Learning from UN’s Experience

Introduction

The COVID-19 pandemic has affected us in various ways and at different levels, but amongst the most distressed have been the refugees, internally displaced persons (IDPs) and other people of concern. By the end of 2020, 80 million people were forcibly displaced globally. The pandemic does not only raise concerns on the spread of COVID-19 infections, but also on the exacerbation of the already pressing issues faced by the refugees. These include food insecurity and malnutrition. One-third of all refugees and IDPs combined live in the top 10 most food-insecure countries, of which Muslim-majority countries are suffering acute food insecurity. Other dilapidating impacts have been on education, jobs, shelter, and marginalized communities (women and children).

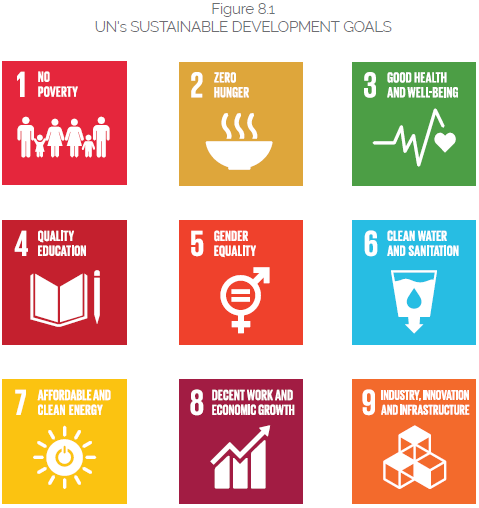

The 17 Sustainable Development Goals (SDG) by the United Nation are set to help evade the ever-increasing human crisis through responsibility and collaboration. It is an ideal roadmap for individuals, corporates, international institutions and governments to plan for a safer and more sustainable economy.

Islamic social finance is a sector that aligns perfectly with the SDGs. It promotes socioeconomic balance and can effectively address issues like income distribution and poverty alleviation, which conventional finance has not been able to address adequately. Globally, Islamic finance assets are valued at US$2.941 trillion. The Islamic social finance instruments, such as zakat, sadaqa, waqf, sukuk and Islamic microfinance, collectively are estimated to surpass the US$1 trillion mark annually.

Most refugees, IDPs and other people of concern originate from, or are hosted by the Organization of Islamic Cooperation (OIC) member countries. Realizing this, the UN agencies are now increasingly taking initiatives to leverage Islamic social finance tools to meet the SDGs and support refugees globally.

“The Islamic social finance instruments, such as zakat, sadaqa, waqf, sukuk and Islamic microfinance, collectively are estimated to surpass the US$1 trillion mark annually.”

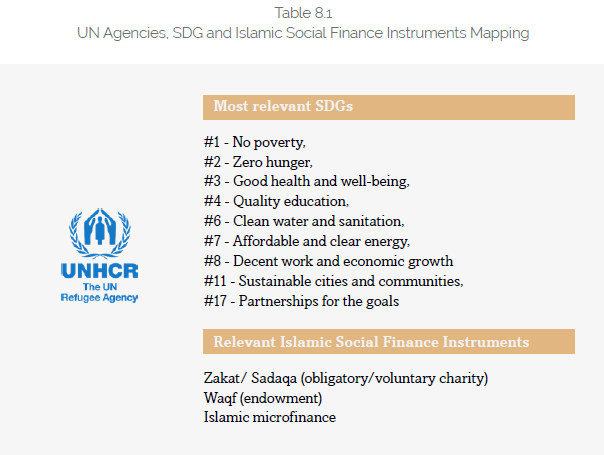

One of the leading examples is United Nations High Commissioner for Refugees (UNHCR), the UN Refugee Agency. In 2020, through its Refugee Zakat Fund, UNHCR reached over 2.1 million beneficiaries in 13 countries through US$61.5 million in zakat and sadaqa funds. Like UNHCR, other UN agencies are also investing in integrating zakat and sadaqa in their initiatives and are also exploring other Islamic social finance tools.

