AN ISLAMIC FINANCE PERSPECTIVE

Introduction

The linear economy model is about taking natural resources, processing them for making goods and finishing them as waste. However, the world cannot keep this “Take, Make, Waste” approach anymore due to its severe economic, social and environmental impact. A paradigm shift is required to tackle global challenges such as climate change, environmental degradation, inflation, etc. Islamic finance has a crucial role to play in this paradigm shift to achieve global sustainability. In this chapter, we provide an overview of the current environmental situation at the global level to elucidate the role of Islamic finance.

Atmospheric CO2 Concentration at the Global Level

As one of the most critical indicators for the proxy of global changes, the term global warming is often interchangeably used with climate change. Global warming indicates the increase of general temperature levels across the globe, which impacts different species of animals, people, and the broad ecosystem. The term climate change means these extra changes, as there are many other consequences besides just an increase in the ground temperature. According to 97% of climate scientists – human actions are the primary drivers for these environmental changes during this era.

In recorded history, there has never been such a high carbon dioxide concentration. According to scientists, in order to stop global warming, we must go back to a “safe” concentration of 350 ppm by the year 2100.

Urbanization and its Consequences on Climate Change

According to the UN prediction, by 2050, around 68% of the world population will live in cities, up from the present 55%. China, India, and Nigeria are predicted to add over a billion people to the urban population, which will account for the majority of the rise in urbanization. Urbanization has expanded unevenly over the world thus far, but that is changing now as urbanization continues to grow more quickly in emerging areas.

Cities are resource-intensive, accounting for 75% of global resource use and carbon emissions but taking up just 2% of the planet’s surface.

According to the World Health Organization, ambient air pollution is the cause of roughly 4.2 million annual deaths, and 90% of individuals who live in metropolitan areas inhale air that doesn’t satisfy the organisation’s standards for particle matter. In many metropolitan areas, burning fossil fuels for buildings, traffic, and transportation (particularly diesel) are the main contributor to local outdoor (ambient) air pollution.

Global Generation of Waste and Garbage

Out of the total 2.01 billion tonnes of solid municipal garbage produced throughout the world, 33 percent is not tackled in a proper ecological way. An average person produces 0.74 kilograms of garbage per day in the world; however, the data is nonsymmetrical and it shows variations from 0.11 to 4.54 kilograms. The countries with high income produced 34% (683 million tonnes) of the world’s total garbage, accounting for only 16% of the world population.

It is anticipated that global garbage will reach 3.40 billion tonnes at the end of 2050, more than twice the population growth rate. The creation of waste and income level are often positively correlated. In contrast to low-and-middle-income nations, which are anticipated to rise by around 40% or more, daily per capita trash creation in high-income countries is forecast to rise by 19% by 2050. When income levels fluctuate incrementally, waste creation declines at the lowest income levels and rises more quickly there than at higher income levels. By 2050, it is predicted that the garbage produced by the countries with low income will increase up to three-fold.

How could Climate Change Impact the Global Economy?

Climate change is generally used to show the change in earth’s surface temperature at the regional or international level. Climate change has been commonly used to represent the increase in the world temperature, which is primarily caused by human actions since the start of the industrial era (1850 onward), primarily through the use of fossil fuels and the cutting of forests, which results in the abrupt increase of carbon dioxide concentration in the atmosphere.

