ISFIRE presents this thought-provoking article to its readers, with a view not to impose a new ideology but to think independently and draw their own conclusions. Many readers would find the line of argument provocative, which is actually the intention of the authors. Needless to say that these are not the views held by the Editorial Team of ISFIRE and are presented here to stir a debate on the issue, which is relevant to all the Muslim countries in the world.

INTRODUCTION

If only achieving full Shari’a compliance is as easy as flicking on a switch. The reality however is much more complicated. It is a process that starts from zero, i.e., the initial starting point of being completely Shari’a non-compliant with the final objective of working to attain the ultimate goal of achieving full Shari’a compliance.

This article will examine the question of governments and government agencies in Islamic nations with proactive and positive social programmes designed with the purpose of uplifting the economy of their citizens, including or especially that of the economically weak. However, these government initiatives are taking place in a world where Islamic finance is barely 2% of the global financial market. Under these conditions, it is inevitable that ‘halal’ monies will be mixed with ‘haram’ monies tainted either directly or indirectly with riba. There is no doubt that for Muslims riba constitute a major sin, so much so that the Holy Quran states that the Prophet (peace be upon him) and the Almighty will wage war against those who are involved in riba [Sura al Baqara (2:279)]. No other wrong-doing in Islam carries such strong wording. However, we now live in an age where we are emblematically or almost entirely immersed in a world that revolves and operates its finances and economy on riba. A saying of the Prophet (peace be upon him) foretold or at least hinted at the period we are in now.

Abu Huraira reported: The Messenger of Allah, peace and blessings be upon him, said, “A time will come upon people when they will consume riba.”

They said to him, “Is that all of the people?” The Prophet said, “Whoever does not take from it will be afflicted by its dust.”

Therefore, today – in such a case, particularly in a poor or developing Islamic nation, how would you see the bigger picture for such nations if a social programme can be launched that would benefit the ummah economically but is unable or where in some cases it is impossible to completely avoid riba – simply because the fact is we live in a world that approximately operates 98% of its finances on riba? What would be the priority here? Strengthening or even rescuing the ummah from poverty or a strict observance of riba avoidance that would kill programmes that could help to enrich or economically strengthen the ummah?

In reality, that journey from zero Shari’a compliance to achieving a full ten out of ten compliance is fraught with various Shari’a issues that can put not only an Islamic nation but also any government organizations in Islamic nations under a lot of superfluous pressure from the Shari’a angle or lobbyist to achieve full compliance either immediately or at least within a short time frame. For example, in Malaysia, familiar names that unceasingly champion Islamic finance, such as Bank Negara Malaysia (BNM), the Securities Commission or even the Ministry of Finance are not in themselves fully Shari’a-compliant institutions. They cannot be fully Shari’a compliant even if they want to.

Because at this point of the Islamic finance industry’s development and the state of the global financial system that has been in place for hundreds of years – such government institutions of Islamic nations cannot attain full Shari’a compliance immediately or in the short term simply because as stated before approximately 98% of the world still deals with conventional finance. Perhaps in the future we will see such obstacles becoming less problematic for Islamic nations or maybe even the complete removal of fractional reserves in the banking system of Islamic countries which creates paper wealth but not actual, real economic growth. Let us not befool ourselves, Islamic banks today are also part of the fractional reserves banking system which in most cases results in Islamic banks not being able to back up or equate their cash with assets of the same value, i.e., that for an Islamic bank it is not just paper wealth created by the fractional reserves banking system but is reflective of the actual wealth of the economy.

That is not to say all Islamic nations are like that. The Republic of Iran and Sudan adopts a fully Shari’a-compliant financial system. But these two countries are special cases because of their political dimensions. Also it cannot be argued that these two countries are economic powerhouses – they are not. The question is – is it still worthwhile for an Islamic country to adopt Islamic finance wholesale when it is not ready for it? In the case of Republic of Iran and Sudan, there are many other factors at play of course including UN economic sanctions, for example.

