Introduction

Every Islamic bank collects its deposits based on modaraba, musharaka or wakala structure. The funds thus collected under these mechanisms are subsequently invested in investments assets (like equities, sukuk, mutual funds, etc) or used for providing financing to the bank’s wholesale and retail customers using the modes of murabaha, tawarruq, ijara, musharaka mutanaqisa, istisna, etc.

Hence every Islamic bank manages a pool of assets which have tangible, intangible, liquid and illiquid assets. The depositors while making a deposit of funds are assumed to purchase an undivided share in this pool of assets and upon withdrawal are deemed to sell the undivided share in this pool of assets. Hence every day the underlying owners of this pool are constantly changing depending upon the volume and the number of depositors.

In this article we propose a new solution using the trading of ownership share in the assets of these pools as a vehicle for meeting working capital requirements of retail, wholesale segments and liquidity management needs of Islamic banks in a Shari’a compliant manner.

Basic Structure

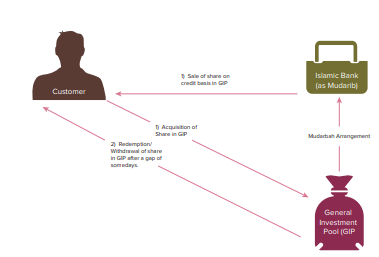

Under this solution any person or entity requiring liquidity can approach an Islamic bank for the required financing. The Islamic bank, acting as manager of a specific asset pool, shall sell an undivided share in that pool to that entity on a credit basis. This sale shall be without any undertaking or agreement to repurchase. Upon this purchase the purchasing entity shall become the owner of a share in the identified pool, and the value of its investment or share in that pool shall be equal to the Net Asset Value of the share in that pool on the day of the purchase as if the entity had purchased the share through cash deposits in its account. Subsequently, the purchasing entity shall be free to hold this investment. Alternatively, in case the purchasing entity wants to withdraw its investment to generate liquidity it will be free to do so by writing a cheque, through ATM or any other means which are normally used for withdrawal.

Operational Mechanism

This proposed product can effectively be implemented through the following two practical structures:

- Direct trading of pool assets

- Securitization and trading of pool assets

a. Direct Trading of Pool Assets

- Any person/corporate entity/banking company requiring liquidity shall open an investment account with the Islamic bank

- Subsequently, instead of purchasing a share in the General Investment Pool (GIP) by

depositing cash or cheque, the Customer shall purchase a share in the GIP on a credit basis. For this purpose a Share Sale Contract (SSC) shall be executed between the parties

- The price of this sale shall be equal to the Net Asset Value (NAV) of the share to be purchased prevailing at the time of purchase plus the profit for the credit sale period that the Islamic bank and the Customer agrees to build into the price.

- The Net Asset Value of the share to be purchased shall be equal to the financing amount that the Customer requires. The undivided share to be sold on credit basis shall be calculated as follows:

NAV of the share (or financing amount) divided by the NAV of the pool prevailing on the day of the transaction.

- NAV of the pool shall be calculated by adding up the value of all the assets of the GIP including accrued income and receivables (like murabaha receivables); in other words it shall be the size of the GIP on any given day.

- The SSC shall contain the Offer and Acceptance for the sale of the undivided percentage share in the GIP for the agreed selling price.

- Upon the execution of the SSC the Customer shall become the owner of the specified percentage share in the GIP. To reflect this purchase the account of the Customer will be credited with the amount of the NAV of the share purchased.

- Subsequently, the Customer will be free to hold this investment in the GIP and share in the profits and losses of the GIP or withdraw/ redeem this investment through cheque or any other method at any time to fulfil its liquidity requirements without any binding undertaking, waad or agreement.

- If the entity withdraws or redeems its share it shall be at the NAV of its share prevailing on the day of redemption. The NAV of the entity shall not remain static and will change every day based on the amount of income or loss accruing to the pool from its investing and financing activities. Hence at the time of redemption, the NAV shall be calculated as follows:

NAV = Initial investment + accrued profits till the redemption date – losses till the redemption date

- It is not necessary that only GIP is used for this transaction; any other pool may be used by the Islamic bank provided the tangible assets of the pool are sufficient enough to avoid the sale of debts.

