It is alarming to know that Pakistan will reach absolute water scarcity by 2025, and on its way to become the most water-stressed country in the region by 2040 according to United Nations Development Programme (UNDP) and the Pakistan Council of Research in Water Resources (PCRWR). Presently, major cities such as Karachi, Quetta and other urban areas are facing massive water scarcity. Unfortunately, the country dumps water worth US$22 billion into the sea every year due to mainly the lack of storage capacity and poor conservation practices. This has also resulted in low and costly production of electricity in the country.

To address the above issues, the Supreme Court (SC) of Pakistan recently taken a suo motu notice of the blooming crisis. The SC issued directives for the immediate construction of two dams and appealed to the people, including Pakistanis living overseas, to make necessary contributions. In the wake of the apex court order, the government has decided to establish the Diamer Bhasha and Mohmand dams fund to raise financing for the construction of these two critical reservoirs in a bid to fight impending water scarcity and electricity shortage.

However, despite the urgent need and tacit pressure from the government, it seems that the public is reluctant to contribute evident by the slow donation rate. As at 22 July, 2018; the total amount deposited was about PKR280 million (US$2.2 million), whilst the expected cost of Diamer Bhasha dam alone is about PKR1.450 trillion (US$11 billion). Although the total cost is not required at the inception stage, however, one-year cost is estimated to be valued at PKR23.68 billion as per the Public-Sector Development Programme (PSDP). At PKR18 million (US$0.15 million) per day ratio, it will take 1315.55 days (3.5 years) to reach the target of PKR23.68 billion (US$194 million). This means even next year’s PSDP allocation (for the dam part alone) will not be possible to meet the amount.

The lack of public interest and slow donation is probably due to the absence of an effective policy framework. For example, who will supervise the whole project? Is it SC, WAPDA (The Water and Power Development Authority) or Ministry of Finance? How the funds will be distributed? People are concerned to find answers to these questions so as to prevent similar mishaps in donations to be repeated. For example, similar projects announcements in the past by the government such as the Musharraf President Relief Fund after the 2005 earthquake, Nawaz Sharif ‘qarz utaro, mulk sanwaro’ scheme (1990s), and a similar scheme by Zulfikar Ali Bhutto; had all ended up with massive corruption and misconduct of the funds.

Due to the above setbacks, there is a need to explore a viable source of funding that is cost-effective on one hand and ensures public interest and participation on the other hand. One possible approach could be an Islamic financing mechanism known as “waqf sukuk”. Waqf is an Islamic endowment of valuable asset to be held in trust and used for a charitable purpose.

“IT IS NOTEWORTHY TO HIGHLIGHT THAT PAKISTAN IS THE SECOND LARGEST MUSLIM COUNTRY (212 MILLION POPULATIONS) IN THE WORLD WHERE ABOUT 95-98% OF THE POPULATION IS MUSLIM.”

Sukuk refers to Islamic bonds, structured to generate returns to the certificate holders without infringing Islamic law. In the case of raising fund for the said dams, waqf sukuk simply means establishing an Islamic endowment through issuance of financial certificates that will represent donations of the individuals and corporate entities in that charitable fund.

WHY RAISE FUNDS THROUGH ISLAMIC FINANCE?

It is noteworthy to highlight that Pakistan is the second largest Muslim country (212 million populations) in the world where about 95-98% of the population is Muslim. Therefore, the growing demand of Islamic finance in the country is not surprising. In 2014, the State Bank of Pakistan (SBP) has conducted a survey to investigate the public perception about Islamic finance. The study has quantified an overwhelming demand of Shari’a-compliant financing activities in the country that is evenly distributed amongst rural and urban areas, varied income strata and education level. According to the study, 95% of the retail and 73% of the corporate sector prefers Islamic finance over conventional one.

It offers depositors a stake in the actual investments instead. As such, they are very attractive to a broad range of investors, especially individuals and institutions with a strict mandate to invest in Shari’a-compliant instruments. It also provides greater liquidity in terms of redemption as compared to its conventional equivalents. Another critical factor favoring sukuk is that as securities, they are anchored in actual assets—ownership in particular projects, properties or special investments, while bonds are more or less mere debt instruments. Recently, sukuk has become the preferred investment choice because of the profit rates offers.

It can offer on average a return of five per cent per annum, while fixed deposits for the same period and currency (usually US dollar) pay 1.75 per cent per annum at best.

Pakistan is among the fastest-growing countries in sukuk issuance. In 2016, according to Securities & Exchange Commission of Pakistan (SECP), the total fund raised by sovereign and corporate entities in the country through sukuk was PKR0.87 trillion. This shows that there is a huge untapped potential to finance the dam’s construction through the issuance of sukuk.

An interesting element in this proposal is the combination of waqf and sukuk. Even though Islam does not tolerate negligence of the state in providing necessities and preserving the welfare of its citizens, it offers a voluntary option for the public to support state’s responsibilities through the institution of waqf. Indeed, this institution has played a crucial role in enhancing socio-economic activities throughout Muslim civilization. Due to its flexible nature, it inherits a tremendous capability to answer to modern-era economic challenges. Waqf-sukuk is considered for a number of reasons as a perfect sustainable financing instrument offered by Islam to finance state’s projects by the people and for the people.

Several waqf sukuk has been issued successfully in recent years, such as the sukuk intifa (US$390 million) to construct Zam- Zam Tower in Mecca and the musharaka sukuk (US$60 million) issued by MUIS (Islamic Religious Council of Singapore) in Singapore.

