Since 2010, GIFR has reported briefs on the state of affairs of the global Islamic financial services industry as an opening chapter of the annual report. During the last 10 years, the global Islamic financial services industry has gone through significant changes, particularly with reference to its growth. Following the tradition, this chapter provides an overview of major developments in IsBF in 2019-20 and over the last 10 years.

Although a major bulk of assets under the management of the institutions offering Islamic financial services (Islamic financial AUM) is in the Islamic banking segment of the industry, the global Islamic financial services is dominated by the issuance of sukuk2. Issued by multilateral institutions, governments and the private corporations, both in local currencies and dollar, the sukuk have attracted cross-border investments from financial institutions and other businesses. Sukuk are thus an important tool that have proven effective in the globalization of IsBF.

In addition to sukuk as an instrument, there are a few institutions that have helped the industry to globalize it. Some of them are listed below:

- Dar al-Maal al-Islami Group (DMI Group)

- Dalla Albaraka Group

- Kuwait Finance House Group and

- Dubai Islamic Bank Group

There are some other financial institutions that have emerged as cross-border Islamic financial conglomerates, namely, Abu Dhabi Islamic Bank (ADIB), Al Rajhi Bank, Masraf Al Rayan, CIMB Bank and Maybank.

Islamic Development Bank (IsDB) and its subsidiaries – Islamic Corporation for the Development of the Private Sector (ICD), International Islamic Trade Finance Corporation

(ITFC) and Islamic Corporation for Insurance of Investment and Export Credit (ICIEC) have been instrumental in internationalization of IsBF.

Islamic fund management industry, another component of Islamic capital market (other than the sukuk market), continues to struggle in terms of AUM. This segment has for the last 10 years struggled to maintain its AUM above US$100 billion. Global equity has attracted only marginal attention of the Shari’a-sensitive investors, as most of the Shari’a-compliant global equity funds have less than US$25 million under management3. There have been numerous attempts to popularize Shari’a-compliant ESG funds, but so far there has not been any considerable success story in this respect. Also, although there have been repeated suggestions for reinvigorating the institution of waqf for developing Islamic social finance (IsSF), Islamic investment funds based on the concept of waqf have yet to emerge to any significance.

“GLOBAL EQUITY HAS ATTRACTED ONLY MARGINAL ATTENTION OF THE SHARI’A-SENSITIVE INVESTORS”

The most profound demand for Islamic financial services happens to be in Islamic banking, which holds the maximum Islamic financial AUM. The above-mentioned banking groups have played their roles in attaining the size the industry has now grown to.

Islamic social finance remains at best in its infancy despite IsBF having attained a track record of about 50 years. This should be a matter of great concern for the industry leadership, as IsBF has always maintained its superiority in terms of its commitment to social responsibility. Failing on this front will have long-term implications for the sustainable growth of IsBF.

We shall next give a brief on the aforementioned four groups that have globalised Islamic banking.

Dar Al-Maal Al-Islami Trust

DMI Group pioneered IsBF in various countries of the world. Founded in 1981 in Switzerland principally by Prince Mohamed Al Faisal, it set up Islamic banks and financial institutions throughout the world. Although once it was known for its Faisal Banks brand, the Group has now become more diversified in business and branding. Ithmaar Bank in Bahrain is now more prominent brand within the Group through which it holds shareholdings in other entities in different parts of the world (e.g., Faysal Bank in Pakistan). Once Faisal Banks in Bahrain, Senegal and Switzerland, many of the Faisal Banks have now been rebranded for a variety of reasons5.

