As Muslims become increasingly affluent, there is a need to plan effectively for the future. Murniati Mukhlisin discusses the importance of financial planning, and introduces the novel idea of sakinah as means to secure one’s financial future. For a Muslim, temperance in spending, community welfare and worshipping God are the key pillars of financial planning.

Introduction

Islamic financial planning involves the creation, development and delivery of individualised customer products and services at a profit to the organization in the light of Islamic values and principles. The idea of financial planning according to Islamic law has antecedents in the works of Ibn Yusuf, Ibn Taimiyyah, and Ibn Khaldun. For conventional financial markets, it is defined by Investopedia Dictionary as a comprehensive evaluation of an investor’s current and future financial state by using currently known variables to predict future cash flows, asset values and withdrawal plans.

Conventional financial planning has been growing rapidly; the aim to build wealth seems to be the core objective of those involved.

However, this is not the main purpose for Muslims. Allah has reminded believers to fear Him in whatever actions they perform “O you who have believed, fear Allah as He should be feared and do not die except as Muslims [in submission to Him]” (Ali-Imran: 102). Every Muslim has a personal responsibility to ensure that actions are imbued with this principle.

Moreover, Allah says in the Quran “O you who have believed, protect yourselves and your families from a Fire whose fuel is people and stones.” (At-Tahrim: 6). Hence, the responsibility extends to protecting and educating next of kin and loved ones.

Financial planning is an important element in protecting one’s family. Poverty has been seen by many Islamic scholars to be a cause of the reduction of faith and practice. Securing finances both in the present and in the future can have a deeper spiritual effect. This is ignored by conventional financial planning approaches. The following sections will cover the strategies in Islamic financial planning that are ‘beyond wealth management.’

What is ‘beyond the wealth management’?

Sakinah (or tranquillity) can be defined as a condition in which peace prevails, and it is a major characteristic of a harmonious family life. The Prophet Muhammad is reported to have said, “When a group of people assemble for the remembrance of Allah, the angels surround them (with their wings), mercy envelops them, sakinah descends upon them and Allah makes a mention of them before those who are near Him.’’ Sakinah is also a process, a continuous pursuit for perfection – or struggle, if you like. Indeed, peace or tranquillity is a state of mind, but it still needs to be maintained and pursued. Just as a person’s faith (iman) may go up and down, his status as a Muslim remains intact so long as he meets the minimum criteria of being a ‘Muslim’, i.e. keeping his faith in the Oneness of Allah.

Sakinah has to be present in financial affairs as well. Each person or family may have different criteria and levels in deciding when they can safely say, “We are, or I am, financially sakinah”. In the context of conventional financial planning, this condition is referred to as financial freedom or financial independence. But financial freedom is more synonymous with the freedom from working (hard) and benefitting from a secondary source of income. For example, Rich Dad Poor Dad author Robert Kiyosaki says financial freedom/independence is obtained when a person is able to support various expenses only from passive income, such as investment returns from property/real estate or a business. Whilst for the financial advisor and motivational speaker Suze Orman, financial freedom means permanent absence or disappearance of anxiety or worries on money matters.

Ahmad Gozali, an Indonesian financial planner, defines financial freedom as a situation where someone has managed to ‘put the wealth in his hands, but not in his heart.’ In other words, financial freedom is obtained when qanaah (contentment) resides firmly in a person’s heart. That is, a person who does not feel deprived with having little wealth and not too wasteful when the wealth is abundant.

This condition should be considered in the context of maqasid al-Shari’a (higher objectives of the Shari’a). The objective of the Shari’a is to realize or to make real the best interests of humans on earth. These best interests are to secure benefits or to prevent harm and are divided into three descending priorities: meeting the essentials or necessities (dharuriyyah), then secondary needs (hajiyyat), and finally procuring luxuries (tahsiniyyat).

In terms of searching for wealth, a person would give priority to the basics (necessities) and deliberately do things that ensure the protection of his religion, life, lineage, intellect (knowledge) and wealth. Therefore, in the context of consumption or expenditure in Islam, meeting basic needs (dharuriyyat) is of absolute necessity and meant to preserve the aforementioned five concerns.

The so-called secondary needs (hajiyyat) are something that if not met will not cause harm. To that end, sakinah could be explained as a way of life that creates a sense of contentment or qanaah when most of the basic and secondary needs are met. While for luxurious goods (tahsiniyyat), they can be obtained within reasonable limits and for good purposes.

