With the growth in Islamic finance stagnating, a fresh solution is required to kickstart interest and usage in this space. This is expected to come in the form of financial technology (Fintech), which has seen astronomical growth in the conventional finance space. Adopted for Islamic finance, Fintech can provide the means in boosting interest in Islamic finance and in increasing its accessibility to the wider Muslim world. It has been argued that Fintech is closer to the spirit of Shari’a as it removes two major risks specific to the banking sector, namely uneven maturity and leverage (Alaabed and Mirakhor, 2017). Even though Islamic Fintech is growing, it is still in its early phase. While pioneers in the sector started four to five years ago, the sector growth has been anaemic, especially when compared to the overall Fintech market. Among the factors holding back growth are lack of institutional support and the lack of public knowledge about Islamic finance in general.

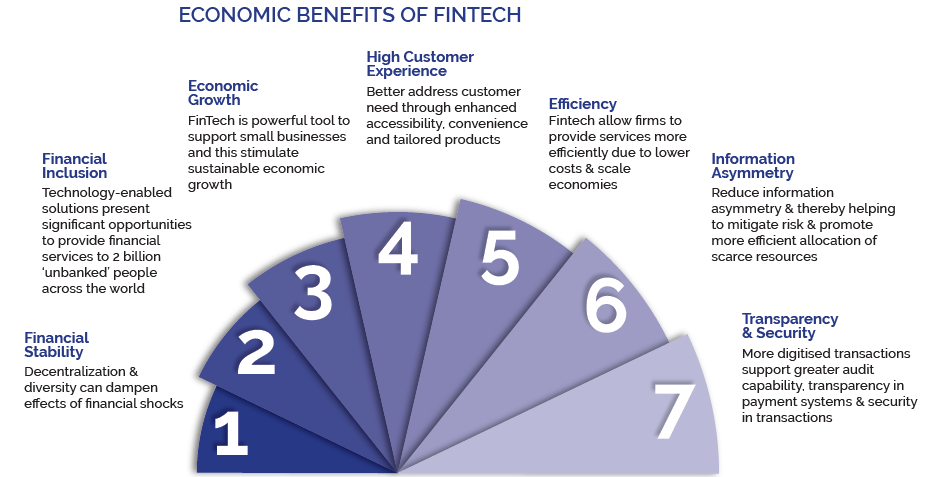

Collaborations between incumbents (banks and large financial institutions) and Islamic Fintech companies will be required to accelerate expansion in both markets. Support from the government of Muslim countries is also needed, especially with respect to setting regulations that are clear and do not disadvantage Islamic finance and Islamic Fintech. Once these are in placed, the benefits from Islamic Fintech can be more obvious and can be easily applied as a way to address various financial-related problems in the Muslim world. In the long term, this has the potential to bring economic improvements and poverty reduction. In the last two years, the Islamic finance industry has begun to take Fintech seriously. It may be just in time as the industry is in need of a growth boost. The wider Islamic economy also stands to benefit significantly from the prominent features of Fintech, which include access to financial services to the unbanked; digital-based services; user-friendly services that provide faster payments; and new business models for investments and insurance.

Fintech – A Solution for Islamic Finance

Islamic finance has seen respectable growth over the last 4 decades. During this time, the sector grew from an idea to an industry with over US$2 trillion in assets. The industry now covers more than 40 countries with institutions offering a wide range of services from consumer/wholesale banking to custom capital market instruments, insurance (Takaful), home financing and more.

While Islamic finance experienced double-digit annual expansion over the past few decades, growth has slowed to single digit in the past four years (GIFR, 2018). This slowdown cannot be attributed to market saturation alone. Islamic finance only makes up approximately 2% of the total global financial assets. In comparison, Muslims comprise around a quarter of the global population. A more likely driver of the sector slowdown is the fall in oil prices resulting in less financing activities by Muslim-dominant oil exporting countries. Additionally, the US dollar has strengthened in the past two years, resulting in a depreciation of the currencies of countries with strong Islamic finance markets, such as Malaysia and the Gulf Cooperation Council (GCC).