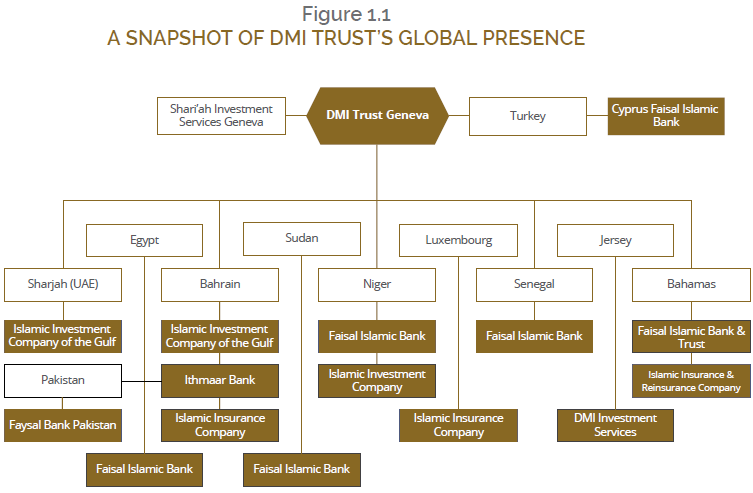

Figure 1.1 presents a snapshot of an old, albeit rough, structure of DMI Group. Quite a few entities are now either dysfunctional or have been sold/rebranded. For example, Faisal Islamic Banks in Senegal and Niger have now been taken over (and rebranded as Islamic Banks of Senegal and Niger) by Tamweel Africa Holding, which in turn is owned by ICD and IsDB. This is an indicator of the emerging role of ICD in promoting IsBF globally.

Dalla Albaraka Group

Founded by Sheikh Saleh Kamil roughly around the same time as DMI Trust, Dalla Albaraka Group emerged as the second most important Islamic financial conglomerate in the world. Albaraka Banking Group now has presence all over the world through direct investments and by way of ownership in various Islamic banks and financial institutions.

Kuwait Finance House

Established in 1977, Kuwait Finance House (KFH) Group has emerged as an important Islamic financial conglomerate with operations in a number of countries. With the subsidiaries and banks owned by it in the UAE, Bahrain, Saudi Arabia, Turkey, Germany and Malaysia, it has established itself as a truly global Islamic financial institution. The Group has investments in a lot more other jurisdictions in a number of sectors, particularly in property. It also has invested in the likes of Liquidity Management Centre (Bahrain) and Sharjah Islamic Bank (UAE).

The visionary leadership of KFH Group established KFH Research, an independent research think-tank specializing in research & development in Islamic finance, but unfortunately this experiment was not successful owing to the incompetent research team employed. Consequently, it was closed down. KFH Group is also a founding shareholder of ITS – a global firm specializing in Islamic financial technology.

With shareholding of government and government-linked entities, it has directly or indirectly contributed to social sector development in its native Kuwait and elsewhere. The bank is partly owned by the government of Kuwait and different state entities.

Dubai Islamic Bank

Claimed to be the first Islamic commercial bank set up in the world6, Dubai Islamic Bank (DIB) is fast emerging as a global Islamic financial conglomerate. Headquartered in Dubai and with Islamic banks in Pakistan, Sudan, Kenya and Indonesia, DIB Group is an important player in the global Islamic financial services industry. Majority held by the government of Dubai, it still remains a Dubai bank with most of the profits of the Group drawn from its UAE operations. The prudent investment strategy of the Group is expected to result in its heavy global presence in the long run. With its recent acquisition of another government-owned Islamic bank, namely Noor Bank, DIB is in the process of consolidating its Dubai operations.

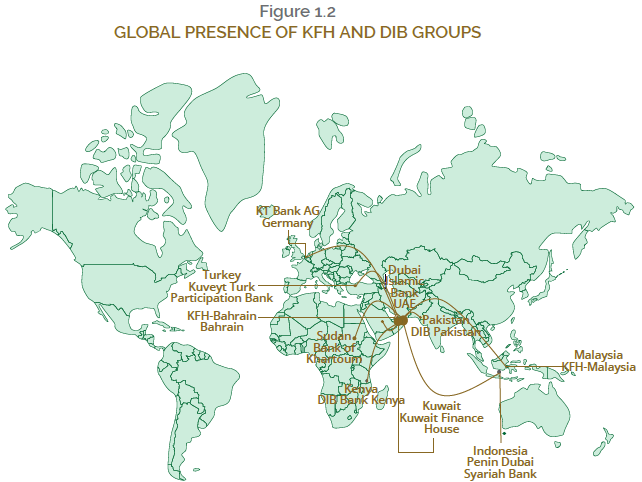

A snapshot of the global presence of KFH and DIB is given in Figure 1.2.