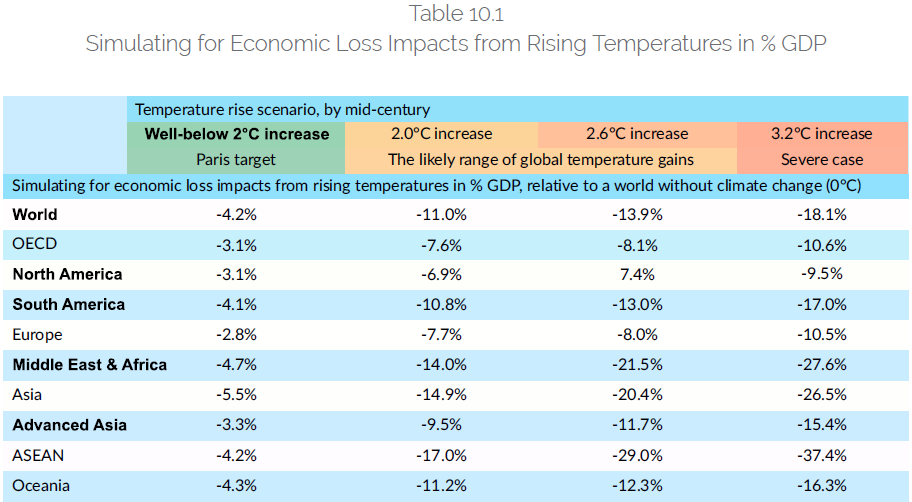

According to the Swiss Re Institute, the worst scenario could be in the form of world GDP decreasing by 18% till 2050 if the temperature increases by 3.2°C.

These predictions are based on the assumptions that the current rate of global change will continue to happen in the same fashion, and the Paris Agreement’s net-zero emissions aims won’t be fulfilled. To assess the climate resilience of 48 nations, which accounts for 90% of the global economy, the Swiss Re Institute developed the Climate Economics Index.

According to the projections, Asian economies will be most severely impacted by the effects of climate change, with a best ideal case of a GDP increase of 5.5% and the perfect worst case would be a GDP decrease of 26.5% (see Table 10.1).

The results clearly show a geographical variance. In the event of an increase below 2°C and in a devastating case, developed Asian economies are anticipated to see GDP decrease of 3.3% and 15.4%, respectively, while ASEAN nations are predicted to experience declines of 4.2% and 37.4%. In the most critical situation, China is predicted to incur a loss of 24% of its GDP, while the loss for the US, Canada, and the UK is 10% and 11% for Europe.

According to the analysis, assuming temperature increase does not surpass 2°C and 27.6°C in the ideal worst-case scenario, the Middle East and Africa will see a decrease of 4.7%.

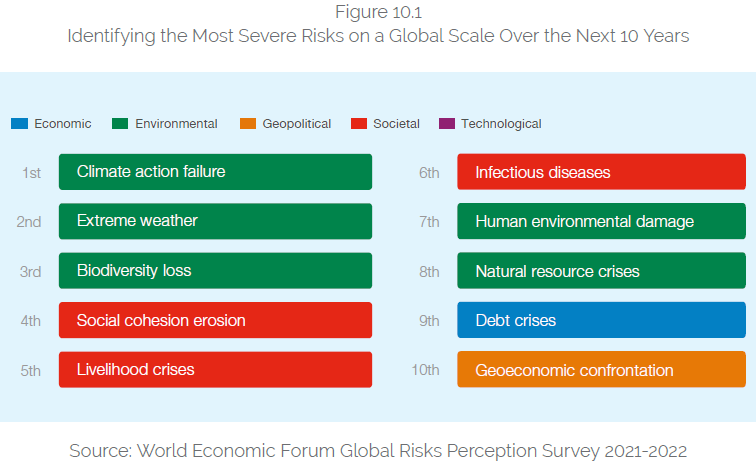

In a year in which people struggled to lessen the effects of the COVID-19 pandemic, the World Economic Forum’s Global Risk Report 2022 ranked climate action failure as the most significant and second-most probable long-term risk confronting the world (see Figure 10.1). The research issued a warning that billions of people worldwide ran a serious danger of passing on upcoming business possibilities and the advantages of a robust international community.

Consequences of Air Pollution

Our chance of contracting a number of ailments rises when we are exposed to air contaminants. These conditions may be divided into three main groups: cancers, respiratory illnesses, and cardiovascular illnesses.

These figures are best thought of as “avoidable deaths” since that is how many more people would live if air pollution were lowered to levels that did not raise the chance of contracting these deadly illnesses. Death is not the only adverse effect of air pollution. Millions of people suffer their whole life in the form of poor health as well.