But Pakistan provides an interesting example where changes were called upon for Islamic finance to be implemented in the country but due to lack of preparation in the system, such move failed officially in 2002. The country have decided that notwithstanding Pakistan’s Constitution on obligation to live in accordance with the injunctions of Islam, the country found that implementing one of Islam’s key commands was simply not possible at the moment. The initiative began in 1991 as the Federal Shariat Court in a sweeping judgment declared that all laws relating to interest offend the Quran and the Sunna and thus instructed the government to bring laws regarding finance and banking to conform to Islamic requirements. Since this is in line with the Constitution of Pakistan , it made it obligatory for the government to take steps to enable the Muslims of Pakistan to lead their lives in accordance with the injunctions of Islam. Various taskforces were set up by the government to map the transformation to a riba-free economy but it was not successful and the bodies reached some form of consensus that such transformation is impossible within a short period citing lack of genuine support from the society as the main reasons for the failure. A compromise was eventually reached whereby the Islamic banking system is allowed to operate in parallel to the conventional banking system and the decision made by Federal Shariat Court on 1991 was considered obsolete by the Supreme Court in 2002.

To delve further into these complicated issues yet relevant to all Islamic countries, this article will be divided in three parts.

Firstly, we will (and must) look back at history to see two crucial interregnums that befell Islam. The first interregnum, the ummah rose to the occasion and overcame the challenge – eventually. The word eventually is used here because from the period between Baghdad’s sacking by Hulagu’s Mongols and the rise of the Ottoman Empire. That period was fraught with many challenges. Some of these involved atrocities directed internally and externally encouraged by the clergy of monotheist religious leaders of the period to antagonize their religious rivals for the purpose of obtaining land and political gain. The rise of the second phase of Islamic civilization after the first civilizational interruption that ended the Abbasid influence in Iraq was a very demanding period and took decades for Islam to repair. We use the word ‘repair’ and not ‘recovery’ because recovery would imply Islam and the ummah did not suffer permanent injury from this first interregnum.

This article does not have enough legroom to study in-depth the interesting period between the two timelines (i.e., Mongols’ invasion, their acceptance and embracing of Islam and the rise of the Ottoman Empire). Suffice to say here, it is a history that took decades before the Islamic civilization restored its influence back in the world after the defeat in the hands of the Mongols. Longer if you consider the fact that the Ottoman Empire grew over the years and was not immediately the superpower nation of the time – that growth and achievement also took a long time.

Whilst today, we are in the midst of the second interregnum. Here is where the article will focus most.

The second part will examine the impact of the second interregnum that the ummah still suffers from today, i.e., the fall of the Ottoman Empire, the subsequent occupation and fundamental changes made to Islamic countries by Western colonists on key aspects of their economy, education and law. These changes impacted the ummah heavily, as regulations based on Shari’a for hundreds of years were quickly eroded and replaced with Western laws and values – including conventional banking.

We will look at Malaysia as a case study to see that among the three communities in this country, it is the Muslim Malays that lay bottom of each and every meaningful economic statistics post-colonial era and today. We will also touch on what the Malaysian government attempted to do to change this dangerous situation.

Why dangerous? Because people can and will lose all sense of sensibilities when their stomach is empty and when they find they no longer have nothing to lose. Malaysia went through that in our reprehensible racial riot of May 13, 1969.

The third part will discuss the issue from two perspectives – Shari’a and its practical or plain logic application in the world we live today.

A fairly common example cited on the issue of choosing life over death from Shari’a perspective is the classic instance of being stranded with only carrion birds for a person to eat. According to the vast theories of Maqasid al-Shari’a, in such situation one must put survival as a priority and the ego of consuming something unwholesome as carrion as secondary, in fact not even secondary to completely ignore it for the sake of the individual’s survival. Most if not all of you have heard of such analogy before.

But we are in the 21st century now – how many of us have had to choose between starving to death and eating a carrion bird? It is a situation that hardly applies today. But the type of situations you may be familiar with is this – do you choose a conventional mortgage that is cheaper than an Islamic mortgage – particularly where the Islamic mortgage is not affordable for you? Or for a Muslim to make investments that provide competitive returns as opposed to those with poor returns – but the high-yielding investment scheme itself has mixed views on whether such investment is Shari’a compliant or not.

