Introduction

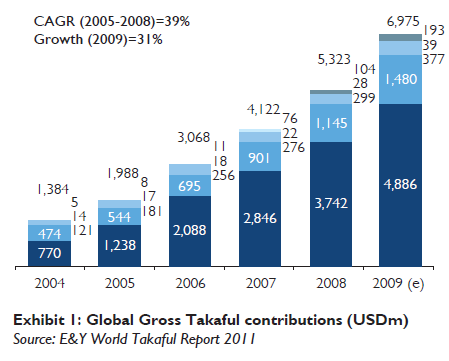

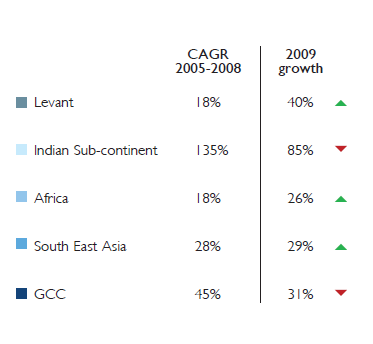

It has been called the Cinderella of Islamic finance and the rising star of the insurance industry. Takaful, is undeniably a growing global phenomenon that has managed to sustain growth despite the turbulent financial situation. In fact it has exceeded experts’ predictions, with constant 2 digit growth rates in some emerging markets, while its conventional peer grew at a slower pace averaging 5-10%. According to Ernst & Young, continuing on this trajectory, the industry could touch USD25 billion by the end of 2015. Indeed, global contributions from takaful are on their way to reach USD12 billion by the end of this year, from a total of USD 9.15 billion in 2010, according to the latest Ernst & Young World Takaful Report.

Although this is still a fraction of the USD4trillion generated by conventional insurance, the fastest growing and most dynamic insurance segment has attracted many global players who realized the vast potential of the takaful markets, highlighted by a sizable underinsured population, growing GDP, increasing affluence of middle classes, and a changing mindset towards financial protection and planning.

An internationalisation phase

Takaful has undergone a significant internationalization phase and managed to cross borders into new geographies, while continuing its spread within its main markets.

Middle East and Africa: Growing strong

The GCC remains dominant with USD 409 billion,75% of which, is held by Saudi Arabia, the world’s largest takaful market (USD 3.9 billion). It’s worth noting that the continued rollout of compulsory insurance lines gave a significant boost to the Saudi takaful market, as well as the UAE which stands today as the World’s third largest market after Malaysia. Smaller markets of Qatar, Bahrain and Kuwait are also witnessing considerable growth fuelled mainly by the expected boom in infrastructure and energy projects. Kuwait has seen the number of takaful operators triple in less than 3 years from 4 to 12. Oman, has been slower to embrace Islamic finance, and has joined the takaful ranks only very recently with the licensing of Al Madina Gulf Insurance Company as the first takaful operator in the Sultanate in 2009.

Africa is witnessing considerable developments with Kenya launching its first takaful operator in January 2010, and the acquisition in September of the same year, of Takaful South Africa by Absa Group. Industry experts are predicting that this deal could have implications for the reach of Islamic insurance beyond the borders of South Africa to southern, central, west and east Africa.

- Spreading across Asia

Home to the largest Muslim population in the world, Asia is a natural market for takaful. Its potential is set to spread across the continent, entering into China and India. According to the Ernst &Young World Takaful Report 2011, the Indian subcontinent’s takaful contributions have increased by 85 percent, making it the fastest-growing takaful market in the world. However, Southeast Asia remains to date the preeminent market in the Islamic insurance segment in the region, with a growth rate of 29% in 2009, and total contributions approximately at USD1.5 billion.

Malaysia, dominates the takaful industry in the Southeast Asian region. According to Bank Negara, the Malaysian central bank, the industry experienced a compound average growth rate of 27 percent in terms of net contributions between 2005-2010, creating a USD1.158 billion industry. Next door, Indonesia has over 39 takaful operators in Indonesia with the majority operating through “windows”. This model was introduced in order to facilitate the entry of major insurers in the market and promote the growth of the industry.