Sustainable Development Goals and Climate Change

To achieve sustainable development outcomes by 2030, the UN SDGs, launched in 2015, have set 17 particular objectives or goals. Seven of the 17 objectives were established for environmental sustainability, including clean water and sanitation, affordable and clean energy, sustainable cities and communities, responsible consumption and production, climate action, and life on land and below the water.

The SDGs must be accomplished via a comprehensive strategy involving securing the necessary public and commercial sector funding. It is evident that government financing sources fall short of meeting the investment demands, and the private capital infusion is needed if the objectives are to be met.

Many institutions have increased their policy efforts in mobilising financing for green development investments via regulations, incentives, standards, and awareness raising due to their realisation of the significance of advancing toward the SDGs. The image below lists a few of the instances.

Concept of Sustainability

One of the commissions of the United Nations (UN) i.e., the Brundtland Commission, described the most well-known definition of sustainable development: “Meeting the needs of the present without compromising the ability of future generations to meet their own needs”.

A study on investors’ views about sustainability initiatives found that efforts in this area do not inhibit or stop growth. Sustainable investment is important in examining and deciding the status of an organisation and functioning regarding the environment, social matters, security and health, and governance. Corporate sustainability is defined in consideration of the better analysis of social welfare expenses of pollution. Weak sustainability means that the whole world’s wealth should not be reduced. The overall set is shifted to the future that values and counts. Weak sustainability does not permit rapid elimination of non-renewable resources or directs that extreme ecological deterioration is not very important. Strong sustainability depicts more substantial stress on the protection of natural assets within the broader target of carefully managing a set of assets over time.

One Concept with Different Labels

After reviewing the literature on sustainability, it can be concluded that the main pillars of sustainability are environmental sustainability, social sustainability, and governance or economic sustainability. These three pillars have been discussed in extensive literature, including articles, research papers, and books, etc., and were under discussions in conferences and round talks among academicians, industry experts and policyholders. But all of them discussed this one or the same concept with different labels. For example, it is discussed under the titles of “Millennium Development Goals (MDGs)”, then in its extended and revised form as “Sustainable Development Goals (SDG’s)”, “Social Responsible Investment (SRI)”, “Environmental, Social and Governance (ESG) Management”, “Islamic Finance”, “Responsible Finance & Investment (RFI)”, “Green or Ethical Finance” “Corporate Sustainability”, and “Corporate Social Responsibility (CSR)” and “Environmental Friendly Investment”, “Circular Economy”, and “Green Finance”. This shows that the concept of sustainability is not new but has gained attraction and reached its peak in recent years due to rapid global changes at environmental, social and economic levels.

Islamic Perspective on Sustainability and Islamic Finance

According to the Islamic point of view, financial sustainability may be defined as a multifaceted schema that enforces a balance between social and economic development on one side and the environment on the other. It demands that humans gain the benefits from the resources in the best possible and proper way by taking care of the environment upon which those resources depend and rely.

From an Islamic point of view, human beings are God’s representatives on earth, (Quran: 2:30) and humans are allowed to benefit from the earth’s resources without exploiting them. Human beings have to seek to spend their lives on the planet according to the guidelines of the Holy Quran and the teachings of Prophet Muhammad (PBUH).

By following these guidelines, any human being can meet their current needs without demolishing the resources which lead to the future generations in danger. The Islamic financial system is based on ethical notions connected with the real sector and potentially contributes to global financial stability. In addition, Islamic banking and financial institutions are not only for Muslims but they follow rigorous principles to become socially and ethically responsible and embrace high transparency and risk sharing. Islamic finance highlights the combination of finance with the real economy. Debt creation must be contractually linked with trade and production. That could also help in global sustainability, social and economic development.

The essential points are the tools that are best for the socio-economic sections directed by Islamic financial industries and approved by governing bodies that should not be prohibited and impermissible in Islamic values and regulations. After reviewing the literature, we have found the best ways to strengthen financial sustainability are zakat, waqf, riba-free loans and other financial ways like sukuk are very helpful for the development of social, economic and environmental sustainability.

