The first months of 2020 have brought to the world an unprecedented global sanitary crisis that reached all sectors and areas indistinctively. The novel virus of COVID-19 has rapidly spread across borders with more than 32,867,270 confirmed infections and 994,499 deaths in more than 195 countries and territories worldwide, carrying mortality of approximately 6.07% compared with the mortality rate of less than 1% from influenza. However, beyond the immediate social and psychological effect of the pandemic, indirect effects through fear are taking hold of a significant number of people and investors around the world, which has had dramatic impacts on financial markets all over the world (Sherif, 20201). The global economies along with financial markets were amongst the first components to endure the pandemic’s shock. The outbreak of the COVID-19 pandemic has put markets under great stress and led to unprecedented uncertainty.

Thus, the conventional and Islamic financial markets have gone through a severe period of uncertainty and stress as public responses lack visibility and determination. Indeed, as the status quo of travel bans and movement restrictions in the world have started coming to an end, we can witness a rush towards establishing trust and paving the path towards a global recovery. Conventional sectors and the Islamic finance industry have both set up efforts to mitigate the effects of this global pandemic. For instance, the Islamic Development Bank (IsDB) announced a USD2 billion fund to minimise the impact of COVID-19 on both the private and public sectors of its member countries. Likewise, Bursa Malaysia has also undertaken regulatory measures to help financial markets’ players cope with the current exceptional crisis through facilitating the submission of financial statements, flexibility in handling margin accounts and expanding the list of collaterals for purposes of margin financing.

Although the Islamic finance industry including capital markets have enjoyed a steady growth in the past twenty years, the current global situation is worsened by the fluctuating oil prices and an uncertain macroeconomic environment posing great challenges to the industry. Although the conventional and Islamic equity indices are traded within the same markets, there are structural differences between them. Indeed, Shari’a-compliant equity indices must undergo a set of qualitative and quantitative screens. Qualitative screens or activity-based screens render the growth of Islamic equity indices and is small-cap focused; while conventional indices are more directed towards high-value activities with higher-risk environments. On the other hand, quantitative screens limit debt exposure of Shari’a-compliant firms and reduce financial downturns related to an unstable crisis like the current global pandemic.

As many countries adopted stringent quarantine policies during February and at the beginning of March, economic activities were heavily impacted and financial markets across the world plunged downward. Taking the S&P500 as an example, it reached its peak (3386) on February 19, 2020, but fell to 2237 on March 23, 2020, a drop of over 30% within one month.

Similarly, Islamic financial markets are not spared. Indeed, the COVID-19 outbreak exposed both the Islamic and conventional investments, to the same financial shocks as the pandemic resulted in shutting down and limiting a large part of the economic activities causing an unprecedented contraction in the real economy. However, as reported by S&P and Dow Jones, despite the dramatic market movement in the first quarter of 2020, their Islamic indices outperformed their conventional benchmarks (see John Welling, 2020)1. This outperformance of Shari’a-compliant investments can be ascribed to the Islamic-based criteria in screening, which forbids investment in firms with higher leverage. Indeed, (Khan & Azmat, 20202) found recently that low-leverage portfolios and indices performed better than high-leverage portfolios in the down market.

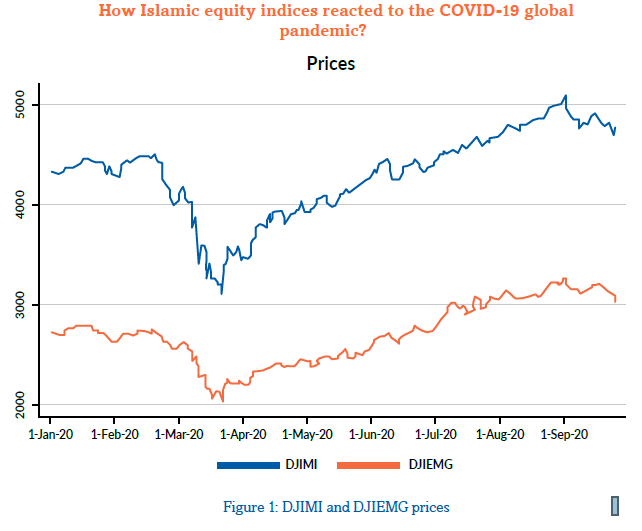

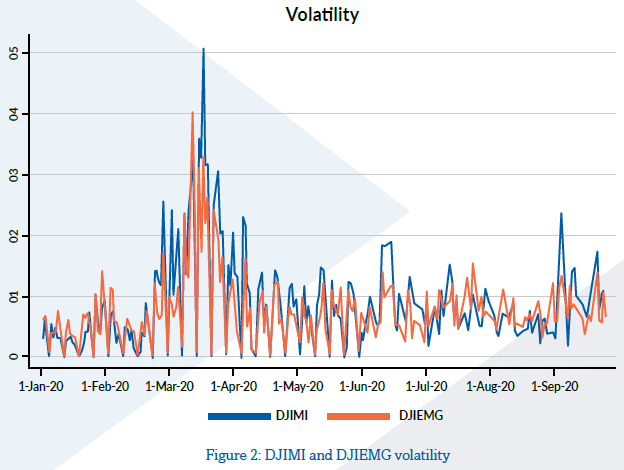

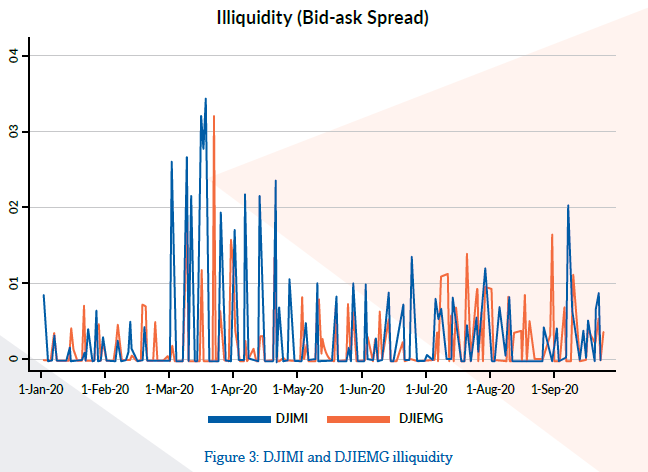

Choosing two Shari’a-compliant equity indices namely the Dow Jones Islamic World (DJIMI) and Dow Jones Islamic Market World Emerging Markets (DJIEMG), we highlight how different markets reacted to the crisis. As illustrated in Figure 1, in the period of mid-February to the end of March, the prices of the two indices experienced a dramatic drop (about 42% for DJIMI and 23% for DJIEMG) considerably similar to the drop during the subprime crisis of 2007-2009. This fall was accompanied by an acute volatility3 reaching its peak in March with more than four times higher than its levels in February (see Figure 2). Furthermore, market liquidity4 is also affected as shown in Figure 3. In fact, market tightness5 was heavily impacted during March, meaning that the transaction costs reached their highest level. This indicates that the Shari’a-compliant stocks had become more expensive to buy and sell.

Globally, this shows that Islamic stock markets responded strongly to the increase in the number of confirmed COVID-19 cases and can be also explained by the degree of uncertainty that reigned in the financial markets. However, it should be noted that the prices and index volatility returned to their normal levels during the month of April. This leads us to deduce that the response of the financial markets to the pandemic was mainly driven by the sentimental factors which triggered some kind of hypersensitivity among investors that was quickly intensified through the media.

Even though the COVID-19 pandemic heavily impacted the real sector especially SMEs, which constitutes the core exposure of Islamic finance industry, the impact on stock markets is rapidly mitigated. The early fluctuations are mainly due to investors’ panic under intensive media coverage and information dissipation. The same conclusions can be drawn from our overview analysis on the main Islamic equity indices. Furthermore, no study has revealed the significant impact pandemics have had on the stock markets around the world. In fact, the global financial markets have experienced multiple pandemics during the past thirty years. Here, while the stock markets experienced sharp drops in the first days of the pandemic, the persistence of the volatility was quickly dissipated.

Consequently, the current pandemic might create new opportunities for the Islamic capital market industry in reshaping their investment strategies and screening methodologies. Indeed, lesson should be drawn from the current crisis in order to implement sustainable strategies and efficient risk management frameworks.