Developed by Edbiz Consulting in 2011, Islamic Finance Country Index (IFCI) is the oldest index1 for ranking different countries with respect to the state of Islamic banking and finance (IsBF) and its relative importance in a national context, and benchmarked to an international level. IFCI has evolved over the last 10 years, with two adjustments in 2018 and 2019. These adjustments aimed at normalizing the data over the time series, and to reflect on our increased intelligence into some key IsBF markets.

The IFCI was initiated with the aim to capture the growth of the industry, and to provide an immediate assessment of the state of IsBF in each country. With only 50 countries included, the index is based on a multivariate analysis providing a comprehensive assessment of the state of affairs of IsBF in the countries included in the sample.

With the 10-year data since its inception, IFCI can now be used to compare the countries not only in a given year but also over time. As more countries open up to IsBF, the index will provide a benchmark for nations to track their performance against others. Over time, the individual countries on the index should also be able to track and assess their own performance.

Table 3.1 provides an example. While Bahrain started ahead of Bangladesh on the IFCI score and ranking, Bangladesh has, however, over the 10 years left Bahrain behind. The faster improvement in IFCI in case of Bangladesh owes to a comprehensive gradual improvement in all the constituent variables/factors of IFCI (see Box 2). In our 2019 review of the index, Bangladesh experienced a significant jump in score and ranking, primarily because of inclusion of previously excluded (or unavailable) information on the IFCI variables.

This shows that both the quality and quantity of Islamic financial intelligence has improved over the last 10 years.

Table 3.1 IFCI FOR BAHRAIN AND BANGLADESH: COMPARISON FOR 2011-2020

| Bahrain | Bangladesh | |

| 2011 | 16.00 | 12.00 |

| 2012 | 19.41 | 5.16 |

| 2013 | 18.77 | 9.19 |

| 2014 | 22.18 | 9.97 |

| 2015 | 23.93 | 11.11 |

| 2016 | 21.90 | 16.14 |

| 2017 | 21.95 | 16.72 |

| 2018 | 22.35 | 17.78 |

| 2019 | 30.09 | 43.01 |

| 2020 | 33.43 | 50.37 |

| Significant | Exceptional |

The IFCI shows the growth of IsBF in an objective manner, making it a useful tool for industry analysis and comparative assessments. We recommend to readers to refer to previous editions of GIFR (2011-19) for a comprehensive view on IFCI.

IFCI 2020

Table 3.2 presents the latest IFCI scores and ranks. Following are some of the important observations:

- Malaysia has once again regained its number one position, with 83.33 score, overtaking Indonesia that claimed that position last year. Malaysia has dominated the index since 2011, being number one in 2016, 2017 and 2018. Before that, Iran held the coveted position. Last year, Indonesia jumped 5 positions up to capture the top position, but this year it has dropped to the second position.

- There is no change in ranks of seven countries (Iran, Saudi Arabia and Sudan remained on the third, fourth and fifth positions; Other countries with no change in ranking include Kenya, South Africa, Palestine and Spain). Although it seems like a large variation in the annual ranking, the changes are in fact primarily due to only a few countries that have affected rankings of most of the other countries. For example, there are 33 countries that have moved up or down by one position (two moving up and 31 shifting down).

- In total, 42 countries witnessed changes in their IFCI scores: all of them upwards except India that is the only country with deterioration in its IFCI score.

- The aggregated figure of IFCI for the full sample is 900.70, up by 16.38% from the last year’s aggregate of 773.96. This implies that the overall developments in IsBF globally have grown/increased by 16.78%, according to our composite index and the constituting factors. This year, Senegal took the biggest leap and improved its position from 47 to 27. This improvement in ranking is primarily because of the quality of intelligence we gathered on the country. West Africa has by and large been on the fringe of the global Islamic financial services industry. Among other factors, the language is a major barrier as most of the official information on IsBF in the region is in French. Last year, the biggest leap was taken by Morocco, which improved its ranking from 48 to 19. This improvement was also partially be explained by the language constraint.

