A Systematic Literature Review

Introduction

Businesses are taking advantage of adapting and innovating to meet social and environmental challenges with new technology (Ghezzi & Cavallo, 2020). Things are not different in the financial sector, whereby FinTechs are using a mix of technology and financial methods to improve the efficacy and efficiency of financial operations (Nguyen, 2022). Their emergence has transformed commercial banking systems (Alt et al., 2018). As a new financial sub-sector, FinTech’s contribution to application of technology is substantial. Consequently, the financial services sector can now better implement new processes, systems, products, and services expected to improve efficiency (Rahmayati, 2021). It was due to FinTech that corporations were able to reorganize their operations and shift toward hybrid client interactions and customer self-service during COVID-19 (Papakonstantinidis et al., 2021). As it takes advantage of the most recent advancements, such as cloud computing, big data, the Internet of Things (IoT), social computing, and others, it is now being considered as future of banking and finance (Legowo et al., 2021).

The use of Artificial intelligence (AI) technologies is now a norm in FinTech (Martínez-Plumed et al., 2021). Numerous studies contextualise user facilities and web interface experiences in the financial services industry, machine learning tools in electronic financial market trading, and advanced modelling for stock movements and settlement models based on Blockchain technology (Nicoletti, 2021).

In this year’s GIFR – centred around futurism – we thought it beneficial to consider the following questions:

- Which are the leading writers and publications in FinTech literature related with Islamic finance?

- What are some of the most pressing issues in Islamic finance that can be addressed through FinTech?

- What future research gaps may researchers, academics, and practitioners address with the support of FinTech literature research streams?

This chapter is organised into several sections. Following the introduction, it outlines the systematic literature review method for business management studies. Next, a scoping investigation is conducted to summarise current perspectives on FinTech, the subjective nature of financial technology and Islamic motivations. The following section discusses the thematic findings arising from the review, showing the existing state of knowledge in the field and what is still unknown by identifying existing work’s limitations and suggesting further research opportunities. The chapter concludes by asserting the necessity of advancing research on the FinTech joint with Islamic to enhance adaptability and relevant practice.

Literature Review

FinTech has proven to be a beneficial innovation for the financial service industry and has improved the level of financial inclusion by reaching a diverse group of customers (Gomber et al., 2018). While the concept of FinTech is new, it has already made its mark in the Islamic finance industry. Islamic FinTech has paved the way for developing innovative Shari’a-compliant products for Islamic consumers, which could lay the foundation for a more significant competitive edge for the Islamic finance sector (Hasan et al., 2020b). It is essential to highlight that Islamic FinTech differs from conventional FinTech due to the requirements of Shari’a compliance (Rahim et al., 2019). However, the emergence of the FinTech solution has provided Islamic financial institutions (IsFIs) with more excellent opportunities to improve their infrastructure and product offerings (Oseni & Nazim Ali, 2019). As such, research on the application of FinTech in the Islamic finance sector has increased in recent years (Rabbani et al., 2020).

Islamic finance, particularly Islamic FinTech, has a bright future in Muslim nations. Mobile and smartphone technology has opened the path for FinTech’s rise in these nations (Glavina et al., 2021). Of course, these possibilities do not come without their share of difficulties. Regulators and a lack of credible research in the Islamic FinTech field are significant challenges for Islamic FinTech businesses (Rabbani, Bashar, et al., 2021). However, according to another research, Islamic FinTech businesses’ existence might positively impact entrepreneurs (Hadiyan et al., 2020). Moreover, not many organisations assist young graduates with Shari’a-compliant finance, which will significantly help (Rabbani, Asad, et al., 2021).

Shari’a-based Islamic FinTech may dominate the global financial market (Muryanto et al., 2022). Islamic FinTech is clear, simple, and accessible (Saba et al., 2020). The global financial crises have not hampered its performance. Islamic FinTech gives Islamic institutions a chance to improve the financial industry and become a transparent, ethical alternative (Atif et al., 2021). Technological advancements are merely the beginning of banking and finance innovation. Islamic financial organisations must accept change. Dawood Mahmood et al. (2022) forecasted its expansion when the Muslim population reaches 3 billion by 2060. Another research found that lacking skilled employees and transparent government policies hampered Islamic FinTech development (Salim & Ilyas, 2020). Researchers said a healthy ecosystem for Islamic FinTech growth in the nation requires effective government regulation, solid research, and qualified employees (Asia’s Fintech et al., 2022). Islamic FinTech’s success may be attributed to the number of financial service fields it can connect to, such as cryptocurrencies, Blockchain, and cross-border payments (Rabbani et al., 2020). Islamic FinTech must keep up with traditional finance’s fast growth. Islamic finance has more effective options than traditional finance since FinTech-shared capital follows Shari’a principles. Islamic FinTech shares Islamic Finance’s beliefs and ethics (Naeem et al., 2021).

Many researchers have examined the impact of FinTech and crowdfunding on customer retention in Malaysia and the UAE (Ishak & Rahman, 2021; Oseni & Omoola, 2015; Rahim et al., 2022; Shaikh et al., 2020). Malaysian Islamic banks benefit from crowdfunding-based client retention (Oseni et al., 2018). Oladapo et al. (2021) suggest that Islamic FinTech may enhance financial transactions, service offers, and ease, leading to better customer loyalty for Indonesian banks. FinTech’s integration with Islamic finance may be achievable if Shari’a compliance is adhered to. They have done an excellent job of adhering to Shari’a principles and going through regulatory audits to guarantee that their business models comply with Shari’a regulations. Despite this, Shari’a compliance has remained a significant focus for Islamic FinTech researchers. Shari’a-compliant crowdfunding invests in halal items, distributes investment risk, and does not charge interest (Yildiran et al., 2021). Moreover, studies reaffirmed that the interest ban is critical to accepting FinTech-based business models as Shari’a-compliant (Hasan et al., 2020b). By establishing an early line of communication between the client and the investors, FinTech helps IsFIs become more open and accountable (Altwijry et al., 2021).

