Navigating the post-COVID-19 era, leaders in the Islamic banking industry are rewriting the rules of operating and revamping their current business strategies. They also view that success in the new-normal environment certainly demands mental agility. Agile was popularised in 2001 as a software development approach discovering requirements and developing solutions through the collaborative effort of self-organising and cross-functional teams and their customers (Beck et al., 2001). Due to its effectiveness, the Agile management approach is now widely adopted by non-tech companies and businesses that aim to provide new product and service development in a highly flexible and interactive manner, based on the principles expressed in the Manifesto for Agile Software Development.

At an enterprise level, Mckinsey defines Agility as “moving strategy, structure, processes, people, and technology toward a new operating model by rebuilding an organisation around hundreds of self-steering, high-performing teams supported by a stable backbone”. The Mckinsey research also found that organisations with Agile mindset and culture responded faster to the current crisis, while those that do not embrace Agile working may well forfeit the benefits of speed and resilience needed in the “new normal” after the COVID-19 pandemic (Jurisic et al., 2020).

An Agile mindset is the combination of attitudes supporting a productive working culture. These include respect, collaboration, iteration, improvement and learning cycles, pride in ownership, focus on delivering value, and the ability to adapt to change. Agile minds prioritize adoption to change over sticking to a plan and hold themselves accountable for outcomes (such as growth, profitability, and customer loyalty), not outputs (such as the number of new products, etc.) (McDonald, 2015).

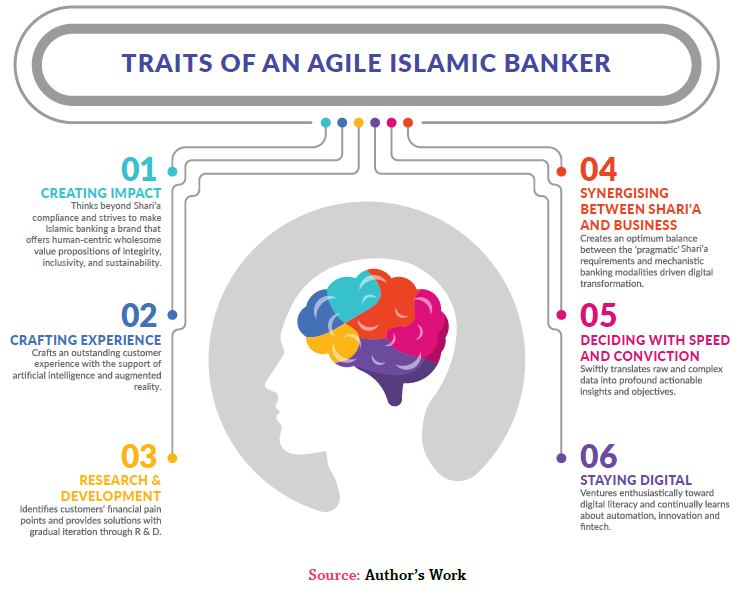

A distinguishing function of Islamic banking is Shari’a management that serves as a connecting point between all other departments of the bank and as a conduit between the management and the Shariah Advisory Board. This vibrant job description requires Islamic banking professionals to develop an agile mindset that synthesises, on one hand, between the persistent Shari’a requirements and fast-faced changing business landscape, and on the other hand, progresses an indispensable career for the digitised future. This article provides practical insights for developing “an Agile mindset” in Islamic banking.

- Synergising between Shari’a and Business

Shari’a compliance is the raison d’etre of an Islamic bank with a set of firm principles to govern the bank’s operation and products. However, the nature of the banking business is inherently shaped by the evolving financial needs of its customers that consistently require innovative solutions. This dichotomy between persistent Shari’a principles and ever-changing business needs, frequently, creates a challenge for the Shari’a minds either to enact a new rule or to suggest a modification to the product/ service or operation.

In such cases, an agile Shari’a mind resorts to the first-principle thinking of Islamic finance: (1) the default rule in a financial transaction is permissibility, and (2) ribā (interest) shall be eliminated by converting a financial facility (cash vs cash) to a trade transaction (cash vs asset/service) fulfilling the minimum requirement of Shari’a compliance. When a profitable business opportunity contradicts a core Shari’a principle, the solution is not to abandon the opportunity, but to find a better strategy that synergizes between the Shari’a requirements and business prerequisite. You should always strive to accommodate the Shari’a by modifying the business, not the other way around.

- Deciding with Speed and Conviction

The digital revolution in banking compels the executives for quick decision-making to timely materialise a business opportunity or prevent a loss. According to Harvard Business Review, most CEOs are fired not because of the wrong decision they have made, but for being “indecisive” in situations where on-the-spot action was needed (Botelho et al., 2017).

A unique feature of Islamic banking is Shari’a decision-making where qualified professionals identify a commercially viable and Islamically acceptable solution to a problem faced by the bank, or to develop a new strategy, with a systematic course of action that is also in line with the Shari’a (Agha, 2020). A nimble mind recognises that a slow decision-making process wrapped in a complicated bureaucracy will risk being overtaken by competition and deserted by customers. An imperfect decision is always better than no-decision. To develop an astute Islamic banking acumen in the digital age, you should have the ability to swiftly translate raw and complex data into profound actionable insights.

- Staying Digital

The banking industry is aggressively adopting digital transformation in all areas of business. This revolution is not a mere enabler for greater efficiency and cost-cutting, it actually rewires the DNA of the banking by disrupting the traditional channels of operation and service, and eventually changing consumer financial behaviours (Grace 2019). Consequently, it will also alter the paper-based Shari’a governance and advisory structure deployed in the current “brick and mortar” banking model.

