Artificial Intelligence (AI) is a transformative technology that is disrupting many sectors. Organizations are now using machines algorithms to identify trends and insights in vast reams of data and make faster decisions that will potentially position them to be competitive in real time. To this effect, the possible benefits that can be achieved by utilizing AI in the finance sector is manifold. Predictions estimate that the financial services industry can save some US$1 trillion by 2030 by incorporating AI in their operations (Joyce, 2018).

The Islamic finance industry has been witnessing a decline in growth rate over the last few years as stated by the Global Islamic Finance Report 2018. A strategic overview of the root cause of this decline and possible ways to circumvent the hurdles in the progress requires structured planning. The first step towards this is to gain a greater understanding of the growth and decline patterns and trends witnessed by the industry through insights drawn from accumulated data using machine learning, a subset of AI. In recent years, a growing number of Islamic financial institutions are rapidly developing their own AI tools to aid their operations as part of the digitalization strategies that will provide them the leap towards a more digital future.

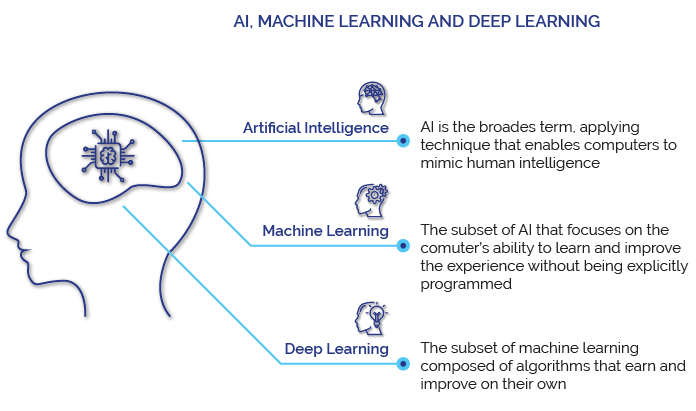

Artificial Intelligence, Machine Learning and Deep Learning: What Is The Difference?

Modern technologies like AI, machine learning, and deep learning have become integral for many businesses. These technologies are not only revolutionizing various industries such as retail, finance, travel, manufacturing, healthcare, etc; they have permeated our daily lives, influencing the ways in which we think and perform our everyday activities. When John McCarthy first introduced the AI concept, the objective was to explore possible ways a machine can reason, think, solve problems and improve like a human; thus simulating human intelligence in principle (Childs, 2011). There has been a resurgence of interest in AI recently mainly due to the advent of big data, which can be leveraged through AI applications to aid in the healthcare industry, the automotive industry, the linguistic arena as well as the financial services sector (Commission, 2016).

AI can be viewed as an interdisciplinary concept that involves a study of the possibility of creating machines that interact with the environment and act on the received data in an intelligent manner. AI can be broadly classified into General AI and Narrow AI. The proposition of AI envisaged machines as having human-like intelligence fall into the broad category of General AI. However, this still remains an idea, whereas what has been achieved so far falls in the category of Narrow AI. An example of Narrow AI is face recognition in Facebook and the category relates to specific tasks that can be performed by machines in a similar way or better than humans but lacks general reasoning capability.

The achievement of intelligence to perform the specific tasks indicated above was initially made possible by machine learning, which can be considered to be a subset of AI. In machine learning, a machine is first trained using large amounts of data and algorithms that gives it the ability to learn how to perform a specific task. Algorithms are used to first parse data, learn from it and then a prediction is made about a certain matter rather than humans feeding hard-coded software routines into a machine to perform a specific task.

Deep learning is a subset of machine learning and absolves the need for human supervision in the learning process of the machine. In machine learning, the supervision by the human is very specific and dependent on his interpretation of the target subject. For example, if the machine is being trained to look for a certain image, then the programmer would need to provide a group of features the machine should look for. In deep learning, the learning process is unsupervised and the machine builds its own feature set. For example, it is presented with images of the target and other random images with meta tags to distinguish whether the image belongs to what is being sought after or not. The machine then looks at the images that belong to the target object and starts building the feature set. The learning process is hierarchical and is iterative somewhat aping the neural networks of a human brain. Deep learning has brought Narrow AI closer to the dream of a General AI (Copeland, 2016). Uses of deep learning include stock market trading signals, medical diagnosis and many of the recent notable innovations in AI like self-driving cars, Google DeepMind’s AlphaGo and intelligent voice assistants.

