Rizwan Malik is a passionate advocate of Islamic banking and finance with a keen interest in Islamic equities, fund management and indices. As a consummate professional with extensive experience in strategy and relationship management, Mr. Malik has been instrumental in the development and execution of successful campaigns promoting Islamic banking and finance, and has managed different international projects. He has developed strong ties with international organisations and leading practitioners in the industry built from extensive travels and meetings. Having completed a master’s degree in banking and finance, he joined BMB Islamic as an Associate. His rapid career progress at BMB Islamic led to his move to Edbiz Consulting as Head, Business Development and Strategy. In addition to his managerial tasks, he has profound experience in Shari’a review of Islamic funds and indexes where he liaises extensively with Shari’a scholars, fund managers and present Shari’a reports on a regular basis.

The Islamic banking and finance (IBF) industry has evolved from over the last five decades as an important Islamic financial system. With worldwide acceptance Islamic financial services are now being offered by more

than 1,000 institutions in 75 countries. The personalities and institutions that initiated IBF benefitted from their first-mover advantage and have developed themselves into credible competitors to the existing conventional banks and financial institutions. Similarly, some of the products that were introduced in the early days underwent a process of transformation, evolvement and enhancement and have now become irreplaceable as well as competent when compared to the conventional products.

The development of Islamic banking and finance has given rise to some of the most important products. This article discusses some of the important products that have contributed to the growth of IBF and are defining the way forward for the industry.

SUKUK

Within the Islamic financial system, sukuk market is a new development. The first corporate sukuk was issued by Shell MDS

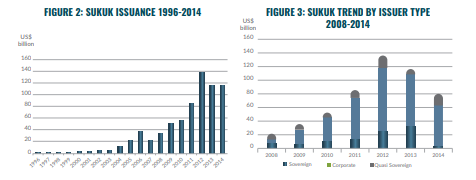

(Malaysia) in 1990. After that , there were no active issuances by other players or markets until 2001 when Majlis Ugama Islam Singapura (MUIS) and the Government of Bahrain, issued sukuk. The first global corporate sukuk was issued by Guthrie Malaysia. This also marked the start of an active sukuk market. The sukuk industry took off in the year 2010 after the recent financial crisis. Before the financial crisis the sukuk market peaked in 2007 to US$47 billion issuance in that year, however after the famous pronouncement by Justice Mufti Taqi Usmani that most of the existing sukuk are Shari’a non-compliant, the market took a hit and sukuk issuances dropped by 55%. The total sukuk outstanding in 2010 were only worth US$180.03 billion, issued globally since 1996. Until 2010 Malaysia accounted for 58% of total sukuk issuances, followed by United Arab Emirates (UAE) 18%, Saudi Arabia 8% while Bahrain accounted for 6%. The issuances in Malaysia are more frequent compared to the GCC, however the ticket size for the former is usually smaller than the latter. The Central Bank of Bahrain’s regular sukuk ijara and sukuk salam programmes since 2002 have played an important role for liquidity management of local Islamic banks. Other Muslim majority countries entering the sukuk market before the financial crisis included Pakistan, Brunei and Indonesia. The non-Muslim countries have also tapped the sukuk industry before the financial crisis, for example, German Federal State (Saxony-Anhalt) issued US$123 million sukuk ijara in 2004. Further, corporations in the USA have also tapped into the sukuk market in 2006 when East Cameron, an oil and gas company, issued sukuk worth US$167 million, while General Electric, a large US conglomerate, issued US$500 million worth of sukuk in November 2009. The experience of East Cameron sukuk was interesting as the company filed Chapter 11 bankruptcy in the USA in 2008.