Egypt went through this in the early 1900s during their proposed Sunduq at-tawfir initiative for its citizens with learned scholars such as Muhammad Abduh and Rashid Rida providing Shari’a opinions. Like other developed countries, Egypt introduced their own interest-bearing postal Sunduq al-Tawfir which essentially means ‘Savings Fund’. This fund accepted cash deposits from individuals to be used for various small investments. In exchange, the fund issued certificates that yielded depositors a return on their investments according to a fixed and predetermined rate. Over 3,000 people refused the fixed interest from the investment so the government then asked the Mufti informally if there was a legal way around this.

Muhammad Abduh, who had been appointed Mufti of Egypt in 1899 had been asked to issue a fatwa clarifying the status of such certificates in Islamic Law. On this issue, Muhammad Abduh and Muhammad Rashid Rida (Abduh’s disciple) disagreed with Khedive Abbas who was the Director of Post so the Khedive assembled a group of ‘Ulama in Qasr al Qubha and requested for a Shari’a interpretation for Sunduq at Tawfir for the ummah. Rida found the discussion among the ‘Ulama to be the same as the plan he had suggested earlier.

Khedive then appointed a board of ‘Ulama from Al Azhar University to revise the case but eventually the ‘Ulama presented a plan which was similar to the one originally suggested by Mufti Abduh. Later Mufti Abduh also agreed that technically, some loans for interest (Qard bil-Faida) were ‘Shirkat al-Mudaraba” hence interest on them was not riba . However, it was not a final decision made by Mufti Abduh as it happened only in his private conversation. He did not reach a final satisfaction on this matter and refused to declare his opinion to the public and bear the responsibility for this conclusion to the Egyptian Muslims. Furthermore, his opinion on riba was not written by himself but it was conveyed by Rida, who is also known to have often mixed his own ideas with his master’s. As a conclusion, we can say that the Sunduq at tawfir was a failure and the ummah failed to benefit from this programme due to the dispute between scholars and regulators, from Shari’a perspective.

Receiving a fixed amount is certainly tantamount to riba, but was there no way of restructuring or getting the appropriate Shari’a consensus to compromise for the greater good of the Egyptian ummah? We invite the readers to draw their own conclusions on this matter. Could a savings programme undoubtedly tainted by riba be structured in a way that would reach the programme’s ultimate objective – a perpetual method for providing economic empowerment of the Egyptian ummah?

This article will also examine the issue regarding mixture of halal and haram income in Malaysia. We will look at the federal government’s financial practice as our example for this case study.

Government collects taxes from companies – all companies, including banks, casinos and gaming companies. This money then goes towards paying civil servants – including those working in State Fatwa Councils and government-funded Islamic universities. If we look at the bigger picture, this money is tainted with riba money since originally it is from a mixture of halal and haram income. If we accept this at the government level which is also considered as ulul amr, why can’t we use this methodology to also be applicable as an exception or at least a compromise to government-owned institutions that are tasked to uplift the economy of the ummah?

It is impossible to avoid the mixture of halal and haram income in this modern world, and as the hadith prophesized – you will at least be “afflicted by its dust”. For example, 8 out of 10 Malaysian Islamic banks are owned by conventional banks. The growth of Malaysian- owned Islamic banks is largely dependent ironically enough on the strategic directions taken by their Shari’a non-compliant owners.

That may seem distasteful now, but history shows great things can be borne from vice – for example Saydina Umar’s conversion to Islam originated from murderous anger, the defeat at Uhud was at the hands of Khaled al Waleed who later became one of Islam’s legendary general and the rise of the Abbasid empire was preceded by the murder of 80 members of the Umayyad family who gathered in Jaffa because they were promised clemency by the Abbasids.

So the questions is – as ummah, and let’s face it, there isn’t a single developed Islamic country today; how then do we equate the carrion example above to an entire ummah where the majority is under agonizing economic pressure? Can we argue that this situation calls for a jihad on the economies of Islamic nations?