However, these types of sukuk were solely meant for investment purposes, without a socially favorable outcome. The closest example of the proposed waqf-sukuk was the launch a social project in New Zealand based on waqf- sukuk by the International Shari’a Research Academy for Islamic Finance (ISRA) in 2017. The goal was to issue the world’s first waqf-sukuk worth of US$1 billion to establish farming industry in New Zealand and Canada. Via these farms, Qurbani(slaughtering animals)will be provided for Muslims particularly in the west. The waste of the animals and skins will be used to produce shoes and bags etc.

The revenue will be used for charitable and social purposes all over the world. More recently, Indonesia has also decided to issue waqf-sukuk for developing social properties.

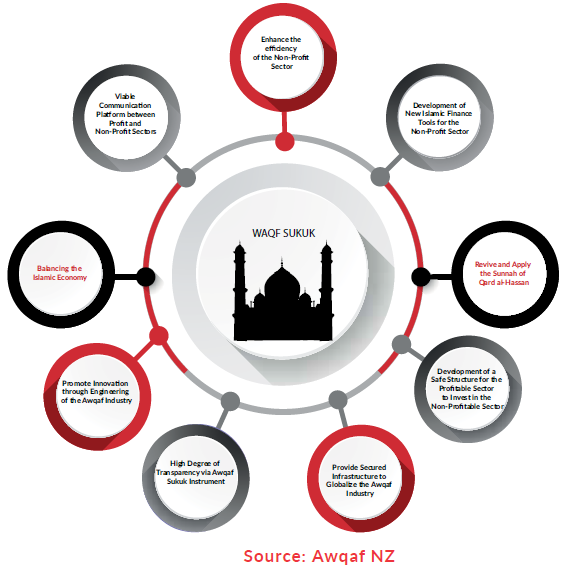

It is noteworthy to point out that the sukuk proposed here is different from Sustainable and Responsible Investment (SRI) sukuk, since only sovereign entities and governments typically underwrite SRI sukuk, usually with private placement. On the other hand, the waqf- sukuk will be issued through a public placement. In this type of structure, sukuk owners are not motivated by financial returns. Instead, they are focused on the delivery of sustainable social outcomes and philanthropic objectives over the long run. The following chart depicts benefits of waqf-sukuk:

Another important reason of choosing waqf model is that unlike other Shari’a-compliant financing modes, waqf fund by itself acts as an independent legal entity which will remain functional perpetually. In other words, waqf by nature is inalienable. Hence, it cannot be owned by anyone rather it will remain beneficial. Once the defined objectives are achieved, waqf proceeds would be utilized for other social causes.

MODUS OPERANDI OF THE PROPOSED WAQF-SUKUK

Assuming the first priority is to raise fund for the Diamer-Bhasha dam that will approximately cost around PKR1.450 trillion (US$11 billion).

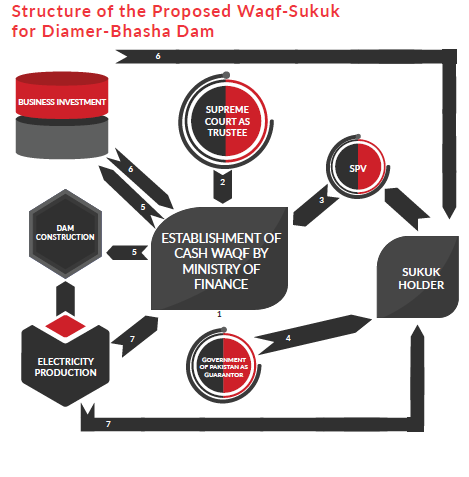

Since the total fund is not required at the beginning, the required fund will be raised gradually in three tranches of waqf-sukuk each for PKR0.47 trillion (US$3.6 billion). The following diagram explains structure of the proposed waqf- sukuk:

- The Ministry of Finance (MoF) establishes cash waqf fund, which will act as an independent entity.

- To ensure public’s confidence and participant’s interest, the Supreme Court of Pakistan will act as trustee of the waqf scheme.

- Special purpose vehicle (SPV) will be created to deal on behalf of the sukuk holders, and waqf will issue sukuk to the participants through SPV. Sukuk holder (donors/investors) could be divided into four categories: (a) perpetual investor with zero return i.e. pure waqf contributors, (b) perpetual investors with certain return (c) contemporary investors with zero return i.e. creditor to the waqf, (d) investors aiming commercial gain i.e. getting back principal investment and profit.

- The Government of Pakistan will act as a third-party guarantor for sukuk holder.

- Since total sukuk proceeds will not be utilized at the inception, it will be divided into two parts: (1) a portion will be invested in Shari’a-compliant business to generate profit, while (2) the remaining will be channeled for dam construction.

- The profit earned through investment will be channeled to (1) waqf fund and (2) those sukuk holders who invested for commercial gain (to entertain them during the grace period).

- Once the dam is fully constructed, electricity production will start. Profit from the electricity unit’s sale will be channeled to (1) waqf fund and (2) those sukuk holders who invested for commercial gain. Redemption of the sukuk will take place in two cases: (a) contemporary investors with zero return i.e. creditors to the waqf aim to get back their principal(2) investors intended commercial gain. In both cases, they can redeem sukuk in secondary market.

CONCLUSION

The proposed waqf-sukuk will generate various benefits to the country. For example, it will support the public financing of the government and will enhance the efficiency of the non-profit sector by reviving the Sunnah of donation, qard al-hassan and waqf. Furthermore, a successful issuance will ensure to (1) set a standard for low-cost fundraising (2) provide a secured infrastructure to globalize the awqaf industry (3) attract investment from other waqf institutions specially from the Middle East and (4) entice religion-oriented donors. In addition, a robust governance framework under the supervision of the Supreme Court of Pakistan will address the most critical aspect of this project i.e. public interest and welfare assurance to save the project from massive corruption and misconduct. The construction of proposed dam will also produce electricity to reduce the current shortage.