An overwhelming criticism of the practice of Islamic finance is in terms of lack of application of the principle of profit and loss sharing (PLS). This article, written by an established academician, analyses this issue by drawing upon the existing literature. The writer observes that while PLS is used in Islamic deposits, home financing, sukuk, equity funds and, in case of Pakistan, by Mudarabas and Mudaraba Companies, banks do not use with enthusiasm the PLS for their financing business. The lack of PLS in Islamic banking and finance has given birth to a controversy that has continued to put a question mark on its authenticity

INTRODUCTION

Modern Islamic finance is an emerging area, starting with the establishment of the Islamic Development Bank and Dubai Islamic Bank in 1974-75, with a global volume of assets of US$1.984 trillion by the end of 2014, displaying annual growth of 16.1% from 2009-14 (GIFR 2015). Despite this phenomenal growth, Islamic banking and finance (IBF) must face the same challenges as encountered by conventional finance. Although Islamic finance is not just for Muslims, it has primarily existed to meet the requirements of a large Muslim population scattered around the globe. It emerged as a reaction to a few questionable practices that do not adhere to Islamic teachings.

Given the competition with the conventional finance industry, Islamic Financial Institutions (IFIs) offer competitive prices for their services. Similarly, the return to depositors and financing rates are similar for both streams of banking.

Due to the small size of the IFIs in the global financial market, it is known that IFIs are price takers. Hence, if we compare Islamic financial products with their conventional counterparts, there is no significant and meaningful economic difference between the two. This has led to the widespread perception that Islamic finance is little different from conventional finance – a view held by even Muslims.

Despite the tremendous growth of IBF, there still remains controversy over the for-profit nature of Islamic banking. Although the criticism in this respect has in general diluted, it remains a topic of debate in academia.

One may argue that profit charging in a business transaction is more of a business decision than Shari’a. Islam requires fair play in business, with only general guidelines regarding a fair rate of profit. It is, therefore, the process of transactions, and not the pricing of the product, which differentiates IBF from conventional banking and finance. Islamic financial instruments (in practice) used by the industry can be categorized objectively as trade-based, rental based and profit and loss sharing-based.

This article discusses controversies around PLS, the pricing of Islamic financial products and profit motive of IFIs in the context of the debate over Shari’a-based and Shari’a-compliant banking and finance.

A FOCUS ON INDIVIDUAL CONTRACTS

Trade-based contracts include murabaha [a type of sale where seller is required to disclose cost of goods and profit charged], bai’ mu’ajjal [a credit sales without disclosing amount of profit charged], salam [purchase of goods with deferred delivery by making spot payment] and istisn’a [order to manufacture goods].

Murabaha is very much similar to conventional loans, hence used extensively by IFIs, globally. Under a murabaha agreement, a customer requests a bank for supply of a physical product (including e.g. computers, machineries, inventory etc.), the bank purchases the asset and then sells it to the customer by charging a profit based upon the length of the payment period. In this transaction, the bank informs the customer of the cost and profit it is charging. (AAOIFI Shari’a Standard No. 8). Usually banks charge profit on murabaha based upon an interbank offered rate (IBOR).

Under bai’ mu’ajjal, the process is similar to murabaha, except the cost the bank incurs in procuring the item is not disclosed. In practice, however, murabaha and bai’ mu’ajjal are combined to effectively offer a deferred payment murabaha.

Salam sale is a contract usually used in agricultural finance. Accordingly, bank makes immediate payment to the farmer for a delivery of agricultural produce at a later stage (after harvesting). The bank makes an estimate of the future price, and the difference in the spot price negotiated at the time of the contract and future price is the profit of the bank.

Similarly, under an istisn’a sale, the seller places an order to the manufacturer. Price can be paid in advance, through progress payments or at completion.(AAOIFI Shari’a Standard No. 11).

