“Mughees Shaukat is a renowned global financial/Islamic strategist, policy adviser and pioneer Head of Islamic Finance in the CBFS, under the Central Bank of Oman, Muscat, Sultanate of Oman. He is an internationally known Fintech specialist from MIT, USA and a PhD Scholar from Malaysia in Entrepreneurship & Assessing the new-age entrepreneurial ecosystems. His focus includes, macroeconomic policies, multi-polar economy, political economy, behavioural and institutional economics, environmental economics, halal industry, China-Pakistan Economic Corridor-CEPC & governance among other.

Mughees is a prolific author and has over 50 publications while he has so far delivered over 100 policy talks, keynote addresses, expert sessions, high-level presentations, and executive lectures, globally. He has himself so far founded, organised & delivered over 15 International conferences, seminars, symposiums, & forums. He is also the Chair & Co-Chair in multiple international conferences. Given his role and global contributions, CBFS has been awarded the Global Islamic Finance Award from H.E the Honourable President of the Islamic Republic of Pakistan. Alongside holding multiple key strategic and international advisory positions, Mughees is also the Vice Chairman Education Board, AAOIFI, Bahrain; a member of the Society of Advancement of Socio-Economics (SASE), France; a member of the Western Economic Association International (WEAI), USA. He has been a member of the International Expert Panel created by the Central Bank of Bahrain for developing Islamic Profit Rate benchmark; a member of the BLOCKCHAIN Society, Oman; a Certified Shari’a Adviser and Auditor, AAOIFI & Vice Chairman Advisory Board of Fingel Global Inc. Toronto, Canada.

As a strategist, policy expert, advisor and someone who has been the Head of Islamic Finance in the College of Banking & Financial Studies, Oman, how do you assess the current human resources in the global Islamic finance industry and how do you think this shortfall, if any, can be abridged?

Although the Islamic financial industry has shown impressive growth, particularly over the last decade, it continues to face criticism. It is felt that the operations of the current Islamic finance industry (IFI) resemble that of conventional finance, thus undermining key value propositions of the ideal Islamic finance. These value propositions come from verse 275 of chapter 2 of Al Qur’an where Allah (saw) permits ‘Al-Bay’ (exchange) and prohibits Riba (interest). In a recent working paper (2015), IMF warned that the continued focus of IFI on risk transfer mechanisms would impede its further progress. It should be noted that Islamic finance is forced to operate in an extremely challenging and disadvantageous environment.

For long, observers have concurred that answer lies in developing the rightly attuned human capital that is well-equipped to address the given challenges while correcting perceptions. As a result, with time, the focus must shift from bashing practitioners to hinging hopes on educational endeavours. This is even more crucial given the fact that the last four decades of Islamic finance is still based on/ driven by the intellectual pedigree of scholars from the 70s and 80s. While crediting the contributions, the same appears overstretched to mould or acclimatise to the demands of the fast-changing Islamic financial industry, one that is essentially dictated by a financially innovative and ‘tech-intensive’ environment. There is thus an amplification in the need of a new breed of an intellectual wave, ideally accustomed to meet the prerequisites of the age of the ‘new normals’ and possible frontiers. What is present currently, is a filling of the ‘scholarly gab’ via what could be termed as ‘Surrogate Expert/Scholars’; those who could be characterised as ‘knowers’ rather than ‘believers’ and ‘visionaries’ of Islamic finance.

It can be argued that the presence of the surrogate experts is not by chance, but an outcome of a common approach adopted to practice Islamic finance. Nearly every region (old or new) that embraced Islamic finance, always started it in beta mode, evidencing tentative trust on the market response for the Quranic system. The same tentativeness was never there when adopting a system that is not only meant for a nonlinear downfall (see verse 276: 2 of Al Quran) but also leads to war against Allah and His Prophet (see verse 279:2 of Al Quran). The beta approach gave rise to an instant involvement of experts, in academia and industry, who by origin are conventional experts, via their years of education in conventional economic philosophies, followed by years of practising the same. Furthermore, operationalising a religiously sensitive system meant training conventional experts on a fast track.