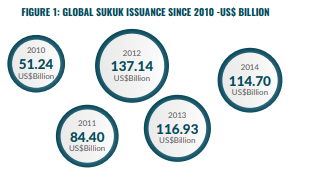

Since 2010, more than US$505 billion worth of sukuk have been issued in the global market. Out of this approximately US$80 billion were issued in the GCC, while US$28.01 were issued by Asia excluding Malaysia, and US$16.56 billion were issued by other regions. Malaysia accounted for majority of the issuances since 2010, a total of US$380 billion, highlighting the leadership role played by Malaysia in the capital markets as well as IBF assets. The total sukuk outstanding as of September 2014 are US$312.3 billion with 587 issues1. Figure 2 presents the sukuk issuances per year since 1996.

The market players still prefer domestic markets compared to international markets although the preference difference is only marginal (52% versus 48%). This means that most issuers prefer to fulfil their needs from the local currency as they are economical and quicker to issue. Further, the regulators also prefer to activate the local market compared to global markets. Since 2008, only between 25% – 30% of the total sukuk issued in the year have been international, the rest have been domestic issuances.

While it is Malaysia that is driving the sukuk growth in the Islamic banking and finance industry, it is the corporate sukuk that is leading among the type of issuers. Until

the third quarter of 2014, corporate sukuk issuance was US$63.05 billion, followed

by sovereign sukuk issuance of US$22.6 billion (Figure 3). Within the corporate sukuk issuances, sukuk issued by financial services is leading, followed by power and utilities, construction companies, and the real estate, etc. The most important sovereign issuance for the year 2014 included the UK sukuk of GBP200 million, which was oversubscribed by more than 12 times and the order book reached a total of GBP2.3 billion. Other

vital sovereign issuances included South Africa (US$500 million), Hong Kong (US$1 billion), and Luxembourg (EUR 200 million). It is expected that in the year 2015, more sovereigns will tap into the market, these include: Oman, Egypt, Tunisia, Libya, Jordan, and the Philippines.

The year 2014 has been very successful for the sukuk industry as it continued the growth in the asset class. A total of US$116.4 billion worth of sukuk were issued from more than 19 jurisdictions and 16 currencies. The Malaysian ringgit continues to dominate the sukuk issuances for the year 2014 with more than 63% of sukuk, followed by US dollars with 21%, Saudi riyals (5%), Indonesia rupiah (3%), Qatari riyal (3%), and Bahraini dinar (2%). Further, the year 2014 was a good year for the euro and UK pound sterling, as both entered the market with inaugural issuances. According to a market survey USD is the most preferred currency of all markets, whether to invest or issue sukuk, since a number of currencies (especially the GCC) are pegged to USD to reduce currency risk.

SOME OF THE KEY MILESTONES FOR THE SUKUK INDUSTRY FOR THE YEAR 2014 INCLUDED:

Regulatory Developments

• Egypt’s sukuk law to be replaced with chapter in existing securities law

• UAE exposure curbs to boost bond and sukuk issuance

• Hong Kong and Luxembourg pass sukuk bills

• UAE cuts minimum corporate sukuk size, announces other standards for issuing , listing and trading

• Jordan introduces sukuk rules

• Bangladesh seeks sukuk rule amendments, sovereign issuance

• Malaysia provides guidelines for socially responsible sukuk

• State Bank of Pakistan announces to trade government sukuk in the open market

Issuance

• First sukuk of Maldives issued- 10 year corporate sale worth US$3.29 million

• Malaysia’a EXIM Bank sells first USD sukuk, issuing a US$300 million, 50 year sukuk

• Malaysia’s AmIslamic issues RM200 million Basel III-compliant Tier 2 Subordinated Sukuk Murabaha

• Turkiye Finans raises US$252 million from first sukuk issuance in Malaysia

• Senegal raised Sub-Saharan Africa’s first sovereign sukuk of 100 billion CFA francs, a 4-year paper

• Goldman Sachs raises US$500 million, becoming the first US based conventional bank to issue a sukuk

• Britain becomes the first sovereign outside the Islamic world to issue sukuk, a GBP-denominated 200 million 5 year paper

