An ISFIRE Report to which Fouzia Hassan Abdullah contributed significantly, along with research team of Edbiz Consulting.

“An associate professor specialising in Islamic banking and finance (IBF) resigned from his current position at a university in Pakistan to join another to receive a salary almost double of what he was earning at that time. The university in question had to find a replacement on an emergency basis, as development of its IBF programmes was in jeopardy due to the movement of that particular staff. Similarly in the UK, a university hired two professors of Islamic finance, who left their jobs at two other universities that are now facing difficulties in finding their replacements. These are not isolated cases of shortage of human resources in IBF. In fact, in some cases the problems are even more acute. Another institution was in serious trouble a couple of years back when its sole professor of Islamic finance left to start a new job in Saudi Arabia. Facing the short notice, the institution had to arrange for temporary resources to supervise five PhD students the professor in question left behind unsupervised. It proved to be an extremely difficult and painful process for the management as well as the students.”

Lured by the rhetoric of limited human resources in the global Islamic financial services industry, a British youth embarked upon his journey of education in IBF by leaving his country of birth – UK – and enrolling himself at an undergraduate course at International Islamic University Malaysia. The young man was intelligent, hardworking and on top of that possessed excellent English language skills. He finished his undergraduate studies with distinction and won a scholarship to study for a master’s degree in Islamic finance at INCEIF. He spent six months as an intern with London- based Edbiz Consulting (under HD Placements), as a partial requirement for his degree programme at INCEIF. He, however, had to spend more than one year at Edbiz before succeeding in procuring a full-time position with a Middle East-based Islamic bank. This particular person was lucky to have exposure to the global Islamic financial services industry by working with a world leader in Islamic financial consultancy and intelligence. There are scores of other able graduates of IBF, who find it hard to procure a meaningful position with an Islamic financial institution in a reasonably short span of time.

HD Placements is an Islamic finance internship programme that was founded by Professor Humayon Dar when he was the CEO of Dar Al Istithamar, subsidiary of Deutsche Bank. Since then, it has helped numerous young graduates to enter global Islamic financial services industry, many of whom are now serving at key positions. Two glaring examples are as follows:

Mehdi Popotte: After finishing his MSc Islamic Finance at Durham University, Mehdi Popotte joined BMB Islamic as an intern for three months under HD Placements. He was keen to learn Shari’a structuring but the programme assessed him to be suitable for a sales and marketing role. He was exposed to various tasks in structuring, stock screening and marketing. Within three months, he found a job with Amiri Capital, a London-based Islamic financial firm that at the time was developing an Islamic alternative investments platform.

Within the next three months while he was with Amiri Capital, he was offered an even better opportunity with Abu Dhabi Islamic Bank where he is currently serving as a senior fixed income and equity trader.

Wijdan Tariq: After finishing MSc Accounting and Financial Management at Lancaster University, Wijdan Tariq joined BMB Islamic as an intern under HD Placements. He spent a lot of time on different research projects the team at BMB Islamic was involved in during his four months stay in London. Later, he decided to join an organisation involved in research & development in Islamic finance. He is currently Islamic Economics and Finance at Qatar Faculty of Islamic Studies.

These success stories must highlight the importance of mentoring in nurturing talent and development of human resources in the Islamic financial services industry. While there is huge interest in spending time, money and resources on education, very few people are willing to pay for mentoring. If proper awareness is created about this opportunity, this is a viable business in its own right.

INTRODUCTION

Demand for qualified and experienced human resources is set to rise with the ever-increasing number and size of Islamic financial institutions. This is having a positive effect on the demand for Islamic financial education and qualifications. A US$2 trillion industry as it stands today; IBF is fast assuming mainstream relevance in a number of countries comprising the Organisation of Islamic Cooperation (OIC). At the same time, new Islamic financial markets are taking roots in the countries that have historically been unwelcoming to IBF. With this, a dire need is emerging for Islamic finance education, both academically and professionally.

This is in particular true in the countries with recent interest in IBF. Libya, Nigeria and Kenya are a few countries where qualified personnel in IBF are difficult to find. Hence, a number of training providers from other parts of the world are targeting these countries for providing trainings in IBF.

Even in countries like Pakistan where share of Islamic banking is merely 10 per cent of the total banking sector, there are huge growth prospects in terms of deposit growth and resource mobilisation through Islamic modes of financing. Islamic banks are expanding rather quickly with new branches being opened very frequently. This is creating a resource gap in terms of demand and supply of bank staff who have relevant qualifications in IBF.

