REVISITING SHARI’A SCREENING

METHODOLOGIES

Let us consider the S&P Dow-Jones Shari’a screening, which has the following financial screens:

- Total debt divided by market capitalisation ≤ 33%

- Cash plus interest-bearing securities divided by market capitalisation ≤ 33%

- Accounts receivables divided by market capitalisation ≤ 33%

- Non-permissible income other than interest income divided by total revenue ≤ 5%

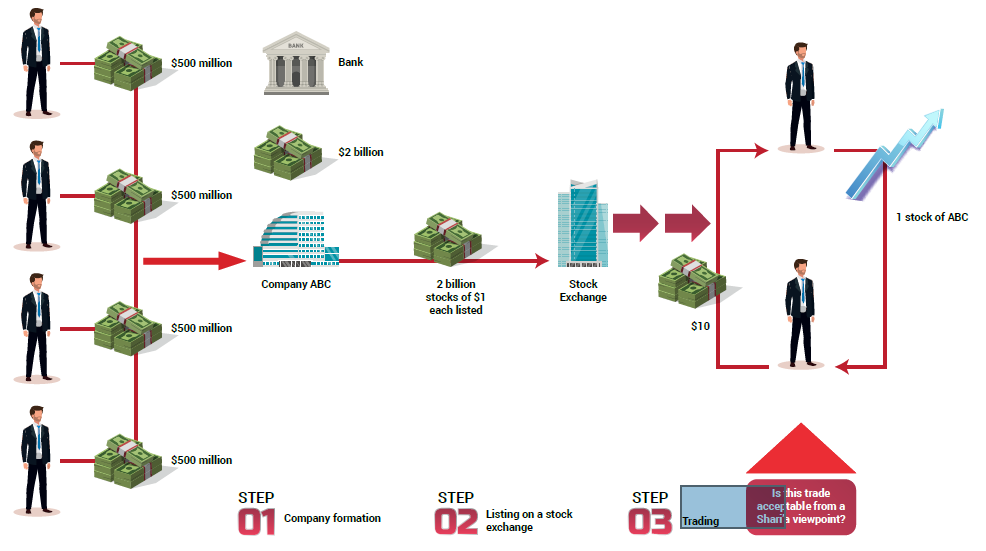

Now let us consider a hypothetical example depicted in the Figure below.

A company is set up with a paid-up capital of USD2 billion, which is kept in a bank account. Before starting any business, the company is floated on a stock exchange with the issuance of 2 billion stocks of USD1 each. The issuance is fully subscribed and the additional USD2 billion is also kept in a bank account (total cash of USD4 billion). Subsequent to this if the secondary market trading starts and the company’s stocks go up in price to, say, USD1.25, is it Shari’a-compliant to trade in this stock?

Obviously, the answer would be NO, as the second screen will be in breach [USD4 billion / USD2.5 billion = 160%].

Now, if the company starts a financing business whereby it offers Shari’a-compliant home financing based on Murabaha, what would be the view on the trading in stocks of such a company?

Suppose the company uses USD2 billion to offer home financing and uses the remaining USD 2 billion to invest in Sukuk al-Ijara. It would have the following assets:

Sukuk al-Ijara: USD2 billion

Murabaha Receivables: USD4.16 billion

Is it still impermissible to trade in the stocks of the company on a price of USD1.25 per share?

The first screen remains irrelevant to this simple example.

The second screen will give a numerical value of 80% [USD2 billion / USD2.5 billion], which may imply that the company will be in breach. But actually, this isn’t the case, as the company doesn’t have any cash any more but rather has invested in Sukuk al-Ijara. The second screen will yield a value of zero, and the company will not be in breach.

The third screen will yield a value of 166.31%, which implies a Shari’a breach.

Hence, it will not be acceptable to trade in the stocks of this company for a premium or discount.

If, however, the company offered home financing on the basis of Diminishing Musharaka and held the titles of the properties (financed), then the amount of receivables will be only USD2.16 billion, and the third screen will have a value of 86.4%, still higher than the 49% threshold.

The above discussion alludes to an important point.

Those who advocate for more use of asset-backed financing in Islamic banking and finance, can insist on the strict application of Shari’a screens even in the case of Islamic banks and financial institutions. The close scrutiny of the financials of listed Islamic banks and other financial institutions may reveal that they do not fulfil Shari’a requirements for trading in stocks.

More importantly, the screening methodology breaks down partially or fully when applied to Islamic banks and financial institutions. To understand this point, consider the following table:

Financial Screens Applied to Dubai Islamic Bank (in AED)

| Market Capitalisation | 30,121,496,608 | Financial Screen | Receivables to Market Capitalisation |

| Receivables | 9,385,000,000 | 3 | 31.16% |

| Receivables (including due from banks and financial institutions | 14,372,000,000 | 3 | 47.71% |

| If Islamic financing is also scrutinised | 197,436,000,0004 | 3 | >> 50% |

| Cash and balances with central banks | 37,917,000,000 | 2 | 125.88% |

If S&P Dow Jones Shari’a screening methodology is applied in letter and spirit, DIB’s stock isn’t Shari’a-compliant, at least for trading, if not investing and holding. This is a limitation of the S&P Dow Jones’s and other Shari’a screening methodologies. This necessitates revisiting the approach taken for Shari’a screening of listed stocks and shares.

One simple approach could be just looking into the prohibition of interest and ignoring other aspects like liquidity and trading in debt. This approach could involve applying the following two simple screens:

- Interest receipts divided by total revenue ≤ 5%

- Interest payments divided by total expenses ≤ 5%

This should filter out the Shari’a repugnant businesses if it is applied along with the sectoral/business screen.

Are we ready to rebook an approach we have taken anyway as a second-best solution, which has been used for over two decades with, admittedly, limited success?