Zakat and waqf-based microfinance institutions can be used to serve the social sector. Like real estate-based waqf can show fruitful results through the rental of properties, which are also useful for the financial social development needs. Waqf based on cash and commodity can provide interest-free loans to the needy in different sectors like health, education, agriculture and other essentials and needs. And in microfinance, takaful is a concept of insurance based on shared responsibility, support and cooperation principles. Real estate-based waqf can generate proceeds by renting properties, which can then be used to finance social development needs.

The further section will discuss the three main pillars of sustainability and the role of the Islamic finance industry in these three main pillars. Moreover, this section will also shed light on the steps taken by the Islamic finance industry and the future goals in achieving sustainability in three main pillars: environmental, social and economic sustainability.

Three Pillars of Sustainability and the Role of Islamic Finance

It is worth mentioning that Islamic finance supports the achievement of three main pillars of sustainability as discussed below.

Environmental Sustainability and Islamic Finance

According to Islamic teachings, an individual’s relation with the environment is established through some moral principles. A man is not limited to enjoying and taking advantage of other creations worldwide. His responsibility is to preserve and protect the environment and struggle for its betterment. As the prophet (PBUH) said:

“The whole of creation depends on God, so the most beloved to God is the one who is most beneficial to His creation”. (al- Tabrani in al- Mu’jam al- kabir ,1-:86, I0033).

Islamic teaching always emphasises on work for the uplifting of the humanity at large. Even if the last hour draws near, one, being on one’s best behaviour, should not discontinue working for human welfare. Anas b. Malik reports that the Prophet said:

“If the last hour arrives, and a man holds a date palm sapling in his hand, and can manage to plant it, he should go ahead”. (Ahmad b.Hanbal in al musnad, 3:191, 13004).’’

Scholars substantially agreed on the concept of sustainability that encompasses at least ecological integrity, social equity, and economic security. Those corporations having the aim to attain sustainability have to think beyond the concept of the fulfilment of economic standards in their decision-making by analysing environmental effects.

Globally there is a growing awareness of threats to and degradation of many natural resources, energy resources, and environments. One of the significant environmental problems in the world today is handling natural resources with different stakeholders, disputes among them, and a growing shift in resource use. The challenge in such situations is to design decision-making processes that are a participator and that respect the ecological integrity of the resources themselves. Environmental sustainability demands the availability of pure and clean drinking water, sustainable management of sanitation and ensuring the provision of reliable and affordable modern energy for all.

It is estimated that over 2 billion people suffer due to water stress, which can be more severe with population growth and climate change. Eight hundred ninety-two million people (12 percent of the world population) in 2015 practiced open defecation, which poses a significant health risk. Around the world, 1.06 billion people are living without electricity, that is 80 percent from only 20 countries. Approximately 3 billion people still don’t have access to clean, pure, safe cooking fuels and technologies. In 2016 global temperature also continued to increase, hitting a record of about 1.1 Celsius above the pre-industrial era. Moreover, global sea ice fell to 4.14 million km2 in 2016. Atmospheric carbon dioxide levels also hit 400 parts per million.

Customers’ mindset is also changing, as they demand environmentally friendly goods and services. For this reason, green technologies motivate organisations and businesses to participate in sustainable product development.

The above discussion shows the importance of environmental sustainability and highlights the need for initiatives to help attain environmental sustainability. The Islamic finance industry has become the point of debate and attraction of people, institutions, and governments around the globe. In this aspect, the Islamic finance industry is also playing its role in attaining global environmental sustainability. In this regard, some socially responsible investment (SRI) or green sukuk has been introduced and launched internationally to support the financing of environmental- friendly projects. For example, in 2012, the Climate Bonds Initiative (CBI), with the collaboration of Clean Energy Business Council of the Middle East and North Africa (MENA) and Dubai-based Gulf Bond & Association was started and endorsed the concept of green Sukuk, which matches with low-carbon criterion. Likewise, in 2014, Securities Commission SC Malaysia re-edited its Sukuk guideline by including the new requisites for launching SRI sukuk. The revised sukuk guideline elucidates that the revenue of SRI sukuk can also be utilized to preserve natural and ecological resources, save energy usage, enhance renewable energy usage and diminish greenhouse gas discharge.