• Hong Kong issues US$1 billion sukuk

• South Africa issues US$500 million sukuk

• Luxembourg issues EUR200 million sukuk

• Al Baraka Bank Pakistan raised Rs2 billion (US$19.5 million) via country’s first issuance of subordinated sukuk

According to a market research report, sukuk issuances for the year 2015 is expected to surpass all previous years. It is expected that sukuk issuances for the year 2015 will be between US$150 billion and US$174.9 billion. This highlights the market confidence in the future of sukuk. It is expected that sukuk issuances will increase on average at 10% and by the year 2020 the total sukuk outstanding will reach US$906.8 billion, while the demand of sukuk will be US$1102.6 billion, i.e., a

US$195.8 billion demand-supply gap.

The emergence of sukuk has been one of the most important developments in IBF, especially in the aftermath of the financial crisis. The sukuk issuances in the last 10 years have become attractive to not only corporates but government bodies and financial institutions as well. Sukuk can link issuers with a wide pool of investors from different geographies and across various segments and offer diversifications to the traditional asset classes. The growth in the sukuk industry has brought a number of non-Muslim majority governments to access Islamic investments. This is partly due to active secondary markets that provide a tool for liquidity management and low cost of funds in comparison to conventional funds. Further, different types of underlying sukuk contracts and long and short terms sukuk add to the attraction of sukuk for the investors and issuers.

At the same time, many industry practitioners have also warned against the excess use of debt instruments like sukuk, one of the reasons is that the debt may sky rocket to a level making it vulnerable to instability, and may lead to a similar financial crisis of 2007-2008. The other reason also cited by the practitioners and some scholars (and there is difference of opinion on this) that the debt finance is not in the spirit of Islam, and they recommend more equity mode of investments.

ISLAMIC EQUITIES

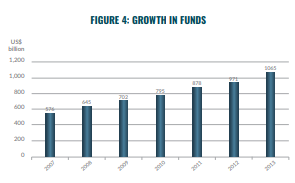

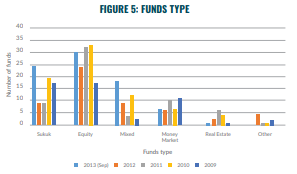

Islamic funds are still in their infancy, compared to conventional and socially responsible investment funds both in terms of assets under management (AUM) and growth. Islamic funds witnessed 7.6% growth in 2010, significantly lower than its conventional counterpart, which saw 35% growth. Within the Shari’a-compliant investments, the Islamic funds industry has grown rapidly over the last 10 years to become an important segment of the global Islamic financial services industry. The total number of Islamic funds reached 1065 in 2013 compared to 576 in 2007, however they remain only a small portion of the overall IBF assets. Further, the Islamic fund management industry has witnessed a 10% increase of funds between 2012 and 2013, the AUM has decreased slightly since then, as managers with small portfolios are exiting the market. Islamic funds have received tremendous success since it was first introduced, but post after the financial crisis it experienced the least growth. A number of financial institutions in the West, including fund managers launched Islamic equity funds before the crisis, market conditions worsened, they had to liquidate their funds. Following the financial crisis more focus and interest was received by sukuk. Consequently, the sukuk industry has flourished since then. There were 24 sukuk funds launched in 2013, while only 9 were launched in 2012 and 2011. However, despite the increase in the sukuk funds, the Islamic equity funds continue to dominate the Islamic fund management industry.

Islamic equity funds have the largest share, with 54% of total Islamic funds and US$60 billion of AUM (Figures 4 and 5).

Islamic equities are required to go through a Shari’a screening process, which ensures that the business, mode and capital structure of the businesses are in line with Shari’a.

Islamic equities are required to go through a Shari’a screening process, which ensures that the business, mode and capital structure of the businesses are in line with Shari’a.

