“We are blind to our blindness. We have very little idea of how little we know. We are not designed to know how little we know.” – Daniel Kahneman, a Nobel Laureate Psychologist

Islamic finance has attracted a great attention globally to justify its introduction as a robust financial system with a unique value proposition of incorporating the principles of Islamic commercial law into the financial products and services. It results in a distinguished process and procedure that differentiates between Islamic and conventional finance. The genuineness of products offered by Islamic financial institutions (IsFIs) is ensured by a rigorous product development (PD) process to confirm that the financial, commercial, regulatory and legal aspects of a financial facility comply with the Shari’a rules and principle in spirit and letter.

The product development function plays a pivotal role in the growth, profitability and reputation of an IsFI. A product manager is expected to strike a balance between the panoply of customer’s financial needs, organization’s risk appetite, market’s norms, regulatory guidelines and Shari’a requirements in structuring a specific product or service. Currently, product developers are struggling to cope with the rapid advances in digital technology that are compelling businesses to transform the ways they operate and changing their customers’ behaviour.

To be competitive in the ever-changing world, financial organizations strives to come up with optimal products and services. One of the challenges in developing successful financial products is cognitive biases that adversely impact decision-making in corporations1. A series of interviews with product managers of IsFIs in different jurisdictions were conducted to examine whether these biases play a role in structuring financial products and services in IsFIs. The below section highlights common biases along with effective antidotes.

Product Development in IsFIs

Product development (PD) process involves a systematic flow of information and activities. In the context of Islamic finance, PD can be defined as an internal process IsFIs adapt in order to create or modify a profit-generating asset, profit-payable liability or fee-based service. The purpose of PD is to address the financing or investment needs of customer (whether retail, corporate, treasury etc.), maintain the relationship with regulator or to manage any unwarranted risk faced by the institution (e.g. Islamic hedging solutions).

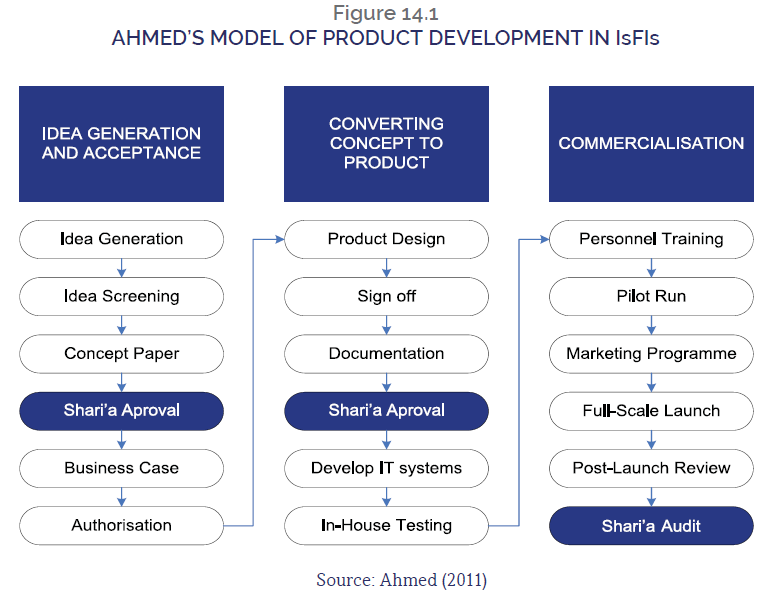

Habib Ahmed2 identified three broad phases of product development that ideally take place in IsFIs: (1) idea generation; (2) converting concept into product; and (3) commercialization. Each phase is then subdivided into six steps as self-explained in Figure 14.1.

Strategies of Product Development in IsFIs

There are generally three strategies in the Islamic finance industry for developing financial products and services: (1) imitation; (2) mutation; and (3) satisfaction.