Impressed by this, State Bank of Pakistan (SBP) – the central bank – has launched a major initiative in offering financial support to universities and other institutions of higher learning in Pakistan in setting up specialised chairs in IBF. Although an Islamic seminary run by Mufti Rafi Usmani and Mufti Taqi Usmani – called Darul Uloom Karachi– has produced almost all the Shari’a advisors working in the IBF market in Pakistan, there has also been growing interest in other seminaries to expose their students to this field.

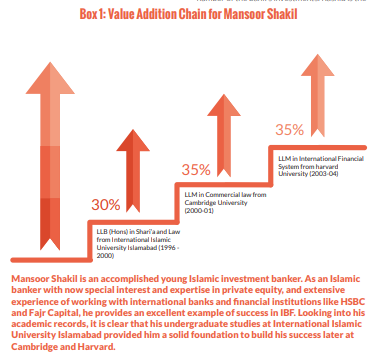

However, IBF education in the country is led by International Islamic University Islamabad (IIUI), which has fed human resources into Islamic financial services industry locally as well as globally (please see Box 1 for a representative example of the kind of talent IIUI has produced for the global Islamic financial services industry). In addition, a number of universities and institutions of higher learning have in recent years embarked upon different projects related with teaching and research in IBF. The prestigious seats of learning like Lahore University of Management Sciences (LUMS) have also started showing interest in this field, primarily due to growing visibility of Islamic banking in the country and subsequent increase in demand for qualified personnel. Institute of Business Administration (IBA) – the oldest business school in Pakistan- has been offering modules in IBF for some time. New entrants like COMSATS Institute of Information Technology Lahore, and PAF Karachi Institute of Economics and Technology (PAF-KEIT) have also recognised an opportunity in Islamic finance education and have embarked upon serious efforts to promote teaching and research & development (R&D) in this area. COMSATS has been organising an annual conference in IBF – branded as Global Forum on Islamic Finance (GFIF) – in Lahore since the year 2013, and the 2015 event is being organised on March 10th – 11th, 2015.

Most notable recent development in this respect is perhaps the setting up of International Institute of Islamic Bankers (IIIB) by Meezan Bank. With all these efforts, it is expected that Pakistan will emerge as a vital player in Islamic finance education.

Needless to say that Malaysia remains on the forefront of Islamic finance education, with scores of universities and institutions of higher learning offering different certificates, diplomas and degree programmes from bachelors to PhD levels. The most notable development in Malaysia in the last couple of years has been establishment of Finance Accreditation Agency (FAA), which has developed a comprehensive framework for accreditation of Islamic finance qualifications. FAA has already received recognition on a global level, and it is expected to play an important role in standardising Islamic finance educational and training programmes.

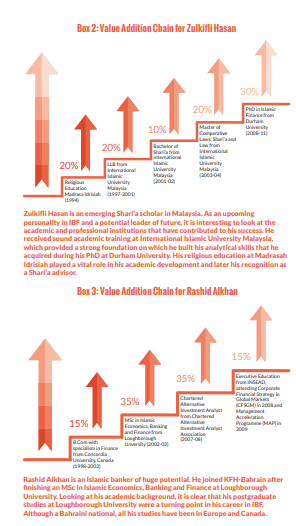

The year 2015 will bring additional opportunities in the Islamic finance education market, as the global Islamic financial services industry has already reached the mark of US$2 trillion. There is a need to explore cost-effective ways of developing and delivering globally recognised qualifications in IBF. The best model for developing and delivering Islamic finance education is in the form of International Islamic Universities, e.g., International Islamic University Islamabad (IIIU) and International Islamic University Malaysia (IIUM) (Box 2 represents just one out of 100s of examples of success stories in IBF, which IIUM has contributed to). These universities offer courses in Islamic economics, banking and finance, and Shari’a and law as part of mainstream disciplines. While setting up of dedicated Islamic finance training providers is understandable, having a full-fledged university engaged in nothing but Islamic banking and finance is at best premature. Many industry analysts believe that the initial idea of setting up International Centre for Education in Islamic Finance (INCEIF) was an excellent approach but its subsequent elevation to the status of a university and degree-awarding institution has yet to work.