Another factor that could halt the growth of Islamic finance in the long term is the lack of accessibility of financial services to the lower-income population (Demirguc-Kunt et al., 2018). This is an issue especially significant for Muslims. While they comprise around 25% of the world’s population, half of the global poverty resides in the Muslim world. A majority of the Muslim population is also unbanked. Without the lower-income group having access to financing and basic financial services, reducing poverty in less-developed Muslim countries will be difficult. This highlights the need for Fintech solutions in improving financial inclusion.

Fintech companies offer greater financial inclusion over banks. They are generally less regulated and have lower transaction costs as they focus on providing simple yet effective online services for the masses. This allows them to target markets, which may be too risky or non-profitable for banks. As an example, through digital payments, micro businesses are able to transact easier with suppliers and customers resulting in improved business efficiency and lower costs. They may also be able to raise financing on short notice via peer-to-peer (P2P) or digital lending platforms without the need to have a long operating track record or asset security.

The core strength of Fintech is ease of use and speed of execution. Popular Fintech services and apps have several things in common. First, they offer an optimized user experience delivered through interfaces that are simplified and familiar (based on common social media platforms). Second is customization. Both are customized for use on mobile, which have become the primary way people use the internet. Because well-designed Fintech apps are easier to use, people gravitate to them even more than using websites and definitely more than going to bank branches. As the convenience of Fintech allows it to win over a larger customer base, physical banking branches will begin to lose relevance over time.

Innovative Fintech solutions are also more likely to grab the attention of young Muslims, who make up the majority of the Muslim population. Millennials (those born between early- phones, which have become the primary way people use the internet. Because well-designed Fintech apps are easier to use, people gravitate to them even more than using websites and definitely more than going to bank branches. As the convenience of Fintech allows it to win over a larger customer base, physical banking branches will begin to lose relevance over time.

Innovative Fintech solutions are also more likely to grab the attention of young Muslims, who make up the majority of the Muslim population. Millennials (those born between the early- 1980s to mid-1990s) and Gen Z (those born between the mid-1990s and early-2000) are internet savvy and are normally attracted towards online-based services offering simplicity. According to the Pew Research Center, the median age of Muslims is 23 years old versus the global median of 28 years old.

Opportunities for Simplifying Banking

Growing importance of innovations and wide use of technologies in service delivery has changed the banking industry globally. Fintech has become an integral part of banking. In recent years, banks have started to compete beyond financial services amidst facing intense competition from non-financial institutions for payment services (Romonova & Kudinska, 2016). The term “challenger bank” is one that has come from within the Fintech industry to describe a Fintech platform that competes with banks in the products and services it offers. These challenger banks were founded to address the unpleasant experience of transacting with banks; which includes long queues in branches, hidden fees, poor customer service, and complicated products.

An example of this is a US-based online bank called “Simple”, which was acquired by the BBVA Group for US$117 million in 2014. This purely-online business allows users to transact easily via the Simple bank app. With zero branches, Simple cuts its overhead costs drastically and offers a simple-to-use experience for its customers. Similar to other banks, it provides FDIC-insured checking/savings accounts to attract depositors and support smart spending with built-in budgeting tools. It also offers other services a traditional bank would; such as debit card, direct deposit and instant transfers to other Simple customers. There are a whole slew of challenger banks sprouting up in Europe that are offering fully digital, branchless solutions. Companies like Revolut, N26, Tandem, and Monzo offer payments, local and international money transfer and even ATM withdrawal services with minimal fees. Each one has slight differences, but all are optimised for being customer-centric and user-friendly.

If Islamic banking customers have any significant pain points in their experience dealing with their existing banks, it is a window of opportunity for Islamic finance-focused challenger banks to arise. Currently, the challenger bank concept has not taken hold in the Muslim world. This is partly due to the varied levels in the adoption of banking services across different countries. For example, a large percentage of Malaysians have bank accounts, but just two hours away in Indonesia, which has the largest Muslim population, the majority of people (78% according to Asian Development Bank) are unbanked.

The unbanked areas are the most prime customer base for Fintech solutions. Many of the people in these communities have smartphones despite not having bank accounts or being financially literate. A report from global consultancy firm Accenture claims that “bringing unbanked adults and businesses into the formal banking sector could generate about US$380 billion in new revenue for banks”. Muslim countries like Indonesia and many others spread across Africa that hold large swaths of unbanked communities offer huge potential opportunities for Islamic Fintech companies.

