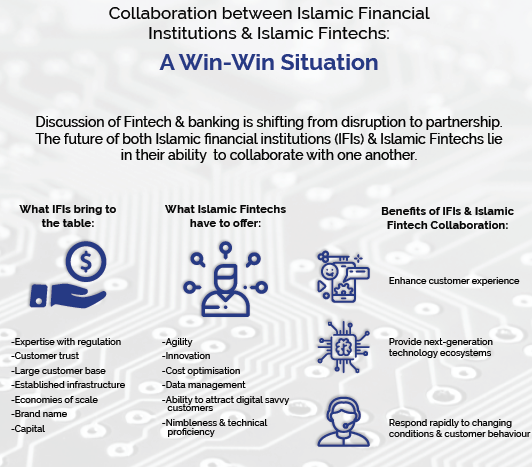

Undoubtedly, for Islamic finance to seize growth opportunity and play a pivotal role in serving the real economy, more collaboration and innovation is needed. This is where Fintech comes in. Fintech startups bring agility and technological know-how to the table; while financial institutions provide resources and regulatory acuity that has been honed over decades. Until recently, the narrative surrounding incumbents and Fintechs insisted the two were at odds. In contrary, the theory that ‘opposites attract’ is valid in this case. Collaboration with Fintech firms could help Islamic financial institutions alleviate the significant challenges brought about by the rapid expansion and diversity of the ecosystem in which they are operating in. Similarly for Islamic Fintechs, collaboration with Islamic financial institutions would help them build trust and scale in a marketplace dominated by legacy banking organizations.

Challenges Faced By Islamic Financial Institutions and Role of Fintech in Addressing Them

The main challenges facing the Islamic finance industry at a global scale are related to regulation, business growth, international expansion and the threats of new entrants. All these challenges necessitate the adoption of new business models that will ensure sustainable growth of the industry. Fintech can contribute to this strategic transition.

Regulation constitutes a major challenge for the finance industry. During the last few years, tightened regulations have deeply affected the financial performance of financial institutions in different ways. The more stringent capital adequacy requirements under Basel III has significantly increased the requirement on holding equity for banks, thus impacting their financial performance. For instance, for the same level of return on assets, banks would now need to mobilize more equity. Similarly, the introduction of IFRS 9 would also affect the financial performance of banks. This standard consists of an impairment allowance calculated based on the expected losses from defaults over the next 12 months, which means that there will be impairment allowances for both healthy and non-performing loans. Such regulation would reduce the return on equity of banks.

International and local regulations are strengthening the different controls related to money laundering, terrorism financing and all external and internal threats. The implementation of these controls represent a significant cost to financial institutions. Indeed regulation seems to be a challenging issue with a direct impact on the financial performance of Islamic banks. Collaboration with Fintechs offers opportunities for Islamic financial institutions to improve the efficiency of systems and operations. For example, the adoption of blockchain would greatly reduce cost of operations as well as improve transparency and disclosure.

Business growth and geographic expansion continues to be a challenge for Islamic finance. While MENA, the GCC and Southeast Asia regions are expected to continue to lead the global Islamic finance industry; emerging markets in Europe, Africa and Central Asia are showing significant growth potential due to the growing presence of Muslim communities living in these regions and the close economic and commercial relationships between them and the Muslim countries where Islamic finance has prospered. Nevertheless, every region has its specific context, constraints and challenges; requiring appropriate business models.

Home to over 250 million Muslims, Africa offers exciting growth opportunities. Key drivers of Islamic finance in Africa are financial inclusion, infrastructure funding and microfinance. Access to finance and financial services leads to economic growth and the lack of it is one of the main challenges faced by Africa. For instance, 350 million Africans do not have a bank account and 30% of them do not use formal financial services due to religious reasons (Global FINDEX, 2017). However, Africa benefits from a huge mobile phone penetration rate with nearly 50% of the population owns a mobile phone. This offers huge potential for financial inclusion by expanding mobile financial services to the financially excluded. Fintech solutions may also be used to evaluate the creditworthiness of microfinance borrowers as well as small and medium-sized enterprises (SMEs) who otherwise cannot be scored by traditional systems due to lack of financial records or credit histories. Hence, by making financial services more widely available and lowering costs and barriers to access finance, Fintech can democratise financial services to the masses.

