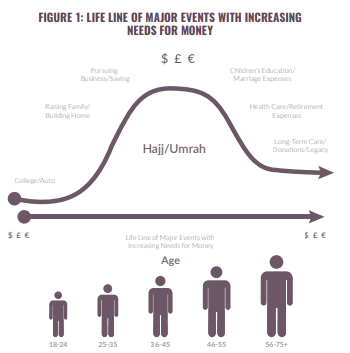

What are the most significant financial events that shape a person’s life? For most people these events can be plotted on a timeline and generally reflect the progress of our maturation; namely acceptance to college or university, family formation and raising children, purchasing or building a home, funding your children’s education, healthcare expenses, money set aside for retirement, assistance to your retired parents, charitable donations, savings for hajj and/or umrah and funeral expenses.

Figure 1 shows a typical lifeline with financial obligations increasing sharply between age 25 and age 45 and then gradually tapering off as a person enters his retirement period (assuming no major healthcare troubles that can trigger substantial additional financial needs).

Since money is crucial to our fulfilment of personal and family responsibilities, we should become acquainted with how money is made, managed, invested and distributed. Practicing Muslims have an added challenge—to adopt a correct attitude and Islamic viewpoint about wealth. Four (4) dimensions are interconnected to form the Islamic view of wealth. These are:

• Correct Attitude about Wealth

• Plan for Accumulation and Preservation of Wealth

• Donation of Wealth (zakat and saddaqa)

• Distribution of Wealth (waqf and inheritance)

Moral and ethical values permeate all aspects of the life of a Muslim, including the realm of financial and commercial affairs. As practicing Muslims we are enjoined to proper handling so that the source of earnings, donations, the application of money to build wealth, and the final distribution of wealth are all halal. Thus, wealth is both an individual challenge and a matter of social justice impacting the broader community.

DIMENSION ONE: CORRECT

ATTITUDE ABOUT WEALTH

According to the Holy Quran, we must accept the paramount fact that all wealth belongs to Allah SWT. Human beings are simply the caretaker of Allah’s SWT wealth – Al Ghani. Wealth is also a test or trial for us to determine how we handle the ease and comfort that accompanies wealth and how much of it we spend in charitable works. In addition, wealth is a duty on those fortunate to have it to share with those less fortunate and needy. We are advised that the poor have a right on our wealth [refer to zakat]. Finally, wealth is a tool for comfort, protection and security for us and our loved ones. As such, we are directed to pay close attention to the source of our food, the nourishment of our bodies, as well as (by analogy) the source of our earnings, which is the nourishment for all daily activities. After all, it is from our earnings that we can afford to acquire and consume our food, our shelter, our clothing and our security.

For those with understanding, our progress in life is to develop the proper attitude about our Creator, Allah SWT, to worship accordingly and this results in the transformation of ourselves into a pious, believing character with truly righteous (Al Birr) and thankful behaviour. Therefore, it is critically important that we assure the source of our earnings is acceptable (halal) and legal under Shari’a guidance.

Needless to say, if we become careless about the sources of our earnings we endanger ourselves and may lose the blessings from Allah SWT on ourselves, our activities and on the consequences of how we apply those earnings; i.e. our food, our shelter, our clothing and our security. The true and final test of mankind is how well each person applies his innate resources and other blessings granted to him by God, the Creator, to self-improvement, family improvement and community improvement – one key measurement will be how one’s wealth is allocated to the advancement of these ends.

Wealth is a comfort and a means to achieve what we plan for in this life. As a widely accepted medium of exchange, we use money to trade/purchase what we need or want of material goods and services. Islam offers us guidance that we must safeguard the source of our money (assure that is legal and “halal”) and should strive to earn a good living in order to care for our families and to position us to transfer portions of those earnings to our offspring.

DIMENSION TWO: ACCUMULATION

AND PRESERVATION OF WEALTH

The first principle about building wealth, as we have seen, is that it must be earned in a legitimate or legal manner in accordance with Shari’a —“halal”. Many verses from the Holy Quran make this point explicitly:

Do not acquire wealth from each other wrongfully, nor knowingly offer it to officials with the objective of unjustly acquiring wealth of another. – V. 2:188 Surah Al Bakarah

Resources are not only gifts from Allah SWT to all human beings” [V.2:29], but also an “amanah” (trust) [V.57:7].