Proper deployment of a digital solution that makes life easier has the opportunity to reach major scale and profitability. A good example is Kenya-based M-Pesa, which provides a mobile wallet with a system that allows people to convert airtime into cash and then make payments and money transfers for other uses. M-Pesa, created by Vodafone’s Kenyan subsidiary Safaricom, started off in 2007 as a solution for microfinance companies to disburse loans to recipients in remote areas. But soon after the system was launched, people began to use the system to send money to each other. The management of M-Pesa noticed the trend and then facilitated it by setting up a network of physical locations for people to withdraw actual cash and also add cash to their accounts. After more than ten years, there are 30 million users in 10 countries and a range of services including international transfers, loans, and health provisions. The system processed around 6 billion transactions in 2016 at a peak rate of 529 per second.

This mechanism of reaching the unbanked is a key potential growth area where Islamic banks and Islamic Fintech can leverage off each other’s strengths. Fintech can reach all those who at least have access to the internet by providing the interface of the bank that would replace visiting a branch or interacting with a teller. With the addition of RegTech companies like Onfido, the KYC and identification/profiling process has now become possible via remote means and thereby, further reducing the need for branches. If Islamic Fintech platforms combine the above services in a way that solves the problems of rural communities, it will open the way to acquiring millions of new customers. In addition, Fintech platforms can partner with banks to satisfy the regulatory requirements for any handling of real bank deposits in the case of deposit services.

One common need for unbanked communities is insurance. Working on a farm or construction sites carries a number of risks and those who work in such professions often do so without being covered by the required insurance. It is partially due to limited knowledge about it or the available options and partly because insurance is assumed to be too expensive for them. With InsureTech solutions like Lemonade that provides online KYC and identification/profiling plus highly affordable plans, insurance services can be made affordable and accessible to a much wider audience than before. Takaful has a role to play in such situation and the possibilities are vast considering that takaful-based Fintech start-ups are not yet many in numbers.

Driving Forces of Islamic Fintech

From payments and investment management to digital currency and lending; Fintech is transforming how consumers are interacting with financial institutions as well as the way they conduct their banking transactions. Through Fintech, financial transactions have now become more automated, user-friendly, and convenient; leading to a better customer experience and wider reach to more segments of society, including even the unbanked or under-banked. While still small, Islamic Fintech is a promising sector with Islamic crowdfunding and P2P financing as the most active verticals to date.

Smartphones Growth

Growth in the smartphone market has driven the rapid growth in technology-related businesses including Fintech. According to market research firm Forrester Research, the total number of smartphone users worldwide in 2018 reached 3 billion, or 40% of the human population. For many, these versatile handheld devices have become much more than communication devices. They are now indispensable tools providing access to news, social media and entertainment via apps and games. In addition, smartphones are becoming a key tool to financial access. Most banks around the world now have apps that allow a person to check their account balance, make transfers, deposit cheques and more. Considering that 10 years ago that was not possible; one can only wonder what will be achievable a decade from now. When it comes to having access to many services, mobile smartphones have changed the landscape of opportunity and made it possible for more people to connect with each other faster and easier than ever before. Platforms like Kiva.com are allowing people around the world to give interest-free loans to strangers anywhere in the world that may be in need. The key area in which Islamic Fintech is expected to create value is providing access to financial services to people who live in rural areas and are usually unable to access traditional financial services.

In leading Islamic finance markets, demand for mobile wallet services is rising. In the UAE, which has a high mobile penetration rate of 173%, the mobile wallet market is projected to surpass US$2.3 billion by 2022. Factors such as government initiatives towards a cashless and digitalized economy, increase in youth and tech-savvy population as well as the growing number of retailers accepting mobile wallet payments and installing POS; are expected to fuel the region’s mobile wallet market. In Indonesia, internet and mobile banking services are becoming increasingly popular, indicating the importance of digital channels for financial institutions. In 2018, the country’s mobile wallet market was estimated at US$1.5 billion and is expected to reach to US$25 billion by 2023.