There is a need to consolidate various efforts to develop a comprehensive model of Islamic finance education. To start with, it is worth to consider merging IIUM Institute of Islamic Banking & Finance (IIiBF) and INCEIF (and its sister organisation International Shari’ah Research Academy (ISRA) for Islamic Finance) to form a bigger entity specialising in teaching and R&D in IBF. It may also be worth to consider bringing IBFIM under the same entity.

There is no denial of the fact that INCEIF has emerged as a global brand in IBF; whether on an operational level it is as successful as expected is a different question. Putting all the teaching and training resources under one strong brand – INCEIF – and attempting to create an Islamic INSEAD in Malaysia will be a huge achievement.

Other markets for Islamic finance education include Indonesia, UAE, Qatar, Bahrain, Saudi Arabia and the UK.

ISLAMIC FINANCE EDUCATION AND TRAININGS

For the purpose of this report, we differentiate between Islamic finance education and trainings by referring the former as the academic courses offered by universities and institutions of higher learning and the latter as the courses offered by non-academic training institutions, leading to professional qualifications.

Islamic Finance Education Providers

In the Western world, Durham University has emerged as a premier institution of higher learning offering postgraduate courses (masters as well as doctorate) in IBF. Although a number of other universities are engaged in teaching and PhD supervision in IBF, Durham University leads by a significant margin.

Loughborough University in the UK, however, was a pioneering institution that started first ever MSc in Islamic Economics, Banking and Finance in the Western hemisphere. Professor John Presley and Dr Humayon Dar jointly started this MSc programme – which although short-lived – but produced some of the most celebrated and able personnel in IBF. Whether it is Senator Dato’ Asyraf Wajdi Dusuki (from Malaysia) or Rashid Alkhan (from Bahrain), all the graduates of this programme went on to become established leaders in the global Islamic financial services industry. There are numerous other distinguished graduates of the programme, notably Azmat Rafique (Head of Islamic Banking at Oman Arab Bank), Madzlan Mohamed (Islamic Finance Partner at ZICO, Malaysia), and Akif Shaikh (Head of Retail Business and Innovation at Al Rajhi Bank Saudi Arabia).

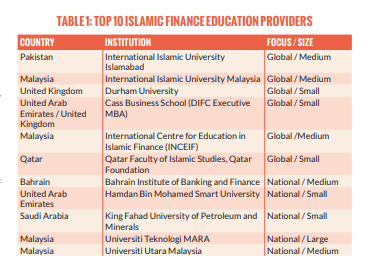

Table 1 lists top 10 providers of Islamic finance education in the world. The table suggests, IBF has emerged as a globally recognised academic discipline in universities in the Muslim world as well as in the West. It is, however, fair to state that the discipline still lacks academic rigour and depth of analyses.

A number of leading publishers are now regularly publishing textbooks in Islamic economics, banking and finance. The most active publishers in this field include Edward Elgar, Wiley, McGraw-Hill and Edinburgh University Press.

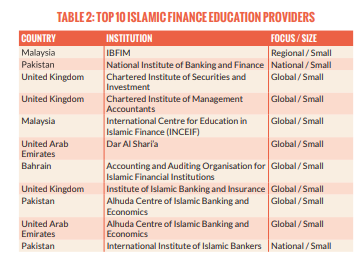

Islamic Finance Training Providers

Amongst the Islamic finance-training providers, IBFIM in Malaysia tops the list. Although Institute of Islamic Banking and Insurance (IIBI) in London has already seen past its glory days, it would be unfair not to mention its role in pioneering role in Islamic finance training. The Diploma in Islamic Banking and Insurance offered by IIBI was perhaps the first global qualification offered by any non-university institution in the world. Another notable Islamic finance qualification provider for affiliated trainers around the world is the Chartered Institute of Securities and Investment (CISI), which has developed arguably the most comprehensive entry-level qualification in Islamic finance, aptly named as Islamic Finance Qualification (IFQ). Chartered Institute of Management Accountants (CIMA) has also developed a comprehensive range of Islamic finance qualifications.

Edbiz Consulting has also been involved in offering one/two-day introductory workshops in Islamic banking and finance under its flagship Islamic Finance Access Programme (IFAP) in UK, Luxembourg, Switzerland, Pakistan and UAE. All these initiatives and a long history of Islamic finance education and training makes UK as a global centre of excellence for Islamic finance education.