Imitation

Imitation is also known as reverse financial engineering. In this strategy, a proposed

Shari’a-compliant product is structured considering the conventional product as a benchmark and reference. With the use of Islamic contracts supported by legal stratagem (hiyal), product developers come up with a Shari’a-compliant alternative having almost identical properties of its conventional counterpart with different process flow. This approach is mostly adopted in dire need cases where alternative solutions are not viable due to regulatory, commercial or other challenges. Some examples include:

- Replicating conventional personal finance through tawarruq or ‘ina,

- Time deposits are replicated through reversed tawarruq,

- A financial call option is replicated through ‘urbun,

- Interest rate swap is replicated through reciprocal tawarruq and reversed tawarruq,

- Replicating conventional bonds with commodity murabaha based sukuk

- Hire-purchase is replicated with sale and lease back

Mutation

Mutation is a genetic process in which genes change and produce permanent difference. In product structuring, mutation refers to modification of an existing Islamic product or contract in order to create an alternative acceptable solution accommodating the financial and business need of a customer. This is also known as ‘innovative Islamic financial engineering’. Compared to the intimation strategy, this approach starts from exploring an existing Shari’a-compliant product or contract. The approach is followed mostly by IsFIs operating comparatively in a supportive regulatory framework. The famous examples could be:

- Combination of musharaka and ijara contract to structure diminishing musharaka product for home and vehicle financing; and

- All hybrid sukuk where more than one Islamic contract is incorporated.

Satisfaction

The second type of innovative Islamic financial engineering is the satisfaction approach. In this strategy, a product developer analyses the actual needs of customers for which they are seeking financing or investment opportunities. Once the need is identified, a suitable Islamic contract is selected to structure a Shari’a-compliant product serving the customer need in a satisfactory manner. In other words, this is a customer-driven strategy where the ends (financial needs) determine the means (Shari’a-compliant solutions) not the other way around.

The satisfaction-based strategy works in less sophisticated cases. For example, a customer approaches to an IsFI for a loan. Apparently, he seeks cash. However, in reality, this is not his actual need, since he must use this money in another real transaction to satisfy his actual need i.e. purchasing a car, home, computer, mobile etc. The product manager may structure a murabaha or ijaraha product to finance the final intended good, not the initial cash, provided that the goods are acceptable from a Shari’a perspective. Other examples include:

- Meeting over-draft needs of business through mudaraba or musharaka facilities;

- Murabaha based LCs facility; and

- Providing fund for working capital need through musharaka product.

Biases in Decision Making

Accurate and fast decision-making is one of the most sought-after leadership skills in the corporate world. It is particularly more demanded in the financial sector where dysfunctional decisions can multiply the negative impacts in a chain reaction. It is observed that more often the fault lies not in the decision-making process, but rather in the mind of the decision-maker. Psychologists have identified a series of manipulative flaws hardwired into the human thinking process known as ‘cognitive biases’. Cognitive biases are systematic patterns of deviation from norm or rationality in judgment and are often studied in psychology and behavioral economics.

From a neuroscience perspective, biases rely on our past experience and methods of applying of our skills and knowledge. The more previous experience one has, the harder it would be for him to solve a problem in an innovative way. This also helps us to understand why the most experienced team members are seen exhibiting conservative behaviour towards innovation, novel ideas and creative approaches. For example, the following are the hints of cognitive biases in a corporate culture:

- “That is the way we have always done it”

- “Middle management won’t let that fly”

- “We should know what to make, not our customer”

- “We cannot challenge the existing market practice”

- “We have come too far to stop now”

Multinational corporations are spending annually a huge amount of money and resources to educate their employees about cognitive biases. As an example, U.S. firms are reported spending an estimated US$200 to US$300 million annual on diversity programmes and sensitivity training, in which all level of employees are trained to minimize the risk of cognitive biases.

