Introduction

Islamic banking is growing in Turkey. The industry is garnering both domestic and international interest, with Turkish citizens increasingly adopting Islamic banking services. However, due to the secular nature of the constitution, Islamic banking is not known as such; rather employing the less religious connotative term, “Participation Banking”. Irrespective of this subtle difference in terminology, the services on offer by Participation banks follow Shari’a guidelines and allow customers to transact within an Islamic framework.

The story of Participation Banking in Turkey begins in the early 1980s. Similar to most Islamic finance genesis stories in other parts of the world, a sizable group wished to obviate interest transactions and mobilize idle funds into the real economy. It was anticipated that this would be a faithful solution to the problem of capital insufficiency, which was blighting the Turkish economy. Keeping money idly in hand or investing it on unproductive investments appeared to be major obstacles in the healthy running of the economy.

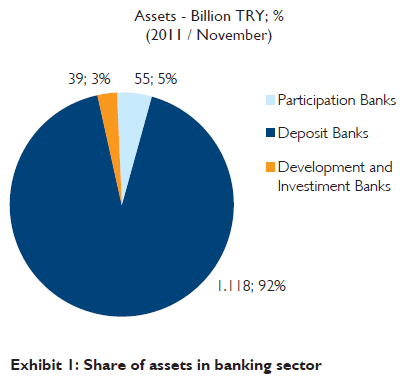

Until 2005, Participation banks, previously known as “Special Finance Houses”, were excluded from Turkish banking law. The Banking Law of 2005 was the first time where Participation Banking gained legal recognition. Currently, the banking system in Turkey consists of deposit-taking banks, development and investment banks, and Participation banks. There are four Participation banks at present in Turkey working on an interest-free basis and according to Turkish banking law. The banking law does not permit any Participation bank to operate in Turkey without being a member of Participation Banks Association of Turkey. In effect, Participation banks and conventional banks all operate according to the same sub regulations although there are differences concerning ac- counting practices and certain regulatory requirements

In the beginning, to attract the savings of religiously sensitive people and channel funds into the real economy, it was necessary to create the Islamic financial intermediary. Albaraka Turk and Faisal Finans ( now known as Turkiye Finans after a change of ownership in 2005) were the first two banks to receive licences in 1985. Kuveyt Turk, formed in 1989, was a Gulf-oriented bank with its capital share held by the Directorate General of Foundations of Turkey. The last of the current four Participation banks in Turkey, Asya Finans, was formed in 1996, with initial paid-up capital coming from local investors. In the process of creating a robust and competitive Islamic finance industry, there have been casualties. Ihlas Finans is one notable example. Formed a year before Asya Finans, it suffered heavily during the 2000-2001 economic crisis and was forced to close. Weak internal management, imprudent financing within the group, and poor crisis management strategies were major contributors to its liquidation. Despite the insolvency, other Islamic banks in Turkey managed to survive, and gradually grow.

| Participation | Capital Owners | Assets Volume | Net Profit | Return on Average | Number of |

| Bank | (% Share) | Million TRY | Million TRY | Equity (ROAE) (%) | Branches |

| (Dec 31, 2011F) | (Sep 30, 2011) | (Sep 30, 2011) | (Dec 31, 2011) | ||

| Albaraka Turk | 54,06% ABG (Albaraka Banking Group); 7,84% IDB; 22,23% Publicity; 15,87% Others | 10.457 | 110 | 12,2% | 123 |

| Bank Asya | 52,46% Publicity; 47,54% Others (no one holds 10% or more capital share) | 17.190 | 164 | 8,1% | 200 |

| Kuveyt Turk | 62% KFH (Kuwait Finance House); 19% Directorate General of Foundations; 9% IDB; 10 Others | 14.890 | 161 | 12,1% | 180 |

| Turkiye Finans | 64,68% NCB (National Commercial Bank); 21,56% Boydak Group; 13,69% Ulker Group; 0,07% Others | 13,528 | 161 | 10,9% | 182 |

Over the last decade, the regulatory and legal infrastructure overseeing Participation banks in Turkey has developed and strengthened. Turkey’s model of Islamic banking is one that can be analysed and followed by nations who wish to enter this industry due is stability and flexibility. The Turkish Participation Banking authorities have delivered seminars to representatives from countries that are interested in the sector.

