Introduction

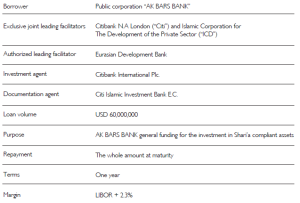

A growing number of businesses in Russia are becoming more interested in using Shari’a-compliant financial instruments. In September, 2011 the Russian bank AK Bars successfully closed the debut murabaha-based deal amounting to USD 60,000,000. It became the first ever murabaha transaction conducted by the banking institution in CIS.

These are the main characteristics of the deal: In February 2011, a new Islamic banking institution, “Amal Financial House” was established in Kazan. Amal started providing Shari’a-compliant banking services based on mudaraba’ agreement. Another major regional financial institution, Bashkomsnabbank in Ufa, have recently decided to introduce halal banking products to a wide range of consumers, while Ellips bank from Nizhny Novgorod established two Shari’a-compliant offices in Nizhny Novgorod and Ufa.

The growing interest in Islamic finance in Russia is constrained by the absence of special legislative rules, particularly in the tax field, which could have stimulated the use of Islamic financial instruments. At the same time, due to Russia’s tax system neutrality and up-to-date character, there are no provisions prohibitive for Islamic finance projects. Having said this, proper tax and legal analysis and structuring will be often required.

REPO

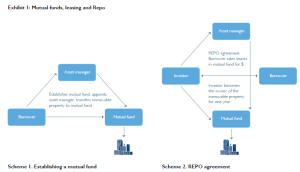

The REPO mechanism is widely used in Islamic financing (for example, in the ijara wa iqtina structures). REPO operations always involve double sale of assets between two contractors. The purpose of the REPO operations for one party is to fulfill his funding needs.

- REPO mechanism

The borrower in REPO operations is the original seller of securities which are used as collateral for a loan. The second transaction in a REPO agreement involves the resale of the same securities by the lender back to the borrower at a higher price. The difference in price represents the profit for a lender.

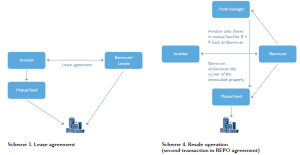

Under the ijara wa iqtina contract, the borrower is also the original seller of the underlying assets (e.g. immovable property). The lender rents out the immovable property (e.g. the office building) to the borrower and receives from the latter rental payments. At the end of the lease agreement the lender sells the office building back to the borrower. The resale price is usually higher as it includes accrued rental payments.

It must be noted that the Russian tax system often follows a form-based approach rather than a substance-based approach. Therefore, it is difficult to convince Russian tax authorities to transpose REPO rules to the deal structures which are similar to REPO, but do not fit the formal criteria established by the law. As a result, the aforementioned tax preferences could not be directly connoted to Islamic financial instruments involving the resale of the underlying assets such as in the ijara wa iqtina scheme. Consequently, this possible disadvantage of the Russian tax system with regard to Islamic financing may be compensated by using of mutual funds in the deal structure.

- Taxation of REPO operations in Russia

The current Russian legislation envisages special rules for REPO operations. However, they can only apply to a restricted variety of underlying assets. The possible timing between the original sale transaction and the resale transaction is also limited.

- AT treatment

Article. 149(3)(15) of the Russian Tax Code provides tax exemption for rendering financial services on granting loans in cash and in securities and also for REPO operations. As a general rule, the sale of assets incurs VAT tax in Russia, and in case of involvement of a non-resident not registered in Russia for VAT purposes, double VAT taxation may also incur.

- Profit Tax

The profit generated by REPO operations is classified for tax purposes as a profit from loan (Article. 282(4) of the Tax Code).The period between the first operation and the repurchase operation must be no longer than one year (art. 282(1) paragraph 3). Both Articles 149(3)

(15) and 282(1) refer to the Federal Law of the Russian Federation “On Securities Market” for the definition of REPO operations². According to Article 51.3(1) of the Federal Law “On Securities Market”, only securities can be used as the assets for REPO operations.

Mutual funds

Under current legislation, a mutual fund does not have legal personality and is not a taxpayer as such. Many ex- perts consider mutual funds as a suitable instrument for Islamic financing. Following Article 10(1) of the Federal Law of the Russian Federation “On Investment Funds”, mutual funds are separate portfolios managed by professional asset managers. According to Article 14.1, investment shares in mutual funds represent by themselves a right on the property that constitutes the mutual fund.

Article 51.3(2) of the law on Securities Market provides that investment shares in mutual funds can be used as the underlying assets for REPO operations. The only obstacle is the time period between the first operation and the repurchase operation, which cannot exceed one year. However, the Russian Tax Code does not prohibit the multi-usage of the REPO agreements.

