Islamic banking and financial services currently has a presence in over 75 countries worldwide; these include the secular countries of Europe, North America and South East Asia.

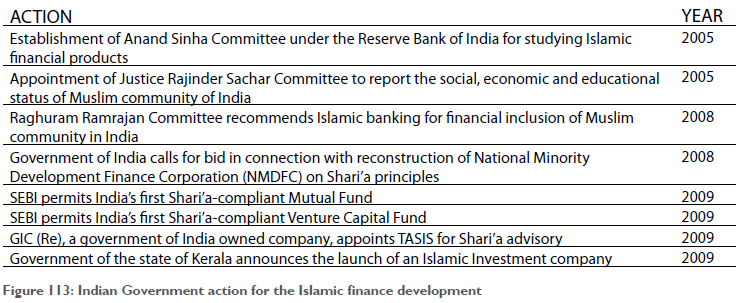

India too, having sensed the momentum and industry buzz globally, has got off the ground with its own activity. Indian regulators, unlike much earlier when they were averse to entertaining anything vaguely ‘Islamic’, have started to look at the positive side of such an undertaking, and have allowed schemes that lay claim to Shari’a compliancy. Figure 113 below gives us a glimpse of the important actions that the Indian Government and its important institutions have taken most recently. These actions are seen to have important ramification for the Islamic finance business in the country. These actions indicate a cautious but systematic ddd approach by Indian policymakers in allowing Islamic financial products and services in the country. Many players from the private sector have come up with Shari’a-compliant products abroad as well as in India. A leading private sector player has created an entire vertical for distributing Shari’a-compliant products. Financial institutions like HSBC, Benchmark, TATAS, Taurus, UTI, Kotak, Reliance, Bajaj Allianz, all have some kind of Shari’a-compliant product already available in the market or in the pipeline.

The potential of Islamic finance in India:

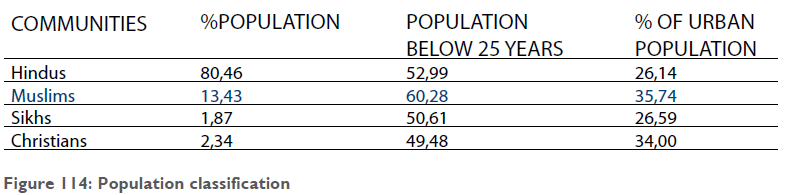

Muslims constitute 13.4% of India’s total population – In absolute terms this number translates into the second largest Muslim population in the world, after Indonesia. One current official estimate puts this figure close to 175 million Muslims. 60% of this population is below the age of 25 and over 35% of them live in urban areas; thus making Muslims, India’s youngest and most urban community. Economically, Muslim communities in India are least dependent on agriculture which is the major source of income for about 65% of India’s total population. One area where Muslims are noticeably absent from is the financial sector of the country.

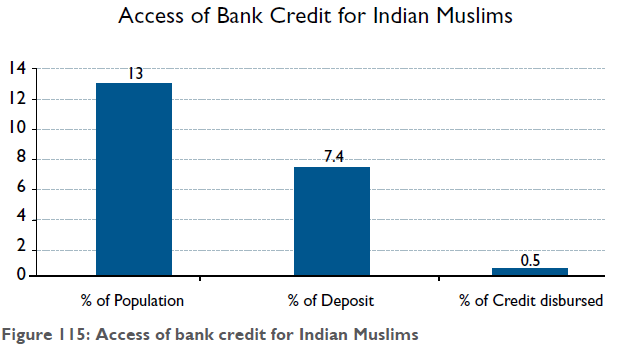

Prominent studies and reports have shown that the participation of Muslims in the financial system of the country is minimal. The most comprehensive of these reports (Sachar Committee) has reported that almost 50% of the Muslim population is excluded from the formal financial sector. In other studies, it was discovered the participation of Muslims in the financial sector is even lesser than their participation in India’s most prestigious government service (Indian Administrative Services (IAS)). According to a report by the country’s Central Bank (Reserve Bank of India), the credit deposit ratio of Muslims stands at 47% against the national average of 74%. Due to this factor alone, Muslims lose around Rs.63,7000 million annually (approximately US$13 billion). Another important study that focuses on the remittance coming from Middle East to the Indian State of Kerala, highlights that annually about Rs125000 million (US$ 2.5 billion) is sent back by the Muslim diaspora. A great majority of this money either lies idle in bank accounts (more popularly known as 786 accounts) or is invested in real estate and jewellery. These findings indicate the aversion that Muslims have with the current interest-based financial system.