Islamic equity investment appears to align with ideal Islamic financial principles. In order to consider an investment proposal compliant with Shari’a guidelines, it needs to be assessed from two angles, i.e., nature of the transaction and nature of contracting parties. Equity Finance, as is usually argued, would make it difficult to accumulate ‘unearned’ fixed income, and generally promotes equity and justice in society. Such assessment can be achieved by considering whether there

is any gharar and riba, etc., involved in the structuring of the transactions and the nature of the business. The two key questions to be asked are: Is the company involved in activities deemed by the Shari’a to be impermissible? This is deemed by a process known as the Business Screen. The second is the financial management of the company, if it is involved in undertaking financial obligations that are not entirely in conformity with Shari’a. This is known as the Financial Screen. They are usually conducted consecutively with the business screens undertaken first as represented by Figure 6 (see next page).

TAKAFUL

Another important Islamic product that has benefitted the industry and the stakeholders in IBF is Islamic insurance known as takaful. Literally the word means joint responsibility and solidarity. It is based on the concept of cooperation, responsibility, protection and guarantee amongst its participants. Before the introduction of Islamic insurance, Shari’a-sensitive investors on the basis of maslaha or darura (necessity) would use conventional insurance. Since then the industry has developed immensely in Muslim-majority countries to offer both family and general takaful, and have also introduced re-takaful companies. A number of developed insurance companies have set up Islamic windows for both takaful and re-takaful to attract Shari’a-sensitive users of insurance.

The idea of takaful is mutual cooperation, where it is based on mutual help amongst the participants, each of them voluntarily contributing to a fund which is used to compensate a member when needed. Islamic law allows measures taken to reduce risk,

as evidenced by the hadith where Prophet Muhammed (PBUH) advised a companion to have faith in Allah and tie his camel, rather than just relying on Allah to prevent the camel from running away.

The word takaful is not used by all takaful companies. For example, in Sudan, it is known as Islamic co-operative insurance while in Saudi Arabia the word co-operative insurance is more often used. Generally, takaful and conventional insurance share the same objective, i.e, to help those affected by a calamity. Hence, insurance started as not for business but a way to help the needy on gratuitous basis. Although takaful and conventional insurance the same, they differ in their operations and management of funds. While mutual or co-operative insurance is owned and managed by its own members, takaful on the other hand could be operated by joint stock companies. Hence, it is also argued that takaful, in essence, may not be purely mutual, In fact most of the takaful companies have resorted to shareholder model-based or commercial entity instead of pure co-operative or mutual organisation. They are operated as commercial entity making profits for the shareholders and this may not render the takaful invalid as takaful companies only act as a mediator to manage participants’ funds and receive remuneration for their services. Hence, it does not have any right towards takaful funds and also does not take responsibility of any deficiency. There are two contractual relationships in takaful: Tabarru – voluntary donations – amongst

the policy members; and wakala – agency or mudaraba-based profit sharing between the participants and the operator. Further, the funds in the agency or mudaraba contract are invested in Shari’a-compliant avenues to generate a return.

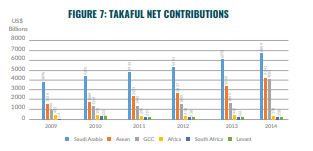

Overall the growth prospects for takaful industry are very positive, Total net contributions were estimated to reach

US$14 billion from US$12.3 billion in 2013 (Figure 7). However, the growth in takaful industry has reduced from 22% (2007-2011) to 14% (2012-2014). Countries like Malaysia, Indonesia, Brunei, Singapore, and Thailand continue to achieve a 22% year on growth.

Saudi Arabia is the largest takaful market with a total of 48% share followed by the ASEAN region with 30%, and the GCC

(excluding Saudi Arabia and Oman) accounts for 15%. The total gross takaful contribution is expected to reach US$10 billion by end of 2015 from an estimated US$8.9 billion in 2014. Within the Gulf region, Saudi Arabia accounts for the majority of the gross takaful contributions – 77%, followed by UAE, at 15%. The rest of the GCC countries account for 8%. The growth has been strong in the new and developing region like Africa. Going forward it is expected that the total size of the global takaful industry will reach US$18.5 billion by the end of 2016, with Saudi Arabia accounting for 50% of the total takaful contributions. Challenges that the takaful industry is facing include competition, lack of qualified talent, and profitability of takaful companies, etc.

