Dr Sofiza Azmi, Director of Strategy, Policy Development & Research at Asian Institute of Finance

For the past 30 years of its existence, the Islamic Financial Services Industry (IFSI) has been successful in providing an array of financial products. We have also seen a steady double-digit growth. According to the forthcoming Global Islamic Finance Report 2015, Islamic banking and finance (IBF) assets grew at an annual rate of about 17.82% between 2008 and 2014. And if it continues to grow like this, global Islamic financial services industry is expected to reach US$5.3 trillion by the end of 2020. While it is an impressive growth in its own right, it is however important to investigate what future holds for the industry vis-à-vis new generation of Muslims who are fast changing in terms of lifestyle and financial choices.

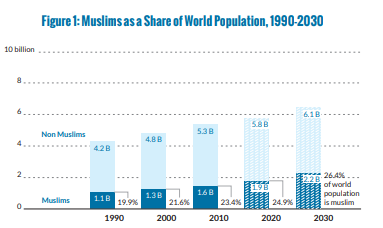

With only about 12% of the world’s Muslims currently subscribing to IBF, the potential for further growth is significant, an expectation that is reinforced by the fact that Muslims make up about a fifth of the world’s population.

According to Pew Research Center, Muslims are forecasted to comprise of nearly 25% of the world’s total projected population of 7.7 billion by 2020 (Figure 1).

The question that arises: how can Islamic banks tap into growing market, especially unbanked segment of Muslims? Understanding the financial behaviour of this segment is important for Islamic banks to formulate a more effective marketing strategy. Most importantly, it is imperative that Islamic banks understand the financial behaviour of Generation Y or better known as Gen Y (under 30s) as they are the next generation of customers.

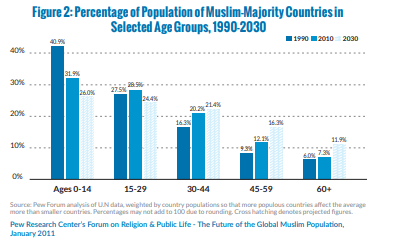

It is estimated that about 30% of the world’s Muslim population consists of young people under the age of 30, which implies that the Muslim community is a relatively young group. As Figure 2 depicts, over 60% of the population is under 30 years of age in Muslim-majority countries. In Malaysia, the below 30% segment makes up nearly 40% the population.

IBF is considered by many to be driving a new Islamic financial lifestyle, and it is assumed that the young Muslims will by default opt for Islamic financial services. Despite the growing perceived importance of young Muslim consumers in fuelling the next stage of growth in Islamic finance, financial behaviour of Gen Y is not yet well established.

GEN Y – WHO ARE THEY? Generation Y (or Gen Y) for the purpose of this article are the segment of the population which is below 30 years of age. Millennials (another name for Gen Y) are the demographic cohort following Gen X. There are no precise dates when the generation starts and ends Researchers and commentators use birth years ranging from the early 1980s to the early 2000s. Generation X, on the other hand, are those who were born before the 1980s.

PwC calls them powerhouse of the global economy. Some refer them as the “Futurist” or the “New Muslim Consumer” as this young Muslim population is seen as more individualistic, ambitious than the mainstream Muslim consumer. They also have tastes and preferences that are very much distinctive from their parents. Studies have shown that they are more tied to their Muslim identity than previous generations and want to associate with brands that can elaborate this identity.

The spectacular acceptance and demand for Islamic finance means that within the next decade, the industry is likely to capture half the savings of the 1.6 billion-strong Muslim world over. It is tempting to assume that the growth is being fuelled by the Gen X of Muslims keen to take advantage of an offering that complies with their traditional way of life. Not so: the vast majority of the uptake comes from the under-30 segment of the Islamic world, and it is this segment that holds the key to success for more than 250 Islamic banks and financial institutions that now operate in more than 75 countries worldwide. The popularity of Islamic finance among these young Muslims responds to a resurgence of interest in their cultural and religious identity. This ‘baby boom’ of customers makes up the backbone of the industry.

However, due caution must be exercised when interpreting such anecdotal evidence as conclusive. More often than not, demand for Islamic banking products and services is anchored on the size of the growing Muslim population, which may not be the best predictor of demand. The growth of the Islamic finance industry has been largely fuelled by the demand for Shari’a-compliant financial services from segments of the population that are consistent with their religious beliefs. Although it is tempting to assume that the industry’s growth will continue in tandem with growth of young Muslims, this may be a perilous assumption to make. The lack of rigour in understanding market behaviour and customer psychology may be an impediment to growth in the long run.

In a recent survey conducted by the Asian Institute of Finance (AIF) on financial behaviour of Gen Y working professionals in Malaysia, it was found that only 34% of young Muslims subscribed to Islamic financial products (see Figure 3). And of those who did, majority had only basic banking products – 46% of respondents had savings account and less than 20% had a current account with Islamic banks. Another 22% of young Muslims financed their property purchase with Islamic home financing or mortgage. Although this may reflect the market share of Islamic banking in the country, it has long-term implication for further growth.

