HIS EXCELLENCY AHMED OSMAN ALI

GOVERNOR OF THE CENTRAL BANK OF DJIBOUTI

ISFIRE has over the last 10 year featured some of the most distinguished political leaders and financial experts from around the world, who shared their views on the topics of interest to our readership. In this issue’s Cover

Story interview, His Excellency Ahmed Osman Ali, Governor of the Central Bank of Djibouti, shares talks to us on a number of matters related with monetary system, with a special focus on Islamic banking and finance.

Djibouti has led the East African market in Islamic banking and finance and has been acknowledged as a regional leader by Global Islamic Finance Awards (GIFA) in 2017 when His Excellency Ismail Omar Guelleh, President of Djibouti, was honoured with the Global Islamic Finance Leadership Award. How has the Central Bank of Djibouti been instrumental in providing a level-playing field to Islamic banks in the country?

The award received by the President of the Republic of Djibouti, His Excellency Ismail Omar Guelleh in 2017, is for us a consecration and recognition of the significant efforts and reforms undertaken since the early 2000s to transform and develop our financial sector.

Indeed, given the characteristics of our country, which is poorly endowed with natural resources but has an excellent geostrategic position and several comparative advantages, promoting a strong financial centre, alongside building a port and logistics platform with international reach are the main pillars of our development strategy.

Thus, the reforms undertaken in this direction have made it possible to profoundly transform our financial sector, which has been densified in terms of the number of operators and diversified in terms of activities and financial products. With only 2 conventional banks and 5 financial auxiliaries in 2006, this sector is now made up of 36 financial institutions, all legal forms and activities combined, for a population of less than one million.

This proliferation has given rise to Islamic finance, which is still relatively young in Djibouti, where the first Islamic banking institution was established in 2006.

Also, in a context where the dominant banking culture is that of conventional banking, we have worked to prevent the marginalisation of Islamic finance by adopting its standards in line with international standards (legal and regulatory corpus, prudential mechanisms, Shari’a Committee, etc.), which allows it to evolve under the best auspices. At the same time, efforts are directed in the field of training and capacity building for Islamic banks and staff in charge of supervision within the Central Bank.

Islamic banks, currently three out of twelve active banks, have been able to adapt very quickly, gain market share and see their activities grow rapidly.

Today, the assets of Islamic banks represent a little more than 25% of total banking assets, compared to only 1.2% in 2006. The deposits collected by these banks, which are growing at an annual rate of 20%, currently represent 19.3% of the total deposits of the banking system, while the volume of credits granted by these banks is in proportion to 20.2% of the total banking liabilities.

In addition, Islamic banks make a strong contribution to improving financial inclusion and developing banking services, holding alone 36% of the number of bank branches, 50.5% of the number of bank accounts and 43% of the number of ATMs.

Lastly, the annual organisation of an International Summit on Islamic Finance in Djibouti since 2012 is part of this promotional effort and has contributed to the spread and expansion of the Islamic financial industry in the region.

Since the establishment of the Central Bank of Djibouti in 1979, you are the third Governor of the Central Bank. It is under your leadership that Islamic banking has progressed in the country. What are the real opportunities available in Djibouti for global and regional players in Islamic banking and finance?

Before going further on this issue, I would like to clarify your point, which I believe is entirely related to the progress made in the field of Islamic finance.

As I said earlier, our performance in this area is the result of the reforms initiated in the early 2000s. It should also be pointed out that this vast project was conceived and launched by our former Governor, the late Djama Mahamoud Haid, who died in January 2013, peace be upon him. A true visionary and leader whom I had the honour of assisting throughout his mandate, he was the architect of the development of our financial sector. We have taken up the torch and are continuing on the same trajectory and strategic vision to consolidate the achievements and anchor the development of our financial centre in duration and stability.

If I go back to your question, Djibouti does indeed present real opportunities for Islamic banking and financial operators, both regionally and internationally.

Capitalising on its political stability in a region plagued by instability, Djibouti has been able, over the past two decades, to bring its economy up to the level of the emerging countries of Africa, thanks to major macroeconomic reforms and massive investments in promising sectors (transport, telecommunications, energy, etc.), as well as in social sectors (education, health, water, etc.).