As a prominent cryptocurrency, Bitcoin has also been the subject of much research in the past. First and foremost, Muslims do not consider cryptocurrencies to be legal tender. Investing in non-Shari’a-compliant ventures has been associated with Bitcoin, according to Egypt’s Grand Mufti, Shaykh Shawki Allam (Abu-Bakar, 2018; el Amri & Mohammed, 2021). Islamic law does not allow virtual currency trading, according to a fatwa issued by the Turkish government (excessive gharar) (Selcuk & Kaya, 2021). While many experts believe that cryptocurrencies are permissible under Shari’a, others believe that they are contrary to the teachings of the Islamic faith (Abulfathi et al., 2020). Kirchner (2020), for example, do not discover any proof that Bitcoin contradicts Shari’a and highlight that high volatility related to the exchange rate of Bitcoin bought for saving reasons may have excessive risk (gharar) and speculation (maysir). It is thus possible to enhance Bitcoin’s Shari’a-compliant status by adjusting its exchange rate to that of major currencies. According to Bakar (2018), Bitcoin conforms with Shari’a and should be utilized to combat allegations that it is being used for money laundering and other illicit acts. According to (Fageh, 2021), Bitcoin should be treated the same as any other money within the Bitcoin community when exchanging it for other currencies. Exchange location and the restriction of speculating are only two examples of requirements that may or may not apply to such an exchange.

Because it offers a low-cost alternative to traditional financial services, Islamic FinTech is a massive boon to underdeveloped nations (Muneeza et al., 2018). It also tests regulatory organisations to keep things stable and safeguard investors and institutions from dishonest business practices. Muslims interested in adopting the technologies should be educated about the benefits of Islamic FinTech to ensure its growth and sustainability (Atif et al., 2021). FinTech must be creative if it is to remain relevant in the long term since the adoption of FinTech by Islamic financial institutions impacts both Muslims and non-Muslims, as well as the entire financial sector (Rabbani, Bashar, et al., 2021).

Methodology

Systematic Literature Review

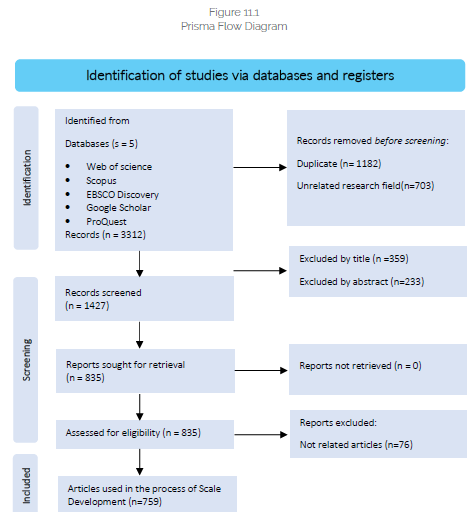

A systematic literature review (SLR) was used to conduct the study behind this chapter. Systematic reviews may provide robust, reliable, summaries of the most reliable evidence (Petticrew & Roberts, 2008). Cooper et al. (2019) highlight that systematic review provides researchers with an organized and structured technique to conduct the study and allows other researchers to replicate the study. The data extracted from the SLR provided sufficient material for bibliometric, content and network analysis. To conduct a total systematic review, Page et al’s (2021) Preferred Reporting Items for Systematic Review and Meta-Analysis (PRISMA) guidelines were followed while conducting the study. Before conducting PRISMA, it is required to define the databases, selection process, search strategy, search date, and inclusion and exclusion criteria. Search terms were carefully selected using advance search in 5 databases; terms included are FinTech, Islamic, Shari’a, Shari’a Finance, Islamic Finance, Technology, and Financial Technology in English journal articles; covered fields are title, abstract, keywords, and topic depending on the database; and the last search was in July 2022. The exclusion criteria are documents that are not peer-reviewed academic journal articles and articles in languages other than English. For the literature search, we used Web of Science (WoS), SCOPUS, Google Scholar (GS), EBSCO Discovery and Proquest, as these databases cover a broad scope of business articles (Martín-Martín et al., 2018). Search results and filtering based on PRISMA are presented in Figure 11.1. Articles were reviewed separately by two authors, who then discussed the findings.

Example of search used in Scopus TITLE-ABS-KEY ( ( Islamic AND FinTech ) OR ( Islamic AND “Financial Technology” ) OR ( Shari’a AND FinTech ) OR (Shari’a AND “Financial Technology” ) OR ( “Islamic Finance” AND Technology ) OR ( “Shari’a Finance” AND Technology ) ) AND ( LIMIT-TO ( DOCTYPE, “ar” ) OR LIMIT-TO ( DOCTYPE, “j” ) ).

An initial analysis of keyword co-occurrences followed a more in-depth examination of articles using the technique of Tranfield et al. (2003). It was determined that keywords and sub-questions would be used in the analysis based on both methodologies. A list of terms related to the writers’ core research interests was then compiled, including FinTech, Financial technology; Islamic Finance; and Shari’a (Table 11.1). We used EBSCO Discover, SCOPUS, and Google Scholar for the literature search as their three go-to electronic databases. The Boolean letter ‘While’ was used to combine keywords into strings for the database subject search, and the Boolean character ‘OR’ was used to combine distinct strings. For specific terms, a wildcard search was used to get the correct number of results for each word.

