The world is experiencing a global pandemic which may further result to a major recession after the 2008- 2009 global financial crisis. A sharp contract of -3 per cent is projected to occur in global economy (IMF, 20201). Interestingly, countries have supported each other by donating palliatives to flatten the curve. This palliative is expected to reduce the spread of the pandemic; but what comes to mind is how this will impact the poor who live below USD1.90 a day post-COVID-19. It is important to note that about 8 per cent of the world’s families and workers still live less than USD1.90 in a day, this is predominant in sub-Saharan Africa and Southern Asia while 55 per cent of the world’s population have no capacity to a social protection with monetary benefit (UN, 20202).

Islamic finance lays great emphasis on redistribution of wealth, social and economic justice and promotion of equality. In contrast to conventional finance, Islamic finance also seeks to redress the general welfare, health, security, comfort and happiness of the society. This article reviews the impact of the key instrument of wealth redistribution in Islamic finance as a solution to flatten the curve post-COVID-19 through Qard-al-Hassan (benevolent loans).

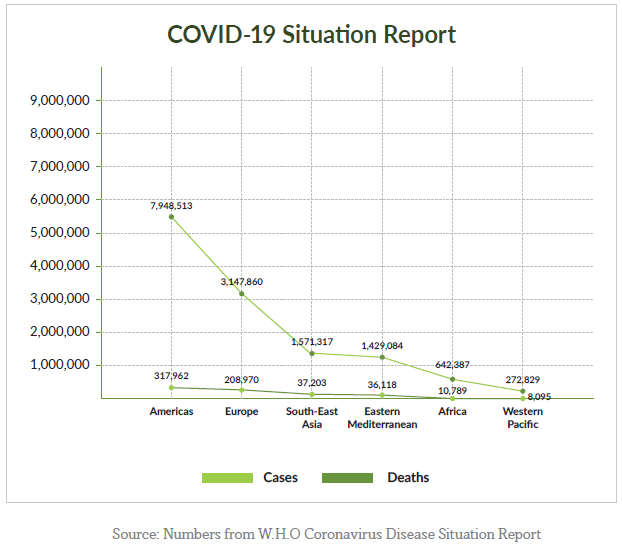

Coronavirus (COVID-19) is an infectious disease caused by a recently discovered coronavirus. Majority of people infected with the virus exhibit symptoms like difficulty in breathing, cough, fever sore throat which later leads to death while some others infected have survived without having the need of a special treatment. (W.H.O, www. who.int, 2020). This disease emerged from Wuhan, China (Muhammad, Suliman, Abeer, Nadia, & Rabeea, July 2020) and widely spread globally with 1,501,273 cases and 619,150 deaths. (W.H.O, Coronavirus disease situation report, 2020).

Several pharmaceutical companies and scientist around the world are working on antiviral drugs to cure the new coronavirus but majority of this vaccines are still at clinical stage. Recently, University of Oxford conducted trial on 1,077 people by making them antibodies to fight the virus, the findings from this trial shows a promising result and soon to be tested on a larger proportion of the population. (Gallagher, 20206). Other preventive measures are regular washing of the hand, social distancing, using of alcohol-based sanitizers and not touching of the face.

The emergence of Islamic banking can be traced back to the Egypt Mit Ghamr Savings bank now Naseer Bank which was established in 1963. In actual fact, the growth of Islamic banking emerged in the late 70’s contributing to new products, innovations and investment skills. The first modern Islamic bank, Dubai Islamic Bank (DIB) was founded in 1975 (Steward, 20087). Presently, it has forty-eight branches and it is competing with conventional banks in terms of profit. (Platt, 20088).

The upsurge of Islamic banking not only in Nigeria but the rest of the world is the increasing growth in the capital value and the need to invest in a Shari’a-compliant business. The aggregate worth of the Islamic Financial Services Industry has increased a milestone USD2 trillion in 2017 and again increased to USD2.19 trillion in 2018, this is due to the significant increment across the three sectors of the IFSI; Islamic banking, Islamic Capital Market and Takaful (Islamic Financial Services Board, 20199).

One of the principles of Islamic finance is the prohibition of interest in the contract. Islam prohibits the payment of riba (interest) over and above the principal as such, since Islamic finance is based on the injunctions of Shari’a, the only form of loan permissible is a kind of loan referred to as qard-al-Hassan (benevolent loan), in this form of loan, the borrower does not pay any interest or compensation on the principal.