These tools include waqf, sukuk and Islamic microfinance instruments. Apart from UNHCR, other UN agencies willing to adopt Islamic social finance include: United Nations Children’s Emergency Fund (UNICEF), The World Food Programme (WFP), United Nations Development Programme (UNDP) and United Nations Relief and Works Agency for Palestine Refugees in the Near East (UNRWA). The recent developments across the UN agencies, with a special focus on UNHCR, will be the focus of this chapter (see Table 8.1).

Islamic Social Finance for United Nation Agencies and Sustainable Development Goals

An introduction to United Nation (UN) agencies

The Islamic finance sector is massive and booming worldwide. As stated previously. At the end of 2020, the Islamic finance assets were valued at US$2.941 trillion, a 7.61% increase from previous year. It is expected to grow at a rate between 6.54% (conservative assumption) and 14.84% (generous assumption) in the next 5 years. Within Islamic social finance, zakat plays an important role. The precise amount paid by donors is impossible to ascertain, since some zakat donations are done informally from donor to recipient, and often in-kind than in cash. However, some institutions have reported that the estimated size of annual zakat ranges between US$200 billion and US$1 trillion.

Humanitarian needs are at its all-time peak, especially due to the impact of the COVID-19 pandemic. At the end of 2020, around 80 million people were forcibly displaced worldwide. Many of the communities and people in need originate from or are located in Muslim-majority countries. With that, UN agencies are now increasingly leveraging Islamic social finance tools to achieve the SDGs and support the vulnerable in these countries.

“The estimated size of annual zakat ranges between US$200 billion and US$1 trillion.”

United Nations High Commissioner for Refugees (UNHCR)

UNHCR, the UN Refugee Agency, is a UN agency working to save lives, protect rights and build a better future for refugees, internally displaced communities and stateless people. UNHCR was founded in 1950 and is headquartered in Switzerland. It currently operates in 134 countries around the world.

United Nations Development Programme (UNDP)

UNDP is the global development network of the UN. It promotes technical and investment cooperation among nations to support poverty eradication, reduce inequalities and exclusion, and build resilience for a sustained progress. It plays a critical role in helping countries achieve the SDGs. UNDP was founded in 1965 and is headquartered in the United States. It currently operates in over 165 countries around the world.

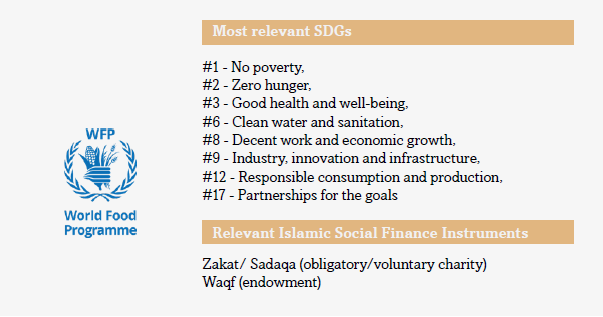

The World Food Programme (WFP)

WFP is the food-assistance branch of UN, focused on hunger and food security, and is the largest provider of school meals. It provides food assistance for people recovering from conflict, disasters, and the impact of climate change. Founded in 1961, WFP is headquartered in Rome and currently operates in over 80 countries around the world.

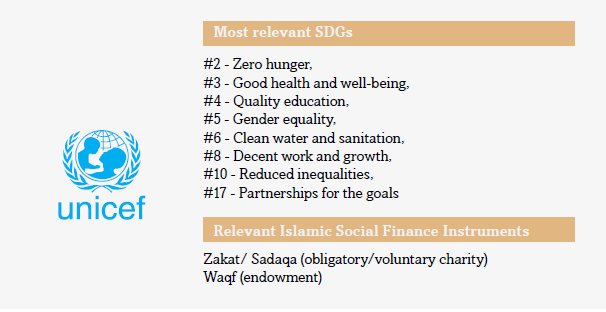

United Nations Children’s Emergency Fund (UNICEF)

UNICEF, also known as the United Nations Children’s Fund, is a UN agency responsible for providing humanitarian aid to children worldwide, to defend their rights and help them fulfil their potentials. UNICEF was founded in 1946 and is headquartered in the United States. It currently operates in over 190 countries around the world.