- Kazakhstan continues to assume increasing importance on the IFCI. In 2018, it was ranked 24th to climb up to the 18th position last year. It has, this year, jumped up to claim the 14th place. This continuous improvement owes to a number of regulatory and advocacy initiative that various government departments have lately started (see Box 1).

- Nigeria has also jumped up 5 positions to claim 21st spot on the IFCI.

- The real beneficiary with significance is, however, Pakistan, which has climbed up 4 slots to become the 6th most important Islamic financial market in the world.

Table 3.2

LATEST IFCI SCORES AND RANKS

| COUNTRIES | 2020 SCORE | 2019 SCORE | CHANGE IN SCORE | % CHANGE IN SCORE | 2020 RANK | 2019 RANK | CHANGE IN RANK |

| Malaysia | 83.33 | 81.93 | 1.40 | 1.71 | 1 | 2 | +1 |

| Indonesia | 82.01 | 81.01 | 1.00 | 1.23 | 2 | 1 | -1 |

| Iran | 79.99 | 79.03 | 0.96 | 1.21 | 3 | 3 | 0 |

| Saudi Arabia | 66.01 | 60.65 | 5.36 | 8.84 | 4 | 4 | 0 |

| Sudan | 61.08 | 55.71 | 5.37 | 9.64 | 5 | 5 | 0 |

| Pakistan | 53.12 | 36.88 | 16.24 | 44.03 | 6 | 10 | +4 |

| Brunei Darussalam | 52.89 | 49.99 | 2.90 | 5.80 | 7 | 6 | -1 |

| United Arab Emirates | 47.84 | 45.31 | 2.53 | 5.58 | 8 | 7 | -1 |

| COUNTRIES | 2020 SCORE | 2019 SCORE | CHANGE IN SCORE | % CHANGE IN SCORE | 2020 RANK | 2019 RANK | CHANGE IN RANK |

| Bangladesh | 47.06 | 43.01 | 4.05 | 9.42 | 9 | 8 | – 1 |

| Kuwait | 43.47 | 40.90 | 2.57 | 6.28 | 10 | 9 | – 1 |

| Turkey | 33.32 | 20.77 | 12.55 | 60.42 | 11 | 13 | + 2 |

| Bahrain | 32.00 | 30.09 | 1.91 | 6.35 | 12 | 11 | – 1 |

| Qatar | 31.03 | 29.88 | 1.15 | 3.85 | 13 | 12 | – 1 |

| Kazakhstan | 26.78 | 5.71 | 21.07 | 369.00 | 14 | 18 | + 4 |

| Oman | 25.45 | 19.21 | 6.24 | 32.48 | 15 | 14 | – 1 |

| Jordan | 23.89 | 18.33 | 5.56 | 30.33 | 16 | 15 | – 1 |

| Egypt | 18.77 | 11.00 | 7.77 | 70.64 | 17 | 16 | – 1 |

| United Kingdom | 10.07 | 4.37 | 5.70 | 130.43 | 18 | 17 | – 1 |

| Afghanistan | 8.17 | 5.01 | 3.16 | 63.07 | 19 | 20 | +1 |

| Morocco | 8.12 | 5.30 | 2.82 | 53.21 | 20 | 19 | – 1 |

| Nigeria | 7.85 | 2.29 | 5.56 | 242.79 | 21 | 26 | + 5 |

| United States of America | 6.11 | 4.37 | 1.74 | 39.82 | 22 | 21 | – 1 |

| Tunisia | 5.57 | 4.09 | 1.48 | 36.19 | 23 | 22 | – 1 |

| Kenya | 4.99 | 3.39 | 1.60 | 47.20 | 24 | 24 | 0 |

| Sri Lanka | 4.01 | 3.89 | 0.12 | 3.08 | 25 | 23 | – 2 |

| Lebanon | 4.00 | 3.30 | 0.70 | 21.21 | 26 | 25 | 1 |

| Senegal | 3.24 | 0.57 | 2.67 | 468.42 | 27 | 47 | + 20 |

| South Africa | 2.25 | 2.01 | 0.24 | 11.94 | 28 | 28 | 0 |

| COUNTRIES | 2020 SCORE | 2019 SCORE | CHANGE IN SCORE | % CHANGE IN SCORE | 2020 RANK | 2019 RANK | CHANGE IN RANK |

| Switzerland | 2.22 | 2.21 | 0.01 | 0.45 | 29 | 27 | — 2 |

| Singapore | 2.15 | 2.01 | 0.14 | 6.97 | 30 | 29 | – 1 |

| Algeria | 2.11 | 2.01 | 0.10 | 4.98 | 31 | 30 | – 1 |

| Azerbaijan | 2.09 | 2.01 | 0.08 | 3.98 | 32 | 31 | – 1 |

| Yemen | 1.99 | 1.99 | 0.00 | 0.00 | 33 | 32 | – 1 |