It goes without saying that, in this dynamic context, the many public and private development projects aimed at consolidating growth and development require substantial financing. Moreover, our country, like other African countries, has many untapped assets and potentialities in various sectors (such as tourism, fishing, extractive and processing industries, energy production and, in particular, renewable energies) that need to be expressed and valued by investors.

Moreover, despite the strong expansion of the Islamic banking sector in Djibouti in recent years, the current market share of 25 per cent is still low, not to mention access to the vast regional market, particularly COMESA, which offers many opportunities and prospects.

Yes, we have strong assets and tremendous potential in Islamic finance, as indeed everywhere else in Africa. Africa remains unquestionably the continent with the most promising prospects in economic and investment terms.

Djibouti, a land of Islam and a commercial crossroads between Africa and Asia, is the natural place for Islamic finance to flourish in Africa.

“TODAY, THE ASSETS OF ISLAMIC BANKS REPRESENT A LITTLE MORE THAN 25% OF TOTAL BANKING ASSETS, COMPARED TO ONLY 1.2% IN 2006. THE DEPOSITS COLLECTED BY THESE BANKS, WHICH ARE GROWING AT AN ANNUAL RATE OF 20%, CURRENTLY REPRESENT 19.3% OF THE TOTAL DEPOSITS OF THE BANKING SYSTEM, WHILE THE VOLUME OF CREDITS GRANTED BY THESE BANKS IS IN PROPORTION TO 20.2% OF THE TOTAL BANKING LIABILITIES.”

Do you think that an offshore Islamic banking and finance centre, like the Dubai Islamic Financial Centre (DIFC) and Astana International Financial Centre (AIFC) is a viable proposition for Djibouti?

As I mentioned earlier, our ambition is to establish Djibouti as a financial hub with international reach, capable of offering the widest range of financial activities, products and services, competitively and sustainably.

To that end, we are striving to create the right environment and optimal conditions to achieve the desired objectives by mobilizing all the necessary energies and resources available.

In this respect, the setting up of offshore Islamic banking and financial centres, such as the DIFC or the AIFC, are as many possible prospects.

To what extent political instability in neighbouring Somalia has helped Djibouti to develop itself as a regional financial centre?

In general, instability in the sub-region tends to impact national economic activity, particularly the transport/logistics chain, which is a key pillar of Djibouti’s service-oriented growth model.

On the financial front, however, Djibouti is capitalizing on its assets and competitive advantages to build and develop its financial centre. These include: (i) a stable monetary system that has been in force since 1949; (ii) an efficient macroeconomic framework; (iii) a general business environment that is particularly attractive; (iv) one of the most efficient communications infrastructures in Africa; (v) a liberal economic system that guarantees total freedom of capital movement and the absence of exchange controls; (vi) a fiscal framework that provides incentives for the exemption of financial products and productive investments; and (vii) an incentive tax framework that exempts financial products and productive investments, etc.

Thus, these essential assets have long given a solid reputation to Djibouti’s financial centre, where operators from the subregion came to register their operations and house, their assets, which already foreshadowed the status of a financial platform for the subregion, which we intend to expand to a more regional and continental scale.

Last year, the Islamic Finance Country Report on Djibouti was published by the Islamic Research & Training Institute (IRTI) of the Islamic Development Bank (IsDB). Can you share some of the main findings of this report and key lessons for the industry moving forward?

The publication of the Country Report on Islamic Finance in the Republic of Djibouti produced by IRTI provides a good overview of the evolution of Islamic finance in Djibouti, its prospects and challenges in the short to medium term, with a focus on the efforts to further promote this industry in our country.

The report notes that, despite the significant progress made by Djibouti in the area of Islamic finance, there is still some way to go to realize its full potential. This includes:

- Raising the low level of adult banking to no more than 25%, despite the multiplication of financial institutions since 2006;

- Increasing diversification in the supply of Islamic financial products and the geographical penetration of the market;

- Improving communication to raise awareness of Islamic financial products and services, which remains poorly informed, despite holding an annual Islamic Finance Summit in Djibouti since 2012;

- Accommodating the low degree of standardisation of Islamic financial practices resulting from the divergence of Islamic currents of thought;

- Promoting the establishment of Islamic insurance operators, currently absent from the market despite the existence of a specific legal framework;

- Expanding the legal arsenal governing Islamic finance activities, notably with the adoption of the regulatory framework for Sukuks;

- Finally, filling the gaps in training and qualified human resources in the field of Islamic finance.