Keyword Graphical Mapping

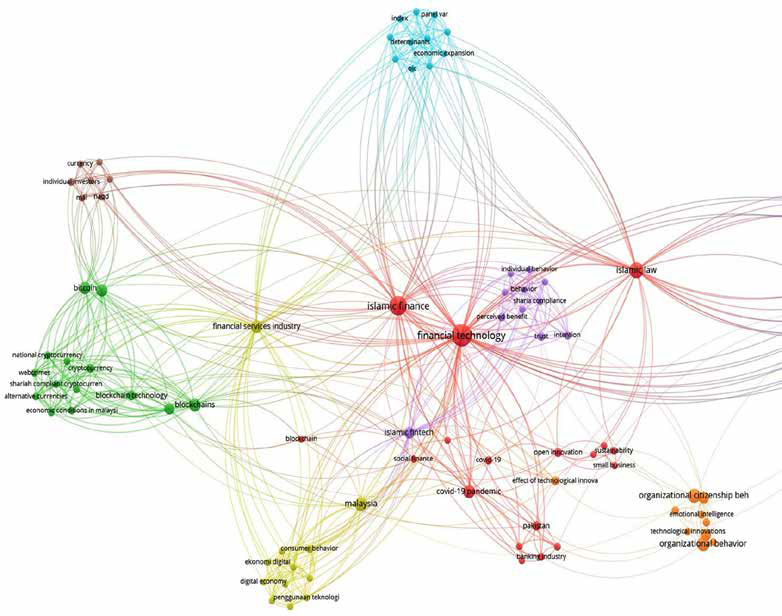

Reading and manually coding articles may be time-consuming and involve human mistakes and prejudice. Therefore, we established a theme framework to code all the papers and then displayed the topic clusters using VOSviewer, version 1.6.18, to see the intensity of research topic word correlations (van Eck & Waltman, 2017).

Table 11.1 Keywords Used to Create Search Strings

| Main Term | Additional Terms |

| FinTech | FinTech OR ‘Financial Technology |

| Islamic Finance | Islam OR Islamic |

| Shari’ah | Shari’a OR ‘Shari’a law’ |

Dinh et al. (2014) and Meuser et al. (2016) reviewed the same ten journals. They claimed these publications published high-ranking, impactful leadership research (Meuser et al., 2016). Therefore, this study investigated references in published leadership-related work using the same criteria as Dinh et al. (2014) and Meuser et al. (2016): journals that often published financial technology research and had a high impact.

Table 11.2 Number of Articles Discovered by Applying Search Strings to the Corresponding Online Database

| Search string | EBSCO | SCOPUS | Google Scholar |

| ‘FinTech’ + ‘Islamic Finance’ | 10 | 60 | 611 |

| ‘Financial Technology’ + ‘Islamic Finance’ | 10 | 84 | 5410 |

| ‘FinTech’ + ‘Islam’ | 5 | 2 | 278 |

| ‘FinTech’ + ‘Islamic’ | 22 | 98 | 640 |

| ‘Financial Technology’ + ‘Islam’ | 11 | 30 | 18700 |

| ‘Financial Technology’ + ‘Islamic’ | 35 | 231 | 11200 |

| ‘FinTech’ + ‘Shari’ah’ | 5 | 22 | 181 |

| ‘FinTech’ + ‘Shari’a’ | 5 | 21 | 116 |

| ‘FinTech’ + ‘Shari’a law’ | 3 | 5 | 102 |

| ‘Financial Technology’ + ‘Shari’a’ | 5 | 36 | 894 |

| ‘Financial Technology’ + ‘Shari’a law’ | 3 | 9 | 956 |

| ‘Financial Technology’ + ‘Shari’ah’ | 3 | 44 | 471 |

We ran a literature search on SCOPUS, EBSCO, and Google Scholar on July 30, 2022. Due to their broad journal coverage and thorough index labels, their formats were readily integrated into bibliometric analysis tools. However, Google Scholar cannot extract bibliometric data as a bulk file. Thus, we compared the number of references for each keyword or combined keywords. We searched 2010-present titles, abstracts, and authors’ and publishers’ keyword fields. The research excluded editors’ remarks, special editorial issues, book reviews, comments, answers, and other non-peer-reviewed papers.

We used VOSviewer’s default settings to load bibliographic files. However, academic writing is challenging because of domain-specific jargon, complexities, and authors’ favoured idioms and writing styles. Therefore, we provided pertinent topic phrases to assist the programme in accomplishing the work, balancing sensitivity and specificity. Sensitivity implies the term must detect as many relevant items as feasible, while specificity implies excluding extraneous articles. Since computers may repeat computations, we chose specificity to guarantee valuable findings. To guarantee the highest level of coverage, we created an extensive list of terminology for each issue and examined synonyms, plural forms, British spellings, and exceptions.