PART 1: THE TWO INTERREGNUMS OF THE MUSLIM CIVILIZATION

Starting from the era of Prophet Muhammad (peace be upon him – PBUH), Islam faced countless obstacles in its implementation. The companions of Prophet Muhammad (PBUH) continued to lead the Muslims and this is where the Caliphate system began. The Muslims reigns continued then with the Umayyad Caliphate before taken over by the Abbasid Caliphate. Scholars and historians label this period as the Islamic Golden era. In the early 11th century, however, the Abbasid Caliphate faced political instability due to internal conflict. The Ilkhanate Mongol, under Hulagu Khan took this opportunity to conquer Baghdad in 1258. The Mongol raid destroyed an empire that lasted for more than 500 years and it was the first major defeat since the establishment of Islam. The impact was severe as approximately 1 million people were killed including scholars and a large number of books were destroyed and permanently lost.

As the Abbasid Caliphate collapsed, the Caliphate institution became a mere symbol without real power. The Muslims became divisive despite the Quranic injunction, “And hold firmly to the rope of Allah all together and do not become divided. And remember the favor of Allah upon you – when you were enemies and He brought your hearts together and you became, by His favor, brothers. And you were on the edge of a pit of the Fire, and He saved you from it. Thus does Allah make clear to you His verses that you may be guided.” [Surah Al Imran (3:103).

However, another Islamic dynasty rose slowly, known as the Ottoman Empire, in 1299. The Ottoman Empire reached their Golden age circa 1520-1566. Hence, it is not incorrect to say that the first interregnum lasted from 1258 till 1520, approximately 260 years or so.

However as the Ottoman Empire collapsed in 1922, the Muslim world faced their second interregnum, which is arguably worse than the first. Almost all Muslim nations were colonized by Western powers, bringing with them not only a new culture but fundamental changes were made to laws that were historically based on the Shari’a. The whole Islamic world was impacted by the second interregnum as fundamental changes were made in the legal, administration, economic system and culture. This eventually paved the way for a financial system founded on conventional banking which today is deemed as riba.

The ‘problem’ of the financial system or riba, however, appeared to be far from the minds of Muslim leaders of that period. A more significant problem has arisen – in Malaysia for example, where the Muslim Malays digressed economically and slid into abject poverty.

PART 2: THE SOCIO-ECONOMIC CONDITION OF THE MALAY MUSLIMS POST BRITISH INDEPENDENCE

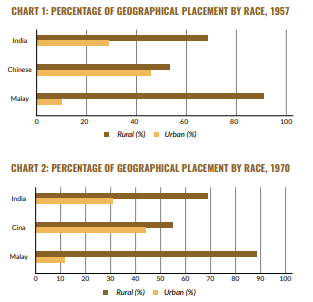

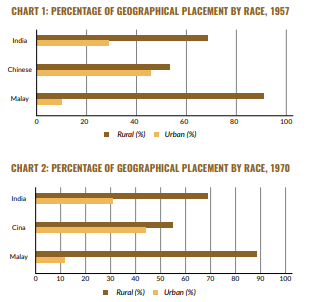

The three predominant races in Malaysia are the Malay Muslims (49.8%), the Chinese (37.1%) and the Indians (11.1%). The latter two communities were brought in by the British mainly to develop the tin mining industry and the rubber industry. Between the periods of post-independence from the British in 1957 till 1970, this is the social stratification of the 3 majority races in Malaysia.

As we can see from the above, more than 80% of the Malay Muslims lived in rural areas, far from any center of economic activities and also where opportunities for education and jobs are limited.

Chart 3 shows the Muslim Malays on average spend just under 4 years in education. As for gainful employment by sectors, almost 70% of the Malays are mainly in the primary sector, i.e., fishing, basic farming and the likes. This is not surprising considering the facts above, i.e., Malays are chiefly in rural areas and are the least educated.

