Introduction

The year ending December 2012 has proven to be a sukuk-dominating period for Islamic banking and finance. With a total value of USD144 billion of sukuk issued, 2012 proved to be a record-breaking year for the issuance of sukuk. Governments and government-linked entities along with large corporates from different countries issued sukuk in 2012, making sukuk look like an elitist phenomenon. Not to say that Islamic banking itself has emerged as a practice catering to the middle and upper middle classes of the societies it operates in. Observing the shareholders’ pursuit of achieving a high street status, large consulting firms are advising such banks to increase their market share by effectively competing with their conventional counterparts. Exploring how to tap the segments of society being underserved or completely ignored is not on the priority list of Islamic banks and financial institutions. Hence, while there is a lot being spent on marketing and advertisement, there is no Islamic bank in the whole world with any significant budget for research and development.

Undoubtedly an interesting year for sukuk, but it appears as if Islamic banking and finance as a whole are fast losing their traction in conventional banking and finance. The perceived role of Islamic banking and finance as a bridge between Islamic communities and the rest of the world is fast evolving to bring it out as a regional phenomenon rather than a global practice attractive for Muslims and non-Muslims. This is a message that should be taken seriously by Islamic bankers – that Islamic banking is “Islamic” because it is for Muslims. Those who advocate Islamic banking as a form of “just” banking must understand that it is always safe to play on home ground in home colours. Any attempt to play “away” and even not in one’s own colour is likely to bring defeat, which certainly will not be supported by the home crowd.

There are about 1.8 billion Muslims in the world (see Chapter 11 for further demographic analysis of the Muslim world), and it is this segment of the global population that Islamic banks should attempt to win. Those who argue for making Islamic banking attractive for all –- Muslims and non-Muslims alike –- must keep in mind that Islamic banking is not the choice of the majority even in a single Muslim country,1 which offers a window of opportunity for Islamic banks. While conventional banks have only limited interest in converting their conventional customers into Islamic –- because of fear of cannibalization–- fully-fledged Islamic banks can take the lead by offering financial products that are customer-oriented in nature and scope.

- Leadership in Islamic banking and finance

While the GCC remains a hub of Islamic banking and finance, newly emerging markets in Africa (Morocco, Tunisia, Libya and Egypt) will bring a new growth dimension to the Islamic financial services industry. In the last 10-15 years, the leadership of Islamic finance has tilted away from the well-established players like Dar al Maal al Islami (DMI) Trust and Dalla Al Baraka Group, in favour of some new players from Qatar (e.g., Masraf Al Rayan and Qatar Islamic Bank) and the UAE (e.g., Abu Dhabi Islamic Bank and Dubai Islamic Bank). Saudi Arabia is still the largest market for Islamic banking and finance, but Qatari institutions now play a role in internationalizing Islamic banking and finance. Qatar Islamic Bank (QIB) has already expanded its presence to other countries like the UK, where it owns QIB-UK, a fully-fledged Islamic investment bank in the country. Masraf Al Rayan is now in the process of acquiring a majority shareholding in the Islamic Bank of Britain, which already has significant Qatari shareholding. After the fall of the Mubarak regime in Egypt, Abu Dhabi Islamic Bank (ADIB) acquired National Bank for Development in Egypt to start Islamic retail banking in the country that pioneered modern Islamic banking in the 1960s. This is certainly a significant development, and industry observers are expecting that the developments in Egypt will give a significant boost to the assets under management (AUM) of Islamic financial institutions.

The likes of Dubai Islamic Bank (UAE), Kuwait Finance House (Kuwait) and Al Rajhi Bank (Saudi Arabia) are playing an increasingly stimulating role in internationalising Islamic financial services – a role that was played by DMI and Dalla Baraka Group in the first phase of internationalisation of Islamic banking and finance. With its presence in Pakistan, Sudan, and Jordan, Dubai Islamic Bank is aggressively pursuing its goal of becoming a pan-Islamic banking institution. Kuwait Finance House is already present in Bahrain, Turkey and Malaysia, and through its shareholdings in a number of other Islamic financial institutions, it has emerged as a global player in the Islamic financial services industry.

With the exit of the likes of HSBC from Islamic retail banking in a number of countries and the very slow start of the Islamic Bank of Britain in the UK, there is no doubt that Islamic banking and finance has very limited scope in the Western hemisphere. The European continent, although developed economically, does not offer future prospects for the global Islamic financial services industry. Financial centres like Luxembourg and Dublin are trying their best to lure Islamic asset and wealth management businesses by bringing changes in regulation and taxation to provide a level playing field to Islamic financial institutions. While this will certainly help bring some limited Islamic business to these financial centres, it is equally true that the new financial centres being developed in the Islamic world will become the prime beneficiaries of growth in Islamic banking and finance.