Applications in the Islamic Finance Industry

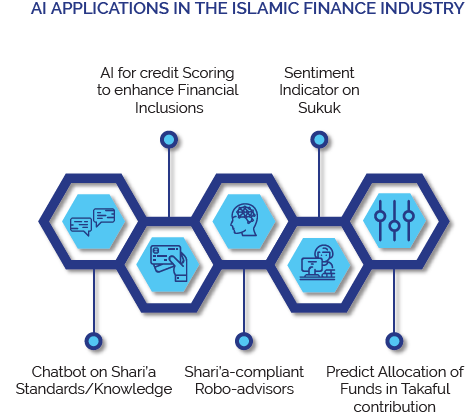

Estimates indicate that by 2030, AI will enable costs savings of 22% for traditional financial services industry (Joyce, 2018). AI can be used to replace human resources or augment the existing infrastructure, which is the current practice to do away with regulatory concerns and inculcate trust in AI-based systems. Many organizations are exploring and implementing applications to save time, cut costs, and improve operations. From identifying fraud to generating reports for investors, many day-to-day operations could be automated with AI technologies. The potential application areas of AI can be divided into the following categories – front office, middle office and back office. It is expected that some US$490 billion of savings can be realized if AI is incorporated in front-office tasks, US$350 billion in the middle office, and US$200 billion in back office (Joyce, 2018).

1. Front Office

In the financial services industry, AI could be the key to more personalized services and information consolidation. Front office activities such as credit scoring and insurance/takaful can be optimized to the extent that many financial decisions are based on wide-scale data analysis. Relevant front office applications can be demarcated as highlighted here.

Credit Scoring

Traditional credit scoring system has long been used in the banking industry as the primary method to rate creditworthiness. The adoption of AI in credit scoring is gaining traction as banks look towards using alternative data sources such as mobile phone activities, social media usage, internet activities, and online behaviour to capture a more accurate assessment of creditworthiness and improve the profitability of loans. This kind of algorithmic credit scoring is considered to be more accurate in predicting risk and is more just as it does away with all discriminations on race and gender amongst others, that have been present in the traditional methods of credit scoring. Alipay, a Chinese payment firm, calculates its credit score using the social media details of its customers, knowledge of the phone they use, the augmented reality games they play and their purchase history. A good credit score in China does not solely help in getting a loan but it also acts as a parameter to evaluate one’s character during employment and similar needs (O’Dwyer, 2018).

There are companies that curtail the credit of their clients if charges for counselling sessions are indicated, as ongoing strife in life can signal potential job loss. Algorithmic credit scoring can prove to be a boon for the Islamic finance industry, which caters to the needs of the Muslim community primarily. A large percentage of Muslims do not access traditional financial services and a significant percentage remains ineligible for loans from traditional financial institutions on account of lack of credit. The same is true for people of other religious beliefs. Firms utilizing AI–based credit scoring are WePay from China, Branch from Kenya (working on data gleaned from M-Pesa mobile payment platform), Kreditech from Germany (utilizes data from Facebook) and ZestFinance, a US company working on big data.

Takaful (InsurTech)

The insurance industry is data-driven and hence, using machine learning is the most plausible tool to enhance the efficiency of the insurance providers. Takaful has not been much embraced by the masses and still remains an area of Islamic finance that still needs mass adoption. A possible conglomeration with AI-based integrations can make it more approachable for the masses. A survey result indicates that 82% of the respondents have the opinion that their organization lacks the knowledge and expertise to integrate AI whereas 57% of the respondents indicated that AI has enhanced the accuracy of their analytical models leading to better risk assessment and decisions (Ismail, 2017).