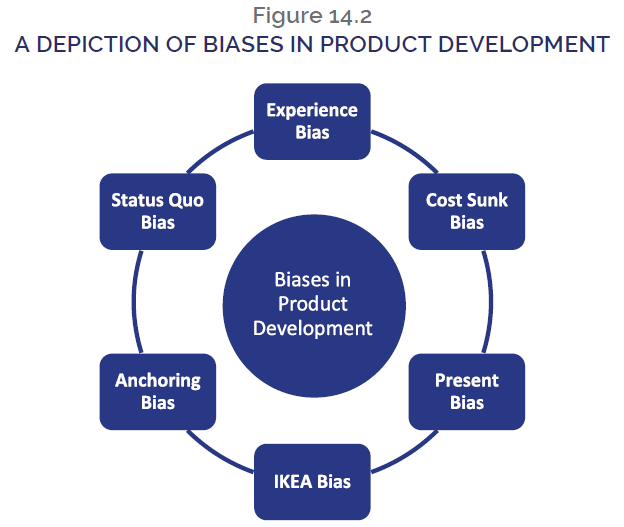

The literature review reveals that cognitive biases equally impair the decision-making ability of product developers in the financial sector. This research attempted to examine the role of cognitive biases in developing Shari’a-compliant products and services. After interviewing multiple product developers working in various IsFIs, this study found the biases shown in Figure 14.2 might adversely impact the decision-making skill of product mangers in the Islamic finance industry.

The Role of Cognitive Biases in Developing Shari’a-Compliant Products

- Status Quo Bias

Uber has been making substantial losses in the last few years. The firm realized one of the reasons was the challenge of hiring new drivers in the United States who didn’t had traditional bank accounts. The drivers were reluctant to sign up for a bank account due to the hassle of lengthy processes and complicated regulations. To grow their business, Uber recently launched its own debit card by embedding banking in the drivers’ onboarding process. Through this facility, the Uber drivers can get earnings, bounces and cash back in “real-time” without having a traditional bank account. This embedded banking does not only increase the firm’s profitability, but Uber instantly became one of the largest acquirers of new SME bank accounts in the United States. It wasn’t their goal—they just wanted to accelerate the growth of their business, which banks were slowing down.

This is not an isolated case of banks in the USA. The history of FinTech reveals that banking is among the most conservative sectors when it comes to adopting new technologies. It seems that the so-called “legacy culture” and “brick-click system” are hard-coded into the DNA of most banks due to which they cannot think “out of the box”. As described by King Bret, “innovation with a bank is often very much thinking inside the box, restricted by compliance, legal and legacy systems behaviour. Iteration on these processes and systems doesn’t produce the same innovations as someone starting without those restrictions or setting up based on completely different assumptions”6. Psychologists describe this phenomenon as the status quo bias.

It is an emotional bias and a preference for the current state of affairs. Psychologically, human brain considers a prevailing practice as a reference point and perceives other alternatives that vary from that baseline as inferior, hence undesirable. This trap affects decision-making as it underpins that the current practice is based objectively on a rationale. Therefore, whenever a new product is introduced there is a great tendency of rejection in the market.

In the case of product development in Islamic finance, it has been argued that the courage of “thinking out of the box” appears to be punished much more severely than the sin of replicating conventional products. The management often displays a strong bias against a “novel” proposal since it perpetuates the ‘status quo’ of existing conventional financial system that still—unfortunately—serves as a baseline for Islamic banking industry. For example, in 2014, Bank Negara Malaysia introduced mudaraba, musharaka and wakala based investment account policy to portray the true spirit of Islamic investment. Nevertheless, instead of adopting this new model, IsFIs resorted back to tawarruq-based products. This bias seems to be one the reasons behind the inclination of IsFIs towards ‘imitation’ based financial engineering.

- Cost Sunk Bias

Concorde was a commercial supersonic transport aircraft jointly manufactured by the British and French governments. It had a maximum speed over twice the speed of sound. When the first Concorde flight was manufactured in January 1976, the enterprise already incurred an unexpected cost. However, the British and French governments continued to fund the costly joint project for three decades. By the last Concorde flight in 2003, this financial misadventure had become unbearable and resulted in the end of Concorde career8. The British government privately regarded the project as a commercial disaster that should never have been started. This is known in cost management as Concord fallacy and sunk cost bias.

Sunk cost bias is a tendency of decision-makers to further invest (time, energy and money) into a failed project just because a cost has already occurred on this project in the past. In daily life, some people eat the food they bought just because they paid for it despite the fact that they do not enjoy it. In IsFIs, it is observed that when product managers’ decisions are tainted by emotional investments, they either “throw good money after bad” or continue to invest in a good project that already passed the point where the effort exceeds its diminishing returns. The bias appears when we hear within the team things like, “we have come too far to stop now” and “if we cut and run, it will all have been in vain”.