Table 11.3 Top Exported Keywords Selected in VOSviewer

| ID | Keyword | Occurrences | Total Link Strength |

| 26 | alternative currencies | 6 | 84 |

| 44 | bank management | 8 | 80 |

| 46 | banking industry | 6 | 21 |

| 55 | Bitcoin | 15 | 116 |

| 57 | Blockchain technology | 10 | 102 |

| 59 | Blockchains | 16 | 114 |

| 60 | bureaucracy | 8 | 80 |

| 65 | business enterprises | 9 | 81 |

| 109 | consumer behavior | 7 | 19 |

| 115 | corporate culture | 13 | 21 |

| 120 | covid-19 | 7 | 16 |

| 121 | covid-19 pandemic | 17 | 53 |

| 133 | cryptocurrencies | 15 | 116 |

| 134 | cryptocurrency | 8 | 94 |

| 136 | cryptography | 6 | 84 |

| 146 | data security | 8 | 80 |

| 164 | digital asset | 6 | 84 |

| 178 | economic conditions in malaysia | 6 | 84 |

| 186 | effect of technological innovations on financial institutions | 8 | 15 |

| 194 | emotional intelligence | 7 | 10 |

| 201 | employee attitudes | 7 | 14 |

| 237 | financial inclusion | 9 | 82 |

| 245 | financial services industry | 16 | 114 |

| 247 | financial technology | 48 | 207 |

| 248 | FinTech | 12 | 102 |

| 276 | gold backing | 6 | 84 |

| 310 | individual investors | 6 | 20 |

| 328 | intention | 7 | 29 |

| 345 | islamic finance | 37 | 120 |

| 346 | islamic FinTech | 13 | 49 |

| 347 | islamic law | 24 | 123 |

| 410 | “micro, small and medium enterprises (SMEs)” | 8 | 80 |

| 414 | mobile banking | 6 | 22 |

FINTECH AND ISLAMIC FINANCE: A SYSTEMATIC LITERATURE

| 433 | national cryptocurrency | 6 | 84 |

| 441 | non-bank financial institutions | 8 | 80 |

| 455 | open innovation | 8 | 21 |

| 464 | organisational citizenship behaviour | 14 | 22 |

| 472 | organisational culture | 6 | 11 |

| 480 | organizational behaviour | 19 | 20 |

| 483 | organizational citizenship behaviour | 19 | 23 |

| 508 | perceived benefit | 7 | 29 |

| 578 | risk management | 8 | 80 |

| 607 | Shari’a | 8 | 80 |

| 611 | Shari’ah-compliant cryptocurrency | 6 | 84 |

| 679 | sustainability | 6 | 9 |

| 696 | technological innovations | 6 | 8 |

| 714 | trust | 7 | 29 |

| 737 | web crimes | 6 | 84 |

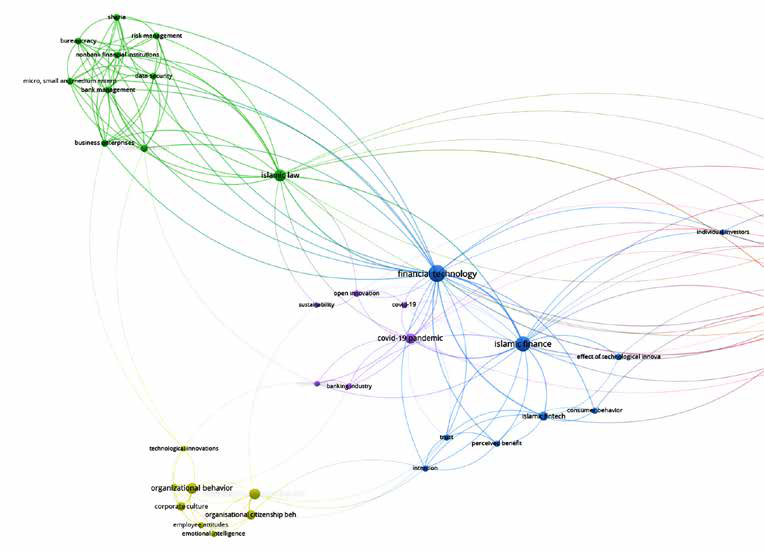

Figure 11.2 Map of the Keyword Co-occurrence Analysis with a Default Cut-off Value of 6

First, VOSviewer extracted co-references from 759 articles. Concerning keyword clustering, we found the predefined 25-occurrence cut-off subjective. The software proposed a 5-occurrence cut-off as the default elaborated value with a maximum value of 24. we attempted 5, 10 and 20 VOSviewer instances to obtain a more informative map. When the cut-off was 5, the analysis generated 88 keywords in 9 clusters, but understanding them was difficult. At 10, there were 17 keywords. Six occurrences were the ultimate cut-off, resulting in 56 items groupings in 5 clusters.

Most of the top 56 most-used words were general (e.g., ‘index’, ‘internet’, ’risk’) or method-related (e.g., ’SEM’, ‘Structural Equation Modelling’, ’panel’, ‘determinants’). Next, ‘internet’ and ‘cell’ were removed since they were article selection criteria, and their frequency was rendered generic. Table 11.3 lists all selection terms. For a list of articles reviewed and data extracted from empirical studies identified by a systematic literature review, see Table 11.4.

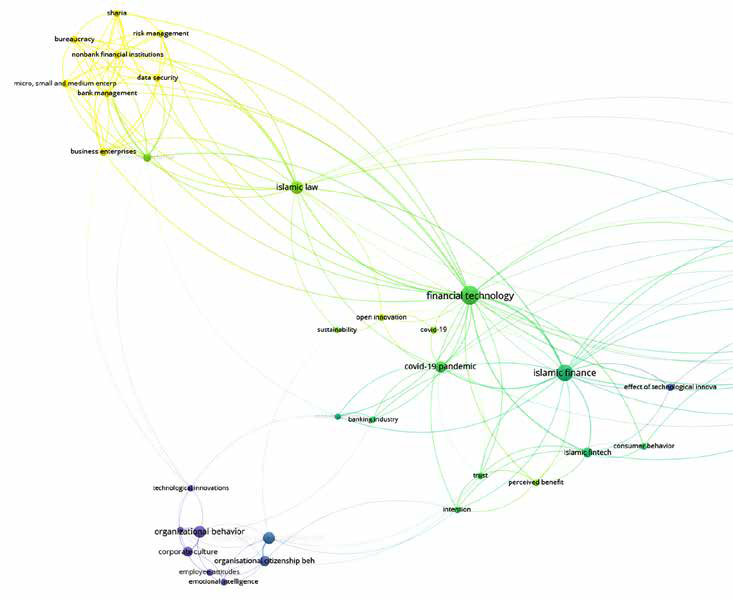

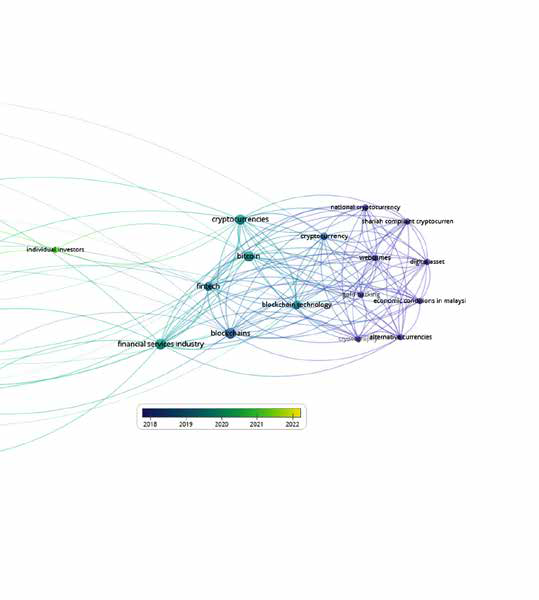

Figure 11.2 shows the cluster network analysis for all the subject words. Figure 11.3 and Figure 11.4 show the keyword maps of the chosen databases’ bibliographies.

