The 7th Global Islamic Finance Awards Ceremony (GIFA Ceremony) was held at a glittery event attended by heads of state and government, ministers, ambassadors and Islamic financial fraternity from around the world. Held on the 6th of September 2017 in Astana, Kazakhstan; more than 200 dignitaries and leaders in Islamic finance attended the awards gala dinner, which was organised by Edbiz Corporation and hosted by the Astana International Financial Centre (AIFC).

In its seventh year, GIFA is now fully embraced by the global Islamic finance industry attracting a host of strong and worthy nominations. The annual ceremony is designed to highlight, encourage and reward exceptional performance and contribution in the growth of the global Islamic banking and finance community with an ultimate objective of promoting social responsibility, adherence to Shari’a authenticity and commitment to Islamic banking and finance. Being the only global Islamic finance awards programme, GIFA winners come from all corners of the world, from the USA to Indonesia, and from the UK to Kazakhstan. The winners are selected from all stakeholders – from industry players to regulators and from Shari’a scholars to the services providers on the fringe of the industry. GIFA is also the only Islamic finance award programme that recognises the role and support of governments and politicians in the development of Islamic banking and finance.

“GIFA prides itself on being the most authentic market-led awards in the global Islamic financial services industry,” said Professor Humayon Dar, Founding Chairman of GIFA. “Since the first awards ceremony in Oman in 2011, GIFA has become the most prestigious Islamic finance awards programme in the world, respected and sought after by leading political personalities and countries involved in Islamic banking and finance.”

Over the last 7 years, GIFA have honoured more than 180 governments, institutions and individuals who have demonstrated strong commitment and leadership in Islamic finance. Commenting on the awards winners, Professor Humayon Dar commented, “Over the years, we have seen new levels of innovation and authenticity in the products and services of our winners. These reflect the growing diversity and strength of the Islamic financial services industry.”

The choice of Astana, Kazakhstan to host the seventh GIFA is strategic, as to highlight the emerging role of Kazakhstan in Islamic banking and finance. With the passing of its first laws for Islamic banking in 2009, Kazakhstan became the first country in the CIS to facilitate the development of Islamic finance and is poised to establish itself as a regional hub for Islamic finance in Central Asia and the CIS region.

AIFC Governor, Kairat Kelimbetov opened the award ceremony with a welcoming address in which he highlighted that “In 2009, Kazakhstan became the first country in the CIS region and Central Asia to create a path for Islamic finance industry. Since then Kazakhstan has witnessed a gradual growth in developing of Islamic finance industry.” The Governor also shared his vision for AIFC to serve as an Islamic finance gateway and Islamic finance hub for the region. As such the Governor said that “one of the pillars in the work of AIFC, scheduled to launch next year is Islamic finance.”

International Financial Centre, delivering his speech.

During her welcoming speech, Dr. Sofiza Azmi, CEO of Edbiz Corporation said that “The coverage of GIFA is comprehensive, as we include all the industry stakeholders from politicians to academicians that have played leadership roles in their respective fields.” She further added that “Since GIFA first made its debut in Muscat, Oman; the awards programme has come a long way to become the number one Islamic finance awards programme in the world.” Today GIFA is indeed a global brand that is recognised as the most authentic and respected Islamic finance awards programme in the world. She also applauded and congratulated all award winners who have displayed leadership and innovation in the industry. She added that their success exemplifies the relentless pursuit of excellence and commitment to create a positive impact in the world through the shared values and principles of Islamic finance.

His Excellency Nursultan Nazarbayev, the President of the Republic of Kazakhstan, addressed the guests and in his speech he said “It is an honour to host the GIFA. Gathering participants of the global financial market is an effective tool of international cooperation.” He added that “the award ceremony will identify the leaders of different areas of Islamic finance, which will contribute to the further development of financial services. I express gratitude to the founder of the global award for the decision to hold a ceremony in our country.” He also reiterated the importance of Islamic finance for the country, saying that the estimated assets of the Islamic finance sector in Kazakhstan is expected to reach US$23 billion by 2025 and make up 10% of the total banking sector assets.