It is expected that with strong challenges from the conventional providers, takaful operators are likely to continue the struggle in the short to medium term. Despite these challenges family takaful and medical takaful are expected

to grow particularly in Malaysia, UAE and Indonesia.

DEPOSITS

Shari’a-compliant deposits constitute the largest proportion of Islamic banks’ liabilities on their balance sheets. Like conventional banks, deposits are money due to depositors, which represent funds accepted from the general public for safekeeping, demand deposits (fixed and notice) and foreign currency deposits. In an Islamic bank all these products are designed and operated in a Shari’a-compliant manner. This is one of the most important products in banking management as a change in the level of deposits in the banking system is one of the most important variables in influencing the monetary policy of the country as growth in money supply is usually calculated using total deposits in the banking system. It further contributes to an increased fiduciary relationship as it also provides means of multiplying funds through the strong guarantees derived from the element of trust in banks.

There are different types of deposits are structured on the basis of different contracts. Some are merely based on the principle of loan (qard) while others like investment accounts may be based on mudaraba where the profit as well as the principle is not guaranteed by the bank. This can also create moral hazard as Islamic banks may be willing to take more risk, as the investment account holders may be ready to absorb losses in case the bank fails to generate the desired returns. Other major types of deposits offered by Islamic banks include savings accounts, current accounts, term deposits and investment deposits.

SAVING ACCOUNTS

Generally based on the concept of qard, wadia and mudaraba, it is a type of account that allows customer to deposit and withdraw their money, whenever required. Unlike a demand deposit, it does not have any withdrawal limitation and hence the funds can be withdrawn and deposited at any time on customer’s demand. A saving account holder, unlike a current account holder, does not receive a chequebook and hence money can be withdrawn from the cash counter or via an ATM machine.

CURRENT ACCOUNTS

Unlike a saving account, current account is a non-interest-bearing bank account that allows the deposit holders similar benefits to the saving account and also offers a chequebook facility. In addition, the current account holder may also have an overdraft facility, which may allow the deposit holders to withdraw more funds than otherwise available in the account.

TERM DEPOSITS

Term deposit is a type of deposit that is held at the bank for a fixed period. It is generally of a short-term, with maturities ranging from a month to a few years. A term deposit holder has to agree with the terms that the funds may not be available to the deposit holder until a fixed period after a predetermined notice period. Typical underlying contract at an Islamic bank for term deposit includes unrestricted mudaraba or wakala, where the bank acts as a partner or agent to invest the funds in a Shari’a-compliant manner. The returns of the term deposits are shared with term depositors and the bank (in case of mudaraba), while the returns in the case of wakala agreement are fully passed on to the depositors, and the agent or wakeel receives a fixed wakala fee.

PROFIT SHARING INVESTMENT ACCOUNTS (PSIA)

PSIAs refer to deposits structured around a mudaraba contract where the depositor is known as Investment Account Holder (IAH). The bank agrees to share the profit generated from the assets funded by the PSIAs, based on an agreed profit sharing ratio, while the losses will be borne by the IAH holders. There are two types of PSIAs: unrestricted and restricted. The former allows the bank or financial institution full independence to invest the funds wherever they like as long as the venture is in compliance with Shari’a. The latter allows investment in only those assets that are otherwise allowed or stated by the IAHs. The funds are managed separately compared to other deposits of the Islamic banks.

Islamic banking deposits have growth in Muslim as well as non-Muslim majority countries and is leading the development of Islamic banking and finance industry. The total size of the Islamic banking and finance industry is US$1.931 trillion while the Islamic banking assets account for 80%, with more than 500 deposit taking institutions. The size of Islamic banking deposits is increasing at different rates in various countries and now accounts for considerable size, for example: the size of Islamic banking deposit in UAE is 25% of the total Islamic banking assets, in Bahrain it is 24%. Bangladesh with 20% of Islamic banking deposits is another major player, while in Pakistan Islamic deposits have exceeded the 10% mark compared to the total banking industry.

