With over 550 branches in more than 140 cities across Pakistan, Meezan Bank is the largest Islamic bank and the 7th largest bank (in terms of branch network) in Pakistan. With such an extensive network, Meezan Bank is fast becoming the Islamic finance hub for its existing and potential customers; who are now closer than ever in benefiting from Islamic banking at their doorstep. All branches of Meezan Bank offer a comprehensive and broad range of Islamic financial products as well as real-time online banking facilities to customers.

OVERVIEW

Pakistan is home to a population of almost 220 million, out of which 70% remains essentially unbanked. The extent of the barrier this creates in socioeconomic development of the country is indeed massive. In line with the financial inclusion goals set by the State Bank of Pakistan, Meezan Bank recently introduced what is hailed to be the world’s first Islamic branchless banking services in Pakistan, a strategy which will prove to be transformational for the Islamic banking sector across the globe. In an economy where only 13% of the population has bank accounts, this will be a much-needed change.

This strategic move was done to leverage on the phenomenal growth in the usage of mobile phones in both urban and rural sections of the population. Keeping in view the surge of mobile subscribers across the country, it is worth noting that mobile banking has not yet matched this rate in delivering banking services to the underprivileged population and to individuals in far-flung locations. While Islamic banking promises good growth, spurred by its ethical and economic values as well as religious orientation; mobile banking is still considered a sluggish sector among other e-banking services in Pakistan.

The development of mobile financial services, which includes mobile banking services, money transfer and mobile payments,

have been steadily gaining momentum in the microfinance sector. However, Islamic microfinance providers are still playing a catch game when it comes to adopting new technologies.

With the launch of its Islamic branchless banking service known as Meezan UPaisa, Meezan Bank aims to play a major role in reducing poverty and improving the living standards of individuals belonging to unbanked and underdeveloped regions. As opposed to traditional banking forms, Meezan Bank’s branchless banking was rolled out with the mission of extending microfinance to individuals and breaking free of the barriers associated with weak banking infrastructure in rural areas.

MEEZAN UPAISA

The launched of Meezan UPaisa is set to transform the financial inclusion landscape is Pakistan. This initiative was made possible through a strategic partnership between Meezan Bank and Ufone, an Etisalat group company renowned for its innovative; out-of-the-box products and services. With 63% of the population being mobile subscribers, branchless banking enables the Bank to extend its market outreach, especially to the wider unbanked population of Pakistan.

This Islamic branchless banking service brings added convenience to both the banked and unbanked population, allowing them to perform banking transactions without having to travel to a physical bank branch, which may be in a different city or location. With Meezan UPaisa, the Bank can now expand access to financial inclusion in the country by tapping into the unbanked, eliminating the need for cash and allowing people from rural areas to conduct banking transactions – receive or send money- without exorbitant interest rates that are often imposed by local merchants.

The initiative to launch Meezan UPaisa in collaboration with the country’s leading telecom provider is based on the already existing dominance of mobile service providers in the branchless banking space. A number of shopkeepers, retailers and consumers are already relying on the services offered by telcos. With Meezan UPaisa, they would now be able to send and receive money, pay utility bills and send mobile top-ups through a Shari’a-compliant model of mobile money. Meezan Bank plans to extend services offered under Meezan UPaisa by an even wider array of Islamic financial services in the future. Meezan Bank brings a Shari’a-compliant solution for those with poor or non-existent credit histories. The service encompasses a host of features under its umbrella including the use of mobile phones or payment cards as methods of transactions, including a future aim of introducing mobile wallets for deposits and withdrawals.

During the launching ceremony of Meezan UPaisa, President and Chief Executive of Meezan Bank, Irfan Siddiqui, said, “This initiative is poised to accelerate financial inclusion by adding convenience and greater reliability, deepening the role of Ufone through enhancing the value it provides to its customers and that of Meezan Bank in expanding the reach of Islamic financial services to every citizen in the country.”

Currently, Islamic banking holds only 10% market share of the total banking system vis-à-vis the target of 50% by 2020 as set by the State Bank of Pakistan. This initiative will not only expand access to Islamic financial services in Pakistan but will also accelerate financial inclusion by adding reliability and greater convenience. Meezan UPaisa services will be made available to every eligible citizen, thus widening the reach of Islamic financial services.

WHAT DOES ISLAMIC BRANCHLESS BANKING OFFER?

The banking industry is going through a paradigm shift which is dominated by digital competition. In order to keep up with the technologically sophisticated customers, integrating new digital technologies into the banking system is essential to maintain competitive advantage. Furthermore, the inclusion of the unbanked sector calls for a seamless and more secure banking experience.

The banking and financial industry in Pakistan is going through major transitions which is evident from the increasing surge in transactional volumes. The total number of mobile users in Pakistan has reached the 121 million mark while the number of bank account holders still remains feeble. In order to close this gap and also to exploit the inherent potential this trend holds, Meezan Bank has embarked on the journey of promoting Islamic financial inclusion in the region, leveraging the use of technological innovations and overcoming the barriers faced by conventional banking channels.

