FIDUCIARY RATINGS – THE CONTEXT

Islamic finance, as a philosophy is centred around sharing of risks and rewards, taking Fiduciary responsibility and ethical conduct of business. Its religious antecedents make it inherently non-exploitative and socially responsible. While it encourages the creation of wealth, it protects societies against idle accumulation of money in a few hands, whereby the rich get richer at the cost of increasing poverty across the society – one of the more significant criticisms of capitalism.

As an approach to business, Islamic finance merits a fresh look at what investors in such businesses are seeking from their investments, and thereby from ancillary financial service providers like rating agencies. The objectives of the investment proposition may range from safety of capital to business participation or the sharing of all risks and compensation amongst all participants, while operating in a manner closest to Shari’a principles.

Sensitivity to an investor’s need and right to know, is central to the methodological framework of ratings catering to Shari’a adhering investor communities. Islamic International Rating Agency (IIRA) is geared towards the development of Islamic capital markets and provide impetus to local economies through an approach that addresses risks relevant to Islamic finance and Islamic Financial Institutions. While we have discussed at length at several other forums how IIRA’s approach to ratings differs in its mechanics to address issues centred on fairness to investors and governance risks important in a fiduciary context, we here lay down its basic framework and what we hope to achieve through these ratings in Islamic countries.

THE PHILOSOPHY OF FIDUCIARY RATINGS

Ratings seek to inform market participants with the objective of making markets more efficient. At the outset, multiple opinions backed by comprehensive analysis, are inherently useful to investors to deepen their understanding of the investment proposition and benefit from potentially varying views on the risks embedded in an investment.

The credit markets have traditionally been dominated by a few opinion providers and Islamic finance can benefit from a deeper understanding of the risks specific to Islamic transactions, through a tailor-made approach to ratings.

As a concept, fiduciary ratings appreciate the distinctive nature of Islamic finance and the capacity of a large-scale mobilizer of public money to act in its fiduciary capacity, as the underlying theme to fiduciary ratings. Islamic finance is as yet dominated by the banking sector, in which funding sources can either in part acquire debt-like characteristics or be participatory in nature; as such investors may have varied expectations from these investments. Even where a transaction is rooted in the concept of trade or commodity exchange and generates a fixed, pre-specified expectation of return and redemption of capital invested, the manner in which transactions are carried out, have financial implications distinct from a typical debt-based transaction. These in turn may have moderate to significant rating implications.

The Fiduciary rating encapsulates the needs of multiple investors as a system of ratings rather than one specific grade. While non-participatory obligations are rated under traditional rating denominations, and are focused on the ability and willingness of an institution to meet its contractual obligations in a timely manner, Fiduciary ratings are geared towards holders of participatory stakes, and which may in essence stand to absorb loss.

The fiduciary rating methodology is conceptually extendable to all types of Islamic institutions, with its emphasis on the principles of governance (including Shari’a Governance), in parallel with an evaluation of financial strength. A similar concept has therefore been developed for Shari’a-compliant business models in other significant businesses like takaful, with the ability to pay claims and overall financial strength being one part of the assessment and a rating for the governance framework being the second part. In takaful firms, the business structure and principal agreements dictate the distribution of rights and obligations of all parties involved and the methodology addresses these distinctions to arrive at a suitable approach for each organizational form. In addition to a financial strength rating which serves as a proxy to the takaful firm’s ability to meet policyholders’ claims, a fiduciary rating is assigned to reflect the governance parameters instituted in the firm. On a similar note, Sukuk ratings also give due consideration to the process by way of which the Sukuk has been structured and approved by Shari’a scholars, and its ongoing conformance to Shari’a precincts.

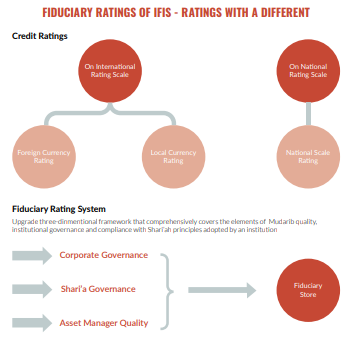

Fiduciary Rating System

Upgrade three-dimensional framework that comprehensively covers the elements of Mudarib quality, institutional governance and compliance with Shari’ah principles adopted by an institution distinctions to arrive at a suitable approach for each organizational form. In addition to a financial strength rating which serves as a proxy to the takaful firm’s ability to meet policyholders’ claims, a fiduciary rating is assigned to reflect the governance parameters instituted in the firm. On a similar note, Sukuk ratings also give due consideration to the process by way of which the Sukuk has been structured and approved by Shari’a scholars, and its ongoing conformance to Shari’a precincts.

