Now that COP241 held in Poland is over, it is clear that the world is more than ever struggling to address not only the impacts of climate change, but also the growing inequalities and widespread deterioration in the natural wealth that sustains communities and underpins the global economy. Unfortunately, the scale of funding and technical support required to achieve the ambitious 2030 Agenda for Sustainable Development are still far beyond the scope of governments’ budgets and traditional funding mechanisms.

As for Islamic finance, this is clearly a timely opportunity to contribute to bridging the sustainability-financing gap. Such involvement will allow the industry to clarify its genuine value proposition based on its core values, serve customers’ expectations and channel funds to address social and environmental challenges, especially in the Organization of Islamic Cooperation (OIC) countries. If the Islamic finance industry is to embed sustainability into its core business models, then investment in Financial Technology (Fintech) should be a top priority.

Fintech is emerging as a core disruptor of every aspect of today’s financial system. Fintech covers everything from mobile payment platforms to Robot advisors, and from crowdfunding and virtual currencies to blockchain. This chapter discusses

Overview of the Fintech Industry

According to The Hong Kong Exchanges and Clearing Company (2018), Fintech refers to “financial innovations driven by technological advancement in the forms of new business models, new financial services, and new software and applications that have a great impact on the provision of financial services and the development of the financial industry”. Ernst and Young (2016) proposes a slightly different definition by presenting Fintech firms as “high-growth organizations combining innovative business models and technology to enable, enhance and disrupt financial services”. This definition is not restricted to start-ups or new entrants; but includes scale-ups, maturing companies and even non-financial services companies, such as telecommunication providers and e-retailers.

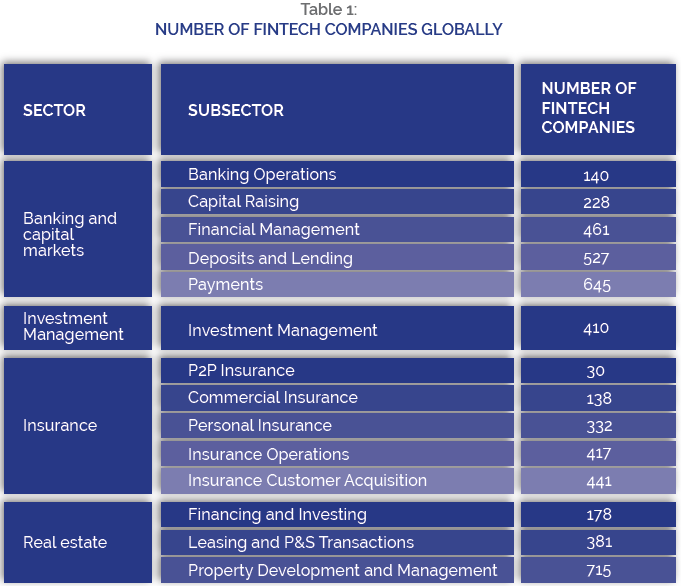

The rise of Fintech is underpinned by several technological, social and economic developments. From the technological side, it is triggered by advancement of the internet and mobile technologies as well as computation capacity. From the demand side, the emergence of the on-demand economy and “social media” culture has spurred the proliferation of “service now” mentality and crowd-sourcing of information and solutions. This changed environment has facilitated the emergence of new market players in financial services, notably smartphones and internet giants (Information Services Department Hong Kong, 2016). The Deloitte research report (2017) on “Fintech by the numbers: Incumbents, startups, investors adapt to the maturing ecosystem” provides interesting statistics on the number of Fintech companies internationally (see Table 1).

The Integration of Finance and Technology

The integration of finance and technology has become a new trend in global economic development. It has resulted in the emergence of new financial instruments and financial service offers. Most interesting is that the emergence of these two worlds has the potential to drive the real economy. In a report published by HKEX on “Financial technology applications and related regulatory framework”, the integration of technology and finance is said to have undergone three phases (HKEX, 2018).

Phase 1: Financial IT

This phase represents the information digitalization of the financial industry where focused was on improving operational efficiency with increased computerization of office and business through traditional IT software and hardware. IT facilitated the introduction of new delivery channels in the form of automated teller machines (ATM), point-of-sale (POS) terminals, including application of technology in the bank’s core trading system, credit system and clearing system.