Financial models in conventional insurance were dependent upon data gathered on the past performance to predict future outcomes. The advent of Internet of Things (IoT) changed things to gather real-time data to make predictions as in the case of automobile insurance, where real-time data on the damage to the car can be sent directly to the insurance provider with the claims being settled in a matter of seconds. Takaful works in a slightly different way in providing a mutual guarante in the case of loss or damage. In a takaful contract, participants agree to pay a sum as their contribution (tabarru) for those in need and invest the rest of the amount in Shari’a-compliant commodities or business and share the profit as per the agreed ratio. Applying machine learning on past data can help predict how much funds are to be allocated for tabarru and investment, respectively.

Another application of AI in takaful is the use of IoT sensors, which will transform the way takaful companies gather information about customers and their environments to process claims, determine risks and calculate contributions. IoT sensors provide personalised data to pricing platforms, allowing takaful companies to price coverage based on real events, in real-time, using data linked to individuals rather than samples of data linked to groups. For example, if such a device is installed in a car, it will be able to develop a larger picture of the customer’s driving habits. With this information, takaful companies can build a comprehensive image of the driver, indicating how likely he is to be the cause of an accident and thus how risky he is as a customer. Individual monitoring can reveal insights to machine learning tools to provide customized fees that each policyholder needs to pay instead of the same amount being paid by all the participants irrespective of their past claims. It not only provides more precise information but also saves money that would otherwise be spent on costly assessments and audits (Burns, 2018).

Automated identity verification can improve customer experience and provide customized takaful policies, which the customer might be interested in. Zhong An is the first conventional online insurance provider in China and since its inception in 2013 has sold 7.2 billion insurance products with image recognition at the forefront of its business model. Lapetus is a conventional life insurance provider where customers can buy insurance using a selfie. Neos Ventures is another company in conventional InsurTech providing smart home monitoring and home insurance. Takaful can follow suit with customizations to suit its Shari’a-compliant business model.

Chatbots

In the digital age, customers want real-time feedback to their queries. Hence, the financial services industry needs to function similar to Amazon and other e-commerce sites, which cater to their clients 24/7. Chatbots offer front-end service to consumers, which appeals to them by providing immediate real-time information. These bots interact directly with consumers on websites, phone systems, mobile apps, messaging apps and home assistants. The chatbots need to be trained in the market area they would be deployed for, especially in Shari’a standards. Consumers can greatly benefit by having chatbots tailored to answer queries related to Shari’a-compliance of products and services citing relevant Hadiths and verses from the Qur’an. This would drastically reduce the wait time a scholar answers a query posed by a customer. An example of such an application is the M Chatbot developed by Hong Leong Islamic Bank through a collaboration with a local research university. This particular chatbot is equipped with Shari’a knowledge regarding the authorities, articles and scholars in relation to Shari’a contracts and products offered by the bank. A chatbot can also assist in basic tasks like balance inquiry, bank account details, loan queries, creating and managing financial budget, offer financial advice, track spending habits and even in providing credit scores.

According to a report by Juniper, chatbots would account for annual cost savings of US$8 billion by 2022 whereas Gartner states that by 2020 chatbots would be handling 85% of customer service interactions (Marous, 2018). Chatbots can be integrated with other technologies to offer innovative products and services. For example, IoT sensors can interact with a chatbot of a takaful provider to provide a claim settlement in real-time. Chatbots have been used in banking generally for front office operations but JP Morgan Chase has introduced COIN utilizing chatbots in back office operations. COIN has enabled the analysis of complex contracts more quickly and efficiently than lawyers, saving more than 360,000 hours of labour (Marous, 2018). Wells Fargo is using a chatbot employing AI and Facebook messenger to answer queries of users on their account balance and the location of the nearest ATM. Islamic banks that have integrated chatbot into their customer service infrastructure are Kuwait Finance House, Bank Syariah Mandiri, Dubai Islamic Bank and CIMB Islamic, to name a few.

2. Middle Office

In the middle office, AI can be applied to report generation, underwriting and credit decision-making, and risk and compliance monitoring. Identifying exceptions (and becoming better at doing so) is one example of AI helping employees become both better and faster at their jobs. Some middle office tasks are elaborated here with the inclusion of AI in their execution.

