Islamic Social Finance (IsSF) is a Corporate Social Responsibility (CSR) tool that has been utilized in the alleviation of poverty and socio-economic development for over 1,400 years. It takes the form of zakat, waqf and sadaqa (charity). These instruments have been deployed to fund education, healthcare, infrastructure development and general social welfare. In the contemporary context, IsSF is in line with the United Nations’ Sustainable Development Goals (SDGs). The primary objective of Islamic social finance is to meet the needs of the poor and to curb the ever-rising levels of relative poverty. To fulfil this objective, it is essential to know to what extent can Islamic social funds meet the resource requirements for poverty alleviation. Also, it is interesting to note whether the current distribution of Islamic social funds has been effectively managed. Economic justice, inclusive participation and shared prosperity are the principles behind IsSF. These principles come from the values of Islamic philanthropy. The likes of Social Impact Bonds (SIBs), Climate Bonds, Green Bonds, Vaccine Bonds, Vaccine Sukuk and Malaysia’s SRI Sukuk have provided evidence that financial returns and social responsibility can co-exist and attract profit-driven corporates to invest in one (Azman & Ali, 2019).

According to the United Nations Assistant Secretary-General, Sofeena Lalani (2019), IsSF can help governments and communities meet a range of development needs. Zakat, with its defined set of beneficiaries and the rapid disbursement towards them, can be vital for crisis response. Waqf, on the other hand is well-suited for building resilience through institutions, infrastructure, and permanent sources for funding the SDGs. She adds that IsSF has a significant potential to address marginalization and vulnerability when directed towards locally driven programmes promoting social and economic inclusion (Azman & Ali, 2019).

One of the fundamental issues today among the poor people is lack of access to financial services. There are three billion people globally who have little to no access to financial tools that could improve their lives. Most adults in emerging economies do not have a bank account, and what’s more, a financing facility. Some do not even have valid identifications.

Consequently, credit information coverage is low, thus limiting their chances of getting funding from traditional financial institutions (Abdullah O., 2019).

In countries like Afghanistan, Morocco, Iraq, Niger, and Djibouti, the percentage of the adult population with no bank accounts for religious reasons stands at 33.6, 26.8, 25.6, 23.6, and 22.8, percent respectively (Naceur, 2015). In Malaysia, around 8% of the adult are still unbanked, with 92% of them with either low or no income (BNM, 2018).

Innovations in FinTech is revolutionizing the financial industry. e-Wallet is one of the FinTech innovations that has been rising in popularity and become the leading cashless payment method in Asia Pacific, especially China. This chapter explores the potential of leveraging e-Wallet in modernizing the IsSF as well as to drive the cashless society that could accelerate financial inclusion for the unbanked segment of the society. While the examples related to e-Wallet and IsSF quoted in this paper are based on Malaysian stories, the recommendations could be applied anywhere in this world.

Mobile Penetration and the Emergence of e-Wallet

Smartphones have become the main device for individuals to access the internet. According to statistics by Quoracreative, 62 percent users access the internet on mobile phones globally. Indonesia has recorded the highest smartphone penetration between all the countries, with 90 percent penetration in 2019 (Quoracreative, 2020).

With the convenience of a smartphone, people are doing day-to-day transactions. That includes paying monthly bills, transferring money as well as paying groceries at the local mart. As reported by the Global Findex Database 2017, there has been a significant increase in the global use of mobile phones and the internet to conduct financial transactions. This has contributed to a rise in the share of account owners sending or receiving payments digitally between 2014 and 2017 from 67 to 76 percent globally, and in the developing world from 57 to 70 percent (AAMINOU, 2019).

In Malaysia, according to Financial Stability and Payment Systems Report 2018, mobile banking service subscribers have grown from 4.4 million in 2017 to 6.6 million in 2018 with the monetary value doubled from RM50.7 billion to RM100.1 billion. The total transactions have also seen more than double-digit growth to 257.4 million from the previous 107.7 million. Non-banks made headway in the provision of mobile payments with three out of every four non-bank e-money issuers offering mobile payment platforms. Subscriptions for non-bank mobile payment services increased to 10.4 million in 2018 from 0.8 million in 2017. The non-banks processed 31.1 million mobile payments transactions worth RM1.3 billion in 2018 compared to one million transactions worth RM240.3 million in 2017. The significant increase indicates that monetary transactions have moved toward mobile (BNM, 2018).