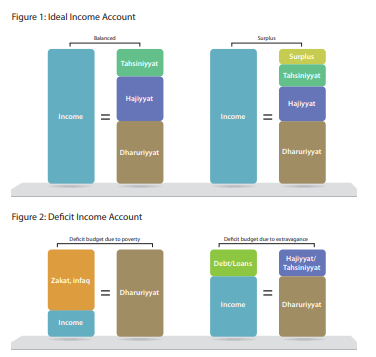

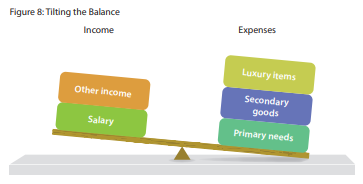

In practice, there is a nominal or sakinah financial threshold. Sakinah will be easily achieved when expenditure is equal to or less than the income. When it is less, then the individual will be in a surplus position, which will also lead to sakinah. A surplus financial position is desired. Both the minimum (balanced) and ideal (surplus) conditions for every family will be able to meet the basic needs of their family life .

Revenue minus expenses equalling deficit is a condition to be avoided . This situation will lead to unhealthy accumulation of debts. There are two main situations in

which deficit can occur: first, because income is lower than what is needed to cover basic needs or necessities (dharuriyyat); and second, expenditure is way beyond the income capacity, especially for satisfying added wants or procuring luxuries. For the first condition, deficit should be covered by the government or charitable programs of the community with revenue derived from tax or zakat. While the second condition often occurs naturally due to an excessive lifestyle, and often times the deficit must be financed with debt. The main objective of sakinah financial planning is to guide plans in managing income, spending on needs and wants, as well as managing savings to achieve a position of stability with a balanced budget and surplus. It strives to avoid excesses and conditions of debt, as described above, and to tilt the balance of income and expenditure more towards income (Figure 3).

The road to financial sakinah

Many Muslim families complain that despite the long and hard working days, sustenance or risq they gained is still insufficient – sometimes only enough for a month or may be less. They also complain that although their income is higher than the previous month they still feel impoverished, and trapped in debt, and worst, not able to set aside savings or plan for a family vacation.

There are a few measured steps, which can be taken to keep family finances in good order. The steps are recommendations for planners as each family deals with its own unique circumstances. The schedule can and should be adjusted according to the needs of the situation.

To illustrate further, below are some of the steps that can be taken to achieve a sound family finance condition or sakinah:

- Clear intentions

The very first step is to align intention with that of the will of the Creator, either in working, running a business or seeking His bounty by any other lawful means. Every believer must strive so that all activities, whether commercial or social, are solely to seek His pleasure and a form a foundation for worship, and not filled with worldly ambition or targets alone.

| Financial aspects | Things to focus and plan |

| Income | Niyyah/intention is only to seek blessing of Allah Focus only on halal sources of income Rise and start work early Maintain good relationships |

| Needs | Based on priority Halal & thayyib Zakat and other contributions Inheritance (mawaris) and wills Qanaah |

| Wants & Dreams | Budgeting Self reflection & repentance |

| Surplus & deficit | Being content and grateful |

| Contingency | Investment, Budgeting, Insurance & Pension, Education. |

A person, who works as an accountant, for example, where almost all his time is consumed working for clients and the company, will enjoy and be motivated because his intention is to increase his income. But this financial satisfaction may be accompanied by a sense of emptiness due to not having enough time with the family. Work-life balance will only be a slogan where the initial intention was not addressed in advance; just a perennial trade-off between increasing revenue and satisfaction with inner peace continuing to decline. Most of us are well aware of this trade-off and might have prioritized job over family consciously, with the consequences that come with it.

Intention to seek material gain or wealth may lead the person to be extremely successful, but he might fail in other respects, i.e. inner peace and receiving blessings. Likewise, when a person pursues his professional dreams with his heart filled with qanaah and seeking the pleasure of Allah, blessings will come along often. When he tries to follow Him, Allah Almighty would not leave his families in despair.

Prophet Muhammad (P.B.U.H), a leader with various obligations (earthly and divine), said: “Verily Allah, the Highest, will test each of His servants with risq which He gave him. Whoever is pleased with the division of Allah, then Allah will bless and good luck will be paved for him. And those who are not satisfied, undoubtedly his fortunes will not be blessed.”

- Only halal income

Halal is a major signpost in the journey to finding financial tranquillity. Halal is also a necessary condition for the realization of the blessings in wealth, which is acquired in a justified way.

Prophet Muhammad (P.B.U.H) said, “If you put your faith completely in Allah, He will arrange for your sustenance in the same way as He provides for the birds. They go out in the morning with their stomachs empty and return filled in the evening.”

Although many are increasingly sceptical about the principle of lawful sustenance and instead argue that halal income is scarce or hard to find, from stories of many successful people, they strive and become successful by sticking to such a principle. Halal sustenance is often considered a normative concept that only applies in medieval times; yet rampant cases of fraud, corruption, bribery, or abuse of authority in the modern age is the result of a loss of concern for a lawful livelihood.