In 2012, two Australian solar companies named Solar Guys International and Mitabu maintained to generate funds of USD100mln for a 50MW photovoltaic project based on green sukuk in Indonesia. The project was designed in Malaysia and fully funded under a Power Purchase Agreement. Islamic Development Bank IDB also aims to support USD180mln pilot projects in clear energy in its 56-member countries. International Finance Facility for Immunisation (IFFIm) based in the UK, also launched SRI Sukuk in 2014 based on murabaha having the value of USD500mln for children’s immunization in the poorest countries of the world via Gavi, the Vaccine Alliance to assist in the protection of tens of millions of children against vaccine-preventable decease.

The above examples show the Islamic finance industry’s activeness in attaining the global environmental sustainability target. Sairally’s study depicted that over 80% of stakeholders agree with the notion that Islamic financers have social responsibilities, preferring more new initiatives in the Islamic finance industry to circumscribe social and environmental welfare.

Social Sustainability and Islamic Finance

After reviewing and analysing various definitions of social sustainability, McKenzie defined this term in these words: “Social sustainability attained when the formal and informal mechanisms, designed structures systems and relationships efficiently support and assist the capacity of present and future generations to establish healthy and livable societies and communities. Socially sustainably societies are interconnected, democratic, innovative, equitable and provide a standard quality of life”.

Vallance, Perkins, & Dixon, (2011) conducted a study having titled “What is social sustainability? A clarification of concepts” in 2011 to check and examine the extensive literature on social sustainability to exhibit what is the meaning of the term social sustainability and also to define various angles in which it can make its contribution to sustainable development generally. Finally, the authors concluded their research with the threefold schema of social sustainability that encompasses, (a) ‘development sustainability’ discussing primary wants and needs, the establishment of justice, social welfare capital, and so on; (b) ‘bridge sustainability’ addressing behavioural changes to attain ecological goals which are biophysical and; (c) ‘maintenance sustainability’ concerning to the protection – or what can be protected – of sociocultural attributes in the name of modifications and changes, and the means through which people rapidly accept or reject those modifications and changes.

From a social perspective, human beings are created by the Creator collective in nature divided into males and females, tribes and nations to get to know each other. However, Islam recognizes that the best among them is the most pious to his Creator-Allah the Almighty (Al-Quran, 49:13).

Qadri (2016) wrote a comprehensive book titled “Islam on Serving Humanity” which explains the notion of Islam regarding humanity and social sustainability. He cited many Quranic verses and Hadiths to prove the Islamic concept of social sustainability. He said Islam is not truly understood today, creating problems among Muslims. Islam demands three main things together religious beliefs (Aqaid), religious practices (Ibadat) and the doing of good deeds in this world. The best act in the light of Islam is to serve humanity to achieve social sustainability (Qadri, 2016).

The indicators of goals related to social sustainability in Sustainable Development Goals (SDG’s) include zero hunger. Poverty alleviation, Quality education, Gender equality, Good health and well-being, and reduced inequalities.

In 2013, 767 million people were living below the extreme poverty line. It is estimated that 10 percent of the employed population around the globe passed their lives with families on less than 1.90 US dollars per person a day in 2016. During 2014-16, about 793 million people were undernourished. Globally in 2012, about 7.3 million deaths occurred due to air pollution from unclean and dangerous cooking fuels, industrial sources, traffic and other fuel combustion. In 2014, globally, 9 percent of primary school-aged children were out of school. According to a survey conducted during 2005 – 2016, 1 in 5 girls and women have to face sexual and/or physical violence by her partner.