The finance industry is also facing challenges arising from threats of new entrants in the market. These new entrants with different business models fall generally under three categories as below:

i. Manufacturers launching their finance companies as a complementary service for their customers. The best example to cite is the car industry. Most of the carmakers own subsidiaries that are specialised in granting loans exclusively to buy cars from the parent company.

ii. Telecom operators offering an alternative distribution channel. The telecommunications industry has been quick to recognize the opportunity that digital services represent. Telecom operators are using their platforms and wide distribution channel to offer their own digital financial services. Mobile payment services such as M-Pesa (developed by Vodafone) not only revolutionized the way people spend, save, and send money; but have contributed significantly to greater financial inclusion in Africa. Telecom operators, through their digital financial subsidiaries, are competing with the traditional financial services providers. The launched of Orange Bank by French telecom company, Orange, marked the first attempt by a telecom company in a major developed market to launch a standalone bank.

iii. Electronic platforms. Online payment methods rely on ten payment categories that are card payments (including credit, debit and prepaid cards), direct debit, e-Wallets, online banking, invoice first pay later, cash on delivery or kiosk payments, direct carrier billing and cryptocurrencies (The Paypers, 2018).

Faced by Islamic Fintech Firms

Islamic Fintech firms face several constraints that limit their growth such as inappropriate regulatory frameworks, customer migration to digital channels and tools, and intense competition from incumbents. In this context, collaboration with incumbents is the way forward for Islamic Fintech firms as they seek to scale their business in a strategic and efficient manner. Fintechs provide innovative solutions to complex problems but need the help of banks when it comes to regulatory compliance, licensed financial products and services, technology infrastructure, customer base, and complementary services (complementing offerings with bank services).

Regulatory compliance remains the biggest impediment to the success and growth of Islamic Fintechs. In some restrictive contexts, innovations in financial products and services would require approval from the financial authorities before they can be made available in the market. Moreover, regulators may adopt overprotection strategies vis-à-vis incumbents, which could potentially limit the innovation efforts under the control of incumbents. From another perspective, even in non-restrictive contexts, once Fintech solutions reach a certain level, financial authorities may try to place them under their control in order to mitigate any systemic risk. For instance, Ant Financial, the subsidiary of Alibaba, has originated an estimated 322 billion Yuan of outstanding consumer loans at the end of 2017. This means that Ant Financial may soon face minimum capital requirements as regulators step up supervision of companies offering financing. In this context, instead of competing with banks, the company sees its future in selling computing power, risk management systems and other technologies (Bloomberg, 2018)1. Eventually, all electronic platforms that are offering financing may turn to collaborative relationship instead of competition once regulators decide to apply minimum capital requirements.

Fintech solutions took the lead in defining the major orientations and the pace of innovation across the different sectors of financial services. Fintech players have defined higher bars for user experience, especially large technology firms such as Google and Apple. Nevertheless, the willingness of customers to switch from incumbents to new Fintech solutions and players has been overestimated (World Economic Forum, 2017). In fact, for customers, using Fintech solutions does not mean renouncing traditional financial services. The migration cost to new solutions is still high enough for customers to renounce the services of incumbents. Hence, collaboration with incumbents would make it easier for Islamic Fintech to acquire sticky customers.

The hardest thing about any transformation is the timing of each steps of the transformation process and the way new technology is introduced. Indeed, there are different factors that could prevent the adoption of technology such as cyber security threats, budget constraints, limited digital skills, poor coordination between IT and other departments, and rigid regulation (CIBAFI, 2018). Therefore, for every new technology that is introduced, Islamic financial institutions should define the impact on existing stakeholders, identify new players as well as the necessary infrastructure required to make the implementation successful (Adner, 2016). Fintech firms have so far failed to create new infrastructure and establish new financial services ecosystems while incumbents showed high abilities to react. This means that the substitution process would be slow unless there is a collaboration between both new players and incumbents in creating new business models.