The easy-to-do Islamic window experiments further assured that such an approach prevails. Of course, the Shari’a committee is there to take care of affairs via their normal binary response. The result is an inertia where the demand for ‘horses for courses’ moved to oblivion. Consequently, a path dependency for creating instant (surrogated) expertise takes centre stage.

It can be stated that reliance and allowance for the surrogate experts or knowers of Islamic finance, in the industry and academia, has contributed to the current model being perceived as a replica of its counterpart, both in form and substance. With this in view and the technological disruption gaining prominence, there is an urgent need to correct the focus and produce believers who could then auto-transform into visionaries of Islamic finance. The capacity-building measure needs to be attuned to create and nurture thinkers via formation than only vanilla training and education. Most importantly is a need to ensure that teachers and academicians mandated to produce a new breed of intellectuals must be rightly equipped. Disability to filter for this ‘known unknown’ of surrogacy may prove fatal for materialising the hopes of producing aspired believers and visionaries.

Leverage must be taken by focusing on the tech-savvy new millennia who appears to ideally and inevitably fit the purpose. Nurturing hermetically on the theology and philosophies of Islamic economy, a group of new-age believers could be created, poised to support the value-based financial stability, sustainability, efficient use of resources, innovation and social consciousness towards Maqasid al Shari’a.

In your opinion, is there a major gap between the recent financial growth of Islamic banks and its compatibility with Maqasid Al-Shari’a?

Yes, there is. This question has roots in my earlier answer. The same among others have ensued a business-as-usual culture-centric approach to shareholders, profits and only left-over attention to CSR (Corporate social responsibility). Robust support could be gained from an extremely expansive and thorough global study that came in the inaugural AAOIFI (JOIFA, 2018) journal. The study showed that the majority of Islamic banks operating in the world were skewed to ensuring efficient financial gains with an unequal or little focus on a simultaneous orientation with the fulfilment of Maqasid al Shari’a, particularly in the post-financial growth.

Using the novel ‘Financial Growth to Maqasid al-Shari’a – FGMS’ Grid Matrix model, on a country-wise global sample, the study rated the jurisdictions based on the performance on both scales. While there were relatively best performers on both scales; rated as ‘A’. Most of the sample performance was rated ‘C’ i.e. high on financial growth but low on deliverance to Maqasid al-Shari’a objectives. It must be asserted that the Shari’a principles can best be understood from an angle it is destined for, namely the purposes and objectives of the Islamic law (Maqasid al-Shari’a). In this respect, innovation in Islamic finance and all endeavours to test the efficacy of an activity must readily comply with the purpose (maqasid) of Shari’a; that is the preservation of religion (Dīn), life (Nafs), family (Nasl), intellect (‘Aql) and property (Mal). However, equally important is a much-needed dynamism in understanding, anticipating, and applying the notion of Maqasid al Shari’a in and as per modern needs and demands. The up-gradation in the relevance of the same is more time-related rather than a straitjacket application. Again, the said new-age breed of visionary young experts and Shari’a scholars may accomplish this.

What has been your role in the vision of the Sultanate of Oman for entrepreneurship-focused economic diversification, especially in the current pandemic situation and the post-COVID-19 era?

Oman’s welcome adoption of Islamic banking and finance has created a valuable opportunity to reap the desired economic benefits of risk-sharing financing, potentially setting trends by resorting to innovative approaches to implement and promote authentic Islamic finance. Although the Sultanate is GCC’s last mover in the discipline, it has thus far appeared to have worked the last mover status into the last mover advantage. Islamic finance is ascending to greater prominence in the Omani financial system. This can be supported by the noticeable measures the country took to implement Islamic finance, enabling the same to reach a fairy tale 15.6% of the market share in nearly 6 years.

“Majority of Islamic banks operating in the world were skewed to ensuring efficient financial gains with an unequal or little focus on simultaneous orientation with the fulfilment of Maqasid al Shari’a.”

