PROFESSOR DIAN MASYITA & BESSE WEDIAWATI – UNIVERSITY OF PADJADJARAN INDONESIA

An Islamic microfinance institution (IMFI) can be distinguished from a conventional microfinance institution (MFI) in terms of compliance with Shari’a requirements the former observes.

Several studies reveal that an IMFI’s financial performance and outreach may lag behind conventional Micro Finance Institutions (MFI). it is also observed that IMFIs do implement Shari’a principles to their true spirit in their business activities. For example, profit-loss sharing-based arrangements, such as Mudaraba and Musharaka are usually avoided by IMFIs because they are considered to have higher risk. On the contrary, most of the products offered are by them based on sale and purchase arrangements like Murabaha as it allows them to earn more certain income. Furthermore, IMFIs often impose higher fees for borrowers (which customers ironically consider the same as interest).

The subsequent weak role of IMFIs in society can be explained with the help of preference of the Muslim community in choosing financial services for economic factors (low-interest rate, less collateral and loan amount) and non-economic factors (service quality, ease, speed, proximity and loan officer profile) rather than religious factors. This may lead someone to conclude that IMFIs will find it difficult to compete with their conventional counterparts, and hence may not sustain in the long run. Having said that, it is also true that there is no conclusive empirical evidence that may suggest that religious factor along with the financial and social aspects may contribute to IMFIs’ success and sustainability. This study is expected to fill this gap by proposing a holistic approach that incorporates financial, social and spiritual and religious intermediation as the basis of IMFIs’ activities to achieve their sustainability.

A HOLISTIC APPROACH TO ACHIEVE THE MISSION OF MICROFINANCE

The term ‘holistic approach’ here encompasses the worldly considerations and the religious or empirical preferences. As a Shari’a-based financial institution, the mission of an IMFI must be consistent with the objectives of Shari’a (Maqasid al Shari’a). This must lead to achieving balance between the worldly purposes (material/financial and social) and spiritual pursuits.

The need to apply a holistic approach to the IMFI must be understood with reference to the following:

1. An IMFI’s social mission is to alleviate poverty by providing quality and qualified financial services to improve the lives of the poor.

2. The lack of knowledge of Muslim societies on Shari’a financial literacy.

Several studies conducted in Indonesia have revealed that Muslim societies prefer economic and non-economic aspects while choosing financial services rather than the religious aspects. Global Inclusion Database (F-index) is also in line with these findings. Based on surveys from Muslims on 148 countries, F-index shows that religious preference is the lowest factor of importance when choosing to open a formal financial account.

SUSTAINABILITY OF ISLAMIC MICROFINANCE IN INDONESIA: A HOLISTIC APPROACH

The present study is expected to address the issue of IMFI’s sustainability using the holistic approach. Therefore, some hypotheses were developed for sustainability as elaborated in the following questions.

DOES FINANCIAL AND SOCIAL INTERMEDIATION AFFECT IMFIs’ SUSTAINABILITY?

MFIs maintain financial sustainability by being exclusively and solely committed to and focused on poverty alleviation. It is interesting to investigate if the same applies to the IMFIs. An implication of achieving the sole objective of poverty alleviation is that financial and social intermediation have a positive effect on an IMFI’s sustainability; and to that end, we seek to validate Hypothesis 1 and Hypothesis 2.

H1: Financial intermediation has a positive effect on IMFIs’ sustainability.

H2: Social intermediation has a positive effect on IMFIs’ sustainability.

DOES SPIRITUAL INTERMEDIATION AFFECT IMFIs’ SUSTAINABILITY?

Khan & Phillips (20121) found that faith motivates borrowers to repay loans so it acts to enhance clients’ repayment rate. Another empirical study exploring the role of spirituality in the IMFIs is an experimental study conducted by Masyita et al. In 2014, 162 clients from 13 IMFIs in Indonesia. The results of this study proved that spirituality along with managerial and technological factors determine behaviour and business performance. Thus, spiritual intermediation may affect the sustainability of IMFIs and to that end, we seek to validate hypothesis.