| Canada | 1.99 | 1.99 | 0.00 | 0.00 | 34 | 33 | – 1 |

| Thailand | 1.98 | 1.90 | 0.08 | 4.21 | 35 | 34 | – 1 |

| Palestine | 1.89 | 1.32 | 0.57 | 43.18 | 36 | 36 | 0 |

| India | 1.81 | 1.88 | -0.07 | -3.72 | 37 | 35 | – 2 |

| Australia | 1.50 | 1.22 | 0.28 | 22.95 | 38 | 37 | – 1 |

| Russian Federation | 1.45 | 1.01 | 0.44 | 43.56 | 39 | 38 | – 1 |

| Syria | 1.00 | 0.99 | 0.01 | 1.01 | 40 | 39 | – 1 |

| Germany | 1.00 | 0.88 | 0.12 | 13.64 | 41 | 40 | – 1 |

| The Philippines | 1.00 | 0.78 | 0.22 | 28.21 | 42 | 41 | – 1 |

| Ghana | 0.90 | 0.77 | 0.13 | 16.88 | 43 | 42 | – 1 |

| Mauritius | 0.89 | 0.68 | 0.21 | 30.88 | 44 | 43 | – 1 |

| China | 0.67 | 0.67 | 0.00 | 0.00 | 45 | 44 | – 1 |

| France | 0.67 | 0.67 | 0.00 | 0.00 | 46 | 45 | – 1 |

| Gambia | 0.62 | 0.62 | 0.00 | 0.00 | 47 | 46 | – 1 |

| Spain | 0.35 | 0.35 | 0.00 | 0.00 | 48 | 48 | 0 |

“THE REAL BENEFICIARY WITH SIGNIFICANCE IS PAKISTAN, WHICH HAS CLIMBED UP 4 SLOTS TO BECOME THE 6TH MOST IMPORTANT ISLAMIC FINANCIAL MARKET IN THE WORLD.”

What Led to Improvement in IFCI Ranks of the Sampled Countries?

Movements in IFCI are determined by changes in values of its constituent factors. There are only six countries that have jumped up in their ranks; the remaining countries either slipped of the ranking or remained put on their previous spots. It seems paradoxical that while India is the only country that have experienced deterioration in its IFCI rank, there are 34 countries that slipped off the rank by at least one position (only 3 by 2 slots and 31 by 1 slot).

What does this mean?

Actually, there are only 5-6 countries that have witnessed comparatively significant improvements with respect to IsBF. In most of the countries, IsBF remained dynamically stagnant. In other words, apart from the few countries (to be discussed below), movements in IsBF domain have seen uniformity.

Senegal: +20

Senegal experienced the biggest jump in IFCI ranking between 2019 and 2020: from 47 to 27.

Islamic banking is not new to Senegal, as it started back in 1982 with the establishment of Faisal Islamic Bank, which has recently been re-branded as Islamic Bank of Senegal. Gradually, the shareholding of the DMI Trust has been replaced with that of the IsDB and its subsidiary Islamic Corporation for the Development of the Private Sector (ICD). Islamic banking in the country remained relatively low-profiled until 2014 when Senegal went ahead of many African peers to issue a sovereign sukuk (100 billion CFA Franc equivalent to US$168 million).

Since 2014, the financing from IsDB has encouraged other international players to invest in Senegal. Prior to this, the country had made it attractive for foreign players to enter the Islamic finance sector. Furthermore, changes in General Tax Code and consequent improvement in general financial regulations in 2018 allowed banks, other financial institutions and microfinance players to operate Islamically.