In leading Islamic finance markets, demand for mobile wallet services is rising. In the UAE, which has a high mobile penetration rate of 173 percent, the mobile wallet market is projected to surpass US$2.3 billion by 2022. In Indonesia, internet and mobile banking services are becoming increasingly popular, indicating the importance of digital channels for financial institutions. In 2018, the country’s mobile wallet market was estimated at US$1.5 billion and is expected to reach US$25 billion by 2023 (SABREE, 2019).

“INDONESIA HAS THE HIGHEST SMARTPHONE PENETRATION IN THE WORLD.”

- Wallet and Digital Money

- Wallet application is a type of electronic payment that is used for transactions made online, mostly through a smartphone. The purpose is akin to a physical credit or debit card. An e-Wallet needs to be linked to the owner’s bank account, credit or debit card as the source of fund. Just like the physical wallet, the act of replenishing the e-Wallet balance is similar to the process of cash withdrawal from an ATM and keep it in the physical wallet. e-Wallet payment providers make heavy use of modern encryption technology to enhance e-Wallet security. e-Wallet enables payments for groceries, online purchases and flight tickets, among others. To setup an e-Wallet account, the user needs to install the apps on their device and enters the relevant information required. Upon utilization for any purchase, the user will be authenticated either using password, fingerprint or iris validation for the payment to go through.

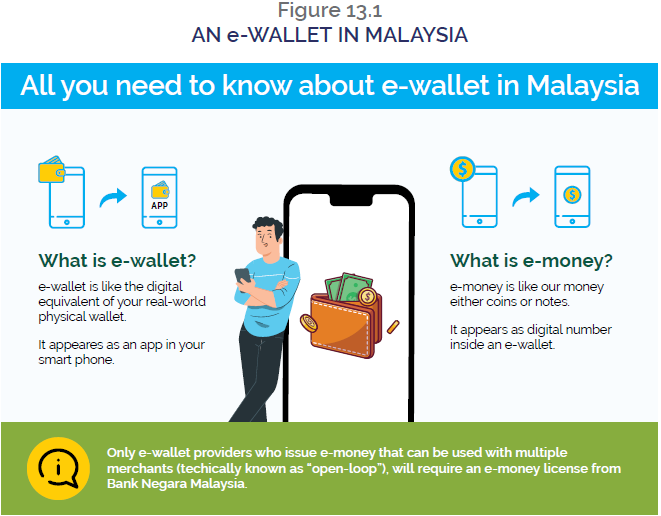

There are various approaches of e-Wallet implementations. Malaysian e-Wallet shall be used as a reference in this chapter (see Figure 13.1).

In Malaysia, e-Wallet has always been described in tandem with e-money. e-Wallet is like the digital equivalent of a real-world physical wallet. It appears as an app on a smartphone. e-money is the monetary value inside an e-Wallet.

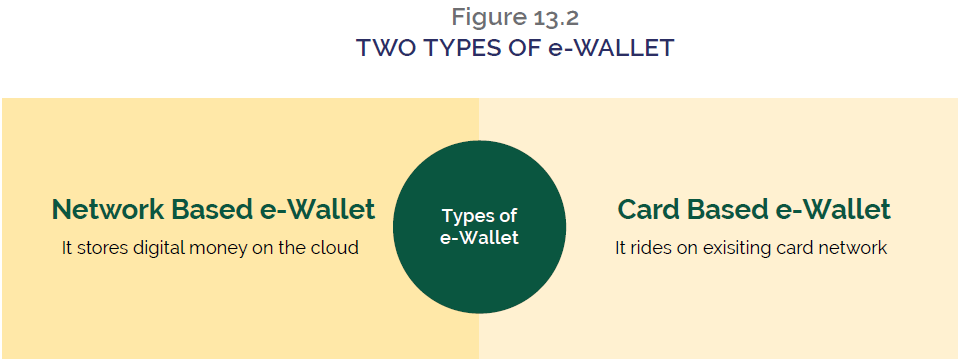

There are two types of e-Wallets (see Figure 13.2):

- Network-based e-Wallet. It stores e-money on the cloud. The examples are WeChat Pay, Grab Pay, Boost and Touch ‘n Go e-Wallet (hybrid network and card based).