Phase 2: Internet Finance

The integration of internet technologies and finance brought about the rise in internet finance. Internet finance is characterized by the pooling of users on online business platforms constructed by technology companies (HKEX, 2018). During this phase, traditional financial institutions and internet companies collaboratively provide financial products and services; including investment brokerage, online payment, person-to-person online loans, crowdfunding and insurance. To a certain degree, internet finance has addressed deficiencies inherent in the traditional financial system, greatly reduced transaction costs caused by the asymmetric information, and opened up a new ways to finance small and medium-sized enterprises.

Phase 3: De Facto Integration of Finance and Technology

At this phase, Fintech – an innovation in the area of financial services created from the integration of “Finance” and “Technology”, focuses on the business of using technology to offer financial services products; especially for payment systems, general financial intermediation and advisory services. The adoption of new technologies like big data, cloud computing, artificial intelligence (AI), blockchain, quantum communication and the internet of things (IoT) has altered the traditional ways of data collection (financial and non-financial), risk-pricing models, investment decision-making process and the traditional role of credit intermediaries. These have resulted in substantial improvement in payment system and addressed the fundamental problems of traditional finance.

Categorising Fintech

While acknowledging that there is no commonly accepted taxonomy for Fintech innovations, the Reserve Bank of India categorised some of the most prominent Fintech innovations into five main groups according to the areas of financial market activities where they are most likely to be applied as shown below (Reserve Bank of India, 2017).

Players in the Fintech Space

The key players in the Fintech space, apart from the incumbent financial institutions, are the new digital-based institutions, other Fintech firms and technology providers or ICT companies, including BigTech firms (EBA, 2018). Traditionally, incumbent financial institutions have been offering the full range of financial products and services through their network of physical branches, including online distribution channels. The evolution and advancement of technology has created a dynamic that is changing the familiar features of the financial services industry and ultimately on how incumbent financial institutions are providing financial channels and services to businesses and consumers.

Fuelled by the financial technology revolution that is disrupting all corners of the financial services industry, incumbent financial institutions have been forced to adopt Fintech solutions to digitize their business products and operations. The Thematic Report published by the European Banking Authority (EBA) reported that the main factors driving digitalization and technological innovation in incumbent institutions are: (i) rapidly evolving customer expectations and behaviour; (ii) profitability concerns that are driven largely by the low-interest rate environment; (iii) heightened competition from new entrants (such as digital-based institutions), Fintech start-ups and technology providers; and (iv) changes in regulatory framework.

The failure of traditional financial institutions to keep up with customers’ embrace of and demand for all things digital and mobile has opened the door to a new breed of digital-based institutions dedicated to delivering an optimal digital customer experience. Known as digital-only/challenger banks, they offer digital-based banking services that hold a credit institution or payment institution or e-money institution license. They are focused on digital delivery channels, either online or mobile (with no physical branches) in response to changing customer expectations primarily amongst digital-savvy customers.

Fintech start-ups have gained prominence and are becoming a dominant force in the global start-up ecosystem. Leveraging digital technologies and smart design to offer innovative, high-touch and customized customer services; Fintech start-ups are emerging in domains such as asset management, lending and financing, insurance, payment processing and capital markets. Through the used of big data, AI, blockchain, cloud and mobility; Fintechs are fundamentally changing the world of financial services.

Technology providers and ICT companies (including BigTech firms) are also moving into the financial services space. These companies provide technical support in terms of software applications and/or hardware. BigTech firms are typically large with established customer networks and accumulated big data. BigTech firms the likes of Amazon, Google and Facebook are well known for leveraging their large customer base and consumer insights to offer a unique and personalized user experience to fully engage consumers. These BigTech firms have gained a foothold in the financial services space having rolled out payment services through mobile solutions and lending platforms for small businesses.