Additionally, the foreign trade and GDP capacity of Turkey have improved annually from 2003. The success is attributed to the stability of the Turkish government and political and regulatory focus on the real sector. The Turkish banking sector assets accounted for 61% of GDP in 2002. This ratio reached 88% by the end of 2011. The strong economy and the growing importance of the overall Turkish banking sector provides the necessary space for Participation banks to develop.

Capital market efforts of participating banks

The interest-free banking system in Turkey has been strengthened with the introduction of capital market instruments such as sukuk, Income Indexed Bonds (IIB) and a Participation Index on the Istanbul Stock Exchange Market (ISEM).

- Sukuk

On April 1st 2010, the Capital Markets Board of Turkey (CMBT) issued a Communiqué which contain provisions relating to the issuance of sukuk. The Commu- niqué focused upon the procedure relating to the issuance of the ijara sukuk. It was followed by two issuances of sukuk by Kuveyt Turk: a 3 year USD100 million Sukuk and a 5 year USD350 million sukuk issued in November 2011. The issuance of sukuk was further facilitated by the introduction of new tax rates, which made sukuk more competitive with treasury bonds.

- Income indexed bonds

The Undersecretariat of Treasury, attached to the Turkish Prime Ministry, periodically issues IIB, the first of which was issued in 2009. Participation banks are avid customers of IIBs and as of June 2011, represented 70% of the market.

- Participation Index

The Participation Index was launched in January 2011 on ISEM with an investment fund based on the Index to be created soon. These developments are expected to meet, at least to some extent, the needs of those in Turkey who wish to transact within the parameters of the Shari’a.

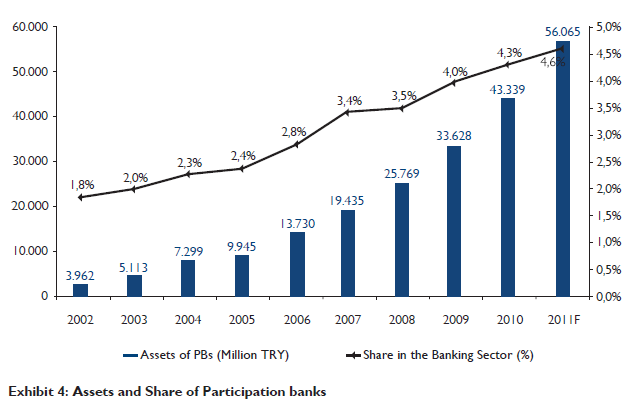

Real sector banking model

Although the retail banking share of Participation banks increased from 15% to 17% in the last quarter of 2011, financing the real sector has always been the primary focus for Participation banks. Precautions taken by Banking Regulation and Supervision Agency (BRSA) enabled banks to go through the financing processes easily. Restructuring some of the payments of the bad debts by the banks decreased the volume of non-performing loans in the whole banking sector (including Participation banks). In 2011, the main challenge for the banking sector has been profitability. Increasing the reserve rates by the central bank along with the payment of duty expenses to the government to open new branches has adversely affected overall banking sector profits. With the ongoing global financial crisis acting as a backdrop, the Turkish banking sector has had to navigate through uncertain times. However, Participation banks increase their share in the sector, registering improvements in their financials. The share of Participation banks in raised funds increased to 5.5%, in allocated funds to 5.8% and in total assets to 4.6%. Despite the weakening of the Turkish Lira (TRY) against the dollar by 23% over the last year, as the main collecting instrument was in TRY, the increase in the raised funds of Participation banks was 18% in 2011 as compared to 2010.