- Card-based e-Wallet. It rides on an existing card network like Visa, Mastercard and China UnionPay. Examples are Big Pay, May WALET, AEON Wallet and Merchantries Money e-Wallet.

e-Wallet with NFC and Smartcard

The key implementation of e-Wallet is almost similar. A majority of e-Wallet providers is using network-based e-Wallet. Each e-Wallet will have its own e-money. Payment can be made either by transfer, QR Scanning or RFID (for NFC enabled phone) and all of them via a mobile phone. However, the mechanism and the implementation of a card-based e-Wallet are unique for each provider. Below are the examples from Bigpay and Touch and Go.

- Touch and Go

- Touch and Go is a Malaysian electronic payment system that uses the Radio-Frequency Identification (RFID) Card technology. Introduced in 1997 for tolls and later for public transport payments, it has now expanded to payments for parking fees and retail outlets.

- For Touch and Go e-Wallet, RFID cards can be linked to the e-Wallet. Each card has its own balance which is not interchangeable. e-Wallet has its own balance too. Payment can be made using both e-Wallet and the physical card. When payment is made via e-Wallet, balance will be deducted from the e-Wallet. On the other hand, if the user used the physical card, the merchant with Touch and Go e-Wallet enabled will inquire the balance in the e-Wallet first. If it’s sufficient, the balance from e-Wallet will be deducted. Otherwise, the balance from the card will be utilized.

- The utilization of Touch and Go is limited within Malaysia and can only be accepted

by merchants with Touch and Go reader and e-Wallet enabled.

- Bigpay

- Unlike Touch and Go, Bigpay integrates their card with Mastercard brand and therefore it has all the advantages similar to a credit card.

- One of the main attractions for Bigpay is that it offers foreign exchange with no fees.

- On top of that, it also allows withdrawal of physical cash.

e-Wallet Functions and Features

The features of e-Wallet are depicted in Figure 13.3. and summarised below:

- Secure and safe

- All the account information is encrypted, which means the actual account numbers aren’t stored on the phone.

- Password/passcode is required whenever users need to change/view the account information or make any purchase or transaction.

- Reward and promotions

- There are plenty of promotions available by using e-Wallets.

- Promotions such as discounts, good deals, cash rebates, reward points, petrol cashback, etc.

- Convenience

- No more fumbling over cash and coins.

- Once your payment is made, the transaction is recorded automatically in e-Wallet apps.

- Easy Transfer

- Easy to transfer/send money to different accounts.

- The convenient of splitting the bills with colleagues or friends.

- Easy Parking

- Street parking is made cashless with e-Wallet. No more scratching parking coupons or paying with coins at the parking machine.

- Save time, save paper and save the world.

- Save Cost

- Best exchange rate offered (direct pay via Mastercard/foreign ATM withdrawal).

- Zero-processing fee for AirAsia air ticket purchase via Big Pay.

Why is consumer moving to e-Wallet? While the main objective of e-Wallet is to promote a cashless society with all the features listed, the driving factor of consumers moving to e-Wallet is due to the abundant rewards available. The government also has played its role in the initiative to accelerate a cashless society. In Malaysia the government are providing a one-off reward to those who register for e-Wallet, which is called e-Tunai rakyat.

Rewards and Promotions

Being the most popular features for the consumer, e-Wallet operators offer a list of rewards to attract the consumer. Below are some of the rewards that have been offered:

- Food and Beverages Reward

- E-Hailing Service Discount

- Shopping Reward

- Travel-related rewards such as:

- Point conversion

- Free food at the airport

- Lounge entrance discount

- Services (bill payment)

- Discount on bill payment

- Entertainment

- Movie ticket discount

- Cashback

Among these rewards, the most famous one for the consumer is the Cashback.

Cashback

Cashback is the most famous reward by e-Wallet. Cashback is not new. In fact, it has been implemented in credit card transactions for quite sometimes. The response from the market is positive which saw banks move the points reward to cashback.

Cashback often refers to credit card benefit that refunds the cardholder a small percentage of the amount spent on each purchase, or purchases above a certain amount. Cashback also applies in a debit card transaction in which cardholders actually receive cash at the time they make a purchase.