United Nations Relief and Works Agency for Palestine Refugees in the Near East (UNRWA)

UNRWA is a UN agency that supports the relief and human development of Palestinian refugees. Sister UN agencies share skills and expertise with UNRWA in addition to projects benefiting Palestine refugees in other multi-sectorial areas. Founded in 1949, UNRWA is headquartered in Amman and in Gaza.

For centuries, Muslim communities, states and organizations have been using the power of religiously mandated communal solidarity for the purposes of economic and social development and charitable giving. This is evidenced in the central role that waqf and zakat agencies play in the economy of any given Muslim country as vectors of both economic stability and economic growth.

UN agencies would immensely benefit from collaborating with such entities, and more so by complementing their local knowledge and expertise with the UN’s international reach, efficiency, and capabilities to serve a common purpose. A brief introduction of the UN agencies actively involved in adopting Islamic social finance follows.

Sustainable Development Goals (SDGs) as the Global Agenda

The 2030 Agenda for Sustainable Development was adopted in 2015 by the UN General Assembly to achieve the Sustainable Development Goals (SDGs) by the year 2030. This followed the Millennium Development Goals, which ended in 2015. These goals are presented in Figure 8.1.

These SDGs seek to alleviate symptoms of a broken and unsustainable economic system that are at the root of all inequalities around the world. The exploitative economic practices have led to not only the impoverishment of communities and states, poverty, and hunger, but also to irreversible global issues such as climate change. Climate change has been contributing to increasing inequalities globally, as low- and middle-income countries are affected by the economic practices and resulting air pollution of the handful of industrialized countries.

Complying with the SDGs is a shared responsibility of governments, industries, international institutions and the general public. It provides a roadmap to combat some of the pressing global issues through commitment and collaboration.

Islamic Finance’s Inherent Social Impact Characteristics

Like the SDGs, Islamic finance provides related core principles for creating a sustainable and just economic order, coupled with various tools for governments, industries, international institutions and individuals. In response to the widely accepted yet fundamentally flawed economic paradigm, governments (in Muslim and non-Muslim countries) and organizations have explored Islamic economics and finance to promote change through participative economic practices with a holistic approach towards the individual, society, and their collective well-being.

Islamic finance hit the spotlight, following the 2008-2009 global recession, when it became evident that the economic meltdown might not have occurred had the non-exploitative and fiscally responsible values that permeate Islamic economics were more widely adopted. This even led Christine Lagarde, then French Finance Minister (now head of the European Central Bank, and previously head of the IMF) to peddle the virtues of Islamic finance and vowed in 2008, “to make Paris a great center for Islamic finance”.

So why is the conventional financing system exploitive? Excessive debt and its servicing are the striking features of the interest-based system, where yesterday’s debt can be repaid by taking out more debt today. It does not only stifle economic growth but also causes social disparities and creates huge gaps between the rich and the poor. It also renders ineffective the efforts made by governments and international institutions, such as the UN, World Bank and IMF, to reduce poverty. Despite the growth in many parts of the world, a large number of people are unemployed, half-fed and mistreated as a consequence of unhindered market forces. There is a need to reduce asset distributional inequalities, and Islamic finance can play its part in striking a balance between the social and economic aspects of the human society in many parts of the world. It can effectively address issues like income distribution and poverty alleviation, which conventional finance has not been able to address as effectively. Some key features that make Islamic finance distinct from conventional finance include:

- Socio-economic and distributive justice, a comprehensive system of ethics and moral values.