For example, an IsFI was planning to launch a murabaha fund in Euro based on their successful offering of a similar funds in US dollar and local currency, which were the largest in the market. The product development team spent a lot of time and money on trips and meetings to ascertain the level of appetite of customers and potential counterparties. The head of product development described this to the researcher:

“We haven’t received a positive feedback, but as we have already spent a decent amount, we couldn’t just stop. So, we did launch the fund. However, there is no real demand in the market, people were worried about other currencies, and so it was a bit of a flop”.

Sometimes, IsFIs spend a huge amount of money on developing an ERP system, core banking software or automation and on training its employees to use the new system. However, with the passage of time, the new system turns out to be heavily confusing or unreliable. The management finds it difficult to replace the system, hence, the sunk cost justifies further expenditure.

- IKEA Bias

Professor Norton of Harvard Business School and his fellow researchers gave consumers a task of assembling IKEA furniture. The researchers then priced the items the experimenters had assembled as well as pre-assembled IKEA furniture. The results showed that the subjects were willing to pay 63% more for the former than for the latter though both were identical. Through a series of similar experiments, Norton concluded that the IKEA effect is a cognitive bias that makes product developers place higher value on things they helped to create. In other words, labor leads to love and inflated product valuation.

On the other hand, Norton warned that the invested labour in the production cycle also results in focusing on the product’s positive attributes while ignoring the downside and criticism. This phenomenon is also observed in the Islamic finance industry. The interviewed experts opined that when a product is designed by a particular IsFI, its product development team often values the product disproportionately to the extent that they show strong discomfort toward the constructive criticism against the product they structured.

In the corporate world, critique is one of the pillars of a successful product development team as it inspires creativity and improvement provided that it is a valid feedback and not destructive criticism or personal attack. However, under the influence of IKEA bias, product managers sometimes do not appreciate the critique whether it is coming from a third party or within the organization. In fact, this type of fixed mindset and resistance are hurdles to the development and innovation in the era fourth industrial revolution where FinTech is redefining financial products and services.

This bias also helps us to understand why the constructive criticism and viable solutions provided by the academia and research centers, unfortunately, have yet to receive its due appreciation by the IsFIs. Due to this fact, it is hard to see a genuine financial innovation and improvement of the existing product in the Islamic finance industry. Reaction to criticism is natural as our brains are wired to bristle at negative comments. Nevertheless, a psychological research found that embracing criticism is positively associated with greater satisfaction in life, and better social and professional relationships.

- Experience Bias

The corporate world gives the highest weightage to the “experience” in screening candidates for management roles and deciding on promotions since the conventional wisdom believes in a proven track record as a predictor of future performance. Is it a wise strategy? To find the answer, Professors Monika Hamori at IE Business School, Madrid, and Burak Koyuncu from Rouen Business School, France, collected data on the career histories of CEOs of S&P 500 corporations including financial services who occupied the CEO post as of 2005 and tracked their performances up to three years after their appointments to the CEO position. Out of the 501 CEOs they examined, 19.6% had at least one prior CEO job. The research found that experienced CEOs performed worse than their peers without such experience. Being a prior CEO was negatively and significantly associated with three-year average post-succession return on assets.

Why do inexperienced CEOs outperform experienced ones? The answer lies in a cognitive bias known as “the experience bias”. Professors Hamori and Koyuncu explain:

We suspect that the job-specific experience these CEOs gained in their prior CEO job or jobs interferes with their performance in the new position. Their job-specific experience may slow down learning because some knowledge and techniques need to be “unlearned” before learning in the new context can take place. In addition, as prior CEOs rely on experience from past events, they are more likely to follow decision-making shortcuts, and this may cause them to give the same answer to a different problem.

Experience bias is also known as the ‘curse of knowledge’, which relies on our past experiences and knowledge in making new decisions. The more previous success we have had in applying that knowledge, the harder it is to imagine alternative solutions. Professors Kishore Sengupta and Luke Van have spent years studying how experience impacts productivity in the workplace. Their research suggests that seasoned managers in complex environments often suffer breakdowns in the learning process, resulting in missed deadlines, budget overruns and other problems.