A Collaborative Business Model

Most of the time, when it comes to strategic analysis, the emphasis is more on the threat that Fintech firms present on incumbents while the capacity of incumbents to compete for survival is neglected. As discussed above, the two main elements that justify the creation of a more collaborative universe for both incumbents and Fintech firms are regulations and customers’ expectations and requirements.

Regulation represents a real constraint to harness Fintech innovation. When regulators are overprotecting incumbents, this could significantly limit innovation efforts. The overprotection can take many forms including requirement for a legal or at least a regulatory framework for every Fintech innovation before offering the service to customers, requiring licenses to be granted to providers of new Fintech services and prioritizing incumbents in terms of licenses. This approach is focusing more on the stability of the whole system and it starts with the stability of incumbents. Moreover, imposing the prudential requirements to Fintech firms can discourage them because risk management is not their core business.

For regulators, the stability focus means adopting and imposing tougher regulations on incumbents, which would have a direct impact on their financial performance. In order to tackle the regulation issue, incumbents and Fintech firms are encouraged to work together in a collaborative approach where each party focuses more on its core business and regulators are reassured of the stability of the financial system.

The relationship between customers and incumbents (financial institutions) is based on trust. Nevertheless, the intangible side of Fintech firms does not inspire enough trust to all customers for them to renounce financial services offered by incumbents. At the same time, customers are expecting from incumbents operational efficiency as well as cheaper financial services. These expectations can be handled easily through Fintech solutions. A collaborative approach can help incumbents to reinforce their operational efficiency while reducing their costs and allow Fintech firms to bring more customers to use their services and platforms based on the trust they have in incumbents. Overall, the power of regulation and customers’ trust would encourage the collaborative approach between Fintech firms and incumbents.

Collaboration between Islamic Financial Institutions and Fintech Firms

Generally, when talking about Fintech firms, there are standalone businesses that are competing with traditional institutions and Fintech firms that are providing them with expertise and technical support. In fact, collaboration concerns both types. Collaboration between incumbents and Fintech firms can take many forms and target different objectives. Collaboration between Islamic financial institutions and Fintech firms or amongst the start-ups themselves is a key driver for the exponential growth of the industry.

Incumbents – Islamic Fintech Collaboration

Growth for Islamic banks and Fintech firms requires different sets of solutions. But together they can collaborate and provide mutual benefits to each other. Fintech firms can develop alternative solutions for the daily transactions of Islamic financial institutions. The aim of these solutions is to lower the cost of transactions and to facilitate access to financial services in a way that reinforces the attractiveness of incumbents. Moreover, for newly established Islamic financial institutions, their implementation strategy should include a Fintech component as a competitive advantage in order to fill the gap in terms of limited geographic coverage.

Through collaborations like building start-up incubators and accelerators, banks can invest long-term into the future of promising start-ups and have access to new technology and equity in the successful “graduates” once the process is completed. In this way, Islamic finance will reach new customers and new levels of growth by creating impact in innovation and SME sectors where the great untapped economic potential lies. Islamic financial institutions can also initiate collaboration through competitions such as Hackathons or innovation awards. The purpose of these competitions is to identify new trends in terms of innovations to guide strategic orientations. At the end of the competition, the Islamic financial institution can sign agreements to implement the solutions or to support the winner in its innovation efforts. Islamic financial institutions can also sign a Memorandums of Understanding with Research and Development Centres in universities and outside the academic sphere in order to support innovation efforts that can contribute to upgrading the current business model.

Generally, an Islamic financial institution should adopt a hybrid strategy including the three channels of partnership with Fintech players (The Economist, September 2016). Indeed, if an institution relies solely on internal initiatives, it could be unproductive while missing opportunities outside the institution. Similarly, if an institution relies solely on external initiatives, they may be successful but not exactly be in line with the global strategy. Therefore, reforming the financial services of incumbents requires a hybrid strategy in order to mitigate the risks of unproductive initiatives.