The likes of Dubai International Financial Centre (DIFC), Qatar Financial Centre (QFC) and Malaysia International Islamic Financial Centre (MIFC) will dominate the cross-border transactions in Islamic banking and finance.

Malaysian government has been aggressively pursuing to develop Labuan as a clean and transparent financial centre for promoting the kind of offshore business that other more recognised offshore jurisdictions of the world have offered for decades.

- Size of the global Islamic financial services industry

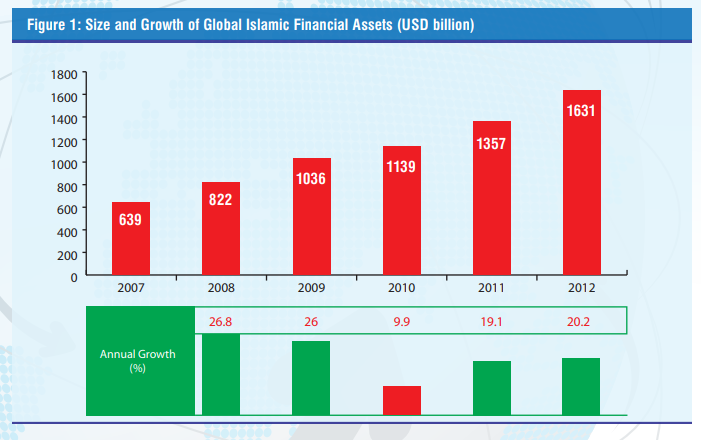

GIFR’s authentic estimate for the size of the global Islamic financial services industry is USD1.632, which includes Islamic financial assets with Islamic banks, conventional banks’ Islamic operations (windows and branches), investment banks and investment companies (e.g., mudaraba companies in Pakistan), Islamic funds, and takaful companies (fully-fledged or Islamic operations of conventional insurance companies). This figure also includes the amount of sukuk outstanding at the end of 2012. The GIFR methodology also takes into account double counting to ensure that the size of the Islamic financial services industry is not exaggerated. For example, it is likely that those assets under the management of Islamic banks, which have been invested in sukuk and other investments are counted twice if we separately add all the components of the industry. Although detailed data on breakdowns of Islamic investments on a transaction and product level remains a challenge, GIFR’s analysis remains the most comprehensive and authentic. Figure 1 presents the size and growth of the Islamic financial services industry in the last five years. It is clear that despite a slowdown in 2010, Islamic banking and finance has consistently grown to remain relevant o the global financial services industry.

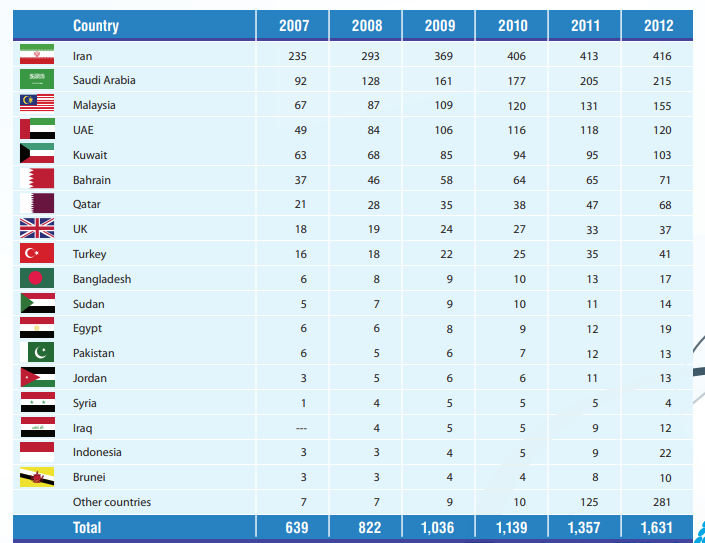

Table 1 presents the breakdown of Islamic financial assets in a selected number of countries. It is interesting to note that the size of the informal Islamic financial assets is on the rise (USD199.51 billion2), despite the obvious institutionalisation of Islamic banking and finance. With the rapid growth of Islamic banking and finance, it was expected that the size of the informal Islamic financial sector would decrease but obviously, this has been the case. It is primarily because a number of strict families, especially in the GCC region (but also in other countries like Pakistan, Bangladesh and other countries), are not sufficiently convinced with the Shari’a authenticity of Islamic banking and finance. There is a definite need to bring such families by bringing these families into the Islamic banking and financial net.

The halal industry and Islamic finance It is surprising that although the halal sector and Islamic banking and finance both draw their legitimacy from Islam, they have developed very independently of each other. The GIFR 2013, therefore focuses on the global halal industry to bring it close to the practice of Islamic banking and finance. If the two industries are integrated, there is no doubt that the combined size of the industry will be many-fold their present individual sizes.