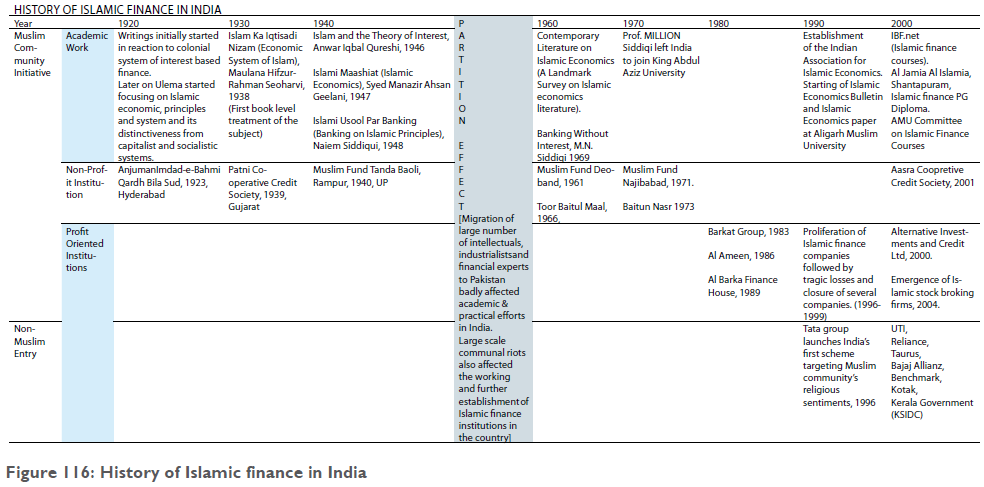

History of Islamic finance in India:

The endeavor of Indian Muslims to run financial institutions in strict accordance with their religion is well recorded. Many economic historians have purported that the conscience of Muslims in avoiding interest is deeply rooted in their struggle against colonial forces. The assertion made is that as the struggle for independence intensified so did the desire to have an economic system free from any kind of un-Islamic element.

There are three distinct phases of Islamic finance movements in the country. During the first phase in the 1920s, we find articles on Islamic economics, riba and related issues appearing. By the 1930s, this effort intensified and manifested itself in the shape of books on the subject. In the 1940s, these efforts further increased and several books were written. It was during this period that Islamic economists appeared on the scene. Until this time, the subject was only tackled by the Ulema and religious leaders.

Running parallel to the academic efforts at the time was the practical application of these teachings in real life. Two major objectives of this effort were to hold poverty alleviation programmes and to provide interest-free loans to the needy. The first organized attempt to pro- vide interest-free loans was found in 1920 during the Aasfia Era of Government in Hyderabad, when employees of the department of Land Development started an institution called Anjuman Imdad-e-Bahmi Qard Bila Sood, (Association of Mutual Cooperation for Interest-free Loan). The third phase started in the 1980s, when Muslims started to venture into profit-oriented businesses under the Shari’a principles of musharaka and mudaraba. This was made possible for three reasons; firstly, by this time, they had gained some expertise through successfully running non-profit financial businesses; secondly, the Islamic financial movement had gained momentum throughout the Islamic world and; thirdly, the new economic policy initiated in the early 1990s that had focused on liberalization, privatization, and globalization (LPG) had opened new vistas of opportunities for them. Most recently we see the entry of Non-Islamic corporates into the country’s Islamic financial business (for more details please refer to Islamic finance history table below).

Islamic finance options in India

The public in India is demanding the development of Islamic finance in India. As previously mentioned, the development of Islamic financial institutions had started quite early, but due to certain legal and bureaucratic impediments, these efforts could not grow beyond a certain limit. Those that did grow could not sustain themselves for long. We will discuss Islamic finance options in India under three heads: banking, finance company and capital market.

Islamic banking in India

Nowadays, there are numerous Islamic institutions in India that are lobbying the government to allow for Islamic banking. Certain developments in the Islamic finance space have added to the speculation and excitement. Nevertheless, it remains a fact that unless certain regulatory concessions are given, Islamic banking will not flourish in India. The main hurdles are mentioned below: Inability to accept deposits from the public based on profits, i.e., a post facto determined return, Compulsion to deploy a substantial portion of the deposits raised as interest-based investments with the government in the process of complying with Cash Reserve Ratio (CRR) & Statutory Liquidity Reserve (SLR) requirements, Prohibition of trading, and Denial of permission to invest to any significant extent in any business other than that of interest based lending and related businesses.