In a recent survey by Price Waterhouse Coopers (2017), 88% of incumbent financial institutions were increasingly concerned about losing revenue to innovators and 82% are expected to increase Fintech partnerships in the next three to five years. As reported by EBA, incumbent institutions are engaging with Fintech in a variety of ways, ranging from investing directly into new entrant Fintech firms to inhouse development of technological solutions

(EBA, 2018). The report suggested that incumbents interact with Fintech using four different approaches and are not mutually exclusive as they may engage in all four at once. These approaches are detailed below:

Partnering with new entrant Fintech firms

At present, this is the predominant mode as a way of accelerating the incumbents’ Fintech development. Incumbents tend to engage with selected Fintech firms whose business aligns with their innovation strategy. In their efforts to attract interest from these Fintech firms and identify potential partners, incumbents often invite Fintech firms to participate in the many events launched by them such as hackathons, competitions or other networking events.

Investing in new entrant Fintech firms

When investing in new entrant Fintech firms, most incumbent institutions take a strategic view. Investment is predominantly via venture capital funds and direct acquisitions, with the former as the most preferred choice.

Collaborating with other stakeholders

Another way in which incumbent institutions approach Fintech is through collaboration with peers (other banks) and other stakeholders. This approach is taken as certain technologies, such as blockchain, require the creation of consortia to further develop the technologies and bring them to market. Such collaboration often includes engagement with academic and research institutions to explore potential Fintech opportunities and to develop new and innovative solutions.

Developing Fintech solutions internally

A number of incumbent institutions have initiated cross-business transformation through increased investment in IT and digitalization projects. There is also a growing focus on in-house R&D conducted by internal accelerators where a dedicated team is tasked to continuously assess Fintech opportunities and developments. The aim is to identify Fintech propositions that best fit the institution’s strategy and profile.

Islamic Fintech

Despite the huge potential that the Islamic finance industry holds, the industry remains a small player in the global financial markets. Fintech offers new opportunities for Islamic finance to achieve its true potential. While Fintech activities in the Islamic finance sphere are still relatively small in scale, they are growing and developing rapidly. To illustrate, Fintech investment in the Middle East represents a tiny proportion of the massive amounts being invested globally (Clifford Chance, 2018). Total Fintech start-ups in the Middle East and North Africa were valued at US$66.6 million as of December 2017. However, by 2022, the Fintech market is expected to reach a value of US$2.5 billion across the broader MENA region (The National, 2019).

Islamic Fintech has substantial room for growth driven by young, digitally native Muslim demographic that is on average younger than the world’s non-Muslim population. Furthermore, there are largely unaddressed opportunities in several areas. The three most significant of which are: (1) leveraging big data and AI in providing Islamic banking services; (2) using blockchain in facilitating the growth of Islamic trade finance; and (3) the use of AI in facilitating investments, in particular addressing institutional investor needs.

There have been recently many promising government-led initiatives such as DIFC’s US$100 million Fintech Fund, and Bahrain’s regulatory sandbox, to support Islamic Fintech. Exciting private sector initiatives have also been launched, such as the Islamic Fintech Alliance in Singapore and Albaraka Garaj in Turkey. The latter is a start-up acceleration center of Albaraka Turk Bank.

Fintech for Sustainable Development

In his reference book “The Age of Sustainable Development”, Jeffery Sachs (2015) paints an alarmist picture of the challenges that humanity faces today. In fact, with a global population of more than 7 billion and growing by 75 million annually, economic and social inequalities have never been greater than at present. To illustrate, no less than 1 billion people today live below the poverty line with problems of access to care, inadequate nutrition and substandard housing conditions. From a climate change perspective, the effect of extreme natural disasters equates to an annual loss of US$520 billion and creates 26 million new poor every year (IFC, 2017).

As for the specific case of health care in OIC countries, average per capita total health expenditure amounted to US$202 in 2014. This contrasts unfavorably even with the corresponding figure to the non-OIC developing countries of US$339. The number of hospital beds is an important indicator of resources available for inpatient care and overall access to hospital services. Between 2007 and 2013, there were 9.5 hospitals per 100,000 people in the OIC countries compared to 22.6 in non-OIC developing countries, 24.5 in the world and 66.6 in developed countries (OIC, 2017).

In response to this critical situation, the international community in 2015 adopted a set of goals to end poverty, protect the planet and ensure prosperity for all as part of a new sustainable development agenda. With this, the international community have pledged their commitment to the global transition from the fossil-fuelled industrial era to low-carbon, knowledge-richer, green economies. Each objective is broken down into specific indicators (169 in total) to be achieved over 15 years (Bertelsmann Stiftung and Sustainable Development Solutions Network, 2017).