On its own, Senegal recognizes Islamic financing and has, since 2012, allowed for its General Tax Code to consider Islamic financing operations. As of 2018, the BCEAO4 also introduced a regulatory framework under which the banks, financial institutions and microfinance institutions in each member state will be able to execute Islamic financing activities.

The BCEAO introduced a series of four instructions in 2018 that set the parameters for Islamic financing in member states that include:

- Instruction No. 002-03-2018 on the specific provisions applicable to credit institutions engaged in Islamic finance activity;

- Instruction No. 004-05-2018 on the technical characteristics of Islamic finance operations carried out by the West African Economic and Monetary Union (WAEMU) credit institutions;

- Instruction No. 03-03-2018 on specific provisions for decentralized financial systems engaged in Islamic finance activity; and

- Instruction No. 005-05-2018 on the technical characteristics of Islamic finance operations carried out by decentralized financial systems of the WAEMU.

This reform is a direct result of Senegal’s advocacy for acceptance of Islamic finance within the economic bloc and resulted from a massive study undertaken by Senegal in order to best formulate the path forward. In addition to working with the WAEMU, Senegal has also been actively engaged with the IsDB. This engagement has resulted in the Program for the Promotion of Islamic Microfinance in Senegal (PROMISE). Through PROMISE, the IsDB supports Senegalese micro-entrepreneurs with US$60 million in financing for a National Program for Islamic Microfinance.

The primary purpose of PROMISE is to contribute to the country’s socioeconomic development. The hope is that this financing will allow for an increase in economic activity and will, in turn, create jobs and improve livelihoods. PROMISE is a welcome initiative in the country, as it will target some of the most vulnerable groups in the poorest communities.

Also with the assistance of the IsDB in 2015, Senegal adopted Law No. 2015-11, which is based on the Moroccan Code of Habous and regulates the use of waqf law in the country. This law defines waqf as any property whose usufruct is allowed on a perpetual or temporary basis to a public or private charitable activity (Article 1 of Law No. 2015-11). Under the law, there are four types of waqf established:

- A public waqf is a property constituted as a waqf, managed by a public authority and allocated to a charitable activity and for an activity of general interest;

- A family/private waqf is a waqf property for the benefit of certain family members or the descendants of the donor or a third party (private individual or corporation);

- A mixed waqf is a property allocated partly for the benefit of a public activity, and partly to a designated private individual or his/her descendants or exclusively to a designated private individual; and

- A public interest waqf is a waqf having a public interest purpose (e.g., combating a disease such as AIDS or cancer) managed by a private individual or a corporate entity.

This law also established the Waqf High Authority, an independent administrative body,This law also established the Waqf High Authority, an independent administrative body, which is in charge of the administration and supervision of waqf across the country. According to Article 27 of Law No. 2015-11, the President of Senegal later defined the organization and operation of the Waqf High Authority by way of Presidential Decree No. 2016-449 of the 14th April 2016.

Box 1 The Republic of KAZAKHSTAN

Kazakhstan (the largest economy in the CIS block and the third largest in the Caspian region) has proven to be a serious and persistent contender to become a regional Centre of Excellence for Islamic banking and finance (IsBF). There are two fully-fledged Islamic banks operating in the country but the share of Islamic banking remains less than 1%.

There are a number of individuals and institutions that have championed the cause of IsBF in the country, it is, however, the Astana International Financial Centre (AIFC), which has emerged as a champion of Islamic banking and finance.

The government has tried on many fronts to promote IsBF in the country through the central bank and later with the help of AIFC. Despite these efforts, it remains curious to determine whether there exists a meaningful quantum of demand for Islamic banking in the country, which has a significant non-Muslim population.

There are at present two fully-fledged Islamic banks, one set up back in 2020 and the other one recently converted from a conventional bank, with the help of ICD. In addition, there is an Islamic leasing company, an Islamic mutual insurance company and an Islamic finance company operating in the country. Despite the limitations, Kazakhstan is the largest Islamic finance market in the Central Asian region, with active participation in industry-infrastructure bodies like Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) and Islamic Financial Services Board (IFSB).