The following is a list of some robust institutional measures;

- Among the most prominent is the Oman’s Islamic Banking Regulatory Framework (IBRF), a detailed and comprehensive document covering all aspects of Islamic banking. The framework has been well received in the international fora and is considered among the most stringent to govern Shari’a-compliant financing.

The launch of the maiden Shari’a index, to be known as the Muscat Security Markets Shariah Index. The index currently comprises of 31 listings with a market capitalisation of around USD30 billion v/s a USD72 billion GDP (Shaukat, 2018).

- The Sultanate’s adoption of AAOIFI’s (Accounting and Auditing Organization for Islamic Financial Institutions) accounting standards.

- In the area of governance and supervision, Oman’s formalisation of a Centralised Shari’a Board as well as the mandatory practice of external Shari’a audit.

- The Sultanate’s issuance of its maiden Sovereign Sukuk and the Capital Market Authority’s latest issuance of a separate legal and regulatory framework for the same; supporting further plans of a second Sovereign Sukuk.

- Moreover, the Central Bank’s award-winning and now globally recognised Islamic finance unit in its College of Banking and Financial Studies, for dedicated training, education, research, consultancy and capacity building in Islamic finance.

- Last but not the least are the Oman’s Capital Market Authority’s Takaful Framework and the current initiative by the Central Bank to soon institute a proper scheme of Islamic Deposit Insurance (Takaful).

It is on the basis of these solid measures that have led the latest Islamic Financial Development Index Report (2019) to rank Oman among the top performers. Nevertheless, in view of the pandemic, the sustainment aspect, the ambitions of economic diversification, entrepreneurship, and the demands of a technologically disrupted multipolar global world, the benefits of Islamic finance could only be reaped best by applying and branding a ‘New Age Islamic Fintech Finance’. The ‘magic sauce’ could be to rely on its risk-sharing value preposition, its well-suited risk-return profile matching for MSMEs and innovative capacities of pure experts via structural support, to unbundle and re-bundle a SMART and automated version of Shari’a finance that is cost, user and efficiency friendly. The same could be linked to serve the UN’s SDGs, Tanfeedh and vision 2040 under the new regime of His Majesty Sultan Haitham Bin Tariq.

“With the intensely globalised world in its technology and pandemic disrupted multipolar state, the challenges could be addressed in a well-planned, phased manner, with the use of proper, smart and effective subconscious level of marketing, media training and formation- driven capacity building.”

What is, in your view, the greatest challenge faced by Islamic finance in the world in general, and in Oman in particular? How you with a potent position in Islamic finance and fintech geared up for this challenge while enhancing its global competitiveness?

It is an open submission if not an open secret that the Islamic financial system is constrained to operate in an extremely challenging and disadvantageous environment. While a list of these challenges could be comprised, what is most important is to have the discernability to distinguish challenges and causes from their effects. I say so as to me the main challenge is the presence of what could be termed as ‘cognitive dissonance’ and ‘cognitive deficiency; among the current scholars, academicians, practitioners and proponents of Islamic finance. The same appears to have perhaps misguided Islamic finance from its actual version, the one focused and run by its main law of ‘Al Bay’ (risk-sharing) than a ‘no Riba’ version; hence the discrepancy among the stakeholders and the model. This is the actual challenge plus the offshoot challenge of reorienting the model back to its original self, amidst the subsequent institutional and operational effects:

- Path Dependency – over-reliance on debt-based products where the global balance sheet of Islamic banks feature a 94% fixed rate instruments

- Presence of interest-based macroeconomic policies

- The problem of the lender as the last resort

- Corporate and Shari’a governance of IFIs

- Lack of instruments of hedging or liquidity

-increased cost of information

-control over cost of funds

-interest rate as a benchmark

- No capital market, money market or an Islamic stock market

- Lack of dynamic and strong regulatory, and supervisory capacity

- The biased tax and legal system

- Risk management in Islamic finance

- Shari’a harmonisation and standardisation

- Lack of government participation

- No government support for risk-sharing

- Need for human capital particularly those who are aware of the core theoretical underpinnings of Islamic finance; the believers and visionaries

