Before Others.

Everything – a phenomenon or a process – can be seen from different angles, and studied and analysed in various ways. While Islamic finance practitioners consider Islamic banking as a new and alternative way of financial intermediation, they still have to convince a majority of Muslims who are not entirely satisfied with its authenticity. Obviously, they hold a diagonal view on this phenomenon. There is also a widespread impression that Islamic finance is all about charity, something that Islamic banking and finance practitioners are trying their best to dispel.

Interestingly, there is a huge emphasis on sadaqa (charity or almsgiving) in Islam, with numerous references to it in the Quran. In the context of Islamic social finance (IsSF), there is not a single paper, book or article written wherein the importance of sadaqa hasn’t been emphasised upon. Yet, no one has ever looked into the phenomenon of begging and its potential for raising Islamic social capital.

Almost everyone who specialises in IsSF would refer to waqf as a vehicle for holding charitable assets and would suggest the role of FinTech in raising Islamic social capital. There is no doubt that technology is a great enabler and that it can play a tremendously important role in raising Islamic social capital. However, it is equally important to consider the role of human resources in raising money. Beggars can play a role in this respect.

BEGGARS CAN PLAY A ROLE [PHILANTHROPIC CAPITAL RAISING]

According to some estimates, there are around 100 million homeless people worldwide (Habitat, 2015). Other estimates put the number of beggars in the world to 250 million. Looking at the figure of US$1.90 per day as the income of the people living under abject poverty, one should think that raising (or getting hold of) this small amount must not be an issue at all for even beggars. For example, this amounts to collecting Rs300 per day, something a beggar should very easily be able to raise on a daily basis. So, if a system could be devised to develop begging as an organised activity, abject poverty could be easily eradicated.

If a not-for-profit Islamic financial institution could be set up to organise begging on a national level, it must help in eradicating poverty. For example, according to some estimates, 55 million people are living in poverty in Pakistan. Out of this, there are an estimated 20 million who are involved in begging in one form or another. If one million beggars can be recruited under a national poverty alleviation programme, they can easily benefit the country in not only eradicating poverty but could also help in improving the level of affluence, asset creation and accumulation for the good of beneficiaries, infrastructure development and many more social-economic activities.

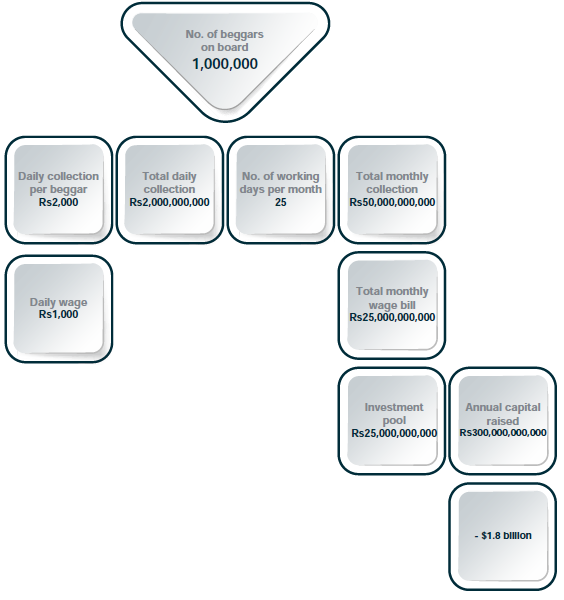

The above diagram depicts the representative statistics of the model based on one million fundraisers. From the figures presented therein, it is not difficult to employ simple maths to find out how a programme like this can eradicate poverty from Pakistan by the year 2030, the deadline for the ongoing Sustainable Development Goals (SDGs) by the United Nations.

Needless to say, the success of such a programme depends on not only technology but also on effective human resource management. Technology will bring the required discipline to the whole project, as embezzlement of funds is expected to be a big challenge if the right strategy is not adopted for the proposed structure.

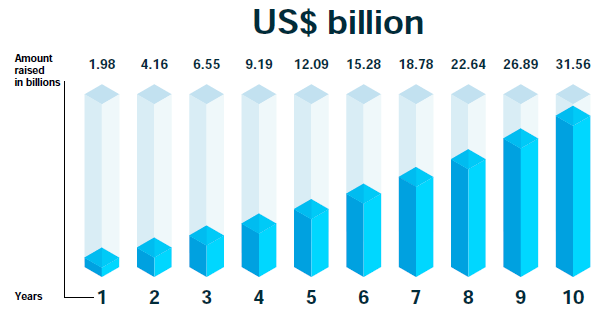

As the chart below suggests, if a proper asset management function is employed, the investment pool will have US$31.56 billions worth of assets in just 10 years. This figure is based on a 10% annual return on investments.

Obviously, this is just a thought that must further be developed by those who are looking for opportunities in Islamic banking and finance. Such thoughts are discussed in further details in our Cambridge Islamic Finance Access Programme (Cambridge- IFAP). Those of our readership who have a keen interest in the structuring of Islamic financial products must attend the 10 modules of Cambridge Islamic Finance Structuring Master Series, offered by Cambridge Institute of Islamic Finance.