Islamic financial institutions are already working together with different categories of businesses. During the last decades, in different sectors, digitization took the lead and created new business models based on electronic platforms, marketplaces and immaterial flows. For instance, retail e-commerce sales worldwide reached US$2.5 trillion in 2017 with an annual growth rate that represents roughly 30%. This reflects the deep change in the way people buy and sell goods and services at a global scale and thus, requires the involvement of Islamic financial institutions in order to maintain their position in the market.

It is essential for Islamic financial institutions to keep an eye on fast-growing technological platforms and initiatives in order to identify the collaboration paths with these players. For example, a marketplace can collaborate with Islamic banks in order to sell its products on murabaha (or any other formula) using its platform. These kinds of platforms are called Multi-sided platforms (MSPs). Such platforms provide support that facilitates interactions (or transactions) among the two or more constituents (sides) that it serves, such that members of one side are more likely to get on board the MSP when more members of another side do so (Hagiu, 2007). There are two main possible strategies to develop MSPs in the Islamic banking context. First is to open the door to third parties. In this context, the product or service the company (the bank or one of its partners) is providing has a big customer base that the third-party sellers of other offerings are interested in reaching. The company can create a MSP by making it possible for those third parties to connect with their customers through advertisement or sales. Generally, the products provided by third parties may be independent or can be combined with the products of the platform owner.

In the Islamic finance context, the platform owner can be the Islamic financial institution or the marketplace owner. Generally, in most countries, there are already marketplaces (such as Amazon, Ali Express, Souq.com, Jumia) that have developed large customer base. Islamic financial institutions can be plugged to these marketplaces as third parties. Nevertheless, in the absence of such marketplaces, Islamic financial institutions can create their own platforms and give access to third parties. Islamic financial institutions can be plugged to marketplaces or create their own platforms providing a large variety of commodities and equipment to sell on instalments. The principle seems to be similar to the invoice first pay later platforms (The Paypers, 2018).

Second is connecting with customers. In this scenario, the platform owner sells a product or service to two distinct customer segments that interact or transact with each other outside its offerings by creating a MSP consists of modifying or expanding the offering so that at least some of these interactions can occur through the platform. Islamic financial institutions can create a platform where their customers (corporations, SMEs) can meet online and conclude deals. After which, Islamic financial institutions can offer appropriate financial services to the deals concluded.

While there has not been much collaboration between Islamic financial institutions and Islamic Fintech firms, there is an increasing trend of moving towards this direction. Finocracy, a consulting company based in Bahrain, is driving efforts to connect Islamic Fintech firms with Islamic banks in the Middle East region. Additionally, accelerator programmes in the United Arab Emirates (UAE) and Bahrain are meant to bring innovative Fintech firms to work together with large corporates including banks. The key difference between conventional Fintech firms, however, is that collaborations in Islamic Fintech firms are less driven by the banks and more through third parties. This perhaps provides some indication that Islamic banks are less prepared or eager to work with Fintech firms, despite the potential technology gain that can be achieved.

Others – Islamic Fintech Collaboration

As Islamic Fintech sector is still in its nascent stage, there is plenty of room for development and progress. This can be achieved through collaboration with key resource institutions such as universities, research bodies and even Shari’a advisory organizations. The two-way transfer of knowledge, research and data can give rise to products not just tuned to market demand but also validated by strong research. Another key aspect of the Islamic Fintech sector is ensuring Shari’a compliance in order to gain the trust of consumers and other stakeholders. By collaborating with Shari’a certifying bodies, it will not only lower the cost of Shari’a compliance but can also encourage innovative products that meet Shari’a standards.

Islamic Fintech – Islamic Fintech Collaboration

Collaborations between Islamic Fintech start-ups in various sectors would also help grow the sector. At this point, we have not seen much of this happening given the dearth of Islamic Fintech firms in the first place. However, as the sector grows, it makes sense for Islamic start-ups to work with each other in supporting businesses and sharing know-how. As an example, through collaboration between companies and peer-to-peer players, they can outsource their payment or cash management services to third parties. They may also outsource their credit scoring or credit monitoring systems via other Fintech businesses.

