In the last two annual editions of GIFR, we have focused on the external shocks like the COVID-19, with references to some previous major crises. In the past two decades, two crises hit the financial sector in significant ways: the global financial crisis and COVID-19. The great recession in 2008 was the first crisis where it did not just affect financial institutions, but also individuals. It started with a housing market bubble due to low-interest rates on mortgages, leading to credit defaults that eventually hit the financial institutions (2008-2009 Global Financial Crisis, 2022). According to the Financial Crisis Inquiry Report (2011), this economic and financial crisis was avoidable due to human activity and not a natural disaster. The report indicated that the crisis resulted from a lack of regulation and supervision, failure in corporate governance, failure in risk management, and lack of transparency.

The global financial crisis led several financial institutions to file for bankruptcy, including America’s fourth-largest bank Lehman Brothers, which resulted in the lay-off of a large number of employees. 2.6 million jobs were lost in the United States, and the unemployment rate increased to 7.2% by the end of 2008 only. Despite this pessimistic outlook, an IMF study in 2010 found that, on average, Islamic banks have shown stronger resilience during the great recession than conventional banks and that the Islamic banks have contributed to the financial and economic stability during the crisis. This was achieved arguably because of the business model of the Islamic financial institutions that is presented to be based on actual economic activities that are ethical and compliant with Shari’a.

The technology industry was booming and advancing day-by-day when the financial industry was going through this crisis. This gave the startups and entrepreneurs an excellent opportunity to utilize the advanced technologies to provide financial services directly to consumers, especially with the lack of trust in the traditional financial systems by many customers globally and the increasing regulatory requirements on these financial institutions. This has led to growth of FinTechs that are now offering financial products and services that once only banks provided. The market valuations of FinTechs have quadrupled since the great recession in 2008.

Similar conditions were behind the birth of Islamic FinTechs in the Islamic financial industry. FinTechs used technologies to provide Islamic financial services and products based on risk sharing, value creation, and ethics (Shari’a-compliant). Furthermore, just like the conventional FinTechs, the Islamic FinTech landscape covers the following areas: alternative finance, Robo- advisors, crowdfunding, Blockchain and cryptocurrencies, payments, P2P lending, digital banks, investments etc. It is worth noting that the only difference between conventional FinTech and Islamic FinTech is the Shari’a-compliance aspect, where Islamic FinTech follows the principles of Islam and ethical practices. As discussed in GIFR 2021 and further elaborated in this edition of GIFR, the Islamic finance industry has been relatively slow in its growth since 2008. This may provide an opportunity to Islamic FinTech firms to play a role in the next wave of growth in the Islamic finance industry.

COVID-19 Pandemic and Islamic FinTech

The world faced the COVID-19 pandemic in late 2019, which resulted in another crisis for the whole economy before fully recovering from the first crisis in 2008. The pandemic started as a global health emergency and became the most significant financial crisis in the past few decades. Despite that, the global financial crisis in 2008 had a significant impact on the economy; there is no doubt that the COVID-19 pandemic had a more substantial impact. This is mainly because the financial crisis began with an economic shock on the demand side of the economy, unlike the pandemic that directly affected the real economy and consequently moved to the supply and demand side of the economy.

Therefore, based on a study by Roland Burger (2020), “the COVID-19 pandemic is hitting many industries harder than the 2008 financial crisis, and most industries will take longer to recover from the losses they sustain”. Hence, financial service providers are expected to play a key role in recovery efforts during and after the pandemic as these are the backbone of any financial system that contributes to the economy’s wellbeing. Islamic FinTechs are one of these financial services providers that found the opportunity in this pandemic to expand their services and products in order to contribute to the recovery of the economy.

Looking into the nature of the pandemic, it is clear that it did not only affect the economy but also consumer behaviour. For example, customers during the lockdowns and in order to avoid close contact with each other increased their usage of digital channels and remote tools to conduct their day-to-day businesses including their financial activities. Here are some numbers indicating the changing consumer behaviour by becoming more digital savvy irrespective of their age or tech literacy during the pandemic:

- 76% of customers expect firms they deal with to provide e-commerce services (KPMG, 2020).