Some discontentment opposed to Riba was given in the below verses of the Holy Qur’an:

- Surah al-Baqarah, verse 275

- Surah al-Baqarah, verse 276

- Surah al-Nisa, verse 161

Basically, there are two types of loan (Qard) permissible in Islamic finance with the most recognised being the type that allows one party to loan the other party at pre-agreed payment date without any return or interest. (Iqbal & Bushra, 201510). This implies that no cost is associated with the loan. The other type is called benevolent loan (Qard-al-hassan), which is for members of a community for day-to-day economic activities of such community.

Literally, Qard is defined as “cutting of a portion” (Muhammad Y. S., 201211). This contract is referred to as qard because assets is transferred from one party (lender) to another party (borrower) with the condition that same asset will be returned to the lender when such need arises and upon demand. In Islmaic finance, having explained that interest is porohibited, Qard (loan) is therefore allowed on the condition that loan will be granted without interest.

– matter.

• The applicable rule is the return of an amount similar to the loan amount at the place where it was delivered.

Emphatically, cash donation is a major prerequisite to flatten the curve but the truth is what happen post-COVID for an average poor person (The country’s poverty rate stands at 40.09 per cent which is 82.9 million of Nigeria’s population. ((NBS), May, 202013), how was the funds donated in Nigeria spent, how does this impact an average Nigerian and a small and medium-scale entrepreneur? According to (Nairametrics, 202014), 25.8 trillion-naira equivalent of in USD66.9 million (386.90 NGN/ 1 USD) has been donated by companies and billionaire to serve as relief for COVID-19.

The country’s poverty rate stands at 40.09 per cent which is 82.9 million of Nigeria’s population. ((NBS), May, 2020)

Below are the donations:

| Organisations | Amount (NGN) | Amount (USD) | |

| 1 | CENTRAL BANK OF NIGERIA | 2,000,000,000.00 | 5,169,347.84 |

| 2 | DANGOTE INDUSTRIES LIMITED | 2,000,000,000.00 | 5,169,347.84 |

| 3 | FLOOD RELIEF FUND | 1,500,000,000.00 | 3,877,010.88 |

| 4 | BUA SUGAR REFINERY LIMITED | 1,000,000,000.00 1,000,000,000.00 | 2,584,673.92 |

| 5 | GUARANTY TRUST BANK | 1,000,000,000.00 | 2,584,673.92 |

| 6 | UNITED BANK OF AFRICA | 1,000,000,000.00 | 2,584,673.92 |

| 7 | FIRST BANK OF NIGERIA | 1,000,000,000.00 | 2,584,673.92 |

| 8 | ZENITH BANK | 1,000,000,000.00 | 2,584,673.92 |

| 9 | FAMFA OIL LIMITED | 1,000,000,000.00 | 2,584,673.92 |

| 10 | NIGERIA DEPOSIT INSURANCE COPORATION | 1,000,000,000.00 | 2,584,673.92 |

| 11 | ACCESS BANK PLC | 1,000,000,000.00 | 2,584,673.92 |

| 12 | GLOBACOM | 1,000,000,000.00 | 2,584,673.92 |

| 13 | AMPERION POWER DISTRIBUTION LTD | 1,000,000,000.00 | 2,584,673.92 |

| 14 | AFRICAN STEEL MILLS NIG. LIMITED | 1,000,000,000.00 | 2,584,673.92 |

| 15 | MTN NIGERIA PLC | 1,000,000,000.00 | 2,584,673.92 |

| 16 | FLOUR MILLS OF NIG LTD | 1,000,000,000.00 | 2,584,673.92 |

| 17 | PACIFIC HOLDING LTD | 500,000,000.00 | 1,292,336.96 |

| 18 | FRIESLAND CAMPINA WAMCO | 500,000,000.00 | 1,292,336.96 |

| 19 | BANK OF INDUSTRY | 500,000,000.00 | 1,292,336.96 |

| 20 | TOLARAM AFRICA ENTERPRISE LTD | 500,000,000.00 | 1,292,336.96 |

| 21 | WACOT RICE LTD | 500,000,000.00 | 1,292,336.96 |

| 22 | UNION BANK PLC | 250,000,000.00 | 646,168.48 |

| 23 | STERLING BANK PLC | 250,000,000.00 | 646,168.48 |

| 24 | STANDARD CHARTERED BANK | 250,000,000.00 | 646,168.48 |

| 25 | STANBIC IBTC | 250,000,000.00 | 646,168.48 |

| 26 | CITIBANK NIGERIA LTD | 250,000,000.00 | 646,168.48 |

| 27 | FCMB | 250,000,000.00 | 646,168.48 |

| 28 | FIDELITY BANK | 250,000,000.00 | 646,168.48 |

| 29 | ECOBANK PLC | 250,000,000.00 | 646,168.48 |

| 30 | AFRICA FINANCE CORPORATION | 250,000,000.00 | 646,168.48 |

| 31 | MULTICHOICE NIGERIA LIMITED | 200,000,000.00 | 516,934.78 |

| 32 | APM TERMINALS APAPA LIMITED | 150,000,000.00 | 387,701.09 |

| 33 | FSDH | 100,000,000.00 | 258,467.39 |

| 34 | FBN MERCHANT BANK | 100,000,000.00 | 258,467.39 |

| 35 | RAND MERCHANT BANK | 100,000,000.00 | 258,467.39 |

| 36 | CORONATION MERCHANT BANK | 100,000,000.00 | 258,467.39 |

| 37 | SUNTRUST BANK | 100,000,000.00 | 258,467.39 |

| 38 | PROVIDUS BANK | 100,000,000.00 | 258,467.39 |

| 39 | WEMA BANK | 100,000,000.00 | 258,467.39 |

| 40 | UNITY BANK | 100,000,000.00 | 258,467.39 |

| 41 | HERITAGE BANK | 100,000,000.00 | 258,467.39 |

| 42 | NOVA MERCHANT BANK | 100,000,000.00 | 258,467.39 |

| 43 | POLARIS BANK | 100,000,000.00 | 258,467.39 |

| 44 | KEYSTONE BANK | 100,000,000.00 | 258,467.39 |

| 45 | KC GAMING NETWORKS LTD | 100,000,000.00 | 258,467.39 |

| 46 | PORTS AND TERMINAL MULTI SERV LTD | 100,000,000.00 | 258,467.39 |

| 47 | PORTS AND CARGO HANDLING SERV | 75,000,000.00 | 193,850.54 |

| 48 | FIVE STAR LOGISTICS LIMITED | 75,000,000.00 | 193,850.54 |

| 49 | ENL CONSORTIUM | 70,000,000.00 | 180,927.17 |

| 50 | JOSEPDAM PORTS SERVICES NIG | 60,000,000.00 | 155,080.44 |

| 51 | SYSTEMSPECS LIMITED | 50,000,161.25 | 129,234.11 |

| 52 | GLOBUS BANK | 50,000,000.00 | 129,233.70 |

| 53 | TITAN TRUST BANK | 50,000,000.00 | 129,233.70 |

| 54 | TAKAGRO CHEMICALS LTD | 50,000,000.00 | 129,233.70 |

| 55 | ADAMA BEVERAGES LTD | 50,000,000.00 | 129,233.70 |

| 56 | WA CONTAINERS TERMINAL | 50,000,000.00 | 129,233.70 |

| 57 | PORTS AND TERMINAL | 50,000,000.00 | 129,233.70 |

| 58 | DEEPER CHRISTIAN LIFE MINISTRY | 50,000,000.00 | 129,233.70 |

| 59 | KAM WIRE LIMITED | 30,000,000.00 | 77,540.22 |

| 60 | DE DAMAK NIG LTD AUTOMOBILE | 25,000,000.00 | 64,616.85 |

| 61 | AHMADU MAHMOUD | 20,000,000.00 | 51,693.48 |

| 62 | CWAY | 20,000,000.00 | 51,693.48 |