Another mode of financing used by IFIs is ijara, under which a bank purchases an asset and leases it to customer for a specific period for a specific rental amount. At the completion of the term, usually asset is handed over to the customer either free of cost or for a specific sum. During the tenure of ijara, asset remains in the ownership of the bank and risk/reward of ownership is borne by the bank (AAOIFI Shari’a Standard No. 9). Total charge to the customer remains the same and competitive with conventional finance industry. The bank has to bear risks including theft, accident, repair and maintenance, technology changes, foreign exchange risk and disposal of asset etc. Ijara contract is also used in combination with musharaka (a partnership contract), particularly in home financing.

Musharaka is another contract used in the Islamic finance industry. According to Islamic law (AAOIFI Shari’a Standard No. 12) any profit-sharing ratio can be agreed among the partners with the only exception that share of sleeping partner cannot be in excess of his equity stake. However, loss sharing is restricted to the amount of equity stake by each partner.

Partnership contracts are of two types: musharaka and mudaraba. Musharaka is a type of partnership where capital is contributed by all partners and management is either performed by all or any/few of them. In case of mudaraba partnership, one or more of the partners must be without capital contribution and act as manager of the business. Profit under mudaraba is shared by the partners as per agreed ratio, while total loss is borne by the capital providers (Shari’a Standard No. 13),.

Salam and istisn’a contracts have great potential, which is yet to be materialized by Islamic finance industry. These contracts can uplift the agriculture as well as manufacturing/ construction industries in underdeveloped countries in particular. Istisn’a contracts can successfully be executed for completion of infrastructure projects including roads, bridges, dams and powerhouses etc. Although in all the above-mentioned contracts profit rate charged by IFIs is comparable with conventional loans, the nature and risk attached to the contracts is different. Under conventional finance the only risk is default risk, while under Islamic finance bank has to bear certain other risks including price, technology, transportation, security, foreign exchange.

IFIs are criticized for low usage of partnership-based contracts in their operations.

Partnership-based contracts are rightly or wrongly called Shari’a-based or more Shari’a compliant while others are known as just Shari’a compliant. According to this view, Islamic finance can only create a real difference in the society if partnership based contracts are used excessively. This study is aimed at an evaluation of partnership-based contracts. Areas covered in this study include the nature of profit and loss sharing (PLS) contracts, industry progress, applicability and hurdles in the way of implementation.

ANALYSIS

Traditionally, partnership means two or more persons entering into a contract to manage a profit or loss-oriented activity. Capital is contributed by all and affairs are managed by all or one of them. Profit is shared according to agreement while loss is distributed according to equity stake. This is called partnership in capital or musharaka. In mudaraba, however, at least one person is not a capital provider, who must manage the business. These contracts are used in modern Islamic financing industry in a variety of ways:

- Mudaraba-based deposits, estimated to be US$1.6 trillion out of US$2 trillion assets under management of the institutions offering Islamic financial services;

- Investments in equity shares of Shari’a-compliant companies listed on different stock exchanges globally;

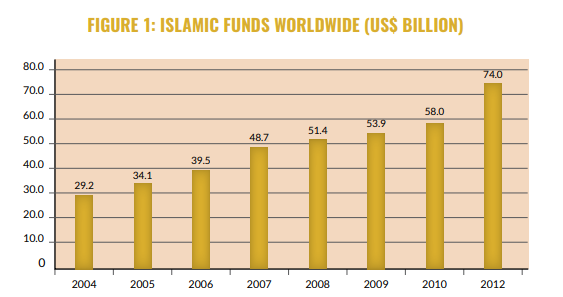

- Investments in Islamic equity funds, estimated to have over US$74 billion under management;

- Some of sukuk structures are based on mudaraba or musharaka, offering Islamic investors an opportunity to invest on the basis of PLS; and

- Islamic mortgages based on diminishing musharaka.