Despite the above challenges and the criticism, the industry stands at USD2.6 trillion in 2020 with further promise on offer. We must not forget that the current model of Islamic banking and finance is no different from the model of Islam the Ummah follows, the former necessarily is born from the later carrying strict Shari’a approvals for all the activities and products. With the intensely globalised world in its technology and pandemic-disrupted multipolar state, the challenges could be addressed in a well-planned, phased manner, with the use of proper, smart and effective subconscious level of marketing, media training and formation-driven capacity building. The framing and projecting of Islamic finance still leaves a lot to be desired.

Failure to address the common wrongful perceptions about the industry is enough evidence to suffice the claim. A well-crafted strategy on the given grounds is the only way forward to not only address the submitted challenges but achieve global competitiveness. Over the last 4-5 years, this is the sole model one is trying to proactively practice and instill: creating both soft and hard capital for the desired objectives in Oman. The outcomes have enabled one to receive the global performance award in form of GIFA via the Honorable President of the Islamic Republic of Pakistan.

How do you see the future of Fintech and its applications in the modern economic ecosystem? Can Fintech solve the Shari’a compliance issues faced by the global Islamic finance industry? What investments are needed to increase technology-driven innovation in the local financial markets?

In recent times, the impact of globalisation and financial innovation has swept through the world in a magnitude that is unprecedented, altering the very fabric of financial and economic behaviour. Automation and mechanisation have already disrupted the traditional financial means to meet the ends. It is difficult to imagine a world without internet or mobile devices that are now central to daily routines.

Consequently, the digital disruption/revolution has brought a paradigm shift, transforming the way customers access financial products and services. This has not only created user flexibility but with it reduced transaction costs. The flexibilities that have consequently called time on the traditional ‘business as usual’ approaches. This could be termed as the ‘new-age innovative or automated financial order’ – it is called FinTech. World Bank (2016) predicted that automation is threatening jobs by, for example, 69% in India, 77% and 85% in China and Ethiopia.

If technology-driven financial innovation is set to lead fundamental transformations in economic behaviour, resorting to novel and adaptive marketplaces become a crucial component. The raison d’etre for enhanced and affordable financial flexibilities is the possibility of transacting without intermediation. Consequently, there is a clear orientation from a ‘financer-intermediator-entrepreneur’ towards a ‘financer-entrepreneur’ model. P2P lending, crowdfunding, angel investing, mobile banking, Airbnb, On Deck, Funding Circle even e-bay are prime examples. These not only have created better opportunities for financial inclusion but have tended to improve the overall social fabric via improved trusteeship and risk-sharing.

What is crucially noteworthy is the fact that the fintech-driven new-age finance is in its complete actuality the application of 101 Islamic finance i.e. a simple resorting to Mudaraba and Musharaka financing. Driven by the Shari’a rules, the Islamic financial system is based on Al-bay (risk-sharing) financing. The epistemological roots of Al-bay as an essence of Islamic finance can be traced from chapter 2 verse 275 of Al-Quran. In a typical risk-sharing arrangement such as equity finance, parties share the risk as well as the rewards of a contract. Assets are invested in remunerative trade and production activities. The return to assets is not known at the instant assets are invested, akin to Arrow- Debreu securities.

“Fintech has the potential to play a greater role in the Islamic finance industry, specifically to improve process efficiencies, cost-effectiveness, increased distribution, Shari’a and other compliances and financial inclusion.”

Fintech has the potential to play a greater role in the Islamic finance industry specifically to improve the process efficiencies, cost-effectiveness, increased distribution, Shari’a and other compliances and financial inclusion.

