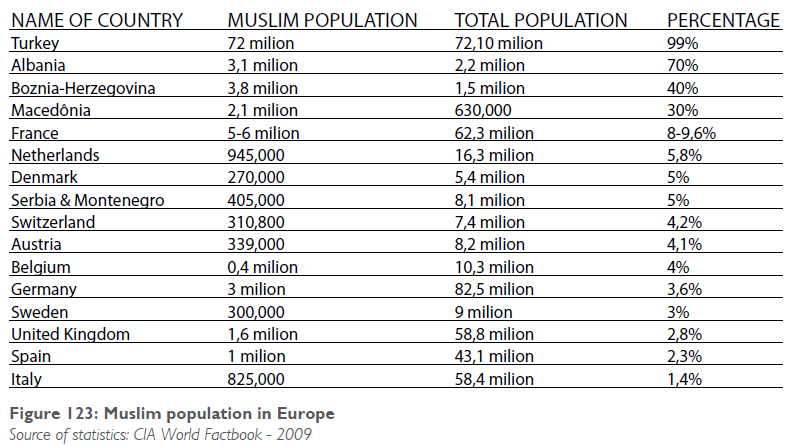

Now more than ever before, the market potential for Islamic banking services in Europe is growing at a fast pace. The reason for this phenomenon is threefold. Firstly, European Muslims have now grown to a significant portion of Europe’s population. There are more than 14.74 million Muslims in Europe, of which 1.8 million are resident in the UK plus an additional 72 million in Turkey. Secondly, the savings of European Muslims are higher than the average saving rates within the EU member states. Lastly, there is a low penetration rate of Islamic banking products among Muslims.

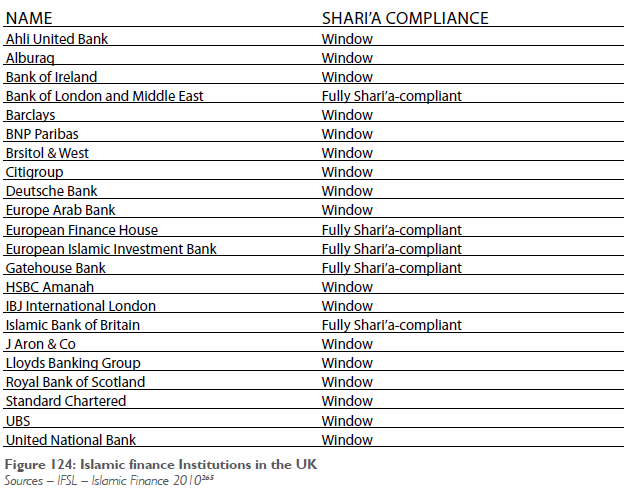

With the creation of the European Union, the regulatory framework for banking and insurance has unified and it has become easier for Islamic finance institutions to operate within the EU member states than across the MENA region. In this region, the cross border operations are difficult to manage and their efficiency is doubtful because of the different regulatory requirements in each country.261 At this point in time, the supply of Islamic financial services in Europe is slow. The UK has shown a clear demarcation compared to other European countries – it has been at the forefront of development in Islamic finance with the establishment of some financial institutions such as Islamic Bank of Britain or Halal Financial Services offering Shari’a-compliant financial products. Some marketing strategies have concentrated in providing advice to the Muslim population but the focus was on advising these clients in their native languages on conventional banking or insurance products instead of promotion of Islamic financial products and services. The follow- ing section provides a brief description and analysis of the scope of Islamic finance in countries where Islamic finance has huge potential due to the economic capacity of these countries.

United Kingdom

The United Kingdom has always been viewed as the largest economically mobile Muslim population in Europe and this image has been enhanced further with the opening of the first Islamic Bank in 2004 – called the Islamic Bank of Britain (IBB).262 IBB provides financial services to both individuals and businesses. In January 2005263, European Islamic Investment Bank (EIIB) was incorporated as Britain’s first Islamic investment bank, which is being regulated by the UK Financial Services Authority.

The IBB began its operation as a company called the Islamic House of Britain before it was converted into a bank in 2004. The bank obtained funding from private investors in the Gulf through its previous chairman, Abdul Rahman Abdul Malik and Abu Dhabi Islamic Bank. Currently, its shareholders include leading Islamic banks and other financial institutions from Abu Dhabi, Bahrain, Qatar and Saudi Arabia.