Descriptive Analysis and Discussion

VOSviewer Results and Discussion

After loading the bibliographic data file and the subsequent analysis, the software reduced the weighted sum of the squared Euclidean distances between all pairs of nodes (topic terms) in the graphic representation. Each round represented a topic term, and the dimensions of topic terms signified the frequency with which the terms were observed in the bibliometric database. Lines between the nodes represented links/edges, and the thickness of the links indicated the frequency of associations between the two terms. To map the relationships among all terms in the network, VOSviewer calculated the association strength based on the ratio of the observed number of co-occurrences of two terms divided by the expected number of co-occurrence terms.

Then, the software used the association strength values as the inputs for the visualisation of similarities (VOS) and positioned the terms as a network in a two-dimensional space so that strongly related terms were located close to each other and terms occupying central positions in the map co-occurred with more terms in the map than those on the periphery. VOSviewer also assigned related terms to a cluster using an intelligent local moving algorithm. Consequently, terms shown in the same colour were similar to terms with different colours (van Eck & Waltman, 2017).

Table 11.5 shows the topics’ cluster affiliations, occurrences, and degrees of centrality. The degree of centrality is the number of unique direct links a node has with other nodes, thus indicating a node’s status in the network. For example, if a topic’s degree of centrality is 55, it is linked to every other topic on the map. Furthermore, the occurrence and the degree of centrality are related in that when a topic appears in many articles, it is likely to be linked to different topics.

Figure 11.3 Overlay Visualization with a Cut-off Value of 6

Looking at the cluster analysis, Blockchain and cryptocurrency are the main topics highlighted in Cluster 1, shown in red in Figure 11.4. It contains many constructs that can potentially explain the study of the adoption of cryptocurrency associated with Islamic finance and FinTech, such as Bitcoin, digital assets, and national cryptocurrency. Shari’a compliance has been confirmed for new Blockchain-based FinTech platforms backed by gold by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).

Because of the new laws, Binance and other worldwide exchanges leveraging Blockchain technology to facilitate the conversion of fiat cash into cryptocurrency have begun functioning in the United Arab Emirates. BitOasis and Fasset are local start-ups that have seen tremendous expansion since their launch in 2018 and 2019, respectively, attracting many users to their respective digital wallet systems.

Identifying diverse instruments that may be used in the Islamic finance sector is a crucial area of future study; thus, it is encouraging to see studies beginning to look at the interrelationships of these themes.

Cluster 2 (shown in green in Figure 11.4) illustrates the banking and small business topics. This cluster also contains constructs like bureaucracy banking, data security, financial inclusion and non-bank financial institution that show how the attention of the FinTech market is now on the small business banking sector for improving the customer experience and banking management. In this topic, Islamic banking is key to providing exemplary service according to Islamic law. It is clear that Islamic FinTech has developed and is now offering a broad range of services, even to SMBs. Crowdfunding platforms in Indonesia and Singapore adhering to Shari’a law have become more popular among Muslim investors.

On the other side, Kaptal Bost seeks to promote small and medium-sized enterprises (SME) access to capital through a crowdfunding platform that complies with Shari’a law.

These related terms also show Malaysia’s pioneer in Islamic FinTech development.

Cluster 3 (shown in yellow in Figure 11.4) illustrates the consumer behaviour topic of FinTech innovation and the Islamic financial service. IsFIs may face additional difficulties due to the development of FinTech and the heightened knowledge of customers about FinTech-based services. It has been shown in recent research that FinTech may serve as an IsFI alternative by functioning as a non-bank intermediary platform (Irfan & Ahmed, 2019). A Shari’a-compliant FinTech platform is free from the shareholder and regulatory limitations of a conventional or Islamic bank, allowing it to provide more specialised services (Hasan et al., 2020a).

Cluster 4 (shown in blue in Figure 11.4) is concentrated on keywords related to corporate culture, organizational culture, emotional intelligence, and technology innovation.

Finally, cluster 5 is focused on the COVID-19 topic with keywords like mobile banking, open innovation, and sustainability. FinTech revelation may soon be a part of the worldwide financial system, as seen by the popularity of mobile apps and open banking. When it comes to money and banking, advancements in FinTech have entirely changed the game using digital technology. As a result, FinTech is often defined as incorporating technological advancements in the financial sector. These aspects have been mainly observed as advanced technologies able to provide remote connections in the COVID times (Ascarya, 2022).

Figure 11.4 Density Visualisation with a Cut-off Value of 6

Discussion of Specific Articles

Based on the number of citations, the authors identified seventeen academic articles among the articles discovered within the bibliography analysis that explored FinTech and Islamic finance. This review confirmed the earlier cluster topics analysis made in the bibliography section. Cryptocurrency and Blockchain is the main topic mentioned and referenced by the reviewed articles; five articles had this focus. The second topic most mentioned is financial inclusion and small business. Topics like FinTech innovation and consumer perception are also researched in several articles. Figure 11.2 represents the mapping of the articles.

Nasir et al. (2021) highlight Blockchain and cryptocurrency’s influential and conceptual aspects in Islamic finance literature with bibliometric analysis. This study establishes conceptual characteristics, essential topics, and prospective research streams. The paper recommends three research streams: cryptocurrencies and Blockchain, privacy, data and information security, and optimum information systems. The research divides basic themes into centralised and motor themes. Consensus protocols, proof of work, DLT, Blockchain, and cryptocurrency operations and structure are underlined. Highly developed and developing topics are future roadmaps. FinTech, Islamic finance, valuations, and cryptocurrency dynamics are discussed. The views of professionals in Islamic finance and Shari’a scholars on Islamic cryptocurrencies are then investigated by M. Abdeldayem & Aldulaimi (2022) and M. Abdeldayem et al. (2021). The study used a qualitative research strategy by interviewing Islamic scholars to inquire into their thoughts on the design of the new Islamic coin. Based on the research conducted, it is clear that Islamic law does not cover the fundamental models for the typical use of cryptocurrencies (like Bitcoin) as a lawful or illegal equipment exchange method.