The Prophet PBUH once said, as reported by Anas Ibn Malik: “Earning a lawful livelihood is obligatory upon every Muslim” and “A man has not earned better income than which is from his own effort.” Extending from the guidance to humankind described above, it becomes clear that we should develop a plan to acquire wealth and property. Whatever wealth and assets that are granted us by Allah SWT should be safeguarded, not squandered or wasted in extravagance. Any commercial transaction or investment that is in accordance with Shari’a principles involves risk so whatever precautions and risk mitigation steps we can take become very important for us to consider carefully. For Muslims, there are legal ways to address risks and one should explore further the concepts of Risk and what risk-sharing techniques exist that are Shari’a-approved.

DIMENSION THREE AND FOUR:

DONATION AND DISTRIBUTION OF WEALTH

One of the main reasons for us to accumulate wealth and assets is to be able to fulfill our duties towards family as well as the poor and misfortunate within society. Muslims have several possibilities by which to distribute their wealth (however modest or abundant the resources) and many opportunities to use these charitable donations for self-purification – i.e., deposits to the Pious Deeds Deposit Account (PDA)2. Donations and charitable distributions are:

• Zakat – annual obligatory charitable donation

• Saddaqa – occasional discretionary charitable donation

• Voluntary and volunteer acts and good works

• Inheritance – estate planning for heirs

• Saddaqa jariya – discretionary living trust or legacy

WHAT IS WEALTH?

Wealth can be divided into two categories: Tangible and Intangible. Tangible wealth consists of assets, cash, money, securities, shares, property, insurance, business ownerships-partnerships, collectibles, jewelry, royalties-patents, and inheritance. As such, tangible wealth appears in our personal worldly bank account. Intangible wealth consists of knowledge, skills, talents, wisdom (iln), beauty, and pious deeds. As such, intangible wealth appears in our pious deeds deposit account with Allah swt, which will be fully known in the life hereafter.

Hence, the goal for every Muslims is to transform ourselves into a lifetime investor by designing our financial life in such a way to achieve our fondest dreams and goals while at the same time fulfilling our responsibilities to family and to society.

FALSE IDEA ABOUT MONEY

Among the most popular false ideas about money in the latter part of the 20th Century, which seems to be persisting in the early years of the 21st Century – money is worth something itself! That is, money is a “storehouse” of value. In purely economic terms, money is a “means of exchange”, i.e., chapter money is fiat value for tangible goods and services provided by people. Hence, chapter money does not contain any intrinsic value.

To clearly see this viewpoint, place some chapter money in an empty room for one month and when you return to that room has that money increased or decreased? Surely not. A wise men once said, money is barren. Only by the imposition of human labor does money increase in value by transforming a good or by creating something of greater value which can be sold or traded. One should not confuse another economic term “inflation” with the concept of money value. Inflation is the interaction of goods and services in the marketplace whereby the purchasing power of individuals is gradually eroded (conversely prices increase) so that US$100 dollar does not acquire the same quantity of goods or services. Rather than the money having lost its intrinsic value (which as we have seen it never had anyway) by an index of inflation, actually it is correctly serving as a medium of exchange whereby the interaction of supply and demand pushes prices higher and hence that unit of money no longer can acquire the same quantity of goods as before. Money as a “yardstick” has not changed—only the prices have climbed higher, which proves the earlier point.

The consequence of believing that money contains value itself, is that we tend now to work for money. We then come to judge ourselves and others by the size of our bank account. Put in another way, at the age 40 there are approximately 329,601 hours (37 years) remaining of a person’s lifetime, according to statistics on life expectancy.

Of course, Allah swt knows best and the exact lifetime remaining cannot be known in advance or predicted for any person. However, assuming that 50% of your lifetime remaining must be dedicated to sleeping, cooking, eating, washing, and other essential bodily maintenance functions, then a person would have only 168,000 hours of a lifetime for discretionary usage at work and play.

Therefore, perhaps you may wish to realign your priorities towards working and play— especially in terms of working to gain money in order to have fun/play or enjoy free time with family members. Try shifting the value from using your time to make money to using your precious time (in fact the most valuable commodity we have) to design your whole life, including your financial life. This new perspective realigns the meaning of money and wealth creation….and reminds us that our daily activities and deeds should be accumulating a combination of worldly wealth and pious deeds deposits for the hereafter. As you can see, the shift is from the false idea of “spending” our time towards a correct idea of “investing” our time.