This institutional development followed three sets of legislative amendments in 2009, 2011, 2015. Furthermore, an Association of Islamic Finance Development (ADIF), established in 2009, is now preparing to go regional to provide a platform for advocacy, promotion and development of Islamic finance in the CIS region.

Following are the major challenges to the development of IsBF in Kazakhstan:

- Lack of awareness and understanding of IsBF;

- Less than required technical assistance from the multilateral institutions for capacity building; and

- Complex and slow legal processes and procedures.

“THE SENEGALESE GOVERNMENT APPEARSPOISED TO SUPPORT AND ENCOURAGE ISLAMIC FINANCING IN THE COUNTRY BUT WILL NEED TO MAKE A STRONGER EFFORT IF THE COUNTRY IS TO TRULY BECOME A CHAMPION OF THE SYSTEMS IT HAS NOW PUT IN PLACE.“

Since introducing these laws and paving the way for the WAEMU to embrace Islamic financing, Senegal has pushed forward with growing Islamic finance in the country. The government is actively working toward educating the general population on Islamic finance and the various programmes that have been introduced to assist vulnerable populations, including PROMISE.

The private sector has also begun to slowly enter Islamic financing. The first Islamic common investment fund was established by the CGF Bourse Company in 2017. In addition, there exists an Islamic mutual fund named FCP Al Baraka, an Islamic window at Coris Bank International Senegal, Pamecas (a microfinance institution that has an Islamic window), and an Islamic window of Sen Assurances VIE (an insurance company).

With the regulatory framework now in place to support Islamic financing in the country, the future prospects for this sector in Senegal are strong. Senegal’s economy as a whole has been steadily growing. This, coupled with the support of the WAEMU, which has had tremendous success in maintaining stability in the economic block, shows promising signs for financial institutions and should facilitate the entrance of additional Islamic banks.

The Senegalese government appears poised to support and encourage Islamic financing in the country but will need to make a stronger effort if the country is to truly become a champion of the systems it has now put in place.

Nigeria: +5

Nigeria has emerged as an important player in the African Islamic banking sector. After the intended setting up of Jaiz Bank in 2003 (with full operations starting only in 2012), the second full-fledged Islamic bank, namely TAJ Bank (founded in 2019), has deepened the Islamic banking sector in the country. Admittedly, the growth in Islamic banking in the country had been slow, prior to 2012, but now with the second fully-fledged Islamic bank entering the market, its visibility has improved significantly. The CEO of TAJ Bank, Norfadelizan Abdul Rahman, has brought the required marketing rigour from his native Malaysia to the Nigerian Islamic banking sector. This is also expected to better connect Nigeria with other well-established Islamic financial markets. There is some anecdotal evidence that the Nigerian graduates returning from Malaysia after having finished their studies at various universities have already started playing instrumental roles in the development of IsBF in Nigeria.

The international connectivity and willingness of the Nigerians to remain active in the global Islamic financial services industry has helped the country to accelerate growth in IsBF. At present, a Nigerian (Dr Bello Lawal Danbetta) serves as Secretary General of Islamic Financial Services Board (IFSB). Dr Mansur Muhtar, another distinguished Nigerian, serves as a Vice President at IsDB.

THERE IS SOME ANECDOTAL EVIDENCE THAT THE NIGERIAN GRADUATES RETURNING FROM MALAYSIA AFTER HAVING FINISHED THEIR STUDIES AT VARIOUS UNIVERSITIES HAVE ALREADY STARTED PLAYING INSTRUMENTAL ROLES IN THE DEVELOPMENT OF ISBF IN NIGERIA

What has really helped Nigeria to climb up on the ladder is the issuance of sovereign sukuk – three in total so far (see Table 3.3). A company that has played an instrumental role in issuing these sukuk is Lotus Capital that has helped in raising capital for the various issues. It is also a major player in Islamic asset management in the country.