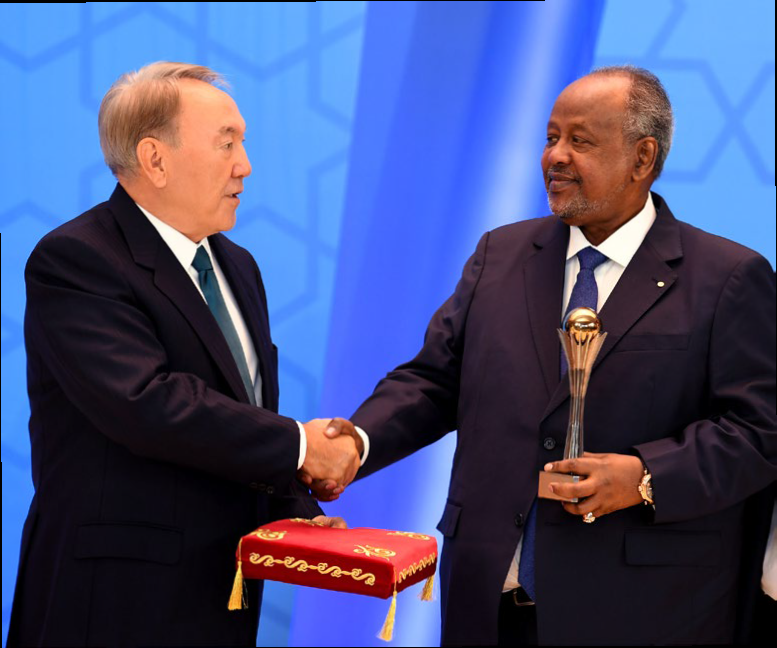

More than 50 individuals and institutions from world over were recognised for their leadership roles in Islamic banking and finance at the prestigious GIFA gala dinner where the President of the Republic of Djibouti, Ismail Omar Guelleh, was honoured with the Global Islamic Finance Leadership Award 2017 for the great strides his country has made in the field of Islamic banking and finance under his direct patronage. It is due to the keen personal interest taken by President Ismail Omar Guelleh that Djibouti is now serving as a gateway for Islamic banking and finance to the East African region.

Djibouti, receiving the Global Islamic Finance Leadership Award 2017

from His Excellency Nursultan Nazarbayev.

The award was presented to him by President Nursultan Nazarbayev who himself was a GIFA Laureate in 2014. With this leadership award, President Ismail Omar Guelleh joins a list of eminent GIFA Laureates, which includes His Excellency Joko Widodo, President of Indonesia; His Royal Highness Muhammadu Sanusi II, Emir of Kano; His Excellency Nursultan Nazarbayev, President of the Republic of Kazakhstan; His Excellency Shaukat Aziz, Former Prime Minister of Pakistan; His Royal Highness Sultan Nazrin Shah, Sultan of Perak, Malaysia; and His Excellency Tun Abdullah Badawi, former Prime Minister of Malaysia.

The Global Islamic Finance Leadership Award 2017 in the Country Category was conferred to the Emirate of Dubai for the global strategic vision the emirate has pursued to make Dubai as a Centre of Excellence for Islamic economy. The Republic of Tatarstan was presented with the GIFA Championship Award (Country) 2017 in recognition of the lead role the country has played in promoting Islamic banking and finance in Russia and the wider region.

the Republic of Tatarstan, receiving the Championship

Award 2017 on behalf of the Republic of Tatarstan.

receiving the Islamic Finance Personality of the Year award

2017

At the individual level, notable awards winner included Adnan Ahmed Yousif, CEO and President of Albaraka Banking Group, who was declared as the Islamic Finance Personality of the Year 2017 for his pan-Islamic leadership role in Islamic banking and finance. Adnan Ahmed Yousif was ranked 6th in the GIFR Influence Index developed by Cambridge IF Analytica, a UK-based think tank. The Index ranked top leaders in Islamic banking and finance on the basis on 5 factors, namely, investment, advocacy, intellectual, thought leadership, technical/professional contribution and tenure. GIFA recognised his strong and visionary leadership in developing Albaraka banks and financial institutions around the world, which has also helped him to effectively advocate Islamic banking and finance on a global level. Under his leadership, Albaraka Banking Group has achieved a number of milestones and has helped the industry to innovate for the benefit of all its stakeholders.

Jamal Saeed Bin Ghalaita (CEO of Emirates Islamic) was named GIFA CEO of the Year 2017 whilst Datuk Ab Latiff Abu Bakar (CEO of Takaful Ikhlas) was awarded Takaful CEO of the Year 2017. Meanwhile, the Islamic Banker of the Year 2017 award went to Amr Saad Al Menhali, Executive Vice President, Head of Islamic Banking Division of Abu Dhabi Commercial Bank.