LIVING A DEBT-FREE LIFE

One principal reason to have a savings plan is not only to be in a position to provide a comfortable lifestyle for your families but also to enjoy the possibility of living debt-free. Muslims are urged in the Holy Quran and Sunnah to minimize borrowings and to repay financial obligations as soon as possible. Those who can afford to repay and delay in doing so may be committing the sin of riba. We should be reminded that if we die and have not settled our debts and outstanding obligations, we could be jeopardizing acceptance into janna (Paradise).

“A Person inquired of the Prophet (PBUH) if someone is killed in the path of Allah (swt) while he remained steadfast, self-critical and moved forward in the way of Allah without ever turning his back, would Allah (swt) forgive his sins? Allah’s Messenger (PBUH) answered in the affirmative. However, the Prophet (PBUH) added, ‘Yes, all sins would be forgiven except outstanding debt.’” Hadith Muslim, 3497, as reported by Abu Qatadah.

Of course, Muslims are forbidden to engage in prohibited activities such as Riba and the injunctions are many [see Al Nisaa 4:160-2; Al Imran 3: 130-6; Al Baqarah 2: 275-9]. For Wealth to be blessed (“halal”), it must not involve riba or any other prohibited aspects:

And the riba-based givings (investments) on your part, in order to increase your wealth on the basis of other people’s (ie borrower’s) assets, do not increase from the point of view of Allah. However, rest assured about the acceptance of what you give by way of zakah for the sake of Allah; those who give zakah are the ones whose net worth increases manifold with Allah swt.” Al Room 30:39

A Person inquired of the Prophet (PBUH) if someone is killed in the path of Allah (swt) while he remained steadfast, self-critical and moved forward in the way of Allah without ever turning his back, would Allah (swt) forgive his sins? Allah’s Messenger (PBUH) answered in the affirmative. However, the Prophet (PBUH) added, ‘Yes, all sins would be forgiven except outstanding debt.’ Hadith Muslim, 3497, as reported by Abu Qatadah.

“And the riba-based givings (investments) on your part, in order to increase your wealth on the basis of other people’s (ie borrower’s) assets, do not increase from the point of view of Allah. However, rest assured about the acceptance of what you give by way of zakah for the sake of Allah; those who give zakah are the ones whose net worth increases manifold with Allah swt.” Al Room 30:39

A very good way to steer clear of riba and other prohibited aspects of financial dealings is to have a plan for your money

and investments. Although there are no guarantees that your personal wealth plan will succeed, if your “fail to plan, then surely you plan to fail”. Therefore, the time to begin preparing plan for savings and investing is now. Like a roadmap, your personal wealth plan can show you the way forward to achieve your financial goals and dreams, despite the inevitable challenges and tests that you may encounter during your life’s journey.

MAJOR THREATS TO SUCCESS IN SAVINGS

A reasonable and realistic personal wealth plan can be derailed or set-back by such threats as:

• Lack of consistency or disciplined savings approach

• Investing “blindly” or with no apparent strategy

• High spending habits

• “Broken trust” whereby you make early withdrawals

• Major health problems or prolonged illness

• Disability, especially causing unemployment

• Extended unemployment without income

• Divorce

• Death of a spouse—cessation of earnings power

• Higher than budgeted education fees and expenses for children

• Unexpectedly giving financial and other assistance to aging parents in their retirement

• Severe stock market “meltdowns” or volatility resulting in sharp valuation declines

Thus, we must challenge ourselves to resist the above temptations and to cope with any such eventualities that may impact us so that we do not succumb to these threats. Make a strong personal commitment that whatever the events that befall us, which can undermine our resolve, we will still save on a regular basis in order to reinforce our positive habits and create real wealth. Among the sound tips for increasing your savings are the following:

• Try to save 10% of monthly income on a regular basis; if past 50 years of age then 20%.

• Start at an early age (21-25 years)

• Determine monthly disposable cash flow.

• Pay yourself first.

• Contribute more whenever possible

• Review your plan and results same time every Year.

• Be aware of inflation erosion of purchasing power

- Realize that a modest 3% inflation over 35 years reduces expected retirement funds to only 40% of your plan at the age of 65 [at 85, reduction shrinks to a mere 22% of the plan].