DEPOSITS

Deposits offered by Islamic banks are classified as current, savings and investment accounts. Current accounts carry all the features of conventional current deposits including guaranteed refund, no earnings and flexibility in withdrawals. Under Islamic law, current account deposits are deemed loans and all rulings of Shari’a relating to loans are applicable. Initially, some of Islamic banks used amanah (safe custody) as an underlying contract for current deposits. However, it was later considered unsuitable for deposit collection due to following two reasons:

- Ameen (custodian, i.e., the bank) cannot use the funds of depositors for financial gains as per the Islamic law, and The bank may not be required to refund/ compensate the depositors in case of loss of deposited money, due to factors beyond its control and without its negligence.

In the later development of Islamic banking, therefore, amanah as a governing contract was disapproved and instead a loan contract was used for the current account offerings of Islamic banks.

Investment accounts in comparison with conventional saving accounts are significantly different.. Conventional savings deposits offer predetermined return, while Islamic investment accounts offer return based on actual profit earned by banks. Following the conventional practice, Islamic investment accounts are offered as regular savings and fixed accounts.

Operationally, Islamic banks create a joint pool of investment account holders’ and their own funds to utilize these funds for extending financing and making investments. As Islamic banks, like their conventional counterparts, face tight regulatory requirements and follow very strict risk management principles, in practice it is rare that Islamic investment account holders will receive a negative return. In fact, in most cases, Islamic investment accounts offer returns comparable with conventional deposits. Furthermore, under PLS principle gross profit sharing as well as net profit sharing is allowed (AAOIFI Shari’a Standard No. 40). In Pakistan, State Bank of Pakistan (SBP) has issued guidance to share gross profit with the depositors (SBP-2015). Hence, it is very unlikely that a depositor may face loss even if an Islamic bank declares net loss at the end of the accounting period.

To cater for frequent deposits and withdrawals, a daily point system with appropriate weightage is used to provide higher return to long-term depositors.

If at any point in time actual profit to be paid to depositors is less than the banking sector benchmark, management of an Islamic bank is allowed to unilaterally contribute from its share of profit to make the shortfall good. This is used as a customer retention tool. Needless to say that such a policy should not be advertised and that it should be with the prior approval of the Shari’a advisory board. However, vice versa is not allowed. This is more of a business strategy. Although Shari’a allows such a policy, its excessive use may dilute the essence of profit and loss sharing (AAOIFI Shari’a Standards Nos. 12, 13, 19 & 40).

INVESTMENTS IN EQUITIES

Marketable securities include shares of companies traded at stock exchanges based upon principles of musharaka. Although, in this modern corporate world, usually partners do not know each other due to the flexibility created by organized stock exchanges, the other principles of partnership are very much in practice. Hence, investment in such companies is allowed subject to certain Shari’a restrictions on business activity (i.e., only halal businesses are allowed) and capital structures of the companies. Ideally, and the most conservative view is that, a firm should be free from both of these issues. However, if we analyze the firms on the most conservative opinion there will be very few companies that will pass both stages. It can be the case that a firm is engaged in a halal activity, but a portion of income is generated through haram sources (e.g., a ghee or cement manufacturer earns interest on bank deposits or an airline serving alcohol on flights, etc.). Furthermore, in the era of widespread conventional banking a firm would look for financing needs to a conventional bank. Hence, financing of the firm would make the operations questionable, in spite of doing a halal business (such as halal consumer goods).

Ulama (clerics and scholars) have designed Shari’a-compliant filters to make a list of companies where Islamic financial industry can invest (AAOIFI-Shari’a Standards Nos. 12, 13, 21 & 27). There are more than ten Islamic indexes including DJIM, FTSE, S&P, MSCI, HSBC, Amiri, BID, Azzad, NASDAQ and KMI working globally with most of them having their own screening filters (screening methodologies). All of them are approved by renowned Shari’a scholars. Derigs & Marzban, (2008) made an interesting comparison of Shari’a compliant filtering criteria and build the case for a central criterion. However given the beauty of difference of opinion accepted in Islamic law, different criteria are equally accepted and respected. What is required is following of such criteria in the letter and spirit. It is worthy to include here Shari’a compliance filters of at least one of the indexes, and we chose KMI-30 (given in the Box 1).