As the largest Islamic bank in the country, Meezan Bank is driven by a vision to empower the economically low-income group through microfinance principles governed by Shari’a. Meezan Upaisa definitely has the potential to revolutionise the Islamic microfinance around the world. In the initial phase, Meezan UPaisa is offering vanilla branchless banking production while in the second phase Meezan Bank plans to offer digital credit. These transactions may be conducted from more than 20,000 authorized agent outlets across the country.

As part of its financial inclusion strategy, the Bank hopes to extend its Meezan Upaisa services to include the opening of BB accounts or commonly referred to as mobile wallet in the first quarter of this year. This service would allow customers to save money and make inter-bank fund transfers through a Shari’a-compliant system.

THE BOOM OF BRANCHLESS BANKING

Although branchless banking first made it debut in Pakistan less than a decade ago, it has attracted banking service providers and gained the confidence of the people as a reliable and trusted form of banking channel. This has brought forth a new wave of competition in the country’s financial services industry. Today, the growth of branchless banking sector in Pakistan has emerged as a remarkable example for the microfinance sector in the world. The country has witnessed a surge in branchless banking accounts at 44.4% in the second quarter of 2015 as compared to the previous quarter.

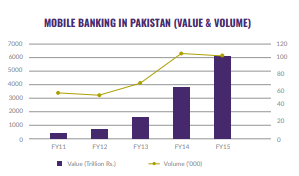

According to statistics released by the State Bank of Pakistan, mobile banking transactions reached 6.16 million by end of 2015 whilst the value increased by 59% reaching Rs.107 billion during the same year as compared to 2014. The number of mobile banking registered users increased by 36% to reach 2.27 million in 2015.

Over the past two decades a number of banking and cellular phone operators have entered the market, toughening the competition as the country’s financial sector develops. For the Pakistani people, transactions are becoming quicker, services are improving, instant money transfer is a reality and utility payments are becoming simpler. It is worth highlighting here that the initial boom in the mobile banking sector was attributable to a number of stakeholders such as the government and telecom operators.

In an effort to add convenience through its branchless banking services, Meezan Bank also offers Meezan Payroll Cards to its corporate clients and has since extended this to its workforce who is in an employment contract with a third party. Meezan Payroll Card enables corporates to disburse payments (salary, pension, staff reimbursements, bonus) to their employees in a cost-effective, convenient and efficient manner. The product offers quicker receipt of salaries as the payment is loaded onto their mobile wallet for instant access to money.

By the end of 2015, Meezan Bank had 14 corporate clients registered for its payroll disbursement services with more than 3,000 payroll cards in circulation. In addition, more than 13,000 salary payments have been credited amounting to over Rs.196 million with the average ticket size of over Rs.14,600. Salaried individuals have performed more than 25,000 financial transactions (including cash withdrawal and bill payments etc.) through their payroll cards amounting over to Rs.180 million, suggesting a steady and growing transition towards branchless banking modes.

But with the advent of Islamic branchless banking services, the Bank expects to record significant increase in the penetration rate of mobile wallets in the country to meet the unprecedented demand for Shari’a-compliant financial services especially amongst the unbanked population. According to the report titled “KAP Study; Knowledge, Attitude and Practices of Islamic Banking in Pakistan”, over 98% of the non-banked population believed in the prohibition of interest whereas over 93% considered the interest charged and given by banks as prohibited. The study also reported that the pent-up demand for Islamic banking is higher amongst retail (95%) than businesses (73%).

The report which was conducted by Edbiz Consulting, a global Islamic finance think tank, and commissioned by the State Bank of Pakistan; quantified the demand for Islamic banking in the country both for retail and corporate customers as well as identified demand-supply gaps. The report presented evidence that individuals in rural areas or in low-income brackets have relatively limited access to financial services. Thus, through Meezan Upaisa, the Bank is now in the position to unlock huge potential for Islamic microfinance amongst them.

BANKING THE UNBANKED VIA TECHNOLOGY

As technology is changing social attitudes and customers’ expectations for online experiences, banks will need to step up to the plate and reconsider their role in the value chain. In recent years, banks and microfinance organizations have strengthened their technological backbone and invested heavily in product innovation in order to bring new age of banking products and services to their customers.

The role of technology, especially mobile phones, in accelerating financial access and expanding financial inclusion in Pakistan

has been tremendous. Almost 90% of bank branches are processing real-time transactions across the country. Over the past few years, branchless banking has reflected a stellar growth, particularly in the rural areas. The sizeable unbanked population in the country has attracted a number of financial players into this market.

For the second quarter of 2015, the number of agents rose to 251,865 from 229,645, representing a 9.7% growth over the previous quarter. However, active agents declined to 77% of total agents as compared to 80% in the same quarter. With the boom of branchless banking in the country, this need for modernizing the ever-changing payment system infrastructure for the masses within the Islamic financial services industry is now being addressed with the introduction of Meezan UPaisa.