PERSONAL FINANCIAL NEEDS

ASSESSMENT: BASIC CONCEPTS

Generally there are three aspects to a Personal Needs Assessment: (1) Lifestyle and Income Needs, (2) Risk Response Needs, and (3) Future Savings Needs. Lifestyle and Income Needs describe basic human necessities of food, shelter, family and recreation. Risk Response Needs describe methods and costs of risk-sharing associated with personal assets, real property, businesses and healthcare. Lastly, Future Savings Needs describe an emergency fund (for contingencies), education expenses, investment and financial goals, saving for Hajj or Umrah, establishment of a Waqf, Charitable Trust or Endowment, plus a retirement fund for the days when you no longer work for wages.

Tools to help us perform a baseline analysis of our current condition and to quantify our future financial requirements include:

• Personal Balance Sheet – where I am now and what I own

• Personal Cash Flow Analysis – how much income I earn and what I can afford to save

• Personal Risk Budget – what are my risk exposures and cost for risk-sharing

• Investment Strategies – time horizon, risk tolerance and preference for asset types to growth your savings.

These four items are combined and integrated into a solid personal wealth plan that contains financial goals and objectives as well as an action plan to achieve them.

WEALTH HIERARCHY

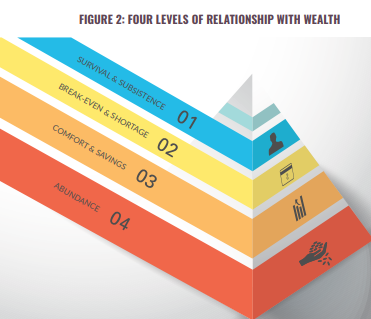

To understand better our present condition, we may say that four levels exist to describe our relationship to wealth (Figure 2).

In a simplified way, we identify our position on this scale by the relative amount of “surplus” money we have at end of each month (or year period). Naturally, as the money and assets grow to become more abundant, we can afford to satisfy needs of our family, friends/associates, businesses, community, and at the highest level, our society. Wealth building is a true integration of physical, emotional, mental and spiritual aspects that must all be in balance, or a person risks concentration of one such aspect to the detriment of the others. By modifying Maslow’s famous Hierarchy of Human Needs, we can appreciate that increasing wealth allows us the flexibility to address a wider circle of needs progressing from:

Physical Needs (self/food/physical comfort/safety)

to Emotional Needs (family/clothing/shelter/recreation/belonging),

to Mental Needs (Others- sense of purpose/education/self-improvement/helping others),

to Community Needs (society/service to community/donations/charity/legacy/ethics).

TECHNIQUES TO BUILD REAL-WORLD WEALTH

As discussed earlier, we should be motivated to build real wealth both in our Worldly Bank Account and our Pious Deeds Deposit Account. Creating wealth in a worldly, material sense can be accomplished by building savings, building investments and building wealth through insurance

Wealth through Savings

Saving money on a regular basis is a patient and gradual yet proven method to gain wealth. A rule of thumb is to save (or set aside) up to 10% of your gross annual income. The amount, however, must be geared so that the chosen percentage can be sustained – often 5% is a more realistic figure. Steady and regular savings can seem painful, especially at first, however, the payoff is the compounding effect of money making more money for you. Elements of saving are:

• Start as soon as possible

• Calculate your monthly cash flow and amount of “free” or disposable income that can be set aside as savings

• Establish savings targets

• Pay yourself first each month

• Contribute more whenever possible to your savings account(s)

- Review your savings plan once per year for adjustments

Wealth through Investment

Investments differ from savings in that investment typically involves the use of a financial instrument or vehicle (commonly

a sophisticated one) which is managed by someone else and exposed to some degree of risk. Savings are commonly managed by banks or credit unions whereby safety and liquidity is paramount and risk exposure is minimal.

Investments include a broad range of securities such as: shares, equities, bonds, mudarabas, leases, real estate, commercial property, etc. It is important to gain an understanding of each type of investment vehicle, how it works, what risks are inherent and what is the probable yield on your investment of funds into it.

In addition, one needs to understand in general the concepts of financial markets (i.e. stocks, bonds and mutual funds) in order to better appreciate the overall trend of investments and public expectations for profits. For example, in a “bear” or down market it may be better to pursue a defensive strategy of capital preservation rather than accepting new or higher risks.