Issuing sukuk in Russia

The Russian tax and legal system does not contain any specific legislation on issuing sukuk. At the same time the tax and legal framework in the field of securitization, developed over the last 10-15 years, is neutral, investor-friendly and efficient. It is also possible to use non-Russian special-purpose vehicles for the arrangement of the issuance of securities. Subsequently, these securities may be traded or listed both in foreign stock exchanges, as well as on a Russian stock exchange.

Therefore, issuance of sukuk by Russian companies is possible either in Russia or abroad. Considering the re- cent increase in interest in Islamic finance in Russia, the issuance of the first Russian sukuk might take place in the not-too-remote future.

- Aviation leasing

In some areas, such as aviation leasing, the typical structure of a transaction resembles the typical structure of sukuk; thus an aviation leasing transaction could be structured as sukuk without significant complications. Despite the above, occasionally it is stated that there are serious obstacles in Russian law on issuance of sukuk. These statements are not entirely correct. Thus, it will be useful to demonstrate the tax consequences that will be triggered by the issuance of sukuk by refer- ring to the tax treatment with regards to the securitization of leasing of aircrafts.

COMMENTARY

“R” represents rental payments, made by the Borrower to the Asset Manager at the end of the Lease agreement. According to the Russian Tax Code, “R” is to be considered as interest payments made by the Borrower.

Expenses

The Borrower reduces the tax base by “R” at the end of the REPO agreement.

Income

The following categories of investors are to pay 20% profit tax on “R” income after the sale of the underlying real estate assets back to the borrower (Art. 282(4)(1) of the Russian Tax Code):

- Russian investors;

- Foreign investors with permanent establishment in Russia;

- Foreign investors without permanent establishment in Russia – the residents of the states which do not have double tax treaties with Russia.

The situation changes where Double Tax Treaty (DTT) provisions apply. According to Article 15(4) of the Constitution of the Russian Federation, international treaties have supremacy over Russian domestic legislation. All DTTs, which Russia is party to, lack specific REPO-related provisions. Consequently, taxation will depend on how the profits derived from the alienation of shares in mutual funds shall be defined by tax authorities. This could be as follows:

- Interest income;

- Income from the sale of immovable property;

- Capital gains on alienation of shares in mutual fund.

The least desirable variant is income from the sale of immovable property where 20% profit tax rate arises.

Tax rate for interest income depends on DTTs. For example, Russia – the Netherlands DTT provides 0% tax rate (Article 11(1) of the Treaty) for Russian taxation of capital gains not related to immovable property, if alienated by a Dutch tax resident. As for VAT, loans and alienations of shares in mutual funds are exempt from the tax.

In the end, investors may benefit from 0% tax rate on their income derived from the resale of shares in a Russian mutual fund. However, tax payments maybe incurred if Russian tax authorities recharacterise sale of shares in a mutual fund into sale of immovable property. Therefore, proper tax structuring and risk evaluation should be made before the transaction is executed.

The analysis will be made on the basis of a typical sukuk structure as seen in Exhibit 2. Under this structure, Investors collect funds and buy sukuk certificates from an SPV. The SPV buys aircraft from the Seller and lets it to the Lessor. Rental payments are used for periodical payments and redemption of shares by investors. In some instances, the Seller and Lessor may be the same person, i.e. Seller sells asset to an SPV and then rents it.

- Location of SPV

Under domestic tax law, lease and interest payments to non-residents are subject to withholding tax of 20%, while lease and interest payments to Russian corporate residents are not taxed by way of a withholding tax. In the latter case, such income is taxed in the hands of the Russian residents by way of self-assessment at the same rate.

For the purposes of present analysis, it must be noted that while interest is regarded as inconsistent with principles of Islamic financing, for tax purposes some payments within Islamic financing structures may qualify as interest for the purposes of application of tax treaties. Under most Russian double tax treaties, the 20% withholding tax on interest and lease payments is reduced or eliminated. Such a tax treaty benefit is granted upon provision of a tax residence certificate by a non-resident recipient of the income. Collection of such tax residence certificates for a significant number of investors might make the process difficult. Therefore, in case of a significant number of foreign investors, it may be useful to issue sukuk through an SPV abroad.

Hence, depending on where investors are located, the SPV may be established in Russia or abroad. As internal Russian leasing operations do not result in sophisticated tax consequences and do not involve an international element, we will consider a structure more appropriate for international investors with the SPV located outside of Russia.

In light of the Russian withholding tax implications, decisions related to the location of an SPV should be made also with regard to provisions of a relevant tax treaty. Preferably, such a tax treaty should provide for zero withholding tax on lease payments and interest deriving from Russian sources. The jurisdiction of SPV should also allow tax-free payment of outbound interest and lease payments.