In Pakistan, the Securities & Exchange Commission of Pakistan (SECP) issued new guidelines in January 2010 relating to takaful. Pakistan counts 5 takaful operators today but has potential to grow considering the young demographics, a population of 160 million people with 97% Muslims. With the extremely low insurance penetration rates, the domestic market base is huge.

Sri Lanka is also taking an active role in the development of takaful despite its small 8% Muslim population. Amana Takaful, with technical assistance from Syarikat Takaful Malaysia represented the starting point for the takaful industry in 2002. The company had a challenging start in introducing the new concept to the Sri Lankan market, but has been able to achieve tremendous success across the country, and beyond, exporting its expertise with the establishment of Amana Takaful Maldives in 2007.

- Europe is ready to welcome takaful

While so many major European brands have moved be- yond their home markets, into the underpenetrated in- surance Muslim countries, a reverse trend looks promising as takaful prepares for its expansion in the West.

In Europe, the depth of the conventional insurance market and the presence of mutual insurance are encourag- ing the introduction and extension of the takaful industry. Indeed, there is a lot in common between mutual and Shari’a-compliant insurance providers. In France, for example, mutuals such as Groupama, MMA, Macif, take up an important market share of the insurance business. Due to these similarities, there is a potential for takaful in France and in other countries with a similar insurance landscape.

Turkey, in the last few years, has made progress in opening up to Shari’a’ compliant finance. Today, it counts four “Participation Banks”, which have so far focused principally on providing basic interest-free banking services. However, one of them – Bank Asya – has a 32% share in Ișik Insurance. Kuveyt Turk has also formed a General Takaful Company in 2009. As the country’s insurance sector is still young and continues to evolve, the potential to develop takaful operations is sizable.