Although the anchoring of Islamic finance in Djibouti’s financial landscape has now been achieved, both among professional and individual clients, we must nevertheless address all the weaknesses identified to give Islamic finance its true dimension and its place in a predominantly Muslim country like ours.

What are the key factors that can enable Djibouti to improve its position in the global market as a competitive investment environment with an attractive profile for foreign investors?

Djibouti has many advantages and advantageous provisions that give it a competitive environment on the international scene and make it attractive to foreign investors.

The primary factor in Djibouti’s competitiveness is unquestionably its geostrategic position. As the gateway to the vast COMESA market (more than 400 million inhabitants) and located at the entrance to the Red Sea, the crossing point for the largest maritime transport traffic (60 per cent of the world traffic), Djibouti is a veritable logistics and commercial hub at the crossroads between Africa, Asia and Europe. The massive foreign investment in ports and free zones in recent years is a good demonstration of this.

Djibouti also has a secure and reliable financial centre with a stable currency indexed to the United States dollar, freely convertible and free of any exchange controls. Thus, in addition to reassuring the expectations of economic operators about the risks of currency fluctuations, Djibouti’s financial system allows for total freedom of movement of capital (currency transfers, free repatriation of returns on investments, etc.), a major advantage in the region and at the continental level.

The high-performance macroeconomic framework, characterised by strong and resilient growth with structurally controlled inflation, in a highly liberal economic environment where all barriers and discrimination with regard to access to industrial and commercial property are proscribed, contributes to the country’s attractiveness.

In addition to its solid assets and strategic advantages, Djibouti has, as a result of the reforms undertaken in recent years, created a business environment that is highly conducive to attracting investors, operators and project sponsors from all walks of life.

“SUCH ACHIEVEMENTS HAVE ALSO ENABLED DJIBOUTI TO LEAPFROG IN THE WORLD BANK’S DOING BUSINESS RANKING TO AN HONOURABLE POSITION.”

Thus, provisions in areas as varied as investor protection, insolvency regulations, business start-up procedures, obtaining credit, enforcing contracts, registering assets, cross-border trade, and so on, have been revised to improve our business climate and consolidate our country’s good reputation on the international stage. Such achievements have also enabled Djibouti to leapfrog in the World Bank’s Doing Business ranking to an honourable position.

Finally, in terms of taxation, exceptional conditions of attraction with various incentives, exemptions and many facilities are offered to investors to implement their projects during the first five to ten years of activity.

How can COMESA (Common Market for Eastern and Southern Africa) ensure trade development, and closer economic and financial integration in the region following COVID-19?

The current COVID-19 epidemic is a tragic phenomenon that has affected the world as a whole with a strong socio-economic impact on countries and regional blocs. We remain convinced that after this difficult period, economies will gradually recover and COMESA will confirm its vocation as a formidable and vast territory for trade, wealth creation and development. In any case, we are contributing to this in concert with all Member States and are making significant progress in the process of convergence and integration.

In my capacity as current Chairman of the Bureau of the Committee of Governors of Central Banks of COMESA, I can tell you that we are on the right track and are very confident.

Djibouti has been successful in maintaining the level of inflation in the country by providing subsidiaries on food and oil. How will this current pandemic affect the overall economic structure and what measures do you propose to be taken to avoid inflation?

Inflation remains structurally low in Djibouti, averaging less than 3% over the long term. This performance, in addition to the fiscal measures in favour of food products, remains essentially linked to monetary policy and the preservation of the currency board type monetary system in force in Djibouti.

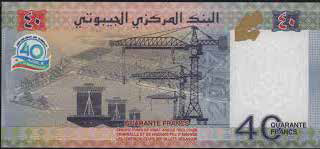

This monetary system, established in 1949, that is, during the colonial era, is based on a fixed parity with the United States dollar. In order to maintain the parity, all currency issued by the Central Bank of Djibouti is provided with proportional coverage in foreign currency.

Since gaining independence in 1977, the Republic of Djibouti has remained committed to this monetary system, whose credibility and stability are virtuous for the country’s economy. In particular: (i) the stability of the monetary anchor, which helps to establish external stability while controlling domestic inflation; (ii) the guarantee of the full and free convertibility of the Djibouti franc in all foreign currencies; and (iii) the prohibition on monetary financing of deficits dictated by the system, which imposes a certain degree of budgetary discipline on the Government.