Global Islamic Financial AUM

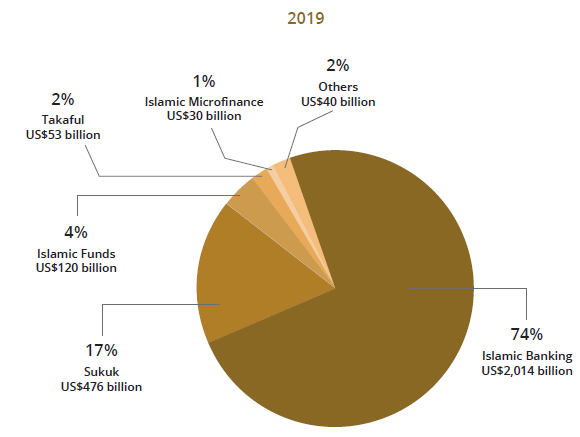

At the end of 2019, global Islamic financial services industry stood at the size of US$2.733 trillion. This includes five segments of the industry, namely, Islamic banking, Islamic capital markets (sukuk and Islamic funds), Takaful, Islamic microfinance, and other non-bank Islamic financial institutions.

The current size of the industry must disappoint many industry observers and infrastructure-building bodies, which predicted this to achieve even a size of US$6.5 trillion by 2020. Such was the growth of the industry prior to the Global Financial Crisis (GFC) of 2008-09 that it was only plausible to predict such a figure at the start of the current decade. However, since then the forecasts have been revised time and again to bring the expectations around size and growth of the industry to more realistic levels.

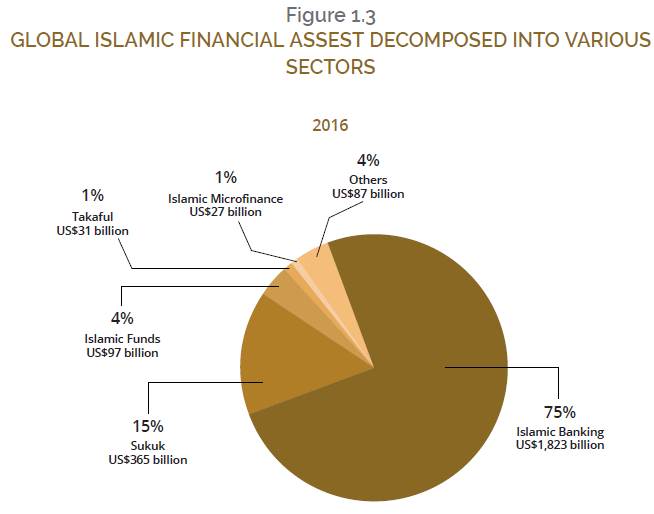

GIFR’s estimates of the size of the global Islamic financial services industry since its inception in 2010 are reported in Table 1.1. Composition of this AUM is shown in Figure 1.3. As stated above, it is dominated by the Islamic banking sector that claims for 73.7% of the global Islamic financial AUM. Out of the Islamic banking assets, almost 65% are held by fully-fledged Islamic banks. Compared this with our last reported figure of 60% in GIFR 2017, it indicates that a pure (fully-fledged) Islamic banking model is a preferred choice over a subsidiary or window model7. Less than 10% of Islamic banking assets are held by Islamic windows and subsidiaries.

