-

Introduction

In 2012, sukuk issuance reached a record USD144 billion1, a 64% increase from 2011. Total Islamic bank assets in the GCC increased to USD445 billion, an over 14% increase from 20112 while conventional assets grew by only 8.1% during this period. 2012 also witnessed the introduction of Islamic finance in a number of new territories. Following the overthrow of governments in Tunisia, Egypt and Libya, all three nations are looking to incorporate Islamic finance into their economic systems. The government of Egypt is working actively to issue a sukuk in order to relieve its debt burden. In Oman, the Central Bank has come up with detailed regulations for the provision of Islamic banking services in the country. In addition, two Islamic banks and a number of windows have commenced operations. Strong growth in a number of African nations such as Tanzania and Nigeria, as well as other emerging markets, adds to this growing industry. There have been many positives in the industries; at the same time, other events have dampened optimism for the growth of Islamic banking and finance. As mentioned in Chapter 1, HSBC has desisted their Amanah window in a number of countries, although their focus is now on Saudi Arabia and Malaysia – two of the biggest players in the Islamic finance industry.

GlFR initiated the Islamic Finance Country Index (IFCI) in 2011 with the aim to capture the growth of the industry, and to provide an immediate assessment of the state of the Islamic banking and finance industry in each country. It has since then emerged as the most comprehensive and, to date, the only globally accepted means to compare countries in this sector. The Index provides a benchmark for nations to track their progress against other nations. The IFCI is a composite ranking that reflects the state of the Islamic banking and finance industry in different countries. More importantly, it highlights the leaders in the industry. The IFCI shows the growth of Islamic banking in an objective manner making it a useful tool for industry analysis and comparative assessments. It is the first, and only, index of its kind in the Islamic banking and finance industry, and has proven to be very popular amongst regulators, analysts, researchers and industry players all over the world.

IFCI ranks countries based on available information for different variables across each country in a manner that avoids any bias affecting the outcome.

- Methodology

The IFCI is based on a proprietary methodology developed by Edbiz Consulting. It is based on a multivariate analysis the details of which are given below.

- Data

There are over 70 countries involved in Islamic finance in some capacity. However, due to limitations related to the authenticity and availability of the data, we have only been able to rank 36 countries in the year 2011, 42 in the year 2012 and 43 for the year 2013. In all cases, the data has been collected from various secondary sources, including central banks’ websites, individual Islamic financial institutions’ published accounts, various agencies and national newspapers, and information portals like IFIS, Bloomberg and Thomson Reuters. Exhibits 1 and 2 evidence the 8 variables used for IFCI 2012 together with their weights.

- Weights

As per IFCI 2013, we collected data on 8 variables for 43 countries for the year 2012. The data was then suitably organized, coded to enable multivariate analysis and construction of IFCI using SPSS. The data was then tested to see if it contained any meaningful information to draw conclusions from. In order for factor analysis to be applicable, it is important that the data fits a specification test for such an analysis. The Kaiser-Meyer- Olkin (KMO) measure of sampling adequacy is used to compare the magnitudes of the observed correlation coefficients in relation to the magnitudes and partial correlation coefficients. Large values (between 0.5 and 1.0) indicate factor analysis may be useful with the data. If the value is less than that, then the results of the factor analysis might not be very useful. For the data we used, we found the measure to be 0.85, which made it reasonable for us to carry out the factor analysis. Bartlett’s test of sphericity is another specification test which tests the hypothesis that the correlation matrix is an identity matrix indicating that given variables are unrelated and therefore unsuitable for structure design. Smaller values (less than 0.05) of the significance level indicate that factor analysis may be useful with the data. For the purpose of IFCI 2013, this value was found to be significant (0.00 level) which means that the data was fit for factor analysis. Factor analysis was run to compute initial communalities to measure the proportion of variance accounted for in each variable by the rest of the variables. In this manner, we were able to assign weights to all 8 variables in an objective manner. By following the above method, we have been able to remove the subjectivity factor in the index as now the data speaks for itself, and the statistical method comes up with the weights. The weights used in IFCI 2013 are similar to IFCI 2011. These weights points to the relative importance of each constituent variable of the index in determining the rank of an individual country. Hence, it is natural to assume that countries which have a large number of Islamic banks, a central Shari’a supervisory authority, and a number of institutions involved in Islamic finance will rank high because they have a high weightage in the index compared to other variables.