FIDUCIARY RATINGS OF BANKS

In a bank, the fiduciary score essentially provides an evaluation of the bank’s ability to function as a ‘Mudarib’ and is in turn a three tiered evaluation. It assesses the extent to which the risk management and business selection processes employed, are effective in preserving the value of investment and deliver returns as earned, allowing for a fair distribution of risk and reward. It also provides information on the level of Shari’a-related controls exercised and the overall supervisory environment in the bank.

While it may not be legally binding on the Mudarib to maintain the amount invested by an investment account holder (IAH), the competence with which these amounts are invested and the level of disclosure to IAHs assumes much greater importance in the context of an Islamic Financial Institution (IFI).

A public institution’s credibility is rooted as much in its governance practices as its financial well-being. As such the concept of the fiduciary score and ratings are not independent of each other and are logically interdependent. A very low score on practices and governance framework will automatically restrict ratings. In Islamic institutions, a lack of confidence in terms of adherence to Shari’a principles can arguably have a greater impact on market sentiment than the appearance of financial difficulties. Therefore screening of practices instituted to inculcate an environment that respects principles of Shari’a are an additional area of study, with potential implications on the credibility or creditworthiness of the institution. Fiduciary scores are factored into ratings in a systematic manner with scores at each end of the spectrum having a particularly strong impact on financial strength ratings assigned. With governance and improved risk management in Islamic banks gaining greater attention amongst Islamic market participants, the fiduciary rating approach serves multiple investor needs, while also in itself becoming a benchmark of transparency amongst IFIs.

TIER-1 – ASSET MANAGER QUALITY

The first tier of the fiduciary score judges the bank’s ability to fairly and transparently manage investment with diligence in line with the objectives of the investment. In Islamic banks, the ability to preserve capital and provide consistent returns, becomes the benchmark of the evaluation. With some overlap in parameters employed to judge an institution as a Mudarib and those employed for a bank’s credit assessment, there is greater focus of the fiduciary scoring mechanism on aspects including the principles of governance and an appreciation of the investment account holders as being quasi-equity holders. The real difference lies in that the Mudarib’s ability is evaluated not in the context of repaying a given amount under an obligation but the processes applied and their effectiveness to serve in the best interest of investors. The financial strength of the institution reflects the success of the institution in deploying sufficient resources to manage investments and is a fair indicator of the risk to investors who are participants in the bank’s business portfolio. Policies and limits in place, in addition to the track record of management in efficiently managing the institution to the best of the investors’ advantage, are key determinants of assessing the bank as an ‘Asset Manager’.

TIER-2 – CORPORATE GOVERNANCE

The second tier of the fiduciary score pertains to the overall governance of the institution and the degree of protection that it offers to all stakeholders. Transparency (absence of ‘Gharar’), is a pillar of Islamic financial transactions, as well as a key principle of good governance. The role of an Islamic bank as ‘Mudarib’ has increased the importance of governance and an independent opinion on the same highlights the organizational system in place to safeguard the interest of all concerned. Emphasis is placed on self-regulation comprising the bank’s control system including internal control, auditing and compliance and risk management systems.

Comprehensive policies and streamlined checkpoints along workflows are evaluated. Complemented by system support these can distinguish institutions exercising adequate vigilance over the investment process vis-à-vis those which feature system weaknesses.

Across all jurisdictions that IIRA works in, we have seen a gradual upgrade of regulatory vigilance on the banking sector. Inspired by the updates by the Basle Committee applicable to globally active banks, regulators have introduced a spate of ‘improvements’ with focus on governance and caution to Investment decisions. Generally, the current wind of caution is favourable to depositors, and has gradually refined banking practices in several jurisdictions. The interwoven objectives of these regulations have served to upscale the governance environment in banks more effectively over recent periods.

TIER-3 – SHARI’A GOVERNANCE

Shari’a Governance is the third element scored as part of the overall fiduciary score. Conceptually, corporate governance in an Islamic Bank cannot be assessed without keeping the institutionalization of Shari’a precepts in view. However, for the purpose of this methodology, the general corporate governance and Shari’a best practices in an Islamic institution are scored independently, to fulfil the understandably common investor need to know more about the ethical standing of an Islamic entity.

Segregation of scores ensures that all stakeholders are provided with an opinion on what they consider more or less relevant to their investment decisions. This may be the financial strength of the institution, its ability to pay back its creditors or the quality of Shari’a governance framework instituted, as the case may be. Shari’a governance primarily focuses on the systems and procedures that ensure Shari’a conscious business processes and a system of checks and balances embedded to verify compliance with the internal guidance provided by an institution.