Example:

AB Corp (ABC) requires PKR100,000 of working capital for six months and approaches Asar Islamic bank (AIB) on 1st January. AIB and ABC agree on a profit rate of 10%; hence AIB needs to charge Rs5000. The total size of AIB’s GIP as per its NAV on 1st January is PKR1bn. Hence AIB sells 0.01% (100000 divided by 1bn) share in the GIP having a NAV of PKR100,000 to ABC on credit basis of 6 months for an agreed price PKR105,000. The parties execute the sale by executing the SSC. Upon this sale AIB opens a mudaraba based account for ABC and credits the value of share purchased by ABC which is PKR100,000. ABC shall be free to hold this investment or redeem it at any time it pleases. If ABC wishes to redeem the share after 7 days on 8th January the NAV of its share shall be calculated as per the following:

NAV = Initial investment + accrued profits for the 7 days – losses incurred in the 7 days.

If the profit earned/accrued during the 7 days is PKR100 AIB shall be able to redeem the share at PKR 100,100. However if there are losses during this period or losses are higher than the accrued profits, ABC will not be able to generate its initial NAV. Losses can occur if there is a default in receivables during the period of investment.

a. Securitization and Trading of Pool Assets

Another way of using pool assets for the purpose of working capital financing is to securitize the pool assets. This can be done by either creating certificates of ownership (COO) in the GIP or through creation of a separate pool by combining ijara, diminishing musharaka, and Murabaha-based assets.

Creating certificates of ownership in the GIP

- Any Islamic bank acting as mudarib or musharaka manager of the GIP can create certificates representing undivided proportionate ownership share in the GIP’s assets up to the value of each certificate. The certificates shall be of equal value and can be created for any denomination.

- Before these certificates are sold in the market the certificates would be owned by the rab ul mal or the musharaka partners of the GIP and represent their proportionate share in the GIP assets. It is not necessary that the certificates are issued for the full value of the GIP but only a partial value. The certificates shall also be assigned a profit-sharing weightage.

- Upon requirement of funding by any Customer, these certificates shall be sold by the Islamic bank (acting as mudarib/musharaka Partner) on credit basis to the Customer. The certificates will be created in a manner that the total face value of the certificates to be sold to the Customer shall be equal to the financing amount required and the NAV of the share being purchased.

- The credit price of this sale shall be equal to the Net Asset Value (NAV) of the share to be purchased prevailing at the time of purchase plus the profit for the credit sale period that the Islamic bank and the Customer agree to build into the price.

- For the avoidance of doubt, the NAV shall be equal to the total face value of the certificates being purchased since the Customer shall be purchasing a share in the GIP equal to the face value of the certificate.

- The undivided share in the GIP (represented by certificates) to be sold on credit basis shall be calculated as follows:

NAV of the share (or financing amount) divided by the NAV of the pool prevailing on the day of the transaction.

- NAV of the whole GIP shall be calculated by adding up the value of all the assets of the GIP including accrued income and receivables (like murabaha receivables). In other words it shall be the size of the GIP on any given day.

- Upon purchase of the certificates, the Customer shall become the owner of an undivided share in the GIP equal in value to the total face value of the certificates purchased.

- Subsequently the Customer will be free to hold this investment in the GIP and share in the profit and losses of the GIP or withdraw/ redeem this investment by selling the certificates in the market or to the GIP itself at any time to fulfill its liquidity requirement without any binding undertaking, waad or agreement.If the Customer sells the certificates in the market it can be at any price agreed between the buyer and the seller.

- If the Customer sells the certificates to the GIP the sale shall be concluded at the NAV of the certificates prevailing on the day of redemption. The NAV of the certificates shall not remain static and will change every day based on the amount of income or loss accruing to the pool from its investing and financing activities. Hence at the time of redemption the NAV shall be calculated as follows:

NAV = Face Value of the Certificates + accrued profits till the redemption date – losses till the redemption date.

AIB Bank has a GIP with a total NAV size of PKR 1bn.

AIB creates 20 certificates of ownership of PKR10,000 each representing a proportionate share of value PKR10,000 in the GIP assets of PKR 1bn.