Always assess your own attitude to and tolerance for risk. This means knowing and understanding how much you can afford to lose. One cannot only focus on how much an investment will gain in value. Moreover, most types of investment require a degree of patience in order to realize the expected future value. Therefore, we will be called upon sometimes to not to panic if valuation dips but stay the course which is possible for us if we had first evaluated our view of risk associated to that investment.

To summarize, the process of achieving wealth through investments is: first, establish financial goals, second evaluate your attitude to risk and the risk involved in the chosen form of investment, third develop an investment strategy (conservative, balanced, growth, aggressive), fourth position your investments within your chosen strategy in accordance with a financial plan, and fifth implement your decisions and carefully monitor the results.

Wealth through Insurance

Regular savings can also be accomplished through insurance instruments. While we are certainly capable of setting aside a portion of our monthly income and investing this sum ourselves into a variety of investment vehicles (such as equity or mutual funds, real estate, leases, trading transactions, etc.), the truth is that few of us do this in a consistent manner. Hence, the beauty of buying an insurance plan is a discipline that imposes on us the habit of saving for the future. Moreover, insurance companies are well-experienced in money management and investments which can help us realize higher returns over a longer term than we might achieve by ourselves. For this sustained professional management of our assets, the insurance company will charge plan fees and/or investment performance fees, which reduce the actual market returns realized by our portfolio. These fees and charges must be carefully assessed in order to decide which plans are appropriate to our needs and whether the expected net returns are worthwhile for the time periods and risks involved.

Insurance has three major roles: (1) to replace income if we should become Disabled and unable to work, (2) to replace income for our families and loved ones if we should die and all earnings are cut off, and (3) to provide the owner of the plan with a substantial sum of money (or an annuity payment) for retirement when s/he reaches the end of the plan and encases the savings accumulated during his working years.

Types of Life and Takaful Plans

Although there are scores of life insurance and takaful plans, the following groupings may be considered as the dominant ones:

• Takaful Individual Retirement Plans/Universal Life: a permanent plan whereby future insurability is guaranteed. Contributions are low (and maybe fixed) over the term which also includes risk protection coverage plus a savings component. Cash values build up and may be withdrawn either during the plan term or at its maturity/end date. Some universal life plan guarantee a minimum cash value.

• Takaful Savings Plans/Variable Life: similar to the above plans except that the plan holder (insured) retains the

full investment risk and lower than anticipated returns may occur due to volatility in share market conditions over the plan term. Consequently, the future cash value may be less than originally projected.

• Takaful Risk Protection/Term Insurance: this form of plan provides coverage for the plan holder of a pre-set amount which becomes a death benefit to the named beneficiaries in the event of death during the plan term. Typically, the contributions are fixed over the entire term, insurability is guaranteed and for the sum covered this plan is the most affordable form of risk protection. Disadvantages are that neither the coverage protection nor the benefits extend beyond the end date of the plan and there is no cash value.

- Whole Life: a conventional type of policy whereby the plan is permanent for the whole of life of insured, the premiums are fixed, future insurability is guaranteed and the death benefit is guaranteed also. Moreover, the cash value is guaranteed by the insurer regardless of the vacillations of share markets. However, the whole life plan usually provided less benefits per premium dollar than other plans and its relative cash values may be less than other financial investment products (due to its guaranteed nature).

Among the Takaful Plans4 currently offered in the marketplace most are designed to encourage long-term savings for individuals and for employees of companies to address the common financial goals occurring during a person’s life cycle:

• Takaful Retirement Plan

• Takaful Risk Protection Plan

• Takaful Education Plan (to pay for higher education costs)

• Takaful Marriage Plan (to save for expenses of marriage and family formation)

• Takaful Executive/ Capital Savings Plan

• Awaqf Plan (to create a charitable donation or legacy)

CONCLUSION

Despite these powerful reasons to put together a personal wealth plan that can facilitate a person’s wealth-building, most people nurture their dreams without a specific plan to achieve them. A coherent plan can be prepared that addresses three (3) dimensions affecting wealth: (1) attitude towards money and wealth; (2) current financial situation (net worth); and (3) clear and written plans. Each dimension when combined together, form the backbone of an individual’s personal wealth plan that can chart a person’s course out of money shortage towards a future of wealth abundance.