Financing Gap of SMEs

Small and medium-sized enterprises (SMEs) continue to be a driving force of Fintech innovation. As SMEs are key players in national economies, contributing to economic growth around the globe; their role is very significant and in most cases crucial. In majority of Organization of Islamic Corporation (OIC) countries, SMEs represent more than 90% of all firms and generate more than 60% of total employment. However, they still lack easy access to funding. In the MENA region for example, the financing gap for SMEs is estimated to be around US$138 billion, equivalent to 26% of the consolidated GDP (IIF, 2018).

There is huge potential offered by SME financing. However, the prevailing belief is that financing SMEs imposes higher risks on the lender and thus, banks tend to avoid lending to this sector. As a consequence, about 70% of SMEs are either financially underserved or not served at all. Given this huge demand and market growth potential, Fintech companies have now entered the market, offering products and services specifically tailored to suit the needs of SMEs. A number of P2P financing providers within the Fintech space are serving the underserved SMEs, especially those who do not meet the requirements of banking credit assessment. P2P lending platforms are able to offer smaller loans with less stringent requirements. Digitization or a good mobile layout also means that these platforms are able to penetrate more communities more quickly and with less upfront cost.

In Indonesia, SMEs make up nearly 99% of the total number of enterprises and generate about 60% of GDP. But no more than 19% of the banking industry’s total credit was allocated to the SME sector in 2018. Thus, resulting in a huge financing gap. Ammana Fintech, a Shari’a P2P financier regulated by the Otoritas Jasa Keuangan (Financial Services Authority), have risen to address this specific problem. Addressing the lack financing option for SMEs, Kapital Boost, an Islamic P2P crowd-funding platform based in Singapore, provides murabaha asset financing to these enterprises whilst allowing its members to invest in accordance to Shari’a principles.

Regulatory Burden

Following the global financial crisis in 2008, regulatory efforts were aimed at limiting future risk and creating stability in the industry brought about a range of new regulatory frameworks. Consequently, resulting in more stringent regulations on bank capital, liquidity and corporate structure. A key implication is financial institutions have been forced to provide greater transparency, enhanced customer protection and safer financial stability; leading to a significant increase in operating costs and regulatory-related costs. This has given rise to new forms of shadow banking completely outside the traditional regulated banking activities, where technological innovation is driving growth. In the US, for example, shadow banking registered a 55% growth between 2007 and 2015; and Fintech firms accounted for about a third of shadow bank loan originations (Buchak et al., 2017). These Fintech firms entered the marketplace with innovative products that used technology to overcome some of the advantages that incumbent banks had (Schindler, 2017). In addition, the challenge of complying with complex regulations has pushed incumbents to digitize processes to improve governance, efficiencies and accountability.

Rise of Fintech-Ready Generation

Fintech is also responding to the preferences of younger and more tech-savvy customers who expect Islamic financial institutions to operate in the same way as their social networks — more personalized, high interaction levels, minimal paperwork and maximum efficiency. Studies have shown that millennial are far more inclined to use non-traditional financial service providers, receive online financial advice, or to use a digital currency. Widely regarded as influential customers of the future, this Fintech-ready generation are driving the rapid adoption of Fintech innovations. In the MENA region where Islamic finance is prevalent, youth represents more than two-thirds of its population, which is the largest youth population in the world. Lack of trust towards traditional financial services coupled with a propensity towards using technology in every aspect of life, makes the millennial generation the single largest market opportunity for startups and innovative corporates seeking to build FinTech businesses.

Changing Consumer Behaviour

The exponential growth and success of Fintech firms is also attributable to the major paradigm shift in consumer behaviour as demand for digital convenience is on the rise. Enabled by a host of new and emerging technologies, consumers are changing their financial transaction behaviours and this is affecting the technology that financial institutions use to deliver their services. Customers of today expect financial institutions to offer personalized services and meet their evolving needs quickly and efficiently. A global banking survey results show that 70% of customers are willing to provide their banks with more personal information, but in return they expect to receive tangible improvements in the suitability of the products and services they are offered (Ernst & Young, 2012). Customers also want mobility and 24/7 access to banking services, implying that they want to fit their banking chores around their lives and not their lives around their banking chores.