MICROFINANCE

Microfinance is a general term used to describe financial services offered to low-income individuals or to those where general banking services are not available. The focus of microfinance institutions has over the years shifted from just providing microcredit to offering an array of financial products that serve the growing needs of the poor such as savings, insurance and investments.

Islamic microfinance, on the other hand, is developing a niche market in Muslim countries including, Pakistan, Indonesia, Malaysia, Bangladesh, Sudan, Lebanon and Yemen. Islamic microfinance is defined as provision of microfinance services in compliance with the Islamic law, and is coherent with its moral values of brotherhood, solidarity and caring for the less fortunate. It is a developing industry and is a synthesis of two industries; microfinance and Islamic finance is expected to develop into a vital industry for the poor and less fortunate who are at present avoiding conventional microfinance services due to religious reasons.

Islamic microfinance can be involved in four main types of productive services:

• Providing access to financial products based on murabaha, salam or equity-based financing in the form of mudaraba, musharaka and ijara;

• Providing asset building products – saving accounts, current accounts and investment deposits;

• Providing safety net products – microtakaful; and

• Providing social services – charity based contracts such as qard hasan, zakat funds, sadaqa and dedicated waqf.

• In the literature on Islamic microfinance, operating instruments have also been defined under two categories:

• Charity-based microfinance instruments that include structures like zakat, sadaqah, charity and qard hasan; and

• Profit-based microfinance instruments that include partnership-based contracts, and murabaha, salam, istisna’ contracts, etc.

In the partnership-based contracts like mudaraba and musharaka, the risk assumed by Islamic microfinance institutions are presumed to be high. Under such contracts, profits are agreed upon while the losses are shared in proportion of the capital provided. In the case of mudaraba all losses will be borne by Islamic microfinance institution while in the musharaka contract it will be shared with the partners. These modes are not often used by the Islamic microfinance institutions, as there is a preference for microcredit modes. This is due to information asymmetry problems and moral hazard where the partner or borrower has the incentive to undertake lower effort that reduces the probability of the micro-projects success.

According to a research paper approximately, 75% of the total active financing in Islamic microfinance is on the basis of murabaha, while 22% is on the basis of qard hasan. Partnership-based modes financing like mudaraba and musharaka are rarely used. Unlike the Islamic financial services industry that is mainly driven by Malaysia and GCC countries, Islamic microfinance is active and has emerged in developing countries. It has achieved interesting scalability in countries like Pakistan and Bangladesh in the South Asia, Indonesia and Malaysia in the South East Asia or Far East and Sub-Saharan Africa and Sudan. Islamic microfinance institutions are found in more than 15 countries including Pakistan, Afghanistan, Bangladesh, Malaysia, Indonesia, Bahrain, Egypt, Lebanon, Iraq, Jordan, Palestine, Sudan, Yemen, and Kosovo. Yet it has grown at a slower pace compared to its conventional counterpart and represents less than 1% of IBF. The total number of clients benefitting from Islamic microfinance services are estimated to be 1.28 million of which more than 80% are concentrated in Bangladesh, Indonesia and Sudan. The Islamic microfinance industry is expected to grow at a compound annual growth rate of about 20% between 2014 and 2018. Bangladesh leads the table of the most number of Islamic micro finance clients, followed by Sudan while Indonesia leads in terms of outstanding dollar amount followed by Lebanon and Bangladesh.

There are now important Islamic microfinance institutions set up in a number of countries; institutions that have received prominence lately include:

Akhuwat: A micro-lending institution based in Pakistan established in 2001. It has since then benefited more than 500,000 clients. With a strong federal and provincial government support Akhuwat is playing a key role in transforming the lives of people in the country through the use of qard hasan.