BOX 1

Filtering Criteria of MKI-30 Index [KMI-2010]

- Halal Business of the Investee Company:

Core business of the company must be halal and in-line with the dictates of Shari’a. Hence, investment in securities of any company whose principal activity consists of a haram (unlawful) business, e.g., dealing in conventional banking, conventional insurance, alcoholic drinks, tobacco, pork production, arms manufacturing, pornography or related un-Islamic activities, is not permissible.

- Interest-based Financing:

Interest-based debts to asset ratio should be less than 40%. Debt, in this case, is classified as any interest bearing debt. Zero coupon bonds and preference shares are, both, by definition, part of debt1.

- Shari’a Non-compliant Investments:

The ratio of non-compliant investments to total assets should be less than 33%. Investment in any non-compliant security shall be included for the calculation of this ratio.

- Purification of Shari’a Non-complaint Income:

The ratio of Shari’a non-compliant income to total revenue should be less than 5%. Total revenue includes gross revenue plus any other income earned by the company. This amount is to be cleansed out as charity on a pro rata ratio of dividends issued by the company.

- Net Liquid Assets to Share Price:

The market price per share should be greater than the net liquid assets per share calculated as: (Total Assets – Illiquid Assets – Total Liabilities) divided by number of shares.

A liquid asset mean the asset which cannot be traded except at par value as per Shari’a rulings and includes cash, bills receivables, promissory notes, accounts receivables, bonds, preferred shares, etc.

- Illiquid Assets to Total Assets:

The ratio of illiquid assets to total assets should be at least 20%. Illiquid assets, here, is defined as any asset that Shari’a permits to be traded at value other than the par and includes physical assets (land, building, furniture, machinery, computer, office equipment, etc.), inventory (raw materials, work in process and finished goods), equity investments (ordinary shares, participation term certificates (PTCs), term finance certificates (TFCs) and sukuk, etc.), intangibles (goodwill, patents and copyrights, etc.).

In order to understand the impact of the Shari’a screening methodology given in Box, let us look at the available equity securities in the capital market. All securities of financial sector including conventional banking, insurance companies, specialized financial institutions, leasing companies, etc., and securities of all companies engaged in haram businesses, e.g., liquor, pornography, pork, speculation, hoarding, tobacco, casinos, night clubs, adultery, etc., are excluded through test one.

We are then left with halal businesses of real sectors including manufacturing, trade and services sectors. However, a large number of companies may not be able to qualify second test restricting interest-based debts to total assets ratio less than 40%. Practically, many large firms employ a huge amount of debt to meet expansion, growth and asset replacement requirements. One of the strongest motivations to employ interest-based debt financing by firms is the tax incentive. It is very interesting to note that as per accounting practices and national taxation laws (almost in every country) interest charge on debt is treated as pre-tax cost and deducted from revenue to calculate income tax. It means regulator itself is promoter of interest-based financing in firms. Had we not have this incentive of interest-based debt financing, firms would lose the benefit and motivation to employ debt financing. With the application of second test IFIs loose a reasonable number of financially sound and profit-generating firms.

Third and fourth tests deal with a portion of investment and revenue generated through haram sources. Even in a country like Pakistan, there are firms that fail these tests, as many firms find it difficult to avoid Shari’a non-compliant investments and revenue. It is primarily because of lack of Shari’a-compliant financing available throughout the country. At present Islamic banks’ branch network is just about 1,200, with 10% of market share in assets and deposits.

Tests 5 and 6 are about the mixture of liquid and illiquid assets and market to book ratio of net liquid assets. Meeting of these criteria is not very difficult for a large number of firms because almost every firm in business of manufacturing, trade and service can easily qualify both tests of having illiquid assets more than 20% and price to book ratio of net liquid assets more than one.