Cashback in e-Wallet uses the same method. For every purchase above certain threshold amount, the e-Wallet will trigger cashback to be credited to the e-Wallet balance. Cashback is very popular that the majority of promotions by e-Wallet is in the form of cashback. This cash reward method has inspired the government of Malaysia to offer cash rewards whenever the customer registered for an e-Wallet.

e-Tunai sample by Malaysia Government

In an effort to encourage Malaysians to opt for digital payments for a safer, cashless, and efficient transaction, to both customer and business owner, the government of Malaysia has created a programme called e-Tunai Rakyat. In this programme, the government has allocated a budget of RM450 million from the 2020 National Budget. A one-off RM30 digital money incentive will be provided to 15 million eligible Malaysians who registered with selected e-Wallet providers. Three providers have been selected to participate in this initiative namely Boost, Touch and Go and Grab. Malaysians aged 18 years old and above with an annual income below RM100,000 will be eligible for this programme. Khazanah Nasional Berhad has been appointed to facilitate and coordinate the whole process (MOF, 2019).

The users of those three providers are required to submit a selfie or short video selfie and a picture of their identification cards (IC) via the apps. The process is seamless and the verification time depends on the operators. The information of the user will then be submitted to the facilitator which will then crosscheck with data from the National Registration Department and Inland Revenue Board. Upon completion of the verification process, the result will be informed via e-Wallet. The user will be notified if the request is successful or not. If successful, the money will directly be reflected in the e-Wallet balance. If not successful, most of e-Wallet providers still provide some kind of rewards for applicants’ participation.

With the available data, the government of Malaysia may utilize the same method for any future financial aid, such as the cost of living aid provided by the Malaysian government yearly to low-income earners.

Within five days of its launch, e-Tunai attracted almost 3 million applicants. This is almost 10 percent of total Malaysia population, with the target at the end of the campaign that it will attract more than 50 percent Malaysian to move to e-Wallet nationwide (Povera, 2020).

Donation from cashback

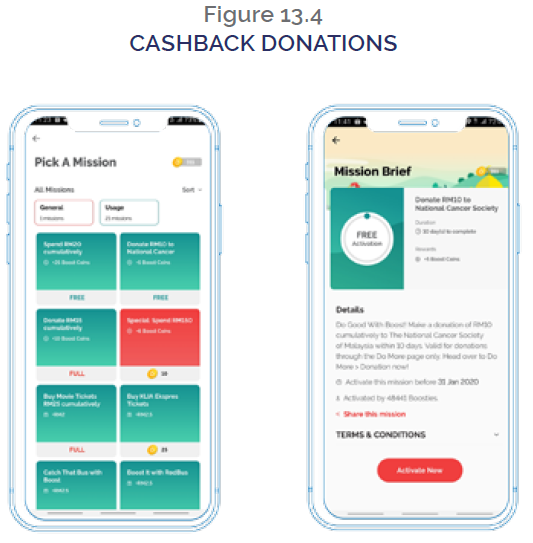

Cash earned from cashback is extra money to e-Wallet users. Since it is extra money, giving it away for good cause will not burden the user. e-Wallet like Boost has a specific function for donation and charitable activity (see Figure 13.4). This is to promote sharing by giving back what we have earned to those who are less fortunate. Whenever cashback is received via any transaction, Boost user can choose either to keep the reward or to donate it to any charitable organization registered with Boost. Alternatively, the user can also navigate to the Donation menu to contribute to any charitable organization of their choices.

One of the new features is the interactive method for charity purpose by taking “Boost Mission”. This definitely will attract the younger generation to do good.

Users can also choose any challenge that they want to participate. The challenge will have a certain mission such as to donate RM10 within 10 days. Upon enrolment, the status of the challenge percentage completion will be displayed in the user dashboard. It creates a competitive feeling just like in gaming to complete the mission.

Grab e-Wallet, on the other hand, utilizes its business platform to motivate charitable contributions. As a platform that originally started with providing transportation services, Grab has grown to include other services such as food delivery services. Grab allows users to create gift cards for both transportation and food delivery services. These gift cards can be shared with anyone within the platform.

IsSF: Management Issues and Challenges

Funding of IsSF

Zakat collection in Malaysia is well-structured and organized. The implementation is getting better every year as reflected by the collection statistics. Zakat collection is managed by each state independently. According to a research (Shawal, 2009; p. 3), the increase in zakat collection can be attributed to the adoption of e-Zakat (a web-based Internet application) that makes zakat contributions accessible electronically. This has helped to increase the awareness of Muslims in fulfilling zakat obligation.