- 82% of consumers stated that they are more likely to use digital wallets or cards in the future (KPMG, 2020).

- 43% of customers say that the main reason to switch to digital banking is for greater convenience and availability (Hajro, Hjartar, Jenkins and Vieira, 2021).

- 72% rise in the use of FinTech apps in Europe since the lockdown (Moden and Neufeld, 2020).

- 35% of customers have increased their online banking usage during COVID-19 (Moden and Neufeld, 2020).

- More than 40% growth in contactless transactions globally during the pandemic reported by Mastercard (Moden and Neufeld, 2020).

- PNC Bank’s CEO said that the bank sales jumped from 25% digital to nearly 75% digital during COVID-19, condensing 10 years’ worth of changes into two months (Moden and Neufeld, 2020).

All these numbers prove that customers, globally, have become more comfortable using digital channels and FinTech applications for their financial services, which has resulted in greater adoption and demand for digital financial services and FinTechs. Furthermore, this pandemic has addressed one of the major issues Islamic FinTechs were facing pre-COVID-19 era related to consumer awareness and trust to use FinTechs and mobile applications for financial transactions. Providing Islamic digital financial services and products became a must during and after COVID-19, not only due to the health emergency state but also due to the demand created by a new consumer behaviour in the market. Therefore, many Islamic financial institutions are keeping digital transformation and FinTech on their top priorities to survive and thrive in the market.

It is worth noting that Islamic FinTech through its various forms, can provide Islamic social financing like sadaqa (charity), awqaf (endowment), zakat (obligatory almsgiving), qard hasan (benevolent loan) etc. to support rebuilding and recovering from the COVID-19 pandemic. The Islamic Social FinTech are in line with the United Nations Sustainable Development Goals (SDGs) that encourage social trust, solidarity, and cooperation to fight poverty and hunger and that is, in essence, the values of Islam (Islamic Development Bank, 2021). Sadaqah Ummah Crowdfunding is an example of Islamic Social FinTech that was born out of the COVID-19 pandemic through necessities to meet the needs of the society and help them overcome their financial challenges through online donations.

Many Islamic financial institutions are keeping digital transformation and FinTech on their top priorities to survive and thrive in the market

Islamic FinTech Outlook in 2022

The Islamic FinTech landscape has improved throughout the years, especially when comparing the landscape pre-COVID-19 with during COVID-19. According to another report3 on Islamic FinTech Landscape, as of August 2022, globally, there are 309 Islamic FinTechs categorized into 12 verticals including alternative finance, blockchain and cryptocurrency, challenger banking, crowdfunding, data and analytics, Islamic enablers, PSP finance, payment and remittance and FX, personal finance management, Robo advisors, taka tech, and trading and investment. Figure 9.1 shows the Islamic FinTech Landscape in 2022.

