Lokesh Gupta is attached to RM Applications as Head of Consulting, having 15 years of extensive experiences in Consulting, Risk Data Mart Development, and Project Management. Currently, he is involved in ALM, Basel 3, Risk and Regulatory Reporting as well as Remittance & Payments Solution implementations. He has also co-authored books in the area of Islamic finance and has published papers in various magazines.

Nafis Alam

Associate Professor and Director for the Centre for Islamic Business and Finance Research (CIBFR), University of Nottingham Malaysia Campus Nafis Alam is an Associate Professor and Director for the Centre for Islamic Business and Finance Research (CIBFR) at the University of Nottingham Malaysia Campus. He has published extensively in the area of finance. He also co-authored three books in Islamic finance among them is Encyclopaedia of Islamic Finance, which is first of its kind. Recently, Nafis was featured as Professor of the Month by Financial Times.

Credit card or plastic money has transformed the face of commerce from physical to virtual shopping, mode of purchasing as well as the spending habit of consumers today. It has become an important part of an individual’s daily life and has influenced their lifestyle and shopping habits. Today, plastic money (either credit card or debit card) is the preferred mode of payment for day-to-day purchase such as grocery, fuel, air ticket, household items, and utility payment. There is hardly any payment, which can’t be done through either a credit or debit card.

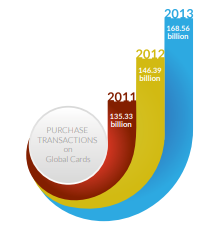

Over the years, growth in the number of credit card users and volume of transactions has grown steadily as security features continue to improve. According to the Nilson Report, purchase transactions on global cards (including MasterCard, Visa, Diners Club, American Express, Union Pay) reached 168.56 billion in 2013, an increase of 19.17 billion or 12.8% over 2012. The total number of cards in circulation recorded 7.37 billion and 6.54 billion in 2012 and 2011, respectively.

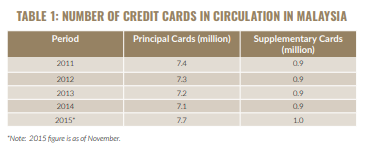

Based on the statistics published by Bank Negara Malaysia (Monthly Statistical Bulletin Nov 2015) there are around 8.7 million card holders in Malaysia and total spending by them is around RM9,952 million by November 2015 (see Table 1). The average credit card spend can be estimated as about RM1,143 based on these statistics.

No longer a status symbol, credit cards have become one of the most inevitable financial products for today’s generation. It provides financial freedom and goes beyond a mere payment instrument. In recent years, the credit card markets have thrived on aggressive marketing practices where cardholders are influenced into making payments with their credit cards through various benefits offered. These include retail discounts, rewards earnings (like miles, points, or cash back based on spending) and complimentary travel insurance, extended warranty etc.

Most of the credit card issuers in Malaysia offer bonus points rewards or cash back rewards on purchases and spending. Cash back rewards are normally given as a form of rebate or credited to the cardholder’s credit card account. In the case of reward points, every swipe made on the card returns points, which can be accumulate to be redeemed at a later date against attractive gifts offered under the redemption catalogue. Most of the banks in Malaysia offer a range of gifts falling under different categories such as lifestyle, gadgets, travel, dining, vouchers etc.

GIVING BACK TO SOCIETY

With the rise of online and mobile payments, donating to charity has become easier than ever. In the West, financial institutions and card issuers are leading the way on charity credit cards. In the UK for example, donations via credit card have become a vital source of funding for many charities, generating an estimated of £16.7 million a year as reported by Guardian.

A number of credit card issuers have now allowed cardholders to redeem their rewards points to donate to charity, thus making it easier to turn unused points into cash donation. The American Express, for example, allows its cardholders to redeem their rewards points at the rate of one cent each (10,000 points = $100) to the charity of their choice. Although a 2.25% transaction fee is charged if the cardholder swipes the card to donate the charity, no transaction fee is imposed if rewards points are redeemed to donate to charity.

Apart from that, some banks waive processing fees on charitable donations so that customer’s entire donation goes to the charity of their choice. Capital One Bank cardholders can donate via the bank’s “No Hassle Giving” programme, which waives transaction processing fees for 1.2 million verified charities. This basically means that 100% of donations go directly to charities. In Australia, Macquarie Bank allows customers’ credit cards points to be redeemed for donations to Aspect (Autism Spectrum). While, Bank of Queensland appears to be the most active in allowing points to be redeemed for donations to charities.

