a set of computer code between two or more parties that run on the top of a blockchain and constitutes of a set of pre-defined rules agreed upon by the involved parties (Pratap, 2018). When run on a blockchain, a smart contract becomes an automated computer programme that automatically executes when specific conditions are met. Hence, smart contracts run exactly as programmed without any possibility of interruption, restriction, fraud or third-party interferences. In other words, a smart contract is a set of promises, specified in the digital form, including protocols within which the parties perform on these promises. Smart contract can facilitate the exchange of money, content, property, shares, or anything of value. The illustration in Figure 2 shows how the mudaraba smart contract works.

Mudaraba Smart Sukuk Structure

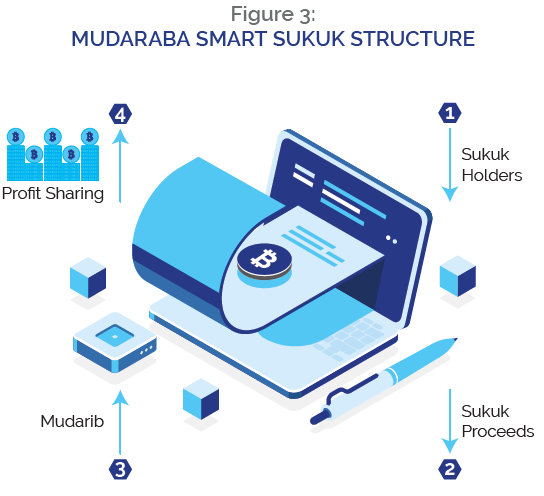

A mudaraba smart sukuk structure skips many players of the conventional sukuk issuance and intermediaries, which helps to minimize the operational cost. The structure involves only the investors, mudarib and the organizer. The blockchain technology is used to receive, manage and reimburse funds raised by the investors and likewise the profit generated from the project or the business venture. The simplicity of this structure and the lower costs involved allows the involvement of different players such as SMEs, social impact organizations and some other profit-wise social initiatives and projects. Figure 3 illustrates the structure of a mudaraba smart Sukuk

1. In a mudaraba smart sukuk structure, the Sukuk holders pay the proceeds directly to the fundraising mechanism, the blockchain technology, to receive and reimburse the proceeds to the relevant mudarib for the business venture or project.

2. Mudarib receives the sukuk proceeds and then invest it in the designated business venture or project with the anticipated profit margin.

3. Mudarib under the mudaraba smart contract will then share the profit with the investors according to the agreed margin as written in the smart contract.

4. The organizer or the tech company will normally collect a fee as an agent or part of the profit as designated in the contract.

Shari’a Issues

Few Shari’a issues could be identified in relations to smart contract. One of the issues is the khiyar (option) in smart contract dealings. Once the contract is executed, there will be no option for cancellation or amendment. In a mudaraba contract, any of the mudaraba contracting parties have the right to terminate the contract individually, except in two conditions. First, is when the mudarib commenced the work relating to the management of the capital of the rab al-mal. Second is when the contracting parties agreed to enter into a mudaraba contract for a specified time or have agreed not to terminate the contract within a specified time. Therefore, there should be an agreement stressing that once the smart contract is actualized and automated; there will be no termination, amendment or cancellation of the contract.

Conclusion

Smart sukuk is becoming the future for sukuk issuance in the Islamic finance industry. However, many players are skeptical in accepting smart contracts and other automated mechanisms for financing purposes. This is due to less familiarity with the automated systems and having no prior experiences with the technology risks involved. Shari’a law has appeared to be tech-friendly in many of the contemporary innovations in Islamic finance. This is because of the general Shari’a principle, which states that any commercial activity of any kind is allowed if it does not violate the precise rules and regulations of the Shari’a law.

Mudaraba sukuk with the smart contract features may be used to actualize many government issuances and social projects of any size. Governments might find it useful to finance SMEs through the mudaraba smart sukuk issuance due to its cost-friendly nature. The instrument could be managed and supervised via blockchain technology innovations. Smart sukuk structure enhances transparency and eradicates fraud and speculations in sukuk transactions. Blockchain technology is undoubtedly helpful and will serve humanity. However, the issue of technology regulations should be the next challenge for the future of smart sukuk structure and smart contracts in Islamic finance.