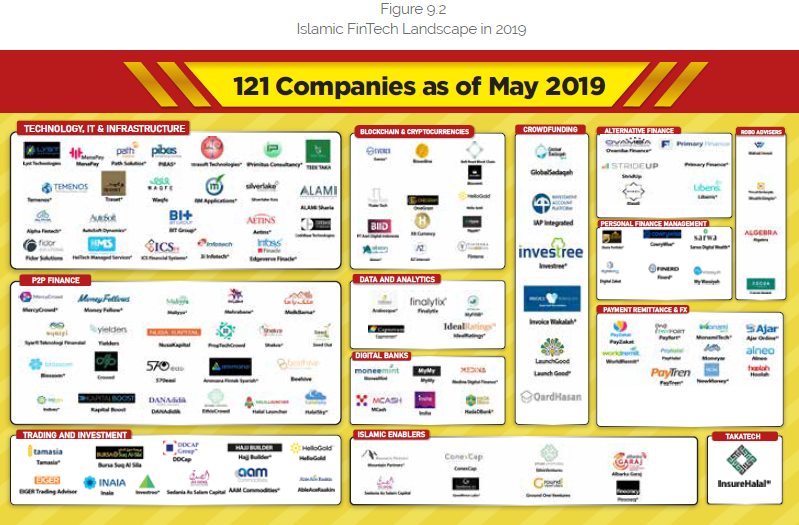

In the meantime, the Islamic FinTech landscape as of May 2019 (pre-COVID-19) has consisted of 121 Islamic FinTechs categorized into 13 verticals such as alternative finance, Blockchain and cryptocurrency, challenger banking, crowdfunding, data and analytics, Islamic enablers, PSP finance, payment and remittance and FX, personal finance management, Robo advisors, taka tech, trading and investment, and technology, IT and Infrastructure (which was removed from the landscape in 2022). Figure 9.2 presents the landscape of Islamic FinTechs in 2019.

Islamic FinTech Landscape 2022

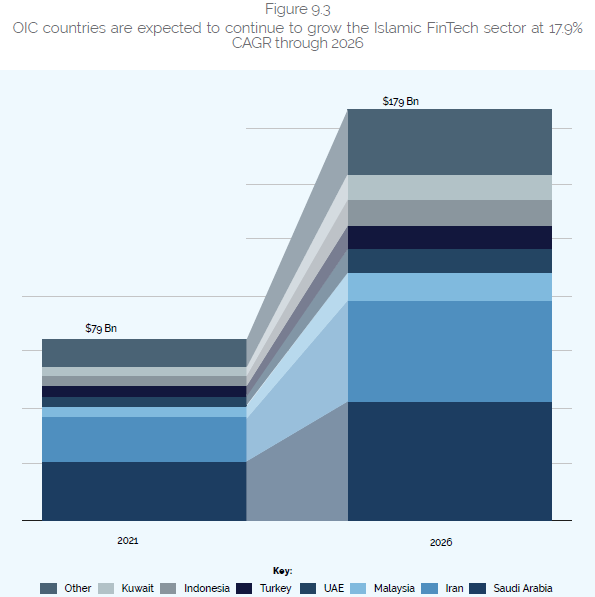

The two landscapes show that the number of Islamic FinTechs drastically increased by 155% after the COVID-19 pandemic. Despite that the number is still very low compared to the conventional FinTechs that reached around 26,000 (Statista, 2021). This growth indicates that the Islamic FinTech sector is maturing, and it still did not tap its full potential. In fact, based on the Global Islamic FinTech Report 2022, the market size of the Islamic FinTech sector as of 2021 was US$79 billion and it is expected to grow up to US$179 billion by 2026 at a CAGR of 17.9% compared to the overall global FinTech industry, which is expected to develop at a CAGR of 13.5% over the same time period (see Figure 9.3). This shows that there is an enormous potential for the Islamic FinTech landscape to further grow and introduce more FinTechs that provide Islamic financial services and products, especially in certain regions that have the right supporting ecosystem. Currently, the biggest countries in terms of projected Islamic FinTech market size are the kingdom of Saudi Arabia, the Islamic Republic of Iran, and Malaysia.

The Islamic FinTech market is dominated by Organization of Islamic Cooperation (OIC) countries with few non-OIC countries (like the United Kingdom, Singapore, Hong Kong, United States of America, and Australia) being on the top 20 Islamic FinTech markets based on the Global Islamic FinTech Index (GIFT Index). This index assesses the countries based on the most conducive to the growth and development of the Islamic FinTech ecosystem and market and it uses the following categories for the assessment: regulation, capital, talent, Islamic FinTech market and ecosystem, and the infrastructure of the country.

According to GIFT index, the top ten countries for Islamic FinTech based on the earlier mentioned criteria, in sequence, are Malaysia, the Kingdom of Saudi Arabia, the Republic of Indonesia, United Arab Emirates, the United Kingdom, the Kingdom of Bahrain, State of Kuwait, the Republic of Singapore, State of Qatar, and finally Hong Kong. These top countries host 82% of the Islamic FinTechs that exist in today’s landscape and 50% of these Islamic FinTechs are from the five main FinTech verticals that the majority of these FinTechs are listed under them, like crowdfunding, payments, challenger banking, Robo advisory, and alternative finance.