- Prohibition of interest, excessive uncertainty, gambling and all other games of chance.

- Emphasis on social welfare system based on mutual help, character building, behavioural changes, and the system of zakat to dignify the poor.

- Right of capital to enjoy a just return with the condition that it also bears the liability of risk of any loss.

- The debtor cannot be charged any amount over the amount of debt owed, although debt would typically have built-in it the margin of profit for the creditor as debt creation is permitted only through an actual trade of a legitimate and compliant asset.

- Loans are only granted in limited circumstances but for no interest – such loans are, therefore, used to cater for consumption needs of poor and needy or temporary overdraft needs of some businesses and the Islamic microfinance model that employs interest-free loan as the financing model.

Indeed, Islamic finance can help create a sustainable and just economic order through its various tools that encourage risk-sharing, economic participation, and social cohesion resulting from mandatory and recommended acts of charity. It prohibits practices such as market speculation and interest (including excessive and exploitative interest) both of which has been among the main reasons for successive economic crises.

The range of Islamic finance instruments, as opposed to the ones based on interest, include sale of goods on mark-up in price, sharing of profits and losses through partnerships, lease of assets, forward sale and the like. One should also mention Islamic social finance tools such as zakat, sadaqa, waqf, qard hasan (interest-free loans) and Social Sukuk. These tools are being widely used by states and organizations alike, including now various UN agencies, for the achievement of the SDGs.

In fact, the World Humanitarian Summit, held in Turkey back in 2016, had brought in more emphasis on the role of Islamic finance in the global humanitarian movement. One of the recommendations states: ‘The Global Islamic Finance and Impact Investing Platform and numerous other Islamic finance initiatives will expand the financing base for crisis-affected people. The global crisis response platform, soon to be operationalized by the World Bank, will also provide resources for risk mitigation and crisis response to low- and middle-income countries, with an emphasis on those hosting refugees.

Islamic Social Finance Instruments

The Islamic social finance can be classified into three broad categories:

- Philanthropy: zakat (obligatory charity), sadaqa (voluntary charity) and waqf (endowment)

- Social investment: sukuk (Islamic bonds)

- Islamic microfinance

Zakat

Zakat is obligatory almsgiving mandated by Islamic law. It must be paid by all Muslims who meet certain wealth criteria (nisab). It is calculated 1/40 (2.5%) of one’s accumulated wealth over the course of a lunar Islamic year. It can be financial or in-kind (gold, silver, crops, livestock, etc.). It is usually given to those most in need, as an immediate form of assistance, rather than an investment. In some Muslim-majority countries, zakat is collected and distributed by the state, while in others, this is done by semi-governmental or private foundations or institutions. In many cases, zakat is given directly to its beneficiary by the donor, without going through an intermediary.

Zakat is especially aligned with the SDGs 1 (No Poverty), 2 (Zero Hunger), 3 (Good Health and Well-Being), 4 (Quality Education), 6 (Clean Water and Sanitation), 8 (Decent Work and Economic Growth) and 10 (Reduced Inequalities)

As zakat is distributed mainly in the form of direct cash assistance to beneficiaries or in the form of goods, it contributes to alleviating poverty, as well as enabling beneficiaries to gain, through said cash assistance, better access to healthcare, education, and clean water. It also stimulates economic growth and helps reduce inequalities. As such, zakat is especially aligned with the SDGs 1 (No Poverty), 2 (Zero Hunger), 3 (Good Health and Well-Being), 4 (Quality Education), 6 (Clean Water and Sanitation), 8 (Decent Work and Economic Growth) and 10 (Reduced Inequalities).