Notwithstanding the fact that the Muslim Malays are at the bottom both in terms of education and jobs, the Malaysian economy paradoxically posted a steady growth since 1957. But this growth had little or no impact on the social mobility and economic condition of the Muslim Malays as they continue to be trapped by poverty.

This severe economic imbalance eventually caused a deadly racial riot on 13 May 1969.

The government’s reaction was to introduce an affirmative economic action plan known as the New Economic Policy (NEP). The NEP had two main objectives:

- Eradication of poverty in a comprehensive manner regardless of race or religion; and

- Elimination of identification of race within income classes.

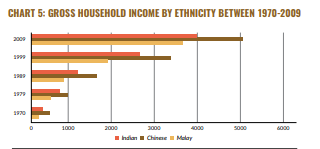

The NEP was successful in reducing the national poverty rate in Malaysia from 49 percent in 1969 to 19 percent in 1990. The second objective of the NEP of eliminating the identification of ethnic groups within income classes has not been achieved – the Malay Muslims are still identified today as the majority populations that are stigmatized with poverty.

This is because the gross income of the Malay community is still low and the ‘soft’ target of 30 percent for corporate equity ownership among the Malay community in 1990 has not been achieved.

Even though the NEP was not labeled as an ‘Islamic’ project, its purpose of uplifting the socio-economic conditions of the Malay Muslims – the ummah’s economy as a whole and gradually over the long term – is certainly fard kifaya at heart and its substance. Since the introduction of the NEP, the economic conditions of the Malay Muslims are steadily improving. However, the deep-seated problems brought by the second interregnum shows that the Malay Muslims are still at the bottom of the pile.

So as we can see, the Malay Muslims still have some ways to go before reaching economic parity. But in a world dominated by riba – would shunning the 98% non-Shari’a compliant market bring economic progress to the ummah?

PART 3: SHARI’A ARGUMENTS AND THE REALITY FROM THE ECONOMIC PERSPECTIVE

Malaysia is well known as one of the major driving force in the development of Islamic finance. Nonetheless, the question remains. Are various government organizations in Malaysia, which strongly promote as well as make important issuance of Islamic investment products, themselves Shari’a compliant? The answer is no. At this point it is simply unworkable.

This is because we live in an economy where it is impossible at this juncture for governments of Islamic countries and other government institutions such as central banks to be fully Shari’a compliant without compromising other aspects of the economy or in some cases, even political stability. Islamic finance is barely 2% of the global financial sector – which central banks could possibly deal in financial transactions in a market with just 2% whilst ignoring the 98% – which is where the real action is as far as trade and commerce is concerned. The authors do not believe any Muslim nation can achieve meaningful growth if they are not at the center of where trade and commerce happens.

Even in Malaysia, with the amount of effort put in by the government and regulators alike since the Islamic Banking Act 1983 (now repealed), the market share of Islamic banks are still hovering around 22%. Meaning, anecdotal evidence point to the irony that only 1 in 5 Malaysians subscribe to Islamic finance, in a nation with 16.8 million Muslims, representing 60% of the population. Thus despite strong year-on-year growth of the industry, Islamic finance in Malaysia still has much to do to catch up with conventional banking. This will inevitably take time.

As stated above – conventional finance is still dominant i.e. 78% in Malaysia and 98% globally. How will it affect those who do not want to do their banking with Islamic finance? The irony is that there is a section of Muslims in Malaysia that are still not convinced Islamic finance meets the objective of Islam.

We have had many debates with fellow Muslims, professionals and otherwise, in board meetings and in seminars, at home with relatives ‘discussing’ this particular matter and we are sure you can find similar arguments in books and publications which conclude or argue that Islamic finance in its current guise is not fully Shari’a compliant and, hence, requires major adjustments.

Given this attitude towards and perception of Islamic finance, we cannot force consumers, Muslims or otherwise, to embrace Islamic finance.

This is not a new problem. Now let us look at the Shari’a aspect.