As the Islamic FinTech market is growing, the sector is expecting to see more countries providing a supportive ecosystem to Islamic FinTechs and improve their index to become a leader in this space. For example, the Kingdom of Saudi Arabia has managed in a very short period of time to move its market maturity from emerging to a leader and similarly other countries in near future are expected to witness such improvement in the maturity level.

Islamic FinTech Challenges and Opportunities

Despite that during the COVID-19 pandemic, the world witnessed an increase in tech literacy, the lack of Islamic financial literacy is still there, which is affecting the growth of Islamic FinTechs and the adoption of their solutions in some markets (Dawood et al., 2022). Similarly, as indicated by a survey conducted in the Global Islamic FinTech Report 2022, the Islamic FinTechs see consumer education as the number one challenge that impacts their growth. In fact, low financial literacy halts the progress of financial inclusion, especially in regions that are dominated by Muslims. Accordingly, addressing this challenge can improve the rate of adoption of Islamic FinTech to achieve financial inclusion, which is not only an Islamic value but also leads to realizing the United Nations SDGs through improving welfare and decreasing poverty levels.

Another challenge faced by Islamic FinTechs is the access to capital, where it is hard for FinTech startups to raise finance for their business growth, as in most cases, investors find it difficult to understand the business model of the Islamic FinTechs (Rabbani, 2022). The growth of such FinTechs is not possible without having access to funds that allow them to expand into new markets or even improve their digital financial offerings using the latest technologies. Accordingly, it is crucial for Islamic FinTech sector key players to not only educate their consumers to improve the adoption rate but also educate the investors to ensure better chances to access funds that will help Islamic FinTech survive and compete with conventional counterparts.

In addition, regulation is one of the major obstacles for the Islamic FinTechs to operate in most jurisdictions, as very few jurisdictions have dedicated Islamic FinTech-related regulations that allow operations of such businesses in their market. This also goes to the fact that there is still a lack of awareness about Islamic FinTech and its potential by regulators globally. Such regulations help Islamic FinTechs to secure investors and access capital besides introducing innovative solutions in the market (Rabbani, 2022).

Based on the GIFT index, countries like Malaysia, the Republic of Indonesia, the United Arab Emirates, and the Kingdom of Bahrain score the highest in the regulation category, which shows that their ecosystems are well-regulated for Islamic FinTechs to operate. Moreover, Islamic FinTech startups have selected the local regulatory environment as one of the top five factors to consider before choosing a Headquarters location for their business based on a survey by the Global Islamic FinTech Report (DinarStandard and Elipses, 2022).

The opportunities on the other side for Islamic FinTechs are tremendous. The COVID-19 pandemic has been a blessing for Islamic FinTechs to grow as it established the foundation for accepting the use of different technologies to conduct financial transactions and activities. This by itself can help Islamic FinTechs gain the trust of their consumers and increase the adoption accordingly. In this regard, the World Bank has mentioned in one of its reports that the young global Muslim population is composed of more than half of the global population that is under 34 years old (World Bank, 2020). This young base of the Muslim population is known to be tech-savvy and can be the future customers of these Islamic FinTechs or even the entrepreneurs that will establish new Islamic FinTechs in the market.

As of 2020, there were around 2 billion Muslims that, according to the World Bank, are becoming wealthier and more digital savvy. This population of Muslims would prefer following their Islamic values in their financial transactions, which creates another opportunity for Islamic FinTechs, especially in the wealth management and investment categories, to come up with suitable products and services to cater to the demand of this growing population. Overall, it is expected that the global Muslim population will have a higher growth rate compared to other religions reaching 26.4% of the world population by 2030. This number shows that there will be an increasing demand for Islamic FinTech products and services by the growing global population, especially in Pakistan and Indonesia which are expected to become the two largest Muslim populations in 2030 (World Bank, 2020).