Other outstanding individuals who were honoured that night included:

- GIFA Lifetime Achievement Award 2017: Dr. Yahia Abdul-Rahman

- GIFA Championship Award (Public Sector Support) 2017: His Excellency Bakhyt Sultanov, Minister of Finance, Republic of Kazakhstan

- GIFA Championship Award (Regulatory) 2017: Ms Elvira Nabuillina, Governor of Central Bank of Russia.

- GIFA Special Award (for Advocacy of Islamic Financial Criminology) 2017: Professor Dr Normah Haji Omar, UiTM GIFA Special Award (Leadership in Takaful) 2017: Wael Al Sharif, CEO of Takaful Emarat

- GIFA Special Award (Leadership Role in Islamic Retail Banking) 2017: Kashif Mohammed Naeem, EVP and Head of Retail Banking, SME and Microfinance at Bank of Khartoum.

- Upcoming Personality in Global Islamic Finance (Product Development & Solutions) 2017: Siraj Yasini, Executive Director – Head of Islamic Finance, Bank of Tokyo-Mitsubishi UFJ, Ltd.

- Upcoming Personality in Global Islamic Finance (Product Development & Solutions) 2017: Othman Abdullah, Managing Director, Islamic Banking, Silverlake

- Upcoming Personality in Global Islamic Finance (HR & Talent Development) 2017: Farid Basir

- Upcoming Personality in Global Islamic Finance (Academic) 2017: Dr Hylmun Izhar

- Upcoming Personality in Global Islamic Finance (Risk Management) 2017: Tauhidur Rahman

Berhad Malaysia, receiving the Takaful CEO of the

Year 2017 award.

Finance, Republic of Kazakhstan, receiving the GIFA

Championship Award (in Public Sector Support)

2017.

Emarat, receiving the GIFA Special

Award for Leadership in Takaful 2017.

Silverlake Axis, receiving the Upcoming Personality in Global Islamic

Finance Award (Product Development & Solutions) 2017.

Islamic Finance, Bank of Tokyo-Mitsubishi UFJ,

Ltd., receiving the Upcoming Personality in Global

Islamic Finance Award (Product Development &

Solutions) 2017

Vice President, Head of Islamic Banking

Division of Abu Dhabi Commercial Bank,

receiving the Islamic Banker of the Year

2017 award.

Banking, SME and Microfinance at Bank of Khartoum,

receiving the GIFA Special Award (Leadership Role in

Islamic Retail Banking) 2017

Achievement Award 2017.

Notable institutional winners included Al Baraka Turk Participation Bank for Best Islamic Bank 2017; Solidarity Saudi Takaful Company for Best Takaful Company 2017; Meezan Bank for Shari’a Authenticity Award 2017; BTPN Syariah for Best Islamic Bank for SME Banking 2017; Mitsubishi UFJ Financial Group for Best Wholesale Banking Award 2017, Bank of Khartoum for Most Innovative Islamic Bank 2017, East Africa Bank for Upcoming Islamic Bank 2017 and Al Hilal Bank Kazakhstan for Pioneer of Islamic Banking (Kazakhstan) 2017.

Bank Nizwa was honoured with Pioneering Islamic Bank Award 2017 for its exceptionally exemplary role in developing Islamic banking in Oman. In tandem with its on-going strategy to bring Islamic banking to customers’ doorsteps and fingertips, the Bank currently offers a suite of financing, savings and investment products for individual customers. The Bank is also in the process of expanding its services to cater to corporate and commercial customers, while providing tailored products for the segments of investment banking and global markets. With innovation at the forefront of its successful operations, Bank Nizwa has been consistently introducing forward-thinking products and services.

receiving the Pioneer of Islamic Banking 2017 award on behalf of Bank Nizwa.

FNB Islamic Banking was awarded the Best Islamic Banking Window 2017 award. FNB was the first of the large four banks in South Africa to open an Islamic banking window and offer Islamic banking to South Africa’s minority Muslim population, which roughly constitutes just 2% of the total population.

This year 4 categories of Market Leadership Award were handed out. GIFA Market Leadership Award (Facilitation & Support) 2017 went to DDCAP; GIFA Market Leadership Award (Islamic Financial Intelligence & Ratings) 2017 was awarded to Moody’s; GIFA Market Leadership Award (Pawnbroking Services) 2017 was once again won by Bank Rakyat Malaysia and GIFA Market Leadership Award (Islamic Asset Management) 2017 was presented to SEDCO Capital of Saudi Arabia.

