According to Imam Muslim, “Abu Hurairah reported Allah’s Messenger (PBUH) as saying: When a person dies, all his/her acts come to an end, but three: recurring (ongoing) charity, or knowledge from which people benefit, or a pious offspring, who prays for him/her.”

In Islam, waqf or plural awqaf (a capital gift to Allah swt in the form of a charitable endowment). The donation is meant to be fully invested in an income-producing capital asset, remains intact and is never diluted unless it is replaced with something of equal value. Traditionally, waqf is practiced by donating buildings or land for Muslim religious or charitable purposes. This is a form of recurring/perpetual charity or sadaqah jariyah.

WAQF IN HISTORY

In the middle ages, awqaf contributed critically to the functioning of cities; without direct state involvement, they financed the building and maintenance of innumerable urban services. In the famous account of his journeys through the Islamic world, Ibn Battuta (1304-69) speaks of a dazzling variety of awqaf, including ones dedicated to providing drinking water, paving of streets, assistance to travelers, financing of pilgrimages, and wedding outfits to impoverished brides. Outside of cities, most of the caravanserai (fortified inns) used by traveling merchants were funded by awqaf. In Marshall Hodgson’s words, the awqaf served as a “vehicle for financing Islam as a society.”

CASH WAQF

When ‘Umar ibn al-Khattab acquired a piece of land, and asked the Prophet, peace be upon him, how best to use it, the Prophet advised him to establish it as waqf: “make the land inalienable (unable to be sold or given away), and give its profit away as charity.” The mainstream concept or general perception of waqf is to donate land for a permanent cause. Commonly that cause is for a masjid (place of worship) or madrasa (school), but the traditional asset donation of land has now expanded to include cash donation, known as cash waqf.

The proceedings of the International Conference of Cash Waqf in 2015 in Malaysia concluded that cash itself is eligible to be the subject matter of waqf. Any asset bought by the money pooled into a cash waqf is not regarded as a waqf asset unless intended specifically to be so. As such, the waqif (one who donates to waqf) may, when necessary, sell the asset with the condition that the value will not decrease from its original waqf amount.

WaqfWorld.org, the first Islamic crowdfunding platform dedicated to waqf, was officially launched during the World Islamic Economic Forum in Jakarta, Indonesia on 4th August 2016. WaqfWorld.org utilises the model of cash Waqf in two different ways. The first is to channel cash pledges towards the acquisition or upkeep of a waqf asset. The second is when the cash itself may be the waqf asset pledged. Cash waqf must be utilised by the mutawalli (waqf trustee/administrator) in a sustainable way and give perpetual benefit.

CROWDFUNDING

The crowd is a large group of people who pool funds together for a common cause. Crowdfunding is generally transacted over the internet. In 2015, the total global crowdfunding industry estimated fundraising volume to be about US$34 billion, which is expected to rise significantly by the end of this year. The World Development Report of 2016 concludes that digital technologies have spread rapidly in much of the world. Digital dividends—that is, the broader development benefits from using these technologies—have lagged behind.

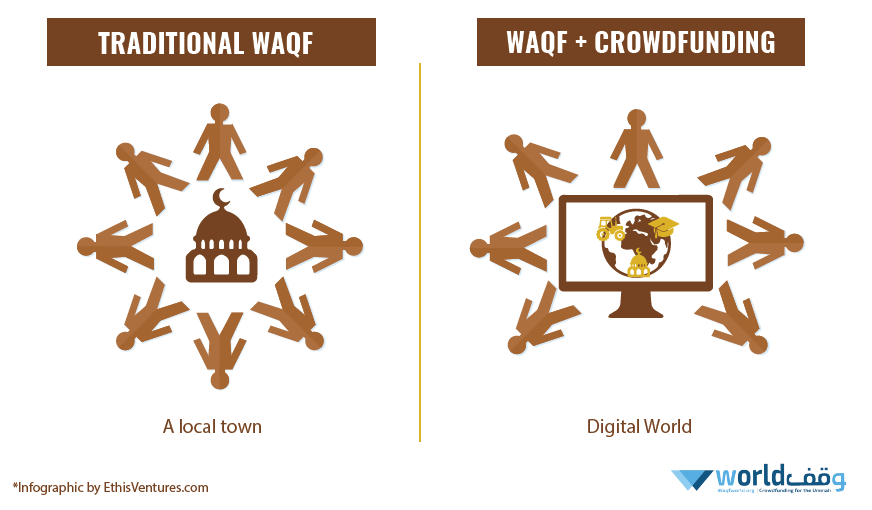

The global Muslim population is about 1.7 billion. The Millennials, also known as “generation Y are people born between 1981 and 1997 and have been quantified by Pew research to be 44.2% of the total population. Given this estimation, we can deduce that there are about 10.2% of the world’s population or 730 million Muslim Millennials. In general, Millennials say they are willing to purchase products or services to support the causes that they believe in. Based on these statistics, crowdfunding waqf on digital platforms and marketing to the Muslim Millennials is a promising proposition. This will facilitate the increase of digital dividends by successfully utilising the 1,400-year-old Islamic practice of waqf to spread social impact.

Waqfworld.org allows mutawallis to use the platform to present their causes to a global digital audience and solicit monetary support. On the other side of the platform waqifs can choose from different causes around the world presented in the said platform and make a cash waqf donation. This innovative platform literally exceeds borders and makes this exchange a vehicle for the redistribution of wealth in a way that is practically seamless.

THE HORIZON

Waqfworld.org is the marriage of a practice by Muslims during the time of the Prophet Muhammed dated more than 1,400 years ago and the modern-day technology behind crowdfunding. The platform creates bridges beyond borders and allows those who are in need and those who are willing to give find each other in a seamless fashion. This facilitates wealth sharing in a whole new manner, and fosters a union to bring forth immediate social impact. The digital nature of the perpetual charity in the world of the Muslim millennials pose great promise to truly transform societies.

WaqfWorld.org is an Islamic financing initiative by University Kebangsaan Malaysia (National University of Malaysia) and Singapore-based Ethis Pte Ltd and part of its EthisVentures. com family of Islamic crowdfunding platforms, including the EthisCrowd.com real estate crowdfunding platform launched in 2014. The founding patron is Malaysia’s 5th Prime Minister Tun Abdullah Ahmad Badawi.

According to Imam Muslim, “Abu Hurairah reported Allah’s messenger (PBUH) as saying: When a person dies, all his/her acts come to an end, but three: recurring (ongoing) charity, or knowledge from which people benefit, or a pious offspring, who prays for him/her.”