| Variables | Description |

| Muslim population | Represents the absolute number of Muslims living in a country |

| Number of Institutions Involved in Islamic Finance Industry | Represents both banking and non-banking institutions involved in Islamic finance in a country |

| Number of Islamic banks | Represents fully-fledged Islamic banks (either stand-alone or subsidiaries of conventional banking groups) in a country of both local and foreign origins |

| Size of Islamic financial assets | Represents all assets relating to the industry in a country |

| Size of sukuk | Represents the total outstanding sukuk in the country |

| The regulatory and legal infrastructure | Represents the presence of regulatory and legal environment enabling IFI to operate in the country on a level playing (e.g., Islamic banking act, Islamic capital markets act, takaful act etc.) |

| Central Shari’a Supervisory Regime | Represents the presence of a state-representative body to look after the Shari’a-compliancy process across the IFI in a country |

| Education and Culture | Represents the presence of an educational and cultural environment conducive to operations of the IFI (this could be formal Islamic finance qualifications, degree courses, diplomas, and dedicated training programmes) |

| Variables | % Weights (2013) |

| Number of Islamic banks | 21.8 |

| Central Shari’a supervisory regime | 19.7 |

| Number of institutions involved in the Islamic finance industry | 20.3 |

| Size of Islamic financial assets | 13.9 |

| Size of sukuk | 6.6 |

| Muslim population | 7.2 |

| Education and Culture | 5.7 |

| The regulatory and legal infrastructure | 4.9 |

One particular change this year in the collection of data is sukuk issuance, which will be the total amount of sukuk outstanding instead of the total size of sukuk issued for the particular year. This is employed to standardise the data throughout the index as other values such as the values used for Islamic financial assets, and the number of Islamic banks are total values and not do not reflect any particular year.

- The model

The model used for the IFCI index is as below:

| i=1 |

IFCI (Cj) = ∑i=8 Wi. Xi

Where

C= Country

j = 1, 2, …., 43

W= Weight for individual variable X= Variable

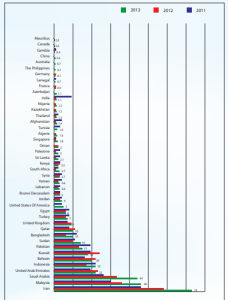

With these minor changes in the data set, and resulting changes in the weights assigned to the variables used, the above model generated some interesting results. Exhibit 3 and 4 provide a comparison of the ranking of the countries for the years 2012 and 2013.

- Analysis

It is the third consecutive year that the top three countries have remained unchanged, with Iran at number one, Malaysia at number two and Saudi Arabia at number three. Iran has an index value of 73, remaining the leading country across all the variables as its entire banking and finance sector is operating under Shari’a law. Total Islamic financial assets in Iran reached USD416 billion, the highest for any country. Malaysia is seen as a leader in the Islamic banking and finance industry. It is interesting to note how a country of less than 30 million people has led the Islamic banking and finance industry and assisted a number of other countries in their own development of Islamic finance. Malaysia is the largest sukuk issuer for the second year in a row: approximately 70% of total global sukuk issuance (USD144 billion) originated from Malaysia. In addition, Malaysia has passed a new comprehensive law, the Islamic Financial Services Act Malaysia 2013, which is coming into force in May 2013. Saudi Arabia, with Islamic financial assets of USD215 billion, the second largest in the world, and an index value of 44, is closing the gap on Malaysia, which has an index value of 46. Saudi Arabia is also the second-largest issuer of sukuk in 2012. UAE ranked fifth in the IFCI 2012, has moved up the ranking. It was the third-largest issuer of sukuk in 2012. H.E. Sheikh Rashid Al Maktoum, the Ruler of Dubai and Vice President of the UAE, has shown interest in making UAE the regional hub for Islamic banking and finance.

Indonesia, a country with the largest Muslim population, is working hard to attract the attention of the global Islamic banking and finance industry and is trying to become a hub. It is a country with high potential, especially as only 14 million out of a population of 215 million are using Islamic finance.3 Indonesia was the fourth4 largest sukuk issuer in 2012. Out of the total sukuk issuance (USD9.3 billion), USD5.8 billion was issued by the government. Regulators are working on improving the legal and regulatory system in the country to accommodate Islamic finance.