Banking, receiving the Best Islamic Banking Window 2017 award

on behalf of FNB Islamic Banking.

Market Leadership Award (Facilitation & Support) 2017 on

behalf of the DDCAP Group.

Financial Institutions, Moody’s, receiving

the GIFA Market Leadership Award

(Islamic Financial Intelligence & Ratings)

2017.

Capital, Bank Rakyat Malaysia,

receiving the GIFA Market

Leadership Award (Pawnbroking

Services) 2017 for Bank Rakyat.

The Best Islamic Fund Manager 2017 award was bagged by Nomura Islamic Asset Management (NIAM) for the second consecutive year. Established in November 2008 to serve as the global Islamic hub for the Nomura Asset Management (NAM) Group internationally; NIAM has have successfully built itself as one of the largest Islamic fund management boutiques in the world by Asset Under Management (AUM) size, and have been ranked amongst the world’s top 25 largest for the past 5 consecutive years by Asian Investor.

Islamic Fund Manager 2017 award on behalf of Nomura Islamic Asset Management (NIAM).

Other notable winners in the category of Islamic wealth/asset/fund management are Volaw Group for Best Islamic Trust Formation Services 2017 and Oasis Crescent Global Equity Fund for Best Shari’a- compliant Global Equity Fund 2017. The Best Islamic Fund 2017 award was presented to International Airfinance Corporation for its Aircraft Leasing Islamic Fund (ALIF).

Corporation, receiving the Best Islamic Fund 2017 award on

behalf of International AirFinance Corporation for its Aircraft

Leasing Islamic Fund (ALIF).

Malaysia-i, receiving the Best Islamic Exchange 2017 award on behalf of

Bursa Malaysia-i.

Bursa Malaysia-i was the proud recipient of the Best Islamic Exchange 2017. Introduced in September 2016, Bursa Malaysia-i, the world’s first end-to-end Shariah investing platform. It offers a comprehensive suite of Shari’a-compliant exchange-related services. The platform supports Shari’a-compliant products, including Stocks (i-Stocks), Indices (i-Indices), Exchange Traded Funds (i-ETFs), Real Estate Investment Trusts (i-REITs) and Exchange Traded Bonds and Sukuk (ETBS).

Amanah Ikhtiar Malaysia (AIM), the largest Islamic microfinance provider in the country, is a true global leader as it was awarded the Best Islamic Microfinance Institutions for the 5th consecutive year. As AIM turns 30 this year, the institution remains devoted to its vision of becoming a renowned, revered, dynamic world-class microfinance institution that eradicates poverty and elevates the well-being of ummah.

Microfinance Institution 2017 award on behalf of Amanah Ikhtiar Malaysia.

Contemporary Islamic Studies, Academy of Contemporary

Islamic Studies (ACIS), UiTM, receiving the Pioneer in

Philanthropic Programmes in the Higher Education

Institutions 2017 award on behalf of ACIS.

Best Sukuk House of the Year 2017 was awarded to AmInvestment Bank, which is part of the AmBank Group, a leading Malaysian investment bank. The Bank provides a full range of wholesale banking related products and services that include corporate finance, equity markets, debt markets, Islamic capital markets, global markets and private banking solutions. AmInvestment also has an award-winning track record in the debt, equity and Islamic capital market.

The GIFA coverage is not limited to just hard core financial institutions. The winners include universities, advisory firms, training providers, rating agencies, multilateral organisations, governments, and numerous other institutions beyond the financial sector.

During GIFA 2017, two academic institutions were recognised for their contribution towards the global Islamic finance industry. Universiti Teknologi Mara (UiTM) walked away with 2 awards – Pioneer in Philanthropic Programmes in the Higher Education Institutions 2017 was presented to Academy of Contemporary Islamic Studies (ACIS), UiTM and Global Research Excellence in Islamic Financial Criminology 2017 was awarded to the Accounting Research Institute (ARI), UiTM. Meanwhile, Universiti Utara Malaysia (UUM) received the Best Islamic Finance Education Provider 2017 award.

Research Institute (ARI), receiving the GIFA Special Award

for Advocacy of Islamic Financial criminology 2017.

of Amanie Advisors, receiving the Best Islamic Finance

Case 2017 award for his Emirates Airline Sukuk book.

receiving the Islamic Social Responsibility Award 2017 on

behalf of Khazanah Nasional.