Although IBFIM stands out in the Islamic finance training, Pakistan has developed some of the most impressive training modules for Islamic bankers. In this respect, the role of National Institute of Banking and Finance (NIBAF) is noteworthy. Another new player in Islamic finance trainings is Meezan Bank’s IIIB, which is fast emerging as a premier centre of Islamic finance trainings.

CASE STUDIES

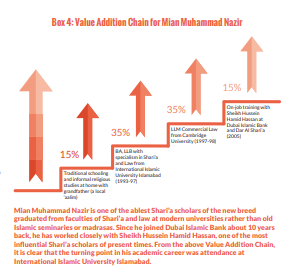

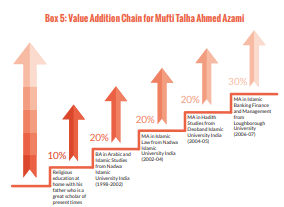

Boxes 1-5 present five interesting cases of successful careers in IBF. Two examples are drawn from IIUI, one from IIUM and another two from Loughborough University.

There is one common denominator in all these cases, and that is of the role of Western universities in career development of the successful personnel in IBF. Global Islamic Finance Report 2014 reported top 10 CEOs of Islamic banks in Malaysia. Almost all the CEOs have foreign qualifications obtained from the Western universities. This should sufficiently indicate that studying at an institution of higher learning outside the home countries contributes to accomplishment in an IBF related career.

Therefore, while a solid foundation in IBF is a pre-requisite for a successful career in IBF, it is absolutely important that a formal qualification from a top Western university is sought to have access to a job in an institution of national significance or of international repute.

One benefit of attending an institution of higher learning for a successful career in any field, including IBF, is the higher level of English language proficiency that studying at a Western university brings. While the likes of Sheikh Saleh Kamil, founder of Dalla Albaraka Group, put a heavy emphasis on Arabic language in developing IBF as a phenomenon for promotion of an Islamic culture and identity, there is no denial of the fact that the English language has emerged as the de facto language of legal documentation, especially if the transaction happens to be a cross-border one.

Because of that national talent development programmes (i.e., Emiratisation and Saudisation etc.) adopted by the countries in GCC and increasing preference for the local leadership in other countries, it is also vital that proficiency in local language is also sought. Gone are the days when foreign personnel used to lead as CEOs of Islamic banks in the GCC countries and in Malaysia. While still there are some Islamic banks in the GCC, which have non-Arab CEOs, the local leadership has gradually taken over these roles. In Malaysia, one out of every fourth CEO of an Islamic bank was a foreign national, but now all the CEOs are Malaysian national. When Islamic banks were set up in the UK, all the CEOs were from the mainstream, now these positions are being filled with the Muslims – the local as well as the Arab.

It is interesting to note that a strong foundation in Shari’a and law is a prerequisite for serving as a Shari’a advisor in IBF. Zulkifli Hasan and Mian Muhammad Nazir are the two scholars who had solid academic backgrounds in Shari’a and law. In the case of the former, attendance of a traditional Islamic seminary – Madrasah Idrisiah – provided the required foundation on which Zulkifli Hasan built further by studying Shari’a and law at IIUM. This, along with mentoring from the likes of Dato’ Asyraf Wajdi Dusuki, allowed him to serve as a member of Shari’a Advisory Committee of Affin Islamic Bank, and consequently be recognised as a Shari’a advisor. In the case of the latter, working with one of the prominent Shari’a scholars of the present times, Sheikh Hussein Hamid Hassan, paved Mian Nazir’s entry into the Shari’a advisory. At present Mian Nazir is a member of the Shari’a Advisory Boards of a number of Islamic financial institutions, in addition to playing a senior-level role in Dar Al Shari’a – a leading Shari’a advisory firm based in Dubai.

Mansoor Shakil has a similar background to Mian Muhammad Nazir but the former chose to pursue a career in hard-core banking and is now an experienced Islamic banker specialising in private equity. In Rashid Alkhan’s academic progression, Loughborough University featured prominent, as his MSc in Islamic Economics, Banking and Finance therein is the only formal qualification in IBF. After finishing his postgraduate studies at Loughborough University Rashid Alkhan joined KFH-Bahrain and has remained there since then. He took examinations of Chartered Alternative Investment Analyst Association (CAIA) and became CAIA in 2008. Rashid was a member of the transaction advisory team which led the first three-way merger between 3 Islamic financial institutions. Rashid currently serves on the board and audit committee of a number of the bank’s investments. Rashid is the author of the book “Islamic Securitization: A Revolution in the Banking Industry”, published in 2006.