Sadaqa

Sadaqa is recommended almsgiving and applies the same Shari’a principles for application as for zakat. For instance, both sadaqa and zakat cannot be used to establish an alcohol shop, or a pork butchery. The only difference is that zakat is a mandatory charity, while sadaqa is a voluntary charity. Also, while sadaqa isn’t as quantifiable as zakat, it remains to be a viable source of funding that can be utilized for various activities that go beyond cash and goods, including services and infrastructure. An interesting form of Sadaqa is called Sadaqa Jariya. It allows for a charitable gift to continue benefiting people, even after the donor has passed away. It can take, for instance, the form of a school, hospital or water well built, and maintained for a positive long-term effect in the community.

Waqf

A waqf (plural awqaf) is an endowment on assets used for education, religious and charitable causes. This endowment can be structured on underlying immovable assets, such as real estate, or it may be structured as a cash-waqf — utilizing financial assets (such as investments in Islamic securities/sukuk) to generate returns. The latter, a more modern approach compared to the traditional real estate-based approach, is being increasingly adopted by charitable organizations to generate funds to serve beneficiaries.

The purpose of a waqf is to benefit the community with its proceeds. A waqf is usually (but not always) given in perpetuity, with no intention of being reclaimed by the donor. Awqaf have been used for development and humanitarian purposes in lower-income countries, including providing for basic needs (housing, food security, disaster relief, clean water access, sanitation facilities), education (building of schools and universities), health (building of hospitals) and community development (creation of related business associations and workforce development). Waqf assets are estimated at anywhere between US$100 billion and US$1 trillion.

Through their role in providing for communities around them as well as facilitating access to healthcare and education, awqaf have been contributing towards the SDGs 1 (No Poverty), 2 (Zero Hunger), 3 (Good Health and Well-Being), 4 (Quality Education), 6 (Clean Water and Sanitation), 8 (Decent work and economic growth), 9 (Industry, innovation, and infrastructure), 10 (Reduced inequalities) and 11 (Sustainable Cities and Communities).

Waqf assets are estimated at anywhere between US$100 billion and US$1 trillion

Sukuk

Sukuk are like bonds and are asset-based securities that can be used to finance a diverse range of projects, especially in real estate. A sukuk holder is given ownership of a designated asset or pool of assets, which then allows them a share of the revenue of the said asset. This market is growing, and Sukuk are being issued at more than USD150 billion per year. Given the wide range of projects that can be funded, sukuk can contribute to the SDGs 3 (Good Health and Well-Being), 4 (Quality Education), 5 (Gender Equality), 6 (Clean Water and Sanitation), 7 (Affordable and Clean Energy), 8 (Decent Work and Economic Growth), 9 (Industry Innovation and Infrastructure), 11 (Sustainable Cities and Communities), 12 (Responsible Consumption and Production), 13 (Climate Action), 14 (Life Below Water), 15 (Life on Land) and 16 (Peace Justice and Strong Institutions).

Sukuk can contribute to the SDGs 3

“(Good Health and Well-Being), 4 (Quality Education), 5 (Gender Equality), 6 (Clean Water and Sanitation), 7 (Affordable and Clean Energy), 8 (Decent Work and Economic Growth), 9 (Industry Innovation and Infrastructure), 11 (Sustainable Cities and Communities), 12 (Responsible Consumption and Production), 13 (Climate Action), 14 (Life Below Water), 15 (Life on Land) and 16 (Peace Justice and Strong Institutions).”

Islamic microfinance

Islamic microfinance tools are used by Muslims around the world as an alternative to conventional banking methods, which include interest-bearing loans. They can meet the specific needs of lower-income Muslim populations, especially in terms of promoting livelihoods and socioeconomic inclusion in a way that is compliant with their values. Islamic microfinancing is also widely used in developing countries, including non-Muslim countries, and contribute significantly towards achieving the SDGs. Islamic microfinance include the following tools:

- Qard hassan: which is a widely used tool and consists of interest-free loans.

- Takaful: which is a form of cooperative insurance where participants contribute to a fund which would then be used to help other participants in case of need.