Datuk Dr. Mohd Daud Bakar, Founder and Group Chairman of Amanie Advisors, took home two awards at GIFA 2017 – Best Islamic Finance Case 2017 for Emirates Airline Sukuk and Best Shari’a Advisory Firm 2017. In the consulting space, Karim Consulting Indonesia was the proud recipient of Best Islamic Finance Consultancy 2017. Khazanah Nasional, the strategic investment fund of the Government of Malaysia, was once again the proud winner of Islamic Social Responsibility Award 2017. Khazanah is a pioneer in the development of Islamic finance on both local and global fronts. This year saw Khazanah issuing the second tranche of its social impact sukuk, which includes both institutional and retail offering. This issuance further attests Khazanah’s continued effort to push the envelope on transaction innovation and the positioning for Islamic structures. The first issuance of the social impact sukuk was in 2015. This was the world’s first ringgit-denominated social impact sukuk that combined education and Islamic finance sectors along with socially responsible investments through an innovative structure.

Other prominent winners included Oman’s US$2 Billion Seven Year Sukuk; MIRAS by ICD for Best Human Capital Development Programme 2017; Malaysian Rating Corporation Berhad (MARC) was the proud recipient of Best Islamic Rating Agency 2017; Best Shari’a-compliant Commodity Brokers 2017 went to AbleAce Raakin; Indonesia Stock Exchange (IDX) took home the Best Supporting Institution of the Year 2017 and the International Corporation for the Insurance of Investment & Export Credit (ICIEC) received Global Islamic Export Credit and Political Risk Insurance Award 2017.

Islamic Reporting Initiative (IRI) bagged the Best Islamic Financial Reporting Award 2017 for its leading initiatives in leading creating the world’s first reporting standard for corporate sustainability and social responsibility – across all sectors of business – based on Islamic values and principles. Meanwhile, GIFA Advocacy Award 2017 was presented to S&P Global for its lead role in Islamic financial ordination.

GIFA also recognises the importance of technology in driving the industry’s growth. In light of this recognition a number of awards in the technology space were handed out during the gala dinner. This included Best Islamic Finance Technology Product 2017 for ETHIX by ITS, GIFA Special Award (Micropayments and Digital Technology) 2017 went to AIMS Solutions, Best Islamic Finance Technology Provider 2017 was awarded to Path Solutions and Silverlake Axis took home the Best Islamic Finance Solutions Provider 2017 award.

“I am truly humbled and honoured to receive the Islamic Finance Personality of the Year 2017 award. I believe the award is a strong recognition of the my team as well who is as committed to furthering the cause out of obligation and firm belief that Islamic finance is good for all of mankind. We will carry this growth & success forward with continuous innovation and persistence and with the aim of ultimately making Islamic banking & finance the norm for the consumers globally. On behalf of Albaraka Banking Group, I also would like to thank the GIFA Awards Committee and applaud their efforts to recognise best practices in the global Islamic finance industry.”

MR ADNAN AHMED YOUSIF

PRESIDENT & CHIEF EXECUTIVE, AL BARAKA BANKING GROUP

“I would like to thank the organisers of the Global Islamic Finance Awards for this honour. I accept this award on behalf of our entire team at Emirates Islamic. It is because of their commitment and dedication, our Bank has managed to successfully grow over the last few years and rank among the leading Islamic banks in the UAE. Together, we have built a platform that truly combines the best of Shari’a compliant banking with the latest in banking technology, as we progress the vision of His Highness Sheikh Mohammed Bin Rashid Al Maktoum, Vice President and Prime Minister of UAE and Ruler of Dubai of making Dubai the global capital of Islamic economy. Going forward, we remain committed to keeping Emirates Islamic at the forefront of growth and innovation in the overall banking sector”

MR. JAMAL BIN GHALAITA

CEO, EMIRATES ISLAMIC

“I am honoured to receive Takaful Ikhlas Berhad second GIFA award and very much appreciate the recognition from GIFA. I am thrilled to be selected to receive this award and indirectly, it gives me the opportunity to be at par with those who have succeeded in their own fields. The accolade also recognises the efforts and commitment of our team and our philosophy to be the perfect Islamic financial protection services provider for our customers. The recognition should be shared with all Takaful IKHLAS’ customers, agents and staffs who have been very supportive to me. This success further strengthens my spirit to be more dedicated and work harder in an effort to provide quality and professional service, which will indirectly enhance and strengthen the status of Takaful IKHLAS as the chosen financial protection service based on Islamic principles and values”.