As the Muslim population grows, it is noticeable that the unbanked population are dominated by countries with a high Muslim population. In fact, in many OIC countries, there are a high number of adults that are not part of the financial system. Therefore, it was found that there is only 41% financial account ownership in the OIC countries, which is considerably lower than the higher-income countries. This unbanked population can be an attractive target market for Islamic FinTechs, as first, it is in line with their Islamic values and second, it matches their tech savviness and current mobile penetration. It is worth noting that 15 member countries of OIC are listed in the list of top countries globally for smartphone penetration (Ordóñez de Pablos, Zhang and Almunawar, 2021). This is a great indication of improving financial inclusion through Islamic FinTechs.

So far most of the Islamic FinTechs in the landscape have copied the business model of the existing conventional FinTechs. However, there is a huge opportunity left on the table related to social financing based on Islamic principles and values that encourages charitable contributions through sadaqa, waqf, and zakat etc. This aims at moving people away from the poverty line and giving them access to finance that can help them become self-sustaining eventually.

The challenge that this system is facing is the process of collection and channelling the money received to the concerned individuals without any fraud. This challenge can be easily solved through Islamic FinTech solutions, which can direct the money through bank accounts in the financial system and eliminate any potential fraud. The provision of such services by Islamic FinTechs can without doubt contribute to the financial inclusion of more Muslim populations.

Islamic social finance is a multibillion-dollar pool that can be accessed by Islamic FinTechs. For example, only the zakat can contribute around US$200 billion to US$1 trillion towards the elimination of poverty (Rehman and Pickup, 2018), admittedly a questionable statistics. Another example is waqf, where only Indonesia has the potential of waqf assets reaching US$60 billion, followed by India with around US$24 billion. These numbers indicate that there is a potential that can be tapped by Islamic FinTechs in a profitable and sustainable manner.

Creating a Conducive Ecosystem for Islamic FinTechs

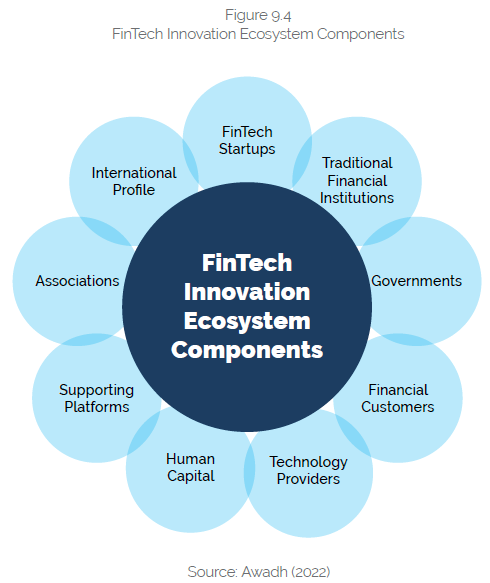

In order to improve the existing landscape of Islamic FinTechs and ensure their growth, countries (especially the OIC countries) should be working on improving their current Islamic FinTech ecosystem and making it more conducive. Based on the below framework, countries need to focus on developing these nine areas to build the right FinTech ecosystem such as FinTech startups, traditional financial institutions, government, financial customers, technology providers, human capital, supporting platforms, associations, and international profile (Awadh, 2022). Summary of these is given in Figure 9.4. Each of these will be explained in relation to Islamic FinTech.

FinTech Startups

The existence of Islamic FinTechs in the market encourages other Islamic FinTech startups to expand in this market as well as new Islamic FinTech startups to be established in this market. The more the country hosts Islamic FinTechs, the more mature the market becomes as it will have experience dealing with different types of Islamic FinTechs and the consumers will also be familiar with using and adopting such services. In fact, the local FinTech industry in any market is one of the top 3 factors that Islamic FinTech firms consider in determining their FinTech Headquarters location (DinarStandard and Elipses, 2022). Therefore, countries need to give importance to hosting more Islamic FinTechs in their markets.