Islamic finance company

This is generally the preferred route of Muslims who want to run their businesses on Shari’a principles. How- ever, the large-scale regulatory changes that took effect in the late nineties, have taken the sheen off this lucrative option. Since then, most Islamic finance companies have either closed shop or reduced their operations to a substantially micro level. Many of the regulatory hurdles that an Islamic bank faces in India are now applicable to Islamic finance companies as well. Not surprisingly, throughout the last decade, we only find a single Islamic finance company which has adopted this route and this company too is working at a very small scale.

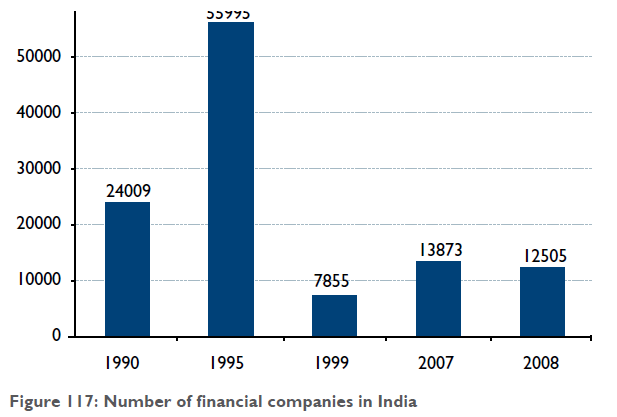

Figure 117 shows the number of financial companies in the country. A close analysis will reveal a decline in the overall sector. Islamic finance is no exception. Major regulatory hurdles affecting the Islamic finance business are:

Public deposit

No permission to accept deposit without indicating a rate of return in advance.

Acceptance of public deposit is linked with the net-owned fund of the company, which further reduces the capacity of the company to expand its operation.

Ceiling on rate of returned to be offered and period of deposit acceptance.

Biased Tax System

Present tax system is highly biased in favor of debt financing.

Stamp duties, service charges and other such levies make Islamic compliant instrument unviable. Prohibition of investments

Prohibition to invest more than 10% of Net Owned Fund in real estate;

Prohibition to invest in unquoted shares; and

Requirement of finance companies to maintain at least 15% of their public deposits into commercial banks.

Low public trust Public trust in the Islamic finance company route is quite low because of failures of several prominent Islamic finance companies in the country.

Capital markets

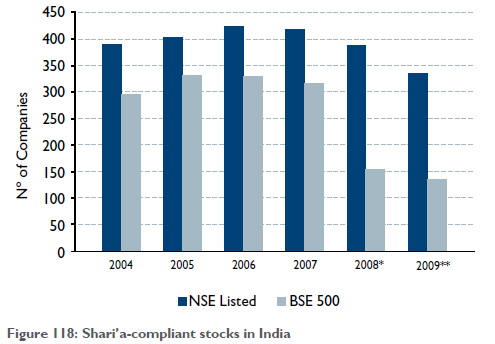

As of now this is the most preferred route adopted by Shari’a-compliant investors in India. In the post-Shari’a screening scenario India has become one of the preferred destinations for Shari’a-compliant investors. Even the most conservative screening process would throw at least a thousand stocks which are compliant under the Shari’a screening process. The following chart gives a glimpse of Shari’a-compliant stocks in India at its two stock exchanges namely Bombay Stock Exchange (BSE and National Stock Exchange (NSE). Qualifying stocks come from various industries such as Steel, Automobile, Pharmaceuticals, IT, Consumer goods, Cement, petroleum, hydroelectricity etc.

Conclusion

The Indian government is showing an interest in the Islamic finance business, and this is reassuring. Various players in the corporate sector have launched Shari’a-compliant products and several state governments are looking at exploring and capitalizing on Shari’a-compliant financing options. The Ministry of Minority Affairs is keen to bring its financing arm – National Minority Development Finance Corporation (NBFC) under the Shari’a rules and regulations, and they are further looking to strengthen Shari’a compliance of various Islamic activities that fall under the waqf act or related to the performance of Hajj.

An important committee which submitted its report to the Indian government about India’s future financial structure has mentioned Islamic banking in the following paragraph;

“While interest-free banking is provided in a limited manner through NBFCs and cooperatives, the Committee recommends that measures be taken to permit the delivery of interest-free finance on a larger scale, including through the banking system. This is in consonance with the objectives of inclusion and growth through innovation. The Committee believes that it would be possible, through appropriate measures, to create a framework for such products without any adverse systemic risk impact.”

(Raghuram Rajan Committee, Chapter 3: Broadening Access to finance)

Looking at overall developments at private, governmental and international levels it can be expected that very soon, India will be formally opening its economy to the Islamic finance business, for which many Indian institutions in the private sector have started to prepare.