The Impact Levels of Collaboration on Incumbents

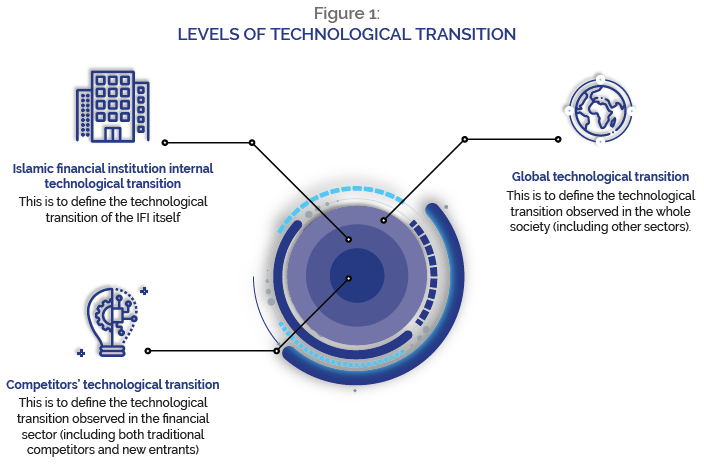

In practice, there are three levels of technological transitions to observe (Figure 1). The first level is the global technological transition that occurs in the external environment (including other sectors). The second level is the technological transition happening within the financial sector (including both traditional competitors and new entrants). The third level is the technological transition that takes place in the Islamic financial institution itself.

When an incumbent is planning its technological transition, the following rules need to be respected:

i. The incumbent needs to analyse the pillars of the global technological transition and its impact on the competitive position and advantage of the business.

ii. The incumbent needs to understand the choices made by different competitors in terms of technological transition and its impact on the competitive position and advantage of the business.

iii. The incumbent needs to identify the pace of transition in each of the three levels as shown in Figure 1.

iv. Based on the different analyses, the incumbent can define the main principles underlying its technological transition and the pace of adoption.

Indeed, if the transition pace of the Islamic financial institution is more important than the global transition, this implies that the Islamic financial institution would want to take the lead on the global transition and create the change. This is the LEADER strategy and the requirements in terms of means and lobbying are high. If the transition pace of the Islamic financial institution is equal to the global transition, this means that the Islamic financial institution is a follower and is part of the change. For the FOLLOWER strategy, the requirements in terms of means and lobbying are not that high. On the other hand, if the transition pace of the Islamic financial institution is inferior to the global transition as well as to competitors, this means that the Islamic financial institution is not considering Fintech as part of its competitive advantage.

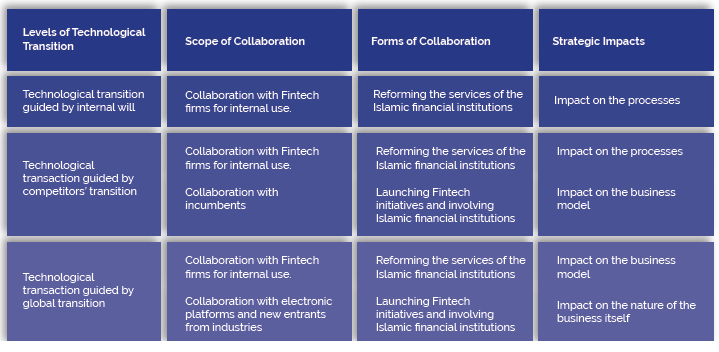

From another perspective, there are many collaboration opportunities with external third parties including competitors. Collaboration with Fintech firms is critical in order to create platforms for internal use such as human resource development platforms, risk management platforms, and all other similar aspects. In terms of collaboration with incumbents, Islamic financial institutions should work together to create national platforms in order to avoid duplications. Such collaboration aims at reducing the costs of regulatory requirements and cost of functioning. The final form of collaboration is with electronic platforms and new entrants from other industries. Here, Islamic financial institutions can create their own electronic platforms and integrate third parties, and thus create multi-sided platforms or be part of existing electronic platforms. Moreover, Islamic financial institutions should collaborate with financial subsidiaries belonging to other industries. In both cases, Islamic financial institutions would renounce their front functions in favor of these new entrants.

