Significant segments of population are disadvantaged in Muslim countries, particularly in Central Asia, Sub-Sahara Africa and the MENA region. They have no proper access to formal banking-conventional or Islamic. Banks, in particular, are not strategically focused on reaching out to the needy. Private and foreign financial institutions or banks seek to maximise profits for their shareholders/ stakeholders by building businesses in relatively easier urban areas. Rural infrastructure projects, microfinance and rural development are generally left only to public sector institutions because of the assumed high risk that is associated with lending and financing microenterprises.

Given the rate of high poverty among the low-income groups and the unavailability of adequate collateral, financing these groups is normally associated with greater risk as reflected in the banks’ high non-performing loans in some countries like Egypt and Morocco.

In this background, Islamic microfinance may be used as a tool for financial inclusion and poverty alleviation in both Muslim and non-Muslim countries. Its significance is paramount, as it can be a means for propagation of Islam, although admittedly Islamic banking and finance has been careful in aligning itself to any non-financial objectives. Having said that, Islamic microfinance can be used to portray economic and financial values of Islam. Irrespective of the ultimate objectives, Islamic microfinance can provide finance to the poor or the people with good expertise without any start-up capital.

EMPOWERING THROUGH ISLAMIC MICROFINANCE

Islamic microfinance is based on sound Islamic financial and economic principles. Islam encourages self-employment and empowerment rather than just donating money and food to the needy for consumption. Providing tools for production to the poor is better than donation of consumable charity. Through this, the self-employed poor can be empowered to care for themselves and their families on a sustainable basis. There is a definite synergy between this thinking and that of contemporary multilateral institutions (e.g., United Nations Development Programme and the World Bank), which also recognize microfinance as a means of eradicating inequality and poverty. Islamic microfinance has great relevance to the Sustainable Development Goals (SDGs) – an important development agenda being pursued by an increasing number of countries around the world.

“Islamic microfinance targets the very poor who are capable of working in the production of goods or services.”

Islam offers various means for eradicating income inequality, such as through zakat (compulsory charity) and sadaqa (general giving), given directly to the poor to solve their urgent needs. Hence, Islamic microfinance targets the very poor who are capable of working in the production of goods or services. Consequently, while zakat should be paid only to specific people, Islamic microfinance has a bigger scope. It can be used to mitigate negative impact of high unemployment among the youth in poor geographies.

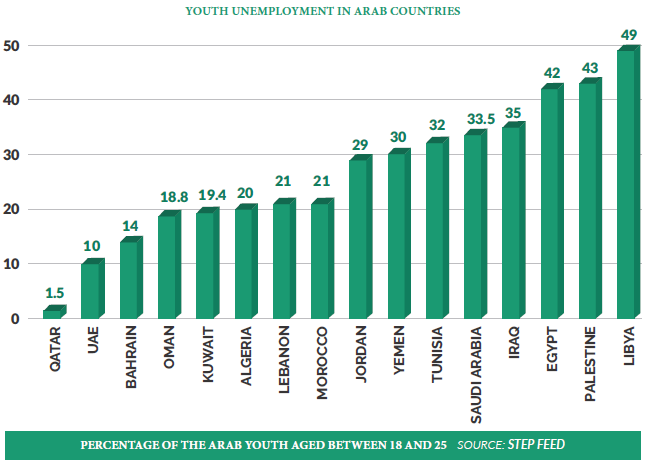

As the below figure suggests, the rate of unemployment is skyrocketing, especially among the Muslim youth. The story is not grossly different in other poor countries with significant non-Muslim populations. In such countries, Islamic microfinance can be used to finance Small and Medium-sized Enterprises (SMEs). This could lead to a solution to hyper unemployment and the challenges facing SMEs in accessing suitable finance. The Sudanese and Pakistani experiences have shown that Islamic microfinance has had a positive impact on income-generating activities. In addition, Islamic microfinance has also been used to finance graduate students as part of a programme targeting the unemployed youth in Sudan.

Despite the positive impact of Islamic microfinance in many Muslim countries, conventional lenders still dominate the market. Most of the Islamic microfinance lenders are small and face greater challenges in reaching out to their customers and expanding their businesses. These challenges include lack of basic infrastructure, rudimentary financial infrastructures, and far and unreachable markets. It has negatively impacted accessibility of Islamic microfinance and has indeed contributed to the cost of finance.