- Baitul Mal wa Tamwil: Set up in 1993 in Indonesia as a religious institution, it was introduced by an Islamic organisation to help facilitate business activities of its members. It was registered as a cooperative. Like Akhuwat it also uses qard hasan mode of financing, in addition to murabaha. It has now more than 3,000 branches throughout Indonesia.

- Family Bank (banking model): Established in 2009 in Bahrain (a country with a very small population and even smaller number of poor people) and operates as a micro-lending bank. As a commercial entity it works with Garmeen Trust as a strategic partner. The programme disburses loans of between US$100 to US$500 while the commercial loans are between US$500 and US$5000.

As citied in 2013 CGAP Islamic microfinance is an important sector within the global microfinance movement. It is estimated that more than 70% of the people in the Muslim majority countries are financially excluded and Islamic microfinance can play an effective role in converting financially excluded people to formal financial services. The International Monetary Fund in April 2015 also claimed that Islamic finance has the potential to contribute to the global economy, promising to foster greater financial inclusion, especially of large under-served Muslim populations. There is now strong government support in a number of countries including Yemen, Afghanistan, Sudan, Malaysia and Pakistan. The industry continues to face challenges from several fronts including competition from commercial banks, tightening of regulatory frameworks, securing sustainable funding as well as a trade-off between poverty outreach and financial sustainability.

HOME FINANCING

Islamic home financing, like deposits, is one of the most important retail banking products introduced by Islamic banks. Retail banking has always accounted for the largest component of financing activities. The products offered through retail banking include home financing, car financing and personal financing. In terms of financing concept, Islamic banks have developed instruments on the basis of murabaha, musharaka, ijara, qard hasan and many more, which are compatible with Shari’a. Before the introduction of Islamic home purchase plan, Shari’a-sensitive clients had very limited choice of owning houses. Hence, some had to rent it out while others choose to follow the opinions of Shari’a scholars, which allowed buying one house through conventional financial services on the basis of darura (necessity).

The main difference between Islamic and conventional home financing is inherent in the underlying contracts used. In a typical home financing deal in conventional banking, the bank will lend a sum to the borrower on interest. On the other hand, in a typical sale based contract, an Islamic bank will buy the property from the seller and then sell it on to the borrower or person seeking home financing at a higher price on a deferred sale basis. The typical underlying sale based contract used is bai’ bithaman ajil (BBA) which is based on a Shari’a concept of deferred payment sale. The term BBA is more commonly used in Malaysia and Brunei, while term bai’ mu’ajjal is more common in South Asian region and murabaha in the Middle Eastern countries.

The other contract used in home financing is musharaka mutanaqisa or diminishing musharaka. It is a hybrid contract and is defined as a form of partnership in which one partner promises to buy the share of the other partner gradually until the title of equity is completely transferred to him. The transaction typically has three steps. First, the bank and customer enter into a partnership contract. Second, they enter into an ijara contract where the customer agrees to rent the banks undivided share in the property. In addition, throughout the contract the customer agrees to buy the share of the bank through a sale, so that every time the customer makes a payment, some of the payment is allocated to buying bank’s share in the property. The diminishing musharaka contract is commonly used for asset finance, property venture and working capital. Al Rayan Bank (formerly known as Islamic Bank of Britain) and HSBC Amanah (no longer in operations) based in the UK use this form of contract for their home purchase plans. Some other contracts used include an Ijara muntahiya bi al tamlik, which is based on the concept of Ijara where the customer leases the house from the bank and it ends with the purchase of the house.

PRIVATE EQUITY

Private equity is a medium to long-term high-growth investment product that provides equity stake in an underperforming company (not listed on the stock exchange) and has limited ability to raise capital. Private equity investors achieve growth by working with the company’s management team to improve performance, provide strategic advice, and drive operational improvements. As stated in GIFR 2010, the term private equity represents a diverse set of investors who take a majority equity stake in private limited liability companies with a view to increase value upon exit. There are three types of private equity activities:

Venture Capital: The funding of a new business, generally at an early stage that is unable or do not prefer to source funds from a bank;

Development capital: Investments in an established business to assist them in expanding; and Buy-out: Funding the purchase of an existing business where there is scope of further improvement.