In a country where banking penetration is only 15% whilst mobile penetration is above 60%, there is a strong value proposition for branchless banking for the unbanked in Pakistan. Meezan UPaisa initiative aims to provide economic value to its customers by allowing the use of mobile phones as a medium of transaction through the Bank’s extensive network of shopkeepers, retailers and agents. The development of a robust payment infrastructure is necessary for promoting long-term development of Islamic branchless banking and therefore partnerships will play a key role in this domain for agent network expansion and accessibility of branchless banking solutions to the common people.

FOSTERING COMPETITION

Market research suggests that the domain of branchless banking is dominated by conventional banks and a few large players. The success of branchless banking in a number of developing countries has inspired financial institutions to invest in alternative, low- cost alternate distribution channels. These delivery models are perhaps one of the biggest untapped potential of drawing a vast section of the previously unbanked population of the country into the formal financial system.

In Pakistan, with the evolution of a regulatory framework for branchless banking, Islamic banking is likely to benefit from the participation of Telcos as well as Islamic banks. Even though the development is still at an infant stage, there is a need to develop regulations on e-money issuers, account opening policies and retail agents in order to enhance the scope for Islamic microfinancing as well as to make room for newer and more innovative business models.

Research suggests that financial habits of people vary and there exist a number of factors that govern their money management practices. Therefore, in order to displace these psychological barriers as well as a variety of informal practices, and to drive this growth towards Islamic financial solutions, Meezan UPaisa needs to emerge as an innovative alternative to conventional branchless banking solutions.

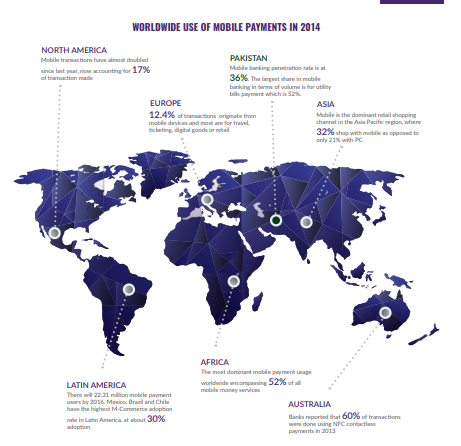

Pakistan is not the only country with a high rate of unbanked population. Nearly half of the world’s adults estimated at about 2.5 billion are not in the formal financial system. According the a report by Standard Chartered, about two-thirds of the adult population in emerging markets of South Asia, Middle East and North Africa and Sub-Saharan Africa remains outside the financial system. Hence, the case for drawing them into the formal financial system is indeed a compelling one.

Individuals with access to banking services are better able to cope with irregular income and financial draws, and avoid usurious interest rates. The report cited that a 10 percentage point increase in financial inclusion can raise income per worker by 1.3% on average. This highlights that greater financial inclusion does result in improvements in total factor productivity and capital per worker. The report further notes “The greater inclusion of people in the formal financial services also strengthens the impact of monetary policy decisions on the real side of the economy, enhancing prospects of non-inflationary growth.”

CHALLENGES AND LIMITATIONS

important to keep in mind that the branchless banking model in the region and particularly those that are linked to Islamic banking are at early stages of development. Market research proposes that the use of branchless banking is relatively infrequent and is also limited to a certain set of applications. Mostly for making basic banking transaction once or twice a month.

With the launch of the first-ever Islamic branchless banking in the world by Meezan Bank, the Bank aspires to serve as a gateway into a fuller range of Shari’a-compliant financial solutions. Its partnership with Ufone will provide the Bank with greater avenues to increase the attractiveness of mobile wallets across the country while at the same time allowing it to offer customers multiple convenient services.

COMPANY PROFILE

With over 550 branches in more than 140 cities across Pakistan, Meezan Bank is the largest Islamic bank and the 7th largest bank (in terms of branch network) in Pakistan. With such an extensive network, Meezan Bank is fast becoming the Islamic finance hub for its existing and potential customers; who are now closer than ever in benefiting from Islamic banking at their doorstep. All branches of Meezan Bank offer a comprehensive and broad range of Islamic financial products as well as real-time online banking facilities to customers.

One of the key objectives of the Bank is to have its footprint strategically placed throughout the country enabling the public to avail the benefits of Shari’a-compliant banking in their neighbourhood. Consistent with this objective, Meezan Bank launched the world’s first-ever Islamic branchless banking service. This milestone illustrates the success story of Meezan Bank while also highlighting how Islamic banking is successfully attracting more customers and gaining larger market shares and revenues in the intensely competitive environment of the country’s banking sector.

Meezan Bank has consistently been recognized as the Best Islamic Bank in Pakistan by numerous local and international institutions, which is a testimony of the Bank’s commitment to excellence. These institutions include Islamic Finance News – Malaysia, Global Finance magazine – New York, Asset AAA – Hong Kong, Asiamoney – Hong Kong, The Banker – United Kingdom and CFA Association – Pakistan.

The JCR-VIS Credit Rating Company Limited, an affiliate of Japan Credit Rating Agency, Japan has reaffirmed the Bank’s long-term entity rating of AA (Double A) and short-term rating at A1+ (A One Plus) with stable outlook. The rating indicates sound performance indicators of the Bank and making Meezan Bank the only Islamic bank with AA credit rating in the Islamic banking industry in Pakistan.