The experience bias equally impairs the decision-making ability of product developers in the IsFIs. It comes to play when we hear the song of “we have always been doing this way”. The more experienced a manager is in developing Shari’a-compliant products in a certain jurisdiction or organization, the harder it becomes for them to think divergently in a new jurisdiction or organization. Indisputably, expertise causes greater insight into one’s own abilities, limitations and confidence, however, that alone cannot guarantee his or her productivity and creativity in a new environment. A product that succeeded in the Malaysian market or solution that worked in the Middle East, doesn’t always work in other jurisdictions due to different regulatory and social environments.

On the other hand, this bias also contributes in shrinking the opportunities for the Islamic finance graduates who incur a huge expense in pursuing their qualification from well-reputed universities. It is astonishing to note that the search for jobs in Islamic finance has never been harder at a time when the demand for Islamic financial services has never been stronger. Each year the Islamic finance industry keeps losing its young foot soldiers since their resumes lack the “experience”. This is an alarming phenomenon for an infant industry that undoubtedly needs fresh blood for its growth and survival.

- Present Bias

Subprime mortgages were introduced in the United States as an innovative product to finance poor people with minimal or non-existent credit profiles to purchase houses. This desirable objective was actualized through a financial engineering known as originate- and-distribute model where mortgages were bundled together and sold to other financial institutions. However, the financial derivatives representing these mortgages were predicted by Warren Buffett as the “financial weapons of mass destruction” that led to the 2008 GFC. A contributing factor to the GFC according to behavioural economists is ‘present bias’ that manipulated the mind of product developers in designing subprime mortgages to achieve short gain at the expense of long-term financial destruction.

Present bias is the inclination to prefer a smaller present reward compared to a larger later reward. Studies proved that in the experiment of choosing between (a) US$100 today and (b) US$110 a week later, majority of the respondents preferred option A over B.14 This human nature is also mentioned in the Quran: but you prefer the worldly life, while the Hereafter is better and more enduring. (16/17:87). In the context of Islamic finance, it has been observed that some products are structured for short-term financial targets. This is evidenced in the marketing slogans such as ‘Can’t afford to go on holiday to Europe? We are glad to offer you a tawarruq facility no security needed’ or ‘Why wait for tomorrow when you can live the life of your dreams today with our tawarruq facility?

The present bias mainly occurs in the intimation strategy of product development. Financial products and services developed based on short-term gains might help an IsFI in its initial stage, but its drawbacks could affect the long-term pace of the industry. Particularly, in the present time when interest is being developed for a global sustainable financial system and its socio-economic impacts. An experienced product developer mentioned that his team proposed to the management to develop a simple product with very little immediate pay-off, but hopefully bringing a positive image to the institution and an impact on society. It was a charitable fund based on murabaha (the Sadaqat Fund), whose income will be paid to a number of local charities. The product team faced resistance demanding an “immediate reward” for the institution. Endless discussions resulted in an increased cost and delayed the launch. Today after 20 years, the product does not only survive, but became a role model for other IsFIs in the region.

Present bias-affected financial engineering creates a number of challenges in the Islamic finance industry: first, it focuses on profit maximization by undermining the larger public interest (maslaha) envisioned in the HOS (maqasid al-Shari’a) whereby the performance of an IsFI is measured by the profits it generates without taking into consideration the impact of its profitable business on the environment and society16. Second, with excessive use of legal stratagem and the law of necessity, it emphasizes on the structure and form over the substance and spirit of Islamic law. Application of Islamic rules becomes a matter of passive and visionless observance of Shari’a with little confidence in its economic value. Third, it makes the Islamic finance industry by design a follower of the conventional industry since it does not need any innovation.

- Anchoring Bias

Anchoring in psychology refers to the common human tendency of giving disproportionate weight to the first information he or she receives18. During decision-making, an initial impression, estimate or idea thwarts subsequent thoughts and judgments, like an anchor that prevents the boat from moving away. For example, the initial price offered for a used car, sets an arbitrary focal point (anchor) for all following discussions. Prices discussed in negotiations that are lower than the anchor may seem reasonable, perhaps even cheap to the buyer, even if said prices are still relatively higher than the actual market value of the car.