Bahrain has the most mature regulatory system for Islamic finance in the Middle East and is home to a number of multilateral organisations that support the industry. It has remained at number 6 for the second year according to the IFCI ranking. The International rating agency, Standards & Poor’s, declared the Bahraini economy stable following political unrest in 2011. The market share of Islamic banking is currently at 13.3 percent as of August 2012. Bahrain Central Bank remains strong in its sukuk programme.

In terms of Islamic financial assets, Kuwait is the fourth largest but has moved from 4th to 7th in the ranking. One reason for the drop in ranking is due to reduced sukuk issuance in the country as compared to other countries.

The growth rate of Islamic finance in Pakistan is increasing yearly, but the country remains at number 8. Total Islamic financial assets in the country have reached USD8.5 billion. With 5 Islamic banks and 13 windows, the total number of Islamic banking branches in the country reached 1097 in 2012. In the last quarter of 2012, one conventional bank commenced its Islamic operations. Total Islamic deposits account for 9.7% of the total deposits in the country. Net financing and investments account for 8.1% of the total investments and financing in the country.

Qatar, the richest country based on per capita GDP, and with the fourth largest sukuk issuance ( USD25 billion) for 2012, moved down 2 ranks to number 11. One would expect that after the strong performance for the year, Qatar would have improved its ranking. However, according to IFCI 2013, it certainly did not. This is perhaps due to the closing of conventional banking windows in the country following the government pronouncement to this effect in 2011. Its effect on IFCI 2012 was negligible due to the lag, which is being felt now.

Bangladesh and Sudan have both improved their IFCI ranking. The United Kingdom was ranked number 11 according to IFCI 2012 and has moved one place down to number 12. While one major UAE bank, Abu Dhabi Islamic Bank, has opened its offices in London, HSBC Amanah has decided to close its business from a number of geographical locations including the UK.

The most surprising result is the movement of the United States of America in the ranking from 41 to 15. However, this is explained by the inclusion of more data to compose the variables. This year we have included all forms of Islamic finance institutions including credit unions, housing firms and other Islamic financial services firms. It is interesting to note that some of the countries which are new to Islamic banking and finance have also been ranked. These include Oman and Egypt. It is expected that with the growth of Islamic finance in these countries, the overall Islamic banking and finance industry will improve and grow.

| Country | 2013 | 2012 | Change |

| Iran | 1 | 1 | – |

| Malaysia | 2 | 2 | – |

| Saudi Arabia | 3 | 3 | – |

| United Arab Emirates | 4 | 5 | +1 |

| Indonesia | 5 | 7 | +2 |

| Bahrain | 6 | 6 | – |

| Kuwait | 7 | 4 | -3 |

| Pakistan | 8 | 8 | – |

| Sudan | 9 | 10 | +1 |

| Bangladesh | 10 | 12 | +2 |

| Qatar | 11 | 9 | -2 |

| United Kingdom | 12 | 11 | -1 |

| Turkey | 13 | 14 | +1 |

| Egypt | 14 | 13 | -1 |

| United States Of America | 15 | 41 | +26 |

| Jordan | 16 | 16 | – |

| Brunei Darussalam | 17 | 15 | -2 |

| Lebanon | 18 | 29 | +10 |

| Yemen | 19 | 19 | – |

| Syria | 20 | 18 | -2 |

| South Africa | 21 | 26 | +5 |

| Kenya | 22 | 17 | -5 |

| Sri Lanka 23 22 -1 | |||

| Palestine 24 28 +4 | |||

| Oman 25 21 -4 | |||

| Singapore 26 23 -3 | |||

| Algeria 27 24 -3 | |||

| Tunisia 28 20 -8 | |||

| Afghanistan 29 25 -4 | |||

| Thailand 30 27 -3 | |||

| Kazakhstan 31 35 +4 | |||

| Nigeria 32 31 -1 | |||

| India 33 30 -3 | |||

| Azerbaijan 34 N/A – | |||

| France 35 34 -1 | |||

| Senegal 36 32 -4 | |||

| Germany 37 37 – | |||

| Philippines 38 40 +2 | |||

| Australia 39 N/A – | |||

| China 40 N/A – | |||

| Gambia 41 33 -8 | |||

| Canada 42 39 -3 | |||

| Mauritius 43 42 -1 |