Pakistan: +4

Pakistan now has the distinction of winning Global Islamic Finance Leadership Award twice, first in 2013 when the former Prime Minister Shaukat Aziz was awarded this prestigious accolade and then this year when Arif Alvi, President of Pakistan, was made the 10th GIFA Laureate in September 2020. Despite the share of Islamic banking surpassing the 17% mark and a tremendous role played by the State Bank of Pakistan, the prohibition of interest from the economic affairs of the country – something that the Supreme Court of Pakistan has time and again been asked to rule in favour of – remains a thorny issue.

Table 3.3 THE SUKUK ISSUANCE BY THE FEDERAL GOVERNMENT OF NIGERIA

| YEAR | Size | Tenure |

| 2017 | N100 billion | 7 years |

| 2018 | N100 billion | 7 years |

| 2020 | N150 billion | 7 years |

Pakistan can further climb up the index if the government of Pakistan shows unambiguous support for IsBF. The country has developed an excellent framework for the implementation of IsBF on a comprehensive scale, but somehow the bureaucracy of the country still needs to be fully educated and convinced.

With five fully-fledged Islamic banks (the sixth in the process of full Islamisation), 17 Islamic banking windows, a vibrant mudaraba sector, a growing Islamic funds management industry, with an ever-increasing focus on Islamic microfinance, and, above all, one of the best human resources in Islamic finance, Pakistan has all the basic ingredients to become a global leader in IsBF (see Table 3.4 for an updated snapshot of Islamic banking in Pakistan).

Table 3.4 A SNAPSHOT OF ISLAMIC BANKING IN PAKISTAN IN SEPTEMBER 2020

| Size (PKR billion) | Annual Growth (%) | Share in National Banking Sector | |

| Assets | 3,809 | 27.2 | 16.0 |

| Deposits | 3,034 | 26.0 | 17.3 |

| Net Financing and Investments | 2,760 | 28.9 | 14.2 |

The regular sukuk issuance by the Government of Pakistan during the reported period has also helped the national Islamic banking sector to play a more vibrant role in the banking sector.

Box 2: A NOTE ON DATA AND METHODOLOGY

IFCI is based on a multivariate analysis. For construction of the index, data was collected on a number of variables, including macroeconomic indicators of the countries included. The data was then tested to see if it contained any meaningful information to draw conclusions from. After consideration of different multivariate methods, it was decided to use factor analysis to identify the factors that may influence IBF in the countries included in the sample.

In order for factor analysis to be applicable, it is important that the data fits a specification test for such an analysis. The Kaiser-Meyer-Oklin (KMO) measure of sampling adequacy is used to compare the magnitudes of the observed correlation coefficients in relation to the magnitudes and partial correlation coefficients. Large values (between 0.5 and 1) indicate that factor analysis is an appropriate technique for the data at hand. If the value is less than that, then the results of the factor analysis may not be very useful. For the data we used, we found the measure to be 0.85, which made it reasonable for us to use factor analysis.

Batlett’s test of sphericity is another specification test that tests the hypothesis that the correlation matrix is an identity matrix indicating that the given variables are unrelated and therefore unsuitable for structure design. Smaller values (less than 0.05) of the significance level indicate that factor analysis may be useful with the data. For the present purposes, this value was found to be significant (0.00 level), which means that data was fit for factor analysis.

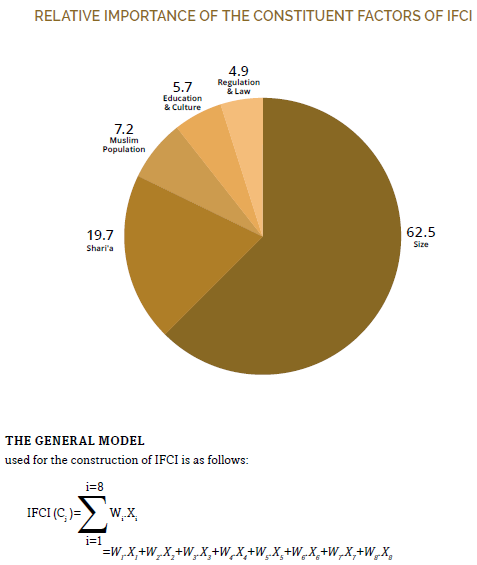

Factor analysis was therefore run to compute initial communalities to measure the proportion of variance accounted for in each variable by the rest of the variables. In this manner, we were able to assign weights to all eight factors in an objective manner.