Now ABC approaches AIB with a requirement of PKR 100,000 working capital requirement for 6 months. AIB acting as Mudarib of the GIP sells 10 certificates having a total NAV/Face Value of PKR 100,000 to ABC on credit basis for PKR 105,000. This sale is actually the sale of an undivided proportionate share in the GIP assets by AIB to ABC. Subsequent to this sale ABC shall be free to hold or redeem the investment. ABC shall also be free to sell these certificates to any 3rd party in the market. In case ABC sells the certificates to any 3rd party it can be at any agreed price between the parties. If it holds the certificates ABC will earn profits as per the allotted profit-sharing weightage on the certificates or losses as per its pro rata share in the GIP in case there is a loss during the investment period. If ABC decides to sell the assets to GIP after say 5 days the redemption shall be done at the NAV calculated as follows:

NAV = Face Value of the Certificates + accrued profits for the 5 days – losses incurred in the 5 days.

Shari’a Compliance Check of the Product

From a Shari’a perspective, the product needs to be analyzed on four major underlying issues:

Trading of ownership/equity share in the underlying pool of mudaraba assets

The product is based on the sale of ownership/ equity shares in the underlying pool of mudaraba assets. The purchase of this share is similar to an account holder depositing funds in a Mudaraba-based account and hence the sale is also similar to the account holder withdrawing his funds from the Mudaraba-based account. This is as per the AAOIFI Shari’a Standard No. 40 ‘Distribution of Profit in Mudaraba Based Investment Accounts,’ clause number 4/9 which states: “It is permissible for the account holder to exit from the mudaraba with all his funds or part of them. Such exit represents the desire of the account holder to redeem his share in the mudaraba assets without withdrawing the total amount deposited in his account or part of it.”. Hence this is the basis upon which the Mudaraba-based accounts of every Islamic bank work.

Avoiding sale of debt and riba

To avoid the sale of debt and riba while trading the mudaraba ownership share, the underlying pool of assets must comprise of at least 33% tangible assets compared to the proportion of other cash and debt-based assets. This problem is not bound to arise since normally GIP assets involve large chunks of ijara assets, musharaka mutanaqisa assets, sukuk, equity stock investments making the proportion of intangible assets higher than the minimum 33%. The minimum requirement of 33% tangible assets is based on the AAOIFI Shari’a Standards. This requirement is also mostly fulfilled by Islamic banks currently as this is also required for managing their current deposit pools.

Credit sale of mudaraba ownership share/equity

The product involves a credit sale of the mudaraba ownership equity whether the sale is made directly or through creation and credit sale of sukuk certificates. Hence it needs to be confirmed as per Shari’a principles whether the sale of this ownership share is allowed on credit basis or not. In essence the mudaraba ownership equity or its certificate represents undivided ownership in the underlying assets of the pool or mudaraba. Hence the subject matter is in reality a combination of assets, both tangible assets as well as intangible debts and liquid cash. The sale of this combination of assets has been approved by various Shari’a boards including AAOIFI’s board with a minimum requirement of tangible asset proportion as has been discussed in the previous section. Fulfilling this minimum condition will not result in the subject matter being considered a source of riba, and hence there does not seem to be any issue in its trading on deferred payment basis.

Secondly the mudaraba share is just like an equity share of any company since both represent an underlying undivided share in the pool of assets or business. Certain rules and criteria have been defined by AAOIFI and Shari’a scholars for the trading of equity shares as discussed earlier. Hence in my humble opinion, if the mudaraba share in GIP or any other pool of assets fulfils this criteria the trading on deferred payment basis of this share whether through creation of sukuk certificates or otherwise is not contrary to the principles and rules of Shari’a. However, the criteria can be slightly different for each Islamic bank depending on the opinion of the respective Islamic bank’s Shari’a board. Hence the credit sale of equity shares has been allowed by AAOIFI in its Shari’a Standard No. 21 ‘Financial Papers (Shares and Bonds,)’ clause 3/2 wherein it states: “It is permitted to buy and sell shares of corporations, on a spot or deferred basis in which delay is permitted.”

Non existence of bai ina

At first instance it may seem that there is prevalence of bai ina in this product structure; however due to the following reasons, bai ina is not present in the structure:

First, in bai inah the subject matter is sold by one party on credit basis and then purchased back on cash basis. Hence the same subject matter returns to the original seller. Under this product the subject matter is the ownership share in the mudaraba’s underlying pool of assets. Initially the share is sold to the Customer on credit by the Mudarib on behalf of the owners of the mudaraba business, which are various individuals/entities (known as Rab ul Mal). However when the share is/will be redeemed by the customer the share will be purchased by the Mudarib on behalf of the Rab ul Mal and it is not necessary that the Rab ul Mal will constitute exactly the same people/ entities which had sold the share to the Customer initially. It is the same as if a person trades on a stock exchange; he/she may trade in a particular stock several times but he/she does not know who the real party on the other side is; hence he may trade with the same party several times involving the same stock. Since the goods do not return to the original seller bai Ina is safely avoided.