Like Rashid Alkhan, Mufti Talha Ahmed Azami attended Loughborough University but after having been to a completely different set of institutions. His religious background, although impressive in its own right, was not helpful in entering an otherwise very competitive UK Islamic financial market. His MA in Islamic Banking Finance and Management provided him the modern education that is deemed as an absolute requirement for a successful career in IBF.

These five are interesting cases of successful careers in IBF and those who are considering a career in this field must study such career progressions to decide for themselves what qualifications they must seek to be successful in IBF.

CHALLENGES IN ISLAMIC FINANCE EDUCATION AND TRAINING MARKET

Challenges

- Lack of Human Resources

The availability of high-quality educationalists and trainers is perhaps the biggest challenge facing the Islamic finance education and training market. While Western institutions (both universities and other training providers) are excellent managers of general quality controls and mechanisms, they are light in terms of human resources to offer in-depth education and training in IBF. There are simply not enough highly qualified academicians at Western universities, who have a strong interest in IBF. This is primarily the case, as the Western universities have so far not been entirely convinced that there is large enough market for Islamic finance education. Even the universities like Harvard and Cambridge where IBF has shown some kind of visibility, the academic communities do not give it the kind of respect they have given to other disciplines like microfinance and development studies.

In the whole Western world, there are no more than 10 committed senior academicians involved in teaching and research in Islamic economics, banking and finance. The veterans like Simon Archer, Rodney Wilson and John Presley have retired and some others (like Volker Nienhaus) are although active in research and training but are approaching the age of full retirement.

- Too Many Too Small

There are a number of IBF training providers with small operations. During and after the recent financial crisis, a number of IBF professionals lost their jobs and many of them opted to start offering trainings in IBF. Ironically, this was not only wrong timing for these individuals, it also had an adverse effect on the incumbent training providers who started to struggle in maintaining their numbers. Given the limited absorptive capacity of the Islamic financial services industry, there is no scope for more than one training provider throughout the world. Too many small players (with “technically” unemployed part-time so-called trainers) are inflicting more harm than actually developing human resources for the industry.

- Lack of Public Sector Funding and Support

In most countries where IBF is significant government support for developing Islamic finance education and training programmes has either been completely missing or inadequate. As mentioned earlier, Malaysian government has supported development of education and training in IBF. Similarly, the government of Dubai has formulated a policy to develop Dubai as a global hub for Islamic economy, and Islamic banking and finance features significantly in this vision. The establishment of Dubai Centre of Islamic Banking and Finance (DCIBF) at Hamdan Bin Mohamed Smart University (HBMSU) is a step in that direction. In other countries, an explicit public sector policy in this respect has yet to emerge.

- Language Barriers

There are some excellent academic and professional programmes available in a few Arabic-speaking countries (e.g., Saudi Arabia, Bahrain and Jordon) but they are taught only in Arabic, which creates a barrier to entry for non-Arabic speaking students and professionals.

For example, General Council for Islamic Banks and Financial Institutions (commonly known as CIBAFI) has been offering certificates and other bespoke trainings in Islamic banking and finance in the Arabic-speaking countries for a number of years. Their language of instruction has mainly been in Arabic, although in some cases it has arranged for delivery of such courses in English as well. However, developing such programmes as English language offerings remains a challenge.

- Absence of Regulatory Requirements for Recruitment of Staff by Islamic Financial Institutions

Apart from Malaysia, the regulators do not require Islamic banks and financial institutions to recruit staff with specific professional qualifications and skills. Even in Malaysia where the central bank requires Islamic banks and takaful companies to employ Shari’a personnel with specific qualifications and skills, there are no such requirements for other staff. Consequently, Islamic banks and financial institutions are not obliged to seek new staff with specific Islamic finance qualifications. This poses a serious threat to the sustainability of a number of Islamic finance educations and training providers who face serious challenges in recruiting students.

Opportunities Developing London as a Centre of Excellence for Islamic Finance Education

There are about 16 universities and scores of colleges and other institutions of higher learning in London. These institutions have for long shown interest and engagement in IBF. However, none of them has been able to develop a centre of excellence in Islamic finance. There have been some half-hearted attempts by a few universities in London to develop relevant resources but they have not been meaningfully successful. For example, University of East London established a Centre of Islamic Banking & Finance in 2011 to offer education, training and consultancy services related with IBF. Nearly four years on and the centre has failed to make a mark on the industry. In fact, the founding management of the centre came from nowhere in the Islamic financial services industry and went back to where it came from. The people who were brought in as advisors possessed very shallow backgrounds in IBF, and hence were not able to play a significant role in the development of the centre. The University of East London continues to offer MSc in Islamic Banking and Finance, a course that has attracted only a limited number of students, consistent with the general trend at the British universities.