By following the above method, we have been able to remove the subjectivity in the index. The weights along with the identified factors make up the IFCI. The weights point to the relative importance of each constituent factor of the index in determining the rank of an individual country.

There are over 70 countries involved in IBF in some way or another. However, due to limitations imposed by authenticity, availability and heterogeneity of the data, IFCI was launched in 2011 with only 36 countries. Over the next three years, the availability of data allowed us to include and other six countries to make the sample size of 42. The current sample stands at 48, and we believe that this is a robust enough number to analyze the state of affairs of the global Islamic financial services industry. Information contents of the data for other countries is not instructive at all.

The data used comes from different primary and secondary sources, but in its collective final form becomes the proprietary data set of Edbiz Consulting, which collects, collates and maintains it.

We collect data on eight factors/variables for the countries included in IFCI. The variable and their respective weights are described in the following table.

| VARIABLES/FACTORS | DESCRIPTION | WEIGHTS | |

| 1 | Number of Islamic Banks | Full-fledged Islamic banks both of local and foreign origin | 21.8% |

| 2 | Number of IsBFIs | All banking and non-banking institutions involved in IsBF, including Islamic windows of conventional banks | 20.3% |

| 3 | Shari’a Supervisory Regime | Presence of a state (or non-state) representative central body to look after the Shari’a compliancy process across the IBFIs in a country | 19.7% |

| 4 | Islamic Financial Assets | Islamic financial assets under management of Islamic and conventional institutions | 13.9% |

| 5 | Muslim Population | Absolute number of Muslims | 7.2% |

| 6 | Sukuk | Total sukuk outstanding in the country | 6.6% |

| 7 | Education & Culture | Presence of an educational and cultural environment conducive to operations of IBFIs, including formal Islamic finance professional qualifications, degree courses, diplomas and other dedicated training programmes | 5.7% |

| 8 | Islamic Regulation & Law | Presence of regulatory and legal environment enabling IBFIs to operate in the country on a level-playing field (e.g., and Islamic banking act, Islamic capital markets act, takaful act etc.) | 4.9% |

where

Cj = Country j including in the index

Wi = Weight attached to a given variable/factor i Xi = A given variable/factor I included in the index

The countries are ranked according to the above formula every year, using the updated annual data.

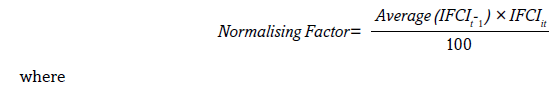

In 2016, a major adjustment exercise was undertaken to take into account some of the time-series characteristics of the data. The primary objective of this exercise was to normalize the data over the time. We adopted a methodology based on a weightage system that we adopted to construct a normalizing factor.

The normalizing factor used in the adjusted IFCI was calculated by the following formula:

Average(IFCIt-1 )= Average of IFCI scores for all the countries included in the sample of the previous year (t-1); and

IFCIit = IFCI score for an individual country i in the current year (t).

This normalizing factor allows us to neutralize the purely statistical effect of data movements on IFCI score in such a way that the overall ranking in a given year remains unaffected.

As the above table and figure suggest, size of Islamic financial services industry as captured by four factors (namely, number of Islamic banks, number of IBFIs, volume of Islamic financial assets, and the sukuk outstanding) is the most important factor in the index, explaining 62.6% variation. Therefore, it is superior to the univariate analyses that focus on just size of the industry in a given country. Furthermore, size in itself is not enough to capture the relative importance of IBF in a country. It is equally important to consider depth and breadth of the industry. Hence, both the size of Islamic financial assets and the number of IBFIs are included. Furthermore, the inclusion of sukuk, which accounts for 15% of the global Islamic financial services industry, as a separate factor is also useful.

Although the other factors collectively explain 37.4% variation in the index, their inclusion is important as they give a comprehensive view on the state of affairs of IBF in a country.

It must be clarified that IFCI is a positive measure of the state of affairs of IBF and its potential in a country, without taking a normative view on what should be the important factors determining size and growth of the industry, and their relative importance (i.e., weights).