Among the things that are not justified is dealing with usury, and could negatively affect one’s wealth as it is tantamount to injustice and extortion. Similarly, reliance on begging in search of money is one of the acts that are forbidden and prevent blessings. In one hadith, the Prophet (P.B.U.H) explained: “On the day of reckoning, begging will be like a blemish on the face of the beggar.

- Working hard and starting work early in the morning

The best way to achieve peace and obtain the blessings of Allah SWT is to work hard and start each activity when it is still early in the day. Regularly waking up early is healthy and could trigger productivity, as well as removing laziness. Early morning is the best time to start looking for a job and good fortune in life. Prophet Muhammad (P.B.U.H) would say a prayer. “O Allah, bless my community for their morning time.”Based on this hadith, some scholars assert that sleeping in the morning is to be avoided (makruh).

- Maintaining good relationships (silaturrahim)

Among the good deeds that will bring blessings in life is establishing and maintaining good relationships. Silaturrahim is a step towards establishing good relations. The Prophet (P.B.U.H) said. “Whoever wants his sustenance to increase, or a delayed death (prolonged life), then he should extend silaturrahim.”

Prolonging life provides the opportunity (taufiq) to do good deeds, filling time with useful activities for life in the hereafter, and avoiding wasting time in useless activities. Besides, one’s legacy can endure in the memories of many people; charitable deeds are always remembered.

- Fulfilling the rights of Allah

From the wealth accumulated, giving to the poor, the elderly and orphans is encouraged, if not obligated. It can be accomplished by distributing a certain portion of wealth in the form of zakat or charity. The collection and disbursement mechanisms for contributions have been set out in Islam to ensure fairness in lives.

Zakat, sadaqah, infaq and any other form of charity can lead to an increase in wealth and contentment with the blessings of receiving an income. When sustenance is not seen as a blessing, for example, it runs out quickly or becomes insufficient. It could also be the result of not fulfilling the obligations of zakat or sadaqah to the poor and the needy.

Allah Subhanahu wa Ta’ala says: “Allah destroys usury and nourishes charity” (Al-Baqarah: 276). In one hadith, Prophet Muhammad (P.B.U.H) once said: “There is no morning, except that two angels come down, then one of them prays:” O Allah, give a replacement for those who paid sadaqah “, while the other one prays: “ O Allah, destory those who are miserly.”

- Muhasabah and repentance

As wrongdoing or sin can curtail risq, seeking forgiveness and repentance can overturn the situation and bring back barakah on income or wealth. Almighty Allah tells the story of Prophet Hud and his people’s Ad. “And (Hud said): O my people, ask forgiveness from your Lord and then repent to Him. He lowered torrential rain upon you, and He will add strength to your strength, and do not turn towards sin.” (Hud: 52)

Managing Needs

As a result of this unfaithfulness and bad deeds, as described by the scholars of tafsir, people of ‘Ad were punished with severe drought and infertility – no woman could bear children.

This situation lasted for several years, while Prophet Hud persistently asked his people to repent and seek forgiveness from God. It was narrated that after the people finally repented and asked forgiveness, Allah SWT granted them with plenty of rain and their families were blessed with many children and descendants.

7. Gratefulness and generosity

For many Muslims, gratitude is usually expressed by exclaiming ‘Alhamdulillah’, especially when a job is done, problems are resolved or when receiving prizes/awards. In addition to the visible and explicit, there are many more favours from God that we receive, which deserve our gratefulness. Among them are the blessings of sunshine, fresh air, joy of gathering with our family, and other favours that God endlessly provides to mankind. Verily Allah says: “And remember when your Lord said,” Except ye thankful, I will add (favours unto you, and if you deny (my favour) then indeed my punishment is severe “(Ibrahim: 7).

How to achieve Sakinah in Islamic financial planning?

There are five main elements that must be managed by the family or planner as described in Figure 4 and explained in following the sub-sections.

- Managing income

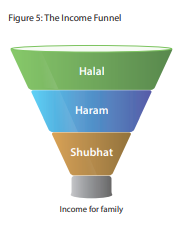

Income is the key to financial tranquillity (sakinah in finance matters). There are three possible types of income: halal, haram and shubuhat (ambiguous). Everyone is ‘free’ to choose any of them to support his life and his family life.