When it comes to technological transition, there are three levels of impacts on the current business model as outlined below.

Impact on the processes

Fintech firms can reform the processes without any major change in the business model of the Islamic financial institution. In fact, this is the most dominant form of collaboration between Fintech firms and financial institutions. It concerns daily transactions and internal processes. The aim of this transition is operational efficiency and lower costs.

Impact on the business model

Fintech firms can impact the business model of Islamic financial institutions. For instance, multi-sided platforms would replace the traditional distribution channels of Islamic banks. Indeed, selling goods on murabaha contract would be possible through an electronic platform without the involvement of internal staff.

Impact on the nature of the business itself

Technological transition in different sectors would impact the nature of the business itself. For example, autonomous vehicles would lower the cost of rides. If so, people would prefer to buy rides rather than buying cars. In this context, Islamic banks would need to grant appropriate financing to firms selling rides instead of people willing to buy their own cars. This change in the nature of the business itself means also a change in risk exposure and in financial performance.

The following table gathers the different elements discussed above. For every level of technological transition, it defines the scope of collaboration between Fintech firms and incumbents, the forms of partnership and the impact on the processes. In the case of the technological transition guided by internal will, collaboration with Fintech firms for internal use aims at reforming the services of the Islamic financial institution with an impact on the processes. When the competitors’ transition guides the technological transition, collaboration with Fintech firms aims at reforming the services of the Islamic financial institution and gets involved in common initiatives with competitors. Know Your Customer (KYC) national platform in Singapore is the best example to cite. When the global transition is guiding the technological transition, collaboration with Fintech firms aims at reforming the services and launching initiatives that would accompany the change in different sectors. The transition would impact the processes, the business model and the nature of the business itself.

Renouncing Collaboration

As discussed above, collaboration between Fintech firms and incumbents is justified by many elements (the regulators’ approach and the customers’ expectations in terms of the trust). The current regulators’ approach constitutes in itself a barrier to entry for Fintech firms. Nevertheless, in some contexts where regulators adopt a more open approach, traditional financial institutions are still taking the lead in the financial ecosystem but their growth rate is very interesting and the technological transition is happening but in a slower pace.

The pace of the technological transition is justified by the trust that customers have in traditional financial institutions that are upgrading their services in order to compete for survival as well as dominance. In fact, collaboration would have two consequences. It will reinforce the position of incumbents since it will help them upgrade their services and business model, and it will reinforce the trust of customers in Fintech solutions.

Indeed, if incumbents were able to create their own Fintech initiatives, they will be able to renounce this collaborative model and vice versa. On the other hand, if Fintech firms were able to gain the necessary trust in their services, Fintech firms will be able to renounce incumbents. In practice, collaboration brings the two elements together and satisfies fully customers’ expectations. Overall, the only thing that will keep the collaboration working is specialization. In fact, each party would focus more on its core business and would rely on the other party to reinforce its strategic position.

Conclusion

The technological sector is taking the lead on the global economy and imposing a transition in all other economic sectors. This transition would bring a big change to the current business models and on the business itself. For Islamic financial institutions, adopting a Fintech strategy is a prerequisite for survival and for continuity. Therefore, harnessing Fintech innovation is a way to ensure sustainable growth for the Islamic finance industry as a whole. Indeed, collaboration between traditional Islamic financial institutions and Islamic Fintech firms seems to be the right path to follow in order to harness innovation and to achieve the goals of the technological transition.

The technological transition of Islamic financial institution requires analysis of global transition as well as competitors’ transition in order to identify the opportunities of collaboration and partnership with other stakeholders. This transition would bring deep changes in processes and business models including the business itself. In fact, moving to the Fintech arena requires identification of the main aspects to handle. For instance, technological transition would require new skills. As such human resources upgrade should be as fast as the transition itself. Otherwise, human resources who are supposed to contribute to the transition would be the main constraint of it.