Consequently, this builds the case for Islamic financial institutions to be more agile and receptive to adapting and adopting fintech solutions. Fintech and digital technology could allow Islamic finance to reach out further and quicker (and possibly cheaper) without having to build a physical presence and distribution channels. Such are the inferences for Islamic finance to aggressively adopt fintech.

Until now, Islamic finance has usually been constrained by the complicated nature of contractual layers, approvals and form over substance issues, increasing operational and transaction costs. The introduction of Smart Islamic Banking Contracts (SIBCs), and other Big Tech and Deep tech alternatives could stimulate the desired version, easing even international trade deals for Islamic banks via automated payment schemes. The value and mechanics of the same could be fully chiselled and endorsed/accredited by WTO, World Bank, IFSB, CIBAFI & AAOIFI. Islamic wealth and asset management could be served via marketplaces, driven by robo-advisory, AI and Numerie. This would also transform and lubricate sukuk for public-private partnership, financing institutional investments, crowdfunding, angle investing, and P2P financings. Further efforts could utilise the Islamic re-distributive modes of Zakat, Waqf (endowment), Infaq and social finance. Marketplace such as ‘Islamic Philanthropy Finance Ventures’ (IPFVs) could well serve Islamic finance in increasing economic empowerment. The recent international expert forum like the Oman Fintech Islamic Finance Youth Forum 2020, the AAOIFI-CBFS- IsDB/IRTI-Minhaj virtual forum 2020, the New Age Fintech Social Finance Forum 2020, The Fintech Waqf Forum 2017 in Oman, and other similar forums are steps in the right direction. Not to miss the golden opportunities created by the China-Pakistan Economic Corridor (CPEC) and the One Belt One Road Initiative (OBOR).

What are some of the challenges and opportunities in Islamic Fintech and what is being done in terms of increasing the share of Fintech in Islamic banking and finance industry?

It has to be understood that technology adoption comes with serious challenges. Primary among those is the mindset, resistance to change, weak or no distinction between renovation and innovation, lack of human capital and the ever-prevalent risk of cybersecurity. Secondary is the category of regulating technology modes and the notion of RegTech. Fintech has to be adopted as an and with its ecosystem and not just as fashion. It is noteworthy that when it comes to regulating fintech, authorities must understand fintech as a collection of technology activities for financial entities. Consequently, the mode has to be an “activity-based regulation” rather than entity-based approach.

This is the key for coding and encouraging suitable fintech regulatory regime and effective RegTech. Of course, the threat is not fintech but Big Tech. The phenomenon of technology-driven financial disruption has moved to a new phase, from ‘Fintech’ to a new notion called ‘Big Tech’ and ‘Deep Tech’. While the former could also be viewed as synergising with, the latter are a direct threat to banking and banks that are not still proactively awake to it. Microsoft, Google, Apple, Amazon and the Facebook are big enough to run the monopoly in financial services. They have (big) data, (big) network, (big) market capital, (big) AI, user-friendly customer base and (big) technology brands. This is the ‘Big Tech’ with ‘Deep Tech’ carrying the potential to even dance the regulatory show on its fingers.

This calls for better proactivity from banks and even more from Islamic banks. This is a fine opportunity for markets that are new to Islamic or Halal banks. Their new-age model could start where the other systems finish.

What is your vision for Islamic Finance in Oman? What are your personal expectations in the expansion of the Islamic banking and finance industry?

Being an idealist and institutionalist and in view of the national agendas that are further amplified by the regime of His Majesty Sultan Haitham Bin Tariq, I desire and aim for Oman to be, this time, the first mover in embracing and then branding a new-age technology-driven smart version of Islamic banking and finance, predominantly driven by the actual value proposition of risk-sharing based finance. The same attuned to economic diversification, entrepreneurship, and financial inclusion with an increasing role of the rightly formatted Omani youth as the driving force. There is a reason Oman has achieved so big in Islamic finance in so little time. To me, there is an apparent ‘Fitrah’ (nature) matching between the overall fitrah of the Omani society and the fitrah of Islamic economics and finance.