Unfortunately, waqf management has a lot to improve. One major issue is lack of funds for operating, maintaining and managing waqf properties. Even though the Federal Government has allocated about RM 256.4 million through the 9th Malaysian Plan (RMK-9) for waqf projects and RM 1.9 billion in 10th Malaysian Plan (RMK-10), all these grants focused on waqf development and not for sustainable efforts. From the previous two RMKs, waqf has been heavily dependent on government funds to sustain. Furthermore, government budget for improvement of waqf properties remain insufficient (Abas & Raji, 2018). Six Islamic banks in Malaysia collaborated with Association of Islamic Banking and Financial Institutions Malaysia (AIBIM) and state Islamic Religious Councils to establish myWakaf, with the main objective to promote waqf development by leveraging on crowdfunding platform. This is a great effort, but the problem remains. The fund is still insufficient. For example, waqf fund for fourteen public universities in Malaysia is only about RM30 million compared to an endowment fund which stood at enormous RM1.8 billion (Bernama, 2018).

Unlike zakat, sadaqa doesn’t have a specific beneficiary. Sadaqa is the voluntary giving and acts of kindness to help the poor and needy. It is not restricted to any form of wealth, money, materials or good deeds. All good deeds done by Muslims to benefit another being is considered as sadaqa in Islam. Due to its open nature, its management may prove to be challenging. The fund may come from individuals or corporates with different mandates. For example, Bank Islam Malaysia Berhad (BIMB) has introduced crowdfunding-based Global Sadaqah with the main objective to put sadaqa into the mainstream landscape and make it organized (Abdullah, 2019). With its huge potential, sadaqa requires a more transparent and organized funding mechanism to unlock its full potential.

Distribution of IsSF

While the management of zakat collection has been getting better, there are still issues in the distribution, which have attracted concerns by zakat payers as well as discussions by scholars. One of the main struggles is in identifying qualified beneficiaries. The issue with zakat distribution is crucial since it might cause dissatisfaction among the payers which could lead them to pay zakat directly to the needy, without going through a zakat institution. According to (Sanep et. al, 2006) this may lead to leakage and inequal distribution of the fund.

Some research highlights a few key factors that may influence the effectiveness of zakat distribution (Haq & Wahab, 2017). Some of these are stated below:

- Zakat literacy amongst the employees of zakat institutions;

- Empowerment and capacity building;

- Effective monitoring or effective service control;

- Lack of understanding of both payers and beneficiaries needs and their satisfaction;

- Transparencies and red tape-ism or administrative bottlenecks;

- Perception of zakat payers on utilization of the fund; and

- Imbalances between zakat funds distribution.

Astro Awani, a Malaysian television news channel created an online polling survey asking what is the preferred method of zakat payment, whether through a zakat institution or direct payment to beneficiaries. With nearly five thousand respondents, 70% preferred direct distribution. Thereafter, Zakat Selangor has come out with a statement to respond to the polling result. Among the stigma covers are; the bureaucracy in zakat distribution, the proactivity of zakat institution in finding the needy, the issue with direct distribution and to whom the responsibility of zakat distribution is mandated to, the transparency and manipulation of Shari’a law, and the embezzlement of zakat fund and why beneficiaries always failed to receive zakat (Abdullah M., 2016).

During Ramadan, Muslims will generally multiply their good deeds. In Muslim world, Ramadan has always been the month with abundant food supply, especially at the time of breaking of fast. Food has been the main item to be donated. The issue with food is that it has a short shelf life. Based on statistics by the Solid Waste and Public Cleansing Management Corporation (SWCorp), about 4,600 tonnes of edible food is thrown away in landfills every day during Ramadan, and the numbers are bound to increase 15 to 20 percent every festive season (Baizura, 2019). This is definitely not in line with Islamic teaching and invalidates the purpose of IsSF itself.

Way Forward and Recommendations

IsSF with e-Wallet

The last few decades saw increasing efforts in improving the management of IsSF. With today’s FinTech and digital age, a lot can be done to ameliorate and revolutionize IsSF by leveraging on digital technology. e-Wallet is one such innovation that can improvise the methods of both funding and distributing the IsSF fund as well as to encourage cashless society.