London School of Business and Finance (LSBF) has been offering a master programme in Islamic banking and finance for quite a few years now. However, the number of students enrolled on this programme over the years has been limited and in fact diminishing every year.

Some other universities in London like Kingston University, School of Oriental & African Studies at the University of London, Queen Mary University of London, and University of Westminster offer single modules in IBF as options for their postgraduate degree courses. The registrations at these modules range from 10 to 25 students.

Given the relative limited success of the IBF degree programmes and the individual modules, it makes sense to develop a portable modular programme in IBF to be offered through participating (possibly all) universities and colleges in London. For example, a single module in IBF can be offered as an optional module to the postgraduate students registered in banking and finance-related degree programmes at the participating universities. The participating universities should pay a fixed amount per student (e.g., £400) to the developer-organiser company/ institution. The participating universities will have the benefit of offering an additional module in a cost-effective way, without having to hire full-time or part-time faculty and committing other resources. The developer-organiser institution will benefit from the accumulated number of students. For example, 10 students from each of say 10 participating universities will fetch enrolment of 100 students to the module. This will ensure the offering of the module on a sustainable basis. Increasing the number of modules thus offered may also allow the developer-organiser institution to offer its own degree programme (e.g., an MBA programme in IBF) in due course.

2. Need for a Global Islamic Finance Accreditation Body

Before the setting up of the Finance Accreditation Agency (FAA) by banking and financial regulators in Malaysia, there was a huge gap in the accreditation of Islamic finance qualifications. FAA, however, has successfully implemented first phase of its plan to develop a comprehensive quality and learning regime for accreditation of Islamic finance qualifications. Nevertheless, this area by and large remains untapped and there is a need to develop a globally accepted specialized body for accreditation of Islamic finance qualifications. This is expected to bring the required standardization of curricula of the Islamic finance academic and professional qualifications.

Opportunity for Law Schools

IBF has emerged as a legalistic phenomenon, necessitating strong legal skills for the personnel involved in product development and structuring. However, law schools and departments around the world have so far failed to recognise this opportunity, although there is clear evidence that Shari’a and law departments at IIUI and IIUM have in fact been the most successful academic departments that have supplied the most distinguished personnel to the global Islamic financial services industry. It has been attempted to engage some top law schools in the world (e.g., Harvard Law School) with the Islamic financial services industry but this has either failed or has yet to bring real benefits to the industry.

- Developing IBF Curricula to Achieve Socio-economic and Political Objectives In the politically troubled countries facing real or potential security threats (e.g., Iraq, Afghanistan, Pakistan, Libya, Egypt and even Saudi Arabia etc.), it is important to bring curriculum reforms to feature IBF education as a tool for modernisation of juristic thoughts. The governments may consider investing in business and finance education, with an emphasis on the relevance of Islamic commercial law. In this respect, emulating the International Islamic University models developed in Pakistan and Malaysia.

SUMMARY & CONCLUSIONS

Islamic finance education and training is an area fast developing, with a number of academic and professional institutions now offering a range of qualifications. The market is inundated with a number of small training providers and quality and standardisation remain among the challenges the industry is facing. There is a need to develop a large institution of higher learning for Islamic finance education. This can be created through investing more resources into the likes of IIUI and IIUM. Alternatively, there are some institutions in Malaysia (notably INCEIF), which can be developed into a large global centre of Islamic finance education, if proper consolidation of resources and mergers with other institutions is achieved as part of a strategic plan.

For those who are looking for a career in IBF must consider studying at a high-ranked university in the Western hemisphere. The Western universities, however, are not sufficiently incentivised to commit resources to the IBF education, which despite being a growth area remains a marginal area of interest in Europe and USA. Professional bodies like CIMA and CISI have already developed qualifications in IBF, which are expected to receive global recognition if they apply for accreditation from the likes of FAA. IBFIM is another institution that has potential to become a global centre of excellence for Islamic finance trainings. It will, however, have to continuously innovate to maintain its leadership role, given the new competition from the institutions in the GCC region.