Islamic private equity works along the same strategies and aims as its conventional counterpart. This means the investment

has to be well diversified across different asset classes and geographies. However,

the difference lies in how the investments are approached. The Islamic private equity approach to investments is largely driven by Islamic injunctions related to Islamic economics and finance rooted in Shari’a. The second difference is the governance structure of the Islamic private equity where an extra layer is added through a mandatory Shari’a supervisory board.

Further, on the investment side Islamic private equity investments have to ensure that the businesses they invest in are involved in Shari’a permissible activities i.e. avoiding businesses including gambling, pork and alcohol production and selling, adult entertainment, conventional banks and financial institutions and other unethical businesses. In addition, the capital structure of the businesses need to be considered that is they should not be heavily involved in interest-based transactions (both on the income and payments side)- this is usually captured through interest-based debt to market capitalisation, cash and receivables to market capitalisation and interest-based investments to market capitalisation. However, if the financial ratios are at the unacceptable level – the investor can agree on restructuring the non-Shari’a aspects of the businesses with the Shari’a supervisory board. Depending on the type of prohibited assets, usually the board would allow up to three years after taking control to remove financial prohibition. Hence, in order to undertake this, Islamic private equity investor usually seeks a majority shareholding in the target in order to ensure smooth transition from Shari’a impermissible activities to Shari’a permissible. Some of the major changes that will be brought by Islamic private equity to target will include, conformity of legal documentation to Shari’a, phasing out Shari’a non-permissible activities, freezing and phasing out of interest-based debt, and alignments of all relationships (including shareholders) with Shari’a.

According to Pregin’s 2015 Global Alternatives Report the global alternative investment assets reached US$7 trillion in 2014. Private equity, including venture capital, accounted for US$3.8 trillion assets under management. Private equity brings a number of benefits to investors including, strong performance, and stake in a growing company. It has a track record of over performing other asset classes, as it is a high risk product and hence high returns. As of June 2013, private equity outperformed S&P 500 index by 1.2% points and 6.8% for the 5 to 10 year period.

The year 2014 was a strong year for deal-making as the M&A across Middle East increased by 23% to reach US$50.3 billion, the highest since 2010. However, according to Thomson Reuters, the private equity firms were not as aggressive as expected

and as a result the M&A activity witnessed a 30% decline last year. Further Arcapita, a private equity bank based in Bahrain, filed Chapter 11 bankruptcy in the United States in the year 2011, highlighting the effects of the financial crisis. Despite the decline, Dubai-based Abraaj Capital had an active 2014 year teaming up with US-based TPG Capital to bid for Saudi fast-food chain Kudu, while it lost to cereal giant Kellogg in a bidding war for Egyptian biscuit maker BiscoMisr. Further the year 2015 looks interesting for private equity as investors look to diversify in the Middle East region and capitalising on the growth opportunities of the young demographics of the region. Small and medium-sized enterprises (SMEs) and start-ups that do not have access to traditional Islamic banking credit are looking into private equity and venture capital as an alternative source of funds.

Islamic private equity industry faces a number of challenges including, experienced and learned personnel’s, differentiating itself from conventional private equity. However, there remains a vital opportunity to contribute

to economic growth by supporting businesses of all sizes.

CONCLUSION

The Islamic banking and finance industry has grown tremendously, from the beginning with no product availability five decades ago to an industry that has set a solid foundation in the wider banking and finance industry. The product availability has seen remarkable growth with Shari’a-compliant alternatives available for most of the conventional products including derivatives, futures and options.

There remain challenges to enhance these products as the industry grow widely and as the product availability in conventional banking and finance is expanding. Needless to say that there is criticism of the existing products that they are mimicking the conventional products and that they are not designed and developed in the spirit of Shari’a.