Islamic Fintech Has Yet to Take Off

Islamic Fintech is the combination of technologies in compliance with the principles of Islamic finance to create a solution for finance-related problems. When compared to their conventional counterparts, Islamic Fintech firms have grown significantly slowly. Only a handful of them has reached series-A financing, including Wahed – a US-based Shari’a-compliance Robo-advisor. This relatively slow progress, however, should not come as a surprise given the increased challenges Islamic Fintech companies face versus their conventional peers. Among these challenges are as follows:

i. Lack of regulatory certainty since Fintech regulations globally are mainly designed for conventional finance.

ii. Lack of public understanding or misconceptions on what Islamic finance is and how it works.

iii. Shortage of venture funding dedicated to Shari’a-based Fintech startups.

iv. The nature of Islamic finance, which limits the funding modes that can be used and the investment options.

v. Higher operating costs associated with Shari’a compliance, educating the public, and constant monitoring of transactions to ensure Shari’a compliance.

There has been an increased in number of Islamic Fintech companies in the past two years driven by the large potential market for Islamic finance and the success seen in the overall Fintech space. In 2016, several of the pioneering Islamic Fintech platforms globally came together and formed the Islamic Fintech Alliance (IFT Alliance), which has helped to promote Islamic Fintech. The alliance’s other objectives were also to broaden innovation in the sector, exchange ideas and know-how between members, and develop a sustainable global ecosystem; which will support growth from industry players.

Among the eight pioneering members is Kapital Boost, a platform that offers financing to SMEs in Indonesia and Singapore via a P2P platform. The company offers a financing solution to SMEs that may not be able to raise financing through banks. It also offers investors a way to invest while helping the community by supporting SMEs. Kapital Boost differentiates itself by utilising Islamic financing contracts – murabaha for asset purchase financing, and qard and wakalah contracts for invoice financing. From inception to current date, they have fully funded 85 projects and have raised a total of SG$5.4 million from more than 150 investors.

Another prominent member of the IFT Alliance is EthisCrowd, a real-estate crowdfunding platform that allows investors to make social impact investments by financing the construction of low-cost homes in Indonesia. After the houses are completed and sold, the profits are shared between the investors and the housing developers via a mudaraba contract. Despite the noble efforts and intentions of the founders of Islamic Fintech platforms, the niche area of Islamic Fintech has not yet become a national agenda for most Muslim countries. In contrast, in major financial hubs like the UK and Singapore, the government is doing its best to spur the growth of local Fintech companies and attract others from outside to set up shop there.

Recipe for Growth

In seeking solutions to create sustainable growth for the Islamic finance industry, a paradigm shift may be needed in terms of what is considered “Islamic finance”. Traditionally, Islamic finance has been thought to be synonymous with “Islamic banking” and therefore, the growth of Islamic finance is often equated with the growth of the Islamic banking industry. In reality, any financial service that complies with the rules of Shari’a can be considered as Islamic finance. With this broader understanding; crowdfunding, Robo-advisors, venture capital and private equity can be considered as a part of the Islamic finance industry as long as they comply with Shari’a guidelines.

While Islamic Fintech has its unique ways of adding value and providing solutions for customers who want Shari’a-based solutions, it still remains a sub-sector of the larger mainstream Fintech industry. For that reason, it is only natural that proven strategies employed by the mainstream Fintech industry can also be equally beneficial and applicable to the Islamic Fintech sector. For example, Fintech in general has benefited greatly from various forms of partnerships between start-ups and resource providers that give access to funding, mentorship and even workspace. These are among some of the ingredients required for the success of the Islamic Fintech sector.

For any sector in its infancy stage, government support is required to accelerate growth and adoption for the public. A good example is the UK market where the regulator offers strong support to Fintech start-ups in the form of grants, tax credits for research, and public-private partnerships, among others. This is driven by the government’s aim to maintain the UK’s reputation as a key financial hub, especially for the European market. The support provided has resulted in the development of innovative Fintech firms domestically and attracted global Fintech firms to be set up in the country, making the UK one of the largest Fintech centres in the world.