Contemporary scholars have the different views on this problem. It should be firstly emphasized here that classical and contemporary scholars never argued on authenticity of the prohibition of riba’, It is clear that the prohibition is based on dalil qat’i (conclusive evidence) stated in the Qur’an and the Prophet’s sunna.

“It is impossible at this juncture for governments of Islamic countries and other government institutions such as central banks to be fully Shari’a compliant without compromising other aspects of the economy or in some cases, even political stability.”

The ‘grey area’ is the argument among scholars today on mixed-income (halal income mixed with riba). As stated earlier in this article, in Malaysia the government collects taxes from all companies including banks, breweries and casinos. These funds are then utilized as emolument to pay the wages of civil servants including that of Muftis, their respective council members, lecturers of public universities and so forth. So if there are scholars and critics out there who continue to overthink this issue of the mixture of halal and haram income, especially when concerning Malaysian government agencies and institutions that are tasked with uplifting the ummah’s economy and have to inevitably deal whether directly or indirectly with the 98% non-Shari’a compliant global financial sector – well these critics need to stop taking income from the Malaysian government first before pointing fingers that so and so government institution is not Islamic.

Nonetheless let us examine the Shari’a aspect further.

The first view is haram (prohibited).

The first view expressed by a number of Shari’a committees namely Fatwa from The General Presidency of Scholarly Research and Ifta’ (KSA), Shari’a Board of Dubai Islamic bank , Shari’a Supervisory Board of central bank of Sudan and a group of Islamic scholars . Their arguments are based on specified Quranic verses those stated the prohibition of riba such as in surah al-baqara, verse 275 “But Allah has permitted trade and has forbidden interest” and other verses and from several books of Hadeeth such as Bukhari, Muslim and Ahmad.

The second view is jawaz (permitted) with special conditions.

First line of reasoning: Maslaha/ Masalih al-Mursalah

This argument is based on several verses of the al-Quran.

- From surah al-Haj verse 78, “and has not laid upon you in religion any hardship”

- “God does not intend to inflict hardship on you” (5:6)

- “God intends for you ease and He does not intend to put you in hardship” (2:258)

Ibn Kathir interprets the verse 2:258 that He (Allah) has not given you more than you can bear and He has not obliged you to do anything that will cause you difficulty except that He has created for you a way out.

This verse was supported by Hadith narrated by Anas bin Malik “Give good news and do not repel them. Make things easy for the people and do not make the things difficult for them”.

From Quranic verses and hadiths, Muslim scholars came out with Islamic legal maxims (Qawa’id al-Fiqh) such as “Hardship begets facility” (Al-mashaqqatu tujlib at-taysir), “Harm is eliminated to the extent that is possible” (Ad-dararu yudfa’u bi-qadr al-imkaan), and “A greater harm is eliminated by means of a lesser harm” (yuzal ad-darar al-ashaddu bi-darar al- akhaff).

Second line of reasoning: Maqasid al- Shari’a

Maqasid al-Shari’ah means the objectives of Islamic Law. In defining it further, there are three Arabic words that occur in the relevant literature of usul al-fiqh and convey similar meanings to maqasid are hikmah (wisdom), illah (effective cause/ratio legis) and maslahah (interest, benefit). The maqasid that applies, in this case, are hifz al-mal: the protection of wealth. Protecting wealth can also mean protecting the other four element of maqasid i.e. protection of deen, life, intellect and family.

Third line of reasoning: Siyasa al-shar’iya

“The affairs of the imam concerning his people are judged by reference to maslahah” (amr al-imam fi shu’un ar-ra’iyyat manutun bil- maslahah). This concerns the need for political aspect and administration of Muslim countries which in certain cases calls for the ruler or the government to commit acts normally forbidden, for example by waging war and causing casualties.