| 63 | ADRON HOMES PROPERTIES LTD | 20,000,000.00 | 51,693.48 |

| 64 | EKEOMA EME EKEOMA | 10,000,000.00 | 25,846.74 |

| 65 | LADOL LOGISTICS LIMITED | 10,000,000.00 | 25,846.74 |

| 66 | GREENWICH TRUST LIMITED | 10,000,000.00 | 25,846.74 |

| 67 | SIL CHEMICALS LIMITED | 10,000,000.00 | 25,846.74 |

| 68 | ECN TERMINAL | 10,000,000.00 | 25,846.74 |

| 69 | APAPA BULK TERMINAL | 10,000,000.00 | 25,846.74 |

| 70 | COWRY ASSET MANAGEMENT LIMITED | 9,999,838.75 | 25,846.32 |

| 71 | HANDY CAPITAL LTD | 5,000,000.00 | 12,923.37 |

| 72 | MECURE INDUSTRIES | 5,000,000.00 | 12,923.37 |

| 73 | COMET SHIPPING AGENCIES NIGERIA | 5,000,000.00 | 12,923.37 |

| 74 | JUBALI BROTHERS LIMITED | 4,000,000.00 | 10,338.70 |

| 75 | ADG INTERNATIONAL RESOURCES LTD | 2,500,000.00 | 6,461.68 |

| 76 | OCEAN LORDS LIMITED | 2,000,000.00 | 5,169.35 |

| 77 | NORRENBERGER INVESTMENT LIMITED | 2,000,000.00 | 5,169.35 |

| 78 | PROSHARENA LIMITED | 1,000,000.00 | 2,584.67 |

| 79 | FEW CHORE FINANCE COMPANY LIMITED | 1,000,000.00 | 2,584.67 |

| 80 | TARABAROZ FISHERIES LIMITED | 594,451.25 | 1,536.46 |

| 81 | ABAYOMI FOLORUNSHO | 500,000.00 | 1,292.34 |

| 82 | NANDU KANAKALA | 100,698.75 | 260.27 |

| 83 | USMAN AHMED | 50,000.00 | 129.23 |

| 84 | MANJI TABWAHAT LONGMUT | 10,000.00 | 25.85 |

| 85 | JAYAKUMAR SELVAM | 10,000.00 | 25.85 |

| 86 | ANYAEHIE STANISLAUS IKECHUKWU | 10,000.00 | 25.85 |

| 87 | FREDERICK KIGHA | 10,000.00 | 25.85 |

| 88 | MR & MRS OJO EDWARD OLUWAJOBA | 3,000.00 | 7.75 |

| 89 | HAMZA MUHAMMAD KAMBA | 2,000.00 | 5.17 |

| 90 | KAMALU AMINU | 1,000.00 | 2.58 |

| 91 | FAGUIYE | 1,000.00 | 2.58 |

| 92 | MOHAMMED GHALI MUHAMMED | 200.00 | 0.52 |

| 93 | ADAMU YUSUF | 100.00 | 0.26 |

| 94 | UCHENDU COLLINS | 100.00 | 0.26 |

| 95 | BASHIR AUWAL | 60.00 | 0.16 |

| 96 | BILAL ABDULSALAM | 50.00 | 0.13 |

| 97 | UMAR NAFIU USMAN | 50.00 | 0.13 |

| 98 | SANI ALTO ISAH | 20.00 | 0.05 |

| 99 | BASHIR SULAIMAN | 20.00 | 0.05 |

| 100 | ABUBAKAR SHEHU | 10.00 | 0.03 |

| 101 | SANNI ZAKARIYYA | 10.00 | 0.03 |

| 102 | IBRAHIM MOHD BELLO | 8.00 | 0.02 |

| 103 | UDRIS MUHAMMAD | 5.00 | 0.01 |

| 104 | ALHAJI MALLAM MUSA | 5.00 | 0.01 |

| 105 | ABUBAKAR ISMAIL ABUBAKAR | 2.00 | 0.01 |

| 106 | BELLO SHUAIBU | 1.00 | 0.00 |

| 107 | GH | 1.00 | 0.00 |

| Grand Total | 25,893,792,792.00 | 66,927,010.86 |

This article recommends such relief fund, most especially from financial institutions should have been focused or contributed as free loan for qualified beneficiaries amid COVID-19, this will not only flatten the curve but promote the economic conditions of the country and mitigate risk of looming recession as forecasted by International Monetary Fund.

Besides Islamic finance, there are verses of the Holy Bible that as seen in Deuteronomy 23:19 “You shall not charge interest on This article recommends such relief fund, most especially from financial institutions should have been focused or contributed as free loan for qualified beneficiaries amid COVID-19, this will not only flatten the curve but promote the economic conditions of the country and mitigate risk of looming recession as forecasted by International Monetary Fund.

Besides Islamic finance, there are verses of the Holy Bible that as seen in Deuteronomy 23:19 “You shall not charge interest on loans to your brother, interest on money, interest on food, interest on anything that is lent for interest” and Exodus 22:25; “If you lend money to any of my people with you who is poor, you shall not be like a moneylender to him, and you shall not exact interest from him” This implies that free loan is not religious biased, irrespective of the religion. Qard can be used to promote financial inclusion, improve economic conditions of the needy and poor and serve as a palliative to flatten the looming economic recession.