Although most Islamic banks are offering Islamic card products and services, only a few offer an option to redeem points for charity to their credit cardholders. In Malaysia, Maybank Islamic introduced social responsible credit cards that provide their cardholders the option to donate to charity. With Maybank Islamic Mastercard Ikhwan Card-I, with every spending charged on the card, the bank will contribute 0.1% to charity. Bank Islam Malaysia launched its E-donation Terminal Using Visa PayWave Programme. Through these terminals which will be placed at mosques throughout major cities in the country, cardholders are able to make contactless donations via their debit or credit card simply by waving the card over the terminal reader. Other credit card issuers have yet to offer such redemption option to cardholders in Malaysia.

There are also a number of affinity cards being offered in Malaysia. This is a type of credit card issues by a bank and a charitable organisation whose logo appears on the card. Each time the card is used for payment, the issuing bank donates a percentage of the transaction to the charity. In Malaysia, MBF Card issued a Budimas Charity Platinum Mastercard, i.e., a platinum card with the Budimas Charitable Foundation. Each time the card is used, 0.12% of transaction is donated to the children of Budimas Charitable Foundation.

This form of charity giving has also taken off in other countries where Islamic banks are in operations. For example, Amal RakBank through its Shari’a-compliant Amal Titanium Credit Card, cardholders are given the option to choose from one of three selected institutions contributing towards humanitarian, charitable causes and educational aspects of social responsibility. Once they have selected their charity of choice, cardholders are asked to indicate the amount they wish to donate on every transaction. Similarly, Mashreq Al Islamic credit card offer a number of rewards and benefits to its cardholder among which is donation to charity. For every AED100 spend using the card, the bank contributes 10 fils to selected charities.

ISLAM AND CHARITY

The foundation of Islamic finance is primarily towards uplifting society through the concept of justice, social equity, charity, cooperation and brotherhood by offering riba (interest) free products and services. Hence, the notion of giving and helping those in need, is entrenched in Islam. Sadaqah or voluntary charity is a virtuous deed in Islam. The Holy Quran promotes charity as equally important as establishing obligatory prayer. Those who perform charity will be recognized by God for their good deeds and will be protected from fear and grief.

The Quran states, “And be steadfast in your prayer and pay charity; whatever good you send forth for your future, you shall find it with Allah, for Allah is well aware of what you do”

(2:110). The significance and thoughtfulness of charity is recognized in all religion. It should be performed with a true spirit and true desire to show support and contribute for a significant cause, e.g., food, clothes, shelter and education for deprived. There has always been a drive to promote Islamic banking to non-Muslims; a Card with Charity could be such a product that will be appealing to all irrespective of their religious affiliation.

The success of any product depends largely on understanding the needs and expectations of customers. Given the increasingly complex and sophisticated wants and needs of consumers today, financial institutions and card issuers have charted new frontiers in providing attractive and creative ways of redeeming points for charity similar to the options provided for redeeming points for food, travel and appliances etc. The few possible options could be:

- Fixed value and transferable –Cardholder will know what he is going to get based on the value of his spending, say 0.1 %. The money collected from spending can be transferred to various charitable organisations with or without any specific cause. This will be useful for sponsoring school books and educational expenses etc.

- Charity coupons for donation-in-kind –Cardholder will be able to redeem points for coupons, with an option to donate it to a charitable organisation. The coupon can be 5 rice bags and groceries worth a fixed amount etc., and then assign to it a charitable organisation for collection from a nearby supermarket outlet

- Contribution to a charity fund – The charity contribution accumulated from cardholders’ spending is consolidated into a common fund. This fund is then utilized by the financial institution for various charitable causes. The institution should provide details of charity for cardholders’ information and reference.

The Card with Charity is appealing, innovative and relatively new within the Islamic financial services industry but has massive potential to expand further. Today’s customers are not only well-informed but are more socially conscious than ever before. Many prefer to patronize businesses that demonstrate a commitment to local or global causes or those organisations that share their values. Hence, a plastic card that is based on the concept of sustainability that includes social, environmental and economic benefits will cater for this social motivation. This will be an avenue for Islamic and conventional financial institutions to provide a platform for collaboration with charities and at the same time offer customers an opportunity to create social impact. The charity motive attached to the card will also act as a unique differentiator for the financial institutions to increase their customer base as people choose credit cards for various reasons. The Card with Charity and its simple modus operandi ‘Spending and Sharing’ will not only satisfy the payment needs but also the conscious customers. In the near future, individual social responsibility will become a driving force for customers to opt for financial products that promote sustainability. Given that charity is deemed as a virtous deed, Islamic financial institutions should embrace this concept of charity giving.