AML/ CTF, KYC and Fraud Detection

In the middle office, AI can perform real-time regulatory checks for Anti-Money Laundering (AML) or Know Your Customer (KYC) on all transactions rather than rely on more traditional methods of using batch processing to analyze only samples of consumers. AI can also aid financial institutions combat crime and detect fraud. For example, AI can identify patterns in vast amounts of data and recognize potential fraudulent transactions more quickly and accurately than human staff. This becomes even more critical as AML is a major challenge for financial institutions and it requires the efforts of a lot of manpower to manage the whole process. Further, financial institutions now need to fulfil many regulatory obligations and compliance requirements, including counter-terrorist financing (CTF) and KYC. A research report by United Nations Office on Drugs and Crime, released in 2011, had put estimates on money laundering as amounting to 2.3% to 5.5% of global GDP and indicated that less than 1% of the illicit financial flows were seized and frozen at the time the report was released (Walker, 2011).

The two key AML activities are suspicious activity monitoring and transaction monitoring. Transaction monitoring can be achieved using blockchain as well as independently with machine learning. Machine learning can be used to teach computers to detect and recognise suspicious behaviour and trigger alerts classifying them on the basis of the severity of crime ranging from high risk to low risk. Further, computers can be taught to handle these alerts so that humans would only need to review the machines instead of reviewing all the triggered alerts manually.

Many businesses need to comply with regulations where a KYC verification is essential before a consumer is registered to use a product or service. Most of the times an official identity document is needed to confirm the credentials of an individual with the aspects governing the acceptance for registration determined by the imposed regulations or the nature of the business. Islamic Fintech firms would need to observe proper KYC too, in addition to Islamic financial institutions, to ensure compliance to regulations and auditing as per the geographical laws. The verification is done either in-house or the services of a third party are utilized. KYC is also helpful in combating frauds by preventing spurious elements from gaining access to a service. AI can help to automate KYC, enabling identity verification in real-time with any tampering or a fake document being detected by the devised AI tool. AI can facilitate facial recognition, document verification, and address verification instantly. Additionally, a system built using KYC can have multiple language support enabling official documents to be read and verified in multiple languages for international financial institutions. AI when integrated into KYC can provide protection from facial spoof attacks as well as enable multiple formats to be used for KYC verification like Optical Character Recognition (OCR)1, Intelligent Character Recognition (ICR)2 and live video verification etc.

Sentiment Analysis

Financial institutions have recently started investing in AI-based tools that aid in providing consumer sentiments for market development. These sentiments help them to develop strategies for the creation of new products or services, determine the appropriate time of their launch, enable the investors to take a decision on what to invest in and determine the lifetime of a launched product or service. Furthermore, AI can be used to not just provide sentiment indicators on a listed sukuk but also to offer customized recommendations to investors on which sukuk to invest in. This can be achieved by using AI to scan through news and social media data for recording of details considered relevant for the target financial institutions. Alternatively, machine learning can be employed on the organizations’ data itself to gain insights on the positive, negative and neutral sentiments of the clients.

3. Back Office

For back office, AI finds more value in process automation and is leveraged to support employees in recurrent and time-intensive tasks. In this case, AI is not directly applied to finance, but the applications are diverse such as the interpretation of legal contracts or the automatic classification of emails and documents. AI has the potential of enhancing back office efficiency with its applications, thereby automating mundane and tedious tasks as well as improving the overall business productivity. Potential usage of AI in this area of operation is given below.

Capital Optimisation

Banks are facing severe capital shortage, especially in Europe, on account of new regulations and the volatility of the financial markets (Bernhard Babel, 2012). Amidst scarce capital resources, maximization of profits is a traditional function in banks that benefit from the use of mathematical approaches. Machine learning can be employed to achieve capital optimization in a faster, more accurate and more efficient manner. Research efforts should be undertaken to see how an Islamic bank’s regulatory capital can be optimized using machine learning to be at par with conventional banks. Most conventional banks have already made efforts to optimize risk-weighted assets (RWA), recording a RWA saving of 5% to 15% (Bernhard Babel, 2012). Conventional banks are also working in the area of margin optimization of the derivatives like margin valuation adjustment (MVA) (Board, 2017).

