INTRODUCTION

Islamic banking is the fastest-growing segment of Islamic finance that provides an alternative form of financial intermediation. In recent decades, Islamic banking has experienced remarkable growth globally offering a comprehensive range of products and services. According to the Global Islamic Finance Report 2016, size of the global Islamic finance industry in 2015 was estimated at US$2.143 trillion. Increased competition with conventional banks will determine the ability of Islamic banking system to remain competitive and relevant. The current wave of internationalisation of Islamic finance has also prompted the need for enhanced risk management strategies for achieving Islamic banking efficiency and sustainability.

The fundamental feature of Islamic banking is the sharing of profit (loss) that entails risk-taking in transactions which requires a high level of financial disclosure and transparency. In facing the challenging financial environment, Islamic banks require a higher standard of risk management. Effective risk management capabilities are important in improving the profitability of Islamic banks. There has been proliferation of writings on risk management in response to the global financial crisis (20072009). Although Islamic banking is less affected by the crisis, Islamic banking is still exposed to various risks. The fact that Islamic banking is submerged in the global financial system makes the risk treatment not only urgent but also complicated that may impede their growth.

Risk management is permissible in Islam and is in congruence with the objectives of Shari’a (Maqasid al-Shari’a) especially with respect to preservation of wealth (hifzulmaal).

THE CONCEPT OF RISK MANAGEMENT

The concept of risk management is acceptable to contemporary Islamic scholars based on the Quranic verse (Al-Baqarah: 282), which requires Muslims to record debt or provide witnesses and supported by Hadith (Sunan al-Tirmidhi: 2517) on the requirement to tie the camel before leaving its fate to Allah swt (tawakal). Risk management is permissible in Islam and is in congruence with the objectives of Shari’a (Maqasid al-Shari’a) especially with respect to preservation of wealth (hifzulmaal). For instance, in mudaraba, the investment project can be specified to reduce the risk of loss.

Risks are uncertain future events that could affect the bank’s desired objectives. It implies the randomness facing a decision-maker that can be expressed in terms of specific numerical probabilities. It can be measured in different ways as follows; measures of dispersion, value at risk and the probability, frequency and severity of loss. Risk management includes creating an appropriate risk management environment, maintaining an efficient risk measurement, mitigating and monitoring process and establishing an adequate internal control arrangement. The management of Islamic banks needs to create a risk management environment by establishing systems that can identify, measure, monitor and manage various risk exposures. A sound risk management framework may help Islamic banks reduce their exposure to risks and enhance their competitiveness.

KEY RISKS IN ISLAMIC BANKS

There are several different types of risk Islamic banks face that can be divided into financial and non-financial risks. Financial risks generally include credit, market and liquidity risk. The nonfinancial risks include operational risk, regulatory risk, business risk, legal risk, strategic risk and Shari’a risk. Realising the significance of risk management, the Islamic Financial Services Board (IFSB) issued a comprehensive standards document on risk management that provides guiding principles of risk management for Islamic financial services. There are unique risks in Islamic banking products that require a unique approach to risk management. This article explores three most common forms of risks that Islamic banks are exposed to namely, credit risk, operational risk and Shari’a risk.

CREDIT RISK

Credit risk is known as the potential risk attributed to delayed, deferred and default in payments by counterparties. The importance of credit risk management becomes critical in the case of Islamic banking where lending is replaced with investments and partnership. For example, in mudaraba investments, Islamic bank as a rabbul–mal (principal) is exposed to an enhanced credit risk on the amounts advanced to exposed to an enhanced credit risk on the amounts advanced to the mudarib (agent). Under mudaraba contract, the bank has no right to participate in the management of the project. Thus, it makes the assessment and management of credit risk difficult in which there is lack of transparency in financial disclosure by the mudarib.

In murabaha transactions, Islamic banks are exposed to credit risks when the counterparty failed to meet its obligation on time. Furthermore, in salam and istisna’ contracts, the bank is exposed to the potential loss resulting from the failure to supply goods as contractually specified that lead to financial losses of income as well as capital. The Islamic banks are exposed to the risk of losing entire invested capital in musyaraka, since such capital may not be recovered as it ranks lower than debt instruments upon liquidation.

OPERATIONAL RISK

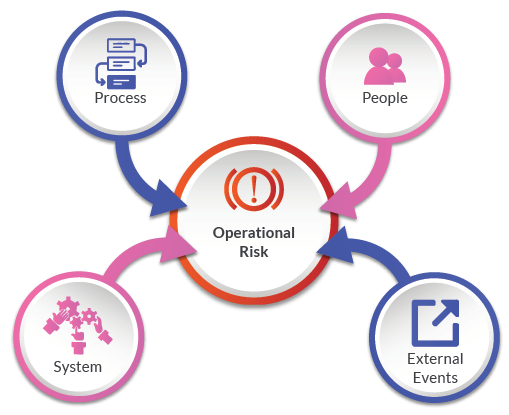

Operational risk has been receiving increasingly attention as the trend towards greater dependence on financial technology, greater competition among Islamic banks and internationalization have left the Islamic banking industry more exposed to operational risks now than ever before. The operational risk is defined as the risk of loss arising from inadequacy or failure of internal processes, as related to people, systems or from external events. Operational risks include the failure of the internal control systems to manage potential problems in the operational processes and back office functions, difficulties in enforcing Islamic contracts in legal framework and monitoring costs of equity-type contracts. Operational risks are likely to be significant in the case of Islamic banks due to their specific nature of contracts. Islamic banking products such as murabaha, salam, istisna’ may increase the operational risk in contract drafting and execution that are specific to such products.