DATUK HJ AB LATIFF HJ ABU BAKAR

PRESIDENT & CEO, TAKAFUL IKHLAS BERHAD

“Alhamdulillah, Meezan Bank is honoured and pleased to be recognized for its strongest USP i.e. Shari’a-compliance. This is indeed a valuable recognition of our commitment towards achieving our Vision of ‘Establishing Islamic banking as banking of first choice…’ This award is a testimony for each one of our team members and for our customers who have supported us in not only becoming the leading Islamic bank in the country, but a full-fledged retail bank across Pakistan. We have one of the largest product development, Shari’a-compliance, audit and research teams in the world who provide innovative, focused and practical banking solutions that are in line with Islamic Shari’a. Since its inception, Meezan Bank has also established itself as a market leader in providing Islamic advisory and arrangement services to other banks as well as industries in converting their operations Shari’a-compliant. If the business of our customer is Shar’ia-compliant, we take it as a challenge to provide a suitable Sharia-compliant financing solution. We have one of the strongest Shariah Supervisory Boards chaired by Justice (Retd.) Muhammad Taqi Usmani that monitors our products and processes and ensures that they are completely in line with Islamic Shari’a. I would like to thank the Global Islamic Finance Awards committee for conferring the Shari’a Authenticity award to Meezan Bank. It is truly fulfilling for the Meezan Family to be recognised for our core values. We value the trust that our shareholders and customers have put in us in providing top of the line Islamic banking products and services”.

MR. IRFAN SIDDIQUI

PRESIDENT & CEO, MEEZAN BANK

“S&P Global is pleased to receive this prestigious recognition for its expertise in Islamic finance. The award is a testament of the breadth and depth of S&P understanding of Islamic capital markets and its commitment to support the industry growth. S&P in-house global team of dedicated analysts not only monitors the credit quality of Islamic institutions and instruments it rates but also formulates coherent, transparent methodologies and timely opinions about the trends shaping the industry. We are keen to continue raising the awareness and improving the understanding of global investors of this important industry.”

S&P GLOBAL

“We are honoured to receive the “Best Sukuk House of the Year 2017” award from the Global Islamic Finance Awards. This recognition reaffirms our capability to leverage on our position as a leading Sukuk house that continuously reinforces its pole position in innovations in the realm of Islamic finance”.

RAJA TEH MAIMUNAH RAJA ABDUL AZIZ CEO OF AMINVESTMENT BANK BERHAD AND MANAGING DIRECTOR OF WHOLESALE BANKING, AMBANK GROUP

“DDCAP Group is delighted to be announced as the winner of the GIFA Market Leadership Award 2017 (Facilitation & Support). We consider it our privilege and honour to receive the recognition of the GIFA Committee. It is respected validation of the commitment and investment that DDCAP has made, during the past two decades, to developing a robust platform to facilitate the execution of Sharia’a compliant liquidly management and capital market transactions, as well as innovating automation for the post trade environment. We are proud of the intermediary business services model that we pioneered, which has clearly encouraged others to follow us”.

STELLA COX CBE

MANAGING DIRECTOR OF DDCAP GROUP

“It is a great honor for us to have this trust and support that reinforces SEDCO Capital’s position as the leading Shariah asset management company globally. This award is a result of SEDCO Capital’s continued efforts and dedication to serving our clients and bridging our Shariah asset management practice with ESG through our Prudent Ethical Investment practice; in addition to great diversification in product development, including international real estate, global private equity and our illiquid assets strategies in listed equites and Sukuks that provide exceptional returns to clients. I would like to thank GIFA for this recognition and thank my colleagues in SEDCO Capital team who worked very hard using their great ideas and years of experience to deliver more innovative products.”

MR HASAN AL JABRI

CEO, SEDCO CAPITAL

“Moody’s is delighted to have been awarded the GIFA Market Leadership Award 2017 (Islamic Financial Intelligence & Ratings). Islamic finance is a fast growing and increasingly important part of the financial markets, the development of which we are committed to supporting, through our ratings, frequent and timely research and outreach to those who have an interest in this sector. We have been increasing the resources we dedicate to Islamic finance and made efforts to strengthen further our coverage across all relevant rating groups, including sovereign, banking, corporates and structured finance. We are therefore very grateful for the recognition received from the GIFA through this award”.

MR HENRY MACNEVIN

ASSOCIATE MANAGING DIRECTOR RESPONSIBLE FOR MOODY’S BANK RATINGS IN THE GCC REGION