Formal attempts to leverage from the modern version of Islamic finance may prove more ideal and beneficial to Oman. Consequently, the aim the aim to induce and attempt to make the same as a pioneer in Islamic finance version 2.0. In view of one’s initiatives the ball has already rolled.

What, in your view, could be the most innovative application of Blockchain technology in Islamic banking and finance?

In my view, considering the new-age halal economy that has the necessary and complementary combination of consumer and Islamic finance, the best current and earliest application of blockchain could be in Halal food security and smart contracts.

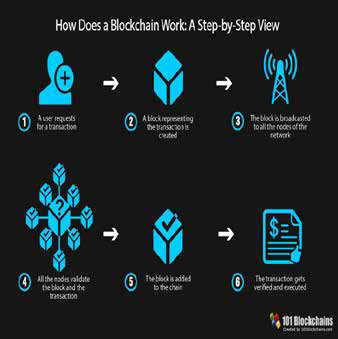

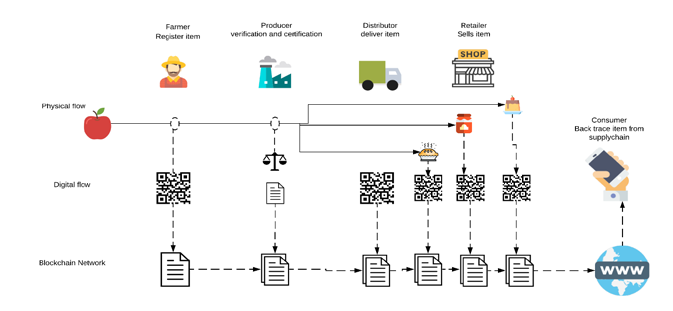

According to the World Hunger Index (2019), every year, 420000 people die because of foodborne diseases. USD55 billion to USD93 billion economic loss is suffered due to health hazard and wastage; meaning food is enough in this world if handled properly. Food fraud costs about USD10 to 15 billion annually. The food traceability industry was already USD14 billion in 2019. To see the relevance of blockchain as a boon, it is important to summarise the basic working of blockchain.

Moreover, the advent of (big) Data and the decentralised distributed nature strictly strains any tempering or adjusting of chronological records, further requiring ‘proof of work or state i.e. simultaneous acceptance by all peers or stakeholders. Data, therefore, could hardly be tempered, giving rise to trustworthy data. Consequently, the same would result in a much efficient, faster, smarter and an airtight supply of assured halal food with each step tightly recorded and monitored for untampered quality and health safety controls.

Walmart-IBM calls this as ‘Food Trust’, traceable and made transparently secure in just two seconds. Vietnam calls it ‘FruitChain’. However, the issue with the given bliss of ‘Food Trust’ is its indifference to non-halal items such as pork. As a result, regular pork meat would also be safe given the traceability. The Islamic notion of Halal begins from where the other systems end. Halal not only accommodates the latter but goes much further than the physics, chemistry, and biology. It brings in the cleansing of soul, heart, mind and spirit i.e. a whole lifestyle. It provides the whole ex-ante and ex-post Halal ecosystem. The Blockchain solution, hence, has huge implications for the halal industry, Halal certification bodies and all the stakeholders, serving also for removing the unfounded distinction between Islamic finance and the halal industry or the consumer Islam and the financial Islam. Both are the same, with the financial part in fact being the pre-requisite of the consumption part. Unfortunately, the similarity is not well understood and projected.

SDGs are the talk of this decade. What in your view can be the role of Fintech, more specifically Islamic Fintech in achieving the SDGs?

In my view, whether it is the SGDs, circular economy, green, blue, even institutional, and/or environmental economics, are all basically a small-scale version of the overall Islamic economic system. The disruption via fintech was, in fact, the actual mandate of Islamic finance upon its rejuvenation. Among the most crucial prerequisites to uphold and deliver the promise of techno-driven Islamic finance, is to have a natural readiness for it before its adoption. The system, skill level and the institutional culture are made ready for such adoption and implementation. Not doing so and adopting the model only because it is becoming a fashion and a form symbol to reflect keeping up with the new-age would risk a misfire and may end up like the current version of Islamic finance, which is driven by knowers and not enough believers and visionaries. The same thus far has fallen short to disrupt and deliver on its true promise, including naturally achieving what we now promote as SDGs.