Islamic social finance advocating a sharing economy and promoting redistribution could play a significant role in helping achieve the twin development objectives of ending extreme poverty globally by 2030 and boosting shared prosperity by raising the incomes of the bottom 40 percent of the population. The institutions and instruments of Islamic social finance are rooted in redistribution and philanthropy. Such interventions, involving qard e hasan, zakat, and sadaqa, can potentially address the basic needs of the needy and create a social safety net.

To tackle the challenges mentioned above and achieve social sustainability, the Islamic finance industry and its stakeholders also begin to take on new initiatives. Social sustainability is the inherited and the inbuilt goal of establishing an Islamic economic system called Islamic Moral Economy (IME).

Currently, Malaysia issued SRI Sukuk named Ihasan by Khasanah Nasional Bhd. These sukuk were designed to introduce a new type of fund, i.e., “trust schools, ” using the capital market. Malaysia issued Sri Sukuk in 2015, which was Ringgit dominated and had a value of RM1bln. These were the first SRI Sukuk that were accepted and approved under Security Commission’s SRI Framework and also given AAA rating from RAM Rating Services Bhd. The aim of gaining revenue from sukuk is to support and fund the entry and rise of 20 Schools under Yayasan Amir’s Trust School Program, which is a non-profit organisation founded by Khazanah to make better the efficiency and quality of education in Malaysian public schools via Public-Private Partnership with the Malaysian Ministry of Education.

Usman & Tasmin (2016) referred to many studies related to Islamic microfinance and concluded that Islamic microfinance is a basic tool for dwindling poverty and improving the standard of quality of the lives of households by providing better-conditioned houses. It can also play a significant role in making the poor people empower by providing opportunities for women to develop and establishing micro-enterprises. It also promotes entrepreneurial education, self-reliance, skills building, asset accumulation, and communal services.

Waqf and zakat can also be utilised to enhance the resilience of the needy. Diwan al Zakat, an institution based in Sudan, has started to provide loans to farmers in the initial period of the agricultural period so that they can buy the most necessary and basic inputs; the provided loans are repaid after the time of harvest. Results show that this implemented policy has enhanced the capability of farms in terms of productivity and zakat collection also increased from farmers, which was equal to 74.4 percent of the provided loans. Another good method to scale down the susceptibility by using waqf and zakat funds to pay the monthly takaful premiums to become secure against various specified risks. This plan can also enhance the adoption of takaful products and services among the needy and poor.

A research study in the context of South East Asian countries (Malaysia, Indonesia, Pakistan etc.) found that obligatory alms included zakat is dependable, viable, and can be an important tool of collecting funds for those organizations that have required men power which are professional in raising of funds and determine to bring improvement in their trustworthiness by scaling up their good governance, integrity and transparency.

To enhance and accelerate the performance of waqf and zakat in achieving social development would demand from these institutions to revive their policies, including the solution of two major problems and issues. 1) This is important to augment the assets on which zakat can be collected by re-editing the definitions and scope of wealth according to the need of modern times. 2) There is also a requirement for a multifold scheme to redescribe the waqf sector’s scope. In this way, it can enhance social development. Some countries have already adopted this approach to revive the waqf sector. Such as the Sudanese Awqaf Authority has generated funds through donations as a new waqf and formed an investment/construction department to enhance the existing waqf assets by making them efficient, more productive and enhancing proceeds.

Governance or Economic Sustainability and Islamic Finance

Economic development is the main element of sustainable development. When this development is sustained, a large number of people can save themselves from poverty due to productive employment expansion.

The indicators of goals related to governance or economic sustainability in Sustainable Development Goals (SDG’s) include decent work and economic growth, sustainable communities and cities, infrastructure and innovation, industry, responsible production and consumption, peace, justice and strong institutional partnerships for the goals.

In the least developed countries (LDCs), the real GDP growth averaged 4.9 percent from 2010- 2015, which did not hit the target of at least 7 percent annually (Miller and Morris 2008).

Focusing on the real economy and based on risk-sharing investments and financing is an opportunity for the Islamic finance industry in the infrastructure sector. By financing infrastructure sector projects that are in accordance with the notion and ideology of Islamic financing, communities, on a large scale, can benefit from these projects.