Traditional Financial Institutions

A market that has Islamic financial institutions creates a better supportive ecosystem for Islamic FinTechs, as many of these FinTechs depend on Islamic banks for some of their operational activities. Besides, Islamic financial institutions, nowadays, depend on FinTechs as well for their digital transformation activities and innovation. Hence, having Islamic financial institutions in the country can help and encourage Islamic FinTechs to grow.

Government

The role of governments can be seen from two perspectives. First, with respect to a government’s utilization and adoption of Islamic FinTech solutions in its services provided to the public. This can encourage Islamic FinTechs to expand into such markets to provide their innovative Islamic financial services and products, given that there is a strong foundation that supports these types of solutions. Second, the introduction of supporting regulations allowing testing of Islamic FinTech products in a safe environment (such as FinTech sandbox), and catering regulations that would fit the nature of the Islamic FinTech business model.

Financial Customers

One of the major factors leading to the success of Islamic Fintech is to have a target segment of customers that are willing to use and adopt Islamic FinTech services and products. In fact, the proximity of target customers is one of the top 3 factors that Islamic FinTech firms consider in order to determine their headquarters location (DinarStandard and Elipses, 2022). Therefore, having a tech-savvy Muslim population that would use such services can lead to having a better ecosystem for Islamic FinTechs to grow.

Technology Providers

Markets that have strong technology infrastructure and technology providers can create a supportive ecosystem for Islamic FinTechs to exist and grow. This could come in different forms, be it from having cloud service providers in the country to having solutions like banking-as-a-service (BaaS) etc. These technologies can be used by Islamic FinTechs to build their business model and easily operate in the market.

Human Capital

Human capital is another key factor that the GIFT index used to assess the maturity of an ecosystem for Islamic FinTechs. It is indeed a vital factor for Islamic FinTechs when deciding on their headquarters location to operate. Based on the GIFT index, countries like Malaysia and Turkey score the highest in the availability of talent that would support Islamic FinTechs. These talents need to be equipped with knowledge in both Islamic finance and technology.

Supporting Platforms

These platforms come in the form of incubators and accelerators that would support the growth of Islamic FinTechs in the market. They play a crucial role in the success of Islamic FinTechs in any market given the services they provide to ensure that Islamic FinTechs are able to overcome the challenges, and leverage the potential of the market to achieve the growth of their business. Therefore, having such platforms will give an edge to any ecosystem aiming to become a leader in Islamic FinTech.

Associations

Having associations that would act as representatives for Islamic FinTechs in the ecosystem can play a major role in improving the existing ecosystem. These types of associations can bring the FinTech together to discuss their challenges and propose solutions to concerned authorities in the market. Furthermore, they can create the necessary awareness required in the market or even lobby with financial institutions and regulators to address new requirements or demands. Such bodies strengthen the existence of Islamic FinTech and encourages more Islamic FinTechs to be established. Each market nowadays has its own representatives, for example, FinTech Saudi in the Kingdom of Saudi Arabia; Fintech Association of Malaysia (FAOM) in Malaysia, and Bahrain FinTech Bay in the Kingdom of Bahrain.

International Profile

Creating an internal strong ecosystem is a positive sign for a conducive Islamic FinTech ecosystem. However, it won’t reach its full potential unless well marketed globally. Collaborating with other ecosystems can create a more inclusive ecosystem that can support Islamic FinTechs locally to expand to new markets and further grow and vice versa. These collaborations can open doors not only for expansion but also to cross-test Islamic FinTech solutions with other countries, which can lead to providing unique Islamic financial products that can contribute to the financial inclusion amongst Muslims.

Finally, looking into the conditions during the COVID-19 pandemic, we can anticipate that the Islamic FinTech status post-COVID-19 can be very optimistic and have the potential to lead in the Islamic finance industry. However, in order for these Islamic FinTechs to grow and lead, they would require a conducive ecosystem that would provide them with the required support.