SHARI’A RISK

The importance of Shari’a risks associated with non-standard practices in respect of different contracts in different jurisdictions and failure to comply with Shari’a rules have attracted the attention of regulators, bankers and customers. The practice of Shari’a rules by different jurisdictions results in differences in financial accounting treatment by Islamic banks. For example, some Shari’a scholars consider the terms of a murabaha contract to be binding on the buyer, others argue that the buyer has the option to decline even after placing an order and paying the commitment fee. The different jurisdictions may lead to potential litigation problems in case of unsettled transactions. In the case of failure to comply with the Shari’a rules, the depositors/investors can lose confidence in the Islamic bank and this can lead to withdrawal and insolvency risk. To some extent, a few Shari’a scholars have suggested that if a bank fails to act in accordance with Shari’a rules, the transaction should be considered null and void.

ISSUES AND CHALLENGES

Islamic banks face crucial challenges in improving their risk management capabilities as they are exposed to various types of risks. Risk management is underdeveloped in the Islamic banking due to limited resources, high-cost management information system and lack of technological machinations to assess and monitor risk. There are still only few risk-hedging instruments and techniques in Islamic finance despite its rapid growth. Moreover, Islamic banks is perceived to have higher operational risk associated with greater number of contracts, newer supporting system, evolving skill sets and lack behind best practice adopted by conventional banks. Applications of financial engineering techniques require Islamic banks to focus on risk-return characteristic of the products.

Another challenge for Islamic banks is the standardisation of the process in introducing new products in the market. In current practice, an Islamic bank currently has its own Shari’a board examining and evaluating each new product, without having coordinated efforts with other Islamic banks. Cross-border comparison of Islamic banking performances is difficult because the regulatory frameworks of Islamic banking jurisdictions are not standardised and remain highly divergent, ranging from frameworks that promote dual banking such as in Malaysia to frameworks that only recognised Islamic banking system such as in Iran. The issue of capital framework and liquidity standards is central in adopting the Basel III. The banking institutions are required to raise minimum capital requirements and hold a capital buffer. However, Islamic banks are exposed to operational risk arising from compliance to Basel III requirements. Some of the principles of risk management as proposed in Basel III can be applicable to the Islamic financial industry with necessary modification and adaptations. Even so, Basel III could not answer all the risk management issues for Islamic financial institutions. Hence, there has been a need for alternative and supportive standards on risk management. Nevertheless, serious and sustained efforts are needed to find the applicability which is specific to countries and markets.

Islamic banks is perceived to have higher operational risk associated with greater number of contracts, newer supporting system, evolving skill sets and lack behind best practice adopted by conventional banks.

RISK MITIGATION STRATEGIES

Islamic banks should enhance the risk mitigation strategies by ensuring best practices through sound risk management. The risk management practices should focus on strengthening their risk culture by increasing awareness of various risks exposure.

Top management should ensure the suitability, adequacy and effectiveness of the risk management framework and risk management processes are embedded into their daily operations. Basel III has to a certain extent, enhanced risk coverage that can be assimilated by Islamic financial institutions. Even so, these accords are not considered much relevant to Islamic banks. Islamic banks need to be ahead in exploring other dimensions of risks in the Islamic financial contracts such as emerging risk.

Extensive investment by Islamic banking requires to have a place in a comprehensive internal risk management infrastructure. The requirement to manage risks in Islamic banking becomes more important due to some special nature of the financial intermediation process that is guided by the Shari’a. The risk management infrastructure in Islamic banking must therefore be in place to identify, measure, monitor and control all specific risks in Islamic financial transactions.

Islamic banking need to be equipped with the required capacity and infrastructure to capture the respective risk weights and assign appropriate amount of regulatory capital at each of the different stages of Islamic financial transactions. There is need for thorough and appropriate credit evaluation techniques focusing on regular assessment of the creditworthiness and repayment abilities of the customers which lower the credit risk exposure. It is essential to carefully examine the risk assessment, asset valuation, due diligence and monitoring before entering into equity-based financing.

The Islamic bank should give high priority to ensure transparency in compliance with the Shari’a and take necessary actions to avoid non-compliance. A proper governance framework should be established to consider appropriate level of disclosure that will create an adequate level of transparency and effective prudential supervision. An effective regulation and supervision will ensure the soundness and the stability of the system. The designing of a risk mitigation strategy calls for a closed collaboration between the management of Islamic banks and regulators that focus on harmonization in Shari’a standards, pool resources among Islamic banks and training programs for human resource development.

CONCLUSION

Effective risk management framework is pertinent as the magnitude of exposure to 2risk is indeed great in banking industry. The growing complexity of various risks exposure will prompt greater demand on Islamic banks’ risk management framework. A well-developed risk management framework is essential for Islamic banks to protect against unforeseen losses, achieve earnings stability, maximise profitability and withstand financial shocks. Therefore, continuous improvement of Islamic banks’ risk management practices is needed to strengthen their risk resilience. Importantly, the risk management goals and strategies must be aligned with the maqasid al-Shari’a. Sharpening risk management capabilities in Islamic banks will contribute significantly to their competitiveness and sustainability.