“ABOUT 4,600 TONNES OF EDIBLE FOOD IS THROWN AWAY IN LANDFILLS EVERY DAY DURING RAMADAN.”

e-Wallet in IsSF Funding and Distribution

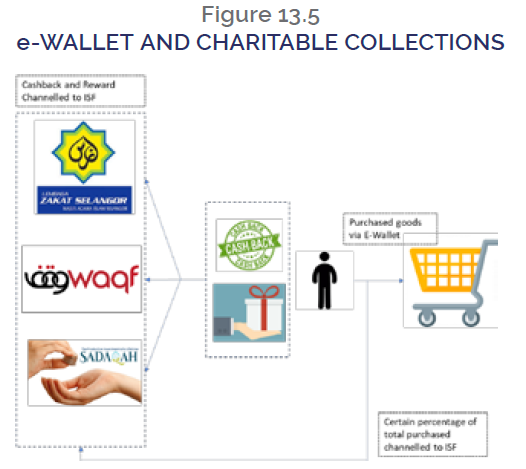

As demonstrated by e-Wallet such as Boost, charitable activity doesn’t have to be dreary. People can do good using rewards that they have earned from their own spending. No amount is too small when it comes to contribution. On top of that, e-Wallet could provide capabilities to make charity more fun by providing charity challenge for each of the user. Upon completion of the challenge, more rewards will be given to the user. e-Wallet providers may also provide a utility whereby a certain percentage to be channelled to IsSF on each purchase made (see Figure 13.5.

It is proven that e-Wallet providers have the capabilities to work together with the government to provide charitable act such as e-Tunai rakyat. The data involves in this exercise is massive and the initiative has benefited almost 50 percent of Malaysian citizens. With its smooth implementation so far, it shows that the collaboration of the government and e-Wallet providers is possible.

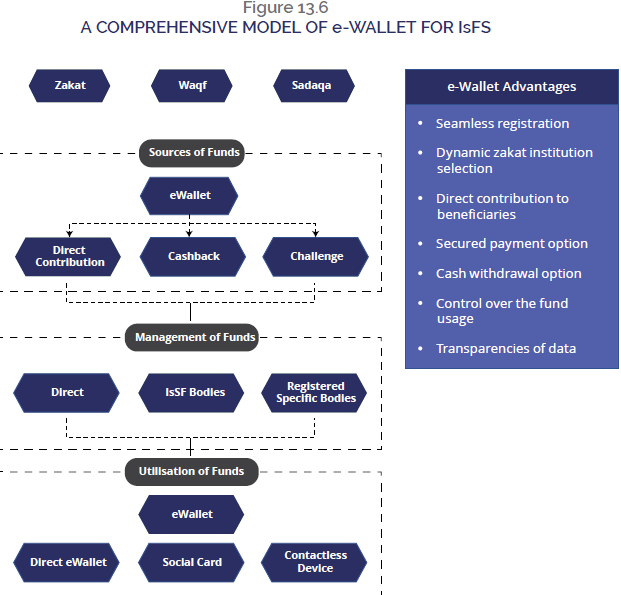

Going into IsSF, there’s a vast potential of tapping on e-Wallet to improve funding capability from what have been currently implemented. Zakat organizations may already have a well-structured way of collecting funds, but with e-Wallet it can be revolutionized further for more sustainable future. Below are the recommendations for IsSF funding and distribution activities (see Figure 3.6):

- Seamless registration

- Registration of a contributor could be done decentralized via e-Wallet. With the capabilities and data available within the e-Wallet, registration will be easy and straight- forward. User doesn’t have to go to counter for registration.

- As easy as registration for the contributor, the same rule can be applied for the beneficiaries. Registration might need more validation such as online video call instead of just a selfie and copy of identification document. Just like what has been demonstrated by e-Tunai Rakyat, this approach is feasible. For zakat, the data can include the eight categories of beneficiaries.

- Dynamic zakat institution selection

- The selection of zakat institution will be dynamic (according to state in the case of Malaysia). Zakat contribution is usually based on the working location or the payer residential place which may lead to an imbalance of the fund within zakat institutions. With e-Wallet, zakat organizations with insufficient funds could create a campaign in its e-Wallet app to attract payment direct to the center.

- In this case, the contribution could flow directly to the institutions that require the funding while at the same time automatically update the relevant information into the database of the zakat institution the payer is registered with. This will reduce the time for fund mobilization compared to the existing method where zakat payers would pay at collection center and later the fund would have to be transferred to the institution that requires the fund.

- Direct contribution to beneficiaries

- In the event that zakat payer has direct contact with their preferred asnaf, they can pay directly to them. When the transaction between him/her and the asnaf happened, the information of the transaction could be sent to zakat operator to update the record of payment.