“SGDs, circular economy, green, blue, even institutional, and/or environmental economics, are all basically small-scale version of the overall Islamic economic system.”

Who has inspired you the most and how? How has this inspiration developed you?

My natural instinct about this is very simple. I get inspired by idealists, genuine visionaries and thought leaders, who not only carry the capacity of dreaming but also know the beauty of achieving their dreams while maintaining spiritual innocence. This is what distinguishes them and inspires me. As long as the prerequisites are met, and actions yielding results, professions are not considered while looking for inspirations. The personal amplification to match frequency with the industry professionals and events helped transform me into an idealist and institutionalist.

Consequently, the combination of the said variables seems to have crafted me in a plausible position at such a young age with much to offer in the future.

What drives you in your personal and professional life?

My contributions and achievements and the success story behind those contributions and achievements.

While both are a powerful driving force, the latter carries more marginal utility for me. Not to miss that the same is contingent on what I call my augmented version of the old success axiom; coupled with the Adam Smithian notion that behind every man’s success is an invisible (feministic) hand.

What has been your most priced achievement, so far?

- Now that I think of it, there are quite a few priced achievements. Primary among them is my current role and contributions in Islamic finance in Oman and globally. Considering that I am still the first of my kind in Oman, starting literally from scratch in an unprecedented manner, in a new market, to eventually reach the formal status of national acceptability and international recognition is indeed a priced achievement; building a powerful brand and market mover status. Equally priced is my subsequent growing global credibility and status as a young international economist, strategist, advisor, technologist, policy expert and thought leader.

“I am still the first of my kind in Oman, starting from scratch in an unprecedented manner, in a new market, to eventually reach the formal status of national acceptability and international recognition.”

The world is fast becoming oriented towards the use of social media. What role can social media play in creating awareness around Islamic finance?

A huge role but only if we realise how weak, if not worse, we are in leveraging the power of media and marketing. The roots lie in this being true even in framing and projecting virtually all the natural and manmade products and services coming from the Muslim world. The present failure to not frame and project Islamic finance properly is, hence, not a surprise but just an extension.

Failing to fix perception issues even among common Muslim consumers; creating an unfounded distinction between the halal industry and Islamic finance so much so that both are studied, understood and made to grow independent of each other where the former is over USD3 trillion and the latter almost USD2.6 trillion; failure to cognate and understand that all the current fancy notions of SDGs, Circular economy, Green economy, Blue Economy, Socially Responsible Finance, Ethical Finance, Value-based Investments etc are nothing but a downscaled version of the overall Islamic or Halal economy. These to me are a clear evidence of how bad we are in framing and projecting our value prepositions and how equally good we are in getting subconsciously influenced. I am also not surprised to see that there is hardly any formal capacity building available to attract the youth in addressing the same. Glad to state that this year (2020) one has already ventured into creating such measures; an effort to bring these topics in the open and filling the vacuum.

What would be your message to the global Islamic financial services community, particularly the younger professionals?

Be a believer and visionary, idealist and institutionalist in and what you do. Have people of the same qualities in your close circle. Stay away from people whose first expression is negative or safety first. Do not be afraid to achieve in what you believe but first, be clear in your ideas and thoughts. Remember if you can imagine it you can achieve it; daydream. Focus on the effort and not the result. The result is nature’s business, as is the timing and quantum. Do not work to get attention rather pay attention (to work). Do not be afraid to go the extra mile, or be fearful of breaking the ice, and take (natural) risks, as they are the lubricant to success. To sum it up, be or have an entrepreneur mentality rather than a job seeker or an employee mentality as nothing underserves true potential more.