It happens to be the case that the largest portion of demand for Islamic financial services in Malaysia still comes from the old generation – Gen X, as 64% of those who are already patronising IBF come from the population segment of 30+ years.

To have a more effective marketing strategy to target Gen Y Muslim customers, Islamic financial institutions must understand their financial behaviour and financial knowledge. For example, the respondents were asked, “What are the sources of financial information they used to get advice on financial matters?” Interestingly, 67% of respondents said that they seek information on financial matters from family, friends and co-workers. Hence, word of mouth plays an important role in reaching out to this young segment. This finding also validates other research on the consumer behaviour of Muslims, which showed that Muslim communities tend to score highly on Hofstede’s collectivism score. This implies that Muslims value word-of-mouth and in-group recommendations. And for young connected Muslims today, this is done at the click of a mouse.

Naturally, as a tech-savvy generation, Internet is the most used source of information. A total of 64% of Gen Y Muslims used this channel as their main source of information to obtain advice on financial matters. Here lies an opportunity for Islamic banks to ramp up their business to serve this untapped segment. Developing Apps that allow these young consumer segments easy access to information on Islamic financial products and services offered, maybe the key to attract new consumers.

The third most popular source of information is the bank officers themselves. Nearly 40% said they sought advice from their banks on financial products and services. Islamic finance professionals can then be looked as brand ambassadors for Islamic finance. But less than half of respondents said bank officers were able to answer most of their inquiries about the product with proof. Furthermore, in a survey conducted by Edbiz Consulting and published in the November 2014 issue of ISFIRE, it was reported that Malaysian banks do not rank high when it comes to loyalty amongst their employees.

This raises another question: whether professionals in the Islamic finance industry have the relevant skills and competencies needed to perform their job effectively. In another study conducted by AIF, skills gaps amongst Islamic finance professionals were a prominent feature in the talent landscape in Islamic banking. Skills that had the widest gaps (between an organisation’s skill needs and the current capabilities of its workforce) are strategic thinking and problem-solving. These are skills that are categorised as highly urgent and need immediate intervention. Product knowledge, on the other hand, had a gap score of 22 – which falls under the category of “very important” gap to close.

AIF’s survey of Gen Y’s financial behaviour also pointed to some disturbing findings. Only half of Gen Y who subscribed to Islamic financial products said they understood how profit rates are calculated and less than half (42%) said they have full knowledge of the financial products they had purchased. When asked to assess their overall financial knowledge, 61% said it was only average, i.e., having limited knowledge. These findings imply that majority of Gen Y still have low understanding of Islamic financial products and services.

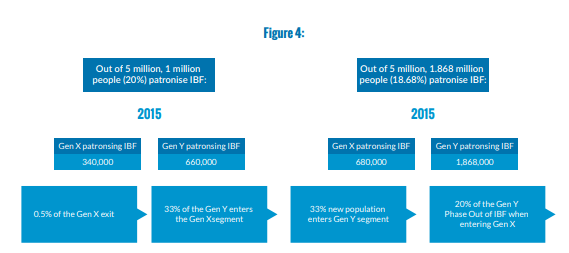

The survey’s findings also show that the average number of Islamic banking products per Gen Y customers is just two, mainly deposits and home financing. While for conventional banks, they normally have an average of 5 products per customer. Hence, Islamic banks would need to focus more efforts on building consumer confidence through service excellence especially in cross-selling. If Islamic banks can do this successfully, the market share of Islamic banks is estimated to increase by 40% from this segment of young consumers. On the other hand, if 20% of the Gen Y are disillusioned by IBF by the time they enter the relevant cohort of Gen X (in future), it is expected to pull down the market share of Islamic banking in the country by 1.32%, if all other things are kept constant (see Figure 4). This is what may be called retardation effect. This is an alarming situation requiring Islamic banks and financial institutions to devise individually as well as collectively to consistently increase their share in the market.

The survey also looked at the financial behaviour of Gen Y Muslims. They were asked how much did they allocate of their money on a monthly basis on savings, investment, loan repayment, living expenses and lifestyle. Some interesting findings emerged. About 57% said they allocated between 10% and 20% of their income for savings purposes whilst 24% allocated more than 30%. Only 32% of Gen Y Muslims set aside money for investments. And of these young Muslims, 56% said they allocated between 10% and 20% for investment purposes while only 2% allocated more than 30%. Unsurprisingly, 66% of young Muslims allocated between 10% and 20% of their income for lifestyle purposes such as clothing, accessories and holidays.

The key to gaining greater market share lies in the ability of Islamic banks to attract the growing middle class of young Muslim consumers. The above findings provide an understanding of young Muslims’ financial behaviour in a more predictive and comprehensive manner. While Islamic banks are reinventing their business models to provide differentiated customer service and scaling up to meet global competition, the banks that are catering to young Muslims are certainly poised for the next wave of growth.

More importantly, Islamic banks as individual players and as part of the Islamic financial services industry have to devise a comprehensive strategy for competition and growth. Assuming that the younger generation will follow the religious sentiments of their parents and hence will continue to patronise IBF may prove fatal. In the world of cutthroat competition, complacency has no place.