Shari’a governance standards of the bank are evaluated in the light of best practices, as also laid down by the AAOIFI and IFSB.

These standards include the structure of the Shari’a governance framework, reporting lines, level of diligence applied, and comprehensiveness of scope of checks and audits, while also covering the institution’s compliance with pronouncements and concerns raised by the Shari’a supervisory authority, internal to the institution.

Given that IFIs are also accountable to Investment Account Holders (IAHs), IIRA will specifically review the measures taken for the preservation of rights of IAHs. It is important that Shari’a internal control framework does not become departmentalized and remains effective, throughout the approach and practices of an institution. Embedded within the concept of Shari’a governance is the area of compliance with internal Shari’a guidance. A relevant point in this regard is that the IIRA does not impose its own interpretation of Shari’a compliance but rather focuses on determining the gap if any between the guidance provided by the institution’s own Shari’a authority and the rules and regulations in the relevant jurisdiction and other best practices employed within the market.

THE FINAL SCORE

The above three elements are scored independently and then a weighted score is computed as the final Fiduciary Score. This rating methodology is expected to ensure a much higher degree of transparency, through enhanced disclosures, thereby giving a higher degree of value addition to investors. In contrast to conventional rating offerings that focus either on credit or governance aspects, the Fiduciary Rating System developed by IIRA recognizes the mutually dependent nature of credit & fiduciary risks in an IFI, effectively.

NATIONAL SCALE RATINGS

IIRA’s focus on national ratings has therefore been the hallmark of its ratings philosophy. In each of the jurisdictions that it rates, IIRA assigns national ratings in addition to international assessments. In some jurisdictions where international funding is not prevalent, only national scale ratings are assigned. This is particularly useful in soliciting retail, local funding and has found increasing acceptance over time. National scale ratings have been prevalent in South Asia and South East Asia for several years now and cater exclusively to local investors, investing in national currencies. These ratings have played a vital role in catapulting local markets to a high degree of local efficiency, also contributing to the documentation of large unstructured economies.

WHAT DO WE HOPE TO ACHIEVE THROUGH FIDUCIARY RATINGS

Unlike the standard model applied by conventional banking institutions, Islamic financial management adapts more conveniently to the concept of asset management and mutual funds and we find various business models within Islamic

banking. The most common is the treatment of unrestricted investments as a class of depositors with loss-bearing characteristics, in contrast to the highest priority given to depositors in a conventional bank. While typically sourced as on-balance sheet funds, Islamically generated deposits can take several forms including off-balance sheet funds, managed both with or without investor discretion. Funds, once sourced may be managed as separate pools, commingled pools or potentially multiple pools.

Having conducted ratings across 12 jurisdictions, IIRA has observed these models from the perspective of investor expectations, acceptability of low returns or capital loss, and possibility and form of regulatory intervention, in some countries. All of these f actors have an impact on how an institution is managed with significant consequences for ratings. IIRA’s fiduciary scores reflect the level of self-discipline in the implementation of Shari’a principles and has as such contributed to providing a cross-country benchmark for Shari’a practices. IIRA’s jurisdictions of influence vary considerably in terms of the acceptance of Shari’a-compliant banking as an alternative form of business and the presence or absence of a regulatory framework. While some Islamic banks have a rudimentary approach to Shari’a governance, fairly developed models have also evolved alongside, with regulatory supervision providing incentive for homogenized practices and in some cases homogenized product offering.

The ultimate goal of ratings in Islamic countries is the development of local capital markets. While these ride the economic curve in any jurisdiction, an enabling environment of which a well-developed ratings culture is an important pillar, is key to growth on solid foundations. Transparency and a system guaranteed steady supply of information contained in commonly understood denominations of ratings, encourages market participation. Robust domestic markets, of which Malaysia is a luminous example, is a path that other Islamic countries are poised to follow, most notably Turkey and Saudi Arabia in the Gulf Cooperative Council (GCC). The Kingdom of Saudi Arabia has recently announced regulations for the licensing of rating agencies operating in local markets, which is an important step to develop local markets.

As such ratings that satisfy the information requirements of Shari’a-conscious investors serve to enhance market confidence in the domain of Islamic finance. In turn, gradual growth of local markets leads to a self-reliant financial structure and enhances cost efficiency of markets, strengthening them for a place in regional economics and lower dependence on external funding, onerous to national treasuries. Most importantly, it brings to the fore players that would not stand a chance to access international funding. These are the SMEs and the smaller corporate concerns which find easier access to funds in nationally developed markets. Sustainable market structures are essential to balanced economic growth and promote savings and investment and insightful ratings play a critical role in this regard.