Standard Islamic finance tools: used to provide financing to micro and small beneficiaries on the basis of partnership, trade, and other such means.

These tools not only help in procuring basic needs, but also promote economic growth, social collaboration and access to equal opportunities. It works towards achieving virtually all the SDGs. Each tool, if properly used and at its full potential in the relevant communities, can substantially help achieve several of the SDGs. The potential of Islamic charitable giving and participative finance, taking into account zakat, sadaqa, awqaf, sukuk and Islamic microfinance tools, surpasses the $1 trillion mark each year. Prime reasons being:

- The central role that charity plays in the spirituality of almost 2 billion Muslim people worldwide; and

- The obligatory nature of many of these tools, whereby zakat payment is incumbent upon most Muslims (namely those financially capable of paying it), as is Shari’a-compliant banking (including microfinance) for Muslims who seek financing or investments for their projects.

UNHCR’s Commitment to Leveraging Islamic Social Finance

The United Nations High Commissioner for Refugees (UNHCR), the UN Refugee Agency, is a global organization working to save lives, protect rights and build a better future for refugees, internally displaced communities and stateless people. Since 1950, UNHCR, together with partners and communities, works to ensure that everybody has the right to seek asylum and find refuge from violence or persecution. UNHCR is committed to work closely with governments that host refugees, to ensure that the 1951 Refugee Convention is honored. The COVID-19 pandemic has had a devastating impact on the zakat eligible countries and their Internally Displaced People (IDP) and refugees, not as much as due to the implications on public health but due to the pandemic crippling the global economy and supply chains. The OIC member countries, while comprising 25% of the world’s population, are hosts to more than half of the world’s displaced people – over 43 million displaced people.

UNHCR has demonstrated high commitment towards Islamic social finance to support the ever-increasing needs of the people of concern (including refugees and IDP) in the OIC region. It has launched several Islamic social finance-related initiatives to achieve its goals. Some of these include:

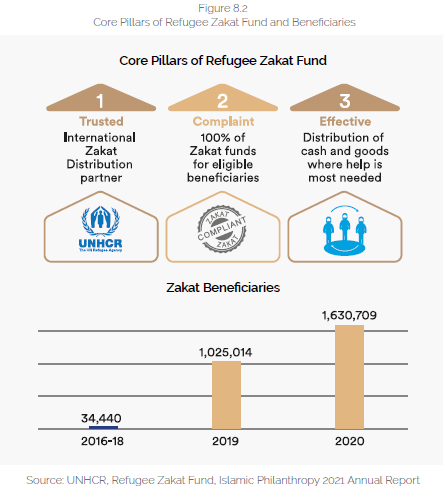

The Refugee Zakat Fund

The Refugee Zakat Fund, launched in 2019 by UNHCR, to harness the power of zakat and transform the lives of people under its mandate, namely refugees, IDPs and other people of concern. It offers primarily cash assistance to refugees and IDPs originating from and located in Muslim-majority countries, such as Yemen, Jordan, Lebanon, Iraq, Bangladesh, Mauritania, and Egypt, among others. In 2020, the Refugee Zakat Fund was able to reach over 1.6 million beneficiaries in 10 countries, through US$48.5 million in zakat funds. Counting sadaqa, this number goes up to over 2.1 million beneficiaries in 13 countries, with a total of US$61.5 million received. The number of beneficiaries saw a 59% increase from 2019, and the total amount of donations a 42% increase (up from US$43.4 million). This markedly shows the potential of zakat and the need to harvest it efficiently and responsibly, not least by UN agencies. Through its various programmes funded by zakat, UNHCR is achieving goals 1 (No poverty), 2 (Zero hunger), 3 (Good health and well-being), 4 (Quality education), 6 (Clean water and sanitation), 8 (Decent work and economic growth). Through microfinance, that UNHCR is currently piloting in collaboration with local entities, it will be working towards achieving additional SDGs such as 9 (Industry, innovation, and infrastructure) and 10 (Reduced inequalities). By creating partnerships for the goals, it also contributes towards goal 17 (Partnerships for the goals). This is summarized in Figure 8.2.