Table 11.4 List of Articles Reviewed and Data Extracted from Empirical Studies Identified by a Systematic Literature Review

| Authors | Method/ Paper Type | Findings | Road Forward |

| (Banna et al., 2022) | Quantitative / Research article | More digital financial inclusion (DFI) adoption increases Islamic banking stability, reducing default risk in the examined area. Moreover, incorporating DFI into Islamic banking promotes inclusive economic development that can make the financial sector viable during crises like the COVID-19 epidemic. | The study, based on the bank data of African and Mena countries, showed that proper application of FI facilitates a bank’s stability. However, this study has certain limitations owing to the lack of DFI data; hence more research is needed. |

| (M. Abdelday em & Aldulaimi , 2022) | Qualitative / Research article | This research presents a new Shari’a-compliant crowdfunding methodology. Content analysis indicated four primary topics as Islamic crowdfunding (ICF) model pillars: Project Idea (Halal) (28.5%), Funding Goal (36%), Return and Risk (14%), and Funding Commitments (21.5%). | Despite the growth of Islamic banking and the number of young Muslims using digital Islamic services, empirical research in the Middle East are insufficient. ICF has gained notice, and Middle Eastern SMEs require urgent finance. |

| (Khan et al., 2022) | Quantitative / Research article | The findings suggest that the independent variables in the UTAUT model have a substantial influence on the behaviour toward adopting Islamic financial technology, implying that consumers are ready to utilise Islamic financial technology while performing online transactions. | Islamic FinTech is crucial to the digital supply of Islamic financial services to clients to achieve Islamic finance goals of financial inclusion, social justice, and fair wealth distribution. Therefore, Islamic financial technology service providers should make the technology helpful and easy to use. |

| (Muryant o, 2022) | Legal research / Research article | Malaysia, Indonesia, and the UK top the GIFT Index. The list contains Islamic FinTech-supporting states. Shari’a compliance is the basic notion of Islamic financial regulation; hence weak monitoring and Shari’a compliance are hurdles. Rules, procedures, a Shari’a Supervisory Board, and standards are needed for Islamic FinTech. Shari’a-governed. | Islamic FinTech will attract investors and users and provide Shari’a-compliant financial services. Therefore, Shari’a compliance requirements, Shari’a supervisory bodies, and Shari’a governance standardisation are needed. This ensures Shari’a compliance and protects Islamic capital market investors and consumers. |

| (Nguyen, 2022) | Quantitative / Research article | While perceived financial expertise positively correlates with increased FinTech use, actual financial knowledge has no effect. | Financial institutions or FinTech enterprises should create and build more user-friendly FinTech products and services to enhance financial well-being. In addition, governments should prioritise user safety in developing countries where individuals are less financially aware. |

| (Nasir et al., 2021) | Systematic literature review / Research article | The paper recommends three research streams: cryptocurrencies and Blockchain, privacy, data and information security, and optimum information systems. The research divides basic themes into centralised and motor themes. Core subjects include Consensus protocols, proof of work, DLT, Blockchain, and cryptocurrency processes and structure. | FinTech, Islamic financial practises, cryptocurrency valuation methodologies, and structural development will shape Blockchain and cryptocurrency literature. |

| (M. Ali et al., 2021) | Quantitative / Research article | Economic gain, ease, and seamless transaction encourage Islamic FinTech. Customers’ trust implies a favourable view of technology. This skill displays a connection with Islamic FinTech. | This study’s findings might be used for FinTech strategy development, helping the global financial industry expand and reap the benefits of economies of scale. |

| (Rabbani, Asad, et al., 2021) | Theoretical approach / Research article | This research suggests ten novel Islamic financial services for each COVID-19 level. It also analyses how to employ these services at various phases to overcome pandemic economic impact. | Islamic financial services are founded on ethics and morals and welcome innovation to enhance financial services. Islamic finance’s social and open innovation will help resist COVID-19’s economic effects. |

| (M. M. Abdelday em et al., 2021) | Qualitative / Research article | Islamic law lacks the basic models for using cryptocurrencies (like Bitcoin) as valid or illegal trading instruments. Therefore, introducing Islamic cryptocurrency reconciles GOLDX and OneGram. | This research will examine if Islamic cryptocurrency will assist in reconciling cryptocurrencies in Islamic finance. A future study might include the perspectives and experiences of Islamic finance specialists and shari’a scholars on whether Islamic cryptocurrency could reconcile cryptocurrencies in Islamic finance. |

| (Naeem et al., 2021) | Quantitative / Research article | Strong safe-haven properties of ethical (green) bonds show that adding them to investment portfolios diversifies them for investors who take fewer risks during economic volatility. In addition, the hedge ratio and hedge effectiveness calculations show that green bonds hedge international stocks well. | The research has consequences for faith-based, ethical politicians and regulators. Green investors may meet their socially responsible goals by investing in sukuk, which is low-risk and interest-free. Policymakers may direct corporations to incorporate portfolio and risk diversifiers. |

| (Baber, 2020b) | Qualitative / Research article | The findings showed that FinTech finance has little influence on customer retention, whereas payments, consulting services, compliance, and crowdfunding do. | This report recommends that Islamic banks extend their FinTech services to retain customers. In addition, crowdfunding should be incorporated into the Islamic banking system to support social entrepreneurship, microfinance, and a worldwide zakat and sadaqa system. |

| (Shinkafi et al., 2020) | Library approach / Research article | The study found that robust technology, microcredit and microfinance services, a legal and regulatory commitment of regulators and policymakers of Islamic financial institutions, extensive public awareness of Islamic financial services and products, financial proficiency and literacy, and financial infrastructure are essential for financial inclusion, especially for women, low-income earners, and rural poor. | The topic is not definitive or all-encompassing. Future ideas should focus on developing the aspects above for improved financial inclusion among Muslims. In addition, other unmentioned issues should be considered. |