| FINANCIAL TOPICS | 2010 | 2011/November | Change (%) | 2010 | 2011/November | Change (%) | |

| Raised Funds | 33.276 | 38.506 | 15,7% | 626.181 | 699.558 | 11,7% | |

| Financing | 31.929 | 40.584 | 27,1% | 551.622 | 701.481 | 27,2% | |

| Assets | 43.339 | 55.309 | 27,6% | 1.006.671 | 1.212.374 | 20,4% | |

| Equity | 5.457 | 6.116 | 12,1% | 134.545 | 143.310 | 6,5% | |

| Net Profit* | 694 | 734 | 5,8% | 20.366 | 18.257 | -10,4% | |

| Employees | 12.677 | 13.771 | 8,6% | 191.180 | 195.508 | 2,3% | |

| Branches | 607 | 685 | 12,9% | 10.066 | 10.594 | 5,2% |

Participation banks continued to branch out across the country spreading the allocation of funds. In this way, not only are the pools of funds protected from high risks, but various sectors are supported by these funds. As of November 2011, the highest share of funds was allocated to construction (15%). This was followed by wholesale trade and commission business (12%), house financing (12%), textile (6%), food (5%), metal (4%),

energy (4%), credit cards (3%) and retail trading 3%. It is notable that construction is a sprawling sector and accommodates approximately 250 sub-sectors in the Turkish economy. Thus, with a higher percentage of the funds from Participation banks placed in this sector, there is a much larger trickle-down effect in society. The remaining 36% of funds were used in 50 other industrial sectors. The diversity ensures that financial risk is distributed across many sectors and is not localised.

Though one of the most trusted and applied financing techniques in Participation banks is murabaha, comprising 95% of banking instruments, it is highly recommended that other techniques such as mudaraba and others should be used in order to meet the needs of the public.

Systematic protection through Profit and loss sharing

The principles of Islamic finance protect Participation banks from many of the risks that typically affect conventional banks. The use of the Profit and Loss sharing model by Participation banks allows exposure on both the upside and the downside of a transaction between the investors mand the banks. Neither party is overly exposed to the risk of loss, thereby producing an equitable distribution of risk and profit and a minimisation of loss of profits.

Profits for the conventional banking sector fell by 10.4% according to figures published in November 2011. How- ever, for Participation banks, profits have increased by 5.8%. A possible reason for this is the sharing of profit with account holders, as opposed to the investment of funds on riskier ventures. Additionally, the fact that financing by Participation banks has been made in return for invoices and that repayments have usually been made by monthly instalments ensures mobility and security in financing.

Absorbing crises and crisis management

The uptake of retail banking operations has been increasing in Turkey, paralleling the experience of neighbouring countries. Regulatory authorities have been keen to ensure that the market does not overheat and, in this regards, no mortgages have been sold in the Turkish capital markets. This protected the market from a crisis though it must be mentioned that the market share was only 11% of total financing. Nevertheless, unbridled speculation and the instruments, which propagate such activity have not been allowed by the public authorities making Turkey a wholly safe harbour.

At present the Government of Turkey guarantees Participation bank deposits of up to 50 thousand TRY per individual participation account. They are also subject to the regulations of BRSA and are required to maintain a saving/deposits insurance fund in the case of liquidation. This has served to enhance confidence. The Participation Banking system has therefore proven to be resilient to the current crisis leveraging off the sound structural principles of the Islamic financial system.

New instruments

improve and deepen the system

With Income-Indexed Bonds (IIB), Participation banks were given the chance to evaluate their excess cash and investments on commodity murabaha facilities abroad. As of June 2011, Turkish treasury issued IIB amounting to TRY2.4 billion (USD1.3 billion). They are an alternative to treasury bills, constitute a second-hand sale opportunity and create a channel for insurance operations through which funds can be invested. The permission to invest pension insurance funds into Participation banks’ accounts was given in Turkey in 2010. There have been agreements between Participation banks and insurance companies to perform Islamic-compliant investments. For example, Kuveyt Turk and Vakıf Retirement Insurance, Turkiye Finans and Garanti Retirement Insurance; and Albaraka Turk and Anadolu Hayat Retirement Insurance.

The bill for public finance through the use of public property is still on the agenda of the Turkish Grand National Assembly. This bill shall regulate interest-free financing instruments like sukuk issued by the state. There has been an official declaration from the State that sovereign sukuk will be issued in 2012.