Virtual Fundraising Programs

The 2020 global Ramadan campaign ‘Every Gift Counts’ played an important role in supporting more than 41,000 people in need. With the holy month taking place under COVID-19 preventative measures and many people staying at home, UNHCR launched innovative virtual fundraising programs, including partnerships with TikTok and YouTube, followed by a Guinness World Record for the “Most Views for an Iftar Livestream Globally”.

GiveZakat App

UNHCR launched the mobile application arm of its Refugee Zakat Fund, GiveZakat. The mobile app allows users to calculate zakat, check reporting information in real-time, and donate both zakat and sadaqa funds easily and quickly. Donors making a zakat donation through the app can track the journey of their donations until it reaches beneficiary families. Donors can also make one-off or monthly sadaqa donations and can check the various fatwas (rulings by Islamic jurisdictions) and endorsements received by UNHCR.

Waqf

UNHCR is also exploring other Islamic social finance tools such as the possible establishment of a cash-waqf. A mechanism where the seed capital raised is invested to generate profits that would then fund refugee and IDP programmes.

Other UN Agencies Commitment to Leveraging Islamic Social Finance

United Nations Development Programme (UNDP)

At the end of 2019, 79.5 million people worldwide were displaced, including 26 million refugees.

Around 54% of these people of concern were hosted by zakat-eligible countries. The COVID19 pandemic turned an already worsening situation into a greater crisis. Conflict has continued despite the pandemic, and in certain countries, it has been aggravated by the disease. In mid-2020, an estimated 46 million people had to flee the conflict and persecution within their countries.

The United Nations Development Programme uses Islamic social finance tools, in collaboration with such entities as BAZNAS in Indonesia (applying zakat towards local SDG projects), Badan Waqaf Indonesia (developing a digital platform for waqf contributions), the Indonesia Ministry of Finance (supporting the issuance of green sukuk), Islamic Development Bank (IsDB) to support SDG goals worldwide and others. UNDP’s efforts are contributing towards the achievement of virtually all the SDGs.

The World Food Programme (WFP)

Globally, 80% of the people of concern are vulnerable to food insecurity and malnutrition, one-third of which live in the top-10 most insecure countries. With the pandemic adding to the burden of acute food insecurity, the situation is expected to worsen, especially in the OIC countries such as Nigeria, South Sudan, and Yemen.

WFP is also using zakat and sadaqa to fund its projects and overcome food insecurity. During the holy month of Ramadan and Eid al-Fitr this year, WFP launched a zakat campaign through its ShareTheMeal fundraising app, providing Muslims around the world the opportunity to support WFP’s initiatives while fulfilling their religious charity obligations. WFP partnered with IsDB and its Shari’a Board to ensure collection and distribution of zakat funds is done in accordance with Shari’a requirements. Hence, WFP contributes actively towards the achievement of the SDGs 1 (No poverty), 2 (Zero hunger), 3 (Good health and well-being), and 6 (Clean water and sanitation).

United Nations Children’s Emergency Fund (UNICEF)

There are over 30 million forcibly displaced children globally. Prior to the COVID-19 pandemic, access to education was limited, with a refugee child twice as likely to be out of school as a non-refugee. The situation worsened due to the pandemic. In Turkey, the second largest OIC host country for the people of need, around 760,000 refugee children have been affected by school closures. Other pressing issues exacerbated by the pandemic impacting refugee children in the OIC and globally include gender-based violence, child trafficking and malnutrition. In Afghanistan, for instance, nearly half of the refugee children face acute malnutrition.