There are a limited number of countries which are used

Exhibit 2: Structuring a potential sukuk in Russia

by Russian organizations for the purpose of establishing SPVs in leasing structures. At present, the Netherlands and Luxembourg are among the most frequently used, as these countries provide for a stable and predictable tax and legal framework, investor-protecting legislation, as well as the experience to support the transaction. and a tax-friendly environment. The Russian tax treaties with these countries provide for zero withholding tax on interest and lease payments. Under domestic law, the Netherlands and Luxembourg do not impose withholding tax on interest and lease payments to foreign investors.

If an SPV is established in a foreign jurisdiction, such an SPV (Lessor) would lease out aircraft to a Russian aviation enterprise (Lessee). Hence, major Russian tax consequences to consider would be:

- Withholding tax on lease payments to SPV

- VAT implications

- Property tax implications

Tax consequences of issuing sukuk in Russia

Withholding tax in Russia

In general, the withholding tax on interest and lease payments in Russia is 20%. Under both Russia – Luxembourg and Russia-The Netherlands DTTs, lease and interest payments to tax residents of Luxembourg and the Netherlands respectively, are exempt from withholding tax.

The only requirement is to provide the Russian Lessor with a tax residence certificate. Such a tax residence certificate may be obtained from relevant competent fiscal authorities. Under Russian requirements, the tax residence should clearly state that the taxpayer is a resident in a given jurisdiction within defined fiscal periods.

Russian fiscal authorities have recommended the wording of the tax residence certificate should be as follows: “It is confirmed that the company … [Company Name] … is … a resident of … [State] … in the sense of the Tax Treaty [Full title of the treaty] be- tween the Russian Federation / USSR and [Foreign country].” Another important requirement to comply with is to certify the tax residence certificate with an apostille which is basically a stamp on a relevant document issued by the competent government authority confirming official validity of these documents. Otherwise, parties should follow the full procedure pro- vided for by legislation, involving the same process of approval of official validity of the documents, though it requires more steps and approvals than the apostille of a tax residence certificate.

Failure to provide such a tax residence certificate may result in withholding tax of 20% on the full amount of the payment. In such a case, a non-resident SPV entitled to tax treaty benefits would have to request refund of the withholding tax from the Russian tax authorities.

Value added tax in Russia

The general VAT rate in Russia is 18%. In general, Russia follows the principles of the EU VAT directive . As in Europe, to analyze VAT implications of a particular transaction, it is important to define the place of supply in such a transaction.

In respect to services, the place of supply is the place of business of an enterprise that provides the services. Exception from this general rule extends to services related to immovable property located in Russia, legal, consulting, accounting and some other services. The place of supply of such services is deemed to be Russia if the buyer of such services is located in Russia. As leasing of aircrafts is not listed among these services, the general rule applies. Under the general rule stipulated in subparagraph 5 of paragraph 1 of Article 148 of the Russian Tax Code, the place of supply of these services is deemed to be Russia only if Russia is the place of business of the supplier of services.

The place of business of an entity providing leasing services shall be Russia if the entity is incorporated in Russia; or on the basis of conducting activities in Russia though a permanent establishment.

Therefore, if a non-resident SPV leasing out aircrafts to a Russian resident company is not incorporated in Russia and does not have a permanent establishment in Russia, leasing services should not be subject to the Russian VAT.

In fact, even if such service would be subject to Russian VAT, due to the fact the service provider is not located in Russia, the VAT would be paid and offset against its own VAT liabilities by a Russian Lessor. This would effectively result in the absence of an additional tax burden on lease payments to the SPV.

Property tax in Russia

Property tax is a regional tax in Russia. As a general rule, regions may impose such a tax on depreciable assets at the rate of up to 2.2%. Certain regions do not impose such a tax. Generally, non-resident taxpayers are taxed on the value of depreciable assets recorded in books of their permanent establishments in Russia, or the immovable property located and registered in Russia. Under domestic law, aircrafts are regarded as immovable property. However, under DTTs with the Netherlands and Luxembourg, aircrafts are specifically excluded from the definition of immovable property. Therefore, aircrafts owned by tax residents of the Netherlands or Luxembourg are not regarded as immovable property in Russia for purposes of property tax and are not taxable, unless such companies have a permanent establishment in Russia.

Conclusion

As demonstrated, the current Russian tax environment is adequate to structure Islamic finance transactions; in particular, with respect to securitization of the leasing of aircrafts with involvement of foreign investors. Appropriate tax structuring may require establishment of an SPV outside of Russia, which is not uncommon for conventional securitized leasing transactions. The use of the Netherlands or Luxembourg for establishment of such an SPV should facilitate the tax efficiency and simplicity of investment for foreign investors.