To achieve the Sustainable Development Goals (SDGs) by 2030, countries must develop roadmaps to meet the commitments made. In the light of current trends, countries will largely miss the goals if policies are not improved, international cooperation is not strengthened and public and private financial resources needed to finance investments are not mobilized. Focusing on the marginal expansion of government services will not be enough to meet the SDGs (Schmidt-Traub & Shah, 2015).

Thus, according to the Sustainable Development Solutions Network, which operates under the auspices of the United Nation Secretary-General, 1.5-2.5% of global GDP may be needed to finance the achievement of the SDGs in all countries. More specifically, low and middle-income countries (LMICs) are expected to increase public and private spending by some US$400 billion a year (US$343 to US$360 billion for low-income countries and US$900 to US$944 billion for middle-income countries) to reach SDGs. This corresponds to 4% of GDP in purchasing power parity and 11.5% of GDP in dollars.

On the climate ground, the World Wildlife Fund (WWF) believes that to limit the increase in global temperature to 2°C (or even 1.5°C) and to adapt to the impacts of climate change, a transformation of the development patterns is needed to move towards a more sustainable and resilient economy. An estimated annual investment of about US$2 trillion over the next 15 years would be needed to transform the energy system, preserve ecosystems and ensure sustainable water use (WWF, 2016).

There has been a growing momentum to align the financial system with sustainable development (UNEP, 2015). Considerable progress has been made in recent years with early innovations being championed by international coalitions of investors, banks and banking regulators, stock exchanges and insurance regulators. Both developing and developed countries have led the way in addressing national development priorities through financial system improvements. Most recently, the G20 finance ministers and central bank governors have, for the first time, explored ways to improve the financial system to mainstream environmental considerations. Additionally, the Financial Stability Board has established a task force to explore how to ensure that climate-related financial risks are fully accounted for and disclosed (UNEP, 2016).

However, sustainable development depends partly on a reset of the global financial system. This is largely due to the major impact that financial institutions have on sustainable development via their intermediary role between savers and borrowers as well as in financing economic projects, corporate innovation and investments. The global financial crisis made it clear that most incumbent financial institutions were overly focused on profit-making and had failed in terms of social and environmental value creation.

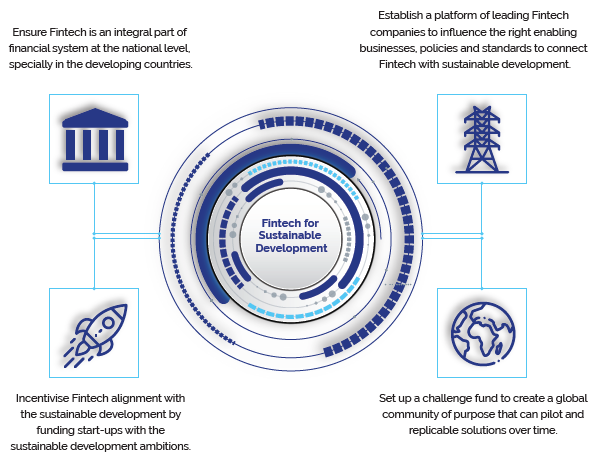

The challenge is to reform these incumbents and democratize financial services in order to drive the transition to an inclusive, green economy. These include mobilizing finance for financial inclusion of underserved groups, raising capital for sustainable and resilient infrastructure and financing critical areas of innovation. Towards this end, Fintech developments can be adapted to support social and environmental priorities alongside economic capital.

Both sustainable development and Fintech have the same ‘basic potential as drivers of change and impact’ and are suitable for ‘creating new, sustainable business models’ (UNEP, 2016). A critical question is how to harness Fintech to mobilize public and private financing to help scale up green investment to meet the broader SDGs agenda and the Paris Agreement on climate change, including areas from biodiversity to connecting rural economies with global market opportunities. In order to successfully tackle sustainability issues, Fintech business models should have the following attributes: low margins, asset-light, scalable, innovative and compliance easy (Ernst and Young, 2015).