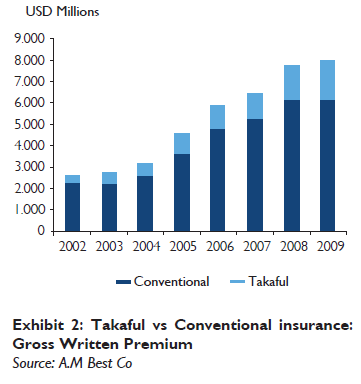

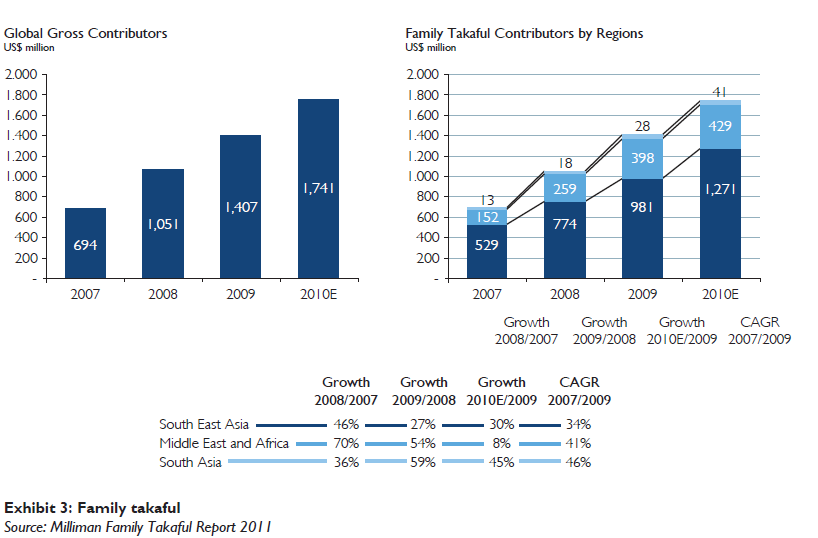

Family takaful: The new growth paradigm for takaful business

Family takaful is emerging as a fast growing component of takaful. The Milliman Global Family Takaful Report 2011 estimated that Family takaful was at USD1.7 billion in 2010, which accounted for 20% of total global takaful gross written premiums. The South East Asian market is the largest and most mature family takaful market, hold- ing 73% of total contributions, followed by the MENA at 25%. A 250% increase is projected for the segment in the next five years to USD4.3 billion. The Report notes “the growth in family takaful thus far outweighs both general takaful growth as well as global conventional life insurance growth”. Malaysia still takes the lead in the family takaful business, dominating with more than 80% of the total takaful market in the country, while the GCC remains underpenetrated, but has grown strongly at an 86% CAGR over 2004 to 2009. This growth is forecasted to continue, as the large young population in the region becomes more aware of the concepts of financial planning and protection.

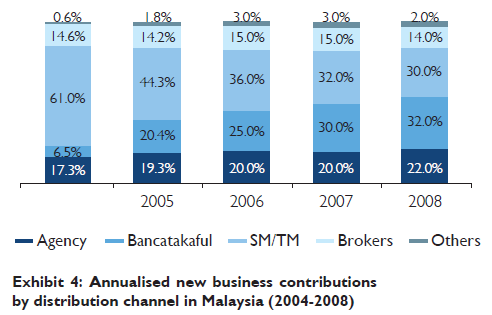

Takaful is an attractive and cost-effective way of selling their products. By leveraging their networks to distribute takaful, banks generate cross-selling opportunities by bundling insurance with other financing products and therefore generate annuity fee income. It also allows banks to achieve valuable economies of scale in areas such as marketing, IT and back-office processes. Similar economies of scale could be made by generating sales leads via referrals through call centers, branch networks and personal bankers.

Today, Islamic banks are not only distributing takaful products, they are engaged in integrating bancatakaful models by either buying stakes in new takaful companies or setting up their own takaful subsidiaries. A recent ex- ample is AIG/AIA the American insurance giant Group Ltd that entered the Malaysian bancatakaful market by setting up a 70%-30% joint venture, AIA AFG Takaful Bhd, with Alliance Bank Malaysia Bhd, in January 2011.

In Malaysia, according to BNM’s late deputy governor, Dato’ Mohd Razif bin Abd. Kadir, bancatakaful, is now the leading distribution channel for family takaful products, ac- counting for 50.3% of contributions in September 2010.

Similar initiatives have been launched in the GCC. In November 2009, Allianz Takaful and Standard Chartered Bank announced a five-year sales agreement to promote insurance products from Allianz Takaful in Bahrain. In Saudi Arabia, FWU Group has a stake in Al Ahli Takaful Company and has forged a successful strategic distribution partnership, with National Commercial Bank. FWU Group also enjoys a very successful partnership with AMAN, the Dubai-based Insurer.

In spite of the obvious efficiencies that can be gained from using banks’ networks as a distribution channels for takaful, delivery mechanisms in the takaful market remain very fragmented, even in markets where Islamic finance has been highly successful.

A positive outlook but challenges still ahead

The renewed interest in ethical investing reflects consumers’ demand for enhanced transparency, security and an equitable approach that extends beyond “profit maximisation”. It creates an appeal to Shari’a-compliant offerings, including takaful, whose fundamental principles rest on mutual protection, solidarity, risk sharing and contribution to the well-being of society.

It is arguable that takaful has the potential to establish itself as a credible alternative to the traditional insurance sector and could cater to a broader customer base by capitalizing on the ethical and social responsibility attributes rather than faith. Takaful products also present other important comparative benefits such as, open and transparent terms and pricing, participant’s protection against mishaps with life cover, annual surplus distribution; providing the Islamic insurance with additional assets in comparison to the conventional industry. Takaful has proven successful among a diversified customer base in other markets, such as Malaysia where 60% of takaful customers are non-Muslims. Despite the thriving growth and progress, a few obstacles still stand in the way, hindering takaful from reaching its full potential. The recurring issues that are frequently raised can be categorized as follows:

- Lack of standardisation

Currently, the global takaful industry includes different operational models, accounting standards, varying Shari’a’ interpretations, and regulatory regimes. Bahrain, Malaysia, Pakistan and the UAE are currently the only markets to have issued specific takaful laws and regulations. However, in spite of the efforts by AAOIFI and IFSB, the industry still has a long way to go before building a set of global regulatory standards that will be binding on all operators in certain localizations.