The United Nations Children’s Emergency Fund (UNICEF), in collaboration with the Islamic Development Bank (IsDB), created the Global Muslim Philanthropy Fund for Children, collecting zakat and sadaqa. Like UNHCR, it aims to harness the power of Islamic philanthropic tools to raise funds for its programmes and provide for the well-being of children in Muslim-majority countries. This fund aims to provide children with access to safe water, nutrition, education, health, and protection, therefore contributing towards the SDGs 2 (Zero hunger), 3 (Good health and wellbeing), 4 (Quality education) and 6 (Clean water and sanitation).

United Nations Relief and Works Agency for Palestine Refugees in the Near East (UNRWA)

At present, 438,00 Palestinian refugees remain in Syria, 73% of which are women and children. The United Nations Relief and Works Agency for Palestine Refugees in the Near East (UNRWA) estimated that 91% of the Palestinian refugees are more in need of cash and in-kind food assistance.

UNRWA is now also collecting zakat to support and assist those under its mandate, namely Palestinian refugees. In 2019, UNRWA and the OIC member countries decided to establish a waqf endowment fund (housed within IsDB) to support Palestinian refugees. The waqf will allow governments, corporates and individuals to participate in the sustainability of UNRWA’s programmes. Like UNHCR, UNRWA is contributing towards goals 1 (No poverty), 2 (Zero hunger), 3 (Good health and well-being), 4 (Quality education), 6 (Clean water and sanitation), 8 (Decent work and economic growth).

Conclusion

Islamic social finance has the potential to become a sustainable financing model and meet the SDGs as well. As a charity, it also plays an important role in the lives of almost two billion Muslims worldwide. The core principles of Islamic social finance are highly aligned with the spirit of the SDGs, to create a sustainable and just economic order.

These principles include: channelling funds to the real economy by promoting risk sharing; prohibition of excessive speculations, interest, gambling and all other games of chance; and limiting debt to the value of assets. Islamic social finance tools that dignify the poor include: zakat, sadaqa, waqf, social sukuk, and Islamic microfinance.

UN agencies have realized the potential of Islamic social finance and leveraged its tools to meet the humanitarian needs that have reached its ever high due to the COVID-19 pandemic. UNHCR has played a central role in supporting over 2.1 million beneficiaries in 13 countries through its zakat and sadaqa funds.

The experience of the UN agencies over the last few years in tapping into Islamic social finance to achieve the SDGs is still at the early stages but the potential is immense for Islamic social finance to create a real impact of social good across global communities

Other UN agencies have also facilitated zakat donations, such as WFP’s zakat campaign through ShareTheMeal fundraising app, UNICEF’s Global Muslim Philanthropy Fund for Children. UNDP and UNWRA are also enabling zakat giving in accordance with the Shari’a principles. Awqaf is also gaining traction, with UN agencies such as UNHCR, UNDP and UNRWA exploring waqf (cash-waqf and digitalizing waqf endowment) through partnerships. UNDP is also adopting other Islamic social finance tools, such as issuance of green sukuk.

The experience thus far of the UN agencies over the last few years in tapping into Islamic social finance to achieve the SDGs is still at the early stages but the potential is immense for Islamic social finance to create a real impact of social good across global communities. The share of zakat harnessed through international organizations is only a fraction of what it could be and, despite the fact that zakat collection and distribution through UN agencies is growing at an exponential rate, there is still a lot more to be done.

UN Agencies must strive harder, both through increased legitimacy (by means of religious endorsements and the compliance monitoring that it entails) and better publicity, to position themselves globally and in the collective Muslim psyche, as transparent and effective collectors and distributors of zakat.

Closer collaboration and cooperation are also needed between international organizations and local players (such as zakat houses and waqf authorities) to combine local knowledge and expertise with transparency, efficiency and international reach. Finally, UN agencies need to look beyond zakat and awqaf and realize the invaluable potential of sukuk and Islamic microfinance as crucial elements of economic development and poverty reduction in Muslim countries as well as powerful weapons in the fight for global peace and equality.