Between the years ending 31 December 2005 to 31 December 2006, there was a 120% rise in customer number at IBB and the bank’s customer deposits grew by 76% to GBP 83.9 million from GBP 47.7 million. In addition, the bank opened two new branches in 2006, reaching a total of eight across the UK. According an HSBC case study, the Muslim families in the UK have taken out 134,000 conventional mortgages worth 9 billion and there are a further 76,000 households with no mortgages at all.

However not all sectors in Islamic finance have enjoyed similar success. An example is in the field of Islamic Insurance. Salam Insurance is a new insurance company incorporated in the UK in 2009, but had to cease operation after a few months due to low demand of services. Salam Insurance is currently restructuring itself and may resurface with new operations in the near future.

France

France has been very keen to develop Paris as the International Finance Centre of Islamic finance in Europe and in that sense, Paris considers London as its rival. France’s finance minister, Christine Lagarde has already introduced several measures to attract global funds since taking office in June 2007. Although the Muslim population of France is almost three times greater than that of the UK, France’s financial sector has not developed its Islamic finance capacity as much as the UK has. Only a few French banks, such as BNP Paribas and Societe General are currently offering wholesale Islamic services, and there is no retail product yet on the market.

The Netherlands

In mid-2007, the finance minister Wouter Bos declared that the country would review its role in the Islamic finance industry. With this in mind, De Nederlandsche Bank (DNB, the Central Bank) prepared a report on the potential regulatory issues that need to be looked at when introducing Islamic finance in the Netherlands. Consumer protection and deposit guarantees, inclusion of different products in the current regulatory framework, and whether Shari’a compliance should be included in the supervision are among some of the issues raised in the report. The Holland Financial Centre has instituted a working group to further promote the opportunities the Netherlands can offer to the Islamic finance industry. The majority of transactions are associated with real estate and private equity investments.

Germany

The State of Saxony-Anhalt was the first Western Euro- pean government to issue sukuk. Although Germany has a Muslim population of 5 million, its financial centre has not yet developed the Islamic finance products and service infrastructure necessary to cater for such numbers. Instead, it relies on its bank branches from London and Middle East to execute Islamic finance transactions.

Turkey

The first Islamic bank was established in Turkey in 1985 under the former prime minister’s ministership, Halil Turgut Ozal.269 It was given the name ‘Special Finance House’ to distinguish it from conventional banking operations. Over the last 25 years, the growth and development of Islamic finance in Turkey has been slow due to the political attitudes adopted by the Turkish bureaucracy since Ozal’s administration.

Although there is a population of over 70 million Muslims, and Turkey having the largest economy in the Muslim world in terms of GNP, the fact that there are only four participation banks shows that its growth is rather slow. The potential of Islamic finance is clearly huge. However it is important to identify the right approach to unlock the potential of Islamic finance so that not only more individuals move towards Islamic finance, but also more investors will utilize the services provided by such banks. In order to achieve this, these banks should open up and create bondage with the global financial market, provided that they obtain a good working environment.

Future prospects for Islamic finance in Europe

The development of the Islamic finance industry in Europe has been slow although its services and products have been there for nearly 30 years. The focus of the business activity has been mainly on Shari’a-compliant institutions from the Gulf and high-net-worth Muslim investors deriving their income from oil market development. The central point for the Islamic finance market has been the UK, although France and Germany have a much larger Muslim population. In order to achieve the full potential of Islamic finance in Europe, one needs to assess the desirability of Islamic finance among the European Muslim community. It is true to say that Islamic finance could work alongside conventional finance if the products and services from Islamic finance were competitive. Undoubtedly, Turkey has the greatest potential for Islamic finance in Europe because it has a substantial Muslim population. The potential lies in the fact that the deposit figures are only 5% of the total financial system. Islamic finance is growing at around 5% per annum in Turkey, and Turkey itself can act as a bridge between the European Union and the wider Muslim world, and in the long run Istanbul is likely to replace London as the Europe leading Islamic finance centre if it receives full support of the government there.