The ideal situation for the family is to have lawful (halal) and good (thayyib) income that covers needs and wants/dreams and at the end ensures balanced or surplus account. As a guide for mankind (not only Muslims), Allah has clearly stated, “O mankind, eat from whatever is on earth [that is] lawful and good and do not follow the footsteps of Satan. Indeed, he is to you a clear enemy.” (Al-Baqarah 168)

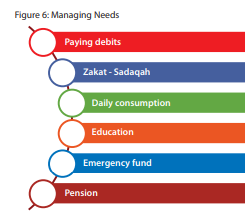

- Managing needs

Maintaining a cash flow is the most important aspect of personal or family financial management. Good cash flow management will end up with surplus or parity in accounts; likewise, poor cash flow will result in deficit and debt. In Islamic financial planning, tool for healthy cash flow management is through Plan, Do Check, Action (PDCA) which involves budgeting, recording transactions, and evaluating. The keyword for the whole exercise is discipline.

3. Managing dreams

Family dreams are intermediary goals to motivate all family members in nurturing the positive habit of saving, as well as to reward the income earner after working really hard.

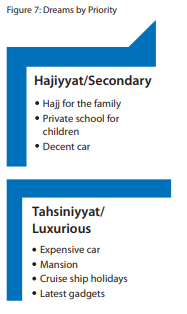

Dreams are not an end in itself – dreams are not primary goods. Dreams are hajiyyat (benefits, to reduce hardship) or tahsiniyyat (perfecting/ complementing our family life). Figure 7 describes a sample of financial dreams that a family can focus on.

The key to keeping family dreams or wants reasonable is being content with what is in possession or ‘putting wealth in our hands, not in our hearts’. Dreams should also be in line with our needs and the maqasid al-Sharia. If these are all in check, then the main tool to achieve our many wants is planning.

- Managing deficit or surplus

Deficit is often caused by high proportion of income spent on hajiyyat/tahsiniyyat items (Figure 8).

For many people, a deficit is usually the result of extremely low income. When a deficit is caused by low earnings, people strive to increase income through additional jobs. When a deficit is caused by overspending on non-essentials, it can be solved through cutting down expenses, employing discipline, or applying shock therapy. In managing debt, it can be worked out through restructuring the financing/loan, reallocation of other expenses to pay the debt first, or selling of assets to pay loan back.

Being indebted is strongly disliked. The Prophet is reported to have said that “The soul of the believer is held hostage by his debt in his grave until it is paid off.”

Being in a surplus condition is an ideal situation. When a family is in this position they should remember the less fortunate, allocate immediately to savings/investment, and spend cautiously.

Surplus may come from extra/extraordinary income, or a pay rise. The best advice when there is a surplus is to maintain the same living standards prior to a rise. The surplus income is best allocated for emergencies, education of children, pensions, and investments to achieve family dreams.

There are various types of financial instruments such as stocks, mutual funds/unit trusts, and fixed deposits that can be invested into. Direct investment into business is another option, e.g. micro-entrepreneurs or to direct known persons such as relatives, friends. Other investments can be in form of gold/dinar, silver, jewelry, or property.

- Managing contingencies

With every financial plan, there should be a backup plan or contingency plan. ‘Risk’ and ‘hazard’ will always be a part of life. Problems can happen at any time and to any person, such as sickness, accident, bankruptcy, etc. It can happen to relatives or family members. Anticipation is required to handle risk, and this has been emphasized by Prophet Muhammad (P.B.U.H) “Treasure five things before five: Your youth before old age, your health before illness, your wealth before poverty, your free time before becoming occupied, and your life before death.” In Islamic financial planning, the emergency fund is the main instrument to prepare for such events as loss of the main income, or other unexpected events. The rule of thumb is that it should be able to cover family needs for 5 – 6 months. It should also be kept in secure accounts, accessible only during emergencies.

Takaful is also a reliable instrument to hedge or manage financial risks in the family. Family takaful is for life-related protection, such as accidents, etc., while general takaful is to protect against financial losses on property, such as car, house, etc. Additionally, health takafu is to ensure costs of medical treatment or hospitalization are covered.

Conclusion

Islamic financial planning is essential as it builds a strong basis from which Muslim families can grow. Figure 9 shows that financial planning is not just mere planning to manage wealth but it is beyond that; it is a process to achieve sakinah or tranquillity in the heart of the Muslims.

Planning is something that is encouraged in Islam as Allah has emphasized in the following verse: “O you who have believed, fear Allah. And let every soul look to what it has put forth for tomorrow – and fear Allah.

Indeed, Allah is acquainted with what you do.” (Al-Hasyr :18). Prophet Muhammad (P.B.U.H) also encouraged Muslims to prepare or anticipate their future in his hadith: “A Muslim should prepare himself for the next world as if he is going to die tomorrow, but at the same time work hard to improve all his worldly comforts as if he is going to live forever.”