The opinion from Ahmad Fathi Bahanasi, for jurist, siyasa shar’iya makes sense of the flexibility for government to make any decision which will benefit the people. But siyasah shar’iya should not contradict to the Islamic principles even if there is no clear particular evidence from Quran and sunna pertaining to the government’s decisions. Decision made through siyasa is therefore based on the ruler’s or the government’s wisdom.

| YEARS | GDP RATE (%) |

| 1956 – 1960 | 4.1 |

| 1961 – 1965 | 5.0 |

| 1966 – 1970 | 5.4 |

GDP PERCENTAGE 1956-1970

Some examples of siyasa syar’iya: Abu Bakr as-Siddiq compiled al-Quran in one book, the formation of government departments and ministries, caliph Umar al-Khatab implemented kharaj (land tax) that was never charged before, burnt the shops which sold liquor and many more examples.

Fourth line of reasoning: Tadarruj fi al-Tatbiq

Tadarruj means to implement the Shari’a in stages.

Based on a hadith, Muaz bin Jabal was sent by the Prophet to Yemen to spread Islamic teachings. The Prophet advised him to bring people in Yemen closer to Islam stage by stage. Even though there are many obligations in Islam, but the obligations should be implemented in stages, based on their ability and acceptance, start from the shahada (proclamation), then prayer, and then zaka.

There is also the evidence that Islam prefers wisdom in implementation of its teachings, to see the big picture as opposed to having a tunnel vision.

This concept was not only accepted in the Prophet’s era but also carried on to the next generation. For example, Umar bin Abdul Aziz, an Umayyad caliph, was asked by his son, “Why didn’t you enforce Islamic law at once after becoming in charge as a leader of the umma?” Umar replied, “Don’t be rash because Allah vilify liquor in two stages before forbidding it in the third (revelation), and I worry to enforce the people with the truth at once but then people reject it and misinterpret”. Umar Abdul Aziz would rather choose to demolish one bida’a and uphold one sunna daily than to eliminate bida’at at once but opposed by Muslims themselves.

This argument is also supported by the other method of ijtihad such as qawaid fiqhiyya, maqasid al-Shari’a, masalih al-mursala and istihsan.

Al-Amadi and Ibn Taimiyya said the majority of Islamic scholars held that in every rule prescribed in Islam, it brings with it the wisdom and goodness in its legislation.

So, the hukm of enforcement can vary due to the situations and places. It depends on the maslahah (goodness) that needs to be achieved. If the enforcement of Islamic law brings the goodness to the people through its legislation, it is recommended to be enforced but if the enforcement of Islamic law brings harm and bad consequences through its implementation, postponement is recommended for capacity generation.

Fifth line of reasoning: authority of ijtihad in Islamic jurisprudence.

As stated in the Islamic Legal Maxim “(A ruling of) ijtihad is not reserved by its equivalent” (Al- Ijtihadu la yunqadu bi-mithlih) The late Lebanese scholar, Sheikh Muhammad Mahdi Shams al-Din, expressed the important role of maqasid-oriented ijtihad in facing the various and infinitude issues experienced by individuals and society at all time. The maqasid in his view play a role in moderating the rigidities of a binding legal text. The limitations of a binding text can be meaningfully addressed, Sham al-Din recommends, through granting a more prominent role to maqasid- oriented ijtihad.

| YEARS | 1970 | 2009 |

| Income disparity ratio of Malay to Chinese | 1:229 | 1:1.38 |

| Income disparity ratio of Malay to Indian | 1:1.77 | 1:1.10 |

INCOME GAP RATIO FOR YEAR 1970-2009

Another feature of the maqasid which is important for ijtihad is the attention a mujtahid must pay to the end result and consequences of his ruling.

For example, the Prophet avoided changing the location of the Ka’bah to its original foundations which Prophet Abraham had laid. The pre-Islamic Arabs evidently changed that location. When Aisha suggested to the Prophet that he could perhaps restore the Ka’bah to its original position, he responded: ‘I would have done so if I didn’t fear that this may induce our people into disbelief.