A paper by Heusser and Varhol giving an introduction to genetic algorithms (Varhol, 2016) and another by Bai on analysis of particle swarm optimization algorithm (Bai, 2010) offer machine learning techniques to optimize funding costs amidst leverage ratio-implied capital charge (Board, 2017). The leverage ratio gives the maximum loss that can be absorbed by equity and hence, is very attractive for the Islamic finance industry where equity-based financing is given priority. Machine learning can be employed to optimize MVA by using different methodologies to reduce the initial margin and similar can be employed to attain margin maintenance when using sukuk as collateral (Alvi, 2017).

Market Impact Analysis

Market impact is a crucial parameter that financial institutions need to keep into account when making decisions to move large amounts of money. Machine learning can be used to support existing market impact models. JP Morgan uses a transient model for liquid assets like equities where it uses AI to carefully time the trades to prevent scheduling trades too closely together, which can maximize market impact (Day, 2017). AI can also be used to create ‘trading robots’ that can teach themselves how to respond to market changes.

Model Risk Management

The number of models used by banks for decision-making is increasing with figures stating a rise of 10-25 annually in large institutions (Ignacio Crespo, 2017). Regulatory challenges have given rise to a number of models to meet regulatory requirements, such as to achieve stress testing. Talent scarcity and the need to meet business needs like pricing have also resulted in the proliferation of models. Model risk management is consequently of paramount importance and unanticipated results can have severe consequences for the organization. Hence, model misuse and defective models need to be monitored to avoid potential pitfalls and ultimately financial losses.

Machine learning can be used to understand the bias in data, relative strengths of the algorithms employed, usage of the model on unseen data and other performance metrics. Back-testing and validation of the models using AI can lend greater transparency to models. A global investment bank has used unsupervised machine learning algorithms to detect faulty projections produced by its stress testing models for its equity derivatives business (Board, 2017). The similar can be employed for not just sukuk but also for models built for products based on musharaka, mudaraba, salam, istisna and istijrar.

Asset and Wealth Management

Asset and wealth management firms have a treasure of historical data making them ideal to use AI. Machine learning employed on social media data, news data and financial data can enable informed investments, thus giving an edge to the firm in the market. AI firms managed about US$10 billion of assets with predictions of an increase in the coming years (Board, 2017). Asset managers are using third-party tools to build indicators using AI. Moreover, AI can assist in both digital and physical asset management by industrial predictive asset management and monitoring, portfolio management and applications aiding consumers in investment decisions.

Aladdin Risk Platform launched by BlackRock Solutions, one of the world’s largest investment management firms, is an operating system that uses machine learning to provide investment managers with risk analytics and portfolio management software tools. As per claims, Aladdin can monitor over 2,000 risk factors per day and test portfolio performance under different economic conditions (BlackRock, 2018). Wahed Invest, a US firm, launched two Shari’a-compliant index-tracking funds under its Robo-advisor platform in 2018. Wahed Invest creates and manages portfolios made up of low-cost funds (Vizcaino, 2018).

Regulatory Technology (RegTech)

RegTech involves using technologies to help in the compliance of regulatory requirements more efficiently than existing capabilities. AI can achieve the same with more ease, accuracy and efficiency than humans and consequently, investments in RegTech initiatives are on the rise. According to a 2016 estimate by Insights, some US$2.3 billion was raised in funding rounds for RegTech companies and it is indicated that this figure is expected to increase with time with the global demand for regulatory compliance and governance software expected to be around US$118.7 billion by 2020 (Ovenden, 2018). Martin Arnold of The Financial Times states that ‘Big banks, such as HSBC, Deutsche Bank, and JPMorgan, spend well over US$1 billion a year each on regulatory compliance and controls. Spanish bank BBVA recently estimated that on average financial institutions have 10 to 15% of their staff dedicated to this area’ (Ovenden, 2018).