| (Suryono et al., 2020) | Systematic literature review / Research article | The findings reveal that FinTech research problems begin with identifying the framework, encompassing business and country-specific models. This affects government rules and policies. This sector needs broad standards that respond to technological advancements. Several nations have used regulatory sandboxes (incubation for FinTech start-ups). | FinTech developments have impacted other business models, such as payment. As a result, the FinTech business model and ecosystem are intensively researched. Mobile phones and the Internet enable this inquiry. In addition, big data can provide financial service information, including robo-advisors. Blockchain technology and cryptocurrencies need further investigation. |

| (Rosavina et al., 2019) | Qualitative / Research article | The findings imply that loan procedure, interest rates, loan fees, loan quantity, and loan flexibility affect respondents’ P2P lending aspirations. In addition, some firms use economic enterprises as a form of funding owing to their straightforward, affordable method and kinship-based basis. These features may explain why SMEs are hesitant to adopt P2P lending services. | This qualitative research can only remark on the meanings and experiences of the respondents, not the relevance of each aspect in convincing SMEs to utilise P2P platforms. Future studies should use surveys or experiments to find the best ways for each borrower. This study’s findings may be utilised in future research. Future studies using the same model may provide different findings as society develops. |

| (Asongu & Nwachuk wu, 2018) | Systematic literature review / Research article | Retained financial innovations focus on the rural-urban gap, women’s empowerment, and skills and training. Case studies, innovations, and investment methods have supported financial policy efforts, including informal finance, microfinance, mobile banking, crowdfunding, microinsurance, Islamic finance, remittances, PES, and the DIA project. | Future polls should include theory. Future research should concentrate on innovation processes and socio-technical issues. |

| (Gomber et al., 2018) | Book chapter | The paper evaluates FinTech innovation in four financial areas. First, the research discusses operations management in financial services and changes; technology innovations that have begun to leverage execution and stakeholder value with payments, cryptocurrencies, Blockchain, and cross-border payments; multiple innovations that have affected lending and deposit services, P2P lending, and social media use; and issues regarding investments, financial markets, trading, risk management, and robo- advisers. | Developing a new research agenda for IS in FinTech application domains has the potential to provide high-value academic information. |

| (Abedifar et al., 2015) | Empirical literature review / Research article | Islamic banks have less default/insolvency risk as efficient than ordinary banks. Islamic banks pursue high-margin, low-risk enterprises. Data suggests Islamic banks are competitive. Other (limited) research suggests Islamic banking may promote financial inclusion and economic development. According to studies, Islamic funds perform as well or better than conventional funds. They do not underperform industry standards. | More study is required on liquidity and market financing issues. In addition, pricing too-big-to-fail and other government safety net subsidies in Islamic banking systems and (hypothetical) stress testing of Muslim banks need additional study. |

A considerable step forward in understanding financial inclusion in Islamic finance has been made by Shinkafi et al. (2020), and their paper aims to provide a theoretical analysis of the factors necessary to realise full financial inclusion in Islamic finance systems. Findings from the study point to the importance of technological prowess, microcredit and microfinance services, the legal and regulatory commitment of regulators and policymakers of Islamic financial institutions, widespread public awareness of Islamic financial services and products, financial expertise and literacy, and sound financial infrastructure in bringing about financial inclusion, especially for women, low-income earners, and rural poor. Another essential paper also explains financial inclusion by Baber (2020a). The research attempts to analyse the performance of countries following Islamic and conventional financial systems in terms of financial inclusion and FinTech by using data from the World Bank and the Global Islamic Finance Report. The prevalence of Islamic and conventional finance in the nation led to the selection of ten countries representing both systems. To quantify the shift in demographic composition, data were analysed from 2011 to 2017, with 2011 serving as a baseline. According to the research, nations with a solid Islamic banking sector have a higher financial inclusion rate, and female financial empowerment is higher in these countries than in their counterparts. However, the opposite is true: more people are using FinTech in nations that rely on traditional banking systems. In light of the recent COVID-19 epidemic, the significance of digital financial inclusion (DFI) in stabilising the Islamic banking industry has been considered by Banna et al. (2022). The findings from their paper imply that increased DFI adoption improves the stability of Islamic banking, which in turn lowers the default risk of banks in the examined area. Therefore, integrating DFI into Islamic banking promotes inclusive economic development that may maintain the sustainability of the financial sector in times of crisis, like the recent COVID-19 epidemic.

M. Abdeldayem & Aldulaimi (2022) explore the potential of Islamic crowdfunding (ICF) as an alternative method of financing, and they analyse the engagement of small and medium companies (SMEs) in Islamic Finance. The research prompted several crucial questions: how are ICF programmes seen in the Middle East? Is it necessary to have an Islamic crowdfunding model for assisting SMEs in the Middle East region? What are the prospects for a Shari’a-compliant crowdfunding site? What elements should an Islamic crowdfunding platform have? The primary contribution of this research is a novel crowdfunding approach that is in accord with Islamic Shari’a law. Additionally, the content analysis uncovered four primary themes that serve as the foundational pillars of creating the ICF model. Project Concept (Halal) (28.5%), Funding Objective (36%), Return and Risk (14%), and Funding Commitments (10%) are all based on Islamic Shari’a requirements (21.5%). Additionally, the results showed that all four forms of crowdfunding (reward-based, donation-based, loan-based, and equity-based) are permissible according to Islamic law and backed by evidence from the Quran and Sunnah.