Innovative Fintech solutions could potentially address some of the sustainable development challenges related to economic and social inclusions that are excluding people from formal financial systems and the multiple inequalities experienced by people living in extreme poverty and marginalization. In countries with large unbanked populations, Fintech has enabled financial inclusion for the masses. The growing adoption of mobile phones and internet worldwide has allowed these economies to leap-frog from a cash economy to using smartphone wallet directly. As reported by The Global Findex Database 2017, there has been a significant increase in the global use of mobile phones and the internet to conduct financial transactions. This has contributed to a rise in the share of account owners sending or receiving payments digitally between 2014 and 2017 from 67% to 76% globally, and in the developing world from 57% to 70%.

There are already examples of ways in which Fintech companies are enabling sustainability. For example, M-Pesa has revolutionized the mobile payments space by offering users the flexibility to make payments quickly and easily from any mobile phone. Since it was first launched in 2007, M-Pesa has had a transformative impact on the lives of millions of people who previously had limited or no access to banking services. Its low-cost technology has reduced the overall transaction costs as payments and money transfer can be done remotely without any physical banking infrastructure. Even more importantly, M-Pesa addresses financial exclusion especially for rural communities and the poor by reaching to 84% of the population earning less than US$2 a day. Today, M-Pesa has expanded its offering to include low-interest loans and savings products to markets across Africa, Asia and Europe; with over 25 million customers worldwide (Safaricom, 2019).

Another innovative Fintech company is M-Kopa, which provides pay-as-you-go solar lighting and energy products to low-income households who could otherwise not afford it. Through M-Pesa, M-Kopa allows the use of solar panels in areas not served by the power grid, with repayments in small instalments. Similarly, SOLshare, a company operating in Bangladesh; produces SOLBox, which is a device that enables homeowners to buy electricity as needed by paying for tokens via mobile phone SMS. These are examples of how mobile is helping to spread sustainable technologies and changing lives for the better.

Another Fintech innovation that addresses sustainability is BanQu. The company aims to address issues of global poverty by providing a permanent identity-based solution for unbanked or under-banked individuals who have remained excluded from the global economy due to lack of historical record on education, finance, employment or other information needed to access banks and their credit services. This is the first ever blockchain economic identity technology platform and network that enables a secure and immutable platform for creating economic opportunities for people around the world who are refugees, internally displaced and/or living in extreme poverty (BANQU, 2019). Through BanQu, they are now able to create a secure online profile via simple SMS-enabled phones, which would keep track of everything from educational qualifications to transaction history, thereby gradually building a credit history. With this information, they can open bank accounts, apply for micro-loans, own property and even access healthcare and other basic services.

Islamic Fintech Solutions for Sustainability

Within Islamic finance, a growing number of innovative start-ups and Fintechs are already focusing on sustainability issues. As the examples below illustrate, these firms are promising examples of Fintech-driven solutions that advance sustainability.

1. Financing Homes for Low-Income People Through Crowdfunding

EthisCrowd, a crowdfunding platform based in Singapore, specializes in social home financing for low-income people. EthisCrowd’s business model is among the initiatives to reduce the shortage of homes in Indonesia from 11.4 million to 6.9 million. The platform uses wakalah (agency contract), istisna (contract to construct an asset) and murabaha (contract to sell the asset). EthisCrowd had gathered so far a community of 25,000 ethical and Islamic crowd investors and donors from 65 countries (BANQU, 2019).

2. Globalizing the Collection and Distribution of Sadaqah

Global Sadaqah is active in the field of social impact Fintech. The Malaysian-based platform makes it easier for donors to give impactful sadaqah, zakat and waqf by matching them to credible charity partners on their platform. Global Sadaqah brings together corporate donors, the public, charity partners and community leaders to crowdfund campaigns online. Current fundraising campaigns include channelling donations to Indonesia’s tsunami and earthquake victims, to Rohingya and Syrian refugees and to establishing waqf in Nigeria (EthisCrowd, 2019).

3. Islamic Microfinancing Through A Digital Platform

Based in Indonesia, Blossom Finance proposes emerging markets and social impact investment opportunities through Islamic microfinance institutions. These financial institutions provide deposit facilities to marginalized communities and commercial financing to help micro-entrepreneurs grow their revenues as well as incomes. Examples of investment projects include vegetable cultivation in West Java, traditional market trading in Indonesia’s cultural heartland and Diversified Central Java Microfinance Fund (Global Sadaqah, 2019).