- Shortage in human capital and technical expertise

The lack of human resources dedicated to takaful is one of the major weaknesses of the industry. Experience in underwriting, accounting and marketing are in conventional insurance. Apart from the lack of technical competence, shortage in Shari’a’ competence also causes setbacks to the takaful industry. It is therefore of paramount importance that the talent pool of trained personnel available to takaful operators grows.

- Awareness

There is still some confusion and lack of knowledge amongst the Muslim population about the takaful operating model and product features as well as the differences between takaful and conventional insurance. To raise the awareness of takaful and to promote full transparency, consumer education is extremely important. Malaysia has pioneered an initiative called “insurance info”, a Consumer Education Programme (CEP) on insurance and takaful. A joint effort be- tween the banking, conventional insurance sectors and the takaful industry, the programme is designed to provide educational information to enable consumers to make well-informed decisions when purchasing insurance or takaful products. It aspires for consumers to be in a better position to select insurance or takaful products that best meet their needs as well as to understand their rights and responsibilities as consumers.

- ReTakaful: the missing link

There is a global need for strong and credible Retakaful operators to assist the growth and expansion of takaful. As a direct consequence of the shortage, it has been necessary for takaful operators to use conventional reinsurance in order to spread risk, reduce the impact of claims volatility and to increase capacity. To date the use of conventional reinsurance by takaful operators has been justified by the Shari’a scholars on the basis of necessity. However, this is changing, as capacity in the Retakaful market increases, particularly with some of the major reinsurers entering the market, such as Swiss Re, Munich Re and Hannover Re.

- Limited investment universe

Still a major difficulty confronting takaful operators is the lack of choice of investment avenues. With an Islamic fund industry still at USD58 billion in mainly equity and real estate classes as compared to USD22 trillion in the conventional world, widening the range of investment instruments and products that are Shari’a’ acceptable remains a high priority. Prudent risk management would dictate that a takaful operator diversify its portfolio in secure, liquid and long-term instruments – which are rare in Islamic finance offerings. Islamic bankers have yet to develop a Shari’a-compliant money-market fund that is sanctioned by a central bank. Although these are under development presently in Bahrain and Malaysia, it

is of utmost importance that leasing funds as bond substitutes, REITS and other securitisable assets are created and then publicly traded to broaden the investment options for takaful operators and assist them to overcome competitive disadvantage where conventional insurers gain interest returns on “idle” and short-term funds.

- Evolving regulations

Regulations vary significantly and continue to evolve, impacting key takaful markets. The UAE have recently issued new regulations specific to takaful, including the appointment of a central Shari’a’ committee. Bahrain has issued bancassurance regulations restricting the number of banks that insurance and takaful providers can dis- tribute through.

Meanwhile in Malaysia, Bank Negara is in the process of implementing risk-based capital requirements for takaful operators, and has issued new guidelines covering the valuation of liabilities, financial reporting and operational framework. In Pakistan, the SECP issued new guidelines back in January 2010 in order to bring necessary disclosures regarding benefits, charges and terms and conditions relating to takaful.

Conclusion

Takaful is entering a stable development phase; its popularity continues to rise among underinsured populations within markets with huge untapped potential; its appeal has also expanded beyond the handful of markets where it is presently concentrated. Evolving market conditions as well as increasing appetite for Shari’a’ compliant products are creating unlimited opportunities. However, major improvements are needed to unlock the full potential of takaful as a viable alternative to insurance. Regulation, technical expertise, marketing, product innovation and positioning are only a few on the list of the pressing issues that need serious attention from takaful operators in order to facilitate uptake and growth in a globalised world.