Second, the nature of the subject matter is also changing from time to time since the underlying pool of assets is also changing. Hence it is highly likely that the share initially purchased by the Customer represents different assets at the time of redemption. This also results in the avoidance of bai ina.

Third, the redemption price is not decided upfront but is instead based on NAV at the time of the redemption. Hence it is also possible that there is loss on the pool assets and the Customer may not get its initial investment value / NAV on redemption. It is also possible the customer may get more than his initial investment value / NAV. Hence since in bai ina, normally, the price of the second sale is also agreed upfront, this product is different from bai ina in this respect as well.

Fourth, there is no undertaking or agreement from the mudarib to purchase back, or the Customer to sell the share back to the mudarib. Hence the redemption of the share is not guaranteed. The Customer is free to hold the investment if it feels that it does not need liquidity immediately. It may keep the investment intact and earn the profits earned from the mudaraba business as per its profit-sharing weightage. Hence the customer may redeem the investment after a week, month or even years. In contrast, in bai ina the second sale is certain, confirmed and with a certainty in price.

Fifth, the customer will also be free to sell the sukuk certificates or transfer its share to any third party in the market rather than selling the asset back to the mudaraba pool. In contrast in bai inah, the goods have to be sold to the original seller.

Hence due to the above-mentioned reasons the transaction cannot be termed as involving bai ina. To confirm that the underlying nature of assets and rab ul mal have changed Shari’a boards, Islamic banks can put an administrative restriction of not allowing the withdrawal before a certain number of days.

Utility for the Industry

- The product in both its forms will be a viable tool for meeting working capital requirements of corporate and small-scale customers.

- Rather than resorting to commodity trades through offshore metal exchanges, Islamic banks would be able to execute these deals locally with minimum administrative and operating procedures and without huge brokerage commissions.

- The product can also be used for providing retail-based personal financing to individual customers requiring funding.

- The creation of certificates representing ownership in the General Investment Pool (GIP) or any other pool of assets. Islamic banks would effectively make their portfolios more liquid.

- Such certificates and sukuk can be traded in the secondary market bringing in more liquidity and much-needed maturity to the

Islamic interbank market, especially in markets where sukuk issuances are very low.

Similarly deficit Islamic banks would be able to arrange liquidity by creating such certificates and selling the same to excess Islamic banks or other financial institutions. Hence this product will be one generation ahead from the recent Interbank Master Wakala Product standardization achieved by IIFM.

- The certificates can be effectively used for developing a Shari’a-compliant financier of last resort facility from the central bank for Islamic banks.

On Firmer Grounds than the Disputed Commodity Murabaha

- The major forms of international commodity murabaha prevailing today have been criticized by a number of scholars on Shari’a grounds, including the Islamic Fiqh Academy (IFA). The reasons for this criticism are due to the following problems inherent in the structure of international commodity murabaha or tawarruq transaction:

- The banks execute transactions on commodities usually in offshore international exchanges like the London Metal Exchange (LME) wherein the commodities are purchased from one broker, sold to the client on credit basis and then to the second broker on behalf of client which is also pre-arranged by the Islamic bank;

- The two brokers are subsidiaries or same group companies;

- Even if they are not subsidiaries, in almost all commodity murabaha transactions the two brokers have netting arrangements to settle the commodities between themselves; hence the commodity almost every time ends up with the original broker. and the funds are directly transferred by the Islamic banks to the clients based on master debit instructions from the two brokers;

- In this scheme of events even the existence of commodities is highly questionable since both the brokers know that the physical delivery is not effected and possession is exchanged merely through delivery warrants. Hence there is no check whether the commodities even exist or not. The purpose of the transaction is merely to provide funding to the client in which every sale is pre-planned.

- The whole scheme of events in a tawarruq appears artificial and made up to accommodate the funding requirement of the customers. In contrast, the product structure of the proposed product involves trading in an underlying mudaraba pool of assets. All Islamic banks have a large pool of such assets which is managed in their normal course of business; each Islamic bank can easily use these assets for trading purposes either through direct sale or through securitization.

- Hence this product is a practical, cost-efficient, easy-to-implement and a much more Shari’a-compliant alternative to the disputed international commodity murabaha currently prevailing in the market.