The Way Forward and Recommendations

The world is changing fast. The financial industry is changing significantly and Islamic finance is no exception. The Islamic finance industry is slowly shifting gears towards embedding sustainability into its core business model. Undeniably, expectations from the private and public spheres are high with respect to sustainability challenges. The Islamic finance industry has no choice but to hasten the pace and leverage impact as a competitive advantage. To do so, Fintech provides a timely opportunity for Islamic financial institutions to harmonies the business model with their core values, ensure continued growth and channel funds for sustainability-friendly projects and initiatives. Nonetheless, the growing Islamic Fintech industry needs the following supporting initiatives to unleash its potential and generate a sustainable impact.

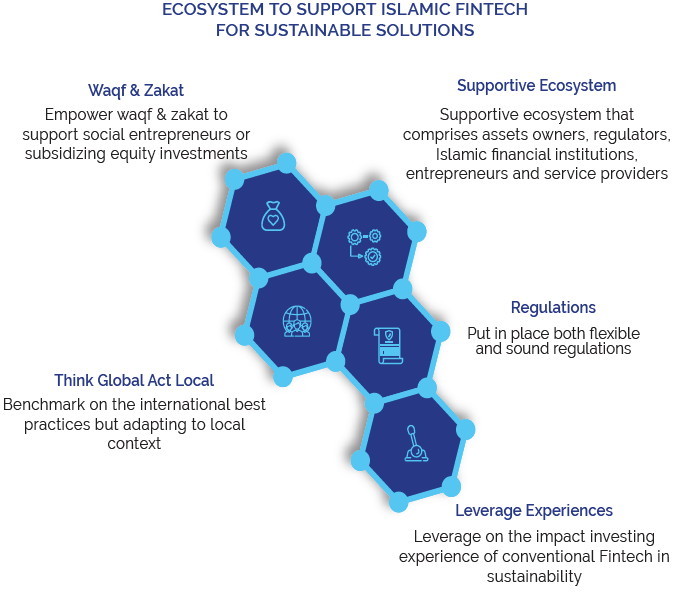

Putting in Place Both Flexible and Sound Regulations

National authorities are naturally concerned about potential risks posed by the rapid transformation of the financial system. Concerns arise regarding a range of issues, including consumer and investor protection; the clarity and consistency of regulatory and legal frameworks; the potential for regulatory arbitrage and contagion, and the adequacy of existing financial safety nets (IMF, 2018).

However, excess regulatory prudence might hinder the ability of Islamic financial institutions to forge ahead in adopting new models linked to various Fintech themes such as crowdfunding and crypto-currencies. For instance, most e-commerce regulations in the MENA region still contain significant exclusions for certain types of transactions of e-commerce and digital signatures such as real estate, negotiable instruments and local law notarization requirements. These, therefore, limit the use of e-contracts and electronic communications in these areas.

Leveraging Conventional Fintech Experiences in Sustainability

Islamic Fintech does not need to start from a blank white sheet. In fact, conventional Fintech has been successfully applied in various sectors (green energy, education, health, food and water) in both developing and developed countries and with diversified financial instruments. Such a rich conventional impact investing experience has to be leveraged and, if needed, adapted to the Islamic finance requirements.

Empowering Waqf and Zakat

Waqf and zakat can bring value to sustainable Fintech. For example, directing cash waqf funds to support social entrepreneurs through Fintech platforms can generate a much higher social return compared to simple cash donations. Cash waqf use includes co-financing, subsidizing or guaranteeing equity investments.

Thinking Globally and Acting Locally

Relying on international best practices is important but adapting them to the local context is even more critical. For instance, copy-pasting a Malaysian crowdfunding platform in Western countries may not necessarily work because the social, economic and legal contexts are not identical.

Building a Supportive Ecosystem

The development of Islamic Fintech industry requires a supportive ecosystem that comprises assets owner (institutional investors and high net-worth individuals), regulators (central banks, securities commissions and finance ministries), Islamic financial institutions (banks, Takaful companies and investment funds), entrepreneurs, and service providers (IT experts, consultants and research institutions). Building the ecosystem will naturally take time, but the Islamic Fintech industry has to start somewhere.