In product development, a common anchor could be the first proposal presented either by the management or a member of the Shari’a board. For instance, when an IsFI intends to replicate a conventional product, its first Shari’a-compliant structure (al-ttakyif al-fiqhi) proposed during brainstorming session may serve as an axis around which the subsequent discussion will revolve.

One good example is the excessive use of tawarruq, which was initially suggested for personal financing in dire need cases. Nonetheless, since last two decades tawarruq has become the ideal baseline for both assets and liabilities sides products offered by IsFIs. Due to its anchoring effect, it paved the way for reverse financial engineering that led to stagnancy and lack of innovation in Islamic finance. A prominent Islamic economist Najatullah Siddiqi demonstrated through macroeconomic analysis that the harmful consequences of tawarruq are much greater than the benefits generally cited by its advocates. He further articulates: the market has enthusiastically welcomed this development (tawarruq) mainly because it takes us back to familiar grounds long trodden under conventional finance20. As a result, several scholars who approved tawarruq in the first instance are raising their voices against its indiscriminate widespread.

Minimising the Risk of Biases

Biases occur in the subconscious part of our brain without any control of the conscious awareness. Thus, individually people are unaware when a cognitive bias influences their decisions. A well-known cognitive expert and psychologist, Daniel Kahneman rightly acknowledged this fact: “we are blind to our blindness, we have very little idea of how little we know. We are not designed to know how little we know”. Nonetheless, the subject experts found that organizations and teams can collectively minimize the role of biases. To minimize the risk of biases in product development, the IsFIs may opt the following practices:

- Product Governance Framework (PGF): an effective PGF is needed to oversight the governance and process of developing a new product or modifying an existing product. This will ensure controls for adopting the best practices to design, approve and market throughout the product’s lifecycle and to comply with the Shari’a, regulatory and other relevant requirements.

- Cultivating Organization-wide Culture: as discussed earlier, cognitive awareness on an individual level may not serve the purpose. An organization-wide awareness culture should be cultivated in which employees constantly remind one another that the brain’s default setting is egocentric and an individual’s experience and perception of reality may not be the only objective truth. Hence, better decisions will come from stepping back to seek out a wider variety of perspectives and views.

- Diversified Team: diversity is a driver for innovation. Phillips, a professor at Columbia Business School explored whether diversity makes us smarter and creative. She concluded that decades of research by organizational scientists, psychologists and economists reveal that teams consisting members from diversified background (ethnicity, education, experience etc.) are more innovative and productive in decision-making than homogeneous groups21. She further added that diversity can improve the bottom line of companies and lead to unfettered discoveries and breakthrough innovations. A diversified team can easily identify biases as they emerge and counteract them on the fly to reduce their impact.

Conclusion

Clayton Christensen, a professor at the Harvard Business School and author of the bestselling management book, “The Innovator’s Dilemma”, studied the phenomenon of disruptive technologies for his entire career. In his last article, he concluded “the best answers to the enormous problems we are struggling with always starts with asking the right question”, a cardinal principle for surviving against disruptive financial innovations and productive decision making. However, our brains are hardwired with a series of manipulative flaws, which prevent us from asking the “right question”, thus we fall prey to the cognitive biases. The present research suggests that these biases also adversely impact the decision of product developer in Islamic financial institutions.

By analyzing the above facts, it can be concluded that these traps together point towards two key findings. First, a biased financial engineering might be the result of partial information received by the product team and their subsequent limited perspectives. As a result, this will not only undermine value addition of the product structured but might also trigger a reputational risk for the Islamic finance industry. Second, most of these traps are correlated. Falling into one trap often leads to becoming a prey of other traps as well. In the era of the fourth industrial revolution where FinTech is redefining the nature of the banking business, the future of Islamic banking and finance will not be solely determined by the digital transformation, but by an agile mindset trained against cognitive biases and equipped with the skills of critical thinking, innovation, and specifically the ability of making effective and efficient decisions.