H3: Spiritual Intermediation has a positive effect on IMFIs’ sustainability

VARIABLES USED

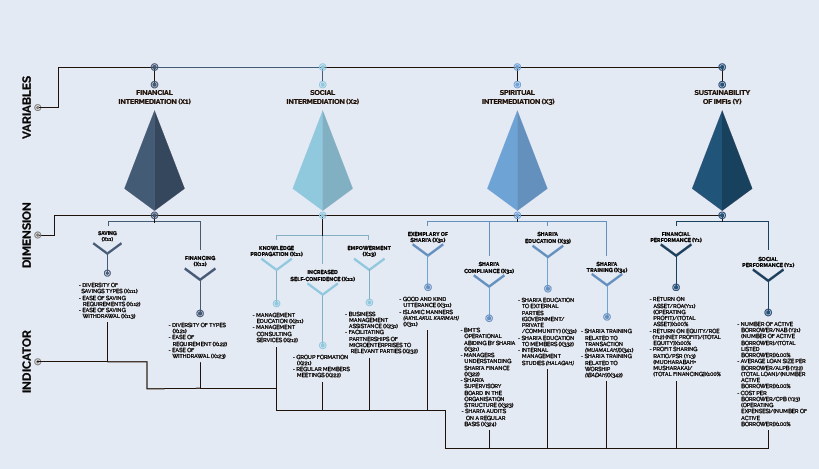

The variables of this study consist of three exogenous variables, namely financial intermediation (X1), social intermediation (X2), spiritual intermediation (X3) and one endogenous variable which is IMFIs’ sustainability. The operationalisation of variables used in the study is summarised in the following:

The variables of this study are latent variables which are developed with dimensions measured through items of question using a Likert scale of 5 points.

SAMPLE

The method used for determination of the sample was ‘purposive sampling’ because of the high level of diversity of Baitul Maal wa Tamweel institutions. Samples of BMTs had to satisfy the determined criteria, that is being active and having operated for at least three consecutive years, having a legal status, and conducting an annual meeting of members for at least two years consecutively. Based on this, the samples comprised of 98 Islamic cooperatives from three different regions in Indonesia, including 10 units from Jambi (Sumatera Island), 84 units from Bandung (Java Island) and 4 units from Kendari (Sulawesi Island). They were selected based on the growth of IMFIs in these cities, according to the data from March-August 2017.

METHOD

This study uses a quantitative approach based on a structured questionnaire survey and uses the technique of statistical analysis based on variants (partial least squares). The use of PLS serves the purpose and model of the research, which is to examine the causal relationship between latent variables with relatively small sample size. Thus, the assumption of deviation from normality is not the issue. Since one of the variables is a new construct (spiritual intermediation), the orientation of this study is aimed more at development, so the prediction model is more suitable than the estimation model. Subsequently, the data were processed with the aid of smart program PLS 3.00.

RESPONDENTS’ DESCRIPTION

The 98 respondents were managers of BMTs. Among these employees, people of productive ages, 41-50 years old constituted 50% of the sample, while the elderly account for 45%. The remaining 5% were 31-40 years old. On average, the males constituted 80% of the BMT management while the rest (20%) were women. As in other strategic positions in Indonesia, BMTs also experiences gender bias, where men are more dominant as executives. In terms of the education profile, 79% of the total chairmen had bachelor degrees, 18% of them were high school graduates and the remaining 3% were postgraduate degree holders. Testing the model went through two stages:

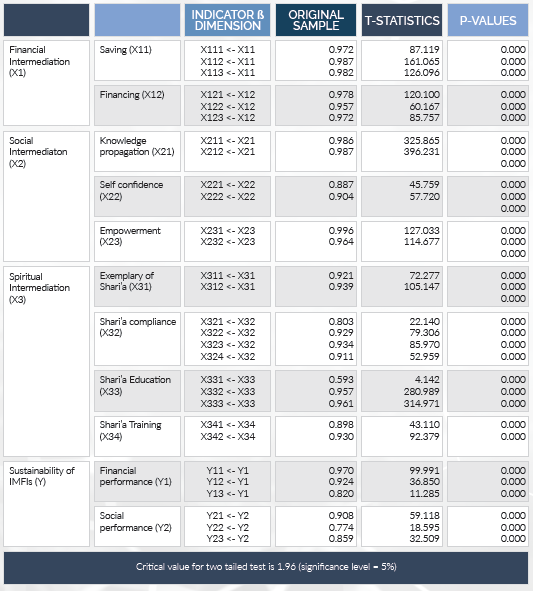

MEASUREMENT MODEL – OUTER MODEL

Measurement model analysis aims to test the validity and reliability of the dimensions and indicators used to measure latent variables. This analysis is measured using discriminant validity through Average Variance Extracted (AVE) value, in which, if AVE value is greater than 0.5, the dimension and indicator are valid. Furthermore, reliability used Composite Reliability and Cronbach’s Alpha, in which, if the value of Composite Reliability and Cronbach’s Alpha are greater than 0.70, the variables are reliable. The outer model testing results are presented below:

| VARIABLES | AVERAGE VARIANCE EXTRACTED | COMPOSITE RELIABILITY | CRONBACH ALPHA |

| Financial Intermediation | 0.945 | 0.990 | 0.988 |

| Social Intermediation | 0.828 | 0.966 | 0.962 |

| Spiritual Intermediation | 0.675 | 0.954 | 0.946 |

| Sustainability of IMFIs | 0.711 | 0.936 | 0.916 |

It can be seen that all variables in the predicted model are valid with AVE greater than 0.5. Similarly, the Composite Reliability and Cronbach’s Alpha values of each variable are greater than 0.70, which indicates that all variables have good reliability. The research used a multidimensional construct; as a consequence, the construct validity test is performed using a second-order Confirmatory Factor Analysis (CFA). The result of the construct validity test is presented below:

It can be seen that all indicators have a loading-factor value greater than 0.70 except the indicator X331 (Shari’a education to the public) which has a loading-factor less than 0.70 i.e. 0.541. It means that all indicators of all dimensions are valid except indicator X331 (an activity of disseminating knowledge about Shari’a literacy to government, private sector and public). Such activities are still found to be restricted in almost all IMFIs because of financial issue and human resources constraints. X331 indicator is unable to explain the dimensions of Shari’a education (X3.3). As a result, it must be left off the model before the data is redone. The result shows that loading-factor values of all indicators in all dimensions are greater than 0.70 and likewise, T-statistics is greater than 1.96. Thus, it is said that all indicators of all dimensions are valid.

Also, the CFA first order was carried out to measure the extent of the validity of the dimensions in measuring the latent variables. The results are presented below:

| LATENT VARIABLES | LATENT VARIABLES -> DIMENSION | ORIGINAL SAMPLE | T-STATISTICS | P-VALUES |

| Financial Intermediation (X1) | X1-> X11 X1-> X12 | 0.997 0.997 | 1.037.711 966.605 | 0.000 0.000 |

| Social Intermediaton (X2) | X2-> X21 X2-> X22 X2-> X23 | 0.967 0.976 0.932 | 183.171 223.625 7 2.645 | 0.000 0.000 0.000 |

| Spiritual Intermediation (X3) | X3-> X31| X3-> X32 X3-> X33 X3-> X34 | 0.851 0.893 0.703 0.735 | 57.618 41.300 33.062 148.887 | 0.000 0.000 0.000 0.000 |

| Sustainability of IMFIs (Y) | Y-> Y1 Y-> Y2 | 0.965 0.956 | 188.000 165.863 | 0.000 0.000 |

According to the measurement model of the variable over its dimension, all dimensions of the four latent variables of this study are valid with loading factor values>0.70 and T Statistics>1.96.

STRUCTURAL MODEL – INNER MODEL Structural model testing used R2 and Q2 (predictive relevance). The criteria of using the value of R2 as 0.75 are regarded as substantial/strong while Q2 of 0.35 is considered great. The following test results in Table 5 show that the value of R2 is “strong” (>0.67) and the value of Q2 is “great” (>0.35). The hypothesis testing results are presented below:

| ENDOGENOUS VARIABLE | R2 | Q2 |

| Sustainability of IMFIs | 720 | 523 |

HYPOTHESIS TESTING

The results of hypotheses testing are presented below:

| HYPOTHESIS | ORIGINAL Sample | STANDARD DIVISION | T-STATISTIC | P-VALUE | NOTE |

| X1 -> Y | 147 | 68 | 2.170 | 15 | Significant |

| X2 -> Y | 333 | 135 | 2.476 | 7 | Significant |

| X3 -> Y | 493 | 149 | 3.298 | 1 | Significant |

Based on the above, Hypothesis 1, which predicts that financial intermediation has a positive effect on IMFIs’ sustainability, cannot be rejected. Similarly, Hypothesis 2, which predicts that social intermediation has a positive effect on IMFIs’ sustainability, also cannot be rejected with the original sample. Furthermore, Hypothesis 3 also cannot be rejected which predicts that spiritual intermediation positively affects the sustainability of IMFIs. These results are in agreement with the studies of Masyita et al. (2014) who found that the implementation of the spiritual aspect of the IMFIs is one of the efforts to improve the performance of IMFI’s clients and in turn, has a positive impact on IMFIs’ sustainability.

CONCLUSION AND RESEARCH AGENDA

The results show that financial, social and spiritual intermediation have a significantly positive effect on IMFIs’ sustainability. Therefore, to achieve this sustainability, IMFIs can simultaneously perform triple intermediation in their activities. Financial intermediation is carried out by providing diverse financial services/products, easy requirements and quick disbursement. Meanwhile, social intermediation can be carried out through knowledge dissemination, increasing self-confidence and enhancing empowerment. Whereas, spiritual intermediation is performed through Islamic examples, role models and Shari’a-compliance as well as Shari’a literacy education and training for clients.

The results of this study can serve as a reference for practitioners to improve sustainability by applying a holistic approach for a manifestation of IMFIs’ role as a financial as well as a religious institution. This research is based on an institutional perspective that implements a holistic approach. While the influence or impact of a holistic approach for changing the life of the poor or the performance of a small micro-enterprise (client perspective) can be the agenda for future research.