- Payment of zakat can be expanded to an organization such as Mu’allaf foundations2. The fund can be used by the organization for the sustainability of the organization and for funding the right personnel.

- In addition, zakat can be channeled directly to the organization that provides debt management programmes such as The Credit Counselling and Debt Management Agency (AKPK) in Malaysia. Currently, the rate charged for this programme is fixed at 8 percent. Zakat contribution could help reduce the rate charged to those under AKPK debt restructuring programme and therefore may lessen their burden.

- Secured payment option

- Zakat payment would be very dynamic with e-Wallet. e-Wallet can enhance the process by making the transaction cashless and more secured.

- With no physical cash involved, the overall security of Amil and the zakat collection will be improved. This is crucial as Amil sometimes may reside at isolated location which are prone to mishap such as robbery.

- Cash withdrawal option

- While zakat distribution via e-Wallet involves electronic money, cash withdrawal is still allowed

- As demonstrated by Bigpay, e-Wallets have the capabilities to allow withdrawal of cash at ATMs as long as they are connected to the payment gateway associated with the e-Wallet.

- Control over the fund usage

- The utilization of the funds can be controlled by the usage of the cards associated with e-Wallet app. For example, funds for the poor can be controlled for purchases of basic needs such as rice, flour, bread and cooking oil. This could bring the Social Family Card which has been implemented in a few countries to another level.

- With control over fund utilization, wastages could also be reduced.

Transparencies of Data

One of the main issues associated with IsSF is the lack of transparency of the transaction. e-Wallet could solve this issue by keeping the transaction within the ecosystem. The mechanism available within e-Wallet could create data that allows monitoring of the whole transaction flows, track the fund’s movement and therefore provide transparencies. The usage of e-Wallet and contactless device (Card or Wearable) will leave a digital footprint which could be extracted for many purposes, such as tax exemption for sadaqa contributions and credit-scoring purposes for the beneficiaries, thus enabling them to apply for microfinancing facility from financial institutions.

An integration between e-Wallet and blockchain shall bring the transparencies and tracking of data to another level. One such example is a Waqf Chain, a blockchain solution designed specifically for IsSF. It provides a smart contract ecosystem and accompanying blockchain to allow waqf boards and other interested stakeholders the opportunity to submit project outlines or plans in order to fund and develop projects on top of endowment or waqf properties.

Conclusion

IsSF instruments in the forms of zakat, waqf and sadaqa have been utilized for socio-economic development since early days of Islam. While their purpose was, and is, general welfare, various issues associated with their management have surfaced all these years. These issues include inefficiency, unsustainability and lack of transparency.

As we are in the digital age, FinTech innovations could help address some of these issues. One such innovation is e-Wallet. e-Wallets and their various features could help modernize the IsSF management. Zakat options provided in e-Wallet app provide convenience for payers to register and make zakat payments. Eligible beneficiaries could also register themselves with zakat organization via e-Wallet.

Zakat funds could be disbursed through e-Wallet with capabilities to control who receives the fund and how the money is spent. Those who failed in their application to receive zakat assistance could be notified and informed of the reasons. In the process, electronic forms of data are created and this will lead to more transparency and better management of the funds. With the digital footprint, data can be further leveraged by providing facilities such as tax exemption for funder and credit scoring for the beneficiaries. With enhanced transparencies, the chances of embezzlement of zakat fund will be much reduced.

In addition, e-Wallet could enable zakat payer to contribute directly to the asnaf of their choice while at the same time could still update their records with zakat institution. With direct distribution enabled, it will be more efficient. This option could also give psychological impact to the payers for being able to help those who prefer to receive their contributions.

For waqf and sadaqa, creative use of e-Wallet features could enhance the funding and mobilization processes of the fund. Donation of cashback rewards earned on e-Wallet and donation campaign are good examples of fun ways or doing good to encourage people to contribute to IsSF funds. Similar to zakat fund management, collecting and distributing waqf and sadaqa funds via e-Wallet platform will also provide transparency. Data could be extracted for auditing and future planning.

Indeed, there are huge opportunities for FinTech to support IsSF. It is our duty to explore all the options available. And for now, creative use of e-Wallet is a low-hanging fruit as one of the options in revolutionizing IsSF as well as accelerating financial inclusion and sustainable development in line with SDGs and IR4.0.