A country that is serious in growing the Islamic Fintech sector should have regulations that provide incentives for start-ups to grow. This could be in the form of grants, regulatory sandbox (a closed environment designed to test new innovations), partnerships, and other facilities. Within the Muslim world, there are a few torchbearers in creating and cultivating an Islamic Fintech ecosystem. We are starting to see Islamic countries providing various forms of support for Islamic Fintech firms. This bodes well for the sector in the near to medium term. Government support for Fintech firms in Indonesia and Malaysia are less direct and tangible. However, both markets offer regulatory sandbox for Fintech innovations and regulations for key Fintech sectors such as P2P and payment gateway. While the majority of early Islamic Fintech firms’ activities have taken place in Indonesia and Malaysia, aggressive initiatives in the UAE and Bahrain are likely to attract more collaboration between Islamic Fintech firms.

Financing and Mentorship

Start-ups have to endure a long process to go from just an idea to become one of the fabled billion-dollar valued “unicorns” of the industry. Starting with an idea; a competent team, financing, and mentors are among the other key components required to successfully go through the start-up journey. For start-ups with basic operations or “Minimum Viable Product” (MVP), there will be a necessity to immediately raise financing to expand its business, and this is often sought from angel investors or venture capitalists.

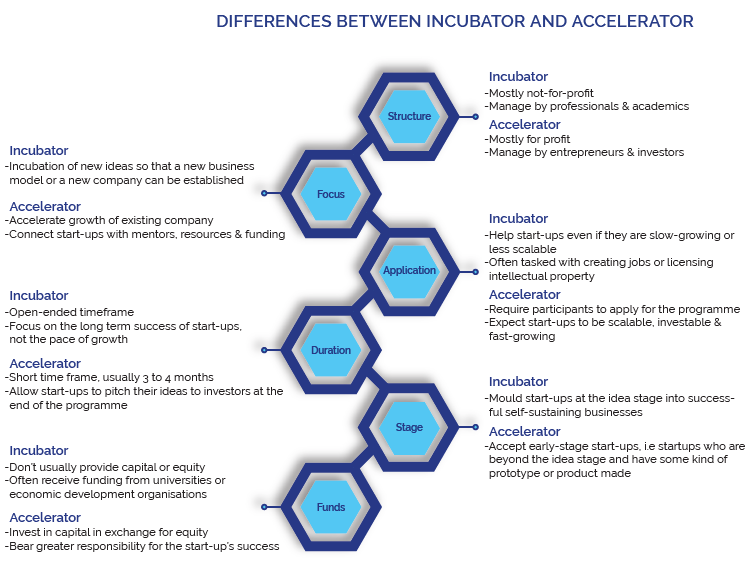

Apart from financing, mentorship and guidance are required for start-ups. While most are founded by innovative entrepreneurs with creative ideas, they are often young and inexperienced in running a business. It is for this reason that successful start-ups normally have a lot of good advisors and support behind them that help them through their journey. One way of getting insightful guidance and mentoring is through incubators and accelerators. These are programmes designed to help start-ups go through the process of rapidly growing their business and avoiding pitfalls associated with it, in a shortened period of time. The key difference between an accelerator and an incubator is the structure of the programme and what it is catered for. Both offer opportunities for start-ups to normally work with mentors and improve the chances of start-ups in attracting venture capital financing in the programme. Below are some key characteristics of an accelerator and incubator.

In the case of Islamic banks, the most ideal combination is when banks come together with start-ups and facilitate the growth of start-ups by providing funding, mentorship, and access to valuable data in exchange for the opportunity to be first in line to invest or adopt the technologies produced in the sponsored incubators or accelerators. There has already been a significant amount of investment pumped into Fintech start-ups in this manner. Globally, the Fintech sector attracted 1,824 investment deals totalling US$14.2 billion of venture capital investment in 2017, according to the Bahrain Fintech Ecosystem Report 2018. By mid-2019, a number of Fintech platforms should be graduating from the accelerator programmes in Dubai and Abu Dhabi and perhaps the first Islamic economy unicorn will be born.

Conclusion

With all the above developments, it seems to be only a matter of time before the right mix of Islamic investments and Fintech innovations come together to create the long-term growth that the Islamic finance industry needs. Governments, resource institutions, banks and other start-ups should work side-by-side to harness Fintech innovation in order to support the next level of growth for Islamic finance. However, these key players should not be limited to Muslims as the benefits of Islamic finance is but for the whole community.