With the emergence of Islamic indexes, Islamic capital market expanded through equity funds and global volume has reached to US$ 74 billion. Equity funds account for the largest segment of the market: around 40% of funds, followed by commodities 15%, other investments including alternative investments and feeder funds 13%, fixed income 12%, money market 9% and balanced 2%. Figure 1 shows the growth of Islamic funds industry.

There are around 900 funds worldwide. According to Ernst & Young potential is US $ 500 billion. Saudi Arabia, Malaysia, UAE and Kuwait are centers of funds management.

Equity funds account for the largest segment of the market: around 40% of funds, followed by commodities 15%, other investments including alternative investments and feeder funds 13%, fixed income 12%, money market 9% and balanced 2%. [IFSL-2013]

SUKUK

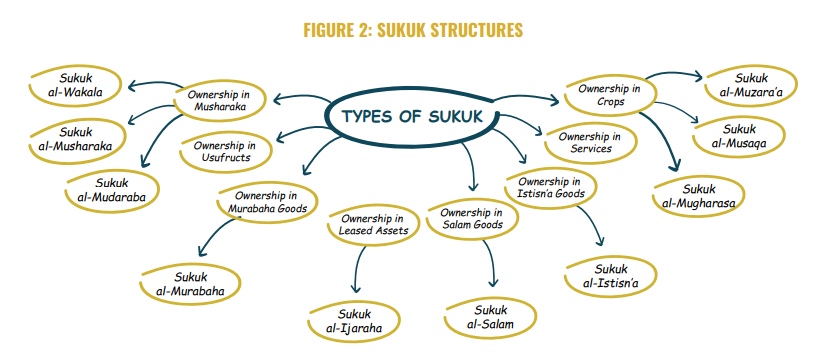

There are various sukuk structures used in Islamic capital markets, but the basic idea is to sell an asset to Sukuk-holders by dividing its total value in smaller amount of certificates (AAOIFI Shari’a Standard No. 17). Sukuk were introduced in the Islamic financial services industry to meet liquidity requirements of IFIs.

Sukuk provide an opportunity to distribute the value of an asset/enterprise/project/ usufruct into smaller amount certificates (of equal value) to create an opportunity for small investors to share the benefits of investment, which is otherwise impossible for them.

According to the AAOIFI Shari’a Standard No. 17, investment sukuk are certificates of equal value representing undivided shares in ownership of tangible assets, usufruct and services or (in the ownership of) the assets of particular projects or special investment activity. Sukuk may be tradable (as is the case of musharaka and mudaraba-based structures) or non-tradable (as in case of murabaha and salam-based structures). Various sukuk structures are presented in Figure 2.

Since 2001-2, sukuk market has continued to grow except in 2008 when the recent financial crisis hit the Islamic capital markets. In total, there have been more than 2,000 issues of sukuk, with about US$500 billion in outstanding sukuk globally. Last year alone, more than US$114 billion worth of sukuk were issued globally.. In addition to corporate sukuk, sovereign sukuk have also been issued by the governments including Pakistan, Jordan, UAE, Thailand, Malaysia, Turkey, Indonesia, Bahrain, Qatar, Cayman Islands, Singapore, Germany, Brunei, Gambia, UK, Hong Kong, Luxembourg, South Africa and Kuwait.

Sukuk were initially developed to replace the conventional bonds with features of fixed return, capital guarantee and liquidity.

However, sukuk cannot guarantee all the features of conventional bonds. Different types of sukuk offer varying degree of feature(s) of conventional bonds. Objective classification of sukuk places them into either fixed return sukuk or variable return sukuk. Variable return sukuk are very much similar to equity securities rather than conventional bonds. However, fixed return sukuk have some of the features of conventional bonds. Practically, sukuk are priced with reference IBOR, making them behave like a conventional bond..