The communiqué concerning sukuk, issued in April 2010 by the CMBT, addresses the legal issues surrounding the issuance of the sukuk, the preferred structure for constituting the sukuk and implications of the sukuk for the domestic market. Attention was given to the ijara model, but other structures may also be constructed, by way of analogy. The communiqué is considered a rather revolutionary piece of legislation, and notwithstanding certain issues, will underpin the issuance of future sukuk from the private sector. Following Kuveyt Turk’s sukuk, there is an interest from other Participation banks who wish to issue sukuk in 2012.

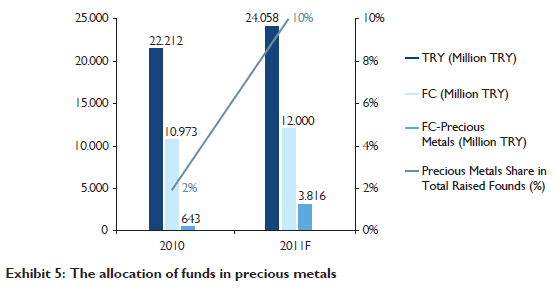

Gold rush for Participation banks

Globally, gold has been seen as a secure investment for investors in 2011. Participation banks have encouraged their customers to invest in gold funds as either current accounts and/or Participation accounts. There has consequently been a 500% increase in investment since 2010.

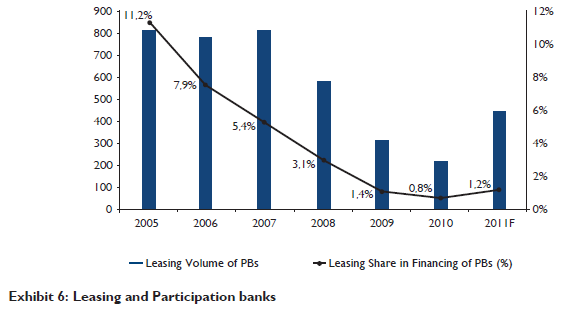

The value-added tax for leasing instruments was increased from 1% to 18% at the end of 2007. It was then observed that the volume of Participation banks’ leasing transactions in financing decreased gradually. At the end of 2011, VAT tax returned to 1% for machinery and equipment.

New opportunities

In 2009, the Turkish government declared a state planning organization decree for the transformation of Istanbul into a financial centre. The decree envisioned Istanbul to be a regional centre in the short run and a global centre in the long run. This is hardly beyond the realm of possibility. With sound financials and a growing interest in Participation Banking, there is almost a certainty that this is an achievable objective over the coming years. The fact that Turkey is close to the Gulf, its close relations with Turkic republics and the strong economic relations with her neighbours, put Turkey in an enviable position.

It is notable that the central bank of Turkey is one of the 14 founding members of the IILM. In 2011, Participation banks became primary dealer participants, which will enable them to better manage their liquidity risks by using the sukuk issued through this platform. This activity shows the integration of Turkey into the global Islamic finance apparatus. It convinces Shari’a sensitive investors that Turkey is committed to developing not only their own domestic Islamic finance industry but also the global Islamic finance market. Furthermore, these actions are anticipated to attract corporate investors from the GCC.

Conclusion

It is estimated by the Association of Participation Banks that Participation Banking will constitute 10% of the banking sector by 2023. Participation banks in Turkey already play an important role in attracting foreign capital investments into Turkey, especially from the Gulf region. In the last decade, approximately USD 30 billion direct investment has been made as private equity in Turkey by Gulf-origin corporations. It is observed that the compound annual growth rate (CAGR) between 2002 and 2011 of raised funds in Participation banking sector has been approximately 30%. As shown in Exhibit 7, the CAGR of Participation banks in all categories is higher than conventional banks over the past decade. It would suggest that the contribution of Participation banks to the Turkish economy as well as to the region is significant. Additionally, Participation Banking has been a catalyst for improvements in the Turkish socio–economic structure. The dynamism of Turkish economy and the support of the state to Participation banks have strengthened the banking sector, and deepened the investment, production and trading opportunities. The future therefore looks very bright.

| CAGR (2002-2011/N) | PBs (%) | Conventional Banks (%) |

| Deposits | 30% | 19% |

| Financing | 35% | 30% |

| Assets | 34% | 21% |

| Equity Exhibit 7: Comparison of CAGR | 35% | 20% |