Other challenge facing Islamic microfinance in Muslim countries is the riskiness of financing poor borrowers. This stems from the small size of their finances, the remote residential areas of the poor from the urban cities, and their uncollateralized risk. In addition, many Muslims countries have only recently recognized the importance of microfinance as a tool of empowering the low-income, reducing the problem of unemployment, and elevating poverty.

Weakness of Islamic microfinance infrastructure owes to the following:

- Limited spread of Islamic financial institutions;

- Lack of relevant financial regulations;

- Unavailability of popular Islamic microfinance agencies; and

- Ineffectiveness of microfinance as a whole.

“A step towards making Islamic microfinance effective in the context of Islamic banking and finance is to increase the share of this type of business from merely 1% to about 5% in the next three to five years.”

For this to happen a strategic approach towards Islamic microfinance must be delineated. Although the countries like Bangladesh are recognised for the provision of microfinance, other models, especially in Malaysia and Pakistan, must also be considered.

The World Bank plans to end extreme poverty by end of 2030. Some empirical evidence has shown that people in the poorest regions of rural Africa can lift themselves out of extreme poverty in just five years. Thus, this can become a reality if proper means and tools of microfinance exist. This will facilitate the particular needs of the poorest, if their diversity is considered. Diversification of the Islamic microfinance products may represent the right intervention for achieving better financial inclusion among the poorest in Muslim communities.

THE READINESS OF ISLAMIC MICROFINANCE Islamic microfinance can be effective for creating hope not only for the poor and those above the poverty line as shown by traditional microfinance. In this respect, the unique needs of extremely poor Muslims who opted out of traditional microfinance must not be ignored. The primary reason for many deserving Muslims to voluntarily exclude from microfinance is the incidence of interest. Other reasons for exclusion are purely economic in nature, as many of the potential users of microfinance refrain from it because they believe that they would not be able to pay back loans – the affordability trap. This has something to do with the risk appetite of such individuals and families.

Success of Islamic microfinance lies in the recognition of these attitudinal issues. It must, therefore, use interest-free loans and combine these with zakat, waqf, and sadaqa.

Islam does not differentiate between the poor based on the conventional notion of poverty. Rather it divides the poor into two main categories: fuqara (singular faqeer) and masakeen (singular miskeen). Fuqara are those who do not have enough substances to satisfy their basic needs for one day, while masakeen are the people that do not have enough substances to satisfy their basic needs for the whole year. While fuqara may be offered help from zakat, the masakeen may also be helped from other sources of sadaqa. In other words, different solutions may be delineated for different segments, based on their peculiar conditions.

In this way, Islamic microfinance must move beyond its conventional counterpart to achieve better and more effective social and financial inclusion. Islamic microfinance is also expected to be more ethical, as it focuses on social responsibility, in addition to profit maximization. It is ethical in two ways: in the choice of the recipient of funds, and in terms of leniency it shows towards those who cannot afford to pay at all or delay. This is in line with Quranic injunction of:

“And if someone is in hardship, then [let there be] postponement until [a time of] ease. But if you give [from your right as] charity, then it is better for you, if you only knew. [Holy Quran, 2:280].”

Despite being an excellent tool for poverty alleviation and financial inclusion, conventional microfinance has not fully succeeded in the Muslim countries. As stated earlier, the failure of microfinance therein is not necessarily due to inherent inefficiency of the conventional model but it is primarily due to the attitude of Muslims towards interest. Islamic microfinance, based on interest-free loans, zakat, sadaqa and waqf, is relevant to global efforts for poverty alleviation. Islam provides tools that are universal, and if used strategically, they will bring benefits to all, irrespective of their religious beliefs.

Islam recognises the right of the poor in the wealth of the rich Muslims in the form of zakat. When this is combined with the prohibition of interest, this gives rise to a universally relevant model of microfinance. Furthermore, sale contracts (salam and istasna’, etc.), profit and risk sharing arrangements like murabaha, musharaka and muzara’a (sharecropping), and ijara can also be used to address the diverse business needs of the poor who look for SME financing.