In the current context, the COVID-19 pandemic is having a strong impact on the economic activity, growth and employment in Djibouti, as it is in countries throughout the world, particularly in Africa. In addition, there are inflationary pressures that may be linked to shortages of food and pharmaceutical products but will have to be limited to an estimated 3% in 2020, the same year-on-year change as in 2019.

The National Authorities have, however, taken steps to strengthen strategic food stocks and sales price controls to counter inflationary trends.

You have been awarded the Central Banker of the Year 2018 at the Global Islamic Finance Awards 2018. How has this achievement been monumental in the proliferation of Islamic finance in Djibouti?

This distinction, after that of the Head of State, is an additional consideration that reflects an honourable recognition of our modest contribution to the development of Islamic finance.

The sustained development of Islamic banks in the country and their remarkable contributions to the economic growth and development are a source of satisfaction for us, which confirms our strategic orientations and ambitions.

Moreover, the strong performance and success of active Islamic banks are helping to attract new institutions, especially conventional banks that are considering opening Islamic windows.

For our part, we still face significant challenges and need to redouble our efforts to unleash the tremendous potential of Islamic finance on our soil and in the region.

What is your personal focus for the next 12-18 months in terms of achieving the Vision 2035, especially in these uncertain times? What changes do you hope to implement?

Vision 2035 aims to make Djibouti a regional and international economic, commercial and financial hub that ensures the well-being of Djiboutians in a peaceful, secure and clean environment. Within this framework, the objectives assigned to the financial sector contribute to the diversification and competitiveness of the economy, with a leading role for the private sector through the implementation of an appropriate financing strategy and the preservation of financial equilibrium.

But given the current difficult and uncertain times linked to the COVID-19 pandemic, immediate priorities are focused on stimulus and support measures for the economy (business and household resilience, job preservation, etc.).

“THE PROMOTION AND DEVELOPMENT OF ISLAMIC FINANCIAL ACTIVITY ALSO REQUIRES MAJOR TRAINING AND CAPACITY BUILDING PROGRAMMES, BOTH AT THE LEVEL OF FINANCIAL INSTITUTIONS, AND REGULATORY AND SUPERVISORY AUTHORITIES. ONCE THESE CONDITIONS HAVE BEEN MET, THE MARKET CAN DO THE REST”

The actions undertaken in this framework by the Central Bank aim in particular to encourage local banking institutions to make their contributions to the national response plan by granting maturity extensions and appropriate financing solutions to their customers in difficulty. To support these initiatives, the Central Bank has undertaken to temporarily relax its regulatory mechanisms and to study with local banks the most appropriate measures to support the economy.

At the same time, we are continuing to roll out our action plan to promote financial inclusion, the financing of SMEs, and the modernisation of the national financial architecture and infrastructure. In this respect, we expect the forthcoming implementation of an automated transfer system coupled with an electronic clearing house, a new fully automated credit register accessible online and the entry in the field of electronic money and mobile banking, following the recent operationalisation of a credit guarantee fund for SMEs and the Register of Personal Property Security.

What lessons other countries in the region can learn from Djibouti if they want to develop Islamic banking and finance?

There’s no magic formula, really. But the important thing is to implement appropriate reforms to provide the country with the relevant legal and regulatory instruments, and clean up the business environment to open up the economy to institutional operators and attract investors. The promotion and development of Islamic financial activity also requires major training and capacity-building programmes, both at the level of financial institutions, and regulatory and supervisory authorities.

Once these conditions have been met, the market can do the rest.

Would you like to give a message to the younger generation of Islamic banking and finance practitioners?

I would like to tell the younger generation of Islamic banking and finance practitioners that the future is bright. The industry is still in its infancy in Africa and has invested little in the rest of the world, which promises tremendous growth potential in the years to come.

In this regard, it is of utmost importance to address the lack of skills and expertise that remains a constraint to the expansion of this industry.

I, therefore, urge young people to embark on this path and be trained in it, and I invite operators and international financial institutions to take more interest in the African continent, which offers many business opportunities and growth potentialities for Islamic finance.