O you who have believed, fear Allah and give up what remains [due to you] of interest, if you should be believers. And if you do not, then be informed of a war [against you] from Allah and His Messenger. But if you repent, you may have your principal – [thus] you do no wrong, nor are you wronged. [Al Baqara: 278-79]

The contemporary Shari’a scholars involved in Islamic banking and finance have taken a pragmatic approach by making a distinction between impermissible and disallowed. According to this distinction, a haram can be either impermissible and disallowed or impermissible and allowed. For example, charging of default penalty in loan contracts is haram – impermissible and disallowed. However, in the context of the contemporary practice of Islamic banking and finance, it is impermissible yet allowed. Impermissibility of the default penalty implies that the lender should not benefit from it (i.e., it should be given in charity), while allowance of it implies that the lender can still charge it to deter moral hazard problem on part of the borrowers.

All the reasoning stated above are linked to each other and should not be examined in silos. For example, when a scholar pronounces the ijtihad he makes, he need to evaluate all the aspects related with maslaha, siyasa, maqasid, tadarruj, waqi’ (situation) and places. This evaluation process is very important to ensure that the decision made provides an overall positive outcome to the ummah.

However, the hukm is not absolute as it depends on the situation that changes from time to time. In that sense, Shari’a resembles the conventional common law in its flexibility to adapt with changes. So for example when the harm can be avoided, rukhsa will no longer be allowed in any given situation. For instance the use of prohibited substances in medicine, if there is a choice of other allowable substances that could replace the prohibited substances, choosing the prohibited substances will not be allowed anymore.

Siyasa al-shar’iya refers to the act of the leaders in a nation based on its knowledge, intelligence and wisdom. However, the siyasa shar’iya that is closer to Islam and could provide more virtuous to society will be the priority compared to siyasa al-shar’iya which could lead to harm and danger.

The concept of tadarruj is accepted in the implementation of Islamic law. However, if there are no obstacles that could prevent Islamic law to be implemented in a society, the delay in implementing Islamic law will not be permissible. For example, the Shari’a Advisory Council of Securities Commission initially allows 25% of non-Shari’a compliant income in the Shari’a screening benchmark. In 2013, the Shari’a screening benchmark was reduced to 20% as the opportunity to invest in Shari’a-compliant assets have increased since the day when the Securities Commission first introduced the screening benchmark.

In conclusion, Muslims are in the midst of the second interregnum. But Islamic jurisprudence since birth till the present has always been divided between scholars that are essentially ahl-al-hadith or ahl-al-ra’y as well as the various derivatives borne from the said two method of Shari’a interpretation. Abdul Razak Sanhurri was among the few that managed to bring the two opposing sides into consensus when he was drafting the Egyptian Constitution in 1950.

We need more of that type of compromise in overcoming the interregnum that we as the global ummah are currently wedged into.

There are enough legal instruments in Islamic jurisprudence that can be utilized to uplift the ummah state of economy. However, for that to happen – all of us, whether Islamic banking practitioners, Shari’a scholars, Muftis, members of various State Fatwa Councils, the federal government, the state government and government institutions need to see the wider picture realistically and provide more practical parameters that are not only gradual in nature but also meet the overall objectives of maqasid al-Shari’a. This is notwithstanding the fact that it will take time before the approximately 98% riba of the world will be eliminated. Until that time becomes a reality, the mixture of halal and haram income and the likes require a compromise today as opposed to endless Shari’a debates that in real life makes little difference to the economic conditions of the ummah. Because action speaks louder than words!

There are several positive projects in Islam and clearly one of them is Islamic finance. This article seeks to remind critics of government and government agencies to give room or temporary indulgence when decisions have to be made for the greater good of the ummah even where riba is inevitably involved. The contemporary Shari’a scholars involved in Islamic banking and finance have taken this pragmatic approach by making a distinction between impermissible and disallowed.

According to this distinction, a haram can be either impermissible and disallowed or impermissible and allowed. For example, charging of default penalty in loan contracts is haram – impermissible and disallowed.

However, in the context of the contemporary practice of Islamic banking and finance, it is impermissible yet allowed. Impermissibility of the default penalty implies that the lender should not benefit from it (i.e., it should be given in charity), while allowance of it implies that the lender can still charge it to deter moral hazard problem on part of the borrowers.

A similar approach must be adopted when referring to the financial and economic matters related with government and its various institutions.