TIME VALUE OF MONEY AS A JUSTIFICATION OF PERMISSIBILITY OF INTEREST

I have always opposed the notion of the Time Value of Money (TVM), and in fact deem it to be nothing but a blatant insistence on charging of interest and reiterating the claim. Let me give a rather vulgar example.

If someone standing at a crossroads is almost 100% sure that if he follows Street A he will meet a woman who will happily allow him to consummate. With this knowledge, the person takes another Street B and halfway he meets a woman standing in the corner of a building. Will the man be justified to demand the woman to consummate because he would have had done so with another woman had he followed Street A? If not, then TVM can also be not used as a justification for charging interest.

Understood? If not, let us look into the concept of TVM. TVM refers to nothing but a loss, also known as opportunity cost, of not putting a one-dollar into an interest-bearing instrument (like a fixed interest paying bond). The concept assumes on a priori basis existence of an interest-based instrument. Therefore, it is tautological to use it as a justification of dealing in interest. It does not explain why interest should be paid; rather it states that a one dollar would generate interest in future and therefore it is better to receive one dollar now rather than in future and lend it to earn interest to have more than one dollar in time.

It is absolutely imperative for those aiming to succeed in IBF to understand the concept of Riba and its prohibition. Money must be put into a productive use to earn a return. Merely lending it to someone on interest and earning a fixed return is problematic from a Shari’a viewpoint. By productive use we mean investing it in a production process and assuming all the risks thus ensuing. This means that the investor of money must assume downside risks to earn a possible upside benefit. In other words, money can only be invested and not used for mere financing.

Can money be used for home or trade financing? Not in the traditional sense, as the contemporary practice of banking and finance prevails. In fact, Islam does not recognise debt financing at all other than lending money interest-free. Period.

All debt-based financing products – whether offered by Islamic or conventional banks – are inconsistent with the relevant Islamic doctrines of business and investments. In fact, debt financing as a concept (or in the form of contemporary practices) is not recognised in Islamic economic doctrine.

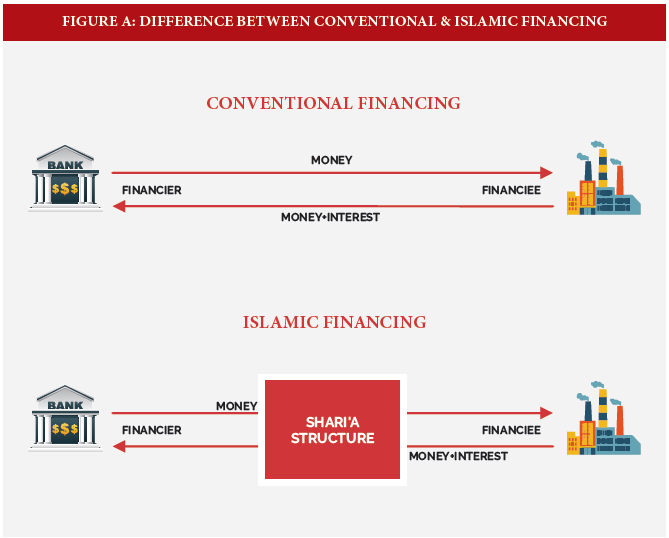

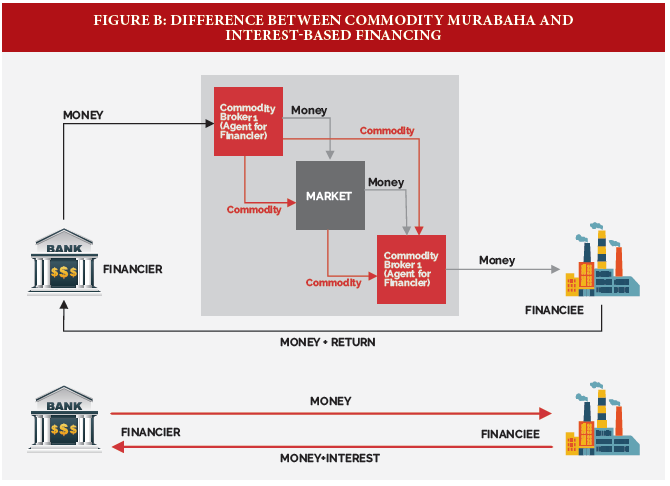

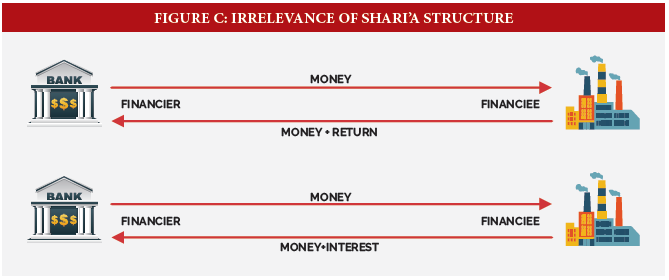

Islamic banks and financial institutions put up an intermediate Shari’a structure – which may be called Green Box for ease of reference – to execute debt-based financing deals in a Shari’a-compliant way. A litmus test of Shari’a authenticity of such financing deals is what may be referred as Irrelevance of Shari’a Structure. A Shari’a structure is deemed irrelevant if its addition does not bring any added economic benefits or by simply stripping it off the deal there is no material economic effect. The principle of Irrelevance of Shari’a Structure may be explained with the help of the following diagrams.

Removal of the Shari’a structure (from Figure B) makes the two structures, Commodity Murabaha and interest-based financing, exactly the same. If that is the case, and if there are no material economic differences between the two arrangements, then structures like Commodity Murabaha are indeed little more than legitimising the economic effects of conventional lending. On technical grounds, Commodity Murabaha looks like a Shari’a-compliant arrangement. However, in its economic effect, it is no different from a conventional interest-based loan. It is a case of eating a halal KFC burger, while being halal making it no better a junk food.

Because of the legitimization of conventional risk returns in Islamic banking and finance, the supply-side players are mere financiers and not investors and traders as they otherwise pretend to be. Isn’t it the right time to start being a bit more innovative to bring the required vitality to Islamic banking and finance?

To read more about the above and the ways to succeed in Islamic banking and finance, pre-book a copy of the author’s forthcoming book, How to Succeed in Islamic Banking and Finance.