The article ‘Determinants of Behavioural Intentions to Use Islamic Financial Technology: An Empirical Assessment’ by Khan et al. (2022) reviews the literature on consumer behaviour in search of links to Islamic FinTech innovation and investigates the antecedents/determinants of behavioural intentions toward the utilisation of Islamic financial technology for Middle Eastern customers. The findings suggest that the independent factors in the UTAUT model significantly affect the behaviour to embrace Islamic financial technology, indicating that individuals are prepared to utilise Islamic financial technology while conducting online transactions. Similarly, Darmansyah et al. (2020) discuss the behavioural intention to use Islamic Finance to investigate the influential factors on behavioural intentions toward Islamic financial technology (FinTech) use in Indonesia, including the following FinTech services: payments, peer-to-peer lending, and crowdfunding. Positive behavioural intentions for using Islamic FinTech were significantly influenced by the latent variables of intended behaviour, acceptance model, and technology usage. The most critical component is the latent variable labelled “acceptance model.” Even though this research was only performed in Indonesia, it offers valuable strategic recommendations for policymakers as they craft a framework to promote the growth of Islamic FinTech and advance the goal of financial inclusion.

Table 11.5 Topic Clusters

| Cluster | Topic | Occurrence | Degree |

| 1 | alternative currencies | 6 | 84 |

| Bitcoin | 15 | 116 | |

| Blockchain technology | 10 | 102 | |

| Blockchains | 16 | 114 | |

| Cryptocurrencies | 15 | 116 | |

| Cryptocurrency | 8 | 94 | |

| Cryptography | 6 | 84 | |

| digital asset | 6 | 84 | |

| economic conditions in Malaysia | 6 | 84 | |

| financial services industry | 16 | 114 | |

| FinTech | 12 | 102 | |

| gold backing | 6 | 84 | |

| national cryptocurrency | 8 | 84 | |

| Shari’ah-compliant cryptocurrency | 6 | 84 | |

| webcrimes | 6 | 84 | |

| 2 | bank management | 8 | 88 |

| Bureaucracy | 8 | 88 | |

| business enterprises | 9 | 89 | |

| data security | 8 | 88 | |

| financial inclusion | 9 | 90 | |

| islamic law | 24 | 121 | |

| micro, small and medium enterprises (SMEs) | 8 | 88 | |

| non-bank financial institutions | 8 | 88 | |

| risk management | 8 | 88 | |

| Shari’a | 8 | 88 | |

| 3 | consumer behaviour | 7 | 21 |

| effect of technological innovations on financial institutions | 8 | 15 | |

| financial technology | 48 | 218 | |

| individual investors | 6 | 20 | |

| Intention | 7 | 30 | |

| islamic finance | 37 | 120 | |

| islamic FinTech | 13 | 49 | |

| perceived benefit | 7 | 31 | |

| Trust | 7 | 29 | |

| 4 | corporate culture | 13 | 23 |

| emotional intelligence | 7 | 12 | |

| employee attitudes | 7 | 17 | |

| organisational citizenship behaviour | 14 | 26 | |

| organisational culture | 6 | 12 | |

| organizational behaviour | 19 | 22 | |

| organizational citizenship behaviour | 19 | 28 | |

| technological innovations | 6 | 8 | |

| 5 | banking industry | 6 | 21 |

| covid-19 | 7 | 17 | |

| covid-19 pandemic | 17 | 53 | |

| mobile banking | 6 | 22 | |

| open innovation | 8 | 21 | |

| Sustainability | 6 | 9 |

Finally, the topic of Open Innovation, which is recently featured in the global FinTech market, is discussed by Rabbani et al. (2020), associating the topic with Islamic Finance. The chapter recommends Islamic banking as a viable strategy to assist afflicted countries safely get through the economic turmoil coming from the epidemic. A four-stage model of the COVID-19 pandemic is identified, and ten novel Islamic financial services are proposed. The report also examines the economic impact of the pandemic and how these services might help mitigate that impact at specific points. The remarkable rise of the Islamic banking sector is primarily because it welcomes innovation, particularly social and open innovation. It has played a vital role in its growth in the past. The battle against the economic effects of the COVID-19 epidemic will be fought through social and open innovation in Islamic finance.

Conclusion

Islamic financial technology can significantly impact the industry as a whole. It can improve the share of corporate and consumer financing that adheres to Shari’a principles and mirrors the growth of the global FinTech ecosystem. Islamic financial technology is progressing thanks to the efforts of governments, new corporate ventures, and individual customers working together to create a strong value chain. The Dubai International Financial Center in the United Arab Emirates and FinTech Bay in Bahrain have recently taken steps to ensure the industry’s continued success. The government’s involvement might be crucial in the growth of the Islamic FinTech industry. In addition, there is a need for digital technology-based product offerings among Muslim consumers, and this trend is only expected to accelerate in the coming years. To ensure Shari’a-compliant products may be bought and sold worldwide, Islamic FinTech has much promise in this context. Thus, the industry’s competitiveness and the range of products it provides may improve. However, the development of relevant Shari’a standards by the required regulatory organisations is essential for the growth of the Islamic financial technology industry. Additionally, Islamic FinTech-specific reporting and governance standards can potentially improve the operational efficiency and transparency of businesses that use Islamic FinTech.

Several national monetary authorities, including the Central Bank of Bahrain, Bank Indonesia, and Bank Negara Malaysia, have identified the requirements for the efficient regulation of Islamic FinTech companies. From a worldwide perspective, we have endeavoured to address essential difficulties in developing Islamic FinTech to give the required help to regulators and academics. This is precisely what we planned. The results of this study can provide fresh insight into this developing area of research. Islamic FinTech has significant growth potential as part of the Islamic economy. UAE Islamic FinTech has a significant Muslim population, a fast-growing halal economy, and the assistance of Islamic organisations. However, Islamic FinTech still confronts local restrictions, cumbersome and overlapping permission processes, and exploitation of FinTech for terrorist funding, illicit FinTech operations, and high consumer dispute incidence. One strategy to overcome these challenges is to create the Islamic FinTech Act, which should cover criminal sanctions, centralised certification, a transparent distribution of power, coordination and synergy between authorities, prevention and mitigation of a digital financial crisis, dispute resolution mechanisms, and alternative institutions for FinTech dispute resolution.