Prior to the financial crisis that started in 2001, there was serious interest from a number of countries in becoming hubs for Islamic finance. These countries included Malaysia, Singapore and Hong Kong in the East; UK, France, Italy, Luxembourg and Ireland in the West; and Bahrain, Qatar and UAE in the Middle East. Even countries like Japan and Korea postured towards Islamic finance in those pre-crisis days.

Sadly, the interest petered out during and after the crisis leaving Malaysia as the most important global player in Islamic banking and finance (IBF).

“Things are changing now. Malaysia’s dominance is being challenged by the likes of UAE and Qatar. Bahrain, once considered a global champion of IBF, is looking to reclaim its mantle with many Islamic banks in the country merging and consolidating their resources and expertise. Even in the UK, there is renewed interest in IBF, evident by the recent issuance of the first UK sovereign sukuk of GBP200 million. It was over-subscribed nearly 12 times.”

According to the Islamic Finance Country Index (IFCI), published in the Global Islamic Finance Report 2014, Iran ranks number one in the global Islamic financial services industry. Malaysia and Saudi Arabia are second and third. Although Iran is positioned so high, the domestic IBF industry remains bounded within the borders of the country, given the long period of economic sanctions imposed upon the country. This may change as we are seeing a gradual easing from Western powers and a rapprochement of sorts. Pakistan ranks ninth in the list but has always been perceived as a major player in IBF.

Now the situation in the country is looking more auspicious for IBF. The current PML-N-led government is the first democratically elected government in the country which has shown serious interest in promoting IBF in Pakistan. The appointment of a dedicated deputy governor at the State Bank of Pakistan (SBP) with a focus on the promotion of Islamic banking alludes to this fact.

More needs to be done to promote the domestic industry both within and internationally. SBP has recently initiated a project to promote quality education in IBF, by committing to invest in Pakistani universities and institutions of higher learning. Under this programme, specialised chairs in Islamic finance will be set up at various universities. The Institute of Business Administration (IBA) is expected to be the first to create such a chair. Other universities interested in the project include Lahore University of Management Sciences (LUMS) and COMSATS.

In Malaysia, the prime minister himself keeps himself abreast with new developments in IBF. In UAE, the ruler of Dubai is directly behind its initiative of making Dubai a centre of excellence for the global Islamic economy. In Pakistan, such a central leadership role has yet to emerge. Given, amongst other things, the ongoing military operation in Wazirastan, political noise created by the likes of Imran Khan and Tahir ul Qadri, the prime minister has not been able to embrace IBF fully. The finance ministry does not have the time or the resources to dedicate to the promotion of IBF. In such circumstances, there is a need for a full-time advisor, appointed by the prime minister, who should have multiple roles, including but not limited to:

[a] advocacy of IBF in Pakistan and overseas; [b] liaison between different government departments (Ministry of Finance, Planning Commission, and SBP etc.) And international bodies like Islamic Financial Services Board (IFSB) and Accounting and Auditing Organisation of Islamic Financial Institutions (AAOIFI) for the promotion and development of

IBF in the country; [c] devising a national strategy on the promotion of IBF; [d] developing a framework for enhancing the role of Pakistan as a global leader in IBF; and [e] more specifically, preparing recommendations for the government to make Pakistan a Centre of Excellence for IBF.

Assets of IBF are fast approaching US$2 trillion under management worldwide. Pakistan should not treat this industry lightly. They should advocate IBF nationally and be involved in the decision-making of international fora like IFSB, AAOIFI and the International Islamic Financial Market (IIFM). It should also look into hosting an international body like IFSB, AAOIFI and IIFM, hosted by Malaysia (IFSB) and Bahrain (AAOIFI and IIFM). There are a number of other bodies that work for the promotion of IBF, including but not limited to the International Shari’ah Research Academy (ISRA) for Islamic Finance and International Islamic Liquidity Management Corporation IILM – both hosted by Malaysia. World Islamic Economic Forum (WIEF), supported by the Malaysian government, is also very active in advocating IBF. Dubai Centre of Excellence for Islamic Banking and Finance is another body trying to pitch Dubai as the capital of the global Islamic economy. Pakistan, on the other hand, lags behind all these countries in such endeavours, despite having contributed significantly to the amount and quality of human capital to the global Islamic financial services industry.

There are a number of reasons behind this indifference to promotion and projection of Pakistan as a global leader in IBF. First, the ongoing war on terror has acted as a major impediment. The law and order situation in the country did not allow the authorities to focus on this area of paramount importance for the long-term health of the national economy. Second, the previous governments (the military government led by Parvez Musharraf and the PPP-led government) shied away from supporting anything Islamic. Third, the lack of talent available in Pakistan was also responsible for not giving confidence to Pakistan to vie for a global role in IBF. Finally, in the absence of a political push, bureaucracy in the country has never considered IBF with sympathy.

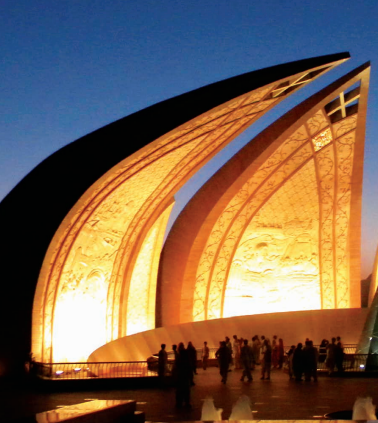

Despite all these obstacles, the share of Islamic banking in the domestic banking sector has exceeded 10%, and its growth is almost double of rate of growth of the conventional banking sector in the last five years. Given this, it is recommended that Pakistan develop an international centre of excellence for Islamic finance, similar to Dubai International Financial Centre (DIFC) and Qatar Financial Centre (QFC). These two Centres are not exclusively for Islamic finance but are certainly engaged in promotion of IBF. Malaysia International Islamic Financial Centre (MIFC), on the other hand, follows a different model to DIFC and QFC, and is a virtual body connecting the country’s Ministry of Finance, Bank Negara Malaysia (the central bank), Securities Commission Malaysia, other bodies in the government and international organisations. Pakistan should start with this model, eventually setting up a physical centre of excellence exclusively for IBF. This centre could be hosted in the outskirts of Islamabad, as a ring-fenced financial centre like DIFC and QFC. The proposed special advisor to the prime minister on IBF should be given the task of developing a framework for setting up such a centre.