HOME FINANCING

House financing is provided by Islamic banks and some other financial institutions either through murabaha financing or as diminishing musharaka. According to AAOIFI Shari’a Standard No. 12, “Diminishing musharaka is a form of partnership in which one of the partners promises to buy the equity share of the other partner gradually until the title to the equity is completely transferred to him.”

Mechanism of a mortgage based on diminishing musharaka is presented in Box 2.

MUDARABA COMPANIES

In Pakistan a dedicated set of laws to regulate mudarabas and mudaraba companies exist in the form of:

- Modaraba Companies and Modaraba (Floatation and Control) Ordinance, 1980;

- Modaraba Rules 1981;

- Prudential Regulations for Modarabas 2004;Shari’a Compliance and Shari’a Audit Mechanism 2012; and

- Code of Conduct of Modaraba Association of Pakistan..

Following are salient features of mudaraba framework in Pakistan:

- Dual registration under companies ordinance 1984 and Modaraba Ordinance 1980 is required;

- Minimum capital requirement for Mudaraba is fixed PKR 2.5 million (US$25,000);

- No question mark on the eligibility of directors;

- Mudaraba can be multipurpose or specific purpose and for an unlimited period or time-bound;

- Shari’a compliance certificate must be included in the financial accounts of mudarabas; and

- Central religious board is formed to supervise mudaraba companies.

Religious board approved twelve modes of Islamic financing for mudaraba companies in 2008. After the promulgation of Modaraba Ordinance 1980, mudaraba business started in Pakistan and number of mudarabas rose to 56 in 1995. However, at present there are 27 mudarabas registered under this law with a total volume of assets Rs31 billion and profit of above Rs2 billion. Mudarabas are engaged in the business of trading, manufacturing, venture capital, equity investment, investment in finance services and home financing, etc.

BOX 2

- Customer contacts IFI for purchase of house as a joint owner and bank search for a builder. Customer himself can identify builder as well as housing unit of his need and inform bank for making payment. Customer makes a part payment, e.g., 20% of value. At this stage a partnership deed is signed between bank and customer. The two parties jointly place a purchase order to vendor (usually one party serving as an agent for the other).

- Property is purchased in joint ownership of bank and customer. In certain cases it is purchased in the name of customer to avoid double taxation on transfer of property.

- Payment in full to vendor is made by bank.

- House is handed over to customer for his use. Bank enters into an ijara contract with customer for his equity share in house.

- Customer makes periodic payments of rental to bank.

- Bank enters into sales contract of his equity divided into units of smaller denominations as per agreed for length of musharaka contract whereby customer purchases one share in equity of bank by making payment along with rentals.

- The customer pays an amount of each equity unit purchased from bank.

CORPORATE AND SME FINANCING

One of the major services modern banking provides is financing facility to meet day-to-day business requirements. Islamic banks provide such facility by applying trading modes and very negligible amount has been provided through musharaka and mudaraba. Perhaps it is the non-conduciveness of business environment for application of such contracts. Hanif & Iqbal (2010) conducted a survey of professionals to get input of market about the lack of popularity of musharaka and documented hindrances to its application. Findings are reported in Table 1.

As per table surprisingly market opines profit manipulation at number three after dominance of conventional banking and riskiness of musharaka and tax considerations found last place in the rankings.

To increase the application of Musharaka financing, professionals suggested number of steps including an awareness campaign among masses about philosophy and operations of IFIs; new products development by IFIs focusing on musharaka; modification of accounting methods to align with Shari’a; capacity building (especially human resource); favorable regulations for musharaka financing; support from government; and general uplift in moral values of society towards honesty and transparency.

CONCLUSION

Although the incidence of PLS in Islamic banking is rather scares. However, in the wider Islamic financial services industry, PLS is more prevalent.

This dichotomy is primarily due to the nature of the banking business, which is designed to be risk-averse. The next article in this issue discusses an important issue of Shari’a compliance.