Machine learning can be used to integrate and monitor various communication channels facilitating bank personnel to operate in a controlled messaging environment; which can help to analyze communications in real-time for identification of culprits to combat wrongdoing. Machine learning can be used with Natural Language Processing (NLP) for analyzing unstructured data and helping asset management firms in complying with regulations. NLP is a subfield of AI that helps computers to understand and process human languages, which is a kind of unstructured data. Islamic finance needs to embark in this direction to have RegTech initiatives that do not cater to just regulatory compliance but also Shari’a compliance, having its own field of Shari’a technology or ShaTech.

Supervisory Technology (SupTech)

Supertech is a supervisory technology for regulators. It can also be understood as RegTech for regulators themselves. The last 10 years have seen a 500% increase in regulatory changes in developed markets and banks are spending US$270 billion per year on regulatory and compliance obligations. It is estimated that in the UK and US, banks will have fines levied on them by regulators equivalent to more than US$400 billion by 2020 (The Emergence of SupTech – Supervisory Tech for Regulators, 2018). In such a scenario, regulators need to do a lot of work to constantly monitor whether the regulations are being adhered to, detect and impose a fine for any lapses, do the detection in a short duration of time and ensure that the staff is able to accomplish the objectives in a reasonable time period with optimum productivity levels.

AI can aid SupTech agencies in developing data-intensive approaches to supervision. Supertech firms help in standardizing, digitizing and automating basic supervisory procedures and working tools like inspection reports. They also provide solutions that can broaden the supervisory scope, transform procedures and techniques to increase the timeliness of supervisory assessments. A shift away from manual assessment to automation using AI can prove to be beneficial in the reduction of human errors, time as well as provide a platform for aggregation of data from regulated firms to help in devising new regulations or on improving the existing ones. Islamic finance industry also needs to look into SupTech and couple it with standardizing bodies in the industry.

Conclusion

The Islamic finance industry can benefit by using AI in reducing costs, time of delivery, accuracy and customization of their products and services tailored to meet the needs of the digital age consumers. However, there are a lot of things that need to be taken into consideration simultaneously to prevent the pitfalls and be prepared for the challenges that come with using a novel technology. A survey conducted by Deloitte and the European Financial Management Association indicates that AI is still in its infancy in the conventional finance sector. Results of surveying more than 3,000 C-suite executives indicate that 40% of the firms surveyed were still learning how to use AI, 11% had not started and around 32% were actually developing AI-based solutions (Deloitte, 2017).

Broadly speaking, AI is a technology that works by analyzing data and producing outputs that depend on the analyzed data. In this scenario, if the underlying datasets employed for an AI-based solution lack quality and robust quantitative analysis, then the decisions made using the technology will not be sound. Some AI-based solutions involve producing a decision dependent on multiple hidden layers, as in deep learning. In this situation, the decision can seem to be coming from a black box, with organizations unable to understand the accuracy of the resulting decision and adherence to the priorities of the organization in arriving at the conclusion. Financial institutions can feel at a loss for their lack of control on the intermediate processing layers in complex AI solutions and this would make both audibility and traceability cumbersome. The high speed of execution of an AI-based tool can produce errors, which might not be caught in time resulting in losses for the financial firm.

Adopting the financial institutions to an AI-driven initiative will require many changes like reallocation of staff to other activities if automation absolves their need, availability of enough skilled personnel to handle tasks manually if an AI solution fails or is temporarily withdrawn, recruitment of technology experts and involvement of staff with expertise in financial engineering. Ultimately, the entire strategy and leadership of the organization would need some changes to accommodate leaders that have the necessary know-how to plan, develop and implement solutions tailored to using AI and other technologies. The Islamic finance sector needs to change its education pattern to involve the study of AI, other technologies and in particular experts in financial engineering to be able to increase and maintain the growth rate of the industry in the coming years.

Businesses still face a number of challenges to integrate AI into operational processes. For AI to succeed, companies must have a large volume of high-quality data to train algorithms. They will also need to ensure technology aligns with business priorities. Additionally, companies will need to consider the cultural implications of AI. Although technology has the potential to eliminate some monotonous tasks for employees, it can also create anxiety about the future of their roles. Addressing the human factors and encouraging employees to contribute to the success of AI initiatives will be critical.