“… IT INDICATES THAT A PURE (FULLY-FLEDGED) ISLAMIC BANKING MODEL IS A PREFERRED CHOICE OVER A SUBSIDIARY OR WINDOW MODEL.”

Table 1.1

THE GLOBAL ISLAMIC FINANCIAL SERVICES INDUSTRY: SIZE & GROWTH

| COUNTRIES | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| Global Islamic Financial AUM (US$ trillion) | 1.036 | 1.139 | 1.357 | 1.631 | 1.813 | 1.981 | 2.143 | 2.293 | 2.431 | 2.591 | 2.733 | |

| Annual Growth (%) | 26.0 | 9.9 | 19.1 | 20.2 | 12.3 | 9.3 | 7.3 | 7.0 | 6.0 | 6.6 | 5.5 | |

| Average Growth (2009-19) | 11.7 | |||||||||||

| Average Growth (2009-14) | 16.1 | |||||||||||

| Average Growth (2015-19) | 6.5 | |||||||||||

| Potential Islamic Financial AUM (trillion) | 4.0 | 4.4 | 4.84 | 5.324 | 5.865 | 6.451 | 7.096 | 7.806 | 8.586 | 9.445 | 10.389 | |

| Size Gap (US$ trillion) | 2.964 | 3.261 | 3.483 | 3.693 | 4.052 | 4.47 | 4.953 | 5.513 | 6.155 | 6.854 | 7.656 |

Actual global Islamic financial AUM is the aggregate of assets under management of all those institutions (pure Islamic financial institutions as well as conventional financial institutions offering Islamic financial services) and includes assets held by banks (Islamic as well as conventional banks), sukuk outstanding, assets under management of Islamic funds and Islamic discretionary portfolios managed by conventional asset managers, insurance companies (Takaful companies as well as conventional insurance operators offering Takaful and re-Takaful services), Islamic microfinance institutions and all other non-bank financial institutions offering Islamic financial services.

Potential Islamic financial AUM can be defined as the assets under management of the institutions offering Islamic financial services to all those who would like to have access to such services, and to all those who would like to use Islamic financial services but have excluded themselves voluntarily from the financial services market because such services are not available.

There is now some indication of Islamic capital markets, particularly sukuk, becoming more prominent in the global Islamic financial services industry. In 2017, GIFR reported sukuk holding 15% share of the global Islamic financial AUM, which has now increased to 17.42%. From a share of 19% in 2016, Islamic capital market instruments (sukuk and Islamic funds) now comprise nearly 21% of the global Islamic financial AUM (see Figure 1.3). Also, Takaful industry has started gradually becoming more prominent, by capturing market share of 2% by the end of 2019, as compared to 1% in 2016.

With the passage of time, IsBF is now being better documented, as evidenced by only 2% of the global Islamic financial AUM reported under ‘Others,’ compared with 4% in 2016.

AT THE END OF 2019, GLOBAL ISLAMIC FINANCIAL SERVICES INDUSTRY STOOD AT THE SIZE OF US$2.733 TRILLION

A Focus on Sukuk

2019 was a bumper year for sukuk issuance, with US$162 billion worth of new sukuk issued during the year. The trend was expected to continue had the COVID-19 not hit the global economy.

Sukuk are funding infrastructure projects around the world, especially in Africa, and contributing to socially useful ventures. Senegal is an excellent example whereby the government issued a sovereign sukuk in 2014 to raise US$168 million.

The predominantly non-Muslim countries that have issued sovereign sukuk include Singapore (2009), UK8 (2014), Luxembourg (2014), Hong Kong (2014), South Africa (2014), Nigeria (2017, 2018, 2020). Kenya has also been considering issuing a sovereign sukuk since 2016/17, and many industry observers believe that this will happen pretty soon.

Many Western financial institutions, e.g., Goldman Sachs and GE Capital, have also issued sukuk to finance some of their operations. The interest is not limited to only Western corporates, as some Chinese corporations, e.g., Country Garden and Beijing Enterprises Water Group, have also benefitted from the issuance of sukuk.

Taiwan’s Formosa Bond Market offers an excellent opportunity to sukuk to further globalise its reach. Qatar Islamic Bank became the first issuer of a Formosa sukuk by raising US$800 million in February 2020.

Sukuk as a Source of Tier-1 Capital

Many Islamic banks have used sukuk issuance to expand their capital base by way of raising Tier-1 capital. These include, among others, Dubai Islamic Bank, Sharjah Islamic Bank, Abu Dhabi Islamic Bank (ADIB).

ADIB was the first Islamic bank to issue a US$1 billion perpetual sukuk in 2012 (which had no maturity date). Prior to that ADIB privately placed a US$2 billion Tier-1 Note in 2009. Between 2012 and 2014, when Basel III standards came into effect gradually, a total of 16 Basel III compliant sukuk were issued, raising US$8.2 billion. Since then, it has become a regular feature in IsBF, as many Islamic banks have issued sukuk to raise capital to expand their capital base.

Slowdown in the Growth of the Industry

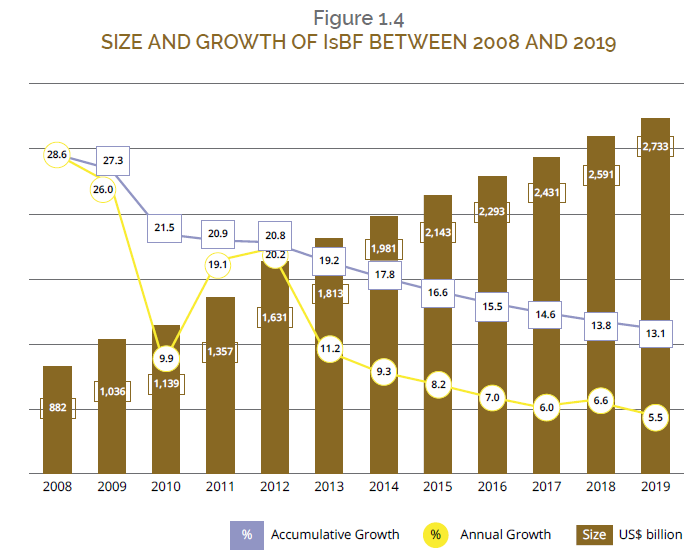

GIFR is the first report to have documented the size and growth of Islamic financial services industry since its inaugural edition in 2010, when it reported that the global Islamic financial AUM has exceeded US$1 trillion by the end of 2009. After 10 year, the size of the global Islamic financial services stood at US$2.733 trillion, an increase of more than 2.6 times during the reported period. However, as Figure 1.4 clearly demonstrates, there is a visible slowdown in the growth of the industry since 2013. GIFR has repeatedly been highlighting this slowdown but obviously the practitioners and the leadership of the industry-building bodies like Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), Islamic Financial Services Board (IFSB) and even Islamic Research & Training Institute (IRTI), research arm of Islamic Development Bank (IsDB), haven’t paid attention to this phenomenon. One possible explanation of this neglect or indifference to slowdown may very well be the accumulated growth figures that continue to be quoted at the industry conferences, seminars and workshops. As Figure 1.4 shows the accumulative growth rate for the period 2008-2019 is 13.1%, which appears to be impressive. However, this is potentially misleading and must not be taken seriously, especially in the wake of continuous decline in the annual growth.

There is a visible decrease in growth of the industry since 2013. In 2019, the industry grew by 5.5%, after a slight improvement of 6.6% the previous year from the reported growth rate of 6.0% in 2017 (see Figure 1.4).

Obviously, not everything is honky dory about the industry, but the slowdown hasn’t been taken seriously by the industry pundits. In the wake of COVID-19, the global economy has already suffered a huge blow, and it is expected that the countries with significant shares of Islamic banking and finance (IsBF) will also face slump in their GDP growth. This has implications for further decrease in the growth of the industry (see below for further details).

Previous editions of GIFR have reported various reasons for the slowdown in the growth.

The main reasons for slowdown therein were reported to be:

- Political conflicts in a number of Muslim countries;

- Low oil prices;

- Receding interest of Western financial institutions in IsBF;

- Structural issues;

- Stifled innovation;

- Wider macroeconomic factors; and

- Maturity of the industry.

While all the above factors have contributed to the slowdown, it must not be written off completely that the initial romance of the Muslims with IsBF is also retroceding. It cannot be denied that the increased awareness around IsBF continues to usher new customers to Islamic financial institutions (who show a lot of enthusiasm), but at the same time they are not winning more loyalty from the existing lot of patrons of Islamic financial services. This doesn’t necessarily imply that Islamic banks are losing support of the incumbent customers. Rather it suggests that they haven’t added significantly to the volume of their business with Islamic banks and financial institutions.

Shari’a authenticity is the principal factor determining a demand for Islamic financial services on all levels, but it is most important in retail business. In capital markets, for example, the motive for using Islamic financial instruments may not inevitably be Shari’a concerns, as many sovereigns, businesses and financial institutions tend to use Islamic financial tools for an array of reasons other than religious requirements.

GIFR takes the view that in addition to the factors listed above and discussed in the previous editions, Shari’a authenticity deficit is a major contributor to the slowdown of the industry. It is important to define Shari’a authenticity deficit to avoid any confusion both on part of the practitioners and Shari’a scholars on one hand side and the researchers and other observers of the industry.

“IN CAPITAL MARKETS, THE MOTIVE FOR USING ISLAMIC FINANCIAL INSTRUMENTS MAY NOT INEVITABLY BE SHARI’A CONCERNS.”

“Shari’a authenticity deficit is the perception held by stakeholders in Islamic banking and finance (particularly people on the demand side of financial services) that Islamic banking and finance is only insufficiently different from interest-based or conventional banking and finance, and hence is only partially in compliance with the strict Shari’a requirements.”

In this sense, Shari’a authenticity deficit is different from Shari’a arbitrage. The latter highlights the exploitation of the conservative Muslims (who are deemed as captive customers of Islamic financial institutions) in the hands of bankers who offer them the same/similar financial services as interest-based financial institutions would offer, in the guise of Islamic nominated contracts. In doing so, Islamic financial institutions maximize their profits as much as their conventional counterparts, and, in fact, may charge more for providing Islamic financial products as an alternative to such conventional products.

The Possible Effect of COVID-19 on IsBF

COVID-19 is a massive shock to the global economy and the financial services industry is expected to get a hit from it as much as other sectors in the economy. It will be too arrogant on part of Islamic bankers and finance experts to assume that IsBF will not be adversely affected by it.

In the second quarter of 2020, there has been a surge in the webinars and other online activities all pointing to the role of Islamic social finance in combating the problems emanating from the COVID-19. In this respect, the role of waqf has been highlighted by most of the industry observers and analysts. The role of technology has also been emphasized in what is now being termed as a New Normal. The COVID-19 is, therefore, a new opportunity for IsBF to go back to basics and re-assess its value proposition, and re-orient itself around social finance. S&P Global asserts that COVID-19 offers an opportunity for more integrated and transformative growth with a higher degree of standardization, stronger focus on the industry’s social role, and meaningful adoption of financial technology (FinTech). However, there is no denial of the fact that it is a medium to long-term opportunity, and that the next year is expected to bring the growth further down.

Multilateral institutions, like the World Bank, have once again started looking at IsBF to play its promised role in the post-COVID-19 era, given that it claims to have an inherent orientation towards supporting the real sector.

Like in the post-GFC period, it is expected that the interest in Sukuk will witness a surge, but this time primarily from the governments of the countries where IsBF is significant in size and proportion.