“TO DEVELOP AN ASTUTE ISLAMIC BANKING ACUMEN IN THE DIGITAL AGE, YOU SHOULD HAVE THE ABILITY TO SWIFTLY TRANSLATE RAW AND COMPLEX DATA INTO PROFOUND ACTIONABLE INSIGHTS.”

An agile mind ventures enthusiastically toward digital literacy and continually learns about automation, innovation, and fin-tech. The evolving banking ecosystem underpinned by disruptive innovation necessitates a fresh look into classical literature to develop more suitable and practical Shari’a-compliant solutions. Therefore, Islamic Banking 2.0 demands Shari’a minds that wholeheartedly embrace the change and create an optimum balance between the ‘pragmatic’ Shari’a requirements and ‘mechanistic’ banking modalities driven by cloud computing, artificial intelligence, virtual reality, digital currencies, crypto assets, and blockchain.

- Creating Impact

Responding to the rising consciousness worldwide, financial institutions have started strategizing “Banking beyond Profit”. Globally, around 171 banks have signed the United Nations Principles for Responsible Banking. The Principles provide a framework for a sustainable banking system to make a positive contribution to society. These banks represent more than a third of the global banking industry (UNEPFI, 2018).

Inspired by this global initiative, the Malaysian Central Bank has issued a guiding framework for Islamic banks known as the “Value-based Intermediation (VBI)”. Recognition of the value-based financial activities and impact-investing provides a level playing ground for the Islamic banking leaders to actualize the greater objectives and higher values of Shari’a (Maqasid al Shari’a). It implies that Islamic banks will adopt an impact-driven approach that ensures the interest of key stakeholders and the planet on one hand and foster good conduct on the other hand. Since meeting legal requirements through comprehensive and technical procedures is not sufficient, an agile mind thinks beyond Shari’a compliance and strives to make Islamic banking a brand that offers human-centric wholesome value propositions of integrity, inclusivity, and sustainability.

- Research and Development

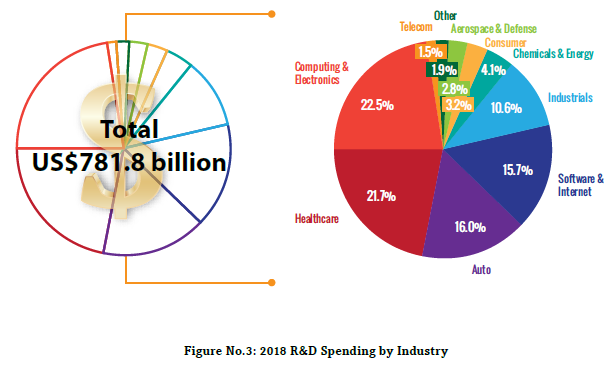

According to the 2018 Global Innovation Report, the total research and development (R&D) spending worldwide is about US$1 trillion annually. Unfortunately, the banking industry’s spending in R&D is very minimal to the extent that it is dumped as “others” at 1.9% in the industry-wise ranking (PwC, 2018).

Usually, Islamic bankers confuse product structuring with R&D. Banking is a service industry by nature, hence the purpose of R&D in banking shall be to enhance the quality of the service. It was historically a challenge to apply the formal R&D processes to services as service is intangible naturally, often existing only in the moment of its delivery to a customer. Thanks to fin-tech that, now, enables banks, to conduct live experiments—with real customers engaged in real transactions.

Banks have started establishing fin-tech innovation labs and collaborations with startups. This new trend of customer-centricity and service orientation forces Islamic bankers to identify their customers’ financial pain points and provide pragmatic solutions with gradual iteration. An Agile mind believes that Islamic banking is no more confined to customer acquisition; it stands now at making customers’ satisfaction and value proposition at the center of its business.

Conclusion

The digital transformation in Islamic banking gradually takes on the ‘humanistic’ domains within the workplace and most of the ‘secured’ careers are wavering under the ‘relevancy’ scrutiny. The skillset that supported your promotion last year, may not guarantee your job for the next year. In a disruptive job market where past success cannot be taken as an indicator of the future, developing and serving with an Agile mindset will assist you as the key strategic differentiators relative to competitors with a ‘value-driven relevance’. Agile is the ability to create and respond to change. It is a way of dealing with, and ultimately succeeding in, an uncertain and turbulent environment. At the core of the Agile mindset is a redefining of how Islamic banking services fit into the lives of the consumers, businesses, and organizations that use those services. FinTech thought leader, Henri Arslanian rightly anticipated in his TEDx Talk: “the bankers of the future and those who will shape the future of this industry are not going to be your traditional bankers, but rather designers, programmers, and creative thinkers”.

AT THE CORE OF THE AGILE MINDSET IS A REDEFINING OF HOW ISLAMIC BANKING SERVICES FIT INTO THE LIVES OF THE CONSUMERS, BUSINESSES, AND ORGANIZATIONS THAT USE THOSE SERVICES

Dr Agha is an Islamic banker and holds a PhD in Islamic banking and finance from IIiBF, International Islamic University Malaysia. He writes about Islamic commercial law and decision-making in Islamic banking. He also works with AAOIFI as an Executive Assistant to develop a governance standard on Shari’a